What is the cost plus contract – What is a cost plus contract? It’s a type of agreement where the buyer pays the seller for all the costs incurred in completing a project, plus an agreed-upon profit margin. This approach shifts the risk of cost overruns from the seller to the buyer, who essentially pays for whatever it takes to finish the project.

Cost-plus contracts are commonly used in industries where project scope or requirements are uncertain, such as construction, engineering, and research and development. They can also be beneficial when dealing with complex projects that involve a high degree of customization or innovation.

What is a Cost Plus Contract?

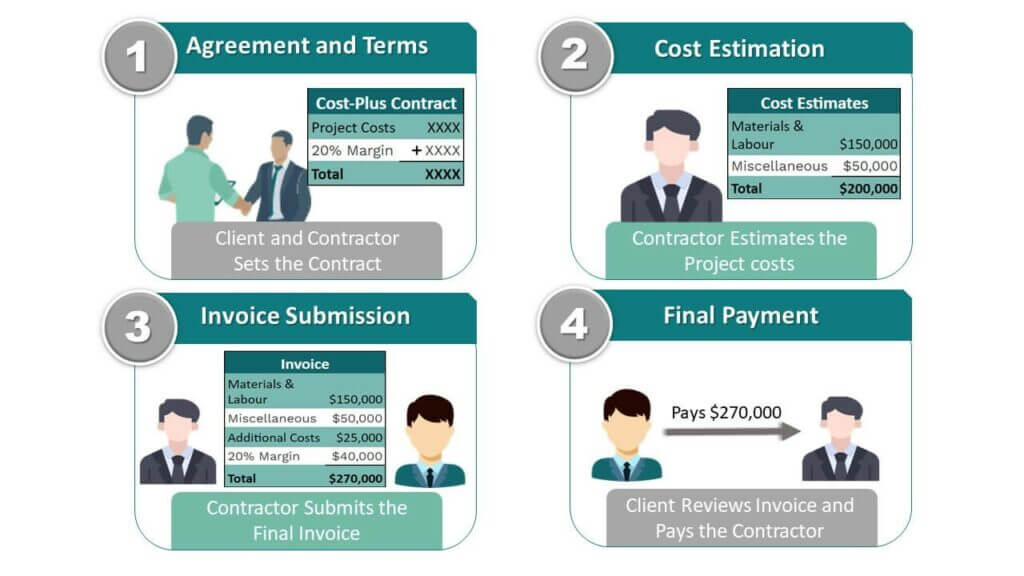

A cost-plus contract is a type of agreement where the buyer pays the seller for all the actual costs incurred in completing a project, plus an agreed-upon profit margin. In essence, the buyer assumes the risk of cost overruns, while the seller is guaranteed a profit.The core principle of cost-plus contracting is transparency and accountability. The seller must meticulously track and document all expenses related to the project, which are then reviewed and verified by the buyer.

This ensures that the buyer is only paying for legitimate costs and that the seller is not inflating expenses to increase their profit.

Industries Where Cost Plus Contracts Are Commonly Used

Cost-plus contracts are prevalent in industries where projects are complex, involve a high degree of uncertainty, or require specialized expertise. These contracts provide flexibility and protection for both parties, particularly when the scope of work is difficult to define upfront.

- Construction: Large-scale infrastructure projects, such as bridges, tunnels, and airports, often utilize cost-plus contracts due to their intricate nature and potential for unforeseen challenges.

- Defense: The development and production of military equipment, including aircraft, ships, and weapons systems, typically involve cost-plus contracts because of the high-tech nature and complex specifications.

- Research and Development: Innovative projects in fields like pharmaceuticals, biotechnology, and aerospace often employ cost-plus contracts to encourage experimentation and accommodate the inherent uncertainty in research endeavors.

- Engineering: Complex engineering projects, such as power plants, refineries, and data centers, frequently rely on cost-plus contracts to manage the inherent risks associated with intricate designs and technical challenges.

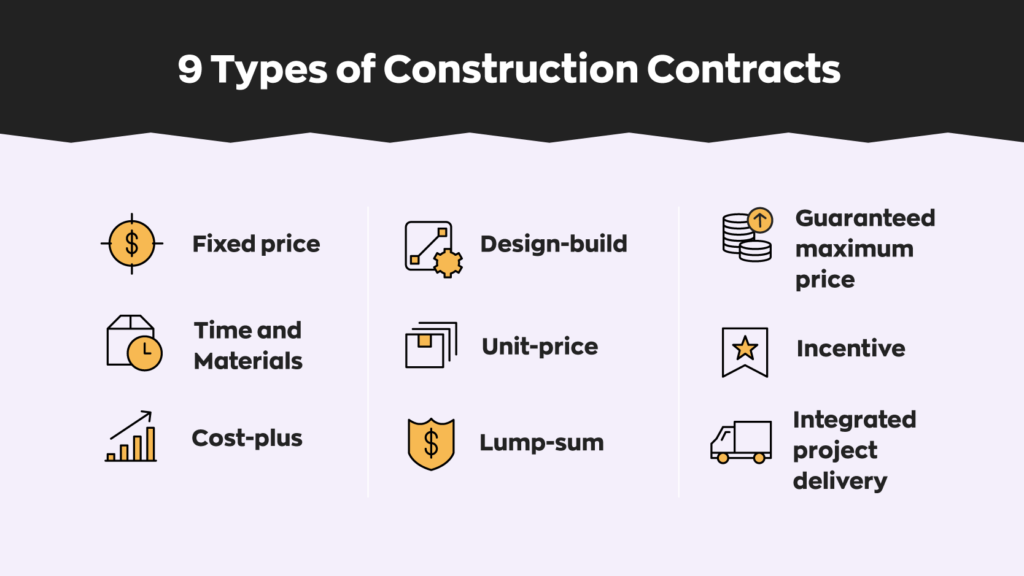

Types of Cost Plus Contracts

Cost-plus contracts, also known as cost-reimbursement contracts, are agreements where the contractor is compensated for all their actual costs incurred in fulfilling the project, plus an agreed-upon fee or percentage. This type of contract is often used when the project scope is uncertain, the technology is new, or the risks are high. There are several types of cost-plus contracts, each with its own risk allocation and pricing structure.

Cost-Plus-Fixed-Fee (CPFF)

The CPFF contract is a popular choice when the project scope is uncertain, and the contractor’s expertise is crucial. In this type of contract, the contractor is reimbursed for all their actual costs, plus a fixed fee that is determined upfront. The fixed fee is not affected by the actual cost of the project. This approach provides a clear and predictable pricing structure for the client, but it also limits the contractor’s potential profit.

- Risk Allocation: The risk of cost overruns is primarily borne by the client, as the contractor is reimbursed for all actual costs. The contractor, however, bears the risk of not meeting the project’s performance requirements.

- Pricing: The total contract price is calculated as follows:

Total Contract Price = Actual Costs + Fixed Fee

Cost-Plus-Percentage-of-Cost (CPPC)

The CPPC contract is less common than the CPFF contract, due to its potential for cost overruns. In this type of contract, the contractor is reimbursed for all their actual costs, plus a percentage of those costs. This percentage is agreed upon upfront and is applied to the total actual costs incurred. This approach provides the contractor with an incentive to keep costs low, as their profit is directly linked to the actual costs.

However, it also creates the potential for cost overruns, as the contractor may have an incentive to inflate costs.

- Risk Allocation: The risk of cost overruns is shared between the client and the contractor. The client bears the risk of the contractor’s percentage of cost, while the contractor bears the risk of not meeting the project’s performance requirements.

- Pricing: The total contract price is calculated as follows:

Total Contract Price = Actual Costs + (Percentage of Cost

– Actual Costs)

Cost-Plus-Incentive-Fee (CPIF)

The CPIF contract is designed to encourage the contractor to achieve specific project goals, such as cost, schedule, or performance targets. In this type of contract, the contractor is reimbursed for all their actual costs, plus an incentive fee that is based on the contractor’s performance. The incentive fee is typically calculated as a percentage of the cost savings achieved or the performance targets met.

This approach provides the contractor with a strong incentive to control costs and achieve project goals, while also providing the client with the potential for cost savings and improved performance.

- Risk Allocation: The risk of cost overruns is shared between the client and the contractor. The client bears the risk of the incentive fee, while the contractor bears the risk of not meeting the project’s performance requirements.

- Pricing: The total contract price is calculated as follows:

Total Contract Price = Actual Costs + Incentive Fee

Cost-Plus-Award-Fee (CPAF)

The CPAF contract is similar to the CPIF contract, but it places more emphasis on subjective performance criteria. In this type of contract, the contractor is reimbursed for all their actual costs, plus an award fee that is based on the contractor’s overall performance. The award fee is typically determined by a panel of experts who evaluate the contractor’s performance against a set of criteria.

This approach provides the client with a high degree of control over the contractor’s performance, but it also creates the potential for subjectivity and disputes.

- Risk Allocation: The risk of cost overruns is primarily borne by the client, as the contractor is reimbursed for all actual costs. The contractor, however, bears the risk of not meeting the project’s performance requirements, which could affect the award fee.

- Pricing: The total contract price is calculated as follows:

Total Contract Price = Actual Costs + Award Fee

Comparison of Cost Plus Contracts

| Type | Risk Allocation | Pricing | Features | Benefits |

|---|---|---|---|---|

| CPFF | Client: Cost overruns; Contractor: Performance | Actual Costs + Fixed Fee | Fixed fee, predictable pricing, less incentive for cost control | Clear pricing, limited contractor profit |

| CPPC | Shared: Client: Percentage of Cost; Contractor: Performance | Actual Costs + (Percentage of Cost

| Percentage of cost, incentive for cost control, potential for cost overruns | Potential for cost savings, incentive for contractor |

| CPIF | Shared: Client: Incentive Fee; Contractor: Performance | Actual Costs + Incentive Fee | Incentive fee, performance-based compensation, potential for cost savings | Strong incentive for contractor performance, potential for cost savings |

| CPAF | Client: Cost overruns; Contractor: Performance | Actual Costs + Award Fee | Award fee, subjective performance criteria, high client control | High client control, potential for subjectivity and disputes |

Advantages of Cost Plus Contracts: What Is The Cost Plus Contract

Cost-plus contracts offer unique advantages for both buyers and sellers, making them suitable for various projects. These contracts provide flexibility, transparency, and risk sharing, making them a viable option in specific situations.

Advantages for the Buyer

Cost-plus contracts can be advantageous for buyers, particularly in situations where project scope or specifications are uncertain. This type of contract allows buyers to:

- Minimize upfront costs: Buyers are not required to commit to a fixed price upfront, reducing financial risk, especially when dealing with complex or uncertain projects.

- Benefit from the seller’s expertise: Sellers, with their specialized knowledge and experience, can effectively manage the project, ensuring quality and efficiency. Buyers can leverage the seller’s expertise without assuming the risk of cost overruns.

- Ensure project completion: With a cost-plus contract, the seller is motivated to complete the project as efficiently as possible, as their profit is directly tied to the actual costs incurred.

- Make changes during the project: Buyers have the flexibility to make changes to the project scope or specifications as needed, without being bound by a fixed price contract.

Advantages for the Seller

Cost-plus contracts also offer benefits for sellers, particularly when dealing with complex or uncertain projects:

- Reduced risk: Sellers are protected from potential losses due to unforeseen circumstances or changes in project scope. They are reimbursed for their actual costs, ensuring profitability.

- Increased profit potential: Sellers can potentially earn higher profits, especially if they can manage the project efficiently and minimize costs.

- Enhanced collaboration: The transparency inherent in cost-plus contracts encourages open communication and collaboration between the buyer and seller, leading to better project outcomes.

Advantages for Complex or Uncertain Projects, What is the cost plus contract

Cost-plus contracts are particularly well-suited for projects where the scope or specifications are uncertain or likely to change. This includes:

- Research and development projects: These projects often involve unknown variables and require flexibility to adapt to new discoveries or technological advancements.

- Construction projects with complex designs: When dealing with unique architectural designs or challenging site conditions, cost-plus contracts allow for adjustments as the project progresses.

- Emergency projects: In emergency situations, where time is of the essence and the scope of work may be unclear, cost-plus contracts provide the necessary flexibility to address unforeseen challenges.

Disadvantages of Cost Plus Contracts

While cost-plus contracts offer advantages in situations with uncertain project scope and complexity, they also come with potential drawbacks. Understanding these disadvantages is crucial for making informed decisions about contract type selection.

The most significant disadvantage of cost-plus contracts is the risk of cost overruns. This risk arises because the contractor is incentivized to maximize their profit by increasing project costs. Without a fixed price, the contractor may have less motivation to control costs, leading to higher expenses that are ultimately passed on to the client.

Lack of Cost Control

Cost-plus contracts can lead to a lack of cost control, as the contractor is not directly responsible for keeping costs within a predetermined budget. This lack of cost control can result in significant cost overruns, particularly if the project scope is not clearly defined or if the contractor is not experienced in managing costs effectively.

- Limited Incentive for Efficiency: Since the contractor is reimbursed for their costs, they may have less incentive to find cost-effective solutions or implement efficient practices.

- Potential for Cost Padding: There is a risk that the contractor may inflate costs or include unnecessary expenses to increase their profit margin.

- Difficult to Track and Manage Costs: Without a fixed price, it can be challenging to track and manage costs effectively, making it difficult to identify and address potential cost overruns.

Examples of Disadvantageous Situations

Cost-plus contracts are not suitable for all projects. They can be disadvantageous in situations where:

- Project Scope is Well-Defined: When the project scope is clearly defined and predictable, a fixed-price contract is often more appropriate, as it provides better cost certainty and incentivizes the contractor to complete the project within budget.

- High Risk of Cost Overruns: If the project involves a high risk of cost overruns due to factors like technological uncertainties or complex regulations, a cost-plus contract can amplify the financial risk for the client.

- Lack of Trust in Contractor: Cost-plus contracts require a high level of trust between the client and the contractor. If there are concerns about the contractor’s integrity or ability to manage costs effectively, a fixed-price contract might be a better option.

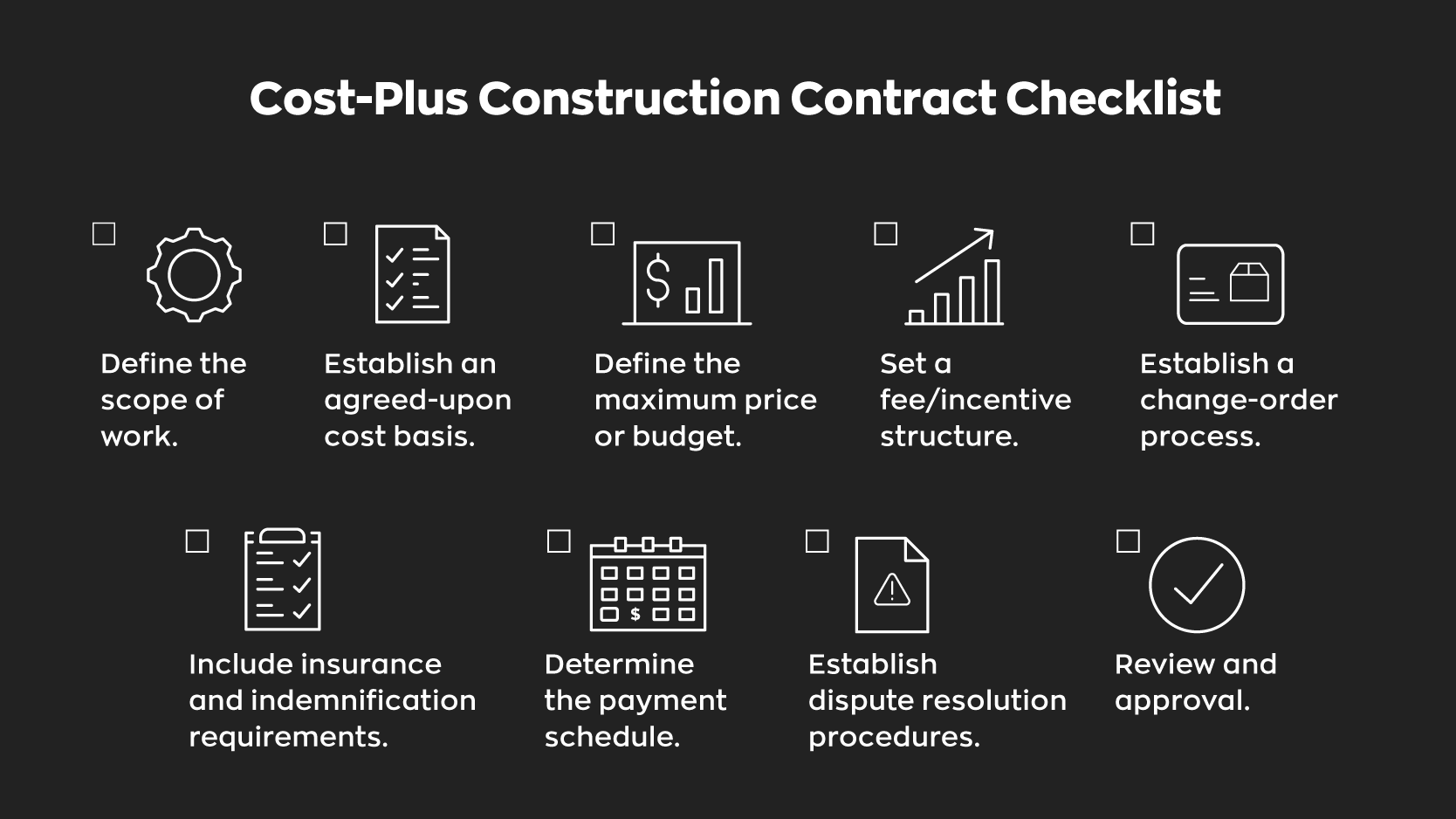

Cost Control Mechanisms in Cost Plus Contracts

Cost-plus contracts inherently carry a higher risk of cost overruns due to the lack of a fixed price. To mitigate these risks, both the contractor and the client implement various cost control mechanisms. These mechanisms aim to ensure that the costs incurred by the contractor are reasonable and necessary for the project’s completion.

Audits and Independent Cost Verification

Audits and independent cost verification play a crucial role in cost-plus contracts. These measures ensure that the costs claimed by the contractor are legitimate and reflect actual expenses incurred during the project. Regular audits, conducted by independent auditors or the client’s representatives, provide a thorough review of the contractor’s financial records, including invoices, receipts, and other supporting documentation.

Independent cost verification helps maintain transparency and accountability, fostering trust between the parties.

- Regular audits: These audits are conducted at predetermined intervals, ensuring ongoing monitoring of costs and compliance with contract terms. They involve examining the contractor’s financial records, comparing them with project budgets, and identifying any discrepancies or potential overspending.

- Independent cost verification: This involves a third-party expert, typically an accountant or cost engineer, who reviews the contractor’s cost data and assesses its accuracy and reasonableness. They ensure that the costs claimed are justifiable and align with industry standards and market prices.

Cost Control Measures

Effective cost control measures are crucial in cost-plus contracts to prevent unnecessary expenses and maintain project profitability. These measures can be implemented by both the contractor and the client, and they involve various strategies to optimize resource utilization, enhance efficiency, and minimize waste.

- Detailed budgeting and cost tracking: Establishing a comprehensive budget with clear cost categories and regular monitoring of actual expenses against the budget are essential. This allows for timely identification of potential cost overruns and enables proactive adjustments.

- Value engineering: This involves analyzing the project’s design and specifications to identify potential cost savings without compromising the project’s quality or functionality. It can involve exploring alternative materials, construction techniques, or design modifications that reduce costs without affecting performance.

- Performance incentives: Implementing performance-based incentives can motivate the contractor to achieve cost-efficiency goals. This can involve rewarding the contractor for exceeding budget targets or achieving specific project milestones within budget constraints.

- Cost-plus contracts with a guaranteed maximum price (GMP): This type of contract sets a maximum price limit beyond which the contractor cannot charge. It provides a ceiling for the client’s total project cost, offering a degree of financial certainty.

Applications of Cost Plus Contracts

Cost-plus contracts find application in various scenarios where uncertainty in project scope, cost, or time is significant, and a collaborative approach between the parties is preferred. This type of contract is particularly suitable for projects with complex requirements, unforeseen challenges, or where the exact nature of the work is not fully defined at the outset.

Construction Projects

Cost-plus contracts are commonly used in construction projects where the scope of work may be subject to change during the project lifecycle. This is particularly true for large-scale infrastructure projects, renovations, or projects involving unique or complex designs. The flexibility of cost-plus contracts allows for adjustments to the scope of work as unforeseen conditions arise, such as soil issues, regulatory changes, or changes in client requirements.

For example, a cost-plus contract might be used for a complex bridge construction project where the geological conditions are uncertain and could significantly impact the construction process.

Research and Development Projects

Cost-plus contracts are frequently employed in research and development (R&D) projects where the outcomes are uncertain, and the scope of work may evolve as the project progresses. This type of contract provides flexibility for the contractor to explore new ideas and adapt to changing research directions.

For example, a pharmaceutical company might use a cost-plus contract for a drug development project where the research process is highly experimental and involves significant uncertainties.

Government Contracts

Cost-plus contracts are commonly used in government contracts, particularly for defense projects, infrastructure development, and research initiatives. The government often prefers cost-plus contracts for these projects because they allow for flexibility in meeting changing needs and priorities.

For example, the government might use a cost-plus contract for the development of a new military aircraft, where the design specifications and technologies may evolve over time.

Other Applications

Cost-plus contracts are also suitable for projects with a high degree of customization, where the client’s specific needs are not fully defined at the outset. This includes projects in industries such as software development, engineering, and consulting.

For example, a software development company might use a cost-plus contract for a custom software application for a specific client, where the requirements and features may evolve during the development process.

Cost Plus Contracts vs. Fixed Price Contracts

Cost-plus and fixed-price contracts are two fundamental types of contracts used in various industries, each offering distinct advantages and disadvantages. Understanding their differences is crucial for selecting the most suitable contract type for a particular project.

Risk Allocation

The allocation of risk is a fundamental difference between cost-plus and fixed-price contracts. In a cost-plus contract, the buyer assumes the majority of the financial risk. The contractor is reimbursed for all actual costs incurred, plus a predetermined fee or percentage for profit. This means the buyer bears the burden of potential cost overruns. Conversely, in a fixed-price contract, the contractor assumes the primary financial risk.

The contractor agrees to complete the project for a fixed price, regardless of the actual costs incurred. This means the contractor is responsible for managing costs effectively and absorbing any potential overruns.

Pricing

The pricing structure is another significant distinction. In a cost-plus contract, the final price is determined after the project is completed. The contractor submits detailed invoices for all expenses, which are then reviewed and reimbursed by the buyer. The final price is calculated by adding the total costs to the predetermined fee or percentage. In a fixed-price contract, the price is established upfront before the project begins.

The contractor agrees to deliver the project for a fixed sum, which remains unchanged regardless of actual costs. This fixed price provides the buyer with certainty about the total project cost.

Contract Management

The management of cost-plus and fixed-price contracts differs significantly. Cost-plus contracts require close monitoring and oversight by the buyer to ensure the contractor is managing costs efficiently and accurately. The buyer typically has access to the contractor’s cost records and participates in the review and approval process. In contrast, fixed-price contracts require less intensive management. The buyer’s role is primarily to ensure the contractor meets the agreed-upon specifications and deliverables within the fixed price.

The contractor is responsible for managing costs and achieving the project objectives.

When to Use Each Contract Type

The choice between a cost-plus and a fixed-price contract depends on several factors, including the complexity of the project, the level of uncertainty, the buyer’s risk tolerance, and the relationship between the buyer and the contractor.

Cost-Plus Contracts

- Suitable for projects with high levels of uncertainty, such as research and development projects, where the scope of work is not fully defined.

- Beneficial when the buyer requires a high degree of flexibility and control over the project.

- Appropriate when the buyer is willing to share the financial risk with the contractor.

- Useful when the buyer lacks the expertise to estimate the project costs accurately.

Fixed-Price Contracts

- Suitable for projects with well-defined scope and predictable costs.

- Beneficial when the buyer seeks cost certainty and a fixed budget.

- Appropriate when the buyer is willing to accept a higher level of risk.

- Useful when the buyer has a clear understanding of the project requirements and can accurately estimate the costs.

Cost-plus contracts offer a unique balance of risk and reward, providing flexibility and transparency for both parties. Understanding the different types, advantages, and disadvantages of cost-plus contracts is crucial for making informed decisions about project procurement. By carefully considering the project’s complexity, risk profile, and the desired level of cost control, businesses can determine whether a cost-plus contract is the right choice for their specific needs.

Query Resolution

What are the main types of cost-plus contracts?

Common types include cost-plus-fixed-fee, where the seller receives a fixed fee on top of incurred costs, and cost-plus-percentage-of-cost, where the seller earns a percentage of the total project costs as their profit.

When is a cost-plus contract not suitable?

Cost-plus contracts can be less suitable for projects with well-defined scope and predictable costs. They are generally not recommended when price is a primary concern, as the final cost can be uncertain.

How can cost overruns be mitigated in cost-plus contracts?

Cost overruns can be mitigated through robust cost control mechanisms such as regular audits, independent cost verification, and clear communication between the buyer and seller.