How much does a call option contract cost? This question is central to understanding the world of options trading, a powerful tool for both investors and speculators. Call options give the buyer the right, but not the obligation, to purchase an underlying asset at a predetermined price (the strike price) on or before a specific date (the expiration date).

This right comes at a cost, the premium, which is determined by several factors, including the underlying asset’s price, time value, volatility, interest rates, and dividends.

Understanding how these factors influence the cost of a call option is crucial for making informed investment decisions. This guide will explore the key components of call option pricing, the methods used to calculate their cost, and the practical implications of these costs in various market conditions.

Understanding Call Option Contracts: How Much Does A Call Option Contract Cost

:max_bytes(150000):strip_icc()/dotdash_Final_Call_Option_Definition_Apr_2020-01-a13f080e7f224c09983babf4f720cd4f.jpg)

A call option contract is a financial instrument that gives the buyer the right, but not the obligation, to purchase an underlying asset (like a stock) at a predetermined price (the strike price) on or before a specific date (the expiration date). This means the buyer has the flexibility to profit from an increase in the asset’s price without actually owning the asset.

The Rights and Obligations of Buyers and Sellers

Call options have two key participants: the buyer (who purchases the option) and the seller (who grants the option). Each party has specific rights and obligations:

Buyer

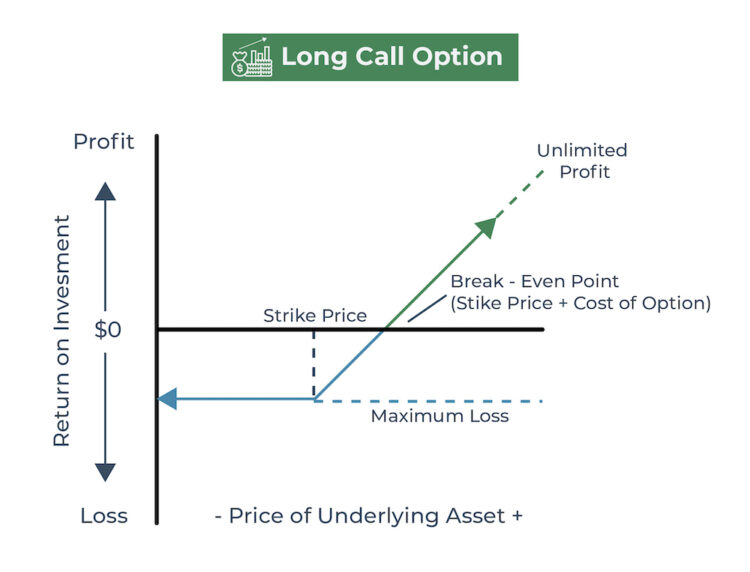

- Right to buy: The buyer has the right to purchase the underlying asset at the strike price, but they are not obligated to do so.

- Potential for profit: If the asset’s price rises above the strike price, the buyer can exercise the option and buy the asset at a lower price, making a profit.

- Limited risk: The buyer’s maximum loss is limited to the premium paid for the option.

Seller

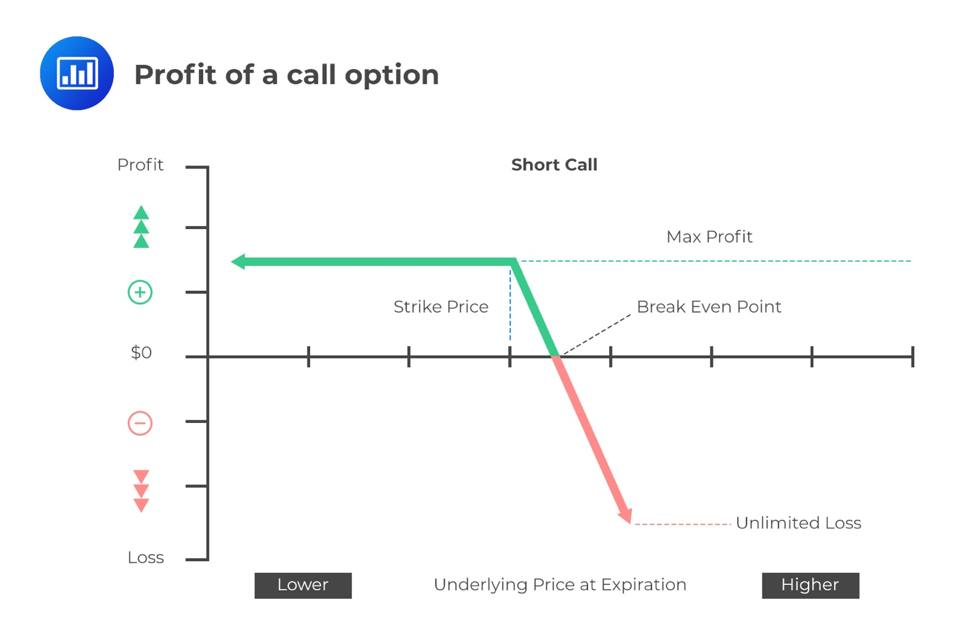

- Obligation to sell: If the buyer exercises the option, the seller is obligated to sell the underlying asset at the strike price.

- Potential for profit: The seller receives the premium paid for the option. However, they risk losing money if the asset’s price rises above the strike price.

- Unlimited risk: The seller’s potential loss is unlimited, as the asset’s price could rise indefinitely.

Real-World Scenarios

Call options are used in various situations:

- Speculation: Investors who believe an asset’s price will rise can buy a call option to profit from the price increase without owning the asset.

- Hedging: A company holding a large amount of an asset may buy a call option to protect against a potential price decline. This strategy ensures they can sell the asset at a predetermined price if the market drops.

- Leverage: Call options allow investors to control a large amount of an asset with a relatively small investment (the premium). This can amplify potential profits but also magnify losses.

Factors Affecting Call Option Contract Cost

The cost of a call option contract, also known as the premium, is determined by several factors that influence its value. These factors are interconnected and work together to shape the price of the option.

Underlying Asset’s Price

The price of the underlying asset plays a crucial role in determining the cost of a call option. As the price of the underlying asset increases, the value of the call option also tends to rise. This is because the call option holder has the right to buy the asset at a predetermined price (strike price), which becomes more valuable as the market price goes up.

For example, if you buy a call option for 100 shares of a company at a strike price of $50, and the market price of the shares rises to $60, your option becomes more valuable because you can buy the shares at $50 and immediately sell them in the market for $60, making a profit of $10 per share.

Time Value and Volatility

Time value and volatility are two key factors that influence the cost of a call option. Time value refers to the amount of time remaining until the option expires. As the time to expiration increases, the time value of the option also increases, as there is a greater chance for the underlying asset’s price to move in your favor. Volatility refers to the rate at which the price of the underlying asset fluctuates.

Higher volatility increases the likelihood of significant price movements, which can benefit the call option holder. Consequently, higher volatility leads to a higher premium.

Interest Rates and Dividends

Interest rates and dividends can also impact the cost of a call option. Higher interest rates tend to decrease the value of call options. This is because investors have the opportunity to earn higher returns by investing in risk-free assets like bonds, making call options less attractive. Dividends, on the other hand, can have a mixed effect on the cost of a call options.

While dividends benefit the holder of the underlying asset, they can also reduce the value of the call option. This is because the dividend payment reduces the price of the underlying asset, making the option less valuable.

Key Components of Call Option Pricing

Think of a call option like a ticket to a concert. You pay for the ticket (the option premium) and it gives you the right, but not the obligation, to see the concert (buy the underlying asset at a specific price). The price of this ticket depends on several factors, and we’re going to break down the main components that influence it.

Intrinsic Value, How much does a call option contract cost

The intrinsic value is the difference between the current market price of the underlying asset and the strike price of the option. It’s the immediate profit you’d make if you exercised the option right now.

If the current market price of the underlying asset is higher than the strike price, the option has intrinsic value.

For example, if you have a call option with a strike price of $100 and the underlying asset is trading at $110, the intrinsic value is $10 ($110 – $100).

Time Value

Time value is the portion of the option premium that reflects the potential for the underlying asset price to increase in the future. It’s like the extra cost you pay for the ticket because you think the concert might be even better than you expect.

The longer the time until the option expires, the higher the time value.

This is because there’s more time for the underlying asset price to move in your favor. As the expiration date approaches, the time value decreases, and the option price will be more closely tied to the intrinsic value.

Volatility

Volatility refers to how much the price of the underlying asset fluctuates. The higher the volatility, the greater the potential for the asset price to move in your favor, but also the greater the risk of it moving against you.

Higher volatility leads to higher option prices.

Think of it like this: if the concert is known for being unpredictable and exciting, with lots of surprises, the tickets will be more expensive because the potential for a great show is higher. However, there’s also a greater risk that the concert might be a flop.

Calculating the Cost of a Call Option

Okay, so you’ve got the basics of call options down. Now, let’s talk about the real deal: how much do these things cost? It’s not just a random number, you know. There’s a formula, some factors, and even online tools to help you figure it out.

Using the Black-Scholes Model

The Black-Scholes model is the go-to for calculating option prices. It’s like the holy grail of options pricing, but don’t worry, it’s not as complicated as it sounds. Here’s the breakdown:

The Black-Scholes model calculates the price of a call option based on the current price of the underlying asset, the strike price, the time to expiration, the risk-free interest rate, and the volatility of the underlying asset.

Let’s break it down step-by-step:

1. Gather the necessary information

You need the current price of the underlying asset (like a stock), the strike price (the price you want to buy the asset at), the time to expiration (how long the option is valid), the risk-free interest rate (the return you can get on a risk-free investment), and the volatility of the underlying asset (how much the price fluctuates).

2. Plug the information into the Black-Scholes formula

This formula is a bit complex, but thankfully, there are online calculators and tools that can do the heavy lifting for you.

3. Calculate the call option price

The Black-Scholes model will spit out a price for the call option, which is the premium you’ll need to pay to buy it.

Using Online Tools and Financial Calculators

You don’t have to be a math whiz to calculate call option prices. There are plenty of online tools and financial calculators that can do the job for you. Just search for “Black-Scholes calculator” online and you’ll find a bunch of options. Most of these tools are free and easy to use. Just input the required information and they’ll calculate the call option price for you.

Comparing Call Option Costs

Here’s a table showing how the cost of a call option can change based on different strike prices and expiration dates. This is just an example, so keep in mind that real-world prices can vary.| Strike Price | Expiration Date | Call Option Price ||—|—|—|| $100 | 1 month | $5 || $100 | 3 months | $7 || $105 | 1 month | $3 || $105 | 3 months | $5 |As you can see, the call option price is generally higher for longer expiration dates and lower strike prices.

This makes sense because the longer the option is valid, the more time the underlying asset has to move in your favor. And the lower the strike price, the more potential profit you have if the asset price goes up.

Call Option Contract Costs in Practice

So, you’ve got a handle on the basics of call option pricing, but how does it all play out in the real world? Let’s dive into the nitty-gritty of how call option costs can vary based on the underlying asset, the level of risk involved, and the current market conditions.

Call Option Costs for Different Underlying Assets

The cost of a call option can fluctuate depending on the underlying asset. Imagine you’re buying a call option on a stock, an index, or a commodity. Each one has its own quirks and characteristics that affect the price of the call option.

- Stocks: Stocks are often considered more volatile than indices, so call options on stocks generally tend to be pricier. Think of it like this: you’re taking on more risk with a stock, so the price of the option reflects that risk.

- Indices: Indices, like the S&P 500, are a basket of stocks, so they tend to be less volatile than individual stocks. This means call options on indices are usually cheaper than those on individual stocks.

- Commodities: Commodities, like oil or gold, can be influenced by factors like supply and demand, global events, and even weather. This can lead to significant price swings, so call options on commodities can be quite expensive.

Call Option Costs and Risk

Think of it like this: the more risk you’re willing to take, the more you’ll likely have to pay for the call option. If you’re betting on a stock that’s expected to make a big jump, the call option will cost more than one on a stock with a more stable price.

Call Option Costs in Different Market Conditions

The cost of a call option can be heavily influenced by the overall market environment.

- Bull Markets: In a bull market, where prices are generally rising, call options are more expensive. Why? Because there’s a higher chance that the underlying asset will increase in value, making the option more valuable.

- Bear Markets: When the market is bearish and prices are falling, call options are cheaper. This is because there’s a lower chance that the underlying asset will rise in value, making the option less valuable.

- Volatile Markets: In volatile markets, where prices fluctuate wildly, call options tend to be more expensive. The higher volatility increases the risk, and that risk is reflected in the price of the option.

The cost of a call option contract is a dynamic factor influenced by a complex interplay of market forces. By understanding the fundamental principles of option pricing, investors can make more informed decisions about whether to buy or sell call options and how to manage the associated risks. As the financial landscape continues to evolve, the ability to navigate the intricacies of option pricing will become increasingly important for both individual investors and institutional traders.

Query Resolution

What are the main risks associated with buying a call option?

The primary risk is that the option may expire worthless. If the underlying asset’s price falls below the strike price before the expiration date, the option will have no intrinsic value, and the buyer will lose the entire premium paid. Additionally, call options are highly leveraged, meaning a small change in the underlying asset’s price can result in significant gains or losses.

How can I learn more about options trading?

There are numerous resources available for learning about options trading, including books, online courses, and websites dedicated to options education. It’s also helpful to consult with a financial advisor or broker who specializes in options trading.

What are some popular online tools for calculating call option prices?

Many online brokers and financial websites offer tools for calculating option prices. These tools often use the Black-Scholes model or other pricing models to provide estimates of the current option price.

Are call options suitable for all investors?

Call options are not suitable for all investors. They involve a high degree of risk and require a thorough understanding of options trading strategies. It’s crucial to assess your risk tolerance and investment goals before trading options.

:max_bytes(150000):strip_icc()/dotdash_Final_Call_Option_Definition_Apr_2020-01-a13f080e7f224c09983babf4f720cd4f.jpg?w=1024&resize=1024,1024&ssl=1)