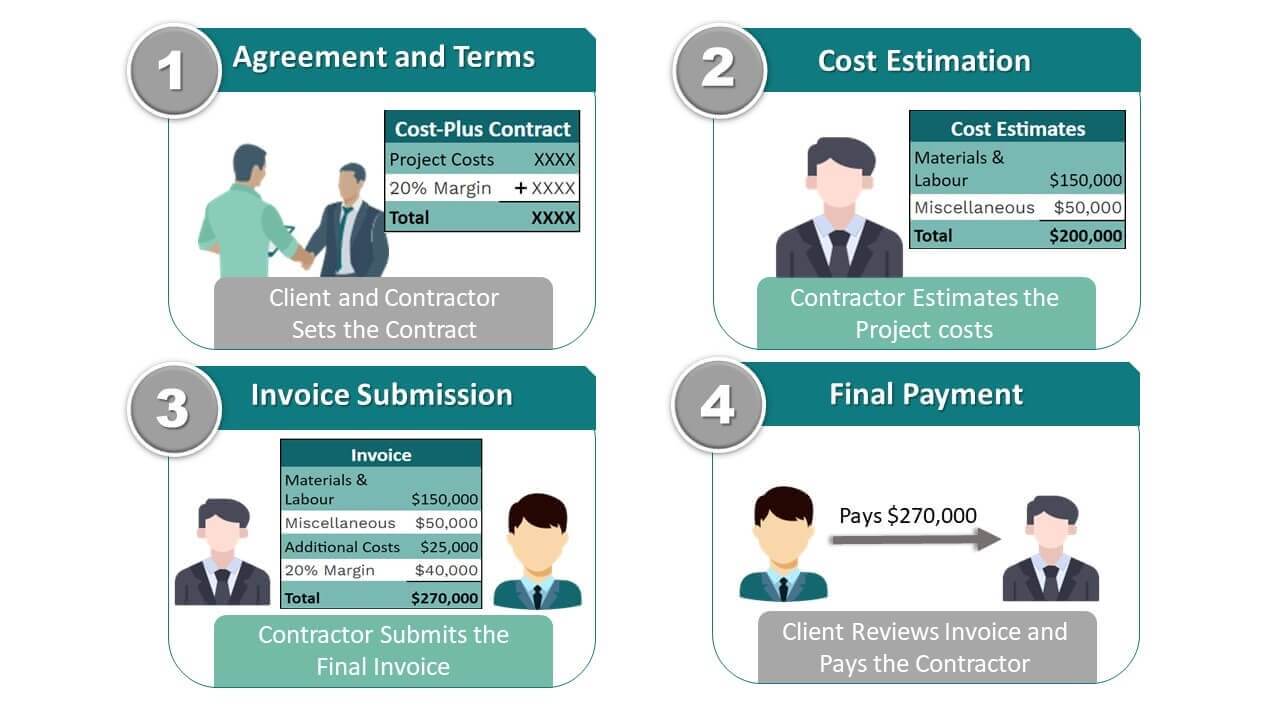

What is cost plus fee contract? It’s a contractual agreement where one party (the client) reimburses another (the contractor) for all allowable project costs, plus an additional fee. This fee can be structured in various ways, offering flexibility but also requiring careful cost tracking and management. Understanding the nuances of cost-plus contracts is crucial for both clients seeking transparent pricing and contractors aiming for fair compensation.

This guide breaks down everything you need to know about this common contract type.

Cost-plus contracts are popular in projects with uncertain scopes or when precise upfront costing is difficult. They offer advantages like shared risk and flexibility to adapt to changing requirements. However, they also require robust cost accounting, transparent reporting, and clear fee structures to prevent disputes and cost overruns. We’ll delve into the various types of cost-plus contracts, negotiation strategies, risk management, and legal considerations to ensure you navigate this contract type with confidence.

Definition and Core Components of a Cost-Plus Fee Contract: What Is Cost Plus Fee Contract

Yo, Jogja peeps! Ever heard of a cost-plus fee contract? It’s basically a deal where one party (let’s call them the contractor) gets paid for all their expenses (the “cost”) plus an agreed-upon fee (the “fee”). Think of it like ordering a custom-made batik shirt – you pay for the fabric, the tailor’s time, and then an extra amount for their expertise.

It’s all transparent, but the final price isn’t set in stone until the project’s done.Cost-plus fee contracts are built on a simple, yet crucial, foundation: accurate cost tracking. The contractor meticulously records every single rupiah spent on the project. This transparency is key, as the client’s payment directly reflects these documented expenses. The fee structure, on the other hand, can vary depending on the type of contract, offering flexibility but also potential for cost overruns if not managed properly.

This makes thorough budgeting and project management crucial for both parties.

Types of Cost-Plus Fee Contracts

There are a few different ways to structure a cost-plus fee contract, each with its own set of pros and cons. Choosing the right type depends heavily on the project’s complexity, risk level, and the relationship between the client and contractor. The most common variations include cost-plus-fixed-fee and cost-plus-percentage-of-costs. A cost-plus-fixed-fee contract, for example, means the contractor gets reimbursed for all allowable costs plus a predetermined, fixed fee.

This fee remains constant regardless of how much the project actually costs. In contrast, a cost-plus-percentage-of-costs contract links the fee directly to the project’s total cost, meaning a higher cost equals a higher fee for the contractor. This incentivizes cost control from the client’s perspective, but can also encourage the contractor to inflate costs.

Industries Using Cost-Plus Fee Contracts

These types of contracts are super common in industries where the project scope is uncertain or might change during execution. Think about government contracts for things like infrastructure projects (building new roads or bridges), research and development in the tech world (developing a new app or software), or even large-scale construction projects. The inherent uncertainty in these projects makes a fixed-price contract difficult, if not impossible, to manage effectively.

The flexibility of a cost-plus fee contract allows for adaptations and changes along the way, which is essential for these dynamic environments. It’s a win-win when you need adaptability!

Comparison of Contract Types

Here’s a table comparing cost-plus fee contracts with fixed-price contracts, which are the most common alternatives. It’s all about finding the right fit for your project.

| Feature | Cost-Plus Fee Contract | Fixed-Price Contract | Hybrid Contract (Target Cost) |

|---|---|---|---|

| Price Certainty | Low | High | Medium |

| Risk Allocation | Shared between client and contractor | Primarily on the contractor | Shared, but with incentives for cost control |

| Suitability | Projects with uncertain scope or high risk | Projects with well-defined scope and low risk | Projects where a balance between price certainty and flexibility is desired |

| Cost Control | Requires strong monitoring and management | Less intensive monitoring needed | Incentives for both parties to manage costs effectively |

Cost Accounting and Reimbursement Procedures

Yo, Jogja-style peeps! So, you’re diving into cost-plus fee contracts? Cool. But let’s get real: keeping track of everything – from the smallest

- sego kucing* expense to the biggest project milestone – is crucial. This section breaks down how to manage the cost accounting and reimbursement side of things. Think of it as your ultimate guide to avoiding any

- uwes* (worries) with your client.

Cost accounting in a cost-plus fee contract isn’t just about adding up numbers; it’s about meticulous record-keeping. Every single expense needs to be documented, justified, and categorized correctly. This ensures transparency and prevents any misunderstandings later on. Imagine it like this: you’re creating a detailed, super-organized spreadsheet that’s ready for your client’s audit anytime.

Methods for Tracking and Documenting Costs

Proper cost tracking involves detailed documentation of all direct and indirect costs. Direct costs, like materials and labor directly tied to the project, are relatively straightforward. Indirect costs, such as office rent or administrative salaries, require careful allocation based on reasonable and agreed-upon methods. This might involve using a percentage of overhead or a more complex allocation system based on project hours.

Accurate time tracking is also crucial; consider using project management software to log every hour worked. A detailed breakdown of every expense, with supporting documentation like invoices and receipts, is key to a smooth reimbursement process. Think of it as building a super-solid case for every expense claim.

Cost Report Submission to the Client, What is cost plus fee contract

Submitting cost reports usually involves a pre-agreed-upon schedule and format. This could be monthly, quarterly, or even based on specific project milestones. Reports should include a summary of costs incurred, a detailed breakdown of each expense category, and supporting documentation. Clear and concise reporting is key; use visual aids like charts and graphs to make the data more accessible.

Pro-tip: Always submit reports on time and communicate any potential delays proactively. Your client appreciates transparency and clear communication.

Challenges in Cost Accounting and Reimbursement

Even with the best intentions, hiccups can happen. One common challenge is accurately allocating indirect costs. Another is dealing with unforeseen circumstances that cause cost overruns. Changes in material prices or unexpected delays can throw a wrench in the works. Another challenge is ensuring all documentation is complete and readily available for audit purposes.

A lack of clear communication between the parties involved can also lead to disagreements over reimbursements.

Best Practices for Accurate and Transparent Cost Reporting

Maintaining meticulous records is paramount. Use a dedicated accounting system designed for project tracking. Regularly reconcile your records to ensure accuracy. Proactive communication with the client about potential cost overruns or changes in the project scope is essential. Consider involving a third-party auditor to provide an independent verification of costs.

Transparency builds trust, so keep the lines of communication open and be responsive to client inquiries.

Fee Structure and Negotiation Strategies

Cost-plus fee contracts,

- ngeri*, are all about transparency—you know exactly what you’re paying for, but the final cost depends on the actual expenses. The fee structure, therefore, is crucial for both the client (the

- wong*) and the contractor (the

- tukang*). Getting it right means a smooth project and a happy ending for everyone.

The fee in a cost-plus fee contract isn’t just plucked out of thin air. It’s usually a percentage of the allowable costs, a fixed amount, or a combination of both. This percentage or fixed amount represents the contractor’s profit and covers their overhead, administrative costs, and the risk they’re taking on. Think of it as theirbayaran* for all the effort and expertise they’re bringing to the table.

Sometimes, there might also be incentives built in, like bonuses for finishing early or under budget, adding another layer to the negotiation.

Fee Determination Methods

Several methods exist for determining the fee. A common approach is to calculate a percentage of the estimated costs. For example, a 10% fee on a projected cost of 100 million Rupiah would result in a 10 million Rupiah fee. Another method involves setting a fixed fee, regardless of the actual costs incurred. This provides more predictability for the client, but it can also incentivize the contractor to control costs more carefully.

A hybrid approach combines a fixed fee with a percentage-based fee, offering a balance between risk and reward. The specific method selected depends on the project’s complexity, the client’s risk tolerance, and the contractor’s confidence in their cost estimations.

Factors Influencing Fee Negotiations

Several factors play a significant role in fee negotiations. The complexity of the project is a major one; a more complex project with higher risks will naturally command a higher fee. The contractor’s experience and reputation also influence the negotiation. A seasoned contractor with a proven track record can negotiate a higher fee than a newcomer. The market conditions, including the availability of skilled labor and materials, also impact the fee.

Finally, the client’s budget and their willingness to compromise are key determinants of the final fee. These factors interact in complex ways, shaping the dynamics of the negotiation.

Negotiation Strategies for a Favorable Fee Structure

For both parties, smart negotiation strategies are vital. The contractor should clearly present their costs, justifying each item, highlighting their expertise, and demonstrating their commitment to efficient project management. They can propose different fee structures, highlighting the advantages of each to find a suitable balance for both parties. The client, meanwhile, should thoroughly review the contractor’s cost breakdown, seeking clarification on any unclear items.

They should also be prepared to negotiate, but also be firm on their budget constraints and expectations regarding project quality and timeline. Open communication and mutual understanding are essential for a successful outcome.

Hypothetical Negotiation Scenario

Imagine Pak Budi, a seasoned contractor known for his meticulous work, is negotiating with Mbak Ani, a client building a

- homestay* in Kaliurang. Pak Budi initially proposes a 15% fee on estimated costs of 200 million Rupiah, citing the project’s complexity and his experience with similar projects. Mbak Ani, however, has a budget constraint of 250 million Rupiah for the entire project. After a detailed discussion, they agree on a 12% fee with a bonus for completing the project ahead of schedule, reducing the overall risk for both parties.

This compromise demonstrates successful negotiation, balancing the contractor’s expertise and the client’s budget. Pak Budi secures a reasonable profit, and Mbak Ani gets a quality

- homestay* within her budget.

Navigating the complexities of a cost-plus fee contract requires a clear understanding of its structure, potential risks, and the importance of transparent cost accounting. By carefully considering the fee structure, negotiating favorable terms, and implementing robust risk management strategies, both clients and contractors can ensure a successful and mutually beneficial project outcome. Remember, proactive communication and a well-defined contract are essential for minimizing disputes and maximizing project success.

Unlock the potential of cost-plus contracts with informed decision-making and a strategic approach.

Key Questions Answered

What are the main disadvantages of a cost-plus contract?

Potential for cost overruns due to less price certainty and the need for rigorous cost tracking. Also, potential for disputes over allowable costs.

How often are cost reports typically submitted in a cost-plus contract?

Frequency varies depending on the project and contract, but monthly or quarterly reports are common.

Can a cost-plus contract be terminated early?

Yes, but usually with pre-defined termination clauses specifying how costs and fees will be settled.

What is the role of an independent auditor in a cost-plus contract?

To verify the accuracy and reasonableness of reported costs, ensuring transparency and fairness.