What is cost reimbursable contract – What is a cost reimbursable contract? It’s a type of agreement where the buyer pays the seller for all actual costs incurred in performing a project, plus a predetermined fee. This arrangement differs from traditional fixed-price contracts, where the seller assumes the risk of cost overruns, and the buyer pays a fixed amount regardless of the actual expenses. Imagine a complex construction project with unpredictable site conditions.

A cost reimbursable contract allows the buyer to share the risk and benefit from the seller’s expertise, while providing flexibility to adapt to changing circumstances.

Cost reimbursable contracts are commonly used in situations where the scope of work is uncertain, the project involves high risk, or the buyer requires a high level of control over the project’s execution. These contracts offer advantages such as flexibility and access to specialized expertise, but they also come with inherent risks, such as potential cost overruns and the need for rigorous cost tracking and monitoring.

Definition of Cost Reimbursable Contracts: What Is Cost Reimbursable Contract

Cost reimbursable contracts are a type of agreement where the buyer pays the seller for the actual costs incurred in completing a project, plus a predetermined fee. This fee compensates the seller for their time, effort, and risk involved in the project.Cost reimbursable contracts are often used when the scope of work is uncertain, the project is complex, or the buyer requires a high level of control over the project.

They offer flexibility and allow for adjustments to the project scope as it progresses.

Characteristics of Cost Reimbursable Contracts

The core characteristics of cost reimbursable contracts distinguish them from other contract types, such as fixed-price contracts.

- Reimbursement of Actual Costs: The buyer reimburses the seller for the actual costs incurred in performing the work. These costs can include labor, materials, equipment, travel, and other expenses.

- Predetermined Fee: In addition to the actual costs, the seller receives a predetermined fee, often expressed as a percentage of the total cost or a fixed amount. This fee compensates the seller for their time, effort, and risk.

- Incentive Clauses: Cost reimbursable contracts often include incentive clauses that reward the seller for achieving specific performance goals, such as completing the project ahead of schedule or within budget.

- Close Collaboration and Monitoring: Cost reimbursable contracts require close collaboration and monitoring between the buyer and seller. The buyer typically has the right to review and approve the seller’s costs and progress reports.

- Risk Sharing: Cost reimbursable contracts involve risk sharing between the buyer and seller. The buyer assumes the risk of cost overruns, while the seller assumes the risk of not achieving the desired profit margin.

Real-World Example

Imagine a company is developing a new, complex software application. The company needs to hire a team of highly skilled developers to complete the project. However, the scope of work is uncertain, and the requirements may change as the project progresses. In this scenario, a cost reimbursable contract would be the most suitable option. The company can hire a team of developers and pay them for their actual costs, including labor, materials, and other expenses.

The developers also receive a predetermined fee for their time and effort. The company can also use incentive clauses to motivate the developers to complete the project ahead of schedule or within budget. By using a cost reimbursable contract, the company can ensure that they have access to the best talent, while also maintaining flexibility and control over the project.

Types of Cost Reimbursable Contracts

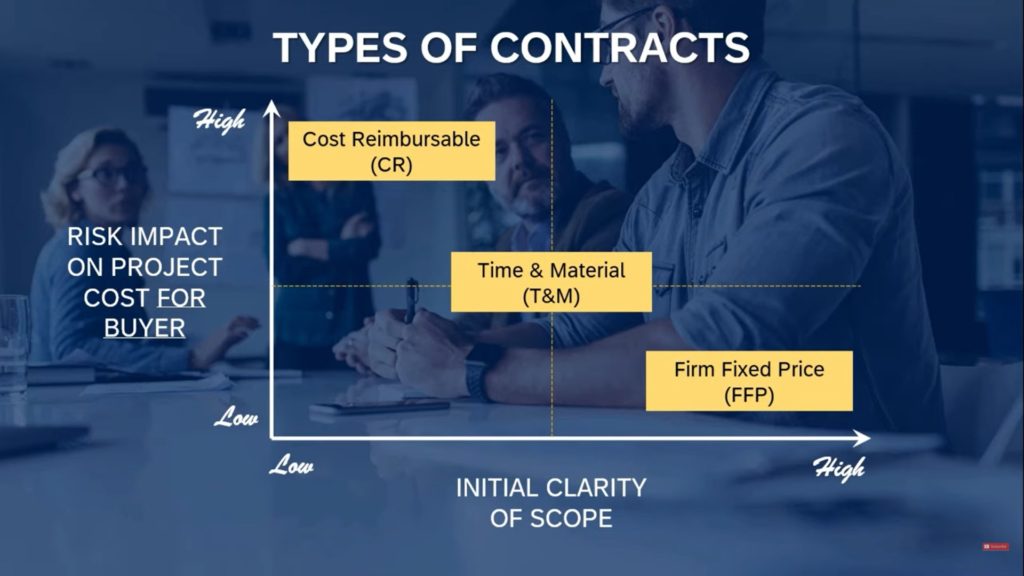

Cost-reimbursable contracts offer flexibility and can be beneficial for projects with uncertain scopes or complex requirements. However, they also introduce greater risk for the buyer, as the final cost is not predetermined. Let’s delve into the different types of cost-reimbursable contracts and understand how they impact risk allocation and financial incentives.

Cost Plus Fixed Fee (CPFF)

In a CPFF contract, the buyer reimburses the seller for all allowable costs incurred in performing the work, plus a fixed fee. The fixed fee is negotiated upfront and remains constant regardless of the actual cost of the project. This type of contract places a significant portion of the cost risk on the buyer, while the seller bears the risk of managing costs effectively.

Cost Plus Incentive Fee (CPIF)

The CPIF contract structure incentivizes the seller to control costs and achieve project goals by offering a potential bonus based on cost savings. The buyer reimburses the seller for allowable costs and a fee that is a function of achieving specific performance targets. The incentive fee is calculated based on a predetermined formula that considers the actual cost and the target cost.

The higher the cost savings, the greater the incentive fee. The CPIF contract aims to align the interests of both parties, encouraging the seller to prioritize cost efficiency while ensuring the buyer benefits from cost reductions.

Cost Plus Award Fee (CPAF)

In a CPAF contract, the buyer reimburses the seller for all allowable costs and an award fee based on subjective performance criteria. The award fee is determined after the project’s completion and is based on the seller’s performance evaluation against pre-defined criteria. This type of contract emphasizes achieving project objectives and delivering high-quality work. The buyer has more control over the project’s success, as the award fee is tied to the seller’s performance.

Comparison of Cost Reimbursable Contract Types

| Contract Type | Fee Structure | Risk Allocation | Incentives |

|---|---|---|---|

| CPFF (Cost Plus Fixed Fee) | Fixed fee, regardless of actual costs | Buyer bears most cost risk | None, except for the fixed fee |

| CPIF (Cost Plus Incentive Fee) | Incentive fee based on cost savings | Shared risk, with buyer sharing in cost savings | Incentive fee for cost savings |

| CPAF (Cost Plus Award Fee) | Award fee based on performance evaluation | Buyer bears most cost risk | Award fee for meeting performance criteria |

Cost Reimbursement Contract Elements

Cost reimbursement contracts, unlike fixed-price contracts, involve the reimbursement of actual incurred costs, making it crucial to establish clear and transparent cost tracking and reporting mechanisms. This section delves into the essential elements that form the foundation of cost reimbursement contracts.

Cost Allowability

Cost allowability refers to the criteria used to determine which costs are eligible for reimbursement under the contract. These criteria are typically Artikeld in the contract itself or in government regulations for government contracts.

- Direct Costs: These are costs directly associated with the performance of the contract, such as labor, materials, and equipment.

- Indirect Costs: These costs are not directly tied to a specific contract but are necessary for the overall operation of the business, such as rent, utilities, and administrative expenses.

- Reasonable Costs: Costs must be reasonable and necessary for the performance of the contract. This means that they should be justified and not excessive.

- Allocable Costs: Costs must be properly allocated to the contract, meaning they are fairly and accurately assigned to the specific work performed under the contract.

Cost allowability is a crucial aspect of cost reimbursement contracts as it ensures that only legitimate and justifiable expenses are reimbursed.

Fee Structure

The fee structure in a cost reimbursement contract represents the contractor’s profit margin and is typically calculated as a percentage of the total allowable costs.

- Fixed Fee: A fixed fee is a predetermined amount that is paid to the contractor regardless of the actual costs incurred. This fee structure provides a predictable profit for the contractor but does not incentivize cost control.

- Incentive Fee: An incentive fee structure rewards the contractor for exceeding performance targets or achieving cost savings. This fee structure incentivizes the contractor to control costs and improve performance.

- Cost-Plus-Percentage-of-Cost Fee: This fee structure involves a percentage of the allowable costs being added as a fee. However, this structure is generally discouraged as it can lead to excessive costs.

The chosen fee structure plays a significant role in shaping the contractor’s financial incentives and can impact the overall cost of the project.

Performance Reporting Requirements

Cost reimbursement contracts typically require detailed and regular performance reporting to ensure transparency and accountability.

- Cost Reports: These reports provide a detailed breakdown of all costs incurred under the contract, including direct and indirect costs. They are typically submitted on a regular basis, such as monthly or quarterly.

- Progress Reports: These reports provide updates on the progress of the project, including milestones achieved, remaining work, and any potential delays or issues.

- Audits: Independent audits are often conducted to verify the accuracy of the cost reports and ensure that all costs claimed are allowable and reasonable.

These reporting requirements are crucial for monitoring project progress, identifying potential cost overruns, and ensuring that the contractor is performing in accordance with the contract terms.

Cost Accounting and Auditing

Accurate cost accounting and auditing are essential for effective cost reimbursement contracts.

- Cost Accounting: This involves the systematic recording, classifying, and summarizing of all costs incurred under the contract. It ensures that costs are properly tracked and allocated to the appropriate contract elements.

- Auditing: Independent audits are conducted to verify the accuracy of the cost reports and ensure that all costs claimed are allowable and reasonable. Audits can be performed by internal or external auditors and are typically conducted at regular intervals.

Robust cost accounting and auditing practices provide a strong foundation for accurate cost tracking and reimbursement, minimizing the risk of disputes and ensuring fair compensation for the contractor.

Potential Risks Associated with Cost Overruns

Cost overruns are a significant risk associated with cost reimbursement contracts, particularly when there is a lack of effective cost control mechanisms.

- Lack of Cost Control: Insufficient attention to cost control can lead to unnecessary expenses and overruns. This can occur due to factors such as poor planning, inefficient processes, or inadequate monitoring.

- Scope Creep: Changes in the scope of work without proper cost adjustments can lead to cost overruns. It is essential to have a clear and defined scope of work and to manage any changes effectively.

- Unforeseen Circumstances: Unexpected events, such as natural disasters or supply chain disruptions, can significantly impact project costs and lead to overruns. It is important to have contingency plans in place to mitigate these risks.

Effective cost control measures are essential to mitigate the risk of cost overruns and ensure that the project remains within budget.

Mitigating Cost Overruns

Several strategies can be employed to mitigate the risk of cost overruns in cost reimbursement contracts.

- Detailed Cost Estimates: Accurate and detailed cost estimates are essential for establishing a realistic budget and identifying potential cost drivers. This involves careful planning, market research, and expert input.

- Effective Cost Control Measures: Implementing robust cost control measures, such as regular cost monitoring, variance analysis, and cost-saving initiatives, is crucial for identifying and addressing potential cost overruns.

- Contingency Planning: Establishing contingency plans for unforeseen events can help mitigate the impact of unexpected circumstances on project costs. These plans should include strategies for managing risks, such as delays, supply chain disruptions, or changes in regulations.

- Performance Incentives: Incentive fee structures can motivate contractors to control costs and improve performance. This can be particularly effective when the incentive is aligned with specific cost-saving targets.

By implementing these strategies, parties can work together to minimize the risk of cost overruns and ensure the successful completion of the project within budget.

Advantages and Disadvantages of Cost Reimbursable Contracts

Cost reimbursable contracts, often used in complex or uncertain projects, allow for flexibility and risk sharing. However, they also present challenges in cost control and potential for cost overruns.

Advantages of Cost Reimbursable Contracts

Cost reimbursable contracts offer advantages in situations where project scope or requirements are uncertain, and flexibility is essential.

- Flexibility: The open-ended nature of cost reimbursable contracts allows for adjustments in scope, requirements, and timelines as the project progresses. This flexibility is particularly valuable in complex projects with evolving needs.

- Risk Sharing: Cost reimbursable contracts distribute risk between the contractor and the client. The client assumes the risk of cost overruns, while the contractor is incentivized to manage costs effectively.

- Innovation and Creativity: The potential for cost recovery encourages contractors to explore innovative solutions and propose creative approaches to meet project objectives.

- Suitable for Complex Projects: Cost reimbursable contracts are well-suited for complex projects with unpredictable requirements, such as research and development, engineering, or construction projects with unique design challenges.

Disadvantages of Cost Reimbursable Contracts

Despite their flexibility, cost reimbursable contracts have inherent disadvantages that can impact project costs and control.

- Potential for Cost Overruns: The lack of a fixed price can lead to cost overruns if the project scope expands or unforeseen challenges arise.

- Challenges in Cost Control: Monitoring and controlling costs can be challenging due to the open-ended nature of the contract. This requires robust cost tracking and reporting systems.

- Limited Incentive for Cost Reduction: Contractors may have less incentive to minimize costs compared to fixed-price contracts, as they are reimbursed for actual expenses.

- Increased Administrative Burden: Cost reimbursable contracts involve extensive documentation and reporting requirements to ensure accurate cost tracking and reimbursement.

Cost Reimbursable Contracts in Different Industries

Cost reimbursable contracts find application across various industries, each with its unique needs and challenges that shape the design and implementation of these contracts. Let’s delve into how these contracts are utilized in different sectors.

Construction, What is cost reimbursable contract

Cost reimbursable contracts are frequently employed in construction projects, particularly for large-scale, complex, or highly specialized undertakings. Here’s how they’re utilized:

- Large-scale Projects: For projects like skyscrapers, bridges, or dams, where the scope and complexity are significant, cost reimbursable contracts allow for flexibility in design and execution, as the exact costs and requirements may not be fully known at the outset.

- Complex Projects: When a project involves intricate engineering or specialized construction techniques, cost reimbursable contracts can provide a framework for handling unforeseen challenges and adjusting the scope of work as needed.

- Uncertain Site Conditions: In cases where site conditions are uncertain, such as when working on a project with unpredictable geological formations, cost reimbursable contracts allow for adjustments to the budget based on actual site conditions.

Engineering

In engineering, cost reimbursable contracts are commonly used for projects involving research and development, design, and construction of complex systems:

- Research and Development: For projects pushing the boundaries of engineering knowledge, cost reimbursable contracts allow for flexibility in research and development, as the exact outcomes and costs may not be predictable.

- Design and Construction of Complex Systems: Projects like power plants, refineries, or aerospace systems often involve complex design and construction phases, making cost reimbursable contracts suitable for managing the uncertainties involved.

- Long-Term Projects: In engineering projects with extended timelines, cost reimbursable contracts can provide a framework for managing the evolving costs and requirements over the project’s duration.

Research and Development

Cost reimbursable contracts are widely used in research and development, particularly for projects involving:

- Innovative Technologies: For projects exploring new technologies, where the outcomes and costs are inherently uncertain, cost reimbursable contracts provide a mechanism for managing the risks associated with innovation.

- Government-Funded Research: Government agencies often utilize cost reimbursable contracts to support research and development projects that align with national priorities.

- University Research: Universities and research institutions frequently employ cost reimbursable contracts to secure funding for research projects, enabling them to pursue ambitious and innovative endeavors.

Government Contracting

Government contracting often involves the use of cost reimbursable contracts, particularly for projects with:

- National Security Implications: Projects related to defense, intelligence, or space exploration often involve high levels of complexity and national security considerations, making cost reimbursable contracts a suitable approach for managing these factors.

- Public Interest: Government contracts for projects like infrastructure development or public health initiatives often involve public interest considerations, and cost reimbursable contracts can provide a framework for ensuring the project’s successful completion.

- Unique Requirements: Government contracts may have specific requirements or specifications that necessitate flexibility in the project’s execution, making cost reimbursable contracts a viable option.

In conclusion, cost reimbursable contracts offer a unique approach to project management, providing both advantages and disadvantages. While they offer flexibility and shared risk, they require careful planning, robust cost controls, and a strong understanding of the project’s potential complexities. Understanding the intricacies of these contracts is crucial for buyers and sellers alike to ensure successful project outcomes and a mutually beneficial relationship.

General Inquiries

What are some common examples of cost reimbursable contracts in real-world scenarios?

Cost reimbursable contracts are often used in government contracting, research and development projects, and complex construction projects. For example, NASA uses cost reimbursable contracts for space exploration missions, while large-scale infrastructure projects may utilize them to account for unforeseen site conditions or design changes.

How are cost reimbursable contracts different from fixed-price contracts?

In a fixed-price contract, the seller bears the risk of cost overruns, while the buyer pays a fixed amount regardless of the actual expenses. In a cost reimbursable contract, the buyer shares the risk of cost overruns, and the seller is reimbursed for actual costs incurred plus a predetermined fee.

What are some of the potential risks associated with cost reimbursable contracts?

The main risk associated with cost reimbursable contracts is the potential for cost overruns. Other risks include a lack of cost control, poor communication, and potential disputes over the allowability of costs.