Does va disability count income food stamps – Does VA disability count income for food stamps? The question hangs heavy in the air, a whisper in the bureaucratic maze. For veterans navigating the complex landscape of benefits, the answer is crucial, a key unlocking access to vital sustenance or a barrier to a stable life. The seemingly simple query unravels into a tapestry of regulations, state-specific nuances, and individual circumstances, each thread adding to the mystery.

Understanding the interplay between VA disability payments and Supplemental Nutrition Assistance Program (SNAP) eligibility requires careful examination, a journey into the heart of government assistance programs and their impact on those who have served.

This exploration delves into the intricate details of reporting VA disability income for SNAP applications, analyzing how different compensation levels influence eligibility. We’ll uncover the impact of additional income sources, the variations across states, and the resources available to veterans seeking assistance. Prepare to navigate the shadows and the light as we unravel the truth behind this critical question.

VA Disability Benefits and Income Reporting

Applying for and receiving government assistance programs like Supplemental Nutrition Assistance Program (SNAP), often called food stamps, can be a complex process, especially when considering additional income sources such as VA disability benefits. Understanding how these benefits are reported is crucial to ensure you receive the assistance you’re entitled to. Accurate and timely reporting prevents delays and potential penalties.VA disability payments are considered income when applying for food stamps.

They must be reported to your state’s SNAP agency. Failure to accurately report this income can lead to overpayment of benefits, requiring repayment, or even disqualification from the program. The reporting process is straightforward but requires careful attention to detail.

Reporting VA Disability Benefits to SNAP

The process of reporting your VA disability benefits involves providing documentation to your state’s SNAP agency. This documentation verifies the amount of your monthly benefit payment. You typically report this income during your initial application and then annually or as your income changes. The specific requirements and timelines may vary slightly depending on your state. You will need to contact your local SNAP office for precise instructions and deadlines.

Many states have online portals that allow for convenient reporting and application tracking.

Documentation Needed for Verification

To verify your VA disability income, you’ll generally need to provide copies of official documentation from the Department of Veterans Affairs (VA). This usually includes a recent award letter or a statement of benefits showing the amount of your monthly disability compensation. Other supporting documentation may include your VA disability rating decision letter and any letters indicating changes to your benefits.

Always keep copies of all submitted documents for your records.

Income Reporting Summary Table

| Income Source | Reporting Requirement | Impact on SNAP Benefits | Relevant Regulations |

| VA Disability Benefits | Report monthly payment amount to SNAP agency during application and annually, or when benefits change. | Reduces the amount of SNAP benefits received; the amount of the reduction depends on household size and other income sources. | State-specific SNAP regulations and the federal Food and Nutrition Act. Specific regulations vary by state, but the core principle of income reporting remains consistent. |

| Other Income (e.g., employment) | Report all income sources, including wages, self-employment income, and other government benefits. | Similar to VA disability, reduces SNAP benefits based on total household income. | State-specific SNAP regulations and the federal Food and Nutrition Act. |

| Deductions (e.g., medical expenses) | Some deductions may be allowed, reducing countable income. Consult your state’s SNAP agency for details. | May increase the amount of SNAP benefits received. | State-specific SNAP regulations and the federal Food and Nutrition Act. |

Impact of VA Disability on Food Stamp Eligibility

Navigating the complexities of government assistance programs can be challenging, especially when dealing with multiple sources of income like VA disability benefits and potential eligibility for Supplemental Nutrition Assistance Program (SNAP), often known as food stamps. Understanding how these interact is crucial for veterans and their families. This section clarifies the relationship between VA disability compensation and SNAP eligibility.VA disability compensation is considered income when determining eligibility for SNAP benefits.

However, the amount of disability compensation received significantly influences the overall calculation. The higher the disability rating, generally leading to higher monthly payments, will naturally affect the applicant’s net income and therefore their eligibility for SNAP. The process is not simply a direct comparison; deductions and other factors play a crucial role.

VA Disability Compensation Levels and SNAP Eligibility

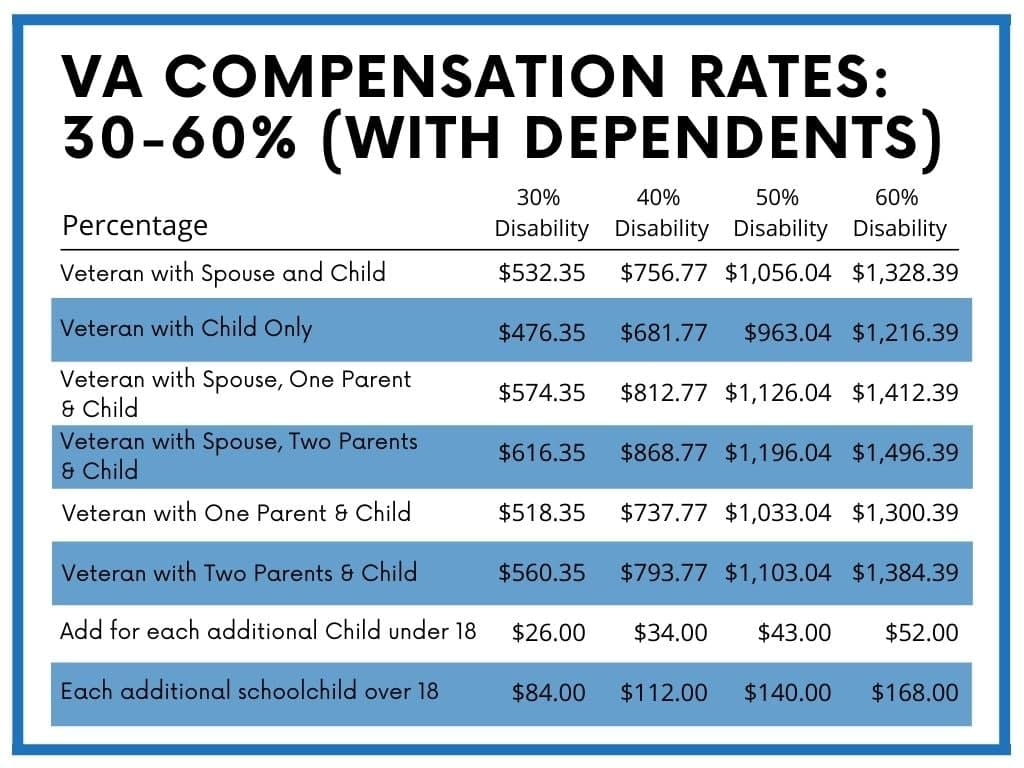

The amount of monthly VA disability compensation directly impacts SNAP eligibility. Someone receiving a 10% disability rating will receive a smaller monthly payment than someone with a 100% disability rating. This difference in payment amounts drastically alters their net income, consequently impacting their eligibility for SNAP. For example, a veteran with a 10% disability rating might easily fall below the income threshold for SNAP, while a veteran with a 100% rating might still qualify after accounting for allowable deductions.

Specific income limits vary by state and household size, so consulting the relevant state’s SNAP guidelines is crucial.

Comparison of SNAP Income Limits and Common VA Disability Payment Amounts

SNAP income limits are determined by household size and state of residence. These limits are updated periodically. To illustrate, let’s consider a hypothetical scenario: A single veteran in California receives $1,500 per month in VA disability compensation (a common amount for a high disability rating). If the SNAP income limit for a single-person household in California is $1,800 per month, this veteran might be eligible for SNAP, especially if deductions for medical expenses or other allowable costs reduce their net income further.

Conversely, a veteran with a lower disability rating receiving $500 might easily fall below the income limit and qualify without needing additional deductions. It’s imperative to consult current SNAP guidelines for accurate income limits in your specific location.

Deductions Allowed for Calculating Net Income for SNAP Applications

Several deductions can significantly reduce a veteran’s net income for SNAP eligibility calculations. These deductions can include medical expenses, childcare costs, and dependent care expenses. For instance, substantial medical bills related to a service-connected disability can be deducted from the gross income, potentially lowering the net income below the SNAP eligibility threshold. Accurate documentation of these expenses is critical for a successful application.

The specific deductions allowed and the documentation required vary by state and should be confirmed with the local SNAP office.

Determining SNAP Eligibility Based on VA Disability Income: A Flowchart

The process of determining SNAP eligibility with VA disability income can be visualized with a flowchart. The flowchart would begin with determining the veteran’s VA disability rating and corresponding monthly compensation. Next, it would involve calculating the gross monthly income, which includes VA disability payments and any other income sources. Following this, allowable deductions (medical expenses, childcare costs, etc.) would be subtracted to determine the net monthly income.

Finally, this net income would be compared to the state’s SNAP income limits for the appropriate household size. If the net income is below the limit, the applicant is likely eligible; otherwise, they are likely ineligible. The flowchart would clearly depict these steps, branching based on the outcome of each calculation.

Additional Income Sources and Their Impact

Understanding how additional income sources interact with VA disability benefits is crucial for accurately determining SNAP eligibility. Many veterans receive VA disability payments and may also have other sources of income, such as employment or pensions. The combination of these incomes determines whether they remain eligible for Supplemental Nutrition Assistance Program (SNAP) benefits. It’s essential to remember that eligibility rules can vary by state, so consulting your local SNAP office for precise details is always recommended.The interaction between VA disability payments and other income sources is complex.

The calculation of eligibility considers both earned income (from employment) and unearned income (from sources like pensions, investments, or alimony). Simply put, the total of all income sources is assessed against the established SNAP income limits. Exceeding these limits will result in a reduction or complete loss of SNAP benefits, even if a significant portion of the income comes from VA disability.

Earned and Unearned Income Considerations

Both earned and unearned income are factored into the SNAP eligibility calculation alongside VA disability benefits. Earned income, such as wages from a part-time job, is directly added to the total income. Unearned income, such as a pension or rental income, is also included in this calculation. The total income, which includes VA disability, earned income, and unearned income, is then compared to the income limits specific to the household size and location.

It’s important to report all income sources accurately and promptly to maintain SNAP eligibility. Failure to do so can lead to penalties, including repayment of benefits received. The calculation often involves deductions for work-related expenses and certain medical expenses, which can slightly alter the final income figure used to determine eligibility.

Examples of Additional Income Sources Affecting SNAP Eligibility

It is vital to understand how various additional income sources can influence SNAP eligibility. Here’s a list illustrating the potential impact:

- Part-time Job Wages: Even a small part-time job can significantly impact SNAP benefits. The wages earned are added to the total income, potentially pushing the individual above the eligibility limit.

- Retirement Pension: Pension income, whether from a government program or a private employer, is considered unearned income and is included in the total income calculation for SNAP eligibility.

- Social Security Income (SSI): SSI benefits are also considered when calculating total income for SNAP. The combination of SSI and VA disability could potentially exceed the income limits.

- Alimony or Child Support: These types of income are considered unearned income and are factored into the SNAP eligibility calculation.

- Rental Income: Income generated from rental properties is considered unearned income and will be added to the overall income assessment.

- Interest or Dividend Income: Income from investments such as interest from savings accounts or dividends from stocks is classified as unearned income and is included in the SNAP income calculation.

Accurate and timely reporting of all income sources is paramount to maintaining SNAP eligibility. Failure to do so can result in penalties and loss of benefits.

State-Specific Variations in Eligibility Rules

Navigating the complexities of Supplemental Nutrition Assistance Program (SNAP) eligibility can be challenging, especially for veterans receiving VA disability benefits. The federal government sets broad guidelines for SNAP, but states retain significant leeway in implementing and interpreting these rules, leading to considerable variations in eligibility criteria across the nation. This often impacts veterans’ access to crucial food assistance. Understanding these state-specific differences is critical for ensuring veterans receive the support they deserve.State-level SNAP programs often incorporate unique rules regarding how VA disability compensation is considered as income.

Some states might have stricter income limits or more stringent asset tests than others. Additionally, the way states calculate income from VA disability can vary, impacting the overall eligibility determination. This necessitates a thorough understanding of the specific regulations in each state to accurately determine eligibility.

SNAP Eligibility Criteria Comparison: California and Texas

California and Texas offer a useful comparison of state-level variations in SNAP eligibility for veterans receiving VA disability. While both states adhere to federal SNAP guidelines, their implementation differs in several key areas. For instance, California may offer more generous deductions or exemptions for certain expenses related to disability, leading to a higher likelihood of eligibility for some veterans compared to Texas.

Texas, on the other hand, might have a stricter interpretation of what constitutes countable income from VA disability benefits, potentially reducing eligibility for certain individuals. These differences underscore the importance of consulting state-specific resources for accurate information.

State-Specific Programs for Veterans’ Food Security, Does va disability count income food stamps

Several states have implemented targeted programs to bolster food security for veterans, particularly those receiving VA disability benefits. These initiatives often complement the federal SNAP program by providing additional resources or streamlining the application process. Some states might offer dedicated veteran assistance programs within their SNAP agencies, while others may partner with veteran organizations to provide food banks or other supplemental food support.

These programs demonstrate a commitment to supporting veterans’ well-being beyond the standard federal benefits.

| State | Specific Regulations Regarding VA Disability and SNAP Eligibility |

| California | California generally follows federal guidelines but may have more lenient interpretations regarding deductions for medical expenses related to a service-connected disability, potentially increasing eligibility for some veterans. Specific details are available on the California Department of Social Services website. |

| Texas | Texas may have a stricter interpretation of countable income from VA disability benefits, potentially resulting in lower eligibility rates compared to some other states. The Texas Health and Human Services Commission website provides detailed information on SNAP eligibility requirements. |

Resources and Support for Veterans

Navigating the complexities of applying for and receiving benefits like food stamps (SNAP) can be challenging, especially for veterans who may be dealing with disabilities or other circumstances. Fortunately, numerous resources and support systems are available to help veterans access the assistance they need. Understanding these resources and how to utilize them effectively can significantly improve the application process and increase the likelihood of a successful outcome.

Organizations and Government Agencies Offering Assistance

Several organizations and government agencies are dedicated to assisting veterans in accessing food stamps and other vital benefits. These entities offer support ranging from application assistance to advocacy and appeals processes. Knowing where to find these resources is crucial for veterans seeking support.

- The Department of Veterans Affairs (VA): While the VA doesn’t directly administer SNAP, their caseworkers can often provide guidance and connect veterans with relevant resources. They can also help veterans understand how their VA disability benefits may impact their SNAP eligibility.

- The Food and Nutrition Service (FNS): This is the federal agency responsible for administering the SNAP program. Their website provides comprehensive information about eligibility requirements, application procedures, and benefits.

- State-level social service agencies: Each state has its own agency responsible for administering SNAP benefits. These agencies can provide personalized assistance with applications, address specific state-level requirements, and offer support throughout the process.

- Veteran service organizations (VSOs): Groups like the American Legion, Veterans of Foreign Wars (VFW), and Paralyzed Veterans of America offer assistance with various veteran benefits, including SNAP application guidance and advocacy.

- Local food banks and pantries: While not directly involved in the SNAP application process, these organizations provide crucial food assistance to veterans facing immediate food insecurity while they await approval or navigate the application process.

SNAP Application Process for Veterans Receiving VA Disability

Applying for SNAP benefits as a veteran receiving VA disability involves providing documentation demonstrating income and expenses. The process generally begins with an online application or through a local SNAP office. Veterans should be prepared to provide documentation of their VA disability rating, bank statements, pay stubs (if applicable), and other relevant financial information. The application will be reviewed to determine eligibility based on household size, income, and assets.

Appealing a Denial of SNAP Benefits

If a veteran’s SNAP application is denied, they have the right to appeal the decision. The appeal process varies by state, but generally involves filing a written request for reconsideration with the state agency administering SNAP benefits. The request should clearly state the reasons for appealing the decision and provide any additional supporting documentation. Veterans can seek assistance from VSOs or legal aid organizations during this process.

Finding Contact Information for Relevant Agencies

Let’s say a veteran, Mr. Johnson, needs to find the contact information for his state’s SNAP agency. He can start by searching online for “[State Name] SNAP benefits” or “[State Name] food stamps.” This search will typically lead him to the state’s human services or social services agency website, which will have contact information, including phone numbers, addresses, and online application portals.

He can also use the FNS website to locate a state-specific contact. Alternatively, he can contact a VSO for assistance in finding the relevant contact information.

The path to securing food assistance while receiving VA disability benefits is fraught with complexities, a winding road requiring patience, persistence, and a thorough understanding of the rules. While the initial question, “Does VA disability count income for food stamps?”, appears straightforward, the answer reveals a nuanced system that necessitates careful navigation. Understanding the reporting requirements, income limitations, and state-specific variations is paramount.

This journey into the world of SNAP and VA benefits underscores the importance of seeking assistance from the organizations dedicated to supporting veterans and ensuring their access to essential resources. The struggle may be real, but the resources to overcome the challenges are available; the key is knowing where to find them and how to effectively utilize them.

Quick FAQs: Does Va Disability Count Income Food Stamps

What happens if my VA disability payment changes?

You must report any changes in your VA disability payments to your SNAP caseworker immediately. Failure to do so can result in overpayment and potential penalties.

Can I receive both VA disability and SNAP benefits if I have a part-time job?

Yes, but your earned income from the part-time job will be factored into your total income when determining your SNAP eligibility. The amount you receive in SNAP benefits will be reduced based on your total income, including the VA disability payment and earnings.

What if my SNAP application is denied?

You have the right to appeal the denial. Contact your local SNAP office to understand the appeal process and obtain necessary forms.

Where can I find more information about state-specific rules?

Contact your state’s SNAP agency or visit their website. Information varies significantly by state.