How much does a silver futures contract cost? That’s the burning question, isn’t it? Trading silver futures can feel like navigating a mystical Pontianak market – exciting, potentially lucrative, but definitely needing a solid understanding. We’re diving deep into the world of silver futures, breaking down the costs, the risks, and everything in between, so you can make informed decisions without getting lost in the jargon.

Think of this as your cheat sheet to conquering the silver market.

From contract sizes and margin requirements to the impact of global events on pricing, we’ll demystify the process. We’ll explore how supply and demand, economic shifts, and even geopolitical drama all play a part in determining the final cost. We’ll even look at real-world examples of both profitable and unprofitable trades, so you get a complete picture. Get ready to level up your trading game!

Contract Pricing and Valuation: How Much Does A Silver Futures Contract Cost

The pricing of silver futures contracts, a complex interplay of supply and demand within a highly speculative market, is far from transparent. While ostensibly driven by fundamental factors like industrial demand and mine production, the reality is far muddier, influenced heavily by market manipulation and the inherent volatility of precious metals trading. Understanding this pricing mechanism requires a critical eye, recognizing the inherent power imbalances within the system.The price discovery process for silver futures contracts primarily occurs on exchanges like the COMEX (Commodity Exchange) division of the CME Group.

These exchanges employ a sophisticated auction system where buyers and sellers interact, setting the price through a continuous process of bid and ask orders. This price, however, is not immune to manipulation. Large financial institutions and even governments have been accused of using their considerable market power to influence prices to their advantage, making it difficult to discern a “true” market value.

Price Determination Methods

Several factors contribute to the price of a silver futures contract. These include global silver supply and demand dynamics, macroeconomic conditions (inflation, interest rates, currency fluctuations), investor sentiment (speculation and hedging activities), and geopolitical events (mining disruptions, political instability in producing regions). However, the weight given to each factor is subjective and often debated, further complicating accurate price prediction.

Quantitative models attempt to capture these relationships, but their effectiveness is questionable given the inherent unpredictability of the market and the potential for manipulation.

Comparison of Pricing Models

Various pricing models exist, each with its strengths and limitations. Fundamental analysis, focusing on underlying supply and demand factors, is often contrasted with technical analysis, which relies on historical price patterns and chart indicators. Quantitative models, employing statistical techniques to identify correlations and predict future prices, are also employed. However, no single model consistently outperforms others, highlighting the inherent challenges in predicting silver prices accurately.

The limitations of these models are exacerbated by the potential for market manipulation, making any model’s predictive power suspect.

Profit and Loss Calculation

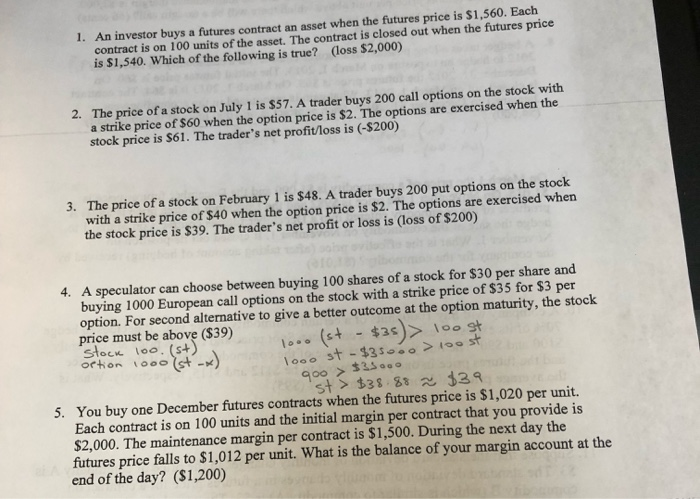

Calculating profit or loss on a silver futures contract involves understanding the contract size (typically 5,000 troy ounces) and the price movement. Profit is realized when the contract is sold at a higher price than it was bought, and loss occurs when the opposite happens. The calculation is straightforward:

Profit/Loss = (Selling Price – Buying Price) x Contract Size x Contract Multiplier

The contract multiplier converts the price per ounce into the total contract value. For instance, a $1 increase in the price of silver per ounce would result in a $5,000 profit (or loss) on a single contract. However, leverage significantly magnifies both profits and losses, making futures trading inherently risky. This leverage is a double-edged sword, capable of generating substantial returns but equally capable of causing devastating losses.

Price Chart Interpretation and Technical Indicators

Interpreting price charts involves analyzing historical price data to identify trends, support and resistance levels, and patterns. Technical indicators, such as moving averages, relative strength index (RSI), and MACD, provide additional signals about potential price direction. However, these indicators are not foolproof and should be used in conjunction with fundamental analysis and a critical understanding of market dynamics.

Over-reliance on technical indicators, without considering the broader geopolitical and economic context, can lead to significant losses. Furthermore, the interpretation of these charts is subjective, and different traders may draw different conclusions from the same data.

Risk Management Strategies

Trading silver futures contracts, while potentially lucrative, exposes investors to significant financial risks. The volatile nature of the silver market, influenced by macroeconomic factors, geopolitical events, and speculative trading, necessitates a robust risk management framework. Ignoring these risks can lead to substantial losses, even wiping out an entire investment portfolio. Therefore, a proactive and comprehensive approach is crucial for navigating the complexities of this market.

Potential Risks Associated with Silver Futures Trading

Silver futures contracts are susceptible to various risks. Price volatility is paramount; sharp price swings can occur rapidly, causing substantial losses if positions are not managed correctly. Market liquidity, while generally high for silver, can thin during periods of extreme volatility or market stress, making it difficult to exit positions at desired prices. Counterparty risk, the risk that the other party in a contract will default, is another concern, although this is mitigated somewhat by the exchange’s clearinghouse.

Furthermore, margin calls, where investors are required to deposit additional funds to maintain their positions, can lead to forced liquidation if funds are not readily available. Finally, geopolitical instability and unexpected economic events can significantly impact silver prices, presenting unforeseen risks. For instance, the 2008 financial crisis saw a dramatic drop in silver prices, causing significant losses for many investors who were not adequately prepared.

Risk Management Techniques

Several techniques can effectively mitigate the inherent risks in silver futures trading. Diversification, spreading investments across different assets, reduces the impact of losses in any single asset. Position sizing, carefully determining the amount of capital allocated to each trade, limits potential losses. Stop-loss orders, automatically selling a contract when it reaches a predetermined price, helps to control losses.

Hedging, using offsetting positions in related markets, can minimize exposure to price fluctuations. Fundamental and technical analysis, evaluating market trends and underlying factors, informs trading decisions. Regular monitoring and review of positions are crucial for early identification and response to emerging risks. For example, an investor might use technical analysis to identify support and resistance levels, setting stop-loss orders accordingly to limit potential losses if the price breaks through these levels.

Hedging Strategies in Silver Futures

Hedging involves using futures contracts to offset potential losses in a related market. A silver producer, for instance, might sell silver futures contracts to lock in a future price for their silver production, protecting against price declines. Conversely, a company that uses silver in its manufacturing process might buy silver futures contracts to hedge against price increases. The effectiveness of hedging depends on the correlation between the hedged asset and the futures contract.

Imperfect correlation can lead to some residual risk, but hedging can still significantly reduce overall exposure to price volatility. The choice of hedging strategy depends on the specific risk profile and objectives of the investor.

Best Practices for Managing Risk in Silver Futures Trading

A comprehensive risk management plan is essential for successful silver futures trading. This includes thorough research and understanding of market dynamics, careful position sizing to avoid overexposure, the consistent use of stop-loss orders to limit potential losses, and diversification across multiple assets to reduce overall portfolio risk. Regular monitoring of positions and market conditions allows for timely adjustments to the trading strategy.

Furthermore, seeking advice from experienced financial professionals can provide valuable insights and guidance. Maintaining sufficient capital reserves to withstand potential margin calls is also crucial. Finally, developing a well-defined trading plan with clear entry and exit strategies helps to maintain discipline and avoid emotional decision-making, which often leads to poor trading outcomes.

Illustrative Examples

Understanding the mechanics of silver futures trading requires examining concrete examples. The following scenarios illustrate both profitable and unprofitable trades, highlighting the inherent risks and rewards involved. These examples are simplified for clarity and do not account for all potential brokerage fees or margin calls.

A Profitable Silver Futures Trade

Imagine a trader, let’s call him Alex, believes the price of silver will rise due to increased industrial demand and geopolitical instability. On June 1st, he buys one silver futures contract (typically representing 5,000 troy ounces) at $25 per ounce, for a total contract value of $125,000. This requires a margin deposit, a fraction of the contract’s total value, say $5,000.

Alex’s analysis proves correct. By July 1st, the silver price has surged to $28 per ounce. Alex closes his position by selling his contract. His profit is calculated as ($28 – $25)5,000 ounces = $15,000. After deducting any brokerage fees, his net profit represents a significant return on his $5,000 initial margin.

This success, however, is contingent upon accurate market forecasting and risk management. A slight shift in market sentiment could easily negate these gains.

A Loss-Making Silver Futures Trade, How much does a silver futures contract cost

Conversely, consider another trader, Beatrice, who anticipates a price decline in silver due to a perceived oversupply in the market. She decides to sell one silver futures contract short on June 1st at $25 per ounce. Her strategy involves profiting from the price decrease. However, unexpected technological advancements boost industrial demand for silver, causing the price to rise to $27 per ounce by July 1st.

Beatrice is forced to buy back the contract to cover her short position, resulting in a loss of ($27 – $25)5,000 ounces = $10,000, before brokerage fees. This example demonstrates how even a seemingly well-informed trade can result in substantial losses if market conditions deviate from expectations. The leverage inherent in futures contracts magnifies both profits and losses, underscoring the need for disciplined risk management.

Beatrice’s loss highlights the crucial role of accurate market analysis and the inherent volatility of the commodities market. Her initial assessment of the market proved flawed, leading to significant financial repercussions.

So, how much

-does* a silver futures contract cost? The truth is, there’s no single answer. The price is a dynamic dance influenced by a multitude of factors, from market sentiment to global economic conditions. But armed with the knowledge we’ve covered – understanding contract specifications, margin requirements, and the various fees involved – you can now approach the silver futures market with confidence.

Remember to always manage your risk, stay informed, and maybe, just maybe, you’ll strike silver!

Commonly Asked Questions

What are the typical commission fees for silver futures trading?

Commission fees vary greatly depending on your broker. It’s best to check directly with your chosen brokerage for their specific fee schedule.

How often do silver futures contracts expire?

Silver futures contracts have various expiry dates, usually monthly or quarterly. Check the specific contract specifications for the exact date.

Can I trade silver futures with a small account?

Yes, but be mindful of margin requirements. Smaller accounts may limit your trading capacity and increase your risk exposure.

Are there any tax implications for trading silver futures?

Yes, profits from silver futures trading are generally taxable as capital gains. Consult a tax professional for specific advice.