Is rent deducted from income for food stamps? This question, central to understanding eligibility for the Supplemental Nutrition Assistance Program (SNAP), often sparks confusion and debate. The answer, however, lies in the complex interplay of federal guidelines, state regulations, and individual circumstances.

Understanding how rent deductions are factored into SNAP eligibility calculations is crucial for those seeking assistance, as it can significantly impact the amount of benefits received.

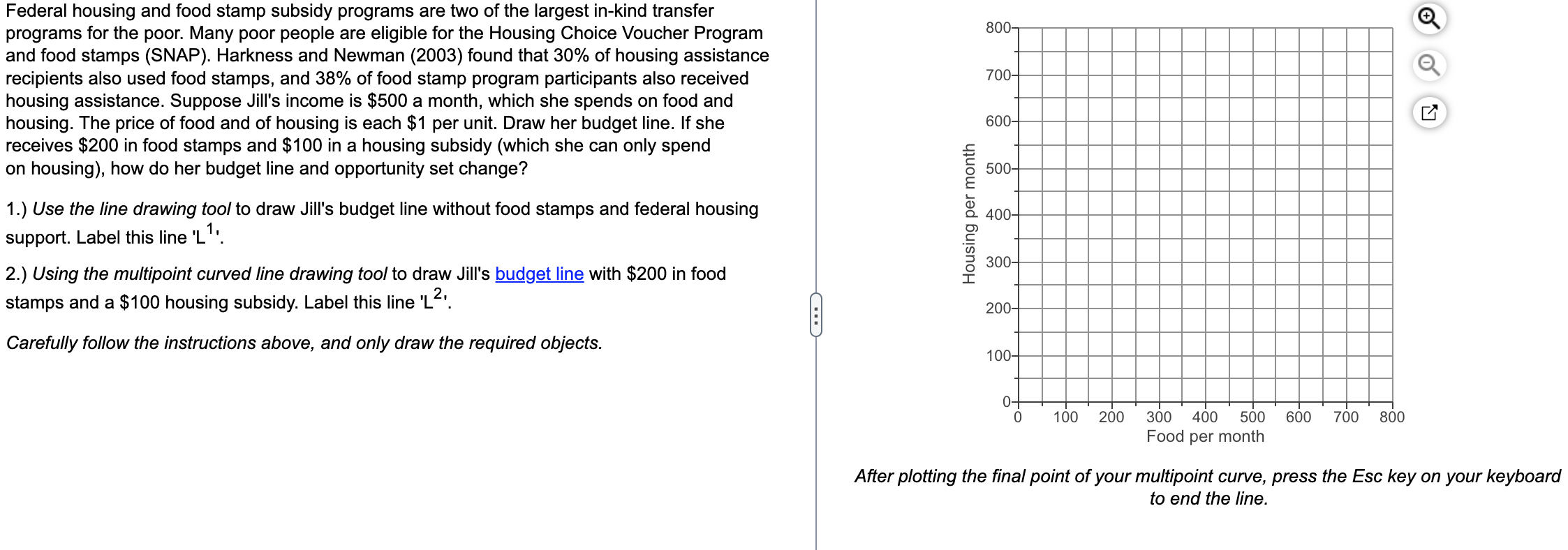

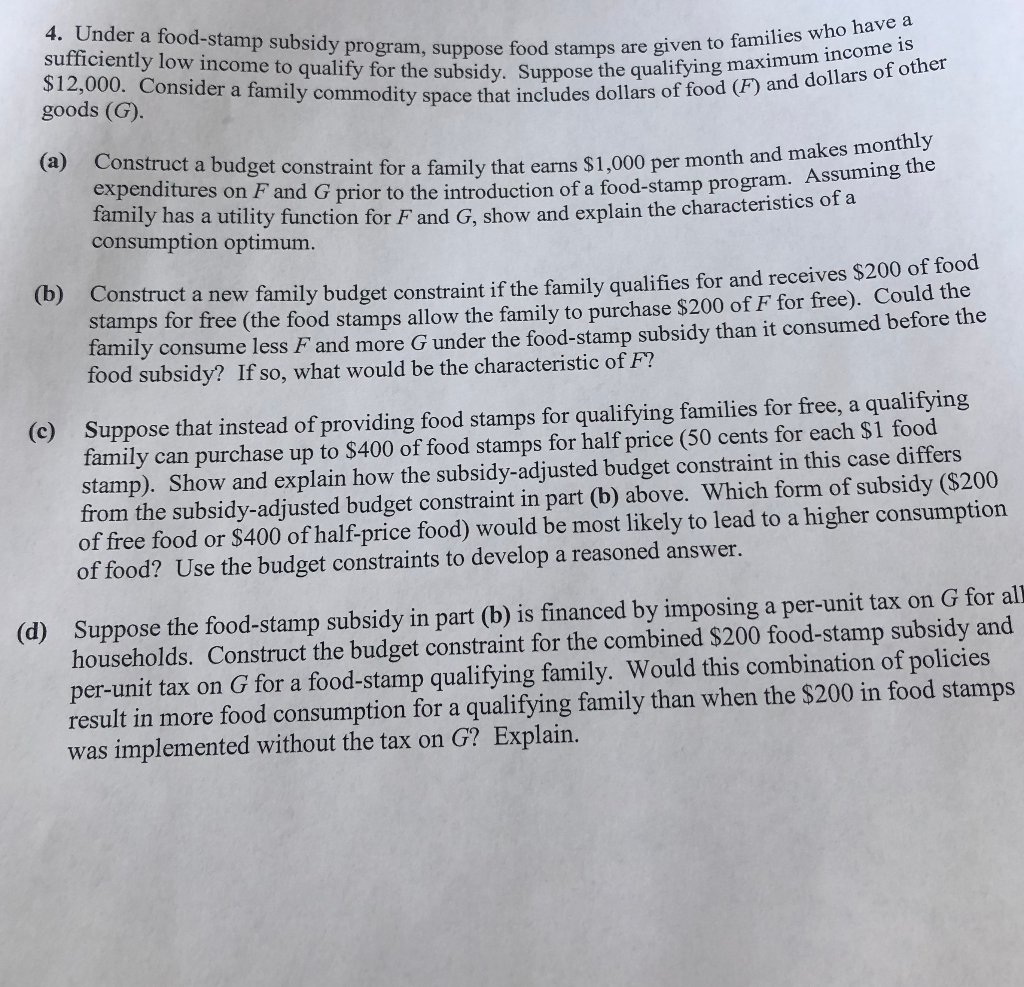

The SNAP program, formerly known as food stamps, provides financial assistance to low-income individuals and families to purchase food. Eligibility for SNAP is determined by a variety of factors, including income, household size, and expenses. Rent, as a significant household expense, plays a pivotal role in these calculations.

This article will delve into the intricacies of how rent deductions are applied, providing a clear understanding of the process and its impact on SNAP benefits.

Eligibility for Food Stamps

The Supplemental Nutrition Assistance Program (SNAP), commonly known as food stamps, is a federal program that helps low-income families and individuals buy food. To be eligible for SNAP, you must meet certain income and asset requirements.

Income Assessment for SNAP Eligibility

SNAP eligibility is determined by your household’s income and expenses. Income is assessed based on a gross monthly income, meaning it is calculated before any deductions. This includes all income received by all household members, including wages, salaries, self-employment income, unemployment benefits, and pensions.

Types of Income Considered for SNAP

- Earned Income:This includes wages, salaries, tips, commissions, and self-employment income. It also includes payments from a business or farm.

- Unearned Income:This includes income that is not earned through work, such as Social Security benefits, retirement income, unemployment benefits, and disability payments. It also includes child support payments, alimony, and certain types of government assistance.

- Other Income:This includes income from sources other than earned or unearned income, such as:

- Scholarships and Fellowships:Scholarships and fellowships used for education expenses are generally not considered income for SNAP purposes. However, any portion used for living expenses or other non-educational purposes is counted as income.

- Alimony:Alimony payments are considered income for SNAP purposes.

- Child Support:Child support payments received are considered income for SNAP purposes.

Rent Deductions for SNAP

The amount of SNAP benefits you receive is based on your household’s income and expenses. Rent is considered a major expense, and the government recognizes that high housing costs can significantly impact a household’s ability to afford food. Therefore, the SNAP program allows for a rent deduction to account for these expenses.

Rent Deduction Calculation

The SNAP program calculates a rent deduction based on your actual rent or housing costs. This includes rent paid for a house, apartment, mobile home, or other living quarters. It also includes other housing expenses like utilities (heat, water, electricity, and gas), property taxes, and homeowner’s insurance.

The maximum rent deduction is calculated based on the “standard” housing cost for your area.

The standard housing cost is determined by the U.S. Department of Agriculture (USDA) and varies based on the location and size of your household.

State-Specific Rent Deduction Rules

Each state has its own specific rules regarding rent deductions for SNAP benefits. Some states may have additional deductions for specific expenses like:

- Rent paid for a disabled person’s specialized housing.

- Housing expenses incurred for an elderly person.

- Rent paid for a household with children.

Examples of Rent Deductions Affecting SNAP Benefits

- Example 1:A single individual living in a one-bedroom apartment pays $800 per month in rent. The standard housing cost for their area is $600. The individual would receive a rent deduction of $600, as this is the maximum allowable deduction.

- Example 2:A family of four living in a three-bedroom house pays $1,200 per month in rent. The standard housing cost for their area is $1,000. The family would receive a rent deduction of $1,000, as this is the maximum allowable deduction.

Calculating Income for SNAP

To determine your eligibility for SNAP benefits, the Supplemental Nutrition Assistance Program (SNAP) considers your household’s net income. Net income is calculated by subtracting certain deductions from your gross income. This calculation is essential for determining your eligibility and the amount of benefits you might receive.

Net Income Calculation for SNAP

Net income is calculated by subtracting allowable deductions from your gross income. Allowable deductions include, but are not limited to, certain expenses like rent, medical costs, and child care. The following steps Artikel how to calculate your net income for SNAP:

1. Determine your gross income

This includes all income from all sources, such as wages, salaries, self-employment earnings, unemployment benefits, and other government assistance.

2. Subtract allowable deductions

These deductions vary depending on your circumstances.

3. Calculate your net income

The result is your net income, which is used to determine your SNAP eligibility.

Rent Deductions for SNAP

Rent deductions can significantly impact your net income calculation for SNAP. The maximum rent deduction is calculated based on the state’s standard of need, which considers the number of people in your household.

The maximum rent deduction for a household of one is typically 50% of the state’s standard of need. For larger households, the maximum deduction increases accordingly.

For example, if the standard of need for a household of one in a particular state is $1,000 per month, the maximum rent deduction would be $500. If your actual rent is less than $500, you can deduct the full amount.

However, if your rent exceeds $500, you can only deduct the maximum amount of $500.

Impact of Other Deductions on SNAP Eligibility

Other deductions, such as medical expenses, can also influence your SNAP eligibility. These deductions can be substantial and can significantly reduce your net income. For example, if you have significant medical expenses, you may be able to deduct a portion of these costs from your gross income, resulting in a lower net income and potentially making you eligible for SNAP benefits.

The specific deductions allowed vary by state and are subject to certain limitations.

It’s crucial to understand the rules and regulations for SNAP deductions in your state to ensure you are maximizing your benefits. You can contact your local SNAP office or consult the SNAP website for specific information.

Resources for SNAP Eligibility

Navigating the SNAP application process can be challenging, but thankfully, there are numerous resources available to guide individuals through the process and ensure they have access to the benefits they qualify for.

Local SNAP Offices

Local SNAP offices play a crucial role in providing assistance and guidance to individuals seeking SNAP benefits. They are often the first point of contact for applicants and offer various services, including:

- Providing application forms and instructions

- Answering questions about eligibility requirements

- Assisting with the completion of application forms

- Scheduling appointments for interviews

- Following up on applications and providing updates

Online Resources

The internet provides a wealth of information and resources related to SNAP eligibility, including:

- The United States Department of Agriculture (USDA) website:This website offers comprehensive information about SNAP, including eligibility requirements, application procedures, and benefit amounts. It also provides access to online tools, such as the SNAP eligibility calculator, which can help individuals estimate their potential benefits.

- State SNAP websites:Each state has its own SNAP website that provides specific information about SNAP eligibility and application procedures within that state. These websites often include contact information for local SNAP offices, online application portals, and frequently asked questions (FAQs).

- Non-profit organizations:Many non-profit organizations specialize in assisting individuals with SNAP applications. They can provide guidance, support, and advocacy to ensure individuals receive the benefits they deserve.

Role of Caseworkers

Caseworkers are professionals who work within local SNAP offices or other organizations to assist individuals with SNAP applications. They play a vital role in:

- Assessing eligibility:Caseworkers review applications, gather necessary documentation, and determine if individuals meet the eligibility criteria for SNAP.

- Providing guidance and support:They offer guidance and support throughout the application process, answering questions, explaining requirements, and assisting with any challenges individuals may encounter.

- Advocating for clients:Caseworkers advocate for their clients, ensuring they receive fair treatment and have access to the benefits they qualify for.

Common Misconceptions about SNAP

Many people have misconceptions about SNAP eligibility and rent deductions. Understanding the rules and regulations of SNAP is essential to ensure that you receive the benefits you are entitled to.

Eligibility Based on Income Alone, Is rent deducted from income for food stamps

It’s a common misconception that SNAP eligibility is determined solely by income. While income is a significant factor, other factors, such as household size, expenses, and resources, are also considered.

Rent Deductions Not Allowed

Another misconception is that rent deductions are not allowed when calculating SNAP benefits. This is inaccurate. Rent deductions are allowed for SNAP recipients.

SNAP Benefits Are Only for Low-Income Families

It is often believed that SNAP benefits are only available to low-income families. However, individuals and households of all income levels may qualify for SNAP, depending on their circumstances and expenses.

SNAP Benefits Are Easy to Obtain

It’s often assumed that obtaining SNAP benefits is a simple process. While the application process is straightforward, it requires careful documentation and verification of eligibility criteria.

SNAP Benefits Can Be Used for Anything

A common misconception is that SNAP benefits can be used for any purchase. However, SNAP benefits are restricted to food items and certain non-food items, such as seeds and plants for home gardens.

SNAP benefits cannot be used for alcohol, tobacco, prepared meals, or pet food.

SNAP Benefits Are a Form of Welfare

SNAP is not a form of welfare. It is a nutrition assistance program designed to help low-income households afford nutritious food.

SNAP benefits are not a form of charity or handouts. They are a federal program designed to improve the health and well-being of low-income individuals and families.

Wrap-Up

Navigating the world of SNAP eligibility can be daunting, especially when factoring in rent deductions. This guide has aimed to demystify the process, providing a comprehensive overview of how rent is considered in SNAP calculations. By understanding the rules and regulations, individuals can confidently apply for assistance, knowing they have a clear grasp of the factors influencing their eligibility.

Remember, accessing resources and seeking guidance from local SNAP offices can further clarify any specific questions or concerns.

Quick FAQs: Is Rent Deducted From Income For Food Stamps

How do I know if I qualify for SNAP?

To determine your eligibility, contact your local SNAP office or visit the USDA website. They will provide information on income limits, household size requirements, and other factors that affect eligibility.

What other expenses are considered besides rent?

Besides rent, other expenses that can be deducted from income include medical expenses, child care costs, and dependent care expenses.

Can I apply for SNAP online?

Many states offer online SNAP applications. Check your state’s SNAP website for details on how to apply online.

What happens if my income changes after I receive SNAP benefits?

If your income changes, you must report the change to your local SNAP office. They will adjust your benefits based on your new income level.