What are cost plus contracts, innit? Basically, it’s a bit like ordering a dodgy kebab – you pay for the ingredients (the costs) and then a bit extra on top (the fee). But instead of a late-night snack, we’re talking about massive projects, like building a skyscraper or developing a new video game. It’s all about sharing the risk, but also, you know, keeping an eye on the price, before it gets properly out of hand.

This means the total cost isn’t set in stone at the start, which can be a good thing or a total nightmare depending on how things pan out.

There are different types of cost-plus contracts, each with its own vibe. Some have a fixed fee on top of the costs, others have bonuses or penalties depending on how well the project goes. It all depends on what you and the other party agree to, which is where the real negotiation comes in. We’ll delve into the specifics of each type, highlighting the pros and cons, so you can decide which is best for your situation, whether you’re a mega-corp or just a small team trying to get stuff done.

Definition and Basic Principles of Cost-Plus Contracts

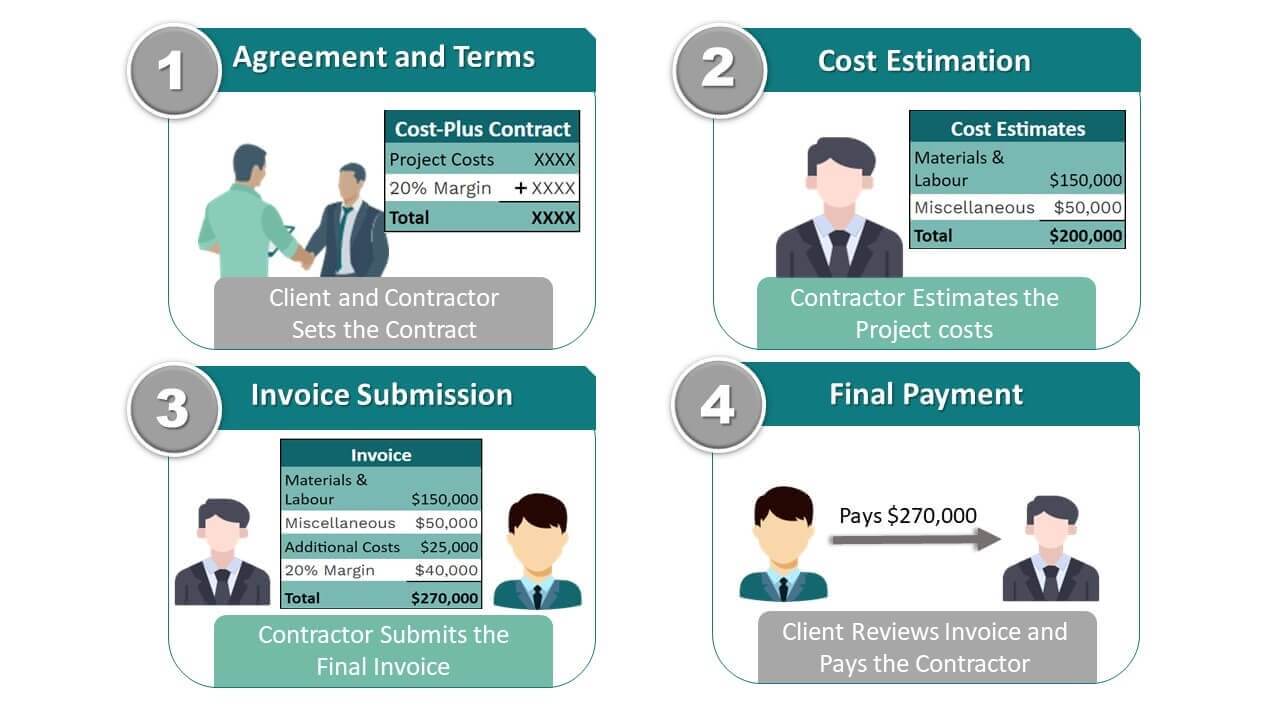

Cost-plus contracts represent a fundamental agreement structure in which a buyer reimburses a seller for all allowable costs incurred in completing a project, plus an agreed-upon fee. This approach contrasts with fixed-price contracts, where the total price is predetermined regardless of actual costs. The core principle lies in shared risk and transparency between the buyer and seller.Cost-plus contracts are characterized by a high degree of collaboration and trust.

The buyer typically retains significant control over the project’s scope and execution, while the seller is compensated for their efforts and expenses. This structure is particularly well-suited for projects with uncertain scopes or those requiring extensive customization and flexibility.

Key Components of Cost-Plus Contracts

The structure of a cost-plus contract hinges on several crucial components. These components work together to define the financial framework and the responsibilities of both parties involved. Accurate cost tracking and meticulous record-keeping are essential for the successful execution of these contracts. The key components include a defined scope of work, a detailed cost accounting system, and a clearly stated fee structure.

The allowable costs are typically specified in detail within the contract, outlining which expenses are reimbursable and which are not. The fee structure, which can take various forms, is a crucial element determining the seller’s overall profit. Finally, a mechanism for dispute resolution is essential to address potential disagreements regarding costs or the fee calculation.

Types of Cost-Plus Contracts

Several variations of cost-plus contracts exist, each tailored to specific project needs and risk profiles. The choice of contract type significantly impacts the risk allocation between the buyer and the seller, as well as the overall project cost.

| Contract Type | Fee Structure | Risk Allocation | Suitability |

|---|---|---|---|

| Cost-Plus-Fixed-Fee (CPFF) | A fixed fee is added to the total allowable costs. | Seller bears most of the cost risk; buyer bears most of the schedule risk. | Suitable for projects with well-defined scopes but uncertain costs, such as research and development. |

| Cost-Plus-Incentive-Fee (CPIF) | A base fee is paid, with additional incentives for meeting performance targets (e.g., cost and schedule). | Risk is shared between the buyer and seller, incentivizing cost and schedule efficiency. | Suitable for complex projects where cost and schedule performance are critical, such as large construction projects. |

| Cost-Plus-Percentage-of-Cost (CPPC) | A percentage of the total allowable costs is added as a fee. | Seller has little incentive to control costs; buyer bears significant risk. | Generally discouraged due to the lack of cost control and potential for cost overruns. |

Cost Elements Included in Cost-Plus Contracts

Cost-plus contracts, by their nature, reimburse the contractor for all allowable costs incurred in performing the contract, plus a predetermined fee or profit margin. Understanding the different cost elements included is crucial for both the contractor and the client to ensure transparency and fair pricing. This section details the common cost elements categorized as direct and indirect costs, and clarifies the distinction between allowable and unallowable expenses.

Direct Costs in Cost-Plus Contracts

Direct costs are those that can be directly attributed to a specific project or contract. Accurately tracking and documenting these costs is essential for accurate reimbursement under a cost-plus arrangement. Inaccurate reporting can lead to disputes and financial complications.

- Labor Costs: Salaries, wages, and benefits paid to employees directly involved in the project. This includes the cost of overtime, if approved beforehand.

- Materials: The cost of all raw materials, components, and supplies directly used in the project. Detailed records of purchases and usage are necessary.

- Equipment: Costs associated with equipment specifically rented or purchased for the project, including depreciation, maintenance, and fuel. This excludes general company equipment.

- Subcontractor Costs: Payments made to subcontractors for work performed on the project. These costs should be supported by subcontracts.

Indirect Costs in Cost-Plus Contracts

Indirect costs are those that are not directly attributable to a single project but are necessary for the overall operation and successful completion of the contract. These costs are usually allocated to projects based on a predetermined formula or allocation method. Accurate allocation is important to prevent cost overruns.

- Overhead Costs: General administrative expenses, such as rent, utilities, and insurance for the contractor’s facilities. These costs are often allocated based on the project’s share of the total company overhead.

- General and Administrative Expenses (G&A): Costs related to the overall management and administration of the contractor’s business, including salaries of administrative staff, legal fees, and accounting costs. Allocation methods should be clearly defined in the contract.

- Marketing and Sales Costs: While typically not directly related to a single project, these costs might be included in certain cost-plus contracts, especially if the contract is secured through significant marketing efforts. Allocation should be transparent and justifiable.

Allowable and Unallowable Costs

The determination of allowable and unallowable costs is a critical aspect of cost-plus contracts. This distinction is usually defined in the contract itself, often referencing relevant government regulations or industry standards. Disputes often arise from disagreements on cost allowability.Allowable costs are those that are considered reasonable, allocable, and consistent with generally accepted accounting principles (GAAP) and the terms of the contract.

Unallowable costs are those that are not considered justifiable expenses under the contract terms or applicable regulations. Examples of unallowable costs include fines, penalties, and entertainment expenses. A clear understanding of these categories is essential to avoid conflicts and ensure accurate cost reimbursement. The contract should explicitly state which costs are allowable and unallowable to prevent disputes.

For instance, a cost-plus contract for government work would adhere to the Federal Acquisition Regulation (FAR) guidelines on allowable costs. For private sector contracts, industry standards and the specific contract terms would govern the determination of allowable and unallowable costs.

Advantages and Disadvantages of Cost-Plus Contracts: What Are Cost Plus Contracts

Cost-plus contracts, while offering flexibility, present a unique set of advantages and disadvantages for both buyers and sellers. Understanding these aspects is crucial for making informed decisions about their suitability for a particular project. This section will explore these benefits and drawbacks, comparing them to fixed-price contracts and illustrating scenarios where each contract type is most appropriate.

Advantages of Cost-Plus Contracts

Cost-plus contracts offer several key advantages. For the buyer, the primary benefit is the reduced risk associated with uncertain project scope or unforeseen complexities. The buyer knows they will only pay for actual costs incurred, plus a predetermined fee or percentage. For the seller, the primary advantage lies in the reduced financial risk. They are guaranteed reimbursement for their actual costs, mitigating potential losses from cost overruns or unexpected challenges.

This encourages greater collaboration and transparency, as the seller isn’t incentivized to cut corners to meet a fixed price.

Disadvantages of Cost-Plus Contracts

Despite the advantages, cost-plus contracts also present significant disadvantages. The most prominent concern is the potential for cost overruns. Without a fixed price, there’s less incentive for the seller to control costs efficiently. This can lead to higher overall project expenses than initially anticipated. For the buyer, a lack of cost certainty can make budgeting and financial planning more challenging.

Additionally, the monitoring and auditing of costs becomes crucial to prevent potential abuses.

Comparison of Cost-Plus and Fixed-Price Contracts

The following table summarizes the key advantages and disadvantages of cost-plus contracts compared to fixed-price contracts.

| Advantages | Disadvantages |

|---|---|

| Reduced risk for the buyer regarding uncertain project scope or unforeseen complexities. Guaranteed reimbursement for the seller’s actual costs. Encourages collaboration and transparency. | Potential for cost overruns. Lack of cost certainty for the buyer. Increased need for cost monitoring and auditing. Less incentive for the seller to control costs efficiently. |

| Suitable for projects with highly uncertain scope or requirements. Beneficial when innovation and flexibility are prioritized. | Less suitable for projects with clearly defined scopes and predictable costs. Can lead to higher overall project costs compared to fixed-price contracts. |

Scenario: Suitable Application of a Cost-Plus Contract

Consider the development of a novel medical device. The exact specifications and manufacturing processes may not be fully known at the outset. A cost-plus contract would be highly suitable here. The seller can focus on innovation and problem-solving without the pressure of meeting a predetermined fixed price. The buyer benefits from the flexibility to adapt to evolving needs and discoveries throughout the development process.

Scenario: Unsuitable Application of a Cost-Plus Contract

Constructing a standard office building with well-defined specifications and readily available materials would be unsuitable for a cost-plus contract. The scope is predictable, and cost estimates can be accurately determined beforehand. A fixed-price contract would be far more efficient and effective, providing cost certainty and incentivizing the contractor to manage costs efficiently.

Risk Management in Cost-Plus Contracts

Cost-plus contracts, while offering flexibility, inherently carry a higher risk of cost overruns compared to fixed-price contracts. Effective risk management is crucial for both the buyer and the seller to ensure a successful and financially sound project. This section details methods for mitigating these risks.Cost overruns in cost-plus contracts stem from various sources, including unforeseen complexities, inaccurate cost estimations, inefficient management, and a lack of robust cost control mechanisms.

Mitigating these risks requires a proactive approach involving careful planning, transparent communication, and stringent monitoring throughout the project lifecycle.

Methods to Mitigate Cost Overruns

Several methods can effectively mitigate the risk of cost overruns in cost-plus contracts. These methods focus on establishing clear expectations, implementing rigorous cost control measures, and fostering collaboration between the buyer and the seller. Effective implementation of these methods is essential for maintaining project profitability and avoiding disputes.

- Detailed Scope Definition: A precisely defined scope of work minimizes ambiguities and reduces the likelihood of scope creep, a major contributor to cost overruns. This clarity ensures that all parties understand the project’s boundaries and prevents the addition of unbudgeted tasks.

- Realistic Cost Estimates: Thorough and detailed cost estimations, developed collaboratively by both the buyer and the seller, are essential. These estimates should incorporate contingency buffers to account for unforeseen circumstances and potential variations.

- Regular Progress Monitoring and Reporting: Frequent progress meetings and detailed reporting mechanisms allow for early detection of potential cost overruns. This proactive approach enables timely corrective actions, minimizing the impact of deviations from the planned budget.

- Incentive Structures: Incorporating incentive mechanisms that reward cost efficiency can motivate the seller to control costs effectively. For example, a shared savings clause can allow both parties to benefit from cost reductions achieved through efficient project management.

Cost Control Mechanisms and Auditing Processes

Robust cost control mechanisms and regular auditing are fundamental to managing risks in cost-plus contracts. These processes provide transparency and accountability, ensuring that costs are tracked accurately and that any deviations are promptly addressed.

- Budgetary Controls: Establishing a clear budget and regularly monitoring expenditures against this budget are crucial. This involves tracking all costs, including direct and indirect costs, and comparing them to the approved budget on a regular basis.

- Cost Variance Analysis: Regularly analyzing cost variances – the difference between actual and budgeted costs – helps identify areas where costs are exceeding expectations. This analysis informs corrective actions and prevents minor issues from escalating into significant cost overruns.

- Independent Audits: Periodic independent audits by a qualified third party provide an objective assessment of the project’s financial performance. These audits verify the accuracy of cost reporting and identify any potential irregularities or areas for improvement.

Clauses to Protect the Buyer from Excessive Costs

Contractual clauses can significantly protect the buyer from excessive costs. These clauses provide safeguards and mechanisms for addressing cost overruns and ensuring fair pricing.

- Ceiling Price: A ceiling price clause sets a maximum limit on the total project cost. This protects the buyer from unlimited liability and provides a clear financial boundary for the project.

- Cost Allowability Clause: This clause specifies which costs are eligible for reimbursement. It clearly defines allowable and unallowable costs, preventing the seller from claiming reimbursement for inappropriate expenses.

- Audit Rights Clause: This clause grants the buyer the right to audit the seller’s cost records to ensure accuracy and compliance with the contract. This allows for independent verification of costs and helps prevent fraudulent or inflated claims.

- Reimbursement Limitations: The contract can specify limitations on the types of costs that can be reimbursed, such as limiting reimbursement for certain indirect costs or overhead expenses. This prevents the seller from passing on excessive or unnecessary costs to the buyer.

Negotiating and Structuring Cost-Plus Contracts

Negotiating and structuring cost-plus contracts requires careful consideration of various factors to ensure a fair and transparent agreement that protects both the buyer and the seller. A well-defined contract minimizes disputes and promotes a successful project outcome. Effective negotiation hinges on a clear understanding of the project scope, cost elements, and risk allocation.

Successful negotiation in cost-plus contracts relies on establishing clear expectations from the outset. This includes defining the project scope, identifying potential cost overruns, and establishing a mutually agreeable fee structure. Transparency and open communication are paramount throughout the negotiation process.

Key Negotiation Points in Cost-Plus Contracts

Negotiating a cost-plus contract involves several crucial points. These points directly impact the financial viability and the overall success of the project for both parties. A well-structured negotiation will result in a contract that is beneficial and manageable for all stakeholders.

The following points should be addressed during the negotiation process:

- Defining the Scope of Work: A detailed and unambiguous description of the project deliverables is essential. This includes specifying tasks, timelines, and acceptance criteria. Vague descriptions can lead to disputes over the scope of work and ultimately impact the final cost.

- Allowable Costs: Clearly defining which costs are reimbursable is critical. The contract should specify which direct and indirect costs are included, and it should establish a mechanism for auditing these costs. This prevents misunderstandings and potential conflicts later in the project lifecycle.

- Fee Structure: The fee structure should be clearly defined, transparent, and fair to both parties. This includes specifying the fee percentage or a fixed fee, as well as any incentives or penalties related to performance. A clear fee structure eliminates ambiguities and fosters trust.

- Payment Terms: The contract should Artikel the payment schedule, including the frequency of payments and the process for submitting and approving invoices. Clearly defined payment terms prevent delays and disputes related to payment.

- Dispute Resolution: A mechanism for resolving disputes should be included in the contract. This could involve mediation, arbitration, or litigation. Having a pre-defined dispute resolution process ensures a fair and efficient way to handle disagreements.

Defining Clear and Measurable Deliverables, What are cost plus contracts

Clear and measurable deliverables are the cornerstone of a successful cost-plus contract. Ambiguous deliverables lead to disputes and cost overruns. A well-defined deliverable ensures both parties are on the same page regarding expectations and acceptance criteria.

Best practices for defining deliverables include:

- Specific and Measurable: Each deliverable should be clearly defined with specific, measurable, achievable, relevant, and time-bound (SMART) criteria. For example, instead of “improve website performance,” a better deliverable would be “increase website loading speed by 20% within 3 months, as measured by Google PageSpeed Insights.”

- Documented Acceptance Criteria: The contract should specify the criteria for accepting each deliverable. This could involve performance benchmarks, quality standards, or other measurable metrics. Clear acceptance criteria prevent disputes over whether a deliverable meets the required standards.

- Regular Progress Reporting: Regular progress reports should be submitted to track progress against the deliverables and identify potential issues early on. This enables timely corrective actions and prevents cost overruns.

Establishing a Fair and Transparent Fee Structure

A fair and transparent fee structure is crucial for building trust and ensuring a mutually beneficial relationship between the buyer and the seller. The fee structure should be clearly defined and easy to understand.

Several methods can be used to establish a fair fee structure:

- Percentage of Costs: A common approach is to set a fixed percentage of the allowable costs as the fee. For example, a 10% fee on allowable costs means that for every $100 of allowable costs incurred, the seller receives a $10 fee.

- Fixed Fee Plus Incentive Fee: This approach combines a fixed fee with an incentive fee based on performance. The incentive fee rewards the seller for exceeding expectations or achieving specific milestones.

- Cost Plus Fixed Fee: This method involves reimbursing the seller for all allowable costs plus a fixed fee that is predetermined at the start of the project. This structure provides more predictability for the buyer regarding the total project cost.

- Hourly Rate: This method is suitable for projects where the scope is less defined or is likely to change significantly. It involves setting an hourly rate for the seller’s services. However, it can be less predictable in terms of total project cost.

Examples of Cost-Plus Contracts in Different Industries

Cost-plus contracts, while carrying inherent risks, are frequently employed in projects where precise cost estimation upfront is challenging or impossible due to the complexity, uncertainty, or novelty of the undertaking. This approach allows for flexibility and adaptation during project execution, making it suitable for specific industries and project types. The following examples illustrate the application of cost-plus contracts in diverse sectors.

The selection of a cost-plus contract is often driven by factors such as the need for flexibility in design or scope changes, the involvement of specialized expertise, or the inherent uncertainty associated with the project’s scope and execution.

Cost-Plus Contracts in Various Sectors

Several industries regularly utilize cost-plus contracts due to their unique characteristics. The following examples highlight the application of this contract type across diverse sectors.

- Construction of a Large-Scale Infrastructure Project: The construction of a new airport terminal often utilizes a cost-plus contract. The complex design, numerous subcontractors, and potential for unforeseen ground conditions make accurate cost estimation difficult at the outset. The cost-plus structure allows for adjustments as the project progresses and unforeseen issues arise.

- Defense Contract for a Novel Weapon System: Development of a new fighter jet typically involves a cost-plus contract. The advanced technology, extensive testing, and iterative design process inherent in such projects make precise upfront cost estimation virtually impossible. The contract allows for adjustments as research and development progresses.

- Research and Development of a New Pharmaceutical Drug: The development of a new drug involves significant research, clinical trials, and regulatory hurdles. The uncertain nature of the R&D process, including potential setbacks and the need for adaptation, often necessitates a cost-plus contract. The contractor is reimbursed for all allowable costs, plus a predetermined fee or percentage.

- Complex Software Development Project: Developing sophisticated custom software with evolving requirements often uses a cost-plus contract. The iterative nature of software development, coupled with potential for changes in scope and unforeseen technical challenges, makes accurate initial cost estimation difficult. The contract enables flexibility to address evolving needs.

Illustrative Example: Cost-Plus Contract in a Complex Engineering Project

Consider the construction of a large-scale offshore wind farm. This project involves several distinct phases: site survey and geotechnical investigation, design and engineering, procurement of materials and equipment, construction and installation, and commissioning and testing. A cost-plus contract would be suitable due to the inherent uncertainties in offshore construction, potential for unforeseen environmental conditions, and the specialized expertise required.

Project Phases and Cost Breakdown:

- Site Survey & Geotechnical Investigation (10%): This phase involves assessing the seabed conditions, analyzing environmental impacts, and determining the optimal turbine locations. Costs include survey vessel hire, geological testing, and environmental impact assessments.

- Design & Engineering (20%): This phase involves detailed design of the wind turbines, foundations, subsea cables, and onshore infrastructure. Costs include engineering fees, software licenses, and design reviews.

- Procurement (30%): This phase involves procuring the turbines, foundations, cables, and other necessary equipment. Costs include material costs, transportation, and customs duties.

- Construction & Installation (30%): This phase involves the actual construction and installation of the wind farm, including foundation installation, turbine erection, cable laying, and grid connection. Costs include vessel charter, labor, and specialized equipment.

- Commissioning & Testing (10%): This phase involves testing and commissioning the wind farm to ensure its safe and efficient operation. Costs include testing equipment, personnel, and final inspections.

Fee Structure: The contractor would be reimbursed for all allowable costs incurred during each phase. In addition, a fixed fee of, say, 10% of the total allowable costs could be agreed upon, or a percentage-based fee structure (e.g., 5% of allowable costs) could be implemented. This ensures the contractor’s profit is tied to efficient cost management while allowing for flexibility in addressing unforeseen challenges.

So, there you have it, mate. Cost-plus contracts: a bit of a gamble, but potentially a really good one if you play your cards right. Understanding the different types, managing the risks, and nailing down a solid agreement is key to making it work. Whether it’s the right choice for your next big project depends entirely on your specific needs and risk tolerance.

Get clued up on the details, and you’ll be able to make an informed decision, and avoid any nasty surprises down the line. No more dodgy kebabs, eh?

Question & Answer Hub

What happens if costs go way over budget in a cost-plus contract?

That depends on the specific contract. Some include clauses limiting cost overruns, while others might require approval for exceeding a certain threshold. It’s all about careful planning and regular checks to keep things on track.

Are cost-plus contracts always a bad idea?

Nah, not always. They can be ideal when the project scope is unclear or likely to change, or when innovation is key. It’s all about finding the right fit for the project.

How do I choose the right type of cost-plus contract?

Consider the level of risk you’re willing to take and the level of control you want. A fixed-fee contract gives more certainty, while incentive-fee contracts can motivate the contractor to keep costs down.

Can I use a cost-plus contract for a small project?

Yeah, you totally can! Although they’re often used for large, complex projects, they can work for smaller ones too. It just depends on whether the benefits outweigh the potential risks.