What does cost plus incentive fee contract mean – What does a cost plus incentive fee contract mean? Imagine a project where the exact costs are uncertain, but success hinges on exceeding expectations. This is where a cost plus incentive fee contract shines. It’s a unique partnership where the buyer pays the contractor’s actual costs plus an incentive fee based on achieving specific performance goals. This type of contract is often employed in complex projects where flexibility and shared risk are crucial, such as research and development, construction, and government contracts.

The core concept is simple: the contractor is compensated for their expenses, and then rewarded for exceeding expectations. This incentive fee structure motivates the contractor to go above and beyond, ensuring the project’s success aligns with the buyer’s objectives. The contract Artikels a target cost, which serves as a benchmark for performance evaluation. If the contractor manages to stay below the target cost, they earn a higher incentive fee.

This incentivizes efficient resource management and fosters a collaborative approach to project execution.

Cost Plus Incentive Fee Contracts

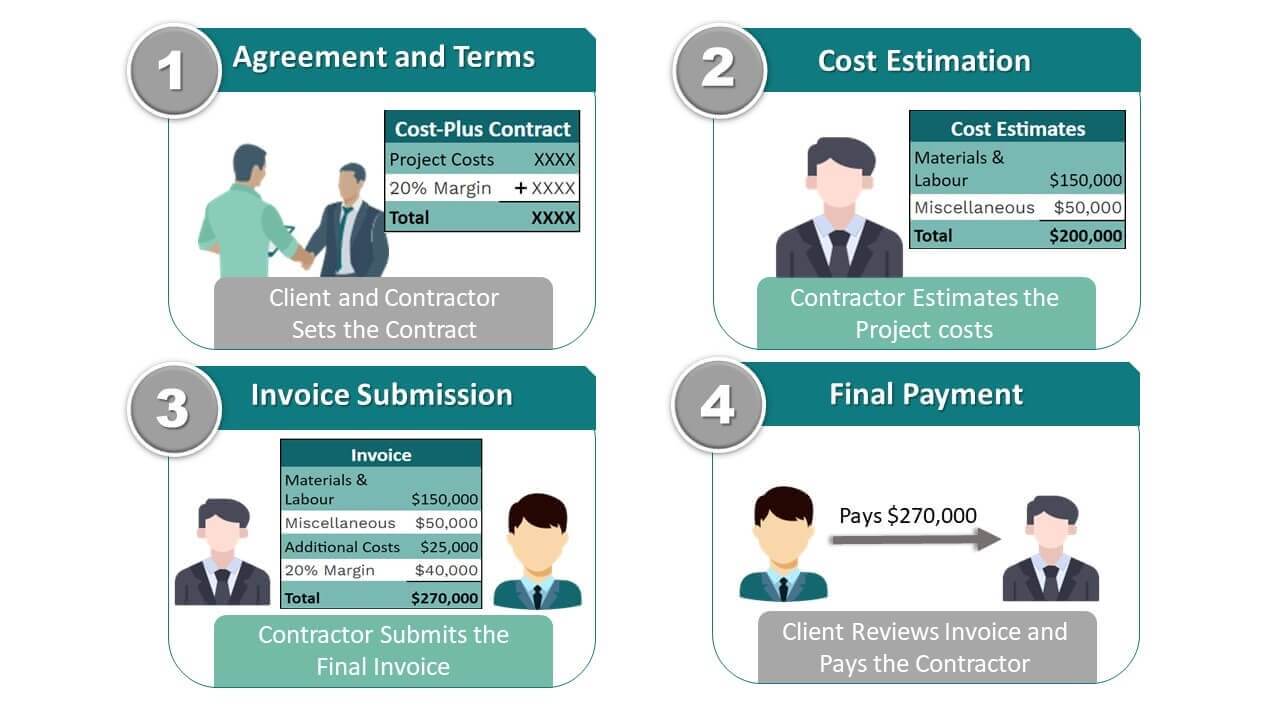

Cost-plus incentive fee contracts are a type of agreement where the buyer pays the seller for all the actual costs incurred in completing a project, plus an incentive fee. This fee is designed to motivate the seller to complete the project efficiently and within budget, aligning the interests of both parties.

Definition and Key Elements

A cost-plus incentive fee contract is a type of contract where the buyer agrees to reimburse the seller for all the allowable costs incurred in performing the contract, plus an incentive fee based on the seller’s performance. The incentive fee is calculated based on a predetermined formula that considers factors like cost control, schedule adherence, and quality of work. This type of contract is commonly used in projects where the scope of work is uncertain or complex, and the buyer wants to share the risk and reward with the seller.

- Cost Reimbursement: The buyer agrees to reimburse the seller for all allowable costs incurred in performing the contract. This includes direct costs, such as labor, materials, and equipment, as well as indirect costs, such as overhead and administrative expenses. The contract typically Artikels the allowable costs and how they will be documented and verified.

- Incentive Fee: This is a payment made to the seller in addition to the reimbursable costs, and it is based on the seller’s performance in achieving certain objectives, such as completing the project on time, within budget, and to the specified quality standards. The incentive fee is typically calculated based on a predetermined formula that considers factors like cost control, schedule adherence, and quality of work.

- Performance Measurement: The contract defines the criteria for measuring the seller’s performance and how the incentive fee will be calculated. This could include metrics like cost overruns, schedule delays, and quality defects.

- Shared Risk and Reward: Cost-plus incentive fee contracts encourage a collaborative relationship between the buyer and seller. The buyer shares the risk of cost overruns, while the seller has the opportunity to earn a higher profit by exceeding performance expectations.

Industries and Projects

Cost-plus incentive fee contracts are commonly used in industries where projects are complex, uncertain, or involve a high degree of innovation. Some examples include:

- Construction: Large-scale infrastructure projects, such as bridges, tunnels, and airports, where the scope of work can be challenging to define upfront.

- Aerospace and Defense: Research and development projects for new technologies and systems, where the costs and timelines are difficult to predict.

- IT and Software Development: Complex software development projects that involve a high degree of customization and require ongoing collaboration between the buyer and seller.

- Research and Development: Projects that involve exploring new technologies or processes, where the outcomes are uncertain and the costs can vary significantly.

Key Components of a Cost Plus Incentive Fee Contract

A cost-plus incentive fee contract, as the name suggests, is a type of contract where the contractor is reimbursed for all eligible costs incurred in performing the project, plus an incentive fee based on the project’s performance. This contract structure encourages both parties to work collaboratively towards achieving the project goals, with a shared interest in maximizing efficiency and cost savings.

Cost Basis

The cost basis forms the foundation of the cost-plus incentive fee contract. It represents the total eligible costs that the contractor can be reimbursed for. This includes direct costs, such as labor, materials, and equipment, as well as indirect costs, such as overhead and administrative expenses.

The cost basis is the starting point for calculating the total contract value.

Incentive Fee Structure

The incentive fee structure defines how the contractor’s compensation is tied to the project’s performance. This structure typically involves a target cost, a shared savings arrangement, and a potential penalty for exceeding the target cost.

Target Cost

The target cost is a pre-determined estimate of the project’s total cost. It serves as a benchmark for measuring the contractor’s performance and calculating the incentive fee. The target cost is typically negotiated between the parties at the beginning of the project, taking into account factors such as the scope of work, historical cost data, and market conditions.

Cost Reimbursable Element

The cost reimbursable element is the portion of the contract value that covers the contractor’s eligible costs. This element is calculated by adding the actual costs incurred by the contractor to the agreed-upon overhead rate.

The cost reimbursable element is calculated as follows:Cost Reimbursable Element = Actual Costs + (Overhead Rate x Actual Costs)

Incentive

The incentive element in a cost-plus incentive fee contract serves as a powerful motivator for the contractor to achieve project goals. It aligns the interests of both parties, encouraging the contractor to minimize costs, improve efficiency, and deliver the project on time and within budget. The incentive fee is typically calculated as a percentage of the cost savings achieved by the contractor.

Incentive Fee = (Target Cost – Actual Cost) x Incentive Fee Rate

For example, if the target cost is $1 million and the actual cost is $900,000, the cost savings achieved by the contractor is $100,000. If the incentive fee rate is 10%, the contractor will receive an incentive fee of $10,000.

Advantages and Disadvantages of Cost Plus Incentive Fee Contracts

Cost plus incentive fee contracts are a type of contract where the buyer pays the contractor’s actual costs incurred in completing the project, plus an incentive fee that is based on the contractor’s performance. This type of contract can be advantageous for both parties, but it also comes with its own set of risks and challenges.

Advantages of Cost Plus Incentive Fee Contracts

Cost plus incentive fee contracts offer several advantages for both the buyer and the contractor.

- For the Buyer:

- Reduced Risk: The buyer’s financial risk is reduced because they are only responsible for the actual costs incurred, rather than a fixed price. This can be particularly beneficial for projects with uncertain scope or high levels of complexity.

- Greater Flexibility: The buyer has more flexibility in making changes to the project scope or specifications during the course of the project.

- Access to Expertise: The buyer can access the expertise of the contractor, who has a vested interest in completing the project efficiently and effectively.

- Incentivizes Performance: The incentive fee structure encourages the contractor to perform well and achieve the desired project outcomes.

- For the Contractor:

- Guaranteed Profit: The contractor is guaranteed a profit, even if the project experiences cost overruns.

- Increased Revenue Potential: The contractor has the potential to earn a higher profit if they exceed the performance targets set out in the contract.

- Reduced Risk: The contractor’s risk is reduced because they are reimbursed for their actual costs.

- Stronger Relationship: The incentive fee structure can foster a stronger relationship between the buyer and the contractor, as both parties are incentivized to work together to achieve success.

Disadvantages of Cost Plus Incentive Fee Contracts

While cost plus incentive fee contracts offer several advantages, they also have some potential drawbacks.

- For the Buyer:

- Lack of Cost Control: The buyer has less control over the project’s costs, as they are ultimately responsible for paying the contractor’s actual expenses.

- Potential for Cost Overruns: Without careful monitoring and management, cost plus incentive fee contracts can lead to significant cost overruns.

- Complexity: These contracts can be complex to negotiate and administer, requiring a significant level of expertise.

- Increased Administrative Burden: The buyer may face an increased administrative burden in tracking and verifying the contractor’s costs.

- For the Contractor:

- Limited Profit Potential: The contractor’s profit potential may be limited by the incentive fee structure, particularly if they are unable to achieve the performance targets.

- Increased Administrative Burden: The contractor may face an increased administrative burden in tracking and documenting their costs.

- Potential for Disputes: There is a greater potential for disputes over the contractor’s costs and the calculation of the incentive fee.

- Lack of Motivation: If the incentive fee is not properly structured, the contractor may lack motivation to perform at their best.

Comparison with Other Contract Types

Cost plus incentive fee contracts can be compared with other contract types, such as fixed-price and time and materials contracts.

- Fixed-Price Contracts: In a fixed-price contract, the buyer pays a predetermined price for the project, regardless of the actual costs incurred by the contractor. This type of contract offers the buyer greater cost certainty, but it also places more risk on the contractor.

- Time and Materials Contracts: In a time and materials contract, the buyer pays for the contractor’s labor and materials at an agreed-upon rate. This type of contract provides the buyer with greater flexibility, but it also exposes them to greater cost uncertainty.

Incentive Fee Structures and Calculations

The incentive fee structure is a crucial element of a cost-plus incentive fee contract. It Artikels how the contractor will be rewarded for exceeding performance targets and incentivizes them to strive for optimal results. This section explores the different types of incentive fee structures and how incentive fees are calculated based on various performance metrics.

Types of Incentive Fee Structures

The incentive fee structure defines the relationship between the contractor’s performance and the amount of incentive fee they can earn. There are several common types of incentive fee structures, each with its own advantages and disadvantages:

- Linear Incentive Fee Structure: This structure provides a direct and proportional relationship between performance and the incentive fee. The fee increases linearly as the contractor’s performance improves. For example, if the target cost is $1 million and the contractor achieves a cost savings of 5%, they might receive a 5% incentive fee on the target cost, which would be $50,000.

- Graduated Incentive Fee Structure: In this structure, the incentive fee increases at a decreasing rate as performance improves. This structure encourages contractors to focus on achieving significant performance improvements, as the reward for marginal improvements diminishes. For instance, the first 5% of cost savings might yield a 5% incentive fee, while the next 5% might only result in a 3% incentive fee. This structure is designed to motivate the contractor to strive for substantial cost savings.

- Target-Based Incentive Fee Structure: This structure defines specific performance targets, and the incentive fee is paid only if those targets are met or exceeded. The incentive fee can be a fixed amount or a percentage of the target cost. This structure is particularly suitable for projects where specific performance goals are critical, such as meeting a strict deadline or achieving a particular quality standard.

For example, a contract could stipulate that the contractor receives a $100,000 incentive fee if they complete the project within a specified timeframe. If they fail to meet the deadline, they will not receive the incentive fee.

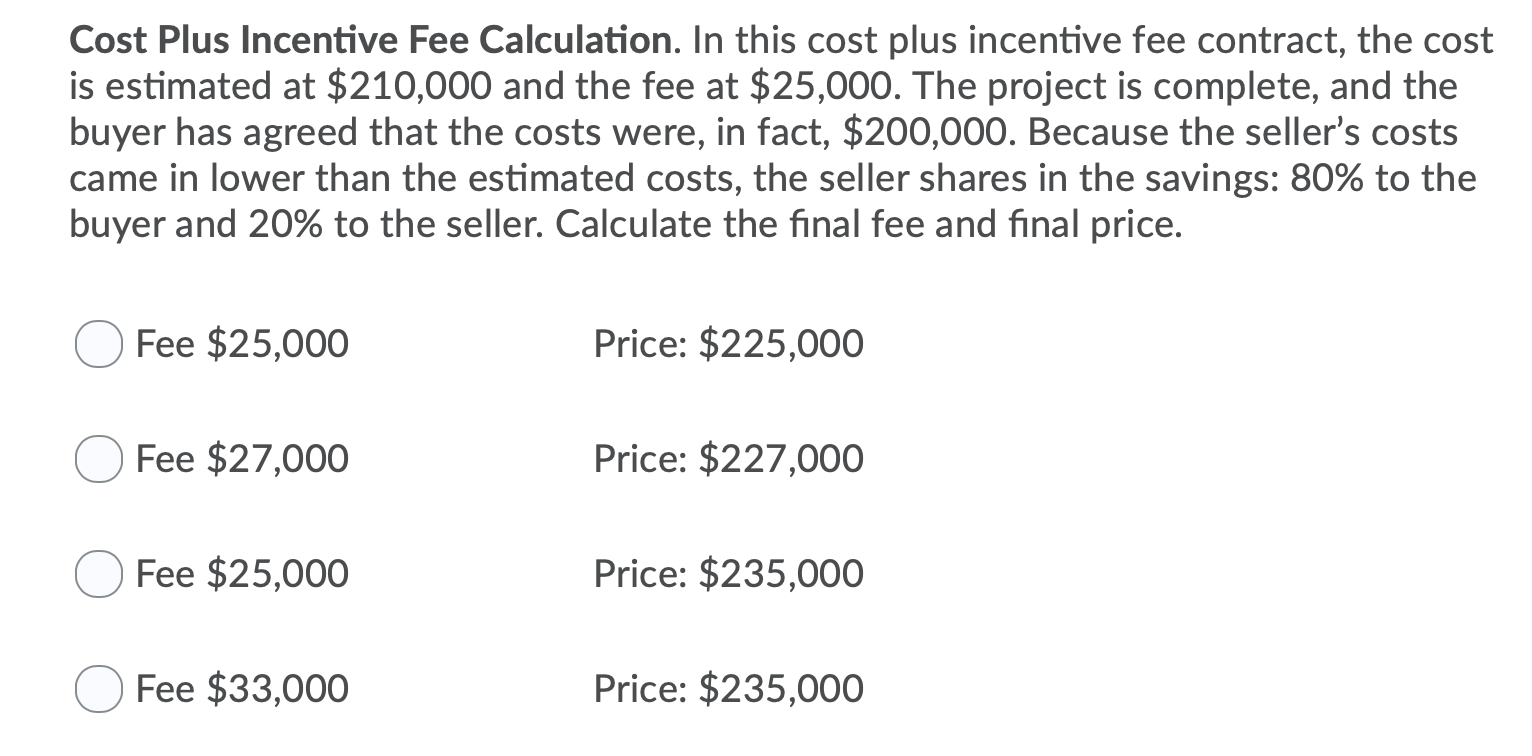

Incentive Fee Calculations, What does cost plus incentive fee contract mean

The calculation of incentive fees depends on the chosen structure and the specific performance metrics Artikeld in the contract. Common performance metrics include:

- Cost Savings: The incentive fee is calculated based on the difference between the actual cost and the target cost. This incentivizes the contractor to reduce project expenses.

- Schedule Adherence: The incentive fee is awarded for completing the project on time or ahead of schedule. This encourages efficient project management and timely completion.

- Quality Standards: The incentive fee is based on meeting or exceeding predetermined quality standards. This incentivizes the contractor to deliver high-quality work.

Hypothetical Scenario

Consider a construction project with a target cost of $5 million. The contract specifies a linear incentive fee structure, where the contractor receives a 1% incentive fee for every 1% of cost savings achieved. The contractor successfully completes the project at a cost of $4.8 million, resulting in a 4% cost savings.The incentive fee calculation would be as follows:

Incentive Fee = (Cost Savings / Target Cost)

Incentive Fee Rate

Incentive Fee = (0.04

- $5,000,000)

- 0.01

Incentive Fee = $20,000

In this scenario, the contractor would receive a $20,000 incentive fee for achieving a 4% cost savings.

Managing and Monitoring Cost Plus Incentive Fee Contracts

Managing a cost-plus incentive fee contract effectively requires a proactive approach to ensure both parties achieve their desired outcomes. This involves meticulous cost tracking, diligent performance monitoring, and open communication throughout the project lifecycle.

Key Steps in Managing Cost Plus Incentive Fee Contracts

The success of a cost-plus incentive fee contract hinges on robust management practices. Here are the key steps involved:

- Cost Tracking: This is the foundation of effective management. It involves meticulous record-keeping of all project expenses, ensuring accurate documentation and timely updates. Regular reconciliation with the agreed-upon budget is essential to identify potential cost overruns and take corrective measures. This can involve using a dedicated cost tracking software, spreadsheets, or a combination of both.

- Performance Monitoring: Monitoring project performance against established goals and milestones is crucial. This involves tracking progress, identifying any deviations from the planned schedule, and analyzing the root causes of delays or inefficiencies. Regular performance reviews with the contractor are essential to ensure alignment and address any concerns proactively. This may involve using project management software, holding regular meetings, or utilizing other performance tracking tools.

- Communication: Open and transparent communication is paramount in fostering a collaborative environment. This involves regular updates on project progress, cost status, and any potential challenges. Maintaining clear communication channels between the contracting parties ensures timely resolution of issues and avoids misunderstandings. This can be achieved through formal meetings, email correspondence, or even using project management platforms that facilitate seamless communication.

Potential Challenges in Managing Cost Plus Incentive Fee Contracts

While cost-plus incentive fee contracts offer potential benefits, they also present unique challenges that require careful management. These challenges include:

- Cost Overruns: The lack of a fixed price can lead to cost overruns, especially if project scope changes or unforeseen issues arise. To mitigate this risk, it is crucial to establish a clear scope of work, implement robust cost control measures, and conduct regular cost reviews.

- Performance Issues: Incentive structures can sometimes incentivize contractors to prioritize maximizing their fees over project quality. This can lead to performance issues, such as delays, substandard work, or failure to meet key performance indicators. Addressing this requires clear performance metrics, regular monitoring, and strong contract enforcement.

- Disputes: Disagreements can arise regarding cost calculations, performance evaluations, or the interpretation of contract clauses. To minimize disputes, it is essential to have a well-defined contract with clear terms, establish a dispute resolution mechanism, and engage in open communication.

Strategies for Mitigating Risks and Ensuring Successful Implementation

Mitigating risks and ensuring successful implementation of a cost-plus incentive fee contract requires a comprehensive approach. Key strategies include:

- Clear Scope Definition: A well-defined scope of work is crucial to avoid ambiguity and minimize the potential for scope creep. This involves detailed specifications, clear deliverables, and agreed-upon milestones.

- Robust Cost Control Measures: Implementing strong cost control measures is essential to prevent cost overruns. This includes regular cost tracking, budget monitoring, and the use of cost-effective practices.

- Performance-Based Incentives: A well-structured incentive fee system should align with the project’s objectives and encourage the contractor to prioritize quality and efficiency. This requires clear performance metrics, objective evaluation criteria, and a transparent incentive calculation methodology.

- Effective Communication and Collaboration: Open and transparent communication between the contracting parties is vital for building trust and resolving issues proactively. This involves regular meetings, timely updates, and effective communication channels.

- Experienced Project Management: Engaging experienced project managers with a proven track record in managing cost-plus incentive fee contracts is essential for successful implementation. They can provide valuable expertise in cost control, performance monitoring, and risk mitigation.

Legal and Regulatory Considerations: What Does Cost Plus Incentive Fee Contract Mean

Cost-plus incentive fee contracts, while offering flexibility and shared risk, are subject to a complex web of legal and regulatory frameworks that govern their formation, execution, and termination. Understanding these legal considerations is crucial for both parties involved, as they can significantly impact the contract’s enforceability, potential disputes, and overall success.

Applicable Laws and Regulations

The legal framework governing cost-plus incentive fee contracts varies depending on the industry, jurisdiction, and specific contract terms. Generally, these contracts are subject to a combination of federal, state, and local laws, as well as industry-specific regulations.

- Federal Laws: The Federal Acquisition Regulation (FAR) provides a comprehensive set of rules and regulations for government contracts, including cost-plus incentive fee contracts. The FAR mandates specific requirements for contract documentation, cost accounting, and dispute resolution.

- State Laws: State laws may also apply to cost-plus incentive fee contracts, particularly those involving commercial transactions. For instance, state laws governing contract formation, breach of contract, and commercial codes may be relevant.

- Industry Standards: Specific industries often have their own standards and guidelines for cost-plus incentive fee contracts. For example, the construction industry has established standards for cost accounting, project management, and dispute resolution.

Potential Legal Issues and Disputes

Cost-plus incentive fee contracts are inherently complex and can give rise to a range of legal issues and disputes. Some common areas of contention include:

- Cost Disputes: Determining the allowable costs and the basis for calculating the incentive fee can be challenging. Disputes may arise over the reasonableness of costs, the accuracy of cost accounting, or the interpretation of the incentive fee formula.

- Contract Breaches: Breaches of contract can occur if either party fails to fulfill its obligations under the agreement. For example, the contractor may fail to meet performance targets or the government may fail to make timely payments.

- Intellectual Property Rights: If the contract involves the development or use of intellectual property, disputes may arise over ownership, licensing, or infringement. Clear provisions in the contract are essential to avoid such issues.

Importance of Clear and Comprehensive Contract Documentation

To minimize legal risks and ensure a smooth contractual relationship, clear and comprehensive contract documentation is paramount. The contract should explicitly define the following:

- Scope of Work: A detailed description of the project’s objectives, deliverables, and performance standards.

- Cost Accounting: The method for tracking and reporting costs, including allowable and unallowable expenses.

- Incentive Fee Structure: The formula for calculating the incentive fee, including performance targets, weighting factors, and payment terms.

- Dispute Resolution: A mechanism for resolving disagreements, such as mediation or arbitration.

In essence, cost plus incentive fee contracts offer a balanced approach to project management. They provide flexibility to handle unforeseen complexities while encouraging the contractor to strive for optimal performance. By aligning incentives and fostering a shared commitment to success, these contracts can pave the way for efficient project completion and mutually beneficial outcomes. While the inherent complexity and potential for cost overruns warrant careful consideration, the potential for significant rewards and collaborative problem-solving make them a valuable tool for navigating challenging projects.

FAQ Compilation

What are some examples of industries where cost plus incentive fee contracts are used?

Cost plus incentive fee contracts are frequently used in industries like defense, aerospace, construction, research and development, and government procurement. They are particularly suitable for projects with high uncertainty, where the scope of work is complex or evolving, and where incentivizing exceptional performance is crucial.

How are incentive fees typically calculated?

Incentive fee structures vary widely depending on the project’s specific requirements. Common approaches include linear, graduated, and target-based methods. Linear structures offer a fixed percentage of cost savings as the incentive fee. Graduated structures provide a progressively higher incentive for exceeding performance targets. Target-based structures award a bonus if the project meets or surpasses predefined performance criteria.

What are some of the potential risks associated with cost plus incentive fee contracts?

While cost plus incentive fee contracts offer advantages, they also present potential risks. The lack of a fixed price can lead to cost overruns if the contractor’s expenses exceed expectations. Furthermore, the complexity of the incentive fee structure can make it challenging to accurately track and measure performance. It’s essential to have robust contract management processes and clear performance metrics to mitigate these risks.