Who has the cost risk in a fixed price contract – Who has the cost risk in a fixed-price contract? This question lies at the heart of any successful fixed-price agreement. In this arrangement, the contractor assumes the responsibility of delivering a defined scope of work for a predetermined price, regardless of unforeseen challenges or escalating costs. This fixed price provides clarity and certainty for the client, but it also places a significant burden on the contractor to manage potential risks.

The allocation of cost risk is a critical factor in determining the success or failure of a fixed-price contract, impacting both parties’ financial outcomes and project completion.

The contractor’s success hinges on their ability to accurately estimate costs, effectively manage risks, and control expenses throughout the project lifecycle. Clients, on the other hand, must carefully evaluate the contractor’s capabilities and the proposed fixed price, ensuring it aligns with their budget and project goals. This careful balance between cost certainty and risk allocation is crucial for achieving a mutually beneficial outcome.

Fixed-Price Contract Basics

A fixed-price contract, also known as a lump-sum contract, is a legally binding agreement where the buyer agrees to pay a predetermined, fixed amount for the goods or services provided by the seller, regardless of the actual cost incurred by the seller. This type of contract offers a clear and predictable financial structure for both parties, with the seller assuming the responsibility for managing costs and the buyer having a clear understanding of their financial obligation.

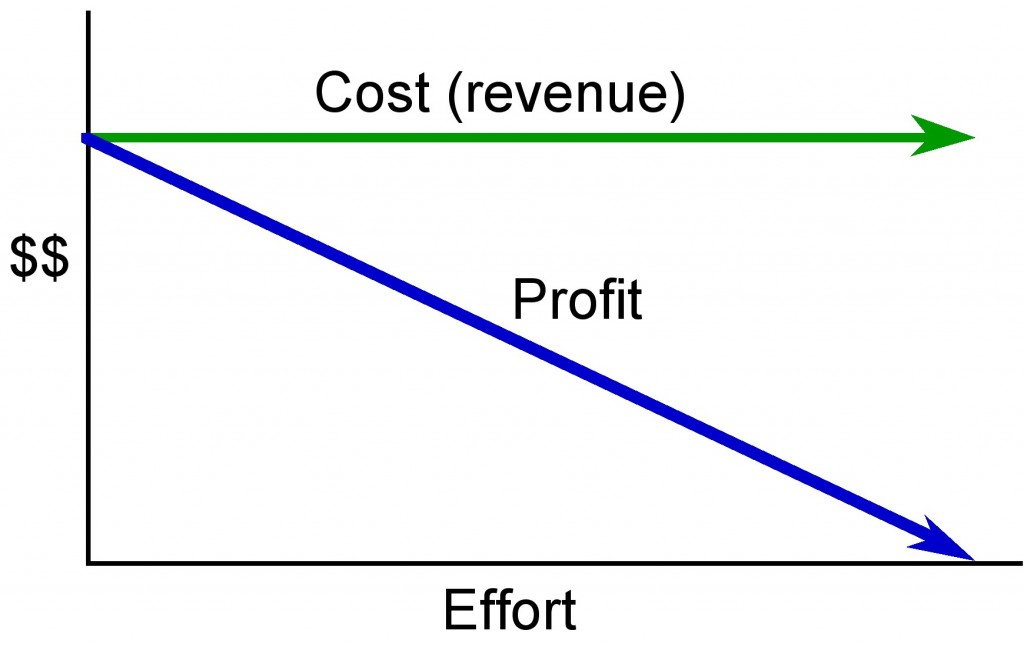

The fundamental principle of “fixed price” in the context of cost allocation is that the seller bears the risk of cost overruns. The buyer pays a set amount, and the seller is responsible for delivering the goods or services within that budget. This principle is reflected in the allocation of cost risk, where the seller assumes the majority of the risk associated with cost fluctuations.

Types of Fixed-Price Contracts

Fixed-price contracts come in various forms, each with its own specific characteristics and implications. The choice of contract type depends on factors such as the complexity of the project, the level of uncertainty surrounding costs, and the risk tolerance of both parties. Here are some common types of fixed-price contracts:

- Lump-Sum Contract: This is the simplest form of fixed-price contract, where the seller agrees to deliver a specific product or service for a single, predetermined price. The buyer pays the full amount upfront or in installments as agreed upon. This type of contract is typically used for well-defined projects with minimal uncertainty regarding scope and costs.

- Unit-Price Contract: In this type of contract, the price is determined based on a specific unit of work, such as per square foot for construction or per hour for labor. The final price is calculated by multiplying the unit price by the actual quantity of work performed. This contract is suitable for projects where the exact quantity of work is unknown at the time of agreement but can be measured accurately during execution.

- Firm Fixed-Price Contract: This is the most common type of fixed-price contract, where the price is fixed and non-negotiable throughout the contract duration. It is used for projects with well-defined scope and minimal risk of cost variations. The seller assumes the entire cost risk, regardless of any unforeseen circumstances that may arise.

Cost Risk Allocation

/common-types-of-construction-contracts-844483_v2-5bc4b4f84cedfd00262c1bc2.png)

In a fixed-price contract, the contractor assumes the primary responsibility for managing costs, making it crucial to understand how cost risk is allocated between the contractor and the client. This allocation determines who bears the burden of potential cost overruns or underruns, influencing the contract’s overall financial stability and success.

Cost Risk Allocation Mechanisms

The allocation of cost risk between the contractor and the client is a critical aspect of fixed-price contracts. Several mechanisms are employed to achieve a balanced distribution of risk, ensuring fairness and protecting both parties’ interests. These mechanisms include:

- Price Adjustments: Price adjustments are clauses incorporated into the contract that allow for modifications to the agreed-upon price based on specific predetermined events or circumstances. These adjustments can be triggered by factors such as changes in material costs, labor rates, or regulatory requirements. For instance, a contract might include a price adjustment clause linked to fluctuations in the price of steel, ensuring that the contractor is compensated for any increases in material costs.

- Contingencies: Contingencies are provisions in the contract that set aside a specific amount of money to cover potential unforeseen costs or risks. These contingencies act as a buffer, mitigating the financial impact of unexpected events. The size of the contingency fund is typically determined based on the complexity and uncertainty associated with the project. For example, a construction project might include a contingency for potential geological surprises or unforeseen weather delays.

- Warranties: Warranties are guarantees provided by the contractor regarding the quality and performance of the delivered goods or services. These warranties ensure that the client is protected from defects or failures within a specified period. Warranties can be extended to cover specific aspects of the project, such as material defects, workmanship issues, or system performance. For example, a software development contract might include a warranty guaranteeing the functionality and stability of the delivered software for a certain period.

Contractor’s Perspective

From the contractor’s standpoint, a fixed-price contract presents both opportunities and challenges. While it provides a guaranteed revenue stream, it also places significant responsibility on the contractor to manage costs effectively and avoid potential overruns. This section will delve into the contractor’s role in managing cost risk and explore strategies for mitigating potential overruns.

Cost Risk Management Responsibilities

Contractors have a crucial role in managing cost risk under a fixed-price contract. This responsibility encompasses several key aspects:

- Accurate Cost Estimation: The foundation of successful cost management lies in developing precise and comprehensive cost estimates. This involves meticulous analysis of project scope, materials, labor, equipment, and other associated expenses.

- Risk Assessment and Mitigation: Contractors must proactively identify potential cost risks throughout the project lifecycle. These risks can stem from factors such as changing market conditions, unforeseen site challenges, or unexpected delays. Effective risk mitigation strategies involve developing contingency plans and implementing measures to minimize the impact of potential risks.

- Project Management and Control: Efficient project management and control are essential for managing costs. This includes establishing clear timelines, monitoring progress, and implementing corrective actions when deviations from the planned budget occur. Regular cost tracking and reporting are crucial for identifying and addressing potential overruns promptly.

- Communication and Collaboration: Open communication with the client is paramount. Contractors should transparently share cost estimates, potential risks, and any changes that might impact the project budget. Collaborative decision-making can help avoid surprises and ensure both parties are aligned on cost management strategies.

Cost Overrun Mitigation Strategies

Contractors employ a range of strategies to mitigate the risk of cost overruns:

- Detailed Cost Estimates: Developing detailed cost estimates is a cornerstone of cost management. This involves breaking down the project into manageable work packages, estimating costs for each component, and factoring in potential contingencies. Contractors often use cost estimation software and industry benchmarks to enhance accuracy.

- Risk Assessments: Thorough risk assessments are crucial for identifying potential cost risks. This process involves identifying potential threats, assessing their likelihood and impact, and developing mitigation strategies. Risk assessments can cover various areas, including technical risks, market fluctuations, regulatory changes, and unforeseen site conditions.

- Contingency Planning: Contractors should allocate a contingency reserve to cover unexpected costs. This reserve is a percentage of the total project budget and should be calculated based on the identified risks and their potential impact. Contingency planning involves defining how and when this reserve will be used, ensuring that it’s available when needed.

- Value Engineering: Value engineering is a systematic process for optimizing project costs while maintaining or enhancing performance. It involves exploring alternative design solutions, materials, and construction methods to achieve cost savings without compromising quality or functionality.

- Change Management: Effective change management is essential for controlling costs. Any changes to the project scope or specifications should be carefully documented, evaluated for their impact on costs, and agreed upon by both parties. Change orders should be issued to reflect the cost implications of changes.

Client’s Perspective

From the client’s perspective, a fixed-price contract offers the advantage of predictable costs and a clear understanding of the project’s financial scope. However, it also places the burden of managing cost risks on the client. The client must ensure that the agreed-upon price accurately reflects the project’s complexity and potential risks, and they must actively monitor the project to mitigate any unforeseen cost increases.

Client Responsibilities in Managing Cost Risk

Clients play a crucial role in managing cost risks in a fixed-price contract. Their responsibilities include defining clear project requirements, conducting thorough risk assessments, and actively monitoring the project’s progress.

- Define Clear Project Requirements: Clients must provide detailed and unambiguous project specifications to ensure that the contractor fully understands the scope of work. This minimizes the risk of misunderstandings or scope creep that could lead to cost overruns.

- Conduct Thorough Risk Assessments: Identifying potential risks early in the project is essential for cost management. Clients should conduct thorough risk assessments to identify potential cost drivers and develop mitigation strategies. This can involve evaluating factors like market volatility, technological uncertainties, and potential delays.

- Actively Monitor Project Progress: Clients must monitor the project closely to ensure that the contractor is adhering to the agreed-upon schedule and budget. Regular progress reviews, performance reporting, and communication with the contractor are crucial to identify and address any potential cost deviations.

Evaluating and Negotiating the Fixed Price

Clients need to carefully evaluate and negotiate the fixed price with the contractor to ensure that it accurately reflects the project’s scope, complexity, and potential risks.

- Detailed Cost Breakdown: Clients should request a detailed cost breakdown from the contractor, outlining the specific costs associated with each project phase, material, labor, and other expenses. This provides transparency and allows for better evaluation of the proposed price.

- Benchmarking and Market Research: Clients should conduct market research to compare the proposed price with industry benchmarks and competitor offerings. This helps determine whether the price is reasonable and competitive.

- Negotiation and Risk Allocation: Clients should negotiate with the contractor to allocate risks and responsibilities. This may involve including clauses in the contract that address potential cost overruns, unforeseen circumstances, and changes in project requirements.

Strategies for Cost Control

Clients can employ several strategies to ensure cost control throughout the project.

- Contract Review: Clients should carefully review the contract to identify potential cost risks and ensure that appropriate clauses are in place to mitigate them. This may include clauses addressing change orders, payment milestones, and dispute resolution.

- Project Monitoring: Regular monitoring of the project’s progress, budget, and schedule is essential. This can involve using project management tools, conducting regular progress reviews, and communicating with the contractor to address any potential cost deviations.

- Performance Incentives: Clients can incentivize the contractor to achieve cost-efficient performance by including performance-based incentives in the contract. This could involve rewarding the contractor for meeting budget targets, completing milestones ahead of schedule, or implementing cost-saving measures.

Factors Influencing Cost Risk

The allocation of cost risk in fixed-price contracts is influenced by several factors that determine the degree of uncertainty and potential financial exposure for both the contractor and the client. These factors are often interconnected and their impact can vary depending on the specific project and its context.

Project Complexity, Who has the cost risk in a fixed price contract

Project complexity significantly influences cost risk allocation. Complex projects with intricate specifications, numerous stakeholders, and demanding timelines increase the likelihood of unforeseen challenges and cost overruns.

In such scenarios, contractors may demand a higher fixed price to account for the inherent uncertainty. Clients, on the other hand, might prefer a cost-plus contract to mitigate their exposure to potential cost overruns.

Market Conditions

Fluctuations in market conditions, such as material prices, labor costs, and availability of resources, can significantly impact project costs.

For example, if a project involves specialized materials subject to price volatility, the contractor may require a fixed price that reflects the potential for cost increases. Conversely, in a market with abundant labor and stable material prices, the contractor may be willing to accept a lower fixed price.

Regulatory Requirements

Regulatory requirements, including environmental regulations, safety standards, and permitting processes, can impose additional costs and complexities on projects.

If a project is subject to stringent regulations, the contractor may demand a higher fixed price to cover the potential for compliance-related expenses. Clients, in turn, need to ensure that their project specifications comply with all relevant regulations to minimize the risk of cost overruns due to non-compliance.

Contractual Provisions

Contractual provisions play a crucial role in allocating cost risk in fixed-price contracts. These provisions define the scope of work, payment terms, and change management processes, directly impacting the financial responsibilities of both the contractor and the client. Understanding the implications of these clauses is essential for both parties to effectively manage cost risk and ensure a successful project outcome.

Scope of Work

The scope of work clause Artikels the specific deliverables, tasks, and activities that the contractor is obligated to perform. It serves as the foundation for determining the contract price and allocating cost risk.

- A clearly defined scope of work minimizes ambiguity and reduces the potential for disputes regarding additional costs. A detailed description of deliverables, including specifications, quantities, and performance criteria, helps both parties understand their obligations and manage expectations.

- The scope of work should include a clear distinction between included and excluded items. This helps avoid situations where the contractor claims additional costs for work not explicitly stated in the contract. It also protects the client from unexpected expenses arising from unforeseen work requirements.

- Exclusions from the scope of work should be explicitly stated to prevent disputes and misinterpretations. For example, if certain design elements or materials are not included, the contract should explicitly state this exclusion. This clarifies the responsibilities and limits the potential for cost overruns due to misinterpretations.

Payment Terms

Payment terms specify the payment schedule, milestones, and methods for payment. These provisions directly influence the contractor’s cash flow and ability to manage project costs.

- Milestone-based payments provide the contractor with a steady stream of income, allowing them to manage project costs effectively. This is particularly important for long-term projects where the contractor may need to invest upfront capital.

- Payment terms should align with the project’s progress and milestones to ensure timely payment to the contractor. This reduces the risk of the contractor experiencing financial difficulties due to delayed payments, which could lead to cost overruns.

- Retention clauses, where a percentage of the payment is withheld until project completion, can provide the client with some protection against potential cost overruns. However, excessive retention can strain the contractor’s cash flow and increase the risk of cost overruns due to financial constraints.

Change Orders

Change orders are modifications to the original scope of work that can significantly impact project costs. Contractual provisions governing change orders are crucial for managing cost risk.

- The change order process should be clearly defined, including procedures for initiating, reviewing, and approving changes. This ensures transparency and avoids disputes over the cost and scope of changes.

- The contract should specify the method for calculating the cost of change orders. This can include fixed-price adjustments, time and materials, or a combination of both. Clearly defined cost calculation methods prevent disputes over the financial impact of changes.

- The contract should also establish a mechanism for resolving disputes regarding change orders. This can include a formal dispute resolution process or an agreed-upon third-party mediator. Having a clear dispute resolution mechanism ensures a fair and efficient resolution of disagreements over change order costs.

Common Contractual Provisions Addressing Cost Risk

Several common contractual provisions directly address cost risk management. These clauses aim to protect both the contractor and the client from unexpected financial burdens.

- Force Majeure Clause: This clause releases both parties from contractual obligations in the event of unforeseen circumstances beyond their control, such as natural disasters or government regulations. It protects the contractor from incurring costs due to events outside their control.

- Warranty Clause: This clause specifies the contractor’s responsibility for defects or deficiencies in the work performed. It protects the client from incurring additional costs due to faulty workmanship or materials.

- Insurance Clause: This clause requires the contractor to obtain specific insurance coverage to protect both parties from financial losses due to accidents, injuries, or property damage. It helps manage risk and allocate responsibility for potential liabilities.

- Indemnification Clause: This clause requires one party to compensate the other for losses arising from specific events. For example, a contractor may be required to indemnify the client for losses arising from the contractor’s negligence.

Dispute Resolution

Fixed-price contracts, while offering certainty in pricing, can also lead to disputes when cost overruns occur. This arises because the contractor bears the cost risk, and the client is obligated to pay the fixed price regardless of unforeseen circumstances. Therefore, it’s crucial to understand how contract interpretation and dispute resolution mechanisms play a vital role in resolving these disagreements.

Contract Interpretation and Dispute Resolution Mechanisms

The interpretation of the contract is fundamental to resolving disputes. This involves examining the contract’s specific terms, including scope of work, deliverables, payment terms, and provisions for change orders. Disputes often arise from differing interpretations of these terms, leading to disagreements on cost responsibility. To address such situations, contracts typically include dispute resolution mechanisms. These mechanisms provide a structured approach to resolving disagreements, aiming to avoid costly and time-consuming litigation.

Common Dispute Resolution Approaches

- Negotiation: This is the most common and preferred approach, as it involves direct communication between the parties to find a mutually agreeable solution. This approach emphasizes collaboration and compromise, potentially leading to a faster and less expensive resolution.

- Mediation: This involves a neutral third party, a mediator, who facilitates communication and helps the parties reach a settlement. The mediator does not have the authority to impose a decision but acts as a facilitator to guide the parties toward a resolution.

- Arbitration: This involves a neutral third party, an arbitrator, who hears evidence and makes a binding decision. Arbitration is a more formal process than negotiation or mediation and is often chosen when parties want a quicker and more cost-effective alternative to litigation.

- Litigation: This is the most formal and expensive dispute resolution approach, involving a lawsuit filed in court. Litigation is typically used as a last resort when other methods have failed or when there is a significant legal issue at stake.

Ultimately, the allocation of cost risk in a fixed-price contract is a complex interplay of factors. Understanding the intricacies of this relationship is essential for both contractors and clients to navigate the complexities of fixed-price agreements. By carefully considering the potential risks, establishing clear contractual terms, and implementing effective cost management strategies, both parties can mitigate potential disputes and achieve successful project outcomes.

FAQ Guide: Who Has The Cost Risk In A Fixed Price Contract

What happens if the contractor faces unforeseen cost increases?

In a typical fixed-price contract, the contractor absorbs the cost increases. However, certain provisions like change orders or price adjustments might be included to address unforeseen circumstances.

Can a client modify the scope of work in a fixed-price contract?

Yes, but any changes to the original scope of work typically require a formal change order process. This process usually involves price adjustments to reflect the impact of the changes on the contractor’s costs.

What are the benefits of a fixed-price contract for a client?

Fixed-price contracts offer clients budget certainty, clear project scope, and predictable timelines. This allows for easier financial planning and reduces the risk of cost overruns.

What are the risks for a contractor in a fixed-price contract?

Contractors face the risk of cost overruns if they underestimate costs or encounter unforeseen challenges. They also bear the responsibility for managing risks and ensuring project completion within the agreed-upon price.

/common-types-of-construction-contracts-844483_v2-5bc4b4f84cedfd00262c1bc2.png?w=1024&resize=1024,1024&ssl=1)