A cost plus incentive fee contract has the following characteristics, and it’s basically like this: imagine you’re hiring a contractor to build your dream house. You want it to be perfect, but you also want to make sure you’re not overpaying. This contract type lets you pay the contractor for their actual costs, plus an extra incentive fee if they meet certain performance goals.

It’s a win-win, right? But like any relationship, there are some things to consider before jumping in headfirst.

This type of contract is often used in situations where the project scope is uncertain or complex, and where the contractor needs a strong incentive to perform well. Think of it like this: if you’re hiring someone to build a spaceship, you probably want them to be super motivated to make sure it works, right? That’s where the incentive fee comes in.

Definition and Purpose

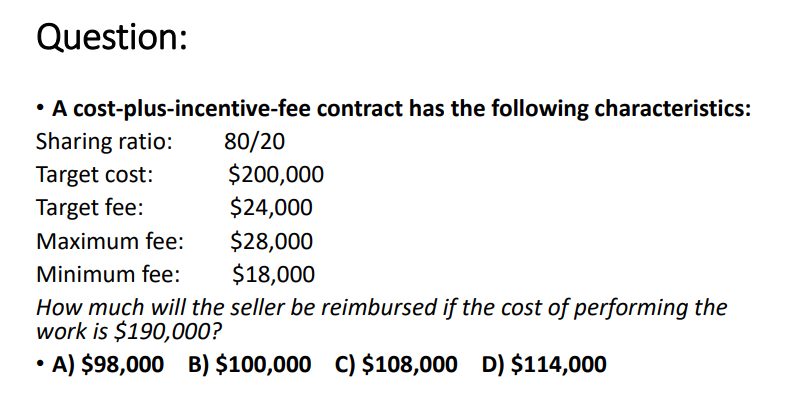

A cost-plus incentive fee contract is a type of agreement where the contractor is reimbursed for all allowable costs incurred in performing the work, plus an incentive fee that is based on the contractor’s performance. The incentive fee is designed to motivate the contractor to achieve specific performance targets, such as completing the project on time and within budget, or exceeding certain quality standards.The purpose of using a cost-plus incentive fee contract is to align the interests of the contractor and the client.

By sharing the risk and reward, both parties are incentivized to work together to achieve the best possible outcome. This type of contract can be particularly beneficial when the scope of work is complex or uncertain, and when the client values the contractor’s expertise and experience.

Suitable Circumstances

A cost-plus incentive fee contract is suitable in a variety of circumstances, including:

- Complex projects with uncertain scope: When the scope of work is complex and the requirements are not fully defined, a cost-plus incentive fee contract can provide flexibility and allow for adjustments as the project progresses.

- Projects with high performance requirements: When the client has specific performance targets that are critical to the success of the project, a cost-plus incentive fee contract can incentivize the contractor to achieve those targets.

- Projects where the contractor’s expertise is crucial: When the client values the contractor’s expertise and experience, a cost-plus incentive fee contract can provide the contractor with the necessary incentives to bring their best skills and knowledge to the project.

- Projects with a high degree of risk: When the project involves a high degree of risk, a cost-plus incentive fee contract can help to mitigate the risk by sharing it between the contractor and the client.

Key Characteristics: A Cost Plus Incentive Fee Contract Has The Following Characteristics

Cost-plus incentive fee contracts are characterized by a unique blend of elements that aim to align the interests of both the buyer and the seller. This type of contract structure incentivizes the seller to control costs while striving for optimal performance. The key characteristics of a cost-plus incentive fee contract differ significantly from other contract types, such as fixed-price contracts, where the price is predetermined, or time and materials contracts, where costs are reimbursed but with less emphasis on performance.

Incentive Fee Structure

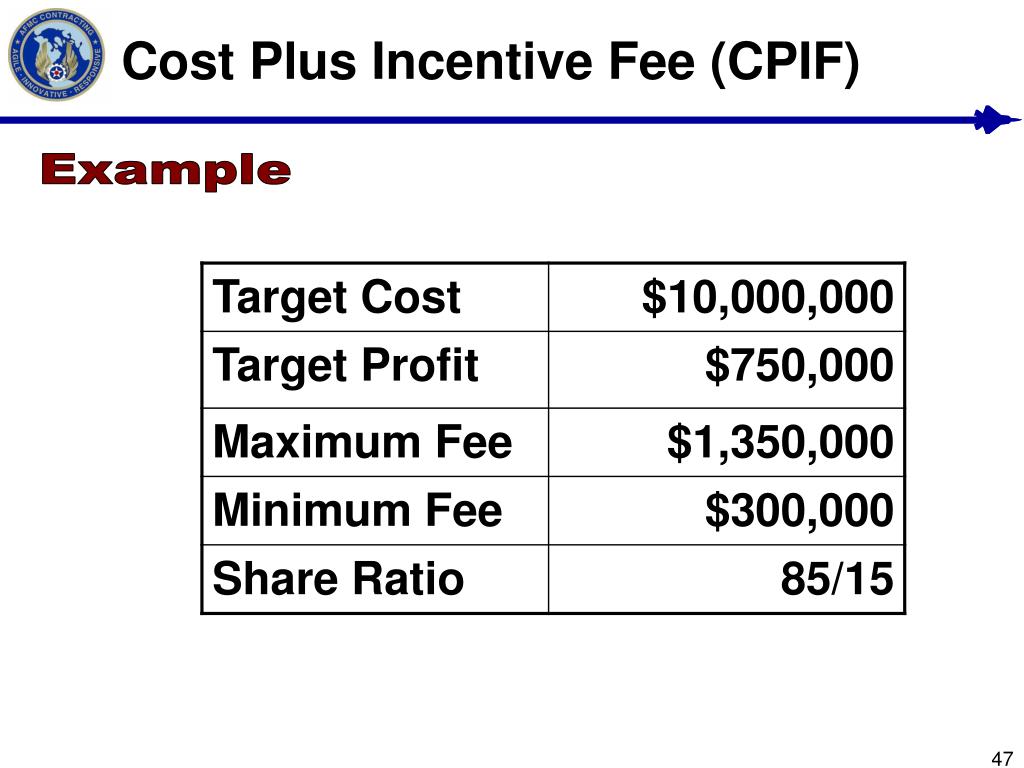

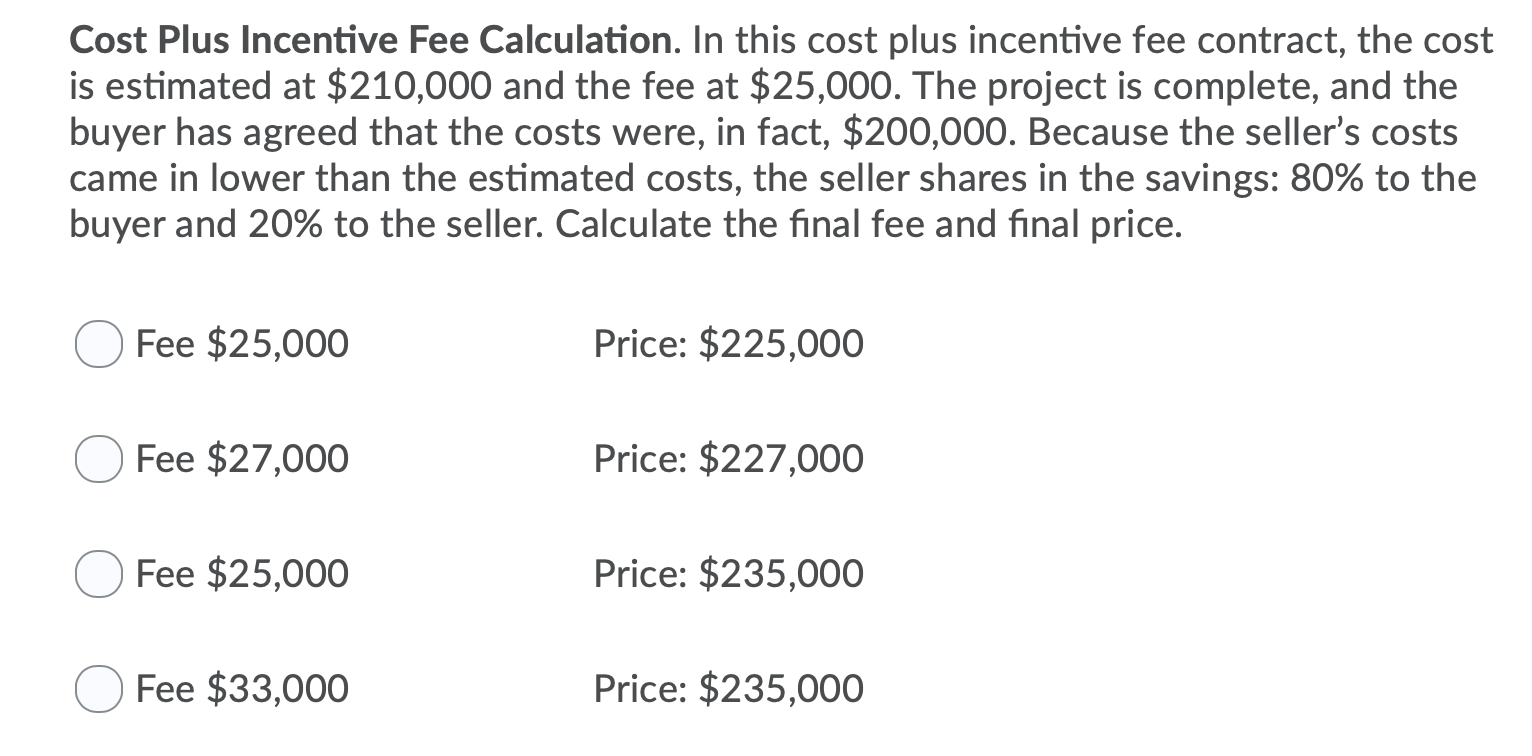

The incentive fee structure is a core characteristic of cost-plus incentive fee contracts. It provides a mechanism for rewarding the seller for exceeding performance targets or exceeding cost-saving goals. The incentive fee is calculated based on a pre-defined formula, which typically involves a combination of factors, such as:

- Cost control: This component rewards the seller for staying within or below the estimated budget.

- Performance targets: This component rewards the seller for achieving or surpassing specific performance goals, such as on-time delivery, quality standards, or technical specifications.

The formula used to calculate the incentive fee is typically negotiated during the contract negotiation process. The incentive fee structure can be designed to motivate the seller to focus on different aspects of the project, depending on the buyer’s priorities.

The incentive fee is calculated based on a pre-defined formula, which typically involves a combination of factors, such as cost control and performance targets.

Risk Allocation

In a cost-plus incentive fee contract, the risk is shared between the buyer and the seller. The buyer assumes the risk of cost overruns, while the seller assumes the risk of not achieving the performance targets. This shared risk allocation encourages both parties to collaborate and work together to achieve the project goals.

- Buyer’s risk: The buyer assumes the risk of cost overruns, meaning they are responsible for paying for any costs that exceed the estimated budget. However, the buyer benefits from the potential cost savings and improved performance that the incentive fee structure encourages.

- Seller’s risk: The seller assumes the risk of not achieving the performance targets. If the seller fails to meet the targets, they will receive a lower incentive fee, or even no fee at all. However, the seller is also rewarded for exceeding the targets, potentially earning a significant incentive fee.

This shared risk allocation encourages a collaborative approach, fostering a partnership between the buyer and the seller.

Transparency and Cost Reporting

Cost-plus incentive fee contracts emphasize transparency and detailed cost reporting. This allows the buyer to monitor the seller’s expenses and ensure that they are reasonable and necessary. The contract typically requires the seller to provide regular cost reports, which are reviewed and approved by the buyer.

- Detailed cost breakdowns: The seller is obligated to provide detailed breakdowns of all costs incurred, including labor, materials, and overhead. This ensures that the buyer has a clear understanding of where the money is being spent.

- Regular cost reporting: The contract typically specifies a schedule for regular cost reporting, allowing the buyer to monitor the project’s progress and identify any potential cost overruns early on.

This transparency promotes trust and accountability, as both parties have access to the necessary information to make informed decisions.

Examples of Clauses

Cost-plus incentive fee contracts typically include specific clauses that address key aspects of the contract, such as:

- Incentive fee calculation: This clause Artikels the formula used to calculate the incentive fee, including the factors that will be considered, such as cost control and performance targets.

- Performance targets: This clause defines the specific performance targets that the seller is expected to achieve, including metrics such as on-time delivery, quality standards, and technical specifications.

- Cost reporting requirements: This clause Artikels the frequency and format of the cost reports that the seller is required to submit to the buyer. It may also specify the level of detail required in the cost reports.

- Dispute resolution: This clause Artikels the process for resolving any disputes that may arise between the buyer and the seller, including the mechanisms for mediation and arbitration.

These clauses provide a clear framework for managing the contract, ensuring that both parties understand their responsibilities and obligations.

Cost Reimbursement

The cost reimbursement aspect of a cost-plus incentive fee contract is a fundamental element that defines the financial framework of the agreement. In essence, the contractor is reimbursed for the actual costs incurred in performing the work, providing a degree of financial security and flexibility.

The cost reimbursement aspect of the contract allows the contractor to recover all eligible expenses incurred in fulfilling the project requirements. This can encompass direct costs such as labor, materials, and equipment, as well as indirect costs like overhead, administrative expenses, and other supporting activities.

Cost Tracking and Documentation

The meticulous tracking and documentation of costs are crucial for ensuring transparency, accountability, and accurate reimbursement under a cost-plus incentive fee contract. This process involves the following key elements:

- Detailed Cost Records: The contractor is required to maintain comprehensive records of all costs incurred. These records should include invoices, receipts, time sheets, and other supporting documentation.

- Cost Classification: Costs must be categorized according to the contractually agreed-upon classification system. This typically involves distinguishing between direct and indirect costs, as well as identifying specific cost categories (e.g., labor, materials, travel).

- Cost Audits: The contracting authority has the right to audit the contractor’s cost records to verify the accuracy and reasonableness of the claimed costs.

- Cost Reporting: The contractor is typically obligated to submit periodic cost reports to the contracting authority, detailing the costs incurred during a specific period.

Potential for Cost Overruns and Mitigation Strategies

While cost reimbursement contracts offer financial security, they also carry the inherent risk of cost overruns. Several factors can contribute to cost overruns, including:

- Unforeseen Circumstances: Changes in project scope, unforeseen technical challenges, or delays due to external factors can significantly impact costs.

- Inefficient Management: Poor planning, inadequate project management, and a lack of cost control can lead to cost overruns.

- Inflation: Rising costs of materials, labor, and other inputs can contribute to cost overruns, especially in long-term projects.

To mitigate the risk of cost overruns, both the contractor and the contracting authority can implement various strategies, including:

- Detailed Cost Estimates: Thorough and realistic cost estimates, developed through careful analysis and expert input, can provide a solid foundation for managing costs.

- Cost Control Measures: Establishing cost control measures, such as regular cost monitoring, cost variance analysis, and value engineering, can help identify and address potential cost overruns early on.

- Incentive Fee Structure: The incentive fee structure should be designed to encourage cost efficiency and incentivize the contractor to control costs.

- Change Management Processes: Effective change management processes are essential for managing the impact of changes in project scope or requirements on costs.

Incentive Fee Structure

The incentive fee structure is a crucial component of a cost-plus incentive fee contract, as it directly links the contractor’s performance to the potential financial rewards. It incentivizes the contractor to exceed the baseline performance expectations and achieve greater project success. The incentive fee is calculated based on a pre-defined formula that considers the contractor’s performance against agreed-upon metrics. These metrics are carefully chosen to align with the project’s objectives and reflect the desired outcomes.

Examples of Incentive Fee Structures

The structure of the incentive fee can vary significantly depending on the project’s specific goals and the contractor’s capabilities. Some common examples of incentive fee structures based on performance metrics include:

- Performance-Based Incentive Fee: This structure rewards the contractor for exceeding predetermined performance targets. For instance, if the project’s goal is to complete construction within a specific timeframe, the contractor might receive a higher incentive fee for early completion.

- Cost Savings Incentive Fee: This structure incentivizes the contractor to reduce project costs below the initial budget. The incentive fee is calculated as a percentage of the cost savings achieved.

- Quality-Based Incentive Fee: This structure rewards the contractor for achieving high-quality deliverables. The incentive fee is calculated based on the quality of the completed work, which may be assessed through inspections, audits, or customer satisfaction surveys.

- Safety-Based Incentive Fee: This structure incentivizes the contractor to maintain a safe work environment. The incentive fee is calculated based on the number of safety incidents or accidents that occur during the project.

The incentive fee structure should be clearly defined in the contract, outlining the performance metrics, target levels, and corresponding incentive fee amounts.

Risk and Reward Sharing

A cost-plus incentive fee contract explicitly defines how risks and rewards are distributed between the contractor and the client. This arrangement encourages both parties to work collaboratively toward achieving project goals, as their financial interests are directly aligned.

Risk Allocation

The contractor assumes a significant portion of the cost risk in a cost-plus incentive fee contract. They are responsible for managing project expenses within the agreed-upon budget. However, the client bears the primary responsibility for scope changes and unforeseen circumstances that may impact the project’s overall cost. For instance, if the client decides to add features or functionalities after the contract is signed, the additional costs will be borne by the client.

Similarly, if unanticipated technical challenges arise, the client will be responsible for covering the associated expenses.

Reward Allocation

The incentive fee structure allows the contractor to share in the project’s success. This is achieved through a predetermined formula that links the fee to specific performance metrics, such as project completion within a defined timeframe, exceeding quality standards, or delivering cost savings. The incentive fee serves as a motivator for the contractor to go beyond the minimum requirements and strive for optimal project outcomes.

For example, a contract might stipulate that the contractor receives a 10% incentive fee if the project is completed on time and within budget, with a 5% bonus for exceeding quality targets.

Impact on Project Outcomes

The risk and reward sharing mechanism in a cost-plus incentive fee contract can significantly impact project outcomes.

- Increased Motivation: The potential for earning an incentive fee motivates the contractor to prioritize efficiency and effectiveness, leading to better project execution.

- Improved Communication: The shared financial interest fosters open communication between the contractor and the client, facilitating proactive problem-solving and collaboration.

- Enhanced Quality: The incentive fee structure incentivizes the contractor to deliver high-quality work, as it directly impacts their financial rewards.

- Reduced Cost Overruns: While the client bears the primary responsibility for cost overruns, the contractor’s shared financial interest in the project can help minimize the likelihood of cost overruns due to inefficient practices or poor planning.

Contract Management

Effective contract management is crucial for the success of cost-plus incentive fee contracts. It ensures that both parties understand their obligations, track progress, and address potential issues promptly. This section will delve into the key elements of contract management, focusing on cost monitoring, performance measurement, and reporting.

Cost Monitoring and Control

Effective cost monitoring is essential to ensure that the project stays within budget. It involves tracking actual costs against the planned budget, identifying variances, and taking corrective action to mitigate potential overruns.

- Establish a Cost Baseline: A detailed cost baseline is crucial for monitoring progress. It should include all anticipated costs, including direct costs, indirect costs, and contingency allowances.

- Regular Cost Reporting: Regular cost reports provide a clear picture of project spending. They should compare actual costs to the baseline, highlight variances, and explain the reasons for any discrepancies.

- Cost Variance Analysis: Analyze cost variances to identify the root causes of overruns or underruns. This analysis helps determine if the deviations are due to unforeseen circumstances, inefficiencies, or poor planning.

- Cost Control Measures: Implement cost control measures to mitigate potential overruns. This can include negotiating lower prices with suppliers, optimizing resource utilization, and implementing cost-saving initiatives.

Performance Measurement and Reporting

Performance measurement is crucial for evaluating the project’s progress and determining the incentive fee. It involves defining key performance indicators (KPIs), collecting data, and analyzing the results.

- Define Key Performance Indicators (KPIs): KPIs are quantifiable measures that track the project’s progress against specific objectives. They should align with the contract’s incentive fee structure.

- Data Collection and Analysis: Collect data related to the KPIs and analyze it to assess the project’s performance. This analysis should be done regularly to identify trends and potential areas for improvement.

- Performance Reports: Prepare regular performance reports that summarize the project’s progress against the KPIs. These reports should highlight areas of strength and weakness, and identify any potential risks or challenges.

- Incentive Fee Calculation: The incentive fee is calculated based on the project’s performance against the KPIs. The contract should clearly define the formula used to determine the incentive fee.

Advantages and Disadvantages

Cost-plus incentive fee contracts offer a unique approach to project management, balancing cost control with performance incentives. This contract type presents advantages and disadvantages that must be carefully considered before implementation.

Advantages, A cost plus incentive fee contract has the following characteristics

The primary advantage of cost-plus incentive fee contracts lies in their ability to encourage optimal project performance by aligning the interests of both parties. The incentive fee structure motivates the contractor to exceed expectations and achieve desired outcomes.

- Enhanced Performance Motivation: By linking the contractor’s financial rewards to project performance, this contract type encourages them to go beyond merely meeting basic requirements. This can lead to increased efficiency, innovation, and a higher likelihood of exceeding project goals.

- Risk Sharing: The cost-plus structure allows for a more balanced distribution of risk between the owner and the contractor. The owner bears the cost of the project, while the contractor assumes the risk of exceeding the estimated costs. This shared risk can encourage a more collaborative approach to project management.

- Flexibility and Adaptability: The cost-plus incentive fee contract offers greater flexibility than fixed-price contracts, allowing for changes in scope or requirements during the project lifecycle. This adaptability can be particularly beneficial for complex projects with uncertain outcomes.

- Access to Specialized Expertise: This contract type can be attractive to contractors with specialized expertise or unique capabilities. The owner can access the best available talent by providing a contract structure that accommodates the contractor’s risk and rewards.

Disadvantages

While offering potential benefits, cost-plus incentive fee contracts also present inherent challenges and disadvantages that must be carefully addressed.

- Cost Control Challenges: The potential for cost overruns is a significant concern with cost-plus contracts. Without a fixed price, the contractor may have less incentive to control costs, potentially leading to higher overall project expenses.

- Complexity and Administration: Establishing a clear and fair incentive fee structure can be complex and require meticulous contract management. This involves defining performance metrics, setting realistic targets, and ensuring transparent cost accounting.

- Potential for Disputes: Disagreements regarding cost allocations, performance measurements, and incentive fee calculations can arise, leading to potential disputes between the owner and contractor.

- Limited Price Certainty: The final project cost is not known upfront, making it difficult to budget accurately. This uncertainty can be a challenge for owners seeking predictable project expenses.

Comparison to Other Contract Types

Cost-plus incentive fee contracts offer a middle ground between fixed-price contracts and cost-plus contracts.

- Fixed-Price Contracts: Fixed-price contracts provide price certainty but limit flexibility and may discourage contractors from exceeding expectations. They offer lower risk for the owner but may not incentivize optimal performance.

- Cost-Plus Contracts: Cost-plus contracts provide maximum flexibility but lack price certainty and may lead to cost overruns. They offer higher risk for the owner but provide greater incentive for the contractor to focus on achieving the project’s goals.

So, there you have it. A cost plus incentive fee contract can be a great way to manage risk and incentivize performance on complex projects. Just remember, like any contract, it’s important to carefully define the scope of work, the incentive fee structure, and the performance metrics. And, like any relationship, communication is key. Make sure you’re on the same page with your contractor, and you’ll be on your way to a successful project.

Quick FAQs

How does a cost plus incentive fee contract differ from a fixed-price contract?

In a fixed-price contract, the contractor agrees to complete the project for a predetermined price, regardless of the actual costs. With a cost plus incentive fee contract, the contractor is reimbursed for their actual costs, plus an incentive fee based on performance. So, in a fixed-price contract, the risk is on the contractor, while in a cost plus incentive fee contract, the risk is shared between the parties.

What are some examples of performance metrics that can be used to calculate the incentive fee?

Performance metrics can vary depending on the project, but common examples include on-time completion, budget adherence, quality of work, and customer satisfaction. The key is to choose metrics that are relevant to the project’s goals and that can be objectively measured.

What are some of the potential downsides of using a cost plus incentive fee contract?

One potential downside is that it can be difficult to track and control costs. Another is that the contractor may have less incentive to be efficient if they know they’ll be reimbursed for their costs. It’s also important to make sure that the incentive fee structure is fair and that the performance metrics are clearly defined. If not, it could lead to conflict and disputes.