A cost-plus-percentage-fee contract is a _____ points 5 – A cost-plus-percentage-fee contract is a risk-sharing deal where the contractor gets paid for their expenses plus a percentage of the total cost. It’s like when you order a pizza and the delivery guy gets a cut of the total bill, except instead of pizza, it’s a big project. This type of contract is often used when the project is complex and the exact costs are hard to estimate upfront.

It’s like saying, “Hey, let’s work together and split the costs, but I get a little extra for my effort.”

The percentage fee is usually a fixed amount agreed upon beforehand, and it’s calculated based on the total cost of the project. This means that the higher the cost, the higher the fee. It’s like saying, “The bigger the project, the bigger the reward.” But, it also means that the contractor has a strong incentive to keep the costs down, as they get a smaller percentage if the costs go up.

Definition

A cost-plus-percentage-fee contract is a type of agreement where the contractor is reimbursed for all project costs, and in addition, receives a percentage of those costs as a fee. It’s like saying, “Hey, we’ll pay you for all the expenses you incur, plus a little extra for your effort.” This type of contract is often used when the project scope is uncertain or the risks are high.

Key Characteristics

The key characteristics of a cost-plus-percentage-fee contract include:

- Reimbursement of Costs: The contractor is reimbursed for all legitimate and verifiable costs incurred in completing the project. This can include labor, materials, equipment, and other expenses.

- Percentage Fee: The contractor receives a percentage of the total project costs as a fee. This fee is typically negotiated upfront and can vary depending on the complexity of the project, the contractor’s experience, and the risks involved.

- Incentives: Cost-plus-percentage-fee contracts can incentivize the contractor to control costs, as they are directly impacted by the final project cost. However, it’s important to note that this incentive can be mitigated if the contractor is not careful in managing expenses.

Real-World Example

Imagine you’re building a custom home. You’re not sure exactly what the final design will be, and there’s a lot of uncertainty about the cost of materials and labor. In this scenario, a cost-plus-percentage-fee contract could be a good option. You would agree to pay the contractor for all their expenses, plus a percentage of those expenses as a fee.

This way, you’re not locked into a fixed price, and the contractor is incentivized to keep costs under control.

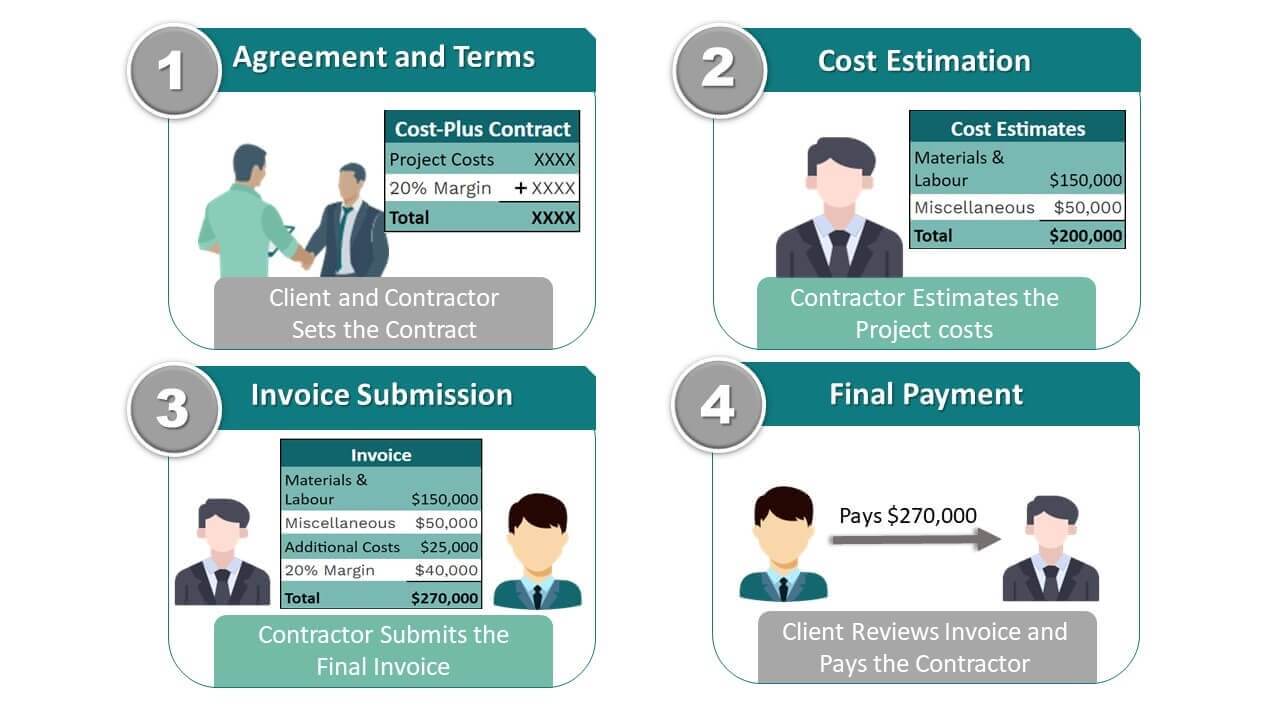

How it Works

In a cost-plus-percentage-fee contract, the contractor is reimbursed for all allowable costs incurred in completing the project, plus a predetermined percentage of those costs as a fee. This fee serves as the contractor’s profit and compensation for their efforts.

Calculating the Total Contract Cost

The total contract cost is calculated by adding the actual costs incurred by the contractor to the percentage fee. The percentage fee is a fixed percentage of the total cost, agreed upon in advance by both parties.

Total Contract Cost = Actual Costs + (Percentage Fee x Actual Costs)

For example, if a project has actual costs of $100,000 and the percentage fee is 10%, the total contract cost would be:

$100,000 + (0.10 x $100,000) = $110,000

Cost Components

The “cost” component of the contract includes all expenses directly related to completing the project. These costs can be categorized as follows:

- Direct Costs: These are costs directly attributable to the project, such as labor, materials, equipment rentals, and subcontractors.

- Indirect Costs: These are costs that support the project but are not directly associated with specific tasks. Examples include overhead costs (rent, utilities, administrative salaries), insurance, and bonding.

- Allowable Costs: Not all costs are included in the contract. The contract will specify which costs are allowable and will be reimbursed.

Percentage Fee

The percentage fee is a predetermined percentage of the total cost, representing the contractor’s profit and compensation for their services. It is calculated by multiplying the total cost by the agreed-upon percentage.

Percentage Fee = Percentage Fee Rate x Total Cost

The percentage fee rate is typically negotiated based on factors such as the complexity of the project, the contractor’s experience, and market conditions. It can be a fixed percentage or can vary based on the project’s progress or completion milestones.

Advantages

The cost-plus-percentage-fee contract offers a number of advantages, particularly in situations where the project scope is uncertain or complex. This type of contract allows for greater flexibility and risk sharing between the parties involved, making it a suitable choice for specific projects.

Risk Sharing

The cost-plus-percentage-fee contract allows for a more equitable distribution of risk between the contractor and the client. Since the contractor is compensated for their actual costs, they are less likely to cut corners or take unnecessary risks to maximize profits. This encourages the contractor to focus on delivering a high-quality project that meets the client’s needs.

Flexibility

The contract’s open-ended nature allows for adjustments to the project scope and requirements as the project progresses. This is especially beneficial when dealing with complex projects with unforeseen challenges or evolving needs. Clients can modify the project without the need for renegotiating the contract, leading to a more collaborative and adaptable project environment.

Transparency, A cost-plus-percentage-fee contract is a _____ points 5

Cost-plus contracts promote transparency by requiring the contractor to provide detailed documentation of their expenses. This allows the client to monitor and verify the costs incurred throughout the project, ensuring that the contractor is not overcharging or misusing funds. This transparency builds trust and reduces the potential for disputes.

Suitable Projects

Cost-plus-percentage-fee contracts are most suitable for projects where:

- The scope of work is complex and uncertain, requiring flexibility in design and execution.

- The project involves significant technical challenges or risks that require specialized expertise.

- The client values transparency and accountability in project management.

- The client is willing to share the risk of cost overruns with the contractor.

Disadvantages

While cost-plus-percentage-fee contracts can be beneficial in certain situations, they also come with potential drawbacks. Understanding these risks is crucial before opting for this type of contract.

Potential for Cost Overruns

The biggest risk with cost-plus contracts is the potential for cost overruns. Since the contractor is paid for their actual costs plus a percentage, they have less incentive to control expenses. This can lead to situations where the project costs significantly exceed the initial estimates, leaving the owner with a hefty bill.

Lack of Incentive for Efficiency

Cost-plus contracts can disincentivize contractors from finding cost-effective solutions. As the contractor is reimbursed for all costs, they may not be motivated to explore ways to reduce expenses or improve efficiency. This can lead to higher overall project costs.

Difficulty in Monitoring Costs

Monitoring costs can be challenging under cost-plus contracts. The owner needs to closely track all expenses incurred by the contractor to ensure they are legitimate and reasonable. This requires significant time and resources, potentially adding to the project’s administrative burden.

Potential for Abuse

There’s always a risk that the contractor might inflate their costs or take advantage of the cost-plus arrangement. This could lead to the owner paying for unnecessary expenses or inflated prices.

Limited Price Certainty

Unlike fixed-price contracts, cost-plus contracts offer limited price certainty. The final cost of the project can vary significantly depending on the actual costs incurred, making it difficult to budget accurately.

Situations Where Cost-Plus Contracts Are Less Desirable

Cost-plus contracts are generally less desirable when:* The project scope is well-defined and the costs can be accurately estimated.

- The owner has a high level of expertise in the project area and can effectively monitor costs.

- The owner is seeking a fixed price for the project to facilitate budgeting and financial planning.

- There is a high risk of cost overruns or contractor inefficiency.

- The owner is concerned about the potential for contractor abuse or inflated costs.

Examples: A Cost-plus-percentage-fee Contract Is A _____ Points 5

Okay, so you’ve got the basics down, but how does this actually work in real life? Let’s take a look at some real-world examples of cost-plus-percentage-fee contracts.This type of contract is most often used when the scope of work is uncertain or complex. It’s a good choice for projects where the risks are high and the contractor needs to be compensated for their efforts, even if the project goes over budget.

Scenarios

Here are some scenarios where a cost-plus-percentage-fee contract might be used:

- Construction of a new hospital: The design and construction of a new hospital can be very complex and involve many unforeseen challenges. A cost-plus-percentage-fee contract allows the contractor to be compensated for these challenges, while also giving the hospital some control over the project costs.

- Research and development project: Research and development projects are often highly uncertain, and it can be difficult to estimate the costs upfront. A cost-plus-percentage-fee contract allows the contractor to be compensated for the risks associated with the project.

- Emergency repairs: When a disaster strikes, it’s often necessary to make repairs quickly, without the time to get detailed bids. A cost-plus-percentage-fee contract can be used to expedite the repair process.

- Government contracts: The government often uses cost-plus-percentage-fee contracts for projects that are considered to be of national importance, such as defense contracts. This type of contract allows the government to ensure that the contractor is compensated for the costs of the project, while also providing some oversight.

Industries

Here are some industries where cost-plus-percentage-fee contracts are commonly used:

- Construction: Cost-plus-percentage-fee contracts are often used for large-scale construction projects, such as hospitals, schools, and government buildings.

- Engineering: Cost-plus-percentage-fee contracts are also used for complex engineering projects, such as bridge construction or power plant construction.

- Aerospace: The aerospace industry often uses cost-plus-percentage-fee contracts for the development and production of advanced aircraft and spacecraft.

- Defense: The defense industry also uses cost-plus-percentage-fee contracts for the development and production of military equipment.

Implications

Using a cost-plus-percentage-fee contract can have both positive and negative implications. Here are some things to consider:

- Potential for cost overruns: Since the contractor is compensated for their costs, there is a potential for cost overruns. This is especially true if the contractor is not closely monitored.

- Lack of incentive to control costs: Some contractors may not have as much incentive to control costs if they are being paid a percentage of the total cost. This could lead to higher project costs.

- Transparency issues: There is a potential for lack of transparency with cost-plus-percentage-fee contracts. The contractor may not be fully transparent about their costs, which can make it difficult to track project expenses.

- Potential for conflicts of interest: There is a potential for conflicts of interest if the contractor is also responsible for approving their own expenses. This could lead to inflated costs.

So, when you’re dealing with a complex project and you need to share the risk with the contractor, a cost-plus-percentage-fee contract might be the way to go. It’s a flexible and transparent way to work together, and it can be a good option when you don’t have a clear idea of the final costs. But, remember, it’s important to carefully define the scope of work and the percentage fee to avoid any surprises down the line.

Question Bank

What are some examples of projects that use a cost-plus-percentage-fee contract?

This type of contract is often used for projects where the scope of work is unclear, like research and development projects, government contracts, and construction projects with unpredictable conditions.

What are some potential drawbacks of a cost-plus-percentage-fee contract?

One of the biggest drawbacks is that the contractor might have an incentive to inflate the costs to increase their profit. It’s important to have strong oversight and clear reporting mechanisms to prevent this.

Is a cost-plus-percentage-fee contract always the best option?

Not necessarily. If you have a clear understanding of the project scope and costs, a fixed-price contract might be a better option. But, if you need flexibility and want to share the risk with the contractor, a cost-plus-percentage-fee contract can be a good choice.