A major problem with cost-plus contracts is that they – Cost-plus contracts: They Encourage Contractors to Party Hard. Imagine this: you’re hiring a contractor to build a swimming pool. You agree to pay for all the materials, labor, and a hefty percentage on top for their “profit.” Sounds fair, right? Wrong. Suddenly, your contractor is throwing lavish pool parties for the entire neighborhood, complete with a DJ, a catered buffet, and a flaming water show.

You’re paying for it all, and they’re just living the high life. That’s the beauty (or nightmare, depending on your perspective) of a cost-plus contract.

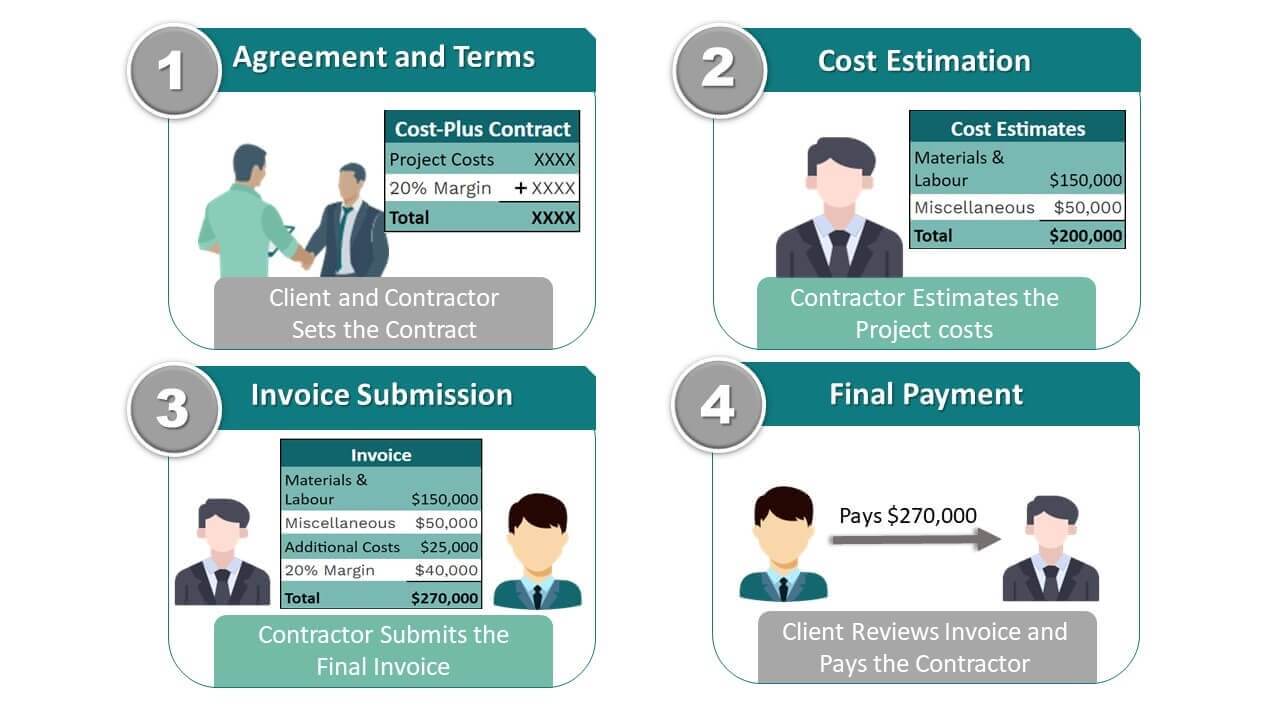

Cost-plus contracts, where the contractor gets reimbursed for all their expenses plus a percentage for profit, can be a recipe for financial disaster. They can incentivize contractors to spend more, not less, and they can make it nearly impossible to track their actual costs. It’s like giving a teenager a credit card with no spending limit – good luck getting them to pay it back!

Lack of Incentive for Cost Control

Cost-plus contracts, where the contractor is reimbursed for their expenses plus a predetermined profit margin, can inadvertently create a situation where they have less motivation to manage costs effectively. This lack of incentive can lead to cost overruns, impacting project budgets and potentially causing financial strain for the project owner.

Potential for Cost Overruns

Cost-plus contracts can lead to cost overruns due to the lack of incentive for the contractor to control expenses. Since the contractor is guaranteed to be reimbursed for their costs, they may be less inclined to prioritize cost-efficiency. This can result in situations where the contractor prioritizes maximizing profits over minimizing costs, leading to unnecessary expenses and higher overall project costs.

“The contractor may be tempted to inflate costs, knowing that they will be reimbursed for them.”

Source

[Name of the source]

Examples of Situations Where Contractors Might Prioritize Maximizing Profits Over Minimizing Costs

- Using higher-priced materials: The contractor may choose to use more expensive materials even if cheaper alternatives are available, as they will be reimbursed for the higher cost.

- Hiring additional personnel: The contractor may hire more workers than necessary, increasing labor costs, as they will be reimbursed for these expenses.

- Incurring unnecessary expenses: The contractor may engage in activities that are not essential to the project but increase their costs, such as unnecessary travel or entertainment expenses.

Difficulty in Assessing Performance

In a cost-plus contract, the contractor’s compensation is directly linked to the project’s costs. This creates a unique challenge when it comes to evaluating their performance. Since the contractor is essentially rewarded for higher costs, it can be difficult to determine if they are truly delivering value or simply maximizing their profits.This lack of clear performance metrics can make it challenging to assess whether a contractor is performing efficiently or if they are simply inflating costs.

It can be difficult to determine if the contractor is using the most cost-effective methods or if they are simply taking advantage of the contract’s terms.

Challenges in Evaluating Contractor Performance

The absence of objective performance indicators can lead to disputes and disagreements. This can create tension between the contractor and the client, leading to delays and increased costs.

- Lack of Incentives for Efficiency: The cost-plus contract structure can incentivize contractors to prioritize maximizing costs over efficiency. They may be less motivated to find cost-saving solutions or optimize their processes.

- Difficulty in Measuring Value: It’s difficult to objectively measure the value a contractor is providing when their compensation is tied to project costs. It can be challenging to separate cost increases from actual improvements in quality or performance.

- Potential for Cost Inflation: Without proper oversight, contractors may be tempted to inflate costs, knowing that their compensation will increase proportionally. This can lead to significant budget overruns and project delays.

Increased Risk of Fraud and Abuse

The lack of incentives for cost control in cost-plus contracts creates a fertile ground for fraudulent activities. Contractors, motivated by profit maximization, may exploit the contract’s open-ended nature to inflate costs and manipulate accounting records, ultimately benefiting at the expense of the project owner.

Vulnerabilities in Cost-Plus Contracts

The absence of clear cost benchmarks and the contractor’s control over cost reporting can lead to potential vulnerabilities. This creates an environment where contractors can easily manipulate costs to their advantage.

- Inflated Labor Costs: Contractors may overestimate the number of labor hours required or inflate the hourly rates of their employees. This can be done by claiming excessive overtime, employing unnecessary personnel, or simply padding the time sheets.

- Unnecessary Materials: Contractors might purchase higher-quality materials than specified in the contract or order more materials than needed, claiming it’s necessary for the project. They can then sell the excess materials at a profit, adding to their earnings.

- Unjustified Markups: Cost-plus contracts often include a fixed markup on direct costs to cover overhead and profit. Contractors may inflate their overhead expenses or claim higher profit margins than justified by the market conditions.

Contractor Manipulation of Accounting Records

Contractors may engage in various accounting practices to inflate costs and maximize profits. These manipulations can be subtle and difficult to detect without rigorous auditing.

- Misclassifying Costs: Contractors might classify expenses that are not directly related to the project as project costs. This could include personal expenses, entertainment costs, or even unrelated business expenses.

- Double-Billing: Contractors might bill the project owner for the same expense twice, creating a false impression of higher costs and generating additional profits.

- Creating Fictitious Costs: Contractors may invent or fabricate costs that never occurred, claiming them as legitimate project expenses. This can involve creating fake invoices, contracts, or other documentation to support their claims.

Importance of Oversight and Auditing Mechanisms

To mitigate the risk of fraud and abuse in cost-plus contracts, robust oversight and auditing mechanisms are crucial. These measures ensure that contractors are held accountable for their cost reporting and that any irregularities are detected and addressed promptly.

- Independent Cost Audits: Regular independent cost audits by qualified professionals are essential to verify the accuracy of the contractor’s cost reports. These audits should cover all aspects of the project, including labor, materials, and overhead expenses.

- Strong Contractual Provisions: The contract should include clear and detailed provisions regarding cost reporting, auditing, and dispute resolution. These provisions should define the scope of the contractor’s responsibilities, the process for cost verification, and the consequences of fraudulent activities.

- Effective Project Management: A strong project management team with experience in cost control and risk management can play a crucial role in preventing fraud. They can monitor the project’s progress, review cost reports, and identify potential red flags early on.

Complexity and Administrative Burden: A Major Problem With Cost-plus Contracts Is That They

Cost-plus contracts can be a real headache when it comes to administration. They’re like a tangled ball of yarn that takes forever to unravel.Imagine trying to keep track of every single expense, from the cost of a cup of coffee to the price of a new server. That’s what managing a cost-plus contract is like. It’s a constant process of gathering receipts, verifying invoices, and making sure everything adds up.

Tracking Costs and Verifying Expenses

The process of tracking costs and verifying expenses can be a real time-suck. It’s like playing a game of “Where’s Waldo?” but instead of finding a guy in a striped shirt, you’re trying to find every single expense that’s been incurred. This can involve reviewing detailed invoices, scrutinizing purchase orders, and even checking with suppliers to make sure everything is legitimate.

It’s a lot of work, and it can be easy to miss something.

Reconciling Invoices

Reconciling invoices is another administrative burden that comes with cost-plus contracts. It’s like trying to balance a checkbook, but with way more numbers and way more potential for errors. You need to make sure that the invoices match the actual expenses that have been incurred, and that everything is properly accounted for. This can involve comparing invoices to purchase orders, reviewing supporting documentation, and even contacting the contractor to clarify any discrepancies.

Potential for Delays and Disputes, A major problem with cost-plus contracts is that they

All this extra paperwork and administration can lead to delays and disputes. It’s like a recipe for disaster. Imagine you’re trying to build a house, but you have to stop every few weeks to review invoices and make sure everything is in order. It’s not exactly conducive to smooth sailing. Disputes can arise over things like the interpretation of contract terms, the validity of expenses, or the accuracy of invoices.

These disputes can drag on for months, causing delays and adding to the overall cost of the project.

Limited Transparency and Accountability

You know, when it comes to cost-plus contracts, transparency is like a rare gemstone – super valuable but not always easy to find. It’s a bit like ordering a custom-made outfit, but you’re only given the final price tag without any breakdown of the fabric, tailoring, or embellishments. You’re left wondering, “Did they charge me extra for that fancy button?”The lack of transparency in cost-plus contracts can be a real buzzkill for project monitoring and control.

Imagine trying to manage your budget without knowing where the money is going! It’s like trying to navigate a maze without a map.

The Importance of Establishing Clear Reporting Requirements and Auditing Procedures

To make sure everything is above board, clear reporting requirements and auditing procedures are crucial. Think of them as the GPS system for your project, guiding you through the complexities of cost-plus contracts. Here’s how they help:* Regular Reporting: Imagine getting a detailed report every month, outlining all the costs incurred, the progress made, and any potential issues.

This keeps you in the loop and helps you stay on top of things.

Independent Audits

It’s like having a trusted friend review your books. Independent audits provide an objective assessment of the costs, ensuring that everything is legitimate and there’s no funny business.

“Transparency and accountability are the cornerstones of good governance and effective project management.”

Cost-plus contracts are like a wild rollercoaster ride: thrilling at first, but ultimately a recipe for financial headaches. They’re full of unpredictable twists and turns, and the final bill can be a shocking surprise. So, if you’re planning a project, consider all your options before you sign on the dotted line. You might want to steer clear of the cost-plus contract and opt for a fixed-price agreement instead.

You’ll have a better chance of keeping your budget intact and your sanity intact.

FAQ Compilation

What are the benefits of a cost-plus contract?

Well, there are some benefits, like the fact that you don’t have to worry about the contractor running out of money. But those benefits are overshadowed by the potential for financial ruin. So, unless you’re really, really desperate, you might want to consider other options.

Are cost-plus contracts ever used?

Surprisingly, yes! They’re sometimes used in projects with lots of unknowns, like research and development or government contracts. But even in these cases, it’s important to have strong safeguards in place to prevent cost overruns and ensure transparency.

What can I do to protect myself from a cost-plus contract nightmare?

First, do your research and make sure you understand the risks. Second, negotiate a clear and detailed contract with specific cost limits and performance metrics. Third, hire a good lawyer to review the contract before you sign it. And lastly, be prepared to walk away if you don’t feel comfortable with the terms.