Is Social Security a Ponzi scheme? This question has sparked heated debate among economists, politicians, and everyday Americans. While the program provides essential financial support for millions, concerns linger about its long-term sustainability. Critics point to the program’s reliance on current workers’ contributions to fund benefits for retirees, drawing parallels to the structure of a Ponzi scheme. However, proponents argue that Social Security is a vital social safety net that has evolved over time to adapt to changing demographics and economic conditions.

This article delves into the intricacies of the Social Security system, examining both sides of the argument and exploring the key characteristics that have fueled the debate. We’ll analyze the historical context, funding mechanisms, and projected long-term trends to gain a deeper understanding of the program’s strengths and weaknesses.

Understanding Social Security

Social Security is a vital social insurance program in the United States, providing financial support to millions of Americans throughout their lives. It is a cornerstone of the nation’s social safety net, offering financial security during retirement, disability, and in the event of a worker’s death.

The Core Principles of Social Security

Social Security operates based on a simple principle: current workers contribute to the system through payroll taxes, which are then used to pay benefits to current retirees, disabled individuals, and surviving family members. This system is often referred to as a “pay-as-you-go” system, as current contributions directly fund current benefits.

Benefits Offered by Social Security

Social Security provides a range of benefits to eligible individuals and their families. These benefits fall into three main categories:

Retirement Benefits

Retirement benefits are the most common type of Social Security benefit. Individuals who have worked and paid Social Security taxes for a certain period are eligible to receive monthly retirement payments upon reaching retirement age. The amount of the benefit is based on the individual’s earnings history, with higher earners generally receiving larger benefits.

Disability Benefits

Disability benefits are available to individuals who are unable to work due to a severe medical condition. These benefits are intended to help individuals and their families cope with the financial hardship caused by a disability. To qualify for disability benefits, individuals must meet certain medical and work requirements.

Survivor Benefits

Survivor benefits are provided to the surviving spouses, children, and dependent parents of deceased workers who were paying Social Security taxes. These benefits help ensure that families have financial support in the event of a worker’s death.

Funding Social Security

Social Security is funded primarily through payroll taxes, which are levied on both employers and employees. The Social Security Act mandates that a portion of each worker’s wages be withheld for Social Security. This money is then deposited into the Social Security Trust Fund, which is managed by the U.S. Treasury.

Payroll Taxes

The Social Security payroll tax is a flat tax, meaning that everyone pays the same percentage of their earnings, regardless of their income level. The current tax rate is 12.4%, with half paid by the employer and half paid by the employee. This tax is levied on the first $160,200 of earnings in 2023.

Social Security Trust Fund

The Social Security Trust Fund is a government-managed account that holds the money collected from payroll taxes. This fund is used to pay out Social Security benefits to current recipients. The trust fund is also invested in U.S. Treasury securities, which are considered safe and reliable investments.

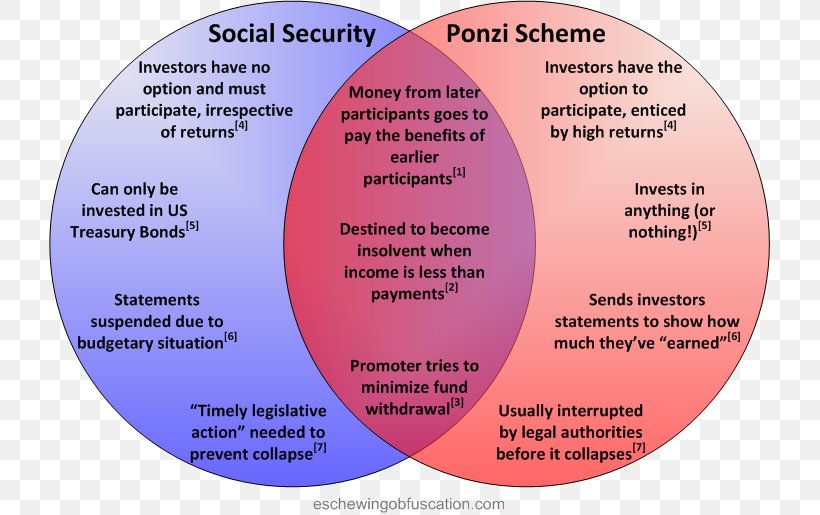

The Ponzi Scheme Analogy

The comparison of Social Security to a Ponzi scheme is a controversial topic, often used to highlight potential vulnerabilities in the system. Understanding the core principles of a Ponzi scheme and how they differ from Social Security’s structure is crucial to assess the validity of this analogy.

The Essence of a Ponzi Scheme

A Ponzi scheme, named after Charles Ponzi, is a fraudulent investment operation that pays returns to existing investors from funds contributed by new investors, rather than from legitimate profits generated by the scheme’s activities. This creates a pyramid-like structure where early investors profit at the expense of later ones.

- Early investors receive returns, but they are not from legitimate profits. The scheme relies on a constant influx of new investors to sustain the illusion of profitability.

- The scheme collapses when new investments dry up, as there are not enough new investors to pay off the existing ones.

- The operator of the scheme often misrepresents the nature of the investments, promising high returns with minimal risk, enticing people to invest.

Comparing Social Security to a Ponzi Scheme

While Social Security shares some superficial similarities with a Ponzi scheme, it’s crucial to recognize the fundamental differences:

- Social Security is a government-run program, not a private investment scheme. It is funded through payroll taxes, not by attracting new investors. This means the government is responsible for ensuring the program’s solvency, unlike a Ponzi scheme, which relies on the continuous influx of new investors.

- Social Security benefits are not dependent on the influx of new participants. While a growing workforce contributes to the system’s sustainability, the program is designed to provide benefits to current retirees, even if there are fewer workers paying into the system. This is unlike a Ponzi scheme, which collapses when new investments stop.

- Social Security benefits are not guaranteed to be profitable. They are based on a complex formula that considers factors such as earnings history and age at retirement. This means that benefits may not always exceed contributions, unlike a Ponzi scheme where early investors typically receive higher returns.

Key Differences

- Social Security is a social insurance program, not an investment scheme. It is designed to provide a safety net for retirees, not to generate profits.

- Social Security is regulated by the government, not a private entity. This means that there are safeguards in place to protect beneficiaries and prevent fraud.

- Social Security benefits are not guaranteed to be profitable. They are based on a complex formula that considers factors such as earnings history and age at retirement.

Arguments in Favor of the Ponzi Scheme Analogy: Is Social Security A Ponzi

The analogy of Social Security as a Ponzi scheme has been a subject of debate for decades. While the Social Security Administration (SSA) strongly refutes this comparison, several arguments point to potential similarities that raise concerns about its long-term sustainability. Proponents of this analogy argue that Social Security relies on a system where current workers’ contributions are used to fund current retirees’ benefits.

This structure, they claim, resembles a Ponzi scheme, where early investors receive returns from the contributions of later investors.

The Trust Fund’s Depletion

The Social Security Trust Fund is a crucial component of the system. It accumulates surplus contributions during periods when more revenue is collected than benefits paid out. These funds are invested in U.S. Treasury securities, serving as a reserve to ensure benefits can be paid out when revenue falls short. However, the Trust Fund is projected to be depleted by 2034, meaning that the program will only be able to pay out 77% of scheduled benefits.

The projected depletion of the Trust Fund highlights the growing imbalance between incoming contributions and outgoing benefits.

This imbalance arises from several factors, including an aging population, rising life expectancy, and slower economic growth.

Historical and Current Ponzi Schemes

Several historical and contemporary Ponzi schemes illustrate the potential risks associated with Social Security. The infamous case of Bernie Madoff’s Ponzi scheme, which defrauded investors of billions of dollars, highlights the dangers of relying on a system where returns are generated primarily from new investments.

Madoff’s scheme promised high returns to early investors, attracting more participants. However, these returns were not based on legitimate investments but were instead funded by the contributions of new investors.

Similarly, Social Security, critics argue, relies on a similar model, where current workers’ contributions fund current retirees’ benefits. If the inflow of new contributions slows down or falls short, the system could become unsustainable, leading to benefit cuts or tax increases.

Arguments Against the Ponzi Scheme Analogy

While the comparison of Social Security to a Ponzi scheme might seem compelling at first glance, it fails to capture the complexities of the system and its long-term sustainability. Critics of this analogy argue that it oversimplifies the program’s structure and overlooks crucial aspects of its financing and operation.

Social Security’s Sustainable Funding Mechanism

Social Security is not solely reliant on contributions from current workers to pay benefits to retirees, as a Ponzi scheme would be. Instead, it operates on a “pay-as-you-go” system, where current workers’ contributions are used to fund the benefits of current retirees. This system is fundamentally different from a Ponzi scheme, which relies on a continuous influx of new investors to pay off earlier investors.

Social Security’s funding mechanism ensures that benefits are paid out regardless of the number of new participants, as long as the system remains solvent.

Government Intervention and Policy Changes

The Social Security system is subject to government oversight and policy adjustments to address potential challenges, such as changing demographics and economic conditions. These interventions aim to ensure the long-term sustainability of the program. For instance, in 1983, a series of reforms were implemented, including increasing the retirement age, raising payroll taxes, and establishing a trust fund to help cover future obligations.

These reforms have significantly strengthened the program’s financial position and extended its solvency.

Social Security’s Long-Term Viability

Despite concerns about the system’s future, projections indicate that Social Security can continue to pay full benefits for the next few decades. The Social Security Administration (SSA) regularly assesses the program’s financial health and provides projections based on various economic and demographic scenarios. These projections suggest that while the trust fund is expected to be depleted by 2034, the system will still be able to pay out about 75% of promised benefits thereafter.

This is due to the program’s ability to generate revenue through payroll taxes, even without the trust fund.

Adaptability to Changing Demographics

Social Security has demonstrated its ability to adapt to changing demographics. The system has been adjusted over time to address factors such as increasing life expectancy, lower birth rates, and shifts in the labor force. For example, the retirement age has been gradually increased to account for longer life spans, and the program has been expanded to cover individuals with disabilities and survivors.

This adaptability ensures that Social Security remains relevant and responsive to the evolving needs of the population.

Government Support and Public Trust

Social Security enjoys strong public support and is considered a vital component of the social safety net. The program provides a crucial source of income for millions of retirees and their families, and it has a significant impact on the economy. The government’s commitment to maintaining Social Security is evident in its ongoing efforts to address potential challenges and ensure its long-term viability.

Alternative Perspectives on Social Security

The debate surrounding Social Security often centers around the Ponzi scheme analogy, but alternative viewpoints offer a broader understanding of its nature and purpose. These perspectives shed light on the program’s role as a social insurance program and an intergenerational transfer system, highlighting its complexities and potential benefits.

Social Security as Social Insurance, Is social security a ponzi

Social Security can be viewed as a form of social insurance, akin to other insurance programs like health insurance or auto insurance. Individuals pay premiums (in the form of payroll taxes) throughout their working lives, creating a pool of funds that provides benefits to those who have reached retirement age or become disabled. This approach emphasizes the concept of shared risk, where individuals contribute to a system that provides financial security in times of need.

Social Security as Intergenerational Transfer

Social Security also functions as an intergenerational transfer system, where current workers contribute to the benefits received by retirees. This system ensures that retirees, who have contributed to the economy throughout their lives, receive a source of income in their later years. However, this transfer of wealth from younger generations to older generations has raised concerns about long-term sustainability, particularly as life expectancies increase and the ratio of workers to retirees declines.

Benefits of Alternative Perspectives

These alternative perspectives offer several benefits:

- Emphasis on Social Solidarity: Viewing Social Security as social insurance highlights the importance of shared responsibility and social solidarity. It recognizes that individuals are not isolated entities but are part of a broader community with shared interests and obligations.

- Focus on Intergenerational Equity: The intergenerational transfer perspective emphasizes the importance of ensuring a fair distribution of resources between generations. It acknowledges the contributions of older generations and the need to provide them with adequate support in their later years.

- More nuanced understanding: These perspectives offer a more nuanced understanding of Social Security, acknowledging its complexities and multifaceted nature. They move beyond simplistic analogies and provide a more comprehensive framework for evaluating the program’s effectiveness and long-term sustainability.

Ultimately, the debate over whether Social Security is a Ponzi scheme hinges on how we define the program’s purpose and sustainability. While the program’s future is undeniably intertwined with economic and demographic trends, the role of government intervention and policy changes cannot be overlooked. Whether we choose to view Social Security as a social insurance program, a form of intergenerational transfer, or a potential Ponzi scheme, one thing is certain: the program’s future requires thoughtful consideration and proactive action to ensure its long-term viability for generations to come.

FAQ Summary

What is the Social Security Trust Fund?

The Social Security Trust Fund is a government account that accumulates surplus payroll taxes collected from workers. It serves as a reserve to pay benefits when annual tax revenues fall short of benefit payments.

When is the Social Security Trust Fund projected to be depleted?

According to the Social Security Administration, the Trust Fund is projected to be depleted by 2034, meaning that the program will only be able to pay out about 76% of promised benefits.

What are some potential solutions to the Social Security funding challenges?

Possible solutions include raising payroll taxes, increasing the retirement age, reducing benefits, or implementing a means-testing system. However, any changes would need to be carefully considered to minimize negative impacts on beneficiaries.