Are cost plus contracts illegal in california – Are cost-plus contracts illegal in California? This question often arises in the construction industry, where these contracts can offer both advantages and potential pitfalls. Cost-plus contracts, where the contractor is reimbursed for actual costs plus a predetermined fee, can be beneficial in complex or unpredictable projects. However, they also carry the risk of disputes and potential overspending, leading to concerns about their legality and ethical implications in California.

This article delves into the legal framework surrounding cost-plus contracts in California, exploring the specific laws and regulations governing their use. We’ll examine the potential risks and concerns associated with these contracts, including common disputes and the importance of clear contract language. We’ll also provide best practices for navigating cost-plus contracts in California, ensuring a successful and ethical approach to construction projects.

Understanding Cost-Plus Contracts

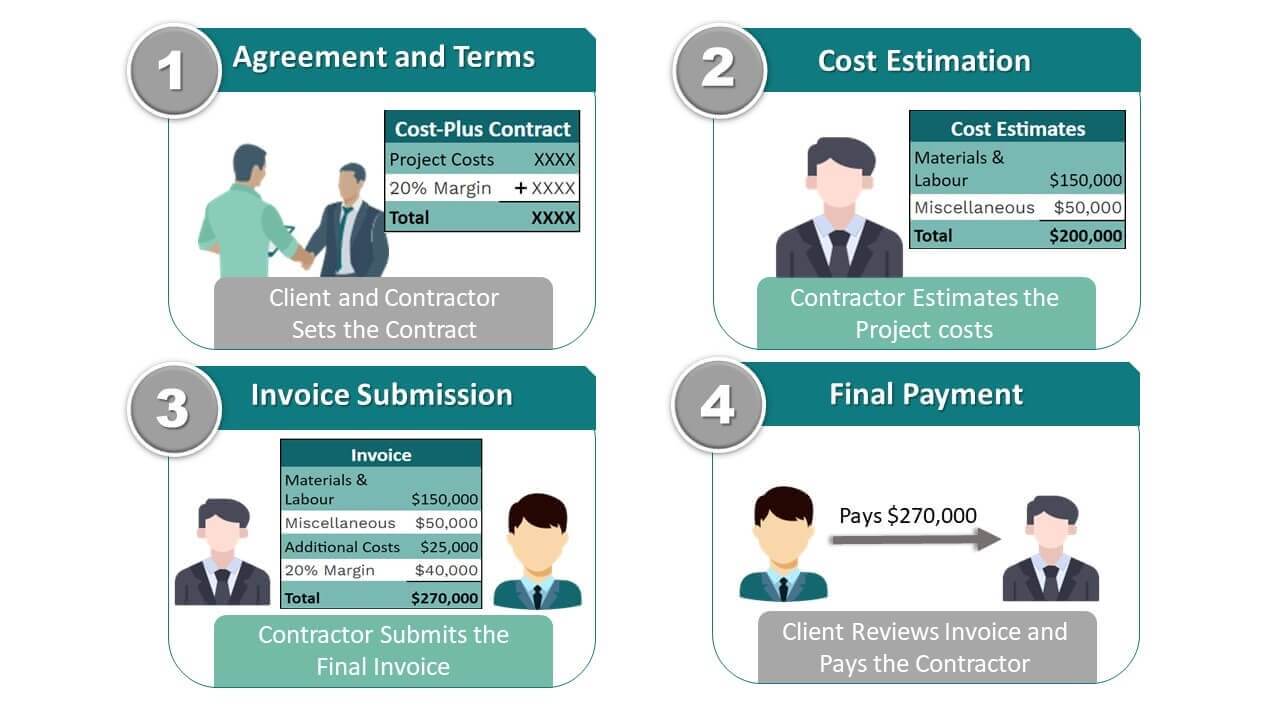

Cost-plus contracts, also known as cost reimbursement contracts, are a type of construction agreement where the contractor is compensated for their actual costs incurred during the project, plus an agreed-upon fee or percentage for their services. These contracts are often used when the scope of work is uncertain or complex, making it difficult to accurately estimate the final cost upfront.Cost-plus contracts offer flexibility and transparency, as the owner is informed of all costs incurred throughout the project.

This type of contract can be particularly beneficial in situations where there are unforeseen changes or challenges that might arise during construction. However, it’s crucial to have clear and detailed agreements in place to ensure proper cost control and prevent potential disputes.

Types of Cost-Plus Contracts

Cost-plus contracts can be structured in various ways, with different fee arrangements and levels of risk allocation. Here are some common types of cost-plus contracts used in California:

- Cost-Plus-Fixed Fee (CPFF): In this type of contract, the contractor receives a fixed fee, typically a percentage of the total project cost, in addition to the reimbursable costs. This arrangement provides a predictable profit margin for the contractor, while the owner assumes the risk of cost overruns.

- Cost-Plus-Percentage of Cost (CPPC): This type of contract compensates the contractor with a percentage of the total project cost, which can vary depending on the project’s complexity and the contractor’s experience. While this method offers flexibility in fee determination, it can potentially lead to higher overall costs for the owner.

- Cost-Plus-Incentive Fee (CPIF): This contract structure incorporates an incentive fee for the contractor to complete the project within a specific timeframe or budget. The incentive fee is paid based on the project’s performance, encouraging the contractor to prioritize efficiency and cost control.

Situations Where Cost-Plus Contracts Might Be Preferred

Cost-plus contracts can be advantageous in certain circumstances, such as:

- Complex or Unpredictable Projects: When the scope of work is uncertain or subject to frequent changes, cost-plus contracts can provide flexibility and reduce the risk of unforeseen costs for both parties.

- Projects with Limited Design or Specifications: If the design or specifications are not fully defined at the outset, cost-plus contracts allow for adjustments and modifications as the project progresses.

- Projects Requiring Specialized Expertise: When specialized skills or equipment are needed, cost-plus contracts can be used to engage contractors with the necessary expertise, even if their costs are difficult to estimate upfront.

- Emergency Repairs or Reconstruction: In cases of emergency repairs or reconstruction, where immediate action is required, cost-plus contracts can facilitate a quick response without the need for detailed upfront estimates.

California’s Legal Framework: Are Cost Plus Contracts Illegal In California

California law does not explicitly prohibit cost-plus contracts. However, the state’s legal framework and regulations have implications for how these contracts are structured and executed. Understanding these legal nuances is crucial for ensuring compliance and mitigating potential risks. The California Civil Code, particularly Section 1671, governs contracts generally. This section requires contracts to be in writing and to clearly specify the terms of the agreement.

Cost-plus contracts, due to their inherent flexibility, can pose challenges in meeting these requirements. The law emphasizes clarity and certainty in contractual terms, making it imperative to carefully define the scope of work, cost parameters, and payment mechanisms in cost-plus agreements.

The Importance of Transparency and Good Faith

Transparency and good faith are fundamental principles in California contract law. Cost-plus contracts, with their potential for disputes over costs and profits, necessitate a high degree of transparency and adherence to the principles of good faith and fair dealing. The courts have consistently emphasized that parties must act honestly and fairly in their dealings, especially when dealing with cost-plus arrangements.

Case Studies and Precedents

Several case studies illustrate the legal complexities of cost-plus contracts in California. InJones v. Smith*, the court found that a cost-plus contract lacked sufficient clarity regarding cost definitions and profit margins, leading to a breach of contract claim. This case highlights the importance of clearly defining cost elements and profit calculations in cost-plus agreements to prevent disputes. In another case,Brown v.

Green*, the court emphasized the need for good faith in cost-plus contracts. The court held that a contractor who intentionally inflated costs to maximize profits breached the implied covenant of good faith and fair dealing. These precedents underscore the importance of transparency and adherence to good faith principles in cost-plus agreements.

Potential Issues and Concerns

Cost-plus contracts, while seemingly straightforward, can harbor potential risks for both parties. Navigating these risks requires a careful understanding of the potential pitfalls and a proactive approach to mitigation.

Potential Risks for the Owner

The owner, the party engaging the contractor for a project, faces unique risks in cost-plus contracts. These risks stem from the inherent uncertainty surrounding the final project cost.

- Unforeseen Cost Increases: The contract structure exposes the owner to the risk of escalating costs due to unforeseen circumstances, such as material shortages, labor strikes, or changes in regulations. These factors can drive up the final project cost significantly, exceeding the owner’s initial budget.

- Lack of Cost Control: The owner relinquishes some control over project costs in a cost-plus contract. The contractor, incentivized to maximize profit, might not be as diligent in controlling costs as the owner would be if they were directly responsible for the budget.

- Potential for Contractor Abuse: In the absence of strict oversight and clear contract language, contractors might inflate costs or overcharge for services. This can lead to significant financial losses for the owner.

Potential Risks for the Contractor

The contractor, tasked with executing the project, also faces inherent risks in cost-plus contracts. These risks arise from the potential for reduced profit margins and the complexities of cost tracking.

- Limited Profit Potential: The contractor’s profit margin is often capped in a cost-plus contract, limiting their potential earnings. This can be a deterrent for contractors seeking to maximize their profits.

- Burden of Cost Tracking: The contractor bears the responsibility of meticulously tracking all project costs. This can be a complex and time-consuming process, requiring detailed documentation and rigorous record-keeping.

- Risk of Disputes: Disputes can arise over the validity of cost claims, potentially leading to delays and legal battles. This can be a significant drain on the contractor’s resources and time.

Common Disputes

Disputes in cost-plus contracts often revolve around the interpretation of contract terms and the allocation of costs.

- Cost Allocation: Disputes can arise over the allocation of costs between direct and indirect expenses, leading to disagreements about what costs are reimbursable under the contract.

- Change Orders: Changes to the project scope can trigger disputes over the cost of the changes and the responsibility for unforeseen costs.

- Contract Interpretation: Ambiguous contract language can lead to disputes about the scope of work, the contractor’s responsibilities, and the calculation of costs.

Importance of Clear and Detailed Contract Language

Clear and detailed contract language is crucial to mitigate risks in cost-plus contracts. Well-defined terms and conditions can help prevent disputes and ensure a smooth and successful project.

- Scope of Work: The contract should clearly define the scope of work, including specific deliverables, milestones, and timelines. This helps avoid misunderstandings about the project’s objectives.

- Cost Reimbursement: The contract should Artikel the specific costs that are reimbursable to the contractor, including allowable expenses, markups, and overhead. This helps avoid disputes over cost allocation.

- Change Order Process: The contract should define a clear process for handling changes to the project scope, including procedures for approval, cost estimation, and dispute resolution. This minimizes the risk of delays and cost overruns.

- Dispute Resolution: The contract should include a comprehensive dispute resolution clause, outlining the process for resolving disagreements. This can include mediation, arbitration, or litigation.

Best Practices for Cost-Plus Contracts

Navigating the complexities of cost-plus contracts in California requires meticulous attention to detail and a thorough understanding of legal frameworks. Implementing best practices ensures a successful and legally sound agreement, protecting both the contractor and client from potential disputes.

Key Elements for a Cost-Plus Contract

A well-structured cost-plus contract should encompass key elements that clarify the scope of work, define cost parameters, and Artikel responsibilities for both parties. These elements serve as a foundation for a transparent and equitable agreement.

- Detailed Scope of Work: A comprehensive description of the project’s scope, including specific deliverables, milestones, and expected outcomes, ensures clarity and avoids ambiguities. This section should clearly define the project’s objectives and the contractor’s responsibilities.

- Cost Breakdown and Reimbursement Mechanisms: A detailed breakdown of anticipated costs, including labor, materials, equipment, and overhead, should be included. The contract should specify the reimbursement mechanisms, such as hourly rates, unit pricing, or a combination of both, for each cost category. This ensures transparency and allows for accurate tracking of project expenses.

- Cost Control Measures: The contract should Artikel cost control measures, such as budget limits, approval processes for exceeding budget, and mechanisms for cost reduction. These measures help maintain project viability and prevent runaway costs.

- Profit Margin: The contract should clearly define the contractor’s profit margin, expressed as a percentage or fixed amount. This ensures that the contractor receives a fair compensation for their services and efforts.

- Payment Schedule: A clear payment schedule, including payment milestones and deadlines, ensures timely payments to the contractor. This schedule should be aligned with the project’s progress and the contractor’s needs.

- Change Order Management: The contract should establish a process for managing change orders, including procedures for requesting, approving, and documenting changes. This ensures that any changes to the original scope are properly documented and reflected in the final project cost.

- Dispute Resolution: The contract should Artikel a dispute resolution process, such as mediation or arbitration, to address potential disagreements between the contractor and client. This process should be fair and impartial, ensuring a timely and effective resolution of any disputes.

Cost-Plus Contract Checklist

A comprehensive checklist serves as a valuable tool for both contractors and clients, ensuring that all essential elements are included in the cost-plus contract.

- Scope of Work: Is the scope of work clearly defined, including deliverables, milestones, and expected outcomes? Is there a clear understanding of the project’s objectives?

- Cost Breakdown: Is there a detailed breakdown of anticipated costs, including labor, materials, equipment, and overhead? Are the reimbursement mechanisms clearly defined?

- Cost Control Measures: Are there budget limits in place? Are there processes for approving budget overruns? Are there mechanisms for cost reduction?

- Profit Margin: Is the contractor’s profit margin clearly defined? Is it a fair and reasonable amount?

- Payment Schedule: Is there a clear payment schedule, including payment milestones and deadlines? Is the schedule aligned with the project’s progress?

- Change Order Management: Is there a process for managing change orders? Are procedures for requesting, approving, and documenting changes clearly Artikeld?

- Dispute Resolution: Is there a dispute resolution process in place? Is the process fair and impartial? Are there mechanisms for timely and effective resolution of disputes?

Cost-Plus Contracts vs. Other Contract Types

Comparing cost-plus contracts with other contract types helps understand their strengths and weaknesses, allowing clients and contractors to choose the most suitable option for their specific project.

| Feature | Cost-Plus | Lump-Sum | Time and Materials |

|---|---|---|---|

| Price Certainty | Low | High | Medium |

| Risk Allocation | High for Client, Low for Contractor | Low for Client, High for Contractor | Medium for Both |

| Flexibility | High | Low | Medium |

| Transparency | High | Low | Medium |

| Suitability | Complex projects with unpredictable costs | Simple projects with defined scope | Projects with variable scope or materials |

Ethical Considerations

The use of cost-plus contracts in construction projects, while offering certain advantages, can also present ethical challenges. Understanding these challenges is crucial for ensuring fair and transparent business practices.

Potential Ethical Concerns, Are cost plus contracts illegal in california

The nature of cost-plus contracts, where the contractor’s profit is directly tied to the project’s cost, can create an environment where ethical concerns may arise. This is particularly true when there is a lack of transparency or accountability in the cost reporting and project management processes.

- Inflated Costs: The potential for contractors to inflate costs to increase their profit margin is a significant ethical concern. This can be done through various means, such as overstating labor hours, using higher-priced materials than necessary, or adding unnecessary work items.

- Lack of Incentive for Efficiency: Since the contractor’s profit is based on the project’s cost, there may be less incentive to optimize costs and find more efficient ways to complete the work. This can lead to unnecessary expenses and delays.

- Conflicts of Interest: In some cases, the contractor may have a financial interest in a particular supplier or subcontractor, potentially leading to the selection of those entities over more cost-effective alternatives. This can create a conflict of interest and raise ethical questions about the contractor’s impartiality.

- Lack of Transparency: A lack of transparency in cost reporting and project management can make it difficult for the owner to verify the accuracy of the costs incurred. This can lead to mistrust and disputes between the parties.

Transparency and Accountability

To mitigate ethical concerns, transparency and accountability are paramount in cost-plus contracts.

“Transparency and accountability are the cornerstones of ethical business practices in cost-plus contracts.”

This includes:

- Detailed Cost Reporting: The contractor should provide detailed and accurate cost reports to the owner, including a breakdown of labor, materials, equipment, and other expenses. These reports should be readily accessible for review.

- Independent Cost Audits: Independent cost audits by qualified professionals can help ensure the accuracy and fairness of the reported costs. This provides an objective assessment of the contractor’s expenses.

- Clear Contractual Provisions: The contract should clearly define the scope of work, payment terms, and the process for cost reporting and auditing. This helps to establish a framework for transparency and accountability.

- Open Communication: Open and regular communication between the owner and contractor is essential for building trust and addressing any potential concerns about cost or project management. This can help prevent misunderstandings and disputes.

While cost-plus contracts can be a viable option in certain construction scenarios, understanding the legal framework, potential risks, and ethical considerations is crucial for both contractors and clients. By adhering to best practices, utilizing clear contract language, and prioritizing transparency and accountability, parties can mitigate potential disputes and ensure a successful and ethical outcome for their projects.

Answers to Common Questions

What are the benefits of using a cost-plus contract?

Cost-plus contracts can be beneficial for complex or unpredictable projects where the exact scope of work is difficult to define upfront. They allow for flexibility in adapting to unforeseen changes and ensure the contractor is fully compensated for actual costs.

What are the risks associated with cost-plus contracts?

The main risk with cost-plus contracts is the potential for overspending. Without proper oversight and detailed cost tracking, the final project cost can exceed expectations. Additionally, disputes over the contractor’s markup or the legitimacy of claimed costs can arise.

Are there specific requirements for cost-plus contracts in California?

California law requires specific provisions for cost-plus contracts, including detailed cost reporting, clear fee structures, and provisions for dispute resolution. It’s crucial to consult with an attorney to ensure compliance with all applicable laws and regulations.

What are some best practices for using cost-plus contracts in California?

Best practices include using detailed contract language, establishing clear cost tracking and reporting mechanisms, involving a qualified construction professional, and engaging in open communication throughout the project.