Is VA disability considered income for food stamps? This question is crucial for veterans relying on both benefits. Understanding how the VA disability payments are factored into food stamp eligibility is vital for securing essential resources. This guide breaks down the complex interplay between VA benefits and food stamp programs, providing clarity on income calculations, state-specific rules, and the impact of other income sources.

Navigating the system can be confusing, with varying rules depending on the type of VA disability, benefit level, and your state of residence. We’ll explore the intricacies of income calculations, highlighting the steps involved in accurately reporting your VA benefits to avoid delays or denials. We’ll also cover how assets and other income sources affect your eligibility.

VA Disability Benefits and Food Stamp Eligibility

VA disability benefits are considered income when determining eligibility for the Supplemental Nutrition Assistance Program (SNAP), often referred to as food stamps. However, the way these benefits are treated can be complex and depends on several factors, including the type and amount of the benefit received. Understanding this relationship is crucial for veterans applying for SNAP benefits.

Categorization of VA Disability Payments for Food Stamp Programs

The Supplemental Nutrition Assistance Program (SNAP) considers VA disability compensation as income. This means that the amount of disability compensation received directly impacts the household’s total income, which is then used to determine eligibility and the benefit amount. Other VA benefits, such as pension payments, may also be counted as income depending on specific circumstances and program rules.

It’s important to note that the rules governing income calculation for SNAP can be intricate and vary slightly by state. Therefore, seeking clarification directly from the local SNAP office is always recommended.

Comparison of VA Disability Benefit Types and Their Impact on Food Stamp Eligibility

Different types of VA disability benefits can affect SNAP eligibility differently. For example, disability compensation based on a service-connected disability is treated as income for SNAP purposes. However, other VA benefits, like education benefits (GI Bill), are generally not considered income for SNAP eligibility calculations. Similarly, VA home loans do not directly impact SNAP eligibility. The key differentiator lies in whether the benefit is intended to replace lost income due to a service-connected disability.

Benefits explicitly designed for this purpose are usually counted as income when assessing SNAP eligibility.

Examples of Situations Where VA Disability Benefits Affect Food Stamp Eligibility Differently

Consider two veterans: Veteran A receives $2,000 monthly in VA disability compensation for a service-connected disability, while Veteran B receives $1,000 monthly in disability compensation and an additional $1,000 monthly from a private disability insurance policy. Both veterans have similar living expenses. Veteran A’s income will be solely the $2,000 from VA disability. Veteran B’s income, however, will be $2,000 ($1,000 VA disability + $1,000 private insurance).

This higher total income for Veteran B could potentially reduce their SNAP benefits or even render them ineligible, while Veteran A might qualify for a higher benefit amount or maintain eligibility. Another example would be a veteran receiving both disability compensation and a non-service-connected pension. The disability compensation will be considered income for SNAP, while the rules for including the pension may vary depending on additional factors like other income and assets.

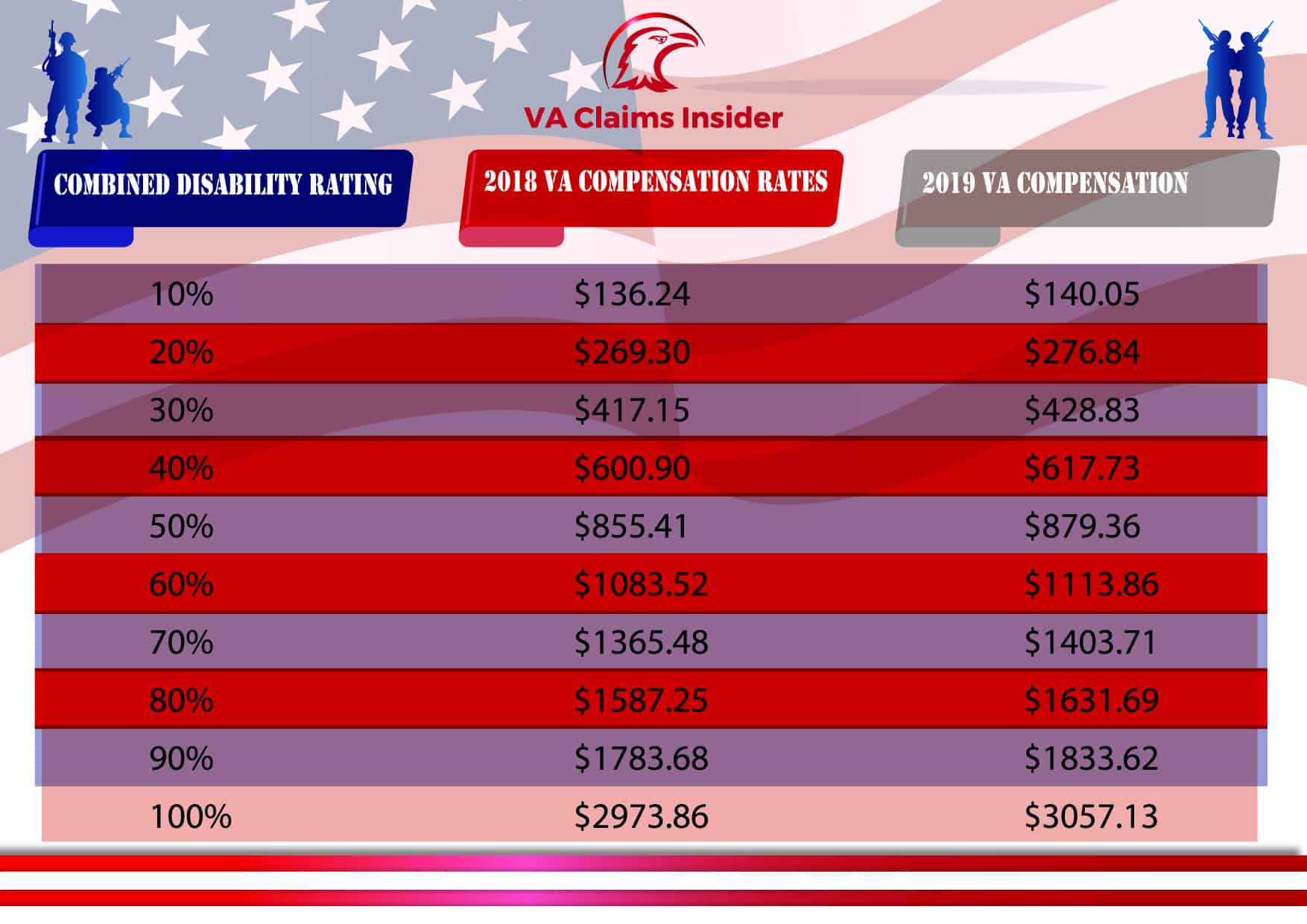

Relationship Between VA Disability Benefit Levels and Food Stamp Eligibility

The following table illustrates a simplified relationship (actual eligibility is determined by state-specific SNAP guidelines and individual circumstances). This table does

not* constitute official SNAP eligibility criteria and should not be used in place of contacting your local SNAP office.

| Monthly VA Disability Compensation | Other Income | Household Size (Example) | Potential SNAP Eligibility Status |

|---|---|---|---|

| $1,000 | $0 | 1 | Potentially Eligible (depends on state guidelines and other factors) |

| $2,000 | $500 | 2 | Potentially Eligible (lower benefit amount likely) |

| $3,000 | $0 | 4 | Potentially Ineligible (income likely exceeds limits) |

| $1,500 | $1,000 | 1 | Potentially Ineligible (income likely exceeds limits) |

Income Calculation for Food Stamps with VA Disability

Determining eligibility for food stamps (SNAP) when receiving VA disability benefits involves a careful calculation of your countable income. This process considers not only your VA disability payments but also any other income sources you may have. Understanding this process is crucial for accurately completing your application and receiving the benefits you are entitled to.

Combining Income Sources for Food Stamp Eligibility, Is va disability considered income for food stamps

The Supplemental Nutrition Assistance Program (SNAP) considers all income sources when determining eligibility. This includes, but is not limited to, wages, self-employment income, Social Security benefits, unemployment compensation, and of course, VA disability compensation. Each income source is treated differently in the calculation, and some income may be excluded entirely. For instance, certain earned income deductions may be applied, and some types of unearned income are considered in full while others may have deductions applied.

The specific rules and regulations can be complex, and it’s advisable to consult your local SNAP office or a qualified benefits specialist for personalized guidance. It’s important to accurately report all income to avoid delays or denials of your application.

Determining Countable Income from VA Disability for Food Stamps

VA disability payments are generally considered income for SNAP purposes. However, not all of the payment is necessarily counted as income. Certain deductions might apply, depending on your individual circumstances and the specific rules of your state’s SNAP program. For example, some medical expenses may be deductible. The specific calculation will vary depending on your state’s SNAP guidelines.

It’s crucial to gather all relevant financial documentation to accurately reflect your income and expenses when applying for food stamps. You should carefully review your award letter from the VA and any other documentation relevant to your income.

Step-by-Step Guide to Reporting VA Disability Benefits for Food Stamp Applications

The process of reporting VA disability benefits when applying for food stamps typically involves these steps:

- Gather all necessary documentation: This includes your VA disability award letter, pay stubs (if applicable), bank statements, and any other documentation showing income or expenses.

- Complete the SNAP application accurately and thoroughly: Be honest and precise when reporting all income sources, including your VA disability payments.

- Provide all required documentation with your application: Failure to provide complete documentation can delay or deny your application.

- Follow up with the SNAP office if needed: If you have any questions or concerns during the application process, contact your local SNAP office for assistance.

- Understand your state’s specific rules: SNAP guidelines vary slightly from state to state. Ensure you understand your state’s specific rules and regulations regarding income reporting and eligibility.

It is important to remember that the rules governing SNAP eligibility can be complex. Seeking assistance from a qualified benefits counselor or your local SNAP office is highly recommended to ensure accurate reporting and avoid any potential issues with your application.

State-Specific Rules Regarding VA Disability and Food Stamps

While the federal government sets the broad guidelines for the Supplemental Nutrition Assistance Program (SNAP), often called food stamps, individual states possess considerable leeway in implementing these rules. This means that the way VA disability benefits are considered in the calculation of income for SNAP eligibility can vary significantly from state to state. Understanding these variations is crucial for veterans seeking food assistance.State-specific rules primarily affect how unearned income, such as VA disability compensation, is treated within the broader SNAP income calculations.

Some states may have stricter interpretations of what constitutes income, potentially leading to lower SNAP benefits or ineligibility for some veterans, while others may have more lenient approaches. These differences are often driven by state budget constraints, differing interpretations of federal guidelines, or specific state-level initiatives aimed at supporting veterans.

Variations in State-Level Policies

State policies concerning VA disability and food stamp eligibility vary primarily in how they treat VA disability payments in the income calculation. Some states may deduct certain expenses, like medical expenses related to the disability, from the VA disability payment before factoring it into the SNAP eligibility calculation. Others may not allow such deductions. Furthermore, states may differ in their interpretation of allowable deductions for other income sources, potentially impacting the overall income threshold for SNAP eligibility.

For instance, one state might allow a higher standard deduction for shelter costs, thereby increasing the likelihood of eligibility for a veteran with a given level of VA disability and other income. Another state, however, might have a lower standard deduction, potentially reducing eligibility. These variations can significantly impact a veteran’s ability to receive SNAP benefits.

Impact of State-Specific Guidelines on Individuals

The impact of these state-specific guidelines can be substantial. A veteran receiving a certain amount of VA disability compensation might be eligible for SNAP benefits in one state but ineligible in another, solely due to differences in how that income is treated within the state’s SNAP program. This inconsistency creates challenges for veterans navigating the system, requiring them to understand the specific regulations of their state of residence.

For example, a veteran living in State A might receive full SNAP benefits due to a more generous state deduction policy, while a veteran with the same level of VA disability living in State B might receive reduced benefits or none at all because of a stricter state policy. This disparity highlights the critical need for veterans to familiarize themselves with their state’s specific SNAP guidelines.

Finding and Interpreting Relevant State Regulations

To determine the specific rules governing VA disability and food stamps in a given state, individuals should consult their state’s Department of Human Services or the equivalent agency responsible for administering SNAP benefits. These agencies typically have websites providing detailed information about their SNAP program, including specific guidelines on how VA disability is considered. Additionally, contacting the agency directly via phone or email can provide clarification on individual situations.

Careful review of the state’s official publications and guidelines is essential to accurately determine eligibility. It’s important to note that the information found on unofficial websites or forums should be treated with caution and verified against the official state sources to ensure accuracy. The specific regulations will be presented in official documents and need to be examined carefully for the precise details relevant to each case.

Resource Limits and Food Stamp Eligibility with VA Disability: Is Va Disability Considered Income For Food Stamps

VA disability benefits are not considered earned income for food stamp purposes, but they do not entirely exempt recipients from resource limits. These limits, which vary by state and household size, determine the maximum value of assets a household can possess while remaining eligible for Supplemental Nutrition Assistance Program (SNAP) benefits, commonly known as food stamps. Understanding these limits is crucial for veterans receiving VA disability.Resource limits interact with VA disability benefits by adding another layer to the eligibility criteria.

While the disability payments themselves are not counted as income, the value of a veteran’s other assets is carefully considered. Exceeding the resource limit can disqualify an individual from receiving food stamps, even if their income falls below the program’s income thresholds. This means that a veteran might receive substantial VA disability payments but still be ineligible for SNAP benefits if they possess excessive assets.

Asset Examples Affecting Food Stamp Eligibility

Several types of assets are considered when determining resource eligibility. These include bank accounts (checking and savings), stocks and bonds, and the equity in a home or vehicle. For example, a veteran receiving $2,000 monthly in VA disability benefits might still be deemed ineligible if they possess $3,000 in savings, exceeding the resource limit for a single individual in their state.

Similarly, a veteran with a significant amount of equity in their home could be ineligible even if their monthly income is low. The value of these assets is evaluated based on their fair market value, not the amount of debt associated with them.

Managing Assets to Maintain Food Stamp Eligibility

Careful asset management is essential for veterans who want to maintain their food stamp eligibility while receiving VA disability. Strategies include reducing unnecessary assets by paying down debts, investing in low-risk, liquid assets that can be easily accessed if needed, or transferring assets to a spouse or another eligible household member if permissible under state and federal regulations. It’s vital to consult with a financial advisor or benefits specialist to create a personalized plan to manage assets responsibly and comply with SNAP guidelines.

These professionals can offer guidance on the intricacies of state and federal regulations.

Resources Impacting Food Stamp Eligibility

It’s crucial to understand which resources impact food stamp eligibility. The following list details common resources and their treatment concerning VA disability benefits:

- Bank Accounts (Checking and Savings): The total balance across all accounts is considered. Exceeding the resource limit will affect eligibility regardless of VA disability payments.

- Stocks and Bonds: The current market value of these investments is included in the resource calculation. Any significant holdings could jeopardize eligibility.

- Real Estate (Home Equity): The equity in a home (home value minus mortgage debt) is typically counted towards the resource limit, though there are often exemptions for the primary residence.

- Vehicles: The value of vehicles may be considered, though there are often exemptions for vehicles used for work or transportation to medical appointments.

- Retirement Accounts (IRAs, 401Ks): These are usually excluded from resource calculations, providing some asset protection for eligible individuals.

It is important to note that state-specific rules may differ. Contacting the local SNAP office for the most up-to-date and accurate information is highly recommended. Regulations and limits are subject to change.

Impact of Other Income Sources on Food Stamp Eligibility with VA Disability

VA disability benefits are considered income when determining eligibility for the Supplemental Nutrition Assistance Program (SNAP), often called food stamps. However, the presence of other income sources significantly impacts the overall calculation and can affect a recipient’s eligibility. This section will explore how additional income streams, such as employment wages or spousal income, interact with VA disability payments to determine food stamp eligibility.

Income Calculation with Multiple Income Sources

The food stamp program uses a complex formula to determine eligibility based on gross monthly income and household size. All income, including VA disability payments, wages from employment, self-employment income, spousal income, and any other regular sources of cash or in-kind assistance, must be reported. The total gross monthly income is then compared to the income eligibility limits established by the state and the USDA.

If the total income exceeds the limit, the household may not be eligible for SNAP benefits, or their benefits may be reduced. It’s crucial to understand that deductions, such as childcare costs or medical expenses, may be allowed in certain circumstances, impacting the net income used in the final eligibility determination. For example, a veteran receiving $1500 in VA disability benefits and earning $1000 per month from part-time employment would have a combined gross income of $2500.

Whether this income exceeds the applicable threshold would depend on the household size and state-specific guidelines.

Reporting Changes in Income

It is mandatory to report any changes in income to the food stamp program promptly. This includes increases or decreases in wages, changes in spousal income, or any other significant alterations in financial resources. Failure to report changes accurately and in a timely manner can result in penalties, including overpayment recoupment and potential ineligibility for future benefits. Most states provide online portals or phone numbers to report changes easily and conveniently.

The required reporting frequency may vary depending on the state. For instance, some states may require monthly reporting while others allow for less frequent updates, depending on the nature and frequency of income fluctuations.

Consequences of Inaccurate Reporting

Inaccurately reporting income on a food stamp application, whether intentionally or unintentionally, carries serious consequences. If an applicant is found to have intentionally misrepresented their income, they may face penalties such as loss of benefits, fines, or even criminal charges. Even unintentional errors can lead to overpayments, which must be repaid. Furthermore, inaccurate reporting can lead to a delay or denial of benefits, potentially causing financial hardship for the applicant and their family.

It’s therefore crucial to accurately and completely report all sources of income to maintain eligibility and avoid potential penalties. A detailed understanding of income reporting requirements and seeking clarification when needed are essential steps in avoiding such consequences.

Flowchart Illustrating Income Consideration for Food Stamp Eligibility

The following describes a flowchart that visually represents the process of determining food stamp eligibility when VA disability benefits and other income sources are involved.[Imagine a flowchart here. The flowchart would begin with a box labeled “Applicant Receives VA Disability Benefits?” Yes would lead to a box labeled “Does Applicant Have Other Income Sources?” Yes would lead to a box labeled “Calculate Total Gross Monthly Income (VA Disability + Other Income)”.

No would lead directly to a box labeled “Compare Income to Eligibility Limits”. The “Calculate Total Gross Monthly Income” box would lead to a box labeled “Apply Deductions (if applicable)”. This would then lead to the “Compare Income to Eligibility Limits” box. The “Compare Income to Eligibility Limits” box would have two branches: “Income Below Limit – Eligible for SNAP” and “Income Above Limit – Ineligible/Reduced Benefits”.]

Securing food assistance while receiving VA disability benefits requires careful understanding of the eligibility criteria and reporting requirements. This guide has provided a comprehensive overview of the process, addressing the complexities of income calculations, state-specific variations, and the impact of additional income sources. Remember to accurately report all income and assets to ensure continued eligibility. If you have questions or encounter difficulties, seek assistance from your local social services agency or a veteran’s advocacy group.

General Inquiries

What if my VA disability is backdated? How does that affect my food stamp application?

Backdated payments are generally considered as income for the period they cover, potentially impacting your eligibility retroactively. You should report this to the food stamp agency immediately.

Can I appeal a food stamp denial if my VA disability is considered income?

Yes, you have the right to appeal a denial. The appeal process varies by state, but typically involves providing additional documentation or requesting a hearing.

My spouse also works. How is their income factored in?

Your spouse’s income is added to your total household income when determining food stamp eligibility. The combined income will be assessed against the established thresholds.

What happens if I don’t report a change in my VA disability benefits?

Failure to report changes in income can lead to overpayment penalties and potential termination of benefits. It’s crucial to promptly notify the food stamp agency of any changes.