Can hospital and contract doctor both charge same fees – Can hospitals and contract doctors both charge the same fees? This question is a complex one, with implications for both patients and the healthcare system as a whole. While the answer may seem straightforward, the reality is that billing practices can vary significantly depending on the type of hospital, the nature of the contract between the hospital and the physician, and the specific services provided.

Understanding the intricacies of hospital and physician billing can help patients navigate the often-confusing world of healthcare costs.

Hospitals typically charge patients for a variety of services, including facility fees, physician fees, and ancillary service fees. The fees charged by hospitals can vary depending on factors such as the location of the hospital, the type of services provided, and the patient’s insurance coverage. Contract physicians, on the other hand, may have different fee structures, often determined by the terms of their contracts with the hospital.

These contracts can vary significantly, impacting the fees that physicians are able to charge patients.

Hospital Billing Practices

Hospitals are complex organizations that provide a wide range of medical services. To cover the costs of providing these services, hospitals charge patients and insurance companies fees. Understanding hospital billing practices is crucial for patients and healthcare providers alike. This section will delve into the various types of fees hospitals charge, how billing departments operate, and common examples of fees.

Types of Hospital Fees

Hospitals charge different types of fees depending on the services provided. These fees can be categorized into several groups:

- Facility Fees: These fees cover the costs associated with using the hospital’s facilities, such as operating rooms, patient rooms, and equipment. These fees are often calculated based on the length of stay, the type of room, and the complexity of the services provided.

- Physician Fees: These fees are charged for the services provided by physicians, including consultations, procedures, and surgeries. The fees are determined by the physician’s expertise, the complexity of the service, and the time spent with the patient.

- Ancillary Service Fees: These fees cover the costs of diagnostic and therapeutic services, such as laboratory tests, imaging studies, and physical therapy. The fees are calculated based on the specific services provided and the resources used.

Hospital Billing Department Operations

Hospital billing departments are responsible for managing the billing process, from generating invoices to collecting payments. These departments employ specialized staff who are trained in billing procedures, coding, and insurance regulations. Here’s a typical workflow:

- Patient Registration: Upon admission, patient information is collected and verified. This includes insurance details, medical history, and billing preferences.

- Service Documentation: During the patient’s stay, healthcare providers document all services provided. This documentation is crucial for billing purposes.

- Coding and Billing: The billing department uses specific codes to represent each service provided. These codes are used to generate invoices and submit claims to insurance companies.

- Claim Processing: Insurance companies review the claims and determine the amount they will reimburse.

- Patient Billing: The billing department sends invoices to patients for any remaining balances not covered by insurance.

Examples of Common Hospital Fees

Here are some examples of common hospital fees:

- Facility Fees:

- Room and Board: This fee covers the cost of the patient’s room and basic amenities. The cost varies depending on the type of room (private, semi-private, or ward).

- Operating Room Fee: This fee covers the cost of using the operating room, including equipment and staff.

- Physician Fees:

- Consultation Fee: This fee is charged for a physician’s initial evaluation of a patient’s condition.

- Procedure Fee: This fee covers the cost of a specific medical procedure, such as a biopsy or surgery.

- Ancillary Service Fees:

- Laboratory Tests: These fees cover the cost of blood tests, urine tests, and other laboratory analyses.

- Imaging Studies: These fees cover the cost of X-rays, CT scans, MRI scans, and other imaging procedures.

Contract Physician Fees

Hospitals and physicians often enter into contractual agreements that Artikel the terms of their working relationship. These contracts encompass various aspects, including the physician’s compensation, billing practices, and responsibilities. Understanding these contracts is crucial for both parties, as they directly impact the financial aspects of their collaboration.

Types of Physician Contracts

Hospitals utilize different contract types to engage physicians, each with its own set of terms and conditions. Common types include:

- Employment Agreements: In this arrangement, the physician is considered an employee of the hospital. The hospital directly employs the physician and assumes responsibility for payroll, taxes, and benefits. Compensation is typically based on a salary or hourly rate, with potential bonuses or incentives tied to performance metrics.

- Independent Contractor Agreements: Under this model, the physician operates as an independent contractor, responsible for their own taxes, insurance, and business expenses. Compensation is usually determined by a fee-for-service model, where the physician receives payment for each service rendered.

- Physician-Hospital Joint Ventures: These agreements involve a collaborative partnership between the physician and the hospital, often focused on specific services or departments. The physician may receive a share of profits or revenue generated from the joint venture, in addition to a base compensation.

Impact of Contract Terms on Physician Fees

Contract terms significantly influence physician fees and compensation. Key provisions that impact these aspects include:

- Fee Schedule: Contracts often specify a fee schedule that Artikels the payment rates for various medical services. These rates can be negotiated based on market benchmarks, the physician’s experience, and the hospital’s financial considerations.

- Billing and Collection Practices: Contracts may detail the process for billing patients and collecting payments. This can include provisions regarding the use of electronic health records (EHRs), billing codes, and revenue cycle management practices.

- Productivity and Performance Metrics: Contracts may include provisions that tie physician compensation to productivity or performance metrics. These metrics can vary depending on the specialty and the hospital’s objectives. For example, a contract may include incentives for meeting patient volume targets, reducing readmission rates, or improving patient satisfaction scores.

- Malpractice Coverage: Contracts may specify the extent of malpractice coverage provided by the hospital to the physician. This coverage can vary depending on the type of contract and the physician’s role.

Contract Clauses Related to Billing Practices and Fee Structures

Contracts typically contain specific clauses that address billing practices and fee structures. Examples of such clauses include:

- Billing and Coding Compliance: Contracts often require physicians to adhere to established billing and coding guidelines, ensuring accuracy and compliance with regulations. These clauses may include provisions regarding the use of appropriate billing codes, documentation requirements, and adherence to coding audits.

- Fee Negotiation and Adjustment: Contracts may Artikel procedures for negotiating and adjusting physician fees. This could involve periodic reviews, adjustments based on market changes, or provisions for renegotiation under certain circumstances.

- Chargemaster Rates: Hospitals often maintain a chargemaster, which lists the prices for various medical services. Contracts may specify how the chargemaster rates apply to physician fees and how any adjustments are made.

- Revenue Sharing: Contracts may include provisions for revenue sharing, particularly in physician-hospital joint ventures. These clauses define the percentage of revenue that the physician receives based on their contribution to the joint venture.

Fee Transparency and Disclosure

Fee transparency is essential for patients to make informed decisions about their healthcare. Patients need to understand the costs associated with their care, so they can compare options and choose the best value for their needs. Fee transparency also helps to prevent surprise medical bills and encourages providers to be more competitive in their pricing.

State and Federal Regulations for Fee Disclosure

State and federal regulations play a significant role in ensuring fee transparency. These regulations require hospitals and physicians to disclose their fees in a clear and understandable manner. Some examples of these regulations include:

- The Hospital Price Transparency Rule requires hospitals to publish a list of their standard charges for all items and services, including negotiated rates with insurers. This information must be made available online in a machine-readable format.

- The No Surprises Act protects patients from surprise medical bills. It requires providers to give patients an estimate of their out-of-pocket costs before receiving care. The law also sets up a dispute resolution process for surprise bills.

- Many states have their own regulations requiring hospitals and physicians to disclose their fees. These state laws may vary in their requirements, but they generally aim to ensure that patients have access to clear and accurate information about the cost of their care.

Resources for Understanding Hospital and Physician Fees

Patients can access various resources to understand hospital and physician fees. These resources can help patients compare costs, identify potential savings, and make informed decisions about their care. Some examples of these resources include:

- Hospital websites: Many hospitals publish their standard charges online, as required by the Hospital Price Transparency Rule. Patients can access this information to compare prices for different services.

- Healthcare price comparison websites: Websites like Healthcare Bluebook and Fair Health offer tools for comparing prices for medical services. These websites can help patients find the best value for their needs.

- Patient advocacy groups: Organizations like the Patient Advocate Foundation and the National Patient Advocate Foundation provide resources and support for patients navigating the healthcare system. These groups can help patients understand their rights and options when it comes to healthcare costs.

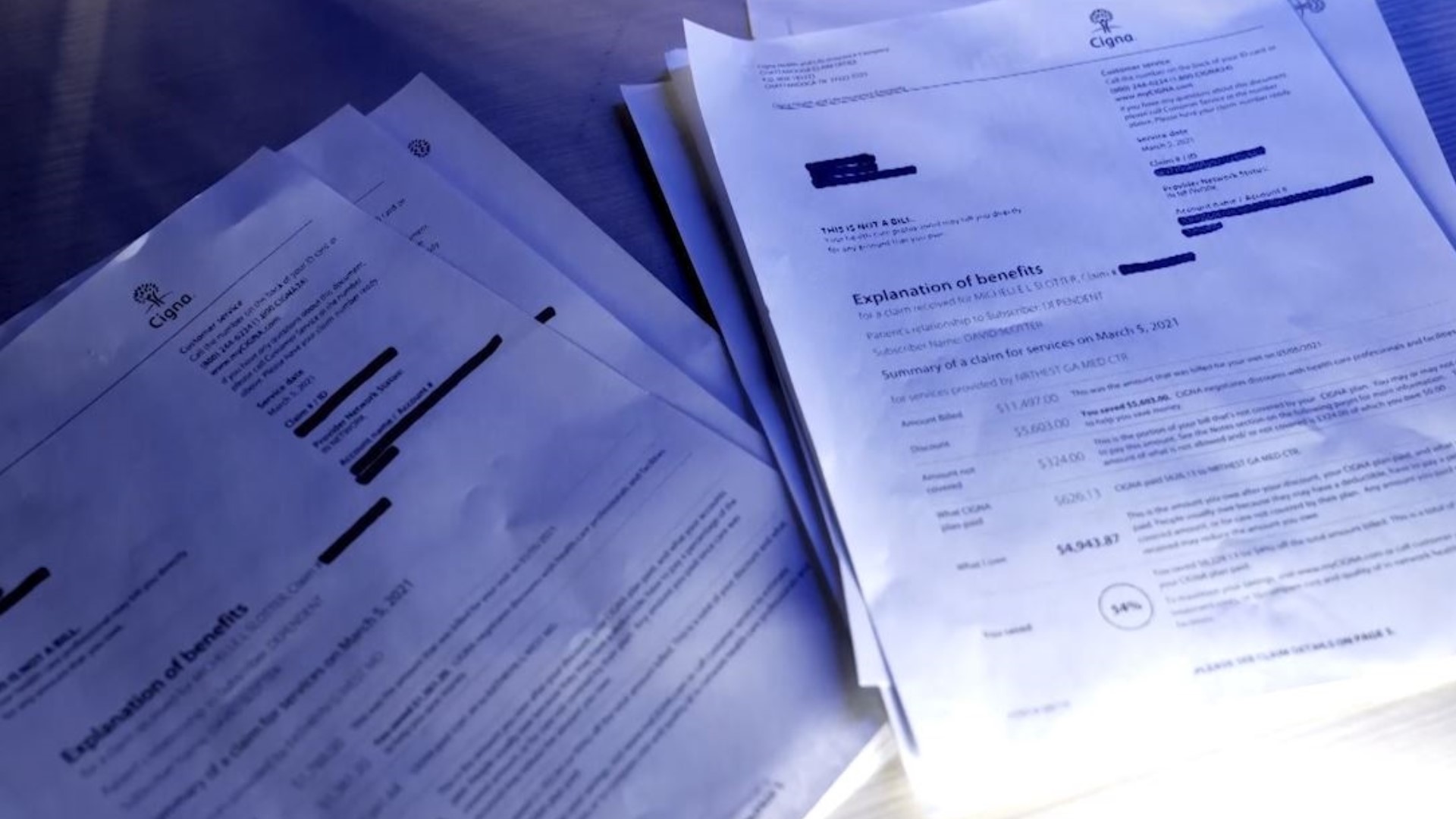

Patient Financial Responsibility

Navigating healthcare costs can be complex, especially when dealing with hospital and doctor bills. Understanding patient financial responsibility is crucial to managing healthcare expenses effectively. This section will delve into the process of determining patient financial responsibility, the role of insurance plans, and common billing errors that patients may encounter.

Determining Patient Financial Responsibility

The amount a patient is responsible for paying depends on various factors, including the type of insurance coverage, the specific services received, and the negotiated rates between the healthcare provider and the insurance company. The process typically involves the following steps:

- Insurance Verification: The healthcare provider verifies the patient’s insurance coverage and eligibility for the services rendered. This involves checking the patient’s insurance card, plan details, and benefits.

- Pre-Authorization: For certain procedures or services, insurance plans may require pre-authorization from the patient’s primary care physician or a specialist. This ensures that the service is medically necessary and covered by the insurance plan.

- Billing and Claims Processing: After the service is rendered, the healthcare provider bills the insurance company. The insurance company processes the claim and determines the amount it will cover. This amount is typically based on the negotiated rate between the insurance company and the provider.

- Patient Co-payment, Co-insurance, and Deductible: Depending on the insurance plan, patients may be responsible for paying a co-payment, co-insurance, or deductible. A co-payment is a fixed amount paid at the time of service, while co-insurance is a percentage of the cost shared by the patient. A deductible is a fixed amount that the patient must pay before the insurance plan starts covering costs.

- Balance Billing: If the insurance company does not cover the entire cost of the service, the patient may be responsible for the remaining balance. This is known as balance billing.

Insurance Plans and Coverage

Insurance plans play a significant role in covering medical expenses. They negotiate rates with healthcare providers and establish coverage parameters. Different insurance plans have varying levels of coverage, deductibles, co-payments, and co-insurance.

- Health Maintenance Organizations (HMOs): HMOs typically require patients to choose a primary care physician (PCP) within their network. Referrals are often required for specialist visits. HMOs generally have lower premiums but may have limited out-of-network coverage.

- Preferred Provider Organizations (PPOs): PPOs offer more flexibility than HMOs, allowing patients to see providers outside their network. However, out-of-network services may have higher costs. PPOs generally have higher premiums than HMOs.

- Exclusive Provider Organizations (EPOs): EPOs are similar to HMOs, requiring patients to choose a PCP within the network. However, they generally have more limited out-of-network coverage than HMOs.

- Point-of-Service (POS): POS plans combine features of HMOs and PPOs, allowing patients to choose between in-network and out-of-network providers. POS plans typically have higher premiums than HMOs.

- High Deductible Health Plans (HDHPs): HDHPs have lower premiums but higher deductibles than traditional plans. They are often paired with Health Savings Accounts (HSAs), which allow individuals to save pre-tax money for medical expenses.

Common Billing Errors

Billing errors can occur, leading to incorrect charges and financial burdens for patients. It’s important to review medical bills carefully for any errors. Common billing errors include:

- Incorrect patient information: This could include wrong name, address, or insurance details.

- Duplicate billing: The same service may be billed multiple times.

- Miscoding: Medical codes used for billing may be incorrect, leading to inflated charges.

- Incorrect billing for out-of-network services: Patients may be billed for out-of-network services even if they had in-network coverage.

- Incorrect application of co-payments or deductibles: The insurance plan may not have applied co-payments or deductibles correctly.

Addressing Billing Errors

Patients can address billing errors by following these steps:

- Review medical bills carefully: Check for any discrepancies in patient information, services rendered, or charges.

- Contact the healthcare provider: If you identify any errors, contact the healthcare provider’s billing department and explain the issue.

- File a claim with the insurance company: If the provider is unable to resolve the issue, file a claim with the insurance company. Provide documentation of the error and any relevant information.

- Seek assistance from a patient advocate: If you’re unable to resolve the issue yourself, consider seeking assistance from a patient advocate who can help navigate the billing process and advocate on your behalf.

Legal and Ethical Considerations

The intersection of hospital and physician billing practices raises significant legal and ethical concerns, impacting both healthcare providers and patients. Understanding the legal framework and ethical considerations is crucial for ensuring fair and transparent billing practices.

Legal Framework Governing Hospital and Physician Billing Practices

The legal framework governing hospital and physician billing practices is multifaceted, encompassing federal and state laws, regulations, and judicial decisions.

- Federal Laws: The False Claims Act (FCA) prohibits knowingly submitting false or fraudulent claims to the government for healthcare services. The Anti-Kickback Statute prohibits offering or accepting remuneration to induce referrals for healthcare services. The Stark Law restricts physicians from referring patients to entities in which they have a financial interest.

- State Laws: State laws may regulate billing practices, including requirements for price transparency, patient rights, and physician disclosure of financial relationships.

- Regulations: The Centers for Medicare and Medicaid Services (CMS) issues regulations governing hospital and physician billing practices for Medicare and Medicaid programs. These regulations address coding, documentation, and billing requirements.

- Judicial Decisions: Court decisions interpret and apply legal principles related to billing practices, shaping the legal landscape.

Ethical Considerations Related to Charging Patients for Medical Services

Ethical considerations guide healthcare providers in their billing practices, ensuring fairness and transparency.

- Patient Autonomy: Patients have the right to understand the costs of their care and make informed decisions. Providers should provide clear and concise information about billing practices and charges.

- Beneficence: Healthcare providers should act in the best interests of their patients, considering their financial circumstances and providing affordable care.

- Non-maleficence: Providers should avoid harming patients financially by engaging in unfair or deceptive billing practices.

- Justice: Billing practices should be fair and equitable, ensuring that all patients have access to affordable healthcare.

Potential Conflicts of Interest in Hospital and Physician Billing Arrangements, Can hospital and contract doctor both charge same fees

Conflicts of interest can arise when financial incentives influence billing practices, potentially compromising patient care and ethical considerations.

- Physician Ownership of Hospitals: When physicians own or have financial interests in hospitals, there is a potential for conflicts of interest related to patient referrals and billing practices.

- Bundled Payments: Bundled payment arrangements, where hospitals and physicians receive a fixed payment for a specific episode of care, may create incentives for providers to reduce costs by limiting services or shortening hospital stays, potentially impacting patient outcomes.

- Financial Relationships Between Hospitals and Physicians: Financial relationships between hospitals and physicians, such as consulting agreements or research grants, can create conflicts of interest if they influence billing practices or patient referrals.

Impact on Healthcare Costs

The billing practices of hospitals and physicians play a significant role in shaping the overall cost of healthcare. Understanding the interplay of these practices, including fee negotiation and price transparency, is crucial for developing strategies to promote cost-effective healthcare delivery.

The Impact of Hospital and Physician Billing Practices on Overall Healthcare Costs

Hospital and physician billing practices can significantly influence healthcare costs. Here are some key aspects to consider:

- Chargemaster Pricing: Hospitals utilize a chargemaster, a comprehensive list of services and supplies with assigned prices. These prices often exceed actual costs, leading to inflated bills.

- Bundled Payments: Hospitals often bundle services together, charging a single fee for multiple procedures or treatments. While this can simplify billing, it can also lead to overcharging if patients receive unnecessary services.

- Balance Billing: When a patient has health insurance, the provider may bill the patient for the difference between the provider’s charge and the insurance payment. This can lead to unexpected out-of-pocket expenses for patients.

- Physician Fee Schedules: Physicians often negotiate fees with insurance companies based on their specialties and experience. These fees can vary widely, leading to inconsistencies in healthcare costs.

Fee Negotiation and Price Transparency in Controlling Costs

Fee negotiation and price transparency are crucial for controlling healthcare costs.

- Fee Negotiation: Insurance companies negotiate fees with healthcare providers to control costs. This negotiation process can be complex and often favors providers with more market power.

- Price Transparency: Providing patients with clear and understandable information about healthcare costs can empower them to make informed decisions and potentially negotiate lower prices.

Strategies for Promoting Cost-Effective Healthcare Delivery

Several strategies can promote cost-effective healthcare delivery:

- Value-Based Care: This model rewards healthcare providers for delivering high-quality care at lower costs. It encourages providers to focus on patient outcomes rather than just the number of services provided.

- Price Transparency Initiatives: Government agencies and private organizations are increasingly promoting price transparency initiatives to empower patients and encourage competition among healthcare providers.

- Comparative Effectiveness Research: Research that compares the effectiveness of different treatments and interventions can help identify the most cost-effective options.

The relationship between hospitals and contract physicians is a complex one, with billing practices often shrouded in opacity. Patients can find themselves facing confusing and sometimes exorbitant bills, leaving them questioning the fairness and transparency of the healthcare system. By understanding the various factors that influence billing practices, patients can better navigate the complexities of healthcare costs and advocate for their financial well-being.

Increased transparency and standardized billing practices are crucial steps towards a more equitable and accessible healthcare system.

Common Queries: Can Hospital And Contract Doctor Both Charge Same Fees

What are some common billing errors that patients should be aware of?

Common billing errors include incorrect patient information, duplicate charges, and charges for services that were not actually provided. Patients should carefully review their medical bills and report any errors to their insurance company or the hospital.

What are some resources available to patients for understanding hospital and physician fees?

Patients can access information about hospital and physician fees through state and federal websites, patient advocacy groups, and online tools that provide price transparency data.

What are some ethical considerations related to charging patients for medical services?

Ethical considerations include ensuring that patients are fully informed about the costs of their care, avoiding unnecessary charges, and providing patients with access to affordable healthcare options.