Can long term disability garnish social security – So, you’re on long-term disability, right? And you’re getting that sweet Social Security cash too. But hold up, what if your disability insurer wants a slice of that pie? Can they actually garnish your Social Security benefits? It’s a real thing, mate, and it’s worth understanding.

This is about the legal battleground between your disability insurer and your hard-earned benefits.

Think of it like this: you’ve got two different systems at play. One’s your disability insurance, which is like a private agreement you made with your insurer. The other is Social Security, which is a government safety net. Sometimes, these two can overlap, and that’s where things get messy. We’ll break down the rules of the game and see how your Social Security benefits can be protected.

Understanding Long-Term Disability and Social Security

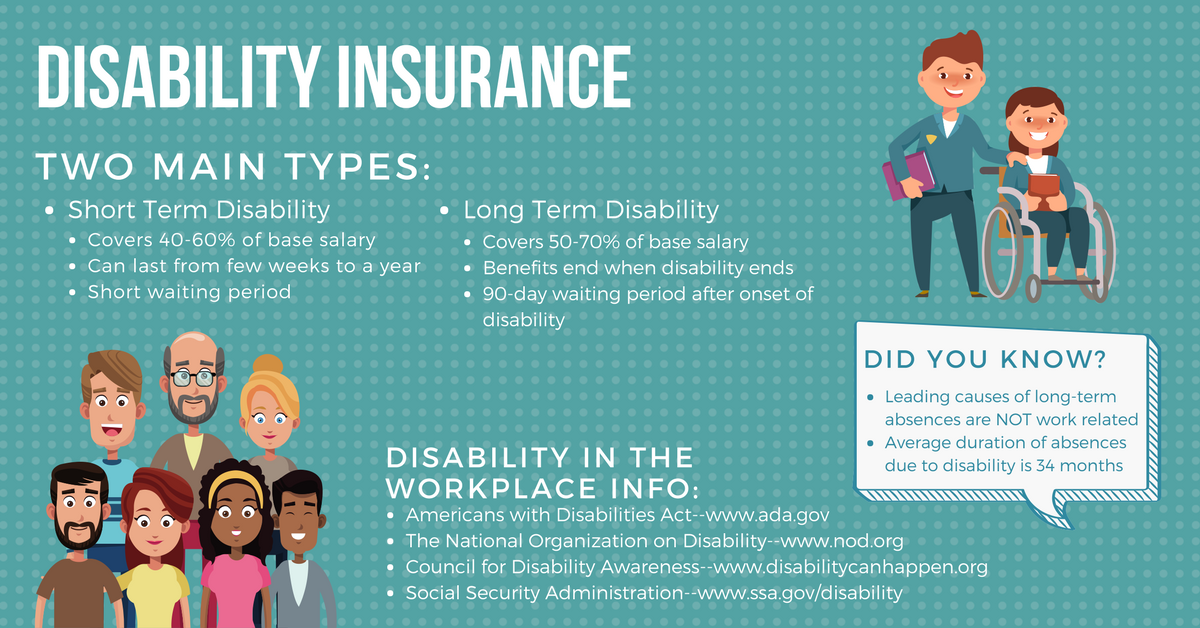

Long-term disability (LTD) benefits and Social Security Disability Insurance (SSDI) benefits are both designed to provide financial assistance to individuals who are unable to work due to a disability. However, they differ in their eligibility requirements, benefit amounts, and how they are funded.

Understanding Long-Term Disability Benefits, Can long term disability garnish social security

Long-term disability insurance is a type of insurance that provides monthly payments to individuals who are unable to work due to a disability. LTD benefits are typically offered by employers as part of a benefits package, or individuals can purchase their own LTD policy.

Eligibility for Long-Term Disability Benefits

- Employment: You must be employed by a company that offers LTD benefits or have purchased your own policy.

- Waiting Period: There is typically a waiting period before benefits begin, usually ranging from 30 to 180 days.

- Disability Definition: You must meet the policy’s definition of disability, which typically requires you to be unable to perform the essential duties of your job. Some policies may require you to be unable to perform any job for which you are qualified.

- Medical Documentation: You must provide medical documentation from a licensed physician supporting your disability claim.

Benefit Amounts for Long-Term Disability

The amount of LTD benefits you receive is typically based on a percentage of your pre-disability income, often ranging from 50% to 70%. LTD policies may have maximum benefit amounts, and the benefits may be subject to a waiting period before they begin.

Understanding Social Security Disability Benefits

Social Security Disability Insurance (SSDI) is a federal program that provides monthly benefits to individuals who are unable to work due to a disability. SSDI benefits are funded through payroll taxes paid by both employers and employees.

Eligibility for Social Security Disability Benefits

- Work Credits: You must have earned enough work credits to qualify for SSDI benefits. The number of work credits required varies depending on your age.

- Disability Definition: You must have a disability that is expected to last at least 12 months or result in death. The disability must be severe enough to prevent you from engaging in any substantial gainful activity.

- Medical Documentation: You must provide medical documentation from a licensed physician supporting your disability claim.

Benefit Amounts for Social Security Disability Benefits

The amount of SSDI benefits you receive is based on your earnings history. The maximum SSDI benefit amount is adjusted annually. You may also be eligible for other benefits, such as Medicare, if you receive SSDI benefits.

Overlapping Benefits

It is possible to receive both LTD benefits and SSDI benefits. However, the amount of SSDI benefits you receive may be reduced if you are also receiving LTD benefits. This is because the Social Security Administration (SSA) considers LTD benefits as “other income” when calculating your SSDI benefits.

For example, if you are receiving $2,000 per month in LTD benefits and your maximum SSDI benefit amount is $3,000 per month, your SSDI benefit amount may be reduced to $1,000 per month.

The Legal Framework of Garnishment: Can Long Term Disability Garnish Social Security

Garnishment is a legal process that allows creditors to collect debts from a debtor’s assets that are held by a third party, such as a bank or employer. The purpose of garnishment is to ensure that creditors have a means of recovering debts owed to them, even if the debtor is unwilling or unable to pay directly.The legal grounds for garnishment vary depending on the jurisdiction and the type of debt.

In general, garnishment is typically allowed for debts that are legally enforceable, such as judgments, court orders, or contracts.

Legal Restrictions and Regulations Governing Garnishment of Social Security Benefits

Garnishment of Social Security benefits is strictly regulated by federal law. The Social Security Act, specifically Section 207, limits the circumstances under which Social Security benefits can be garnished. This is because Social Security benefits are intended to provide a basic level of income to individuals and families who are unable to work or are retired.

“Except as provided in section 1631, no assignment, transfer, or pledge of any payment due or to become due under this title shall be valid, and such payments shall not be subject to execution, levy, attachment, garnishment, or other legal process, or to the operation of any bankruptcy or insolvency law.”

Social Security Act, Section 207

Specific Situations Where Garnishment of Social Security Benefits May Be Permitted

While Social Security benefits are generally protected from garnishment, there are some exceptions. Garnishment of Social Security benefits may be permitted in the following situations:

- Child Support and Alimony: Federal law allows for the garnishment of Social Security benefits to enforce child support and alimony obligations. This exception is designed to ensure that children and spouses receive the financial support they are entitled to.

- Federal Tax Liens: The Internal Revenue Service (IRS) can garnish Social Security benefits to collect unpaid federal taxes. This is because the IRS has a priority claim to unpaid taxes.

- State and Local Taxes: Some states and localities have laws that allow for the garnishment of Social Security benefits to collect unpaid state and local taxes. However, these laws are subject to the restrictions of the Social Security Act.

- Student Loans: The Department of Education can garnish Social Security benefits to collect unpaid student loans. This exception is intended to ensure that students repay their loans and that the government is able to recover its investment in education.

- Court-Ordered Judgments: In some cases, a court may order the garnishment of Social Security benefits to satisfy a judgment against the beneficiary. This is typically allowed only in situations where the judgment is for a debt that is not otherwise protected from garnishment, such as a debt for fraud or intentional wrongdoing.

Garnishment for Long-Term Disability Debts

Garnishment is a legal process where a creditor can seize a portion of a debtor’s assets, including wages or benefits, to satisfy a debt. Long-term disability insurers may seek to garnish Social Security benefits in certain situations to recover debts owed to them.This section explores the circumstances under which a long-term disability insurer might seek to garnish Social Security benefits, the types of debts that could lead to garnishment, and the legal processes involved.

Circumstances for Garnishment

A long-term disability insurer may seek to garnish Social Security benefits if the insured owes a debt to the insurer. This debt can arise from various reasons, such as unpaid premiums, overpayments, or fraud. The insurer must demonstrate that the debt is legitimate and that the insured is legally obligated to repay it. This process typically involves a court order authorizing the garnishment.

Types of Debts Leading to Garnishment

- Unpaid Premiums: If an insured fails to pay their premiums, the insurer may seek to recover the unpaid amount by garnishing their Social Security benefits. This is particularly common in cases where the insured has stopped paying premiums due to financial hardship but continues to receive disability benefits.

- Overpayments: In some instances, the insurer may overpay disability benefits to the insured. This could occur due to administrative errors or miscalculations. If the insurer identifies an overpayment, they may seek to recover the overpaid amount through garnishment.

- Fraud: If the insurer discovers that the insured obtained disability benefits through fraudulent means, such as misrepresenting their medical condition, they may seek to recover the benefits received through garnishment.

Legal Processes in Garnishment

The legal processes involved in garnishment can vary depending on the specific circumstances and the state laws governing the process. Generally, the insurer must obtain a court order authorizing the garnishment.

Garnishment by a Long-Term Disability Insurer

The insurer will typically file a lawsuit against the insured seeking a judgment for the debt owed. The lawsuit will Artikel the basis for the debt and request a court order authorizing the garnishment of Social Security benefits.The insured has the right to defend against the lawsuit and challenge the insurer’s claims. If the court finds in favor of the insurer, it will issue a garnishment order authorizing the insurer to collect the debt from the insured’s Social Security benefits.

Garnishment by a Government Agency

In some cases, a government agency, such as the Social Security Administration (SSA), may garnish Social Security benefits to recover overpayments or debts owed to the government. The SSA typically follows a specific process for garnishment, which may involve issuing a notice of intent to garnish benefits and providing the recipient with an opportunity to appeal the decision.

Protecting Social Security Benefits

Protecting your Social Security benefits from garnishment is crucial if you rely on this income for essential needs. While Social Security benefits are generally exempt from garnishment, there are exceptions, and understanding these exceptions is essential for safeguarding your financial security.

Strategies for Protecting Social Security Benefits

Protecting your Social Security benefits from garnishment requires a proactive approach. It involves understanding your rights, exploring legal options, and taking steps to minimize the risk of garnishment.

- Seek Legal Counsel: Consulting with a qualified attorney specializing in Social Security and garnishment laws is the first step. An attorney can assess your specific situation, advise you on your rights, and guide you through the legal process.

- Negotiate with Creditors: If you’re facing a debt that could lead to garnishment, consider negotiating with your creditors. Explore options like payment plans, debt consolidation, or settlement agreements.

- Utilize Available Resources: State and federal agencies offer resources to help individuals facing financial difficulties. These resources might include debt counseling, credit counseling, or programs for low-income individuals.

- Maintain Accurate Records: Keeping accurate records of your income, expenses, and debts is crucial. These records can be vital if you need to prove your financial situation in court.

Role of Legal Representation in Challenging Garnishment Actions

Legal representation is essential in challenging garnishment actions. An attorney can:

- File Legal Challenges: An attorney can file legal challenges to contest the garnishment order. This may involve arguing that the garnishment violates your rights or that your Social Security benefits are exempt from garnishment.

- Negotiate with Creditors: An attorney can negotiate with creditors on your behalf to explore alternative solutions, such as payment plans or settlements, to avoid garnishment.

- Represent You in Court: If the case goes to court, an attorney can represent you in legal proceedings and argue your case before a judge.

Negotiating Settlements or Alternative Payment Arrangements

Negotiating settlements or alternative payment arrangements with creditors can be a viable option to avoid garnishment. This involves:

- Understanding Your Options: Explore all available options, such as payment plans, debt consolidation, or settlements, to find the best solution for your situation.

- Negotiating with Creditors: Engage in direct communication with creditors to discuss potential solutions. Be prepared to present your financial situation and explore options that benefit both parties.

- Seeking Mediation: Consider seeking mediation if you’re unable to reach an agreement with creditors. A mediator can help facilitate communication and find a mutually agreeable solution.

Real-World Examples and Case Studies

Understanding the legal principles governing garnishment of Social Security benefits is crucial, but real-world examples offer a practical perspective on how these principles are applied in actual cases. This section explores several real-world cases where long-term disability insurers have attempted to garnish Social Security benefits, examining the legal outcomes and the factors that influenced the decisions.

Cases of Garnishment Attempts

Real-world examples highlight the complexities and potential consequences of garnishment attempts against Social Security benefits. Here are some notable cases:

- In the case of

-Smith v. Unum Life Insurance Company of America*, a long-term disability insurer sought to garnish the plaintiff’s Social Security benefits to recover overpayments. The court ruled in favor of the plaintiff, finding that the insurer’s attempt to garnish Social Security benefits was an impermissible “double recovery.” The court reasoned that the plaintiff had already received Social Security benefits, which were intended to replace lost income, and that the insurer’s attempt to recover overpayments from the same source was unfair and unjust.This case illustrates the principle that Social Security benefits are intended to be a primary source of income for individuals with disabilities and should not be subject to garnishment for debts arising from other sources.

- Another case,

-Jones v. Prudential Insurance Company of America*, involved a long-term disability insurer’s attempt to offset Social Security benefits against disability payments. The court held that the insurer could not offset Social Security benefits without a clear and unambiguous contractual provision allowing for such offset. This case underscores the importance of carefully reviewing the terms of long-term disability insurance policies to understand the insurer’s rights and obligations regarding Social Security benefits. - In

-Brown v. MetLife Insurance Company*, the court addressed the issue of whether Social Security benefits could be garnished to recover overpayments on a long-term disability policy. The court found that garnishment was permissible under certain circumstances, such as when the overpayment was due to the insured’s fraud or misrepresentation. However, the court emphasized that garnishment should only be allowed as a last resort and that other remedies, such as offsetting future payments, should be explored first.This case highlights the importance of understanding the specific circumstances surrounding an overpayment and the available remedies before resorting to garnishment.

Consequences of Garnishment

The potential consequences of garnishment for individuals receiving Social Security benefits can be severe. Garnishment can:

- Reduce or eliminate the individual’s primary source of income, making it difficult to meet basic living expenses.

- Create financial hardship and stress, potentially leading to further health problems.

- Impair the individual’s ability to access essential services and resources, such as healthcare and housing.

- Increase the risk of homelessness and poverty.

Knowing your rights and understanding the legal framework is key to protecting your Social Security benefits. If you’re facing a garnishment threat, don’t panic. Seek legal advice and explore your options. Remember, you’ve got rights, and there are ways to fight back. Stay informed, stay strong, and keep that Social Security cash flowing!

Essential FAQs

What are the most common reasons for a disability insurer to garnish Social Security benefits?

The most common reasons include unpaid premiums, overpayments, or if the insurer claims you’re not actually disabled.

Can I stop my disability insurer from garnishing my Social Security benefits?

You might be able to stop it, but it’s not easy. You’ll need to prove your case and fight back legally. Get a lawyer on your side!

What if I’m not sure if I can afford a lawyer?

Don’t worry, there are legal aid organizations and resources available to help people who can’t afford legal representation. Do some research and find the right support.

What if I’m facing garnishment, but I haven’t received any official notices?

If you haven’t been notified, it’s best to reach out to your disability insurer and Social Security Administration to clarify the situation. It’s always better to be proactive and understand your rights.