Do you capitalize maintenance contracts to cost of equipment? This crucial accounting question impacts your bottom line significantly. Understanding the nuances of capitalizing versus expensing maintenance contracts is vital for accurate financial reporting and tax optimization. This deep dive explores the complexities of this decision, examining the various accounting standards, influencing factors, and potential tax implications. We’ll equip you with the knowledge to make informed choices and avoid costly mistakes.

We’ll dissect the key factors driving capitalization decisions, including the materiality of the contract, the equipment’s useful life, and the specific terms of the agreement. We’ll also explore the impact on depreciation and amortization, providing clear examples to illustrate the financial consequences of each approach. This isn’t just about numbers; it’s about strategic financial management.

Accounting Treatment of Maintenance Contracts: Do You Capitalize Maintenance Contracts To Cost Of Equipment

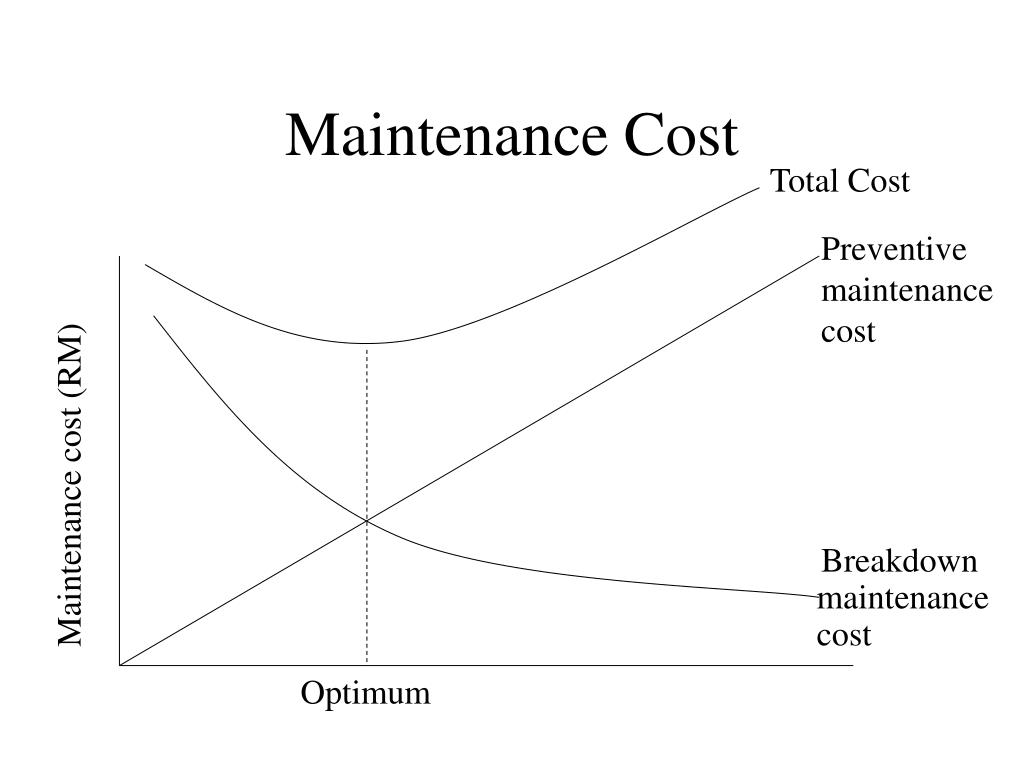

The accounting treatment of maintenance contracts hinges on whether the costs are considered to be capital expenditures, improving the asset’s value and extending its useful life, or revenue expenditures, maintaining the asset’s current operational condition. This distinction significantly impacts a company’s financial statements, affecting depreciation expense, net income, and ultimately, the valuation of the entity. The decision to capitalize or expense maintenance costs is governed by specific accounting standards and internal policies, with a careful assessment of the contract’s nature and impact being crucial.

Capitalization versus Expensing of Maintenance Costs

The determination of whether to capitalize or expense maintenance costs rests on whether the expenditure results in a material increase in the useful life or productivity of the asset. Under Generally Accepted Accounting Principles (GAAP) and International Financial Reporting Standards (IFRS), costs that significantly enhance or extend the asset’s life are capitalized, becoming part of the asset’s carrying amount and depreciated over its revised useful life.

Conversely, routine maintenance costs that merely maintain the asset’s existing condition are expensed immediately. For example, an overhaul of a machine that extends its operational life by several years would be capitalized, while routine lubrication and cleaning would be expensed. The materiality threshold for capitalization is context-specific and depends on the nature of the asset and the magnitude of the expenditure relative to the asset’s overall value.

Accounting Methods Under GAAP and IFRS

Under GAAP, the capitalization of maintenance costs follows the principle of materiality. If the expenditure improves the asset’s quality, efficiency, or extends its useful life, it is capitalized. IFRS similarly emphasizes the improvement or extension of the asset’s useful life as a criterion for capitalization. Both standards require proper documentation to justify the accounting treatment chosen. For instance, a major engine replacement on a delivery truck that substantially extends its useful life would be capitalized under both GAAP and IFRS, while regular tire replacements would be expensed.

The specific documentation required might include invoices, contracts, and internal memos detailing the nature of the work and its impact on the asset.

Impact of Capitalization versus Expensing on Financial Statements

Capitalizing maintenance costs increases the asset’s book value, leading to higher depreciation expense over the asset’s extended useful life. This results in lower net income in the periods following the capitalization but higher net income in earlier periods. Expensing maintenance costs, conversely, reduces net income immediately. The impact on the balance sheet is also distinct: capitalization increases the asset’s value and accumulated depreciation, while expensing affects only the income statement.

For example, capitalizing a $10,000 engine overhaul would increase the asset’s value and lead to higher depreciation expense over the next few years. Expensing the same cost would immediately reduce net income by $10,000.

Comparison of Capitalization and Expensing

| Feature | Capitalization | Expensing |

|---|---|---|

| Impact on Income Statement | Higher net income initially, lower net income later due to depreciation | Lower net income immediately |

| Impact on Balance Sheet | Increased asset value, increased accumulated depreciation | No impact on asset value |

| Tax Implications | Depreciation expense reduces taxable income over time | Full expense deduction in the current period |

| Suitability | Suitable for major repairs extending asset life | Suitable for routine maintenance |

Factors Influencing Capitalization Decisions

The decision of whether to capitalize maintenance contracts as part of the cost of equipment is a complex one, governed by accounting standards and influenced by several key factors. This decision significantly impacts a company’s financial statements, affecting both depreciation expense and the reported value of assets. A thorough evaluation of these factors is crucial to ensure compliance and accurate financial reporting.The materiality of the maintenance contract cost relative to the overall cost of the equipment is a primary determinant.

A small, immaterial cost is unlikely to justify capitalization, while a substantial expenditure may warrant it. Furthermore, the useful life of the equipment and the duration of the maintenance contract are intrinsically linked. Contracts extending beyond the equipment’s useful life are generally expensed, while those aligning closely with the equipment’s operational lifespan are more likely to be capitalized.

The nature of the maintenance services themselves also plays a crucial role. Contracts covering routine maintenance are typically expensed, whereas contracts covering major overhauls or significant improvements extending the equipment’s useful life are more often capitalized.

Materiality Threshold for Capitalization

The materiality threshold dictates whether the cost of a maintenance contract is significant enough to warrant capitalization. This threshold is not rigidly defined but rather determined on a case-by-case basis, considering the specific context of the company and the nature of the contract. Generally, materiality is assessed by comparing the contract cost to the overall cost of the equipment or to the company’s total assets.

If the contract cost is a small fraction of these amounts, it is likely considered immaterial and expensed. Conversely, a substantial contract cost relative to these figures may lead to capitalization. For instance, a $10,000 maintenance contract for a $1 million piece of equipment might be considered immaterial, while a $100,000 contract for the same equipment would likely be material and warrant further analysis for potential capitalization.

The assessment of materiality often involves professional judgment and consideration of industry best practices.

Role of Equipment Useful Life in Capitalization Decisions

The useful life of the equipment is a critical factor influencing the capitalization decision. Accounting standards generally stipulate that costs should only be capitalized if they extend the useful life or enhance the productive capacity of the asset. Maintenance contracts that merely maintain the existing functionality of the equipment are typically expensed. For example, a routine maintenance contract for a machine that covers regular cleaning, lubrication, and minor repairs would generally be expensed.

However, a contract covering a major overhaul that significantly extends the machine’s operational lifespan would likely be capitalized, as it directly enhances the asset’s useful life. The alignment between the contract duration and the equipment’s useful life is therefore crucial. If the contract significantly outlives the asset’s useful life, it should be expensed.

Examples of Capitalization and Expensing

Capitalization is appropriate for maintenance contracts that substantially improve or extend the useful life of the equipment. For example, a major engine overhaul for a large piece of construction equipment, extending its useful life by several years, would typically be capitalized. Similarly, a contract for a significant upgrade to a software system that increases its functionality and extends its useful life would also qualify for capitalization.

Conversely, routine maintenance contracts, such as regular servicing of a vehicle or periodic software updates that merely maintain existing functionality, would be expensed. Another example of expensing would be a contract for repairs necessitated by negligence or improper use of the equipment. These costs are considered operational expenses rather than capital expenditures.

Factors Influencing Capitalization Decision-Making Process

The decision to capitalize or expense maintenance contracts is multifaceted and requires a careful consideration of several interacting factors. A comprehensive assessment should include:

- Materiality of the contract cost: The relative size of the contract cost compared to the equipment’s total cost or the company’s total assets.

- Duration of the maintenance contract: The length of the contract compared to the estimated useful life of the equipment.

- Nature of the maintenance services: Whether the services are routine maintenance or significant improvements extending the equipment’s useful life.

- Enhancement of the equipment’s useful life: Whether the contract extends the equipment’s operational lifespan or enhances its productive capacity.

- Compliance with accounting standards: Adherence to relevant accounting standards and guidelines regarding capital expenditures.

- Management’s judgment: Professional judgment and consideration of industry best practices in evaluating materiality and the impact on financial statements.

Impact on Depreciation and Amortization

Capitalizing maintenance contracts, rather than expensing them, significantly alters the depreciation and amortization calculations for the related equipment. This stems from the fundamental accounting principle that capitalized costs become part of the asset’s overall cost basis, thereby influencing the depreciation expense recognized over the asset’s useful life. Conversely, expensing treats maintenance costs as immediate period expenses.Capitalization increases the initial cost of the asset, leading to a higher depreciation expense over its useful life.

The increased depreciation expense, however, is spread over a longer period compared to the immediate expense recognition associated with expensing the maintenance costs. This impacts both the balance sheet and the income statement.

Depreciation Calculation Adjustments

The capitalization of maintenance contracts directly increases the depreciable base of the equipment. The formula for calculating annual depreciation remains consistent (e.g., straight-line, declining balance, or units of production), but the initial cost used in the calculation now includes the capitalized maintenance costs. For instance, if a piece of equipment originally cost $100,000 and $10,000 in maintenance costs were capitalized, the depreciable base becomes $110,000.

Using the straight-line method over a 10-year useful life, the annual depreciation expense would be $11,000 ($110,000 / 10 years) instead of $10,000 ($100,000 / 10 years) had the maintenance been expensed.

Amortization Methods for Capitalized Maintenance Costs

Capitalized maintenance costs are typically amortized over the remaining useful life of the asset or the period the maintenance contract covers, whichever is shorter. Several methods can be employed:

- Straight-Line Amortization: This method evenly distributes the cost over the amortization period. The annual amortization expense is calculated by dividing the capitalized cost by the number of years remaining in the asset’s useful life or the contract term.

- Units of Production Amortization: This method allocates the cost based on the asset’s actual usage. The amortization expense is calculated by multiplying the capitalized cost per unit of production by the number of units produced during the period. This is suitable when the asset’s usage is directly related to the benefits derived from the maintenance contract.

The choice of amortization method depends on the nature of the maintenance contract and the company’s accounting policies. Consistency in the method used is crucial for comparability over time.

Comparative Depreciation Schedules

Consider a machine with an initial cost of $100,000, a useful life of 10 years, and no salvage value. Suppose a $10,000 maintenance contract is capitalized.

| Year | Depreciation Expense (Expensing Maintenance) | Depreciation Expense (Capitalizing Maintenance) – Straight-Line |

|---|---|---|

| 1 | $10,000 | $11,000 |

| 2 | $10,000 | $11,000 |

| … | … | … |

| 10 | $10,000 | $11,000 |

This table illustrates that capitalizing maintenance results in a higher annual depreciation expense over the asset’s life compared to expensing the maintenance costs. The cumulative depreciation will also be higher at the end of the asset’s life, reflecting the inclusion of the capitalized maintenance costs in the depreciable base. Using a declining balance method would result in a different pattern, with higher depreciation in earlier years and lower depreciation in later years, but the overall impact of capitalization would remain the same.

Impact on Financial Statements

Capitalizing maintenance contracts increases the asset’s book value on the balance sheet, while expensing reduces net income on the income statement in the year the expense is incurred. Conversely, capitalizing defers the expense recognition over the asset’s useful life, resulting in a lower expense in the current period and a higher expense in future periods. This affects key financial ratios such as return on assets (ROA) and profit margins.

A company choosing to capitalize might show a higher ROA in the initial years but a lower ROA in later years compared to a company expensing the maintenance costs. The choice between expensing and capitalizing therefore has significant implications for financial statement presentation and analysis.

Tax Implications of Capitalization

Capitalizing maintenance contracts, rather than expensing them, significantly impacts a company’s tax liability. The decision to capitalize hinges on whether the expenditure extends the useful life of the asset or improves its functionality beyond its original condition. This choice carries substantial tax implications, affecting both the timing and amount of tax deductions.Capitalizing maintenance contracts defers tax deductions. Instead of deducting the expense in the current year, the capitalized cost is depreciated or amortized over the asset’s remaining useful life.

This results in lower tax expenses in the current year but higher tax expenses in future years. Conversely, expensing the maintenance costs allows for immediate tax deductions, reducing the current year’s tax liability but resulting in higher taxes in future years due to the lack of a depreciable base. The optimal strategy depends on the company’s overall tax planning and projected future profitability.

Tax Benefits and Disadvantages of Capitalization

The tax benefits of capitalization primarily stem from the deferral of tax expenses. This allows companies to potentially reduce their current tax burden, freeing up cash flow for other business operations. However, a significant disadvantage is the potential for higher tax liabilities in future years due to the accelerated depreciation of the capitalized asset. The overall tax impact depends on the company’s tax rate, the asset’s useful life, and the applicable depreciation methods.

A company with a high current tax rate and a long-term projection of lower tax rates might find capitalization advantageous. Conversely, a company expecting high future tax rates might prefer expensing.

Examples of Capitalization’s Impact on Tax Deductions

Consider Company A, which capitalizes a $100,000 maintenance contract extending the life of a machine with a 5-year remaining useful life. Using straight-line depreciation, Company A deducts $20,000 annually for five years. In contrast, Company B expenses the same $100,000 contract immediately, resulting in a $100,000 deduction in the current year. The cumulative tax deduction remains the same ($100,000) over the five years, but the timing of the deduction differs significantly, impacting their cash flow and tax liability in each year.

Potential Tax Audit Issues Related to Capitalization

The Internal Revenue Service (IRS) scrutinizes capitalization decisions, particularly those involving maintenance costs. Key audit issues include proper documentation supporting the capitalization decision, accurate determination of the asset’s useful life, and the appropriate depreciation method used. Failure to provide sufficient evidence demonstrating that the expenditure substantially enhanced the asset’s value or extended its useful life could lead to disallowance of the capitalization and potential penalties.

Consistent application of the chosen capitalization policy across similar assets is also crucial for avoiding audit issues.

Best Practices for Tax Compliance Related to Capitalized Maintenance Contracts, Do you capitalize maintenance contracts to cost of equipment

Maintaining thorough and detailed records is paramount. This includes contracts, invoices, engineering reports, and internal memos justifying the capitalization decision. A clearly defined capitalization policy, consistently applied across the company, reduces the risk of inconsistencies and potential audit issues. Seeking professional tax advice to ensure compliance with current IRS regulations and guidance is highly recommended. Regular review of capitalization decisions and depreciation methods ensures ongoing compliance and minimizes potential tax risks.

Finally, a robust internal control system overseeing the process of recording and reporting capitalized maintenance contracts will further strengthen the company’s position during a potential audit.

Internal Controls and Documentation

Effective internal controls and meticulous documentation are paramount for ensuring the accurate and compliant accounting treatment of maintenance contracts, particularly regarding capitalization decisions. A robust system minimizes errors, prevents fraud, and facilitates efficient audits. This section details the necessary components of such a system.

Design of Internal Controls for Maintenance Contract Accounting

Internal controls should encompass the entire lifecycle of a maintenance contract, from initial evaluation to final depreciation. Segregation of duties is crucial; authorization for capitalization should be separate from the accounting function. A pre-approved list of capitalizable maintenance activities, defined by criteria such as materiality and enhancement of asset value, should be established and regularly reviewed. All maintenance contract costs should be documented with supporting invoices and receipts.

Regular reconciliations between the general ledger and supporting documentation should be performed. Furthermore, a system of checks and balances should be implemented to ensure that only eligible costs are capitalized. For instance, a two-signature approval process for capitalization exceeding a predetermined threshold could be implemented.

Documentation Supporting Capitalization Decisions

Thorough documentation is critical for justifying capitalization decisions. This includes a detailed analysis of each maintenance contract, demonstrating its impact on the useful life or productive capacity of the asset. Supporting documentation should include the original maintenance contract, invoices detailing the costs incurred, a comprehensive explanation of the work performed, and an assessment of how the work extends the asset’s useful life or enhances its productivity.

A formal capitalization request form, approved by relevant management personnel, should be completed for each contract considered for capitalization. This form should explicitly state the reasons for capitalization, the relevant accounting standards applied, and a calculation of the capitalized amount.

Importance of Maintaining Accurate Records of Maintenance Costs

Maintaining accurate records of all maintenance costs, both capitalized and expensed, is essential for several reasons. Accurate records ensure compliance with accounting standards (e.g., IFRS, GAAP), provide a reliable basis for financial reporting, and facilitate effective asset management. Complete and accurate records are crucial for internal and external audits, minimizing potential discrepancies and disputes. They also aid in budgeting and forecasting future maintenance expenses, contributing to improved financial planning and resource allocation.

Data discrepancies can lead to misstatements in financial statements, resulting in potential penalties or reputational damage.

Checklist for Reviewing Maintenance Contract Capitalization

A comprehensive checklist ensures consistency and thoroughness in reviewing capitalization decisions. The checklist should include steps such as:

- Verification of the contract’s terms and conditions.

- Confirmation that the maintenance activity meets the pre-defined criteria for capitalization.

- Review of supporting documentation, including invoices and receipts.

- Assessment of the impact of the maintenance on the asset’s useful life or productive capacity.

- Calculation of the capitalized amount, in accordance with relevant accounting standards.

- Approval by authorized personnel.

- Documentation of the review process and any adjustments made.

Management’s Role in Overseeing the Capitalization Process

Management plays a crucial role in establishing and enforcing policies and procedures related to the capitalization of maintenance contracts. This includes defining the criteria for capitalization, approving significant capitalization decisions, and ensuring the integrity of the accounting system. Management should also oversee the implementation and effectiveness of internal controls, regularly reviewing the process to identify and address any weaknesses.

Ultimately, management bears the responsibility for the accuracy and reliability of financial reporting related to maintenance contract capitalization. Regular reporting to senior management on significant capitalization decisions ensures transparency and accountability.

Illustrative Examples

The following examples illustrate scenarios where capitalization versus expensing of maintenance contracts is appropriate. The decision hinges on whether the contract extends the useful life or improves the functionality of the underlying asset, or merely maintains its existing condition.The determination of whether to capitalize or expense maintenance costs requires careful consideration of the specific facts and circumstances of each situation.

Misclassifying these costs can lead to material misstatements in the financial statements, affecting key financial ratios and potentially impacting tax liabilities.

Capitalization Example: Major Overhaul of a Manufacturing Machine

This example details a situation where capitalizing a maintenance contract is appropriate.

- Equipment: A high-speed automated packaging machine used in a food processing plant. The machine is a critical component of the production line and has a significant remaining useful life. Its original cost was $500,000, and it has been depreciated for five years using a straight-line method over its estimated useful life of ten years.

- Maintenance Contract: A comprehensive overhaul contract costing $75,000 was entered into. This overhaul included the replacement of key components such as worn bearings, seals, and motors. The overhaul significantly extended the machine’s useful life by three years and increased its production capacity by 15%. The contract also included preventative maintenance for the next year.

- Reasoning: The overhaul contract substantially improved the machine’s functionality and extended its useful life. The cost of the overhaul is therefore capitalized as an addition to the machine’s carrying amount, increasing its depreciable base. The additional preventative maintenance for one year is expensed as incurred. This treatment reflects the fact that the overhaul resulted in a material improvement to the asset, not merely the maintenance of its existing condition.

Expensing Example: Routine Maintenance of Office Equipment

This example illustrates a situation where expensing a maintenance contract is appropriate.

- Equipment: A fleet of ten desktop computers used by administrative staff in a small office. The computers are relatively inexpensive and are replaced every three years.

- Maintenance Contract: A one-year service contract costing $1,000 covers routine maintenance, including software updates, virus protection, and troubleshooting minor hardware issues. The contract does not involve any major repairs or replacements that would extend the useful life of the equipment.

- Reasoning: The maintenance contract covers routine upkeep and does not enhance the computers’ functionality or extend their useful life. The costs are therefore expensed in the period incurred, reflecting their nature as operating expenses that maintain the existing condition of the assets. The expenditure does not materially improve the asset or extend its useful life.

Mastering the art of capitalizing maintenance contracts isn’t just about adhering to accounting rules; it’s about strategic financial planning. By understanding the implications of your decisions – from impacting depreciation calculations to optimizing your tax burden – you can significantly enhance your company’s financial health. Remember, accurate record-keeping and robust internal controls are paramount. This detailed analysis empowers you to make informed choices, leading to greater financial accuracy and strategic advantage.

FAQ Compilation

What if the maintenance contract covers multiple pieces of equipment?

Allocation is key. You need to allocate the cost proportionally based on the relative value or usage of each asset.

How does inflation affect the capitalization decision?

Inflation can impact the present value of future maintenance costs. Consider this when assessing the materiality of the contract.

Are there industry-specific guidelines for maintenance contract capitalization?

Yes, some industries have specific guidance. Consult relevant industry standards and regulatory requirements.

What happens if I incorrectly capitalize or expense a maintenance contract?

Corrections are possible, but they require adjustments to your financial statements and may trigger tax implications. Consult with a tax professional.