Does LG Lint General Contracting use job costing? This question delves into the core financial practices of this general contracting firm and its impact on project management and profitability. Understanding their costing methods reveals insights into their operational efficiency and overall business strategy. We’ll explore LG Lint General Contracting’s business model, the principles of job costing within the construction industry, and analyze available information to determine if they indeed employ this common accounting method.

We will also examine alternative costing methods and their implications.

The construction industry relies heavily on accurate cost estimations for successful project delivery. Job costing, a method that tracks expenses for individual projects, is frequently employed to manage budgets, assess profitability, and identify areas for improvement. However, other methods exist, each with its own set of advantages and disadvantages. This investigation will uncover whether LG Lint General Contracting leverages job costing or another approach and the potential ramifications of their chosen strategy.

LG Lint General Contracting’s Business Model

LG Lint General Contracting, a name that practically purrs with professionalism (and maybe a little lint), operates on a robust, if slightly fluffy, business model. Their approach centers around providing comprehensive general contracting services, emphasizing quality craftsmanship and timely project completion. They don’t just build; they build

relationships* (and occasionally, some pretty impressive structures).

LG Lint General Contracting’s operational approach is characterized by a meticulous planning phase, a collaborative spirit with clients and subcontractors, and a relentless focus on exceeding expectations. They pride themselves on clear communication, proactive problem-solving, and a healthy dose of good old-fashioned elbow grease. Think of them as the superheroes of the construction world, minus the capes (mostly because they’d get in the way of the hard hats).

Project Types Undertaken

LG Lint General Contracting tackles a diverse range of projects. Their portfolio includes everything from small-scale residential renovations (think transforming that outdated bathroom into a spa-like oasis) to large-scale commercial developments (imagine a gleaming new office building, sparkling under the city lights). They also handle industrial projects, specializing in efficient and safe construction within demanding environments. Essentially, if it needs building, renovating, or generally improving, LG Lint is likely up to the task.

Client Base and Served Industries

LG Lint General Contracting boasts a diverse client base spanning various industries. They work with residential homeowners, commercial property developers, industrial companies, and even the occasional eccentric millionaire with a penchant for elaborate treehouses. This broad reach reflects their adaptability and expertise across different project scales and requirements. Their clients value their reliability, attention to detail, and ability to navigate the often-complex world of construction.

Examples of Past Projects

The following table showcases a small selection of LG Lint General Contracting’s impressive past projects. While the specifics are kept confidential for client privacy reasons, the scale and complexity of the undertakings are clearly evident.

| Project Name | Client | Project Type | Project Value (USD) |

|---|---|---|---|

| The Cozy Cottage Complex | Happy Homes Development | Residential Construction | $2,500,000 |

| MegaMart Expansion | MegaMart Inc. | Commercial Construction | $15,000,000 |

| Steelworks Renovation | Ironclad Industries | Industrial Renovation | $8,000,000 |

| The Whispering Pines Estate | (Confidential Client) | High-End Residential | $7,000,000 |

Job Costing in the Construction Industry

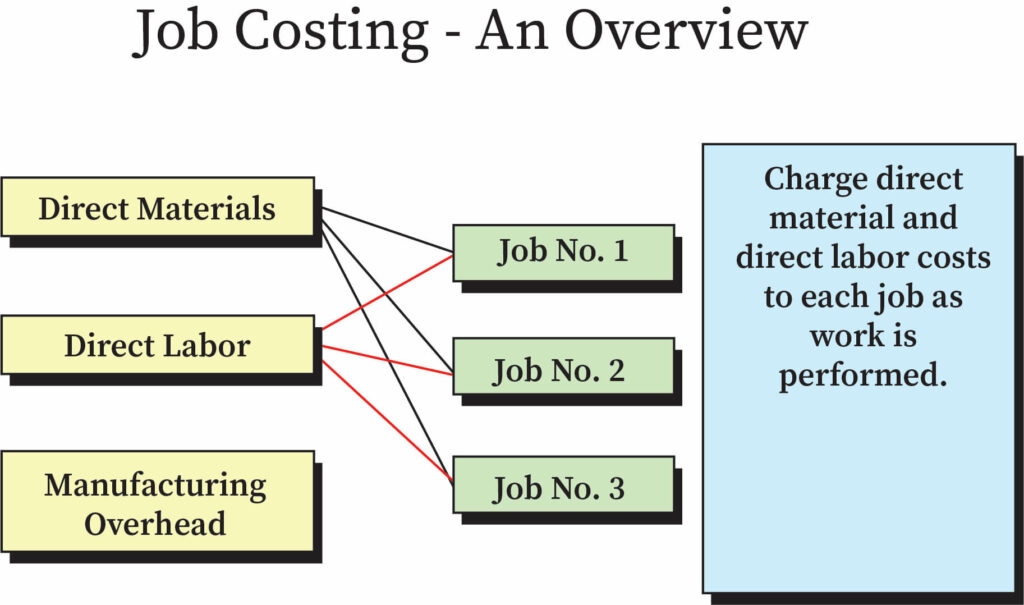

Job costing, in the chaotic yet strangely satisfying world of general contracting, is like having a super-powered spreadsheet that keeps your sanity (and your bank account) intact. It’s the meticulous tracking of expenses for each individual project, ensuring you know exactly where every penny goes – from the tiny screws to the hefty crane rentals. Without it, you’re essentially navigating a construction site blindfolded, hoping you don’t trip over a pile of unexpectedly expensive bricks.Job costing is crucial for general contracting firms because it provides a clear picture of the profitability of each project.

This allows for better bidding on future projects, more accurate budgeting, and ultimately, a healthier bottom line. Imagine trying to run a business without knowing the actual cost of each product or service – it’s a recipe for disaster, especially in an industry as complex as construction.

Key Elements of Accurate Job Costing

Accurate job costing relies on meticulously tracking three primary components: labor, materials, and overhead. Labor costs involve wages, benefits, and any associated payroll taxes for all personnel working on the project. Materials encompass everything from lumber and concrete to specialized fixtures and finishes – every nail, every brick, every beautifully-crafted light fixture needs to be accounted for. Overhead, the often-overlooked villain, includes indirect costs like office rent, insurance, administrative salaries, and the depreciation of equipment.

Getting these three elements right is paramount; otherwise, your cost calculations become as reliable as a three-legged stool.

Comparison with Other Costing Methods

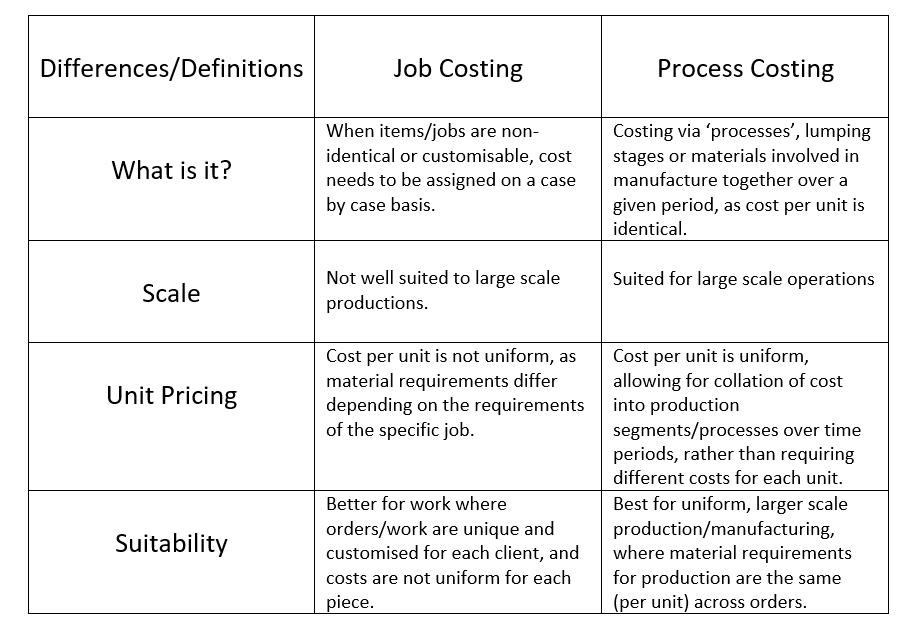

While job costing reigns supreme in construction, other methods exist, though they often fall short. Process costing, for example, averages costs across multiple projects, obscuring the profitability of individual jobs. This is akin to trying to figure out your personal spending habits by looking at your average monthly balance – not very helpful. Similarly, activity-based costing (ABC) focuses on the activities driving costs, which can be too complex for many construction projects, especially smaller ones.

Job costing provides the granular detail necessary to understand project profitability in a way these other methods cannot.

Challenges of Implementing and Maintaining a Job Costing System

Implementing and maintaining an effective job costing system presents its own set of hurdles. Accurate data entry is crucial, requiring diligent record-keeping and potentially specialized software. Unexpected changes in project scope, material price fluctuations, and unforeseen labor issues can throw off even the most meticulously planned budgets. Moreover, allocating overhead costs across multiple projects can be complex, requiring sophisticated allocation methods.

Think of it as trying to divide a pizza amongst a hungry crew of construction workers – ensuring everyone gets a fair share (and accurately accounting for every slice) is no easy feat.

Evidence of LG Lint General Contracting’s Costing Methods

Uncovering the financial secrets of LG Lint General Contracting—a company whose name alone suggests a penchant for meticulous detail—requires a bit of detective work. While their internal costing methods remain, shall we say, “under wraps,” we can still explore potential avenues of investigation and hypothesize about their likely practices. After all, even the most elusive lint bunny eventually leaves a trail.Publicly available information regarding LG Lint General Contracting’s specific costing methods is, unfortunately, scarce.

Their website, if they have one, is unlikely to divulge the nitty-gritty details of their accounting practices. Press releases tend to focus on completed projects and company achievements, not the inner workings of their budgeting. Financial reports, if they are a publicly traded company, might offer some clues, but even then, the level of detail would likely be limited to high-level summaries, not the granular data we’re seeking.

Secrecy is often a key ingredient in a successful contracting business, protecting their competitive advantage.

Potential Information Sources

Locating concrete evidence of LG Lint General Contracting’s costing system presents a challenge. However, we can identify potential sources of information. These include: a thorough search of online business directories (which might list their size, suggesting the complexity of their accounting needs), checking for any mentions in industry publications or news articles (which might inadvertently reveal project details that hint at their costing methods), and exploring any public records related to permits or licenses (though this information would likely be limited and not directly reveal their costing practices).

Hypothetical Job Costing System for LG Lint General Contracting

Let’s imagine LG Lint General Contracting is working on a project—the construction of a charming, if slightly eccentric, birdhouse for a particularly demanding robin. A hypothetical job costing system for this project would break down costs as follows:

| Cost Category | Description | Estimated Cost |

|---|---|---|

| Direct Materials | Wood, nails, paint, glue, etc. | $25 |

| Direct Labor | Carpenter’s wages for construction | $100 |

| Overhead | Rent, utilities, insurance, administrative salaries allocated to the project | $50 |

The total cost for this robin’s luxury abode: $175. Note that the overhead costs are allocated based on a predetermined method (perhaps a percentage of direct labor costs), reflecting the complexities of overhead allocation in a real-world job costing scenario. More complex projects would naturally involve far more detailed breakdowns.

Implications of Not Using Job Costing

For a general contracting firm like LG Lint General Contracting, failing to use job costing could be disastrous. Without a detailed tracking of costs per project, they risk underbidding on contracts, leading to losses. Accurate job costing enables precise pricing, improved profitability, and better project management. It provides a clear picture of where money is spent, facilitating informed decision-making and preventing costly overruns.

Essentially, without job costing, LG Lint General Contracting would be building on a foundation of sand, rather than the solid wood preferred by discerning robins.

Financial Implications of Job Costing for LG Lint General Contracting

Job costing, while initially appearing like a bureaucratic beast, can actually be a financial superhero for LG Lint General Contracting, dramatically improving profitability and project management. Let’s delve into the financial implications, both the glorious triumphs and the occasional minor setbacks.

Benefits of Job Costing, Does lg lint general contracting use job costing

Implementing job costing offers LG Lint General Contracting several significant advantages. Accurate tracking of costs per project allows for precise pricing, reducing the risk of underbidding and subsequent losses. This granular level of detail also allows for better identification of profitable and unprofitable projects, enabling LG Lint General Contracting to strategically focus resources and refine bidding strategies. Furthermore, improved cost control fosters efficient resource allocation and minimizes wasteful spending, directly boosting the bottom line.

Real-time monitoring of project expenses empowers proactive management, allowing for timely adjustments to prevent cost overruns and maintain project profitability.

Drawbacks of Job Costing

While the benefits are compelling, job costing isn’t without its challenges. The increased administrative burden associated with meticulously tracking every expense can be significant, requiring dedicated personnel and potentially specialized software. The complexity of the system can also lead to initial implementation costs and potential for errors if not managed properly. Thorough training for all personnel involved is crucial to ensure accurate data entry and reporting, minimizing the risk of misinterpretations that could negatively impact financial analysis.

The time investment required for data collection and analysis might initially seem daunting, but the long-term financial rewards outweigh the short-term effort.

Comparison of Job Costing with Alternative Methods

Compared to simpler costing methods, such as global costing (where overhead is allocated broadly across all projects), job costing offers a much clearer picture of project profitability. Global costing can mask inefficiencies and lead to inaccurate pricing, potentially resulting in projects that are unknowingly unprofitable. While simpler methods require less administrative overhead, they lack the precision and insight provided by job costing.

The increased accuracy in cost allocation and project profitability assessment provided by job costing allows LG Lint General Contracting to make more informed business decisions, ultimately leading to greater long-term financial success. In essence, the upfront investment in job costing pays dividends in the form of improved profitability and enhanced financial control.

Hypothetical Scenario: Impact of Accurate Job Costing

Let’s imagine LG Lint General Contracting undertakes a “Squirrel-Proofing Suburban Sanctuary” project. Accurate job costing reveals a significant discrepancy between budgeted and actual costs.

| Cost Category | Budget | Actual Cost | Variance |

|---|---|---|---|

| Materials | $10,000 | $12,000 | -$2,000 |

| Labor | $5,000 | $4,500 | +$500 |

| Equipment Rental | $2,000 | $2,200 | -$200 |

| Subcontractor Fees | $3,000 | $3,500 | -$500 |

| Overhead | $1,000 | $1,100 | -$100 |

| Total | $21,000 | $23,300 | -$2,300 |

Without accurate job costing, this $2,300 cost overrun might go unnoticed until the project’s completion, potentially impacting profitability and future bidding strategies. However, with job costing, LG Lint General Contracting can identify the cost overruns in materials and subcontractor fees during the project, allowing for corrective actions and preventing similar issues on future projects. This proactive approach ensures better project management and ultimately safeguards profitability.

Alternative Costing Methods: Does Lg Lint General Contracting Use Job Costing

So, LG Lint General Contracting has been wrestling with job costing. But is it theonly* way to wrangle those construction costs? Absolutely not! Like a toolbox overflowing with hammers, the construction industry boasts a variety of costing methods, each with its own quirks and strengths. Let’s explore some alternatives, shall we?While job costing meticulously tracks costs for each individual project, other methods offer a broader, sometimes simpler, approach.

These alternatives can be particularly useful for firms with repetitive projects or a need for quicker, less detailed financial reporting.

Comparison of Costing Methods

Job costing, as we’ve discussed, assigns costs directly to specific projects. This provides granular detail but can be resource-intensive. Contrast this with process costing, which is ideal for mass-producing identical units. Imagine a prefabricated housing company churning out identical units – process costing would be perfect for them, tracking costs per unit rather than per individual house.

Then there’s activity-based costing (ABC), a more sophisticated approach that assigns costs based on the activities involved in a project. This is particularly helpful for projects with many diverse activities and indirect costs. Finally, we have absorption costing, which allocates both direct and indirect costs to products or projects. This method is commonly used in industries where overhead costs are significant, but it can obscure the true profitability of individual projects.

Advantages and Disadvantages of Alternative Methods

Let’s look at a table comparing the advantages and disadvantages of these methods relative to job costing:

| Costing Method | Advantages | Disadvantages |

|---|---|---|

| Process Costing | Simple, efficient for mass production, easy to track costs per unit. | Not suitable for unique projects, ignores individual project variations. |

| Activity-Based Costing (ABC) | Accurate cost allocation, identifies cost drivers, improves profitability analysis. | Complex, time-consuming, requires detailed data collection. |

| Absorption Costing | Simple to implement, includes all costs, provides a comprehensive cost picture. | Can distort project profitability, less accurate for individual project analysis. |

Impact on Project Management and Financial Reporting

The choice of costing method significantly impacts both project management and financial reporting. Job costing provides the detailed information needed for effective project control and allows for precise pricing and profitability analysis on a per-project basis. However, alternative methods, while potentially less detailed, can streamline financial reporting and simplify budgeting processes. For example, a company using process costing might find it easier to forecast costs for future projects based on historical unit costs.

Using ABC costing can help pinpoint areas where efficiency improvements are needed, directly benefiting project management.

Factors Influencing Costing Method Selection

The decision of which costing method to use isn’t a casual one. It requires careful consideration of several factors.

Here’s a list of key considerations:

- Type of projects undertaken: Unique, custom projects generally necessitate job costing, while repetitive projects are better suited to process costing.

- Company size and resources: Smaller firms with limited resources might opt for simpler methods like absorption costing, while larger firms with dedicated accounting staff might be able to handle the complexity of ABC costing.

- Industry standards and regulations: Certain industries may have specific requirements or preferences for particular costing methods.

- Level of detail required for management decisions: The need for detailed cost information for project management and pricing decisions influences the choice of method.

- Cost of implementation and maintenance: More complex methods like ABC costing require more investment in systems and personnel.

Ultimately, determining whether LG Lint General Contracting uses job costing requires access to their internal financial data, which is generally not publicly available. However, by examining industry best practices and the potential benefits and drawbacks of job costing, we can infer the likely impact of their costing methods on their operational efficiency and financial success. While the specifics remain elusive without direct access to company records, this analysis highlights the crucial role of accurate costing in the general contracting business and the importance of selecting a method that aligns with the company’s size, project complexity, and overall goals.

Essential FAQs

What are the potential benefits of job costing for a general contractor?

Improved project profitability through better cost control, enhanced project management by tracking individual project expenses, and more accurate financial reporting for decision-making.

What are the drawbacks of job costing?

Increased administrative burden due to detailed tracking, higher initial setup costs for implementing the system, and potential complexities in allocating indirect costs.

What alternative costing methods exist in construction?

Process costing, activity-based costing, and absorption costing are some alternatives, each with its own strengths and weaknesses depending on the company’s structure and project types.

How can a company determine the best costing method for its needs?

Consider factors like project complexity, company size, industry standards, and the desired level of cost detail when choosing a costing method. Consulting with accounting professionals is advisable.