Is social security number needed for background check sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. Background checks are a common practice in various contexts, from employment and tenant screening to loan applications. They are designed to provide information about an individual’s past, helping organizations make informed decisions.

But what role does your Social Security number play in this process? This exploration delves into the complex relationship between background checks and personal information, focusing on the significance of Social Security numbers and the potential risks and vulnerabilities associated with their use.

While Social Security numbers are often considered a vital part of identity verification, the use of this sensitive information raises concerns about privacy and security. This discussion explores the legal and ethical considerations surrounding the collection and use of personal information during background checks, including the potential for identity theft and data breaches. We’ll also examine alternative identification methods that can be used in place of Social Security numbers, along with industry best practices for organizations conducting background checks.

Background Checks and the Need for Personal Information

Background checks are a common practice in various aspects of modern life, serving as a tool to assess an individual’s suitability for certain opportunities. They are often conducted to verify information provided by applicants and to mitigate potential risks associated with granting access to sensitive resources. The purpose of a background check is to provide a comprehensive overview of an individual’s past, helping decision-makers make informed choices based on the information gathered.Background checks are used in a variety of contexts, including:

Employment Background Checks

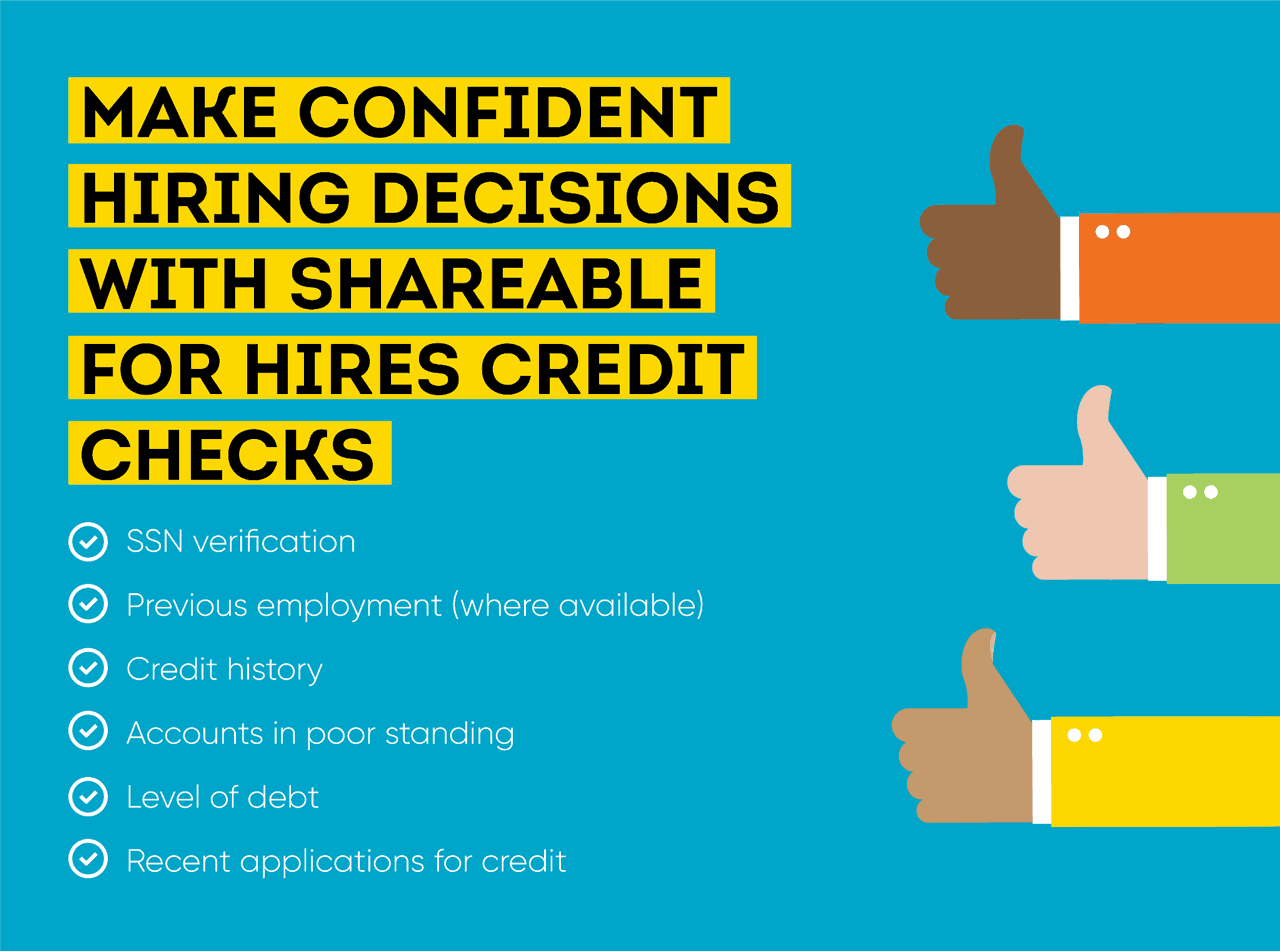

Employment background checks are routinely conducted by employers to verify the information provided by job candidates. They are typically used to confirm employment history, educational qualifications, and to identify any criminal records that might pose a risk to the workplace. Employers may also conduct background checks to assess an individual’s credit history, driving record, and other relevant information depending on the nature of the position.

Tenant Screening Background Checks, Is social security number needed for background check

Landlords and property managers often conduct background checks on prospective tenants to evaluate their suitability for rental properties. These checks typically involve verifying the applicant’s identity, rental history, and credit history. They may also include criminal background checks to assess the potential risk of damage to property or harm to other tenants.

Loan Applications Background Checks

Financial institutions conduct background checks on loan applicants to assess their creditworthiness and ability to repay borrowed funds. These checks typically involve verifying the applicant’s identity, employment history, income, and credit history. They may also include criminal background checks to assess the potential risk of defaulting on the loan.

Information Typically Included in a Background Check

The information collected during a background check varies depending on the specific purpose and context. However, common elements include:

Criminal Records

Criminal records are often included in background checks to assess an individual’s history of criminal activity. These records may include information about arrests, convictions, and pending charges. The specific details included in criminal records vary by jurisdiction and may include the date of the offense, the nature of the crime, and the disposition of the case.

Credit History

Credit history is often included in background checks, particularly for loan applications and tenant screening. Credit history provides insights into an individual’s financial responsibility and their ability to manage debt. This information may include details about credit accounts, credit limits, payment history, and credit scores.

Employment Verification

Employment verification is typically included in background checks to confirm an individual’s work history. This process involves contacting previous employers to verify dates of employment, job titles, and salary information. Employment verification can help assess an individual’s work experience and identify any inconsistencies in their employment history.

Education Verification

Education verification involves confirming an individual’s educational qualifications. This process may include contacting educational institutions to verify degrees, certificates, and other credentials. Education verification helps ensure that applicants possess the required qualifications for a particular position or opportunity.

Legal and Ethical Considerations

The collection and use of personal information during background checks raise significant legal and ethical considerations. These considerations center around issues of privacy, data security, and the potential for discrimination based on information obtained during background checks.

Privacy Concerns

Background checks often involve the collection and use of sensitive personal information, such as criminal records, credit history, and employment history. This raises concerns about the privacy rights of individuals who are subject to these checks. The collection and use of such information must be conducted in a manner that respects individual privacy and complies with relevant privacy laws and regulations.

Data Security

The information collected during background checks is often sensitive and must be protected from unauthorized access, use, or disclosure. Organizations that conduct background checks have a responsibility to implement appropriate data security measures to safeguard the information they collect. This includes measures to prevent data breaches, unauthorized access, and the misuse of personal information.

Discrimination

Background checks raise concerns about the potential for discrimination based on the information obtained. For example, an individual with a criminal record may be unfairly denied employment or housing opportunities. It is important to ensure that background checks are conducted in a fair and unbiased manner and that information is not used to discriminate against individuals based on protected characteristics.

The Role of Social Security Numbers in Background Checks

The Social Security number (SSN) is a unique identifier assigned to every individual in the United States. It serves as a crucial tool for identifying and verifying individuals in various contexts, including background checks. Background checks often require the use of SSNs to access and verify personal information, ensuring the accuracy and reliability of the information gathered.

Situations Where a Social Security Number May Be Required for a Background Check

SSNs play a vital role in background checks, particularly in situations where verifying an individual’s identity and background information is crucial. These situations include:

- Employment: Employers often require SSNs for background checks to verify an applicant’s employment history, criminal records, and creditworthiness. This helps ensure that potential employees are qualified and trustworthy.

- Credit Checks: When applying for loans, credit cards, or other financial products, lenders typically require SSNs to access and review an applicant’s credit history. This information helps lenders assess the applicant’s creditworthiness and determine the appropriate terms for the financial product.

- Government Benefits Applications: When applying for government benefits such as Social Security, Medicare, or unemployment insurance, individuals are required to provide their SSNs to verify their eligibility and prevent fraud.

Potential Risks and Vulnerabilities Associated with Sharing Social Security Numbers During Background Checks

Sharing your SSN during background checks, while necessary in many cases, carries inherent risks and vulnerabilities.

- Identity Theft: Sharing your SSN with unauthorized individuals or entities can increase your risk of identity theft. If your SSN falls into the wrong hands, it could be used to open credit accounts, access your financial information, or commit other fraudulent activities.

- Data Breaches: Organizations that conduct background checks may be susceptible to data breaches, putting your SSN and other sensitive information at risk.

If an organization’s database is compromised, your SSN could be exposed to unauthorized access.

- Misuse of Information: Even if your SSN is not stolen, it could be misused by organizations or individuals for purposes beyond the intended background check. This could include unauthorized access to your credit reports, medical records, or other personal information.

Alternative Identification Methods: Is Social Security Number Needed For Background Check

While Social Security numbers are a widely used identifier in background checks, various alternative identification methods can be employed, each with its own strengths and weaknesses. These methods can be particularly useful when a Social Security number is unavailable, unreliable, or raises privacy concerns.

Government-Issued IDs

Government-issued IDs, such as driver’s licenses, state-issued IDs, passports, and military IDs, are widely accepted forms of identification. These IDs often contain a unique identifier, date of birth, address, and sometimes other personal details.

- Effectiveness: Government-issued IDs provide a strong level of verification, especially when combined with other data points. The issuing authority usually has a database of issued IDs, allowing for verification of authenticity.

- Limitations: These IDs can be forged or stolen. The information on the ID may not always be up-to-date. Additionally, some individuals may not possess a valid government-issued ID, especially in certain situations.

Other Identification Methods

Beyond government-issued IDs, other identification methods can be used in specific circumstances.

- Utility Bills: Utility bills, such as water, electricity, or gas bills, often contain the individual’s name and address. These documents can be used to verify residency and confirm the individual’s identity, especially when combined with other information.

- Bank Statements: Bank statements, particularly those containing account numbers and transaction history, can be used to verify financial information and confirm identity.

- Credit Reports: Credit reports provide a comprehensive overview of an individual’s credit history, including their name, address, and employment information. This data can be used to verify identity and assess creditworthiness.

Comparison with Social Security Numbers

While alternative identification methods can be effective in verifying identity, they often lack the comprehensive nature of Social Security numbers.

- Scope: Social Security numbers are unique and assigned at birth, providing a lifelong identifier that can be used across various systems and databases. Alternative methods, on the other hand, often provide limited information and may not be as widely accepted.

- Data Verification: The Social Security Administration maintains a vast database of Social Security numbers, allowing for thorough verification. Alternative methods may not have such extensive databases or verification processes, increasing the risk of identity fraud.

- Privacy Concerns: While Social Security numbers raise privacy concerns, alternative methods may also present privacy risks. For example, utility bills or bank statements contain sensitive financial information.

Privacy and Security Considerations

The use of Social Security numbers (SSNs) in background checks raises significant concerns about the privacy and security of personal information. Sharing such sensitive data can expose individuals to various risks, making it crucial to understand and address these concerns effectively.

Data Security Measures for Protecting Sensitive Information

Protecting sensitive information collected during background checks is paramount. Organizations conducting these checks must implement robust data security measures to mitigate the risk of unauthorized access, use, disclosure, disruption, modification, or destruction of personal data.

- Encryption: Sensitive data, including SSNs, should be encrypted both during transmission and storage. Encryption transforms data into an unreadable format, making it incomprehensible to unauthorized individuals.

- Access Control: Implementing strict access control measures ensures that only authorized personnel can access sensitive information. This includes assigning unique user accounts with specific permissions based on their roles and responsibilities.

- Regular Security Audits: Conducting regular security audits helps identify and address vulnerabilities in systems and processes. These audits should involve independent security experts to ensure objectivity and thoroughness.

- Employee Training: Training employees on data security best practices is essential to minimize the risk of human error. Employees should be educated on the importance of protecting sensitive information, handling data responsibly, and recognizing potential security threats.

- Data Retention Policies: Organizations should establish clear data retention policies outlining how long sensitive information is stored and when it is destroyed. This helps minimize the risk of data breaches and ensures compliance with privacy regulations.

Best Practices for Organizations Conducting Background Checks

Organizations conducting background checks have a responsibility to minimize the risk of identity theft and data breaches. Implementing best practices ensures the ethical and secure handling of sensitive information.

- Data Minimization: Organizations should only collect and retain the minimum amount of personal information necessary to complete the background check. This principle helps reduce the potential impact of a data breach by limiting the amount of sensitive data at risk.

- Transparency and Consent: Individuals should be informed about the purpose of the background check, the types of information collected, and the data security measures in place. Obtaining explicit consent before collecting and using sensitive information is crucial.

- Data Integrity and Accuracy: Organizations should verify the accuracy of information obtained during background checks and ensure that any errors are corrected promptly. This helps prevent the dissemination of inaccurate or outdated information.

- Third-Party Vendor Due Diligence: When using third-party vendors for background checks, organizations should conduct thorough due diligence to ensure the vendor complies with relevant privacy and security regulations. This includes verifying the vendor’s data security practices, policies, and certifications.

- Incident Response Plan: Organizations should have a comprehensive incident response plan in place to handle data breaches effectively. This plan should Artikel procedures for identifying, containing, and mitigating the impact of a security incident, including notifying affected individuals and relevant authorities.

Legal and Regulatory Framework

The use of personal information, including Social Security numbers, in background checks is subject to a complex web of federal and state laws and regulations. These laws aim to protect individuals’ privacy while allowing organizations to conduct legitimate background checks. Understanding the legal framework is crucial for organizations to comply with regulations and avoid potential legal consequences.

Federal Laws and Regulations

Federal laws play a significant role in regulating the collection and use of personal information during background checks.

- Fair Credit Reporting Act (FCRA): This act governs the collection, use, and disclosure of consumer credit information. It requires organizations to obtain consent from individuals before accessing their credit reports for employment purposes. The FCRA also mandates that organizations provide individuals with access to their credit reports and the opportunity to dispute any inaccuracies.

- Privacy Act of 1974: This act protects the privacy of individuals’ personal information maintained by federal agencies. It limits the collection, use, and disclosure of Social Security numbers and other sensitive information. The Privacy Act also provides individuals with the right to access their records and correct any inaccuracies.

- Driver’s Privacy Protection Act (DPPA): This act restricts the disclosure of personal information from state driver’s license and motor vehicle records. It prohibits the use of this information for marketing purposes and limits its use for employment screening.

- Health Insurance Portability and Accountability Act (HIPAA): This act protects the privacy and security of protected health information (PHI). It applies to organizations that handle PHI, including healthcare providers and insurance companies. HIPAA requires organizations to obtain consent before using PHI for employment purposes.

State Laws and Regulations

In addition to federal laws, states have enacted their own regulations governing background checks.

- State Fair Credit Reporting Acts: Many states have their own Fair Credit Reporting Acts, which often provide more stringent protections for individuals than the federal FCRA. These state laws may limit the types of information that can be collected and used in background checks.

- State Privacy Laws: Several states have enacted comprehensive privacy laws that regulate the collection, use, and disclosure of personal information. These laws may impose specific requirements on organizations conducting background checks, such as obtaining consent before collecting personal information or providing individuals with the right to access their data.

- State Social Security Number Protection Laws: Some states have specific laws that protect the use of Social Security numbers. These laws may prohibit organizations from requiring individuals to provide their Social Security numbers unless it is absolutely necessary.

Legal Consequences of Violations

Organizations that violate federal or state laws governing background checks can face significant legal consequences.

- Civil lawsuits: Individuals whose privacy rights have been violated may file civil lawsuits against organizations. These lawsuits can result in substantial damages, including monetary compensation for emotional distress and harm to reputation.

- Government enforcement actions: Federal and state agencies have the authority to investigate and enforce violations of background check laws. These agencies may impose fines, penalties, and other sanctions on organizations that violate the law.

- Criminal charges: In some cases, violations of background check laws may result in criminal charges. For example, organizations that illegally access or disclose sensitive personal information may face criminal prosecution.

Industry Best Practices

Organizations conducting background checks should prioritize responsible data handling and privacy protection. Implementing best practices helps ensure ethical and compliant practices while minimizing risks.

Minimizing Social Security Number Use and Utilizing Alternative Identification Methods

Employing alternative identification methods can significantly reduce the reliance on Social Security numbers. This approach enhances privacy and security while maintaining the integrity of background checks.

- Driver’s License Number: A widely accepted form of identification, often containing a unique identifier and address information.

- Date of Birth and Address: Combining these elements can effectively verify an individual’s identity, especially when used in conjunction with other information.

- Government-Issued Identification Cards: Utilizing state-issued identification cards or passports provides a reliable method for confirming identity.

- Unique Usernames or Account Numbers: When applicable, using usernames or account numbers associated with specific services or platforms can serve as alternative identifiers.

Obtaining Informed Consent

Transparency and consent are crucial for ethical data collection. Obtaining informed consent from individuals before collecting their personal information is a fundamental principle of privacy protection.

- Clear and Concise Disclosure: Organizations should provide individuals with a clear and concise explanation of the purpose, scope, and potential uses of their personal information.

- Specific Consent: Individuals should explicitly consent to the collection and use of their personal information for specific background check purposes.

- Opt-Out Options: Individuals should be provided with clear opt-out options regarding the collection or use of their information.

Industry-Specific Guidelines and Standards

Various industries have established specific guidelines and standards for background checks, ensuring compliance and responsible practices.

- FCRA (Fair Credit Reporting Act): This federal law governs the use of consumer reports, including background checks, requiring adherence to specific procedures and disclosures.

- HIPAA (Health Insurance Portability and Accountability Act): For healthcare organizations, HIPAA regulations dictate strict guidelines for handling sensitive health information during background checks.

- Financial Industry Regulatory Authority (FINRA): The financial industry has specific guidelines for background checks, focusing on suitability and regulatory compliance.

In conclusion, the use of Social Security numbers in background checks is a complex issue with significant implications for privacy and security. While these numbers are often necessary for identity verification, organizations have a responsibility to minimize their use and implement strong data security measures to protect sensitive information. By understanding the legal and ethical considerations surrounding this practice, individuals can be more informed about their rights and take steps to protect their personal information.

As technology evolves, it is crucial to stay informed about best practices and alternative identification methods that can help strike a balance between security and privacy.

Key Questions Answered

What is the purpose of a background check?

Background checks are conducted to verify information about an individual’s past, such as their criminal history, credit history, and employment history. This information helps organizations make informed decisions about hiring, renting, or lending.

Are background checks legal?

Yes, background checks are legal in most cases. However, there are specific laws and regulations that govern the collection and use of personal information during background checks, which organizations must comply with.

What are some alternative identification methods that can be used in background checks?

Some alternative identification methods include driver’s license numbers, passport numbers, and government-issued IDs. These methods can be effective in verifying identity, but they may not be as comprehensive as using a Social Security number.

What can I do to protect my Social Security number during a background check?

You can protect your Social Security number by only providing it to reputable organizations and verifying their identity before sharing your information. You can also consider using a credit freeze to prevent unauthorized access to your credit reports.