What is a secured bond in NC? This type of bond offers investors a level of security not found in unsecured bonds. Think of it as a loan where the borrower puts up something valuable as collateral, providing peace of mind for the lender. This collateral, which can be anything from real estate to equipment, acts as a safety net, ensuring that the investor can recover their investment even if the borrower defaults.

Secured bonds in North Carolina are governed by a specific legal framework, offering investors a clear understanding of their rights and responsibilities. From the types of collateral used to the procedures for enforcement, this guide will explore the ins and outs of secured bonds in NC, shedding light on their benefits and risks.

Secured Bonds in North Carolina

In the realm of financial instruments, bonds hold a prominent position, offering investors a means to lend money to borrowers in exchange for fixed interest payments. In North Carolina, like in many other states, bonds can be classified as secured or unsecured, with significant implications for investors. Understanding the nuances of secured bonds in North Carolina is crucial for navigating the complex world of investments.

Definition of Secured Bonds

Secured bonds, as the name suggests, are backed by specific assets that serve as collateral. This means that if the borrower defaults on their obligations, the bondholders have the right to claim those assets to recover their investment. This collateralization provides an additional layer of security for investors, reducing the risk of losing their principal.

Key Characteristics of Secured Bonds

Secured bonds are distinguished from unsecured bonds by several key characteristics:

- Collateral: The presence of specific assets pledged as collateral is the defining feature of secured bonds. This collateral can take various forms, including real estate, equipment, or even intellectual property.

- Lower Risk: Due to the collateral backing, secured bonds generally carry a lower risk of default compared to unsecured bonds. This lower risk is reflected in their lower interest rates.

- Priority in Repayment: In the event of a borrower’s bankruptcy, secured bondholders have priority over unsecured bondholders in claiming assets for repayment.

Examples of Secured Bonds in North Carolina

Various types of secured bonds are prevalent in North Carolina, each with its own specific collateral:

- Mortgage-Backed Bonds: These bonds are secured by residential or commercial mortgages. In the event of default, the bondholders have the right to foreclose on the property.

- Asset-Backed Bonds: These bonds are backed by a pool of assets, such as auto loans, credit card receivables, or equipment leases. If the borrower defaults, the bondholders can claim the underlying assets.

- Municipal Bonds: While not all municipal bonds are secured, some are backed by specific assets, such as revenue from toll roads or water utilities. These bonds provide investors with a measure of security through the underlying revenue streams.

Collateral in Secured Bonds

Collateral plays a crucial role in securing bonds, offering an extra layer of protection for investors. It acts as a safety net, ensuring that bondholders have a tangible asset to claim in case the issuer defaults on their obligations.

Types of Collateral for Bonds in NC

The types of assets that can serve as collateral for bonds in North Carolina are diverse, reflecting the various sectors of the state’s economy. These assets provide a tangible backing for the bond issuance, offering investors a degree of security.

- Real Estate: This is a common type of collateral, particularly for bonds issued by developers or companies with significant real estate holdings. The value of the property is directly tied to the bond’s security.

- Equipment: Companies may use equipment, such as machinery or vehicles, as collateral for bonds. The value of the equipment is assessed to determine its worth as a security for investors.

- Inventory: Companies with large inventories of goods can use these as collateral for bonds. The value of the inventory is evaluated to determine its potential to cover the bond’s principal and interest.

- Accounts Receivable: Companies with a strong track record of collecting payments from customers can use their accounts receivable as collateral. This demonstrates their ability to generate revenue and repay the bond.

- Cash and Cash Equivalents: In some cases, companies may use cash or highly liquid assets as collateral for bonds. This provides a direct and readily accessible source of funds for investors in the event of a default.

Value of Collateral and Risk-Return Relationship

The value of collateral directly influences the risk and return of a secured bond.

Higher-value collateral generally translates to lower risk and potentially lower returns for investors.

For instance, a bond secured by a valuable piece of real estate might offer a lower interest rate than a bond secured by less valuable equipment. This is because investors perceive the real estate-backed bond as less risky, as they have a greater assurance of recovering their investment.

Conversely, bonds secured by lower-value collateral may offer higher interest rates to compensate investors for the increased risk.

Investors should carefully evaluate the value of collateral and the issuer’s financial health to determine the overall risk and potential return of a secured bond.

Legal Framework for Secured Bonds in NC

The legal framework for secured bonds in North Carolina is governed by a combination of state statutes, regulations, and case law. These laws provide the foundation for the creation, enforcement, and termination of secured bonds, ensuring transparency and protection for both bondholders and issuers.

Issuance and Registration

The North Carolina Secretary of State plays a crucial role in the issuance and registration of secured bonds. The Secretary of State is responsible for ensuring that bonds meet the requirements of the North Carolina Securities Act, which aims to protect investors from fraud and misrepresentation. This includes reviewing bond offerings for completeness, accuracy, and compliance with relevant disclosure requirements.

- The Secretary of State must ensure that the bond offering document, also known as the prospectus, contains all material information about the bond, including its terms, conditions, and risks.

- The Secretary of State also reviews the bond indenture, which is the legal agreement between the issuer and the bondholders. This document Artikels the rights and obligations of both parties, including the collateral securing the bond.

- Once the Secretary of State approves the bond offering, the issuer can proceed with the issuance and registration of the bonds. This involves filing the necessary paperwork with the Secretary of State and distributing the bonds to investors.

Enforcement

In case of default on a secured bond, bondholders have recourse to the collateral securing the bond. This process is Artikeld in the bond indenture and is governed by the North Carolina Uniform Commercial Code.

- The bond indenture specifies the steps that bondholders must take to enforce their rights, including providing notice of default to the issuer and initiating legal proceedings to recover their investment.

- Bondholders may have the right to foreclose on the collateral securing the bond, which may include real estate, equipment, or other assets.

- The North Carolina courts have jurisdiction to hear cases involving secured bonds and to enforce the terms of the bond indenture.

Termination

Secured bonds typically have a maturity date, after which the bondholder is entitled to receive the principal amount of the bond. However, bonds may be terminated early under certain circumstances, such as a merger or acquisition of the issuer.

- The bond indenture specifies the conditions under which the bond may be terminated early and the process for doing so.

- In the event of early termination, the bondholder may be entitled to receive a premium payment or other compensation.

- The Secretary of State must be notified of any early termination of a secured bond, and the issuer must file the necessary paperwork with the Secretary of State.

Benefits and Risks of Secured Bonds

Secured bonds offer investors a potentially higher return than unsecured bonds due to the added layer of protection provided by the collateral. However, it’s crucial to understand the potential risks associated with these investments before making any decisions.

Advantages of Secured Bonds, What is a secured bond in nc

Secured bonds offer several advantages over unsecured bonds, making them attractive to investors seeking a balance between risk and reward.

- Lower Risk: The presence of collateral provides a safety net for investors, reducing the risk of losing their investment if the issuer defaults. In the event of default, investors can claim the collateral to recover their investment, making secured bonds a less risky option than unsecured bonds.

- Higher Potential Returns: Due to the lower risk profile, secured bonds often offer higher interest rates compared to unsecured bonds. This is because investors are willing to accept a lower return for a higher level of security.

- Greater Transparency: The collateral backing a secured bond is publicly disclosed, providing investors with greater transparency into the issuer’s financial health and the value of their investment. This transparency can help investors make informed decisions.

Disadvantages of Secured Bonds

While secured bonds offer several benefits, they also come with potential disadvantages that investors should consider.

- Collateral Devaluation: The value of the collateral backing a secured bond can fluctuate, potentially decreasing the value of the investment. For example, if a bond is secured by real estate, a decline in property values could reduce the amount investors can recover in the event of default.

- Legal Disputes: Legal disputes can arise over the ownership or value of the collateral, potentially delaying or preventing investors from recovering their investment. These disputes can be costly and time-consuming, adding complexity to the investment process.

- Limited Investment Opportunities: The availability of secured bonds can be limited compared to unsecured bonds, as not all issuers are willing or able to offer collateral. This limited availability can restrict investment options and potentially lead to lower returns.

Importance of Due Diligence

Thorough due diligence is essential before investing in secured bonds. Investors should carefully assess the following factors:

- Issuer’s Financial Health: Analyze the issuer’s financial statements and track record to ensure they have the ability to repay the debt. A strong financial position reduces the risk of default.

- Collateral Value: Evaluate the value of the collateral backing the bond. Consider factors such as market conditions, potential for devaluation, and ease of liquidation.

- Legal Framework: Understand the legal framework governing the secured bond and the process for recovering the collateral in the event of default. This includes reviewing the bond indenture and related documentation.

Real-World Examples of Secured Bonds in NC: What Is A Secured Bond In Nc

Understanding the concept of secured bonds is crucial, but it’s even more helpful to see how they function in practice. North Carolina offers a diverse landscape of secured bonds, issued by both private companies and government entities. These bonds are backed by specific assets, providing investors with a higher level of security compared to unsecured bonds. Let’s explore some real-world examples to gain a deeper understanding.

Examples of Secured Bonds in North Carolina

To illustrate the application of secured bonds in North Carolina, we’ll examine a few examples:

| Bond Issuer | Type of Bond | Collateral | Key Terms |

|---|---|---|---|

| Duke Energy Corporation | Corporate Bond | Power Plants and Transmission Lines | Maturity: 20 years, Interest Rate: 4.5% |

| North Carolina Department of Transportation | Municipal Bond | Toll Roads and Bridges | Maturity: 30 years, Interest Rate: 3.25% |

| Bank of America | Asset-Backed Security (ABS) | Mortgages | Maturity: 10 years, Interest Rate: 2.75% |

These examples showcase the variety of assets that can serve as collateral for secured bonds in North Carolina. Duke Energy Corporation, a major utility company, utilizes its power plants and transmission lines as collateral for its bonds, offering investors a degree of security based on the value of these essential infrastructure assets. Similarly, the North Carolina Department of Transportation secures its bonds with toll roads and bridges, leveraging the revenue generated by these assets to ensure repayment.

Bank of America’s asset-backed securities are backed by mortgages, demonstrating how secured bonds can be used to securitize various types of assets.

Understanding secured bonds in North Carolina is crucial for investors seeking a balanced approach to risk and reward. By carefully evaluating the collateral, the issuer’s financial health, and the legal framework surrounding the bond, investors can make informed decisions that align with their financial goals. Whether you’re considering investing in a secured bond or simply want to expand your financial knowledge, this guide provides a solid foundation for navigating the world of secured bonds in NC.

Question Bank

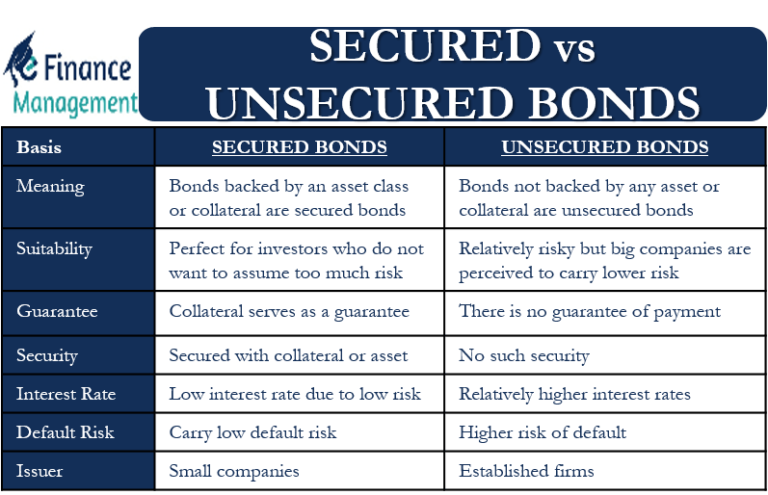

How do secured bonds differ from unsecured bonds in NC?

Secured bonds are backed by specific assets, offering investors a higher level of security in case of default. Unsecured bonds, on the other hand, rely solely on the issuer’s creditworthiness.

What are some examples of common types of secured bonds in NC?

Common examples include mortgage-backed bonds, asset-backed bonds, and bonds secured by specific equipment or inventory.

How do I determine the value of collateral in a secured bond?

It’s essential to have a qualified professional assess the value of the collateral to ensure it accurately reflects its market worth.