How do cost plus contracts work – How do cost-plus contracts work? Understanding this seemingly simple question unlocks a complex world of contract negotiation, risk allocation, and project management. These contracts, unlike their fixed-price counterparts, involve reimbursing the contractor for all allowable project costs, plus an agreed-upon fee. This approach offers flexibility but demands meticulous cost tracking and clear communication between parties. Navigating the intricacies of cost-plus contracts requires a firm grasp of various fee structures, risk mitigation strategies, and administrative procedures, all of which we will explore in detail.

This article will delve into the different types of cost-plus contracts—cost-plus-fixed-fee, cost-plus-incentive-fee, and cost-plus-percentage-of-cost—comparing their features and suitability for various projects. We’ll dissect the components of allowable costs, the intricacies of fee negotiation, and the crucial aspects of risk allocation. Finally, we’ll examine the advantages and disadvantages of using cost-plus contracts, providing a comprehensive guide for anyone considering this contracting method.

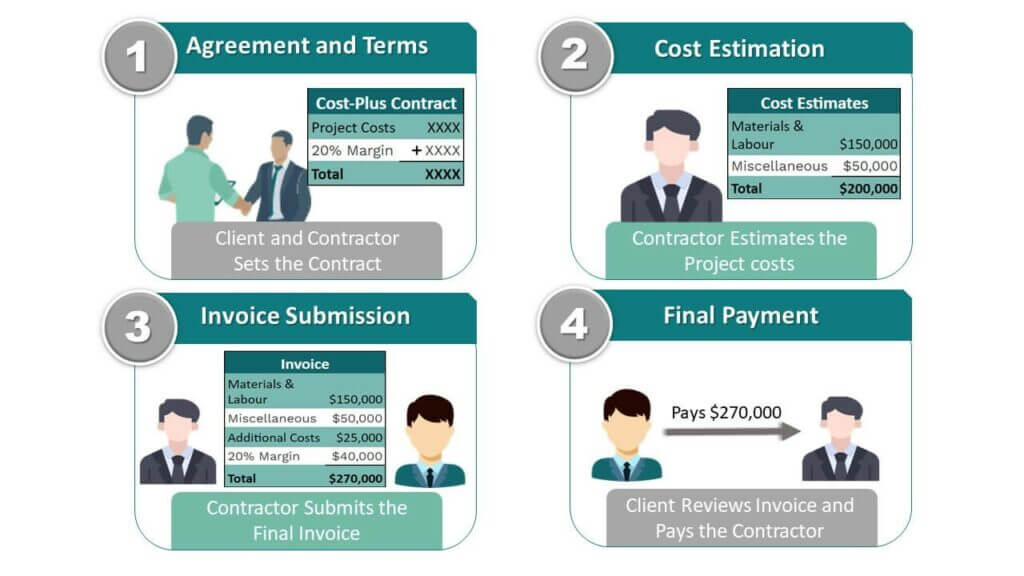

Defining Cost-Plus Contracts

Yo, peeps! Let’s break down cost-plus contracts, a super common way businesses handle projects, especially when the scope’s a bit hazy at the start. Think of it like ordering a custom-made batik shirt – the tailor needs to know the fabric cost, the time it takes to sew, and then adds their profit on top. That’s basically what a cost-plus contract is all about.Cost-plus contracts are all about transparency.

The contractor (the tailor, in our example) keeps track of every single rupiah spent on the project. Then, they add a predetermined fee or percentage on top of those costs. This means the final price isn’t fixed upfront, unlike some other contract types. It’s flexible, but also has its own set of risks.

Cost-Plus Contract Types

There are a few different flavors of cost-plus contracts, each with its own spice level of risk and reward. Choosing the right type depends heavily on the project and the trust level between the client (the person ordering the batik) and the contractor (the tailor).

Cost-Plus-Fixed-Fee (CPFF) Contracts

In a CPFF contract, the contractor gets reimbursed for all allowable costs plus a pre-agreed fixed fee. This fixed fee is their profit, no matter how much the project actually costs. It’s like getting a fixed commission on sales – you get paid a set amount, regardless of how many sales you make. The risk is mostly on the contractor; if costs balloon, their profit margin shrinks.

However, they are incentivized to keep costs in check, as they only profit from the fixed fee.

Cost-Plus-Incentive-Fee (CPIF) Contracts

This one’s a bit more sophisticated. The contractor still gets reimbursed for allowable costs, but the fixed fee is now tied to performance goals. Hit the targets, get a bigger bonus! Miss them, and the bonus gets smaller or even disappears. Think of it like a performance-based bonus system. This type of contract encourages the contractor to be super efficient and deliver quality work.

It shares the risk and reward between the client and contractor.

Cost-Plus-Percentage-of-Cost (CPPC) Contracts

This is the simplest, but often the least used, because it’s the riskiest for the client. The contractor gets reimbursed for all allowable costs plus a percentage of those costs as profit. This means the more the project costs, the bigger their profit! This can create an incentive for the contractor to inflate costs, which is why this type is generally avoided.

Comparison of Cost-Plus Contract Types

Here’s a table summarizing the key differences:

| Contract Type | Contractor’s Fee | Risk Allocation | Incentive for Efficiency |

|---|---|---|---|

| Cost-Plus-Fixed-Fee (CPFF) | Fixed fee regardless of costs | Mostly on contractor | Moderate |

| Cost-Plus-Incentive-Fee (CPIF) | Fixed fee + performance-based bonus | Shared between client and contractor | High |

| Cost-Plus-Percentage-of-Cost (CPPC) | Percentage of total costs | Mostly on client | Low (potential for cost inflation) |

Cost-Plus vs. Fixed-Price Contracts

The main difference between cost-plus and fixed-price contracts is the level of price certainty. In a fixed-price contract, the price is set upfront. It’s like buying a pre-made batik shirt – you know exactly how much it’ll cost. This is great for clients who want budget predictability. However, it puts more risk on the contractor, who has to accurately estimate costs and manage risks.

Cost-plus contracts, on the other hand, offer more flexibility but less price certainty. They’re better suited for complex projects where the scope isn’t fully defined at the beginning.

Cost Elements Included

Yo, so you’re tryna understand what actually gets chucked into the cost of a cost-plus contract, right? Think of it like this: it’s not just the price of the materials, it’s everything that goes into making the project happen. We’re talking about all the expenses, from the smallest detail to the biggest chunk. Let’s break it down.

Basically, a cost-plus contract covers pretty much every legit expense the contractor incurs while working on your project. The client agrees to pay all these allowable costs, plus a pre-agreed profit margin for the contractor. It’s a pretty straightforward system, but there are some nuances you need to know.

Allowable Cost Categories

There are a bunch of categories, and what’s included in each can vary a bit depending on the contract’s specific terms. But generally, these are the main players.

- Direct Materials: This is the stuff that directly goes into your project. Think of building a skate ramp: the wood, the screws, the paint – all direct materials. No debate here, it’s all super clear.

- Direct Labor: This is the cost of the peeps actually doing the work. For the skate ramp, this would be the wages of the carpenters, the painters, and anyone else directly involved in the construction. Again, pretty straightforward.

- Direct Expenses: These are the costs specifically related to the project that aren’t materials or labor. For our ramp, maybe it’s the cost of permits or specialized tools rented just for the job. It’s directly tied to getting the project done.

Indirect Costs and Allocation

Now, things get a little more complicated. Indirect costs aren’t directly tied to one specific project, but they’re still necessary to keep the whole operation running. These are often shared across multiple projects.

Think of it like this: your contractor has an office, they need admin staff, and they need to pay for utilities and insurance. These costs need to be factored in, but it’s not as simple as just dividing the total office rent by the number of projects. There are various methods to allocate indirect costs, and the contract will usually specify the method to be used.

Common methods include allocation based on direct labor hours or direct costs.

Sample Cost Breakdown: Building a Custom Skateboard

Let’s say we’re building a custom skateboard. Here’s a possible cost breakdown:

- Direct Materials:

- Deck: Rp 300,000

- Trucks: Rp 200,000

- Wheels: Rp 100,000

- Bearings: Rp 50,000

- Griptape: Rp 20,000

- Direct Labor: Rp 150,000 (assembly and customization)

- Direct Expenses: Rp 30,000 (special tools rental)

- Indirect Costs (allocated): Rp 50,000 (portion of shop rent, utilities, etc.)

Total Cost: Rp 800,000

Remember, this is just a simple example. Real-world projects will have far more detailed breakdowns. The key takeaway is that cost-plus contracts are all about transparency – everything is accounted for.

Fee Structure and Negotiation

Yo, so we’re diving into the nitty-gritty of how much extra cash the contractor gets on top of their costs in a cost-plus contract. Think of it like this: you’re paying for their expenses, but they also get a bonus for their hard work and expertise. It’s all about finding that sweet spot where everyone’s happy.

The fee structure in a cost-plus contract isn’t just pulled out of thin air. It’s carefully negotiated between the client (that’s you) and the contractor. The size of the fee depends heavily on the type of contract, the complexity of the project, and the level of risk involved. Basically, higher risk means a bigger potential payday for the contractor, and vice-versa.

Let’s break down some common fee structures.

Cost-Plus-Percentage-of-Cost

This is a pretty straightforward setup. The contractor gets reimbursed for all allowable costs, plus a percentage of those costs as their fee. For example, if the total allowable costs are 100 million Rupiah and the agreed-upon percentage is 10%, the contractor’s fee would be 10 million Rupiah. Simple, right? However, this type of contract can incentivize contractors to inflate costs since their fee directly increases with higher expenses.

It’s like giving someone a bonus based on how much they spend—not ideal.

Cost-Plus-Fixed-Fee

This is often seen as a more balanced approach. The contractor receives reimbursement for all allowable costs, plus a pre-negotiated fixed fee. This fee remains constant regardless of how much the project costs. Say the fixed fee is 20 million Rupiah. No matter what the project costs, the contractor receives that 20 million Rupiah on top of their allowable costs.

This reduces the incentive for cost inflation compared to the percentage-of-cost method, because their fee isn’t directly tied to how much they spend. It’s more predictable for both parties involved.

Cost-Plus-Incentive-Fee

This is where things get a little more interesting. The contractor gets a base fee, plus an additional incentive fee if they meet or exceed certain performance targets. Think of it as a performance bonus. For instance, the contract might stipulate a bonus if the project is completed ahead of schedule or under budget. This approach motivates the contractor to be efficient and deliver high-quality work.

It’s a win-win, really.

Factors Influencing Fee Negotiation

Negotiating the fee isn’t just about throwing numbers around. Several factors play a crucial role. The contractor’s experience and reputation are key. A seasoned pro with a proven track record will likely command a higher fee than a newbie. The complexity of the project is another biggie.

A complex project with lots of moving parts will require more expertise and effort, justifying a higher fee. The level of risk involved also matters significantly. High-risk projects often require higher fees to compensate for the potential for unforeseen challenges and costs.

Examples of Fee Structures and Risk Allocation

Let’s say you’re building a new mall. A cost-plus-percentage-of-cost contract might be risky because the contractor could potentially inflate costs to increase their fee. A cost-plus-fixed-fee contract would offer more certainty and better control over the overall cost. If you’re building something really complex, like a high-tech factory, a cost-plus-incentive-fee contract could be a good option. This would motivate the contractor to deliver a high-quality project efficiently, as their bonus depends on meeting certain performance goals.

Best Practices for Negotiating a Fair and Reasonable Fee

Before you even start talking numbers, make sure you have a crystal-clear understanding of the project scope and requirements. Get everything in writing! Thoroughly research the contractor’s experience and track record. Don’t be afraid to shop around and compare bids from different contractors. This will give you a better sense of what’s a fair and reasonable fee.

Finally, remember to clearly define all allowable costs and any performance targets, so there’s no ambiguity later on.

Risk and Responsibility Allocation

Yo, so we’ve talked about the basics of cost-plus contracts – how they work, what gets included in the cost, and how the fee gets decided. Now, let’s get real about the risks involved. It’s not all sunshine and rainbows, especially when you’re dealing with potentially huge projects.Cost-plus contracts, like any business deal, come with a bunch of potential problems for both the buyer (the client, you know, the boss) and the seller (the contractor, the one doing the work).

Understanding and managing these risks is key to a successful project. Think of it like this: if you’re building a sick custom motorbike, you and the mechanic both need to be clear on who’s responsible for what, and what happens if things go sideways.

Buyer’s Risks in Cost-Plus Contracts

The biggest risk for the buyer is cost overruns. Since the seller gets reimbursed for all allowable costs plus a fee, there’s less incentive for them to keep costs down. Imagine ordering a custom-built PC, and the builder keeps adding expensive parts without checking with you first – that’s a nightmare. Another risk is a lack of control over the project’s scope and timeline.

The seller might take longer than expected or add features without your explicit approval, inflating the final cost. Finally, there’s the risk of poor performance or quality if the seller isn’t motivated to deliver exceptional results beyond just covering their costs. They might just meet the minimum requirements to get paid.

Seller’s Risks in Cost-Plus Contracts

For the seller, the main risk is that their actual costs could exceed their projections. Unexpected problems, material price increases, or changes in regulations could eat into their profit margins. Imagine if the price of a crucial component for your motorbike suddenly doubles – that’s a huge hit to your profit. There’s also the risk that the buyer might dispute some of the claimed costs, leading to delays in payment or even legal battles.

Lastly, there’s the risk that the project might be canceled before completion, leaving the seller with losses on already incurred costs.

Risk Allocation in Different Cost-Plus Contract Types

Different types of cost-plus contracts allocate risk differently. A cost-plus-fixed-fee (CPFF) contract puts more risk on the seller regarding cost control, while a cost-plus-incentive-fee (CPIF) contract shares the risk and reward between the buyer and seller based on performance. A cost-plus-percentage-of-cost (CPPC) contract, however, generally puts the most risk on the buyer due to the potential for unlimited cost escalation.

Think of it as choosing different levels of risk depending on the project and your trust in the contractor.

Risk Comparison: Cost-Plus vs. Fixed-Price

Cost-plus contracts shift more risk to the buyer compared to fixed-price contracts. In a fixed-price contract, the seller bears the brunt of cost overruns, while the buyer enjoys more price certainty. However, fixed-price contracts can incentivize sellers to cut corners to stay within budget, potentially impacting quality. Cost-plus contracts offer more flexibility but require robust monitoring and management to prevent cost escalation.

Importance of Clear Contract Language

Dude, seriously, clear contract language is EVERYTHING. Ambiguous wording is a breeding ground for disputes. The contract needs to clearly define allowable costs, the fee structure, the process for change orders, and dispute resolution mechanisms. Think of it as the rulebook for your project – if it’s unclear, the game’s going to be messy. A well-written contract minimizes misunderstandings and protects both parties.

It’s not just legal jargon; it’s your insurance policy.

Contract Administration and Monitoring

Yo, so you’ve got this cost-plus contract, right? Think of it like ordering a super-customised motorbike – you’re paying for the parts and the builder’s time, plus a little extra for their profit. But unlike ordering online, you need to keep a close eye on things to make sure you’re not getting ripped off or the project goes way over budget.

This is where contract administration and monitoring comes in – it’s all about making sure everything stays on track.Contract administration in a cost-plus contract involves meticulously tracking expenses and project progress. It’s like being the project manager and accountant rolled into one, making sure the builder isn’t adding random, unnecessary parts (or charging you for them). Regular checks are essential, because you want to catch any potential problems early before they become massive headaches.

Think of it as regular pit stops during a long motorbike race; you check the engine, fuel, and tires to make sure you can finish the race strong.

Cost and Progress Monitoring Methods

Effective monitoring requires a multi-pronged approach. First, you need detailed records of all costs incurred. This includes everything from materials to labor, permits, and even those unexpected roadside repairs. Regularly compare these actual costs against the initial budget estimates. Secondly, track the progress of the project against the agreed-upon timeline.

Are milestones being met? Are there any delays? Visual tools like Gantt charts can be super helpful here – think of them as a visual roadmap showing the project’s journey. Finally, regular on-site visits to check the work’s quality and overall progress are crucial. You want to make sure that the builder is actually working, and that they are using the right materials and methods.

Importance of Regular Reporting and Communication, How do cost plus contracts work

Communication is key, guys! Think of it as a constant flow of information between you (the client) and the builder. Regular reports, perhaps weekly or bi-weekly, are essential. These reports should detail the costs incurred during the reporting period, the progress made, any issues encountered, and a forecast of future costs. Open communication channels – regular meetings, emails, whatever works best – ensure that problems are identified and addressed promptly.

Don’t let issues fester; nip them in the bud!

Potential Issues and Their Resolution

Several issues can pop up during contract administration. One common problem is cost overruns. This could be due to unforeseen circumstances (like finding hidden plumbing issues during a renovation) or simply poor cost estimation at the beginning. Another issue is delays, which can be caused by anything from bad weather to supplier problems. Finally, disputes over the quality of work or interpretation of the contract terms can arise.

Addressing these issues requires proactive communication, thorough documentation, and potentially mediation or arbitration. Remember, maintaining a good working relationship with the builder is important for resolving these issues smoothly.

Step-by-Step Guide for Effective Cost-Plus Contract Administration

Here’s a simple step-by-step guide to keep you on track:

- Establish a clear and detailed budget at the start.

- Set up a system for tracking all costs and expenses.

- Schedule regular progress meetings with the contractor.

- Conduct on-site inspections to monitor work quality and progress.

- Review and approve all invoices and expense reports.

- Maintain thorough documentation of all communications and decisions.

- Address any issues or disputes promptly and professionally.

- Regularly compare actual costs against the budget and timeline.

Following these steps will help ensure that your cost-plus contract runs smoothly and efficiently, minimizing risks and maximizing the value you receive for your investment. It’s all about being organized, communicative, and vigilant.

Illustrative Example

Yo, check this out: imagine Mas Budi, a super chill contractor in Surabaya, lands a gig building a sick new skate park for a mall. This ain’t your grandpa’s boring concrete slab; we’re talking ramps, rails, bowls – the whole shebang. He decides to go with a cost-plus contract because the design’s kinda fluid, and he needs flexibility to handle any unexpected bumps in the road.Project Scope, Costs, and Fee StructureMas Budi and the mall owner agree on a detailed scope of work, including materials (concrete, wood, metal), labor (skilled construction workers, designers), permits, and insurance.

The initial estimate for direct costs is around Rp 500,000,000. Mas Budi’s fee is set at 15% of the total allowable costs, which means his profit margin is built into the final cost. This covers his overhead, like his trusty team and their admin. Any changes to the scope need a separate agreement, to keep things transparent and avoid misunderstandings.

Final Cost Calculation and Payment Process

Let’s say during construction, they discover some unexpected soil conditions that require extra reinforcement. This bumps up the material costs by Rp 50,000,000. The total allowable cost now becomes Rp 550,000,000 (Rp 500,000,000 + Rp 50,000,000). Mas Budi’s fee is 15% of this, which is Rp 82,500,000 (Rp 550,000,000 x 0.15). The final cost to the mall owner is Rp 632,500,000 (Rp 550,000,000 + Rp 82,500,000).

Payments are usually made in installments based on milestones achieved, like foundation completion, ramp construction, and final inspection. Invoices are submitted with detailed breakdowns of costs, receipts, and a progress report.

Project Progress and Potential Challenges

Initially, the project runs smoothly. Mas Budi’s team is on point, sticking to the schedule. But then, a delay hits when the supplier of specialized skatepark wood is late, pushing back the timeline. This affects the overall schedule and creates some stress. To mitigate this, Mas Budi explores alternative suppliers and manages to get the wood, but at a slightly higher cost.

This additional cost is documented and submitted for approval to the mall owner. Another challenge is dealing with potential disagreements about what constitutes an “allowable” cost. Clear communication and documentation from the start are crucial to prevent disputes. Regular meetings between Mas Budi and the mall owner are held to discuss progress, address challenges, and review invoices. Transparency is key to maintaining a positive working relationship.

Advantages and Disadvantages

Yo, peeps! So we’ve covered how cost-plus contracts work – now let’s get real about the ups and downs. It’s not all sunshine and rainbows, you know? Choosing the right contract type is crucial, and understanding the pros and cons is key to making a smart move.

Cost-plus contracts have their own unique blend of benefits and drawbacks. Whether they’re the right fit for your project depends heavily on the specifics of the job and your risk tolerance. Let’s break it down, Surabaya style.

Advantages of Cost-Plus Contracts

Okay, so what’s good about these cost-plus deals? There are some serious perks, especially when you’re dealing with projects that are a bit unpredictable or complex.

- Less Risk for the Buyer (in some cases): The buyer isn’t stuck with unexpected cost overruns – the contractor bears the risk of cost control, at least to some degree depending on the contract’s specifics.

- Flexibility and Adaptability: Changes and unexpected issues are easier to handle. Need to tweak the design mid-project? No problem, the contract usually allows for it.

- Incentive for Contractor Innovation: Since the contractor gets a fee on top of costs, they might be more inclined to find creative, cost-effective solutions.

- Suitable for Complex Projects: Cost-plus contracts are often better suited for projects where the scope is unclear or likely to change, like large-scale construction or software development.

- Easier to Secure Contractor: Finding a contractor willing to take on a high-risk, fixed-price project can be tough. Cost-plus makes it easier to attract bidders.

Disadvantages of Cost-Plus Contracts

Alright, let’s flip the script. These contracts aren’t perfect, and there are some serious downsides to consider.

- Potential for Cost Overruns: Without strict cost controls, the final cost can balloon way beyond initial estimates. This is a major concern.

- Lack of Transparency: Unless the contract has very specific and detailed cost reporting requirements, it can be hard to track expenses and ensure accuracy.

- Reduced Incentive for Cost Control: The contractor might not be as motivated to minimize costs since their fee is based on total costs.

- Difficult to Budget: Predicting the final cost can be extremely challenging, making budgeting a real headache.

- Potential for Disputes: Disagreements over allowable costs can easily arise, leading to conflict and delays.

Comparison of Advantages and Disadvantages

Let’s put it all together in a simple table to see the big picture. This helps you weigh the pros and cons side-by-side.

| Advantages | Disadvantages |

|---|---|

| Less risk for the buyer (in some cases) | Potential for significant cost overruns |

| Flexibility and adaptability | Lack of transparency and potential for cost inflation |

| Incentive for contractor innovation | Reduced incentive for cost control by the contractor |

| Suitable for complex projects | Difficult to budget accurately |

| Easier to secure a contractor | Potential for disputes over allowable costs |

Ultimately, the success of a cost-plus contract hinges on transparency, effective communication, and a well-defined agreement that clearly Artikels responsibilities and risk allocation. While offering flexibility and potential benefits for complex projects with uncertain scopes, cost-plus contracts demand robust monitoring and careful management to prevent cost overruns and disputes. By understanding the nuances of fee structures, allowable costs, and risk mitigation strategies, both buyers and sellers can leverage the advantages of this contract type while mitigating potential pitfalls.

Choosing the right type of cost-plus contract, coupled with diligent administration, is key to a successful project outcome.

Key Questions Answered: How Do Cost Plus Contracts Work

What happens if unforeseen circumstances significantly increase project costs?

This depends on the specific contract terms. Some contracts include clauses for change orders to address unforeseen circumstances, while others may require renegotiation. Clear contract language is crucial in these situations.

Can a cost-plus contract be terminated early?

Yes, but usually involves specific clauses outlining termination procedures and payment for completed work. Early termination often involves negotiations between parties.

How are disputes resolved under a cost-plus contract?

Dispute resolution mechanisms are usually Artikeld in the contract, which may include mediation, arbitration, or litigation. The contract should specify the process for resolving disagreements about costs or other aspects of the project.