How do you write a contract with variable fees? This crucial question guides businesses and individuals navigating agreements where payment isn’t fixed. Understanding variable fee structures—be it tiered pricing, percentage-based fees, or performance-related compensation—is vital for crafting legally sound and mutually beneficial contracts. This guide will equip you with the knowledge and tools to define, calculate, report, and legally navigate variable fee agreements, ensuring clarity, transparency, and a robust framework for your transactions.

We’ll explore various fee models, offering practical examples and sample clauses. We’ll cover crucial legal considerations, emphasizing fairness and transparency to mitigate potential disputes. By the end, you’ll confidently draft contracts that accurately reflect your variable fee arrangements, protecting your interests while fostering strong business relationships.

Defining Variable Fees in Contracts

Crafting contracts with variable fees requires meticulous attention to detail. The flexibility offered by variable fee structures can be incredibly beneficial for both parties, but only if the terms are clearly defined and understood. Ambiguity can lead to disputes and costly litigation, so precision is paramount. Let’s delve into how to effectively define these variable fee arrangements.

Variable Fee Structures

Variable fee structures offer a dynamic approach to pricing, adapting to changing circumstances or performance levels. Several common models exist, each with its own advantages and disadvantages. Understanding these nuances is crucial for creating a fair and legally sound contract.

Types of Variable Fee Structures

Several distinct models exist for incorporating variable fees into contracts. These models cater to various scenarios, ensuring the fee accurately reflects the services rendered or value delivered.

| Fee Structure | Description | Advantages | Disadvantages |

|---|---|---|---|

| Tiered Pricing | Fees vary based on usage levels, with different price points for different tiers of consumption. For example, a software license might cost less per user for larger organizations. | Simple to understand and implement; incentivizes higher usage within defined tiers. | Can create abrupt jumps in cost as usage crosses tier boundaries; may not accurately reflect true usage costs beyond the defined tiers. |

| Percentage-Based Fees | Fees are calculated as a percentage of a specific metric, such as revenue generated, sales volume, or project budget. A common example is a commission paid to a sales representative. | Directly links compensation to performance; incentivizes increased sales or revenue generation. | Can be volatile depending on market fluctuations or other uncontrollable factors; requires accurate and reliable data tracking. |

| Performance-Based Fees | Fees are tied to the achievement of specific, pre-defined performance goals. This could involve hitting sales targets, completing a project on time and within budget, or achieving a certain level of customer satisfaction. | Strongly incentivizes performance and aligns the interests of both parties; rewards success and penalizes underperformance. | Requires clear, measurable, and achievable performance metrics; can be complex to define and monitor. |

Defining Variables and Calculation Methods

The cornerstone of any successful variable fee contract lies in the precise definition of the variables and the methodology for their calculation. Ambiguity here is a recipe for disaster. The contract should explicitly state:

- The specific variable(s) upon which the fee is based (e.g., number of units sold, project completion rate, customer satisfaction score).

- The formula or method used to calculate the fee (e.g., fee = base fee + (units sold

– unit price), fee = percentage of revenue, fee = bonus based on exceeding a target). - The data sources used to determine the variable’s value (e.g., company sales reports, project management software, customer surveys).

- The frequency of fee calculation (e.g., monthly, quarterly, annually).

- The process for dispute resolution in case of discrepancies in data or calculations.

For example, a clause defining a percentage-based fee might read:

“The fee payable to the Consultant shall be 10% of the net revenue generated by the Client from the sale of products developed under this agreement, calculated monthly based on the Client’s financial statements.”

Another example, illustrating a performance-based fee, could be:

“A bonus of $5,000 will be paid to the Contractor upon successful completion of the project, defined as meeting all deliverables Artikeld in Appendix A by the agreed-upon deadline of December 31, 2024, as verified by the Project Manager.”

The importance of clear and unambiguous language cannot be overstated. Each variable and its calculation method should be meticulously detailed to prevent misunderstandings and potential conflicts. This level of precision is essential for ensuring a fair and workable agreement for all parties involved.

Calculating and Reporting Variable Fees

Accurately calculating and transparently reporting variable fees are crucial for maintaining trust and avoiding disputes in any contract involving them. This section will delve into practical methods for achieving both, ensuring fairness and clarity for all parties involved. We will explore calculation methods, reporting formats, and dispute resolution processes to solidify your understanding of managing variable fees effectively.Calculating variable fees requires meticulous attention to detail and a clear understanding of the agreed-upon metrics.

The accuracy of the calculation directly impacts the financial obligations of both parties, highlighting the importance of robust methodologies. Transparency in reporting is equally critical, fostering trust and preventing misunderstandings.

Methods for Accurately Calculating Variable Fees

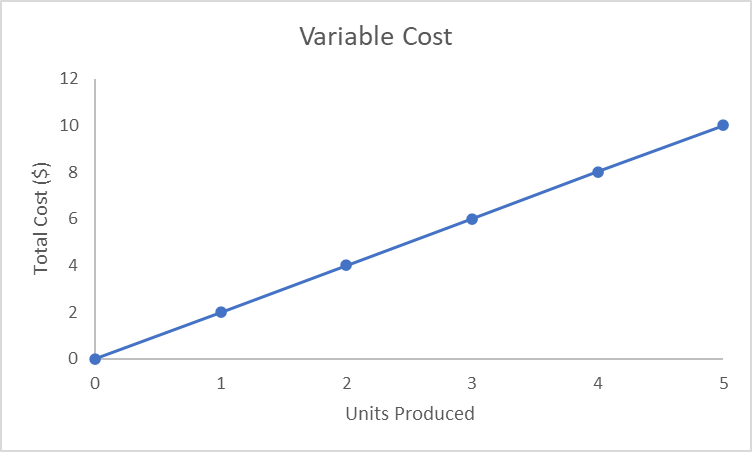

Accurate calculation hinges on clearly defined metrics and a precise formula. The contract should explicitly state the variable fee’s base, the applicable metric(s), and the calculation method. For example, a contract might stipulate a variable fee based on the number of units sold, with a per-unit fee clearly defined. Another example could involve a variable fee tied to project completion milestones, where each milestone triggers a specific payment.

The formula for calculating the fee should be explicitly stated within the contract, leaving no room for ambiguity. For instance, a formula might be: `Total Variable Fee = (Number of Units Sold)(Per-Unit Fee)`. It’s essential to use clear, unambiguous language and provide illustrative examples within the contract to eliminate any potential for misinterpretation.

Importance of Transparent Reporting Mechanisms

Transparent reporting ensures both parties have a clear understanding of how the variable fee was calculated. This transparency builds trust and minimizes the potential for disputes. Regular reporting, ideally at predetermined intervals (e.g., monthly, quarterly), allows for timely identification and resolution of any discrepancies. The reports should be easily understandable and readily accessible to both parties.

Examples of Reporting Formats

A well-structured report should clearly Artikel the calculation process, providing a step-by-step breakdown of how the variable fee was derived. Here are two example formats: Example 1: Simple Variable Fee Report

| Metric | Value | Rate | Calculation | Amount |

|---|---|---|---|---|

| Units Sold | 1000 | $5 | 1000 – $5 | $5000 |

Example 2: Multi-Metric Variable Fee Report

| Metric | Value | Rate | Calculation | Amount |

|---|---|---|---|---|

| Units Sold | 500 | $10 | 500 – $10 | $5000 |

| Project Milestones Achieved | 3 | $2000 | 3 – $2000 | $6000 |

| Total Variable Fee | $11000 |

These examples illustrate how clear, concise reporting can enhance transparency and facilitate understanding. The level of detail should be appropriate to the complexity of the variable fee calculation.

Dispute Resolution Clause for Variable Fee Calculations

A well-defined dispute resolution clause is essential for addressing disagreements concerning variable fee calculations. The clause should specify the process for resolving disputes, including mediation, arbitration, or litigation. It should also define the timeframe for resolving disputes and the applicable governing law.

A dispute regarding the calculation of variable fees shall first be submitted to mediation. If mediation fails to resolve the dispute within [Number] days, the dispute shall be submitted to binding arbitration in accordance with the rules of [Arbitration Organization]. The decision of the arbitrator shall be final and binding on both parties.

This sample clause provides a framework for resolving disputes fairly and efficiently. The specific details should be tailored to the individual contract and the preferences of the parties involved. Remember to consult with legal counsel to ensure the clause is legally sound and appropriate for your specific circumstances.

Legal Considerations for Variable Fee Contracts

Navigating the legal landscape of variable fee contracts requires careful consideration of fairness, transparency, and potential disputes. Understanding the implications of these structures is crucial for both parties involved to ensure a legally sound and mutually beneficial agreement. Failure to adequately address these considerations can lead to costly litigation and reputational damage.Variable fee structures, while offering flexibility, introduce complexities that necessitate precise legal drafting to avoid ambiguity and potential disputes.

The core principle is to ensure the calculation method is clearly defined, readily auditable, and demonstrably fair to both the provider and the recipient of the service. This section will explore the key legal considerations and best practices for mitigating risk.

Fairness and Transparency in Variable Fee Clauses

The cornerstone of a legally sound variable fee contract is ensuring fairness and transparency. This means clearly articulating how the variable fee is calculated, what factors influence it, and providing the client with a mechanism to understand and verify the final fee. Opacity in the calculation process can lead to accusations of unfairness and potentially breach of contract claims.

For example, a contract that states the fee is “based on market conditions” without further defining “market conditions” is inherently vague and risks legal challenges. Instead, the contract should specify the indices, benchmarks, or other objective measures used to determine the variable component. This allows for clear verification and reduces the potential for disputes.

Potential Legal Challenges from Poorly Defined Variable Fee Clauses

Poorly drafted variable fee clauses can create several legal challenges. Ambiguity in the calculation methodology can lead to disagreements over the final fee. Lack of transparency can give rise to claims of unfair practices or even fraud. If the contract fails to adequately address potential changes in circumstances, it may become unenforceable or subject to renegotiation. For instance, a contract stipulating a variable fee based on “cost of materials” without specifying a sourcing method or price verification process is vulnerable to disputes if material costs fluctuate unexpectedly.

Similarly, a lack of a dispute resolution mechanism can lead to lengthy and expensive litigation.

Mitigating Legal Risks Associated with Variable Fees

Several strategies can mitigate legal risks associated with variable fee contracts. First, detailed and unambiguous language is paramount. The contract should explicitly define all variables, the calculation methodology, and the reporting requirements. Second, incorporating objective measures and benchmarks minimizes subjectivity and potential for disputes. Third, a robust dispute resolution mechanism, such as arbitration or mediation, should be included to provide a more efficient and cost-effective alternative to litigation.

Finally, seeking legal counsel during the drafting process is crucial to ensure the contract complies with all relevant laws and regulations. This proactive approach significantly reduces the likelihood of future legal challenges.

Examples of Clauses Addressing Disputes and Legal Remedies

A well-drafted contract should include clauses specifically addressing potential disputes and legal remedies. For example, a clause could specify that any disputes regarding the calculation of the variable fee will be resolved through binding arbitration. Another clause could Artikel the process for providing documentation to support the fee calculation. A further example might be a clause outlining the remedies available to either party in case of a breach of contract, such as the right to terminate the agreement or claim damages.

For instance, a clause could state:

“In the event of a dispute regarding the calculation of the variable fee, both parties agree to submit the matter to binding arbitration under the rules of [Arbitration Institution]. The arbitrator’s decision shall be final and binding on both parties.”

This clarity reduces uncertainty and encourages a fair and efficient resolution process.

Best Practices for Drafting Variable Fee Clauses: How Do You Write A Contract With Variable Fees

Crafting airtight variable fee clauses is crucial for preventing disputes and ensuring a smooth business relationship. Ambiguity in these clauses can lead to costly litigation and damage trust between parties. By following best practices, you can create clear, legally sound agreements that protect both sides.

The key to effective variable fee clauses lies in precision and forethought. Every element, from the definition of the variable component to the payment schedule, must be meticulously articulated to avoid misunderstandings. This section Artikels essential steps to achieve this.

Checklist for Drafting Clear Variable Fee Clauses, How do you write a contract with variable fees

This checklist provides a structured approach to ensure your variable fee clauses are unambiguous and legally sound. Following these steps minimizes the risk of disputes and promotes clarity in your contractual agreements.

- Clearly Define the Variable Fee Component: Specify exactly what factors determine the variable fee. Use precise language and avoid vague terms. For example, instead of “a reasonable fee,” specify “a fee calculated based on the market price of X commodity on the date of service, plus a 10% markup.”

- Establish a Formula for Calculation: Provide a clear, step-by-step formula for calculating the variable fee. This formula should be easily reproducible and understandable by all parties involved. Include specific examples if necessary.

- Specify Data Sources: If the variable fee depends on external data (e.g., market indices, inflation rates), clearly identify the source of this data and the method for accessing it. Include links to relevant websites or specify the specific index used.

- Set a Maximum Fee: Consider including a maximum fee cap to protect against unexpectedly high charges. This provides a safety net for both parties involved.

- Detail Reporting Requirements: Specify how and when the variable fee will be reported to the client. This could involve regular invoices, detailed reports, or a combination of both.

- Address Payment Schedules and Penalties: Artikel the payment schedule, including due dates and any penalties for late payments. Clearly state the consequences of non-payment.

- Include Dispute Resolution Mechanisms: Specify a process for resolving disputes concerning the calculation or application of the variable fee. This could include mediation, arbitration, or litigation.

Avoiding Ambiguity in Variable Fee Definitions

Vague language is the enemy of clear contracts. Using precise terminology eliminates room for misinterpretation and potential disputes.

- Avoid ambiguous terms: Replace terms like “reasonable,” “fair,” or “appropriate” with objective, quantifiable metrics.

- Define all key terms: Provide clear definitions for all terms related to the variable fee calculation, ensuring both parties understand the same meaning.

- Use precise units of measurement: Specify units (e.g., dollars, hours, units of goods) to avoid confusion.

- Provide illustrative examples: Include examples to clarify the application of the variable fee formula in different scenarios.

Importance of Legal Terminology and Definitions

Employing precise legal terminology ensures the contract is legally sound and enforceable. Incorrect or imprecise wording can weaken the contract’s legal standing.

For instance, using legally defined terms like “net 30” for payment terms clarifies the payment schedule, while a vague statement like “payment is due soon” leaves room for interpretation and potential disputes. Consulting with legal counsel is recommended to ensure the contract is compliant with all relevant laws and regulations.

Sample Contract Clause: Payment Schedule for Variable Fees

This sample clause demonstrates how to structure a payment schedule for variable fees, including due dates and late payment penalties. Remember to adapt this clause to your specific circumstances and seek legal advice before using it.

“Variable fees shall be calculated according to the formula set forth in Section 3. Invoices detailing the calculated variable fees will be issued on the 15th of each month, covering the preceding month’s services. Payment is due within 30 days of the invoice date. Late payments will incur a late fee of 1.5% of the outstanding balance per month, or part thereof.”

Illustrative Examples of Variable Fee Contracts

Variable fee structures offer a dynamic approach to compensation, allowing for flexibility and aligning incentives between parties. This adaptability makes them particularly suitable for situations where outcomes are uncertain or heavily dependent on performance. Let’s explore some scenarios where this structure shines.

Scenario: Software Development with a Tiered Variable Fee Structure

Imagine a software development project where the final product’s complexity is initially unknown. A tiered variable fee structure provides a solution. The contract Artikels three tiers based on project scope: Basic, Standard, and Premium. Each tier has a defined set of features and a corresponding variable fee. The initial contract establishes a base fee for project initiation and consultation.

The variable component is triggered upon the client’s selection of a specific tier, adding to the base fee.

| Tier | Features | Variable Fee |

|---|---|---|

| Basic | Core functionality, limited customization | $10,000 |

| Standard | Core functionality, moderate customization, basic integrations | $25,000 |

| Premium | All features, extensive customization, advanced integrations, dedicated support | $50,000 |

This structure benefits the client by providing transparency and control over costs, while the developer receives appropriate compensation based on the complexity undertaken.

Scenario: Performance-Based Variable Fee for a Marketing Campaign

A marketing agency agrees to manage a social media campaign for a client. The contract stipulates a base fee for campaign setup and strategy development. The variable fee is directly tied to achieving specific, pre-defined Key Performance Indicators (KPIs).The KPIs include:

- Number of new followers acquired

- Engagement rate (likes, comments, shares)

- Website traffic driven from social media

- Lead generation

The variable fee is calculated as a percentage of the budget allocated to the campaign, with different percentages assigned to each KPI based on its relative importance. For example, a 10% bonus is awarded for exceeding the target number of new followers by 20%, while a 5% bonus is given for each 10% increase in engagement rate. This structure incentivizes the agency to deliver exceptional results and ensures the client only pays for demonstrable success.

Scenario: Percentage-Based Variable Fee for Sales Commission

A sales representative is employed on a commission-based structure. Their base salary is relatively low, but they earn a percentage of each sale they successfully close. For example, the contract states that the representative receives a 5% commission on all sales exceeding $10,000. This is a classic example of a percentage-based variable fee.

The variable fee calculation is straightforward: Variable Fee = (Sale Price – $10,000) – 0.05

This structure directly links compensation to performance, motivating the sales representative to achieve higher sales targets. The client benefits from paying only for sales generated, minimizing unnecessary costs.

Mastering the art of crafting contracts with variable fees empowers you to navigate complex business arrangements with confidence. By meticulously defining fee structures, implementing transparent reporting mechanisms, and addressing potential legal challenges proactively, you establish a solid foundation for successful and mutually beneficial partnerships. Remember, clarity and precision are paramount; a well-drafted contract safeguards both parties and minimizes future disputes.

This guide provides a strong foundation for creating effective and legally sound variable fee agreements.

Helpful Answers

What happens if the agreed-upon metrics for variable fees are not clearly defined?

Ambiguity can lead to disputes. Ensure your contract precisely defines all variables and how they are calculated, using specific, measurable terms.

Can I use a standard contract template for variable fees?

While templates offer a starting point, always customize them to reflect the specific details of your agreement. A generic template may not adequately address the nuances of your variable fee structure.

What are the implications of failing to provide transparent reporting of variable fees?

Lack of transparency can damage trust and lead to disputes. Establish a clear reporting mechanism outlining how fees are calculated and reported, including timelines and formats.

How do I handle disputes regarding variable fee calculations?

Include a clear dispute resolution clause in your contract, specifying the process for resolving disagreements, such as mediation or arbitration.