How much do contracts cost with insurance? That’s a question many grapple with, navigating the complex world of premiums, deductibles, and coverage. Understanding the cost of insurance isn’t just about the initial price tag; it’s about comprehending the long-term financial implications and ensuring you’re adequately protected. This journey explores the various factors that influence insurance costs, helping you make informed decisions about your financial well-being.

From life insurance securing your family’s future to auto insurance safeguarding your vehicle, the cost varies drastically depending on numerous factors. We’ll break down the different types of insurance contracts, exploring the base costs, potential add-ons, and how elements like age, health, location, and even your credit score impact your premiums. We’ll also delve into the fine print, uncovering potential hidden costs and providing strategies for negotiating better rates.

Ultimately, this guide aims to empower you with the knowledge to navigate the insurance landscape confidently and choose the best coverage for your needs without breaking the bank.

Types of Insurance Contracts and Costs

Understanding the cost of insurance contracts requires examining the various types available and the factors influencing their price. Different policies cater to different needs and risk profiles, leading to a wide range of premiums. This section will break down common insurance types, detailing the key cost drivers and optional add-ons.

Life Insurance Contract Costs

Life insurance protects your loved ones financially after your death. The cost depends heavily on factors such as your age, health, lifestyle, and the type of policy (term life, whole life, universal life). Younger, healthier individuals generally receive lower premiums. The amount of coverage also significantly impacts cost; more coverage means higher premiums.

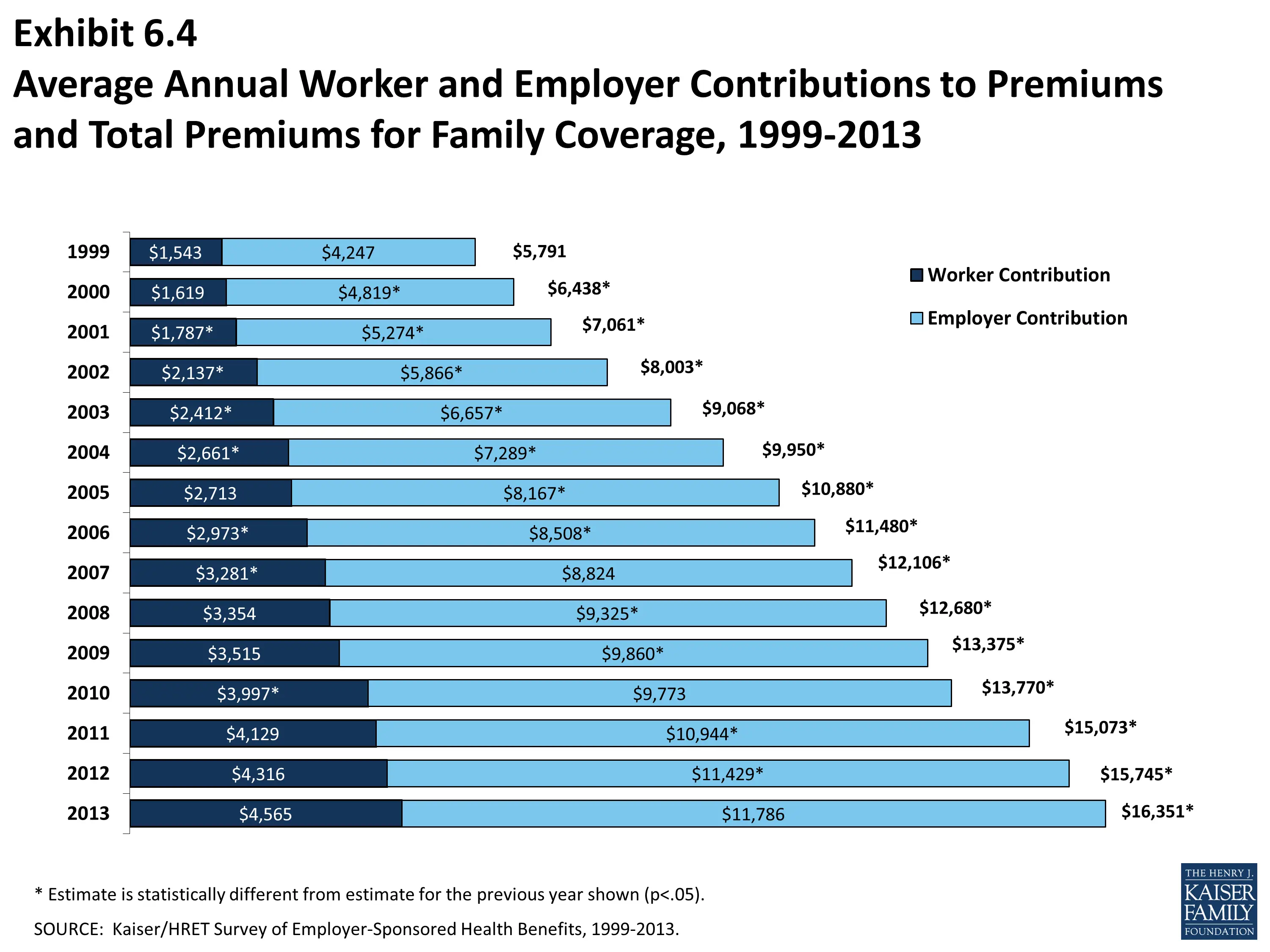

Health Insurance Contract Costs

Health insurance covers medical expenses. Premiums vary based on your location, the plan’s coverage level (deductible, copay, coinsurance), and your age and health status. Pre-existing conditions can significantly increase premiums. Family plans are typically more expensive than individual plans.

Auto Insurance Contract Costs

Auto insurance protects you against financial losses from accidents. Factors influencing cost include your driving record (accidents, tickets), vehicle type (make, model, year), location (higher crime rates often mean higher premiums), and coverage level (liability, collision, comprehensive). Young drivers generally pay higher premiums due to increased risk.

Home Insurance Contract Costs

Home insurance protects your home and belongings from damage or loss. The cost is influenced by factors like your home’s location, age, value, and construction materials. The level of coverage (dwelling, personal property, liability) also affects the premium. Security features, such as alarm systems, can lead to lower premiums.

Table of Insurance Contract Costs and Add-ons

The following table summarizes the base cost factors and common add-ons for each insurance type, along with their cost impact. Note that these are general examples and actual costs will vary widely depending on individual circumstances and the specific insurer.

| Contract Type | Base Cost Factors | Add-on Options | Cost Impact of Add-ons |

|---|---|---|---|

| Life Insurance | Age, health, coverage amount, policy type | Accidental death benefit, critical illness rider, long-term care rider | Significant increase, varying depending on the rider |

| Health Insurance | Age, location, plan type (deductible, copay), pre-existing conditions | Dental, vision, prescription drug coverage | Moderate increase, depending on the added coverage |

| Auto Insurance | Driving record, vehicle type, location, coverage level | Uninsured/underinsured motorist coverage, roadside assistance, rental car reimbursement | Moderate to significant increase, depending on the add-on |

| Home Insurance | Location, home value, age, construction, coverage level | Earthquake coverage, flood insurance, personal liability umbrella policy | Significant increase, particularly for earthquake and flood coverage |

Comparing Insurance Providers and Costs: How Much Do Contracts Cost With Insurance

Navigating the world of insurance can feel like deciphering a complex code, especially when comparing costs and coverage across different providers. Understanding the nuances of pricing structures and benefit packages is crucial for making an informed decision that best suits your needs and budget. This section will illuminate the key differences between three major auto insurance providers, offering a clear comparison to aid in your selection process.

Auto Insurance Provider Comparison

To illustrate the variations in pricing and coverage, let’s examine three hypothetical, yet representative, auto insurance providers: “SafeDrive,” “SecureAuto,” and “RoadGuard.” These providers, while fictional, reflect common characteristics found in the real-world insurance market. We’ll focus on a standard liability policy for a mid-sized sedan driven by a 35-year-old driver with a clean driving record.

Pricing Structures and Coverage Differences

Each provider employs a slightly different pricing model, influenced by factors such as risk assessment, claims history, and the specific coverage options selected. SafeDrive emphasizes a tiered system, offering various levels of coverage at increasing premium costs. SecureAuto utilizes a more personalized approach, tailoring premiums based on individual driver profiles and driving habits. RoadGuard adopts a simpler, flat-rate structure with fewer customization options.

These differences in approach directly impact the final premium and the breadth of coverage offered. At higher price points, you generally find increased liability limits, comprehensive coverage (covering damage from non-collision events), and potentially additional benefits like roadside assistance or rental car reimbursement.

Comparison Chart: Auto Insurance Providers

| Provider | Coverage Details | Premium Costs (Annual) | Key Features |

|---|---|---|---|

| SafeDrive | $100,000/$300,000 Bodily Injury Liability, $50,000 Property Damage Liability, Uninsured/Underinsured Motorist Coverage | $800 | Multiple coverage tiers, optional add-ons (e.g., roadside assistance), online account management. |

| SecureAuto | $250,000/$500,000 Bodily Injury Liability, $100,000 Property Damage Liability, Comprehensive and Collision Coverage, Uninsured/Underinsured Motorist Coverage | $1200 | Personalized pricing based on driving score, accident forgiveness program, telematics integration for potential discounts. |

| RoadGuard | $100,000/$300,000 Bodily Injury Liability, $50,000 Property Damage Liability, Uninsured/Underinsured Motorist Coverage | $750 | Simple, flat-rate pricing, no optional add-ons, basic coverage options. |

Understanding Contract Terms and Conditions

Navigating the complexities of insurance contracts can feel daunting, but understanding the key terms and conditions is crucial for securing the best coverage at the most reasonable price. Failing to grasp these details can lead to unexpected costs and inadequate protection when you need it most. This section will illuminate the importance of careful contract review and provide practical strategies for interpreting key clauses.Understanding policy terms like exclusions, limitations, and waiting periods is paramount to accurately assessing the true cost of your insurance.

These seemingly minor details can significantly impact your overall financial liability in the event of a claim. Overlooking these provisions can lead to costly surprises when you least expect them.

Exclusions, Limitations, and Waiting Periods

Exclusions specify events or circumstances that are not covered by the policy. For example, a homeowner’s insurance policy might exclude flood damage, requiring separate flood insurance. Limitations define the extent of coverage for specific events. A car insurance policy might limit liability coverage to a certain dollar amount. Waiting periods represent the time elapsed before coverage becomes effective for specific events.

For instance, there might be a waiting period before health insurance covers pre-existing conditions. Understanding these three elements is vital to determining the true cost of the insurance, as they directly influence the amount of risk you retain. For instance, if a policy excludes a high-risk event relevant to your circumstances, the perceived cost might be lower, but the actual cost (in case of an incident) can be significantly higher.

Common Contract Clauses Impacting Costs

Several common contract clauses directly influence the overall cost of your insurance. Premium adjustments based on deductibles are a prime example. A higher deductible generally leads to lower premiums, as you agree to shoulder more of the initial cost in case of a claim. Conversely, a lower deductible results in higher premiums. Similarly, clauses relating to coverage limits (e.g., the maximum amount the insurer will pay for a specific claim) influence premiums.

Higher coverage limits typically translate to higher premiums. Co-insurance clauses in health insurance policies require you to share a percentage of the costs after your deductible is met, affecting out-of-pocket expenses.

Interpreting Key Sections for Cost Estimation

To estimate potential costs, carefully review sections detailing coverage limits, deductibles, co-pays, and exclusions. For example, a health insurance policy with a $5,000 deductible and a 20% co-insurance will require significant out-of-pocket expenses before the insurer covers a substantial portion of your medical bills. Similarly, a car insurance policy with a $500 deductible and $100,000 liability coverage will have different cost implications than one with a $1,000 deductible and $250,000 liability coverage.

By carefully comparing these figures across different policies, you can make informed decisions about the level of coverage and associated costs that best align with your risk tolerance and financial capacity. Consider a scenario where you’re comparing two auto insurance policies. Policy A has a $500 deductible and $100,000 liability coverage with a premium of $800 per year, while Policy B offers a $1000 deductible and $250,000 liability coverage for $900 per year.

The difference in premiums is only $100, but the potential savings (or costs) associated with the deductible and liability limits should be carefully weighed against the higher premium.

Hidden Costs Associated with Insurance Contracts

Navigating the world of insurance can feel like traversing a minefield, especially when unexpected costs emerge from seemingly straightforward contracts. While premiums are the most visible expense, a range of hidden fees and charges can significantly inflate the overall cost, leaving unsuspecting policyholders with a hefty bill. Understanding these potential pitfalls is crucial for making informed decisions and avoiding financial surprises.Many insurance policies contain clauses that allow for additional fees or adjustments beyond the stated premium.

These hidden costs can significantly impact the overall expense, sometimes exceeding the initial premium itself. Failing to carefully review the policy documents can lead to unpleasant financial consequences. It’s vital to remember that transparency isn’t always guaranteed, and proactive investigation is key to avoiding these hidden traps.

Administrative Fees and Processing Charges

Insurance companies often levy administrative fees for various services, such as processing claims, issuing policy documents, or making changes to your coverage. These fees can accumulate over time, especially if you frequently need to adjust your policy or file claims. For instance, a seemingly minor change like updating your address might incur a processing fee, adding to your overall expenditure.

A detailed breakdown of these fees should be explicitly stated within your policy documents, allowing you to anticipate and budget for them.

Deductibles and Co-pays, How much do contracts cost with insurance

While deductibles and co-pays are often explicitly mentioned, their true impact can be underestimated. A high deductible means you’ll need to pay a substantial amount out-of-pocket before your insurance coverage kicks in. Similarly, co-pays, the fixed amount you pay for each medical visit or service, can add up significantly, especially with multiple claims or ongoing treatments. Consider a scenario where an individual faces a large medical bill; the deductible, even if initially understood, can create a substantial financial burden.

Careful consideration of these factors, coupled with a realistic assessment of your potential healthcare needs, is essential.

Policy Cancellation Fees

Cancelling an insurance policy before its term ends frequently involves penalties. These cancellation fees can be substantial, often a percentage of the remaining premium or a fixed amount, regardless of the reason for cancellation. For example, if you switch jobs and need to cancel your health insurance policy mid-term, you may incur a significant penalty. It’s important to understand these cancellation clauses to avoid unexpected costs when circumstances change.

Late Payment Fees

Consistent and timely payments are essential to maintain your insurance coverage. Failing to pay your premiums on time usually results in late payment fees, which can add up quickly. These fees can vary depending on the insurer and the length of the delay, potentially leading to substantial additional costs. Consider the example of a busy individual who forgets to pay their premium; a seemingly small oversight can result in a significant penalty.

Establishing a system for automated payments can mitigate this risk.

Increased Premiums Due to Claims

Filing a claim can lead to a subsequent increase in your insurance premiums. Insurers assess risk based on claims history, and a higher number of claims can result in a higher premium for future coverage. For example, multiple car accidents or health issues might lead to a significant increase in your insurance costs in subsequent years. This is a crucial factor to consider, especially if you anticipate a higher likelihood of needing to file claims.

Securing the right insurance is a crucial step in safeguarding your future. Understanding how much insurance contracts cost involves more than just comparing premiums; it’s about carefully evaluating coverage, considering potential hidden fees, and negotiating effectively. By understanding the various factors influencing cost and employing smart strategies, you can find the optimal balance between protection and affordability. Remember, a little research and proactive engagement can save you significant money in the long run, providing peace of mind knowing you’re financially prepared for life’s unexpected turns.

FAQ Overview

What is the average cost of car insurance?

The average cost of car insurance varies greatly depending on location, driving history, age, and the type of vehicle. It’s best to get quotes from multiple insurers for accurate pricing.

Can I negotiate my insurance premiums?

Yes, often you can. Negotiating may involve bundling policies, improving your credit score, or exploring different coverage options.

What are some hidden costs I should be aware of?

Hidden costs can include administrative fees, processing fees, or penalties for late payments. Always read the fine print carefully.

How often can I review my insurance policy?

It’s recommended to review your insurance policy annually, or whenever there’s a significant life change (like marriage, buying a home, or a change in your driving record).