What does a securities attorney do? In the complex world of finance, where investments and markets constantly fluctuate, these legal professionals play a crucial role in ensuring fairness, transparency, and compliance. Securities attorneys navigate the intricate web of regulations governing the issuance, trading, and investment of securities, acting as legal advisors to individuals, corporations, and financial institutions.

Their expertise encompasses a wide range of legal matters, from drafting contracts and conducting due diligence to advising clients on compliance with securities laws and defending against litigation. They are adept at understanding the nuances of securities law, including the different types of securities, the regulatory framework governing their transactions, and the potential legal risks involved.

Securities Law Basics

Securities law is a complex and essential area of law that governs the issuance and trading of securities. It aims to protect investors, ensure fair and transparent markets, and prevent fraud.

Purpose of Securities Law

The primary purpose of securities law is to protect investors by ensuring that they have access to accurate and complete information about the securities they are considering purchasing. This helps investors make informed decisions and reduces the risk of fraud or manipulation.

Types of Securities

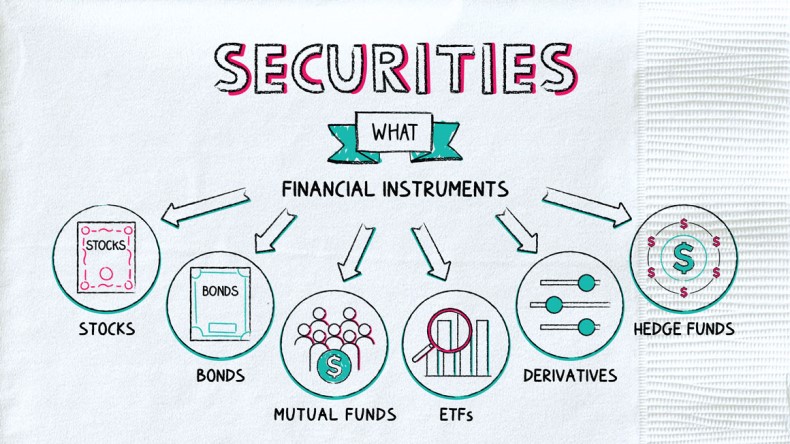

Securities can be broadly categorized into three main types:

- Equity Securities: These represent ownership in a company. Common examples include stocks, which represent a share of ownership in a publicly traded company, and warrants, which give the holder the right to purchase shares at a specific price within a certain timeframe.

- Debt Securities: These represent a loan made to a company or government. Examples include bonds, which are typically issued by companies or governments to raise capital, and notes, which are similar to bonds but typically have shorter maturities.

- Derivative Securities: These are financial instruments whose value is derived from the underlying value of another asset. Examples include options, which give the holder the right but not the obligation to buy or sell an underlying asset at a specific price within a certain timeframe, and futures, which are contracts to buy or sell an asset at a specific price on a future date.

Regulatory Framework

The securities industry in the United States is heavily regulated by various federal and state agencies, including:

- Securities and Exchange Commission (SEC): The SEC is the primary federal regulator of securities markets. It has broad authority to oversee the issuance and trading of securities, protect investors, and ensure fair and orderly markets. The SEC sets rules and regulations for public companies, brokers, and investment advisers, and investigates and enforces violations of securities laws.

- Financial Industry Regulatory Authority (FINRA): FINRA is a self-regulatory organization (SRO) for the securities industry. It sets rules for broker-dealers and their employees, oversees trading activities, and enforces its rules through disciplinary actions. FINRA also provides investor education and protection resources.

Key Principles of Securities Law

The key principles of securities law are designed to ensure fair and transparent markets and protect investors from fraud. Some of the most important principles include:

- Full Disclosure: Companies issuing securities are required to disclose material information to investors, including financial statements, risk factors, and management discussions. This ensures that investors have access to the information they need to make informed investment decisions.

- Anti-Fraud Provisions: Securities laws prohibit fraud and manipulation in the issuance and trading of securities. This includes insider trading, market manipulation, and other forms of deceptive conduct.

- Registration Requirements: Most securities must be registered with the SEC before they can be offered to the public. This allows the SEC to review the offering and ensure that it complies with securities laws.

Securities Attorney Responsibilities: What Does A Securities Attorney Do

Securities attorneys play a crucial role in the financial industry, ensuring that transactions involving securities comply with complex and ever-evolving regulations. Their responsibilities extend beyond legal compliance, encompassing advising clients on investment strategies and mitigating risks.

Legal Tasks Performed by Securities Attorneys

Securities attorneys perform a wide range of legal tasks to protect their clients’ interests and ensure compliance with securities laws.

- Drafting Contracts: Securities attorneys draft and review various contracts related to securities transactions, including offering memoranda, subscription agreements, and private placement memorandums. These contracts Artikel the terms of the transaction, ensuring clarity and protecting the rights of all parties involved.

- Conducting Due Diligence: Securities attorneys conduct thorough due diligence investigations to assess the risks and legal implications of a proposed securities offering. This process involves reviewing financial statements, examining corporate records, and evaluating the legal and regulatory environment surrounding the transaction.

- Advising Clients on Compliance: Securities attorneys provide ongoing legal advice to their clients on a range of compliance issues, including registration requirements, disclosure obligations, and insider trading rules. They help clients navigate the complex regulatory landscape and ensure their actions adhere to all applicable laws and regulations.

Collaboration with Other Professionals, What does a securities attorney do

Securities attorneys often work closely with other professionals in the financial industry, including:

- Investment Bankers: Securities attorneys collaborate with investment bankers to structure and execute securities offerings. They advise on the legal implications of different financing options and ensure compliance with all applicable securities laws.

- Accountants: Securities attorneys work with accountants to review financial statements and ensure that all required disclosures are made. They also advise on accounting and tax implications of securities transactions.

- Brokers and Dealers: Securities attorneys provide legal counsel to brokers and dealers on a range of issues, including regulatory compliance, customer agreements, and dispute resolution.

Types of Securities Litigation

Securities litigation encompasses a wide range of legal disputes arising from the buying and selling of securities, often involving allegations of fraud, misrepresentation, or other violations of securities laws. These lawsuits can be complex and involve intricate legal arguments, making the role of securities attorneys crucial in navigating these cases.

Shareholder Class Actions

Shareholder class actions are lawsuits brought by a group of investors who allege that they suffered financial losses due to a company’s misstatements or omissions. These lawsuits often arise when a company’s stock price declines significantly following the disclosure of negative information. Plaintiffs in shareholder class actions typically seek to recover financial damages on behalf of all investors who purchased the company’s securities during a specific period.

Insider Trading Cases

Insider trading cases involve individuals who trade securities based on non-public information that they obtained through their position or relationship with a company. These cases often arise when individuals with access to confidential information, such as company executives or employees, buy or sell securities before the information is publicly disclosed. The Securities and Exchange Commission (SEC) and the Department of Justice (DOJ) actively investigate and prosecute insider trading cases.

Securities Fraud Claims

Securities fraud claims allege that a company or individual made false or misleading statements about a security to induce investors to buy or sell the security. These claims often arise when a company misrepresents its financial performance, prospects, or operations. Plaintiffs in securities fraud cases typically seek to recover damages for their financial losses.

Types of Securities Litigation: A Comparison

| Type of Litigation | Legal Theory | Potential Outcomes |

|---|---|---|

| Shareholder Class Actions | Misstatements or omissions that misled investors | Monetary damages for investors, injunctions to prevent future wrongdoing |

| Insider Trading Cases | Trading securities based on non-public information | Criminal charges, civil penalties, disgorgement of profits |

| Securities Fraud Claims | False or misleading statements about a security | Monetary damages for investors, injunctions to prevent future wrongdoing |

Securities Regulation Compliance

Securities regulation compliance is a critical aspect of the work of securities attorneys. It involves ensuring that companies and individuals adhere to the complex rules and regulations governing the issuance and trading of securities. This is essential to protect investors, maintain market integrity, and prevent fraud.

Key Securities Regulations and Compliance Requirements

Securities regulation compliance involves understanding and adhering to a vast array of rules and regulations. These regulations are designed to protect investors and ensure fair and transparent markets. Here is a table outlining some key securities regulations and compliance requirements:

| Regulation | Description | Compliance Requirements |

|---|---|---|

| Securities Act of 1933 | Regulates the issuance of new securities. |

|

| Securities Exchange Act of 1934 | Regulates the trading of securities in the secondary market. |

|

| Sarbanes-Oxley Act of 2002 | Enhances corporate governance and accounting standards. |

|

| Dodd-Frank Wall Street Reform and Consumer Protection Act | Reforms the financial industry in response to the 2008 financial crisis. |

|

Registration Statement Filing Process

The process for filing a registration statement with the SEC is complex and involves multiple steps. This flowchart demonstrates the general process:[Flowchart:

1. Preparation of Registration Statement

The company prepares the registration statement, which includes detailed information about the company, the securities being offered, and the proposed use of the proceeds.

2. Filing with the SEC

The company files the registration statement with the SEC.

3. SEC Review

The SEC reviews the registration statement to ensure that it meets all applicable requirements.

4. Comments and Amendments

The SEC may issue comments or requests for amendments to the registration statement.

5. SEC Approval

Once the SEC is satisfied with the registration statement, it declares the registration statement effective.

6. Offering of Securities

The company can now offer the securities to the public.]

Securities Regulation Compliance Checklist

Companies should have a comprehensive compliance program in place to ensure they are adhering to all applicable securities regulations. Here is a checklist that companies can use to assess their compliance:

- Disclosure Requirements

- Are all material information about the company and the securities being offered disclosed to investors?

- Are all required filings made with the SEC in a timely manner?

- Are all investor communications accurate and complete?

- Insider Trading

- Do employees and officers understand the rules and regulations governing insider trading?

- Are there procedures in place to prevent insider trading?

- Are there procedures in place for reporting potential insider trading violations?

- Corporate Governance

- Does the company have an independent audit committee?

- Are the company’s financial statements prepared in accordance with GAAP?

- Are there procedures in place for reporting potential fraud or misconduct?

- Anti-Money Laundering

- Does the company have an anti-money laundering program in place?

- Are there procedures in place for verifying the identity of customers?

- Are there procedures in place for reporting suspicious activity?

- Cybersecurity

- Does the company have adequate cybersecurity measures in place to protect sensitive information?

- Are there procedures in place for responding to cybersecurity incidents?

Emerging Trends in Securities Law

The field of securities law is constantly evolving, driven by technological advancements, changing investor behavior, and evolving regulatory landscapes. This dynamic environment presents both challenges and opportunities for securities attorneys, who must stay abreast of these emerging trends to effectively advise their clients.

Impact of Technological Advancements

Technological advancements, particularly in the areas of blockchain and cryptocurrencies, have profoundly impacted securities law. Blockchain technology, with its decentralized and transparent nature, has led to the emergence of new forms of digital assets, such as cryptocurrencies and non-fungible tokens (NFTs). These assets raise complex questions regarding their classification as securities under existing regulations.

- The Howey Test, a cornerstone of securities law, is being revisited to determine if these digital assets meet the criteria of an investment contract.

- Regulators are grappling with how to regulate these new assets, balancing innovation with investor protection.

- Securities attorneys play a crucial role in navigating this evolving landscape, advising clients on the legal and regulatory implications of digital assets.

Evolving Regulatory Landscape Surrounding Crowdfunding and Alternative Financing Methods

Crowdfunding and other alternative financing methods have gained traction in recent years, providing businesses with new avenues for capital raising. These methods offer opportunities for smaller companies and startups to access funding outside traditional channels. However, they also raise concerns about investor protection and regulatory oversight.

- Regulators are adapting their frameworks to address the unique characteristics of crowdfunding and alternative financing methods.

- Securities attorneys are involved in advising both issuers and investors on compliance with evolving regulations and best practices.

- The focus is on balancing innovation with investor protection, ensuring transparency and disclosure in these alternative financing models.

Potential Future Challenges and Opportunities

The future of securities law is likely to be shaped by continued technological advancements, changing investor preferences, and evolving regulatory approaches.

- Securities attorneys will need to stay informed about emerging technologies and their impact on securities markets.

- The increasing use of artificial intelligence (AI) and machine learning (ML) in finance will present new challenges and opportunities for securities law.

- The regulatory landscape is expected to continue evolving, requiring securities attorneys to stay abreast of new rules and regulations.

The role of a securities attorney is vital in maintaining the integrity of the financial markets and protecting investors. They act as guardians of the law, ensuring that transactions are conducted ethically and legally, and that the interests of all parties are protected. Their work contributes to the stability and growth of the financial system, while safeguarding investors from potential fraud and misconduct.

General Inquiries

What is the difference between a securities attorney and a corporate attorney?

While both specialize in business law, a securities attorney focuses on the legal aspects of securities transactions, while a corporate attorney handles a broader range of legal matters related to corporations, including mergers and acquisitions, corporate governance, and contract negotiations.

What are some of the challenges faced by securities attorneys?

Securities attorneys face numerous challenges, including keeping up with the ever-evolving regulatory landscape, navigating complex legal issues, and managing high-stakes litigation. The constant need to adapt to new technologies and market trends adds to the complexity of their work.

What qualifications are required to become a securities attorney?

To become a securities attorney, individuals typically need a Juris Doctor (JD) degree from an accredited law school, followed by passing the bar exam in the state where they intend to practice. Specialization in securities law often involves additional certifications and experience in the field.