Which of the following describes the securities underwriting process? It’s a fundamental process in the capital markets that involves the issuance and sale of new securities, allowing companies to raise capital for expansion, growth, or other financial needs. This intricate process, a dance between financial institutions and investors, involves a series of carefully orchestrated steps, each playing a crucial role in ensuring a successful offering.

From the initial concept to the final distribution, the underwriting process involves a cast of key players: investment banks, underwriters, and investors. It’s a journey of due diligence, pricing, and allocation, guided by regulatory frameworks and market forces. Understanding this process is vital for anyone seeking to navigate the complexities of the capital markets, whether as an investor, a company seeking funding, or a financial professional.

Introduction to Securities Underwriting

Securities underwriting is a crucial process in the capital markets, enabling companies and governments to raise capital by issuing and selling securities to investors. This process acts as a bridge between the issuer and the investing public, facilitating the efficient allocation of financial resources.

Key Players in the Securities Underwriting Process

The securities underwriting process involves several key players who contribute to the successful issuance and distribution of securities.

- Issuer: The entity that needs to raise capital, such as a corporation, government agency, or municipality.

- Underwriter: Typically an investment bank or a syndicate of investment banks that agrees to purchase the securities from the issuer and resell them to investors. Underwriters provide expertise in pricing, marketing, and distribution of securities.

- Investors: Individuals or institutions that purchase the securities from the underwriter, seeking to invest in the issuer and potentially earn a return on their investment.

- Regulators: Government agencies, such as the Securities and Exchange Commission (SEC) in the United States, that oversee the securities markets and ensure compliance with regulations.

Types of Securities Underwritten

Securities underwriting encompasses a wide range of financial instruments, including:

- Equity Securities: Common stock and preferred stock represent ownership in a company and offer investors the potential for capital appreciation and dividends.

- Debt Securities: Bonds, notes, and commercial paper represent loans made to the issuer, with investors receiving interest payments and principal repayment at maturity.

- Structured Products: Complex financial instruments that combine different types of securities or derivatives, offering investors customized risk and return profiles.

The Underwriting Process: Which Of The Following Describes The Securities Underwriting Process

The securities underwriting process is a complex and crucial step in the issuance of new securities. It involves a series of activities undertaken by an underwriter, typically an investment bank, to facilitate the sale of securities to investors. The underwriter acts as an intermediary between the issuer and the investing public, ensuring the successful and efficient distribution of the securities.

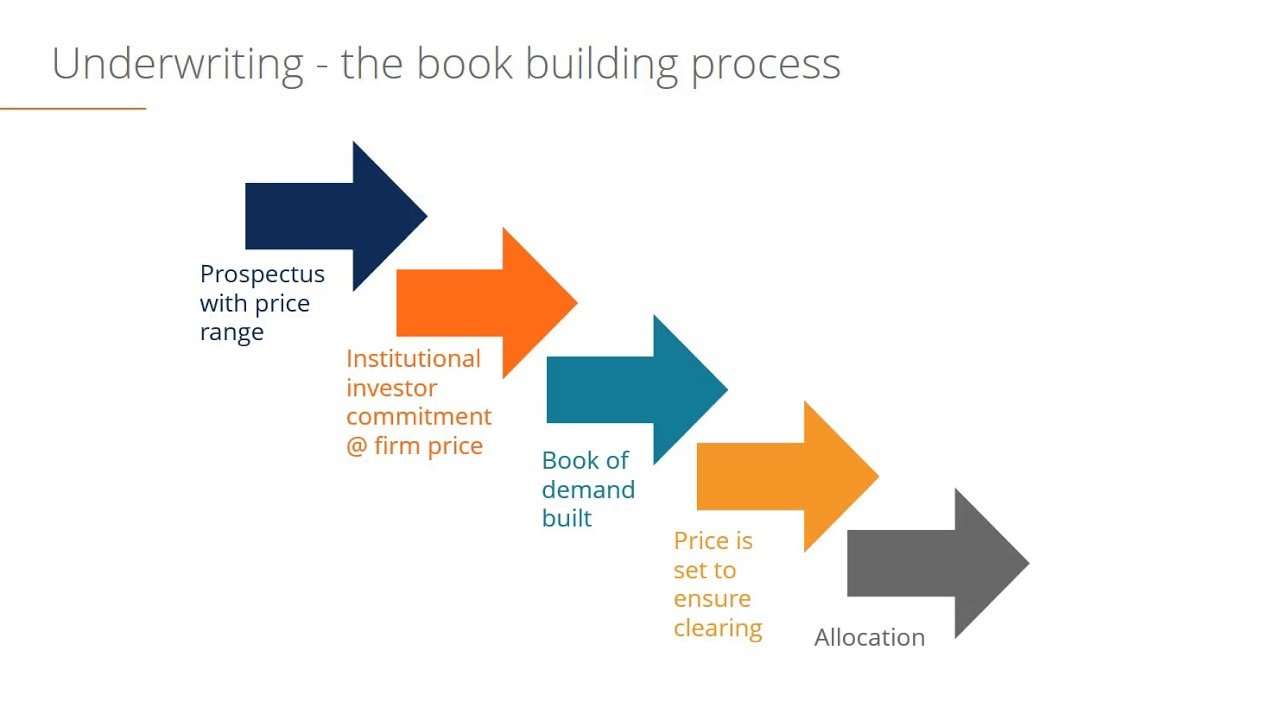

Stages of the Underwriting Process

The underwriting process is typically divided into distinct stages, each with specific objectives and activities. These stages are interconnected and follow a logical sequence, culminating in the successful issuance and distribution of securities.

- Pre-Underwriting Stage: This initial stage involves preliminary discussions between the issuer and the underwriter to explore the feasibility of the offering. The issuer provides the underwriter with a detailed business plan, financial statements, and other relevant information. The underwriter conducts preliminary due diligence to assess the issuer’s financial health, business model, and market potential. This stage typically lasts for a few weeks, during which both parties determine if the deal is viable and mutually beneficial.

- Due Diligence Stage: This stage involves a thorough examination of the issuer’s business, financial condition, and legal compliance. The underwriter conducts an in-depth review of the issuer’s financial statements, management team, legal documents, and other relevant information. This stage is crucial for the underwriter to understand the risks associated with the offering and to determine the appropriate pricing and terms of the securities.

The due diligence process typically takes several weeks or even months, depending on the complexity of the offering.

- Pricing and Structuring Stage: Once the underwriter has completed due diligence, they determine the pricing and structuring of the securities. This involves considering various factors, such as the issuer’s financial condition, market conditions, and the demand for similar securities. The underwriter may also negotiate with the issuer on the terms of the offering, including the number of shares to be issued, the offering price, and the type of securities.

This stage typically takes a few weeks and involves close coordination between the issuer and the underwriter.

- Distribution Stage: This final stage involves the actual distribution of the securities to investors. The underwriter typically creates a syndicate of other investment banks to help distribute the securities. The syndicate members work together to market the securities to potential investors and manage the distribution process. The distribution stage typically lasts for a few days or weeks, depending on the size and complexity of the offering.

Timeline for the Underwriting Process

The duration of each stage in the underwriting process can vary significantly depending on factors such as the size and complexity of the offering, the industry of the issuer, and market conditions. However, a typical timeline for the underwriting process is as follows:

| Stage | Duration |

|---|---|

| Pre-Underwriting | 1-4 weeks |

| Due Diligence | 4-12 weeks |

| Pricing and Structuring | 1-4 weeks |

| Distribution | 1-4 weeks |

Underwriting Methods

The underwriting process involves the assessment and acceptance of risk associated with issuing securities. This crucial step determines whether a company can raise capital through the securities market. Underwriters, acting as intermediaries, play a vital role in this process, connecting companies with investors. They evaluate the issuer’s financial health, market conditions, and potential risks before offering the securities to investors.

The success of the underwriting process depends largely on the chosen underwriting method, each carrying its own risk and reward profile.

Firm Commitment Underwriting

In firm commitment underwriting, the underwriter agrees to purchase the entire issue of securities from the issuer at a predetermined price. The underwriter then assumes the risk of selling these securities to investors at a higher price to make a profit. If the underwriter is unable to sell all the securities at the desired price, they bear the loss.

Risk and Reward

- Risk: The underwriter bears the full risk of not being able to sell the entire issue of securities. This risk is substantial, as the underwriter is responsible for selling the entire issue regardless of market conditions.

- Reward: The underwriter earns a substantial profit if the securities are sold at a higher price than the purchase price. This method also offers the underwriter a significant degree of control over the offering process.

Situations for Firm Commitment

- Strong Issuer: This method is often preferred for companies with a strong financial history, a proven track record, and a solid reputation in the market. The underwriter is more likely to be confident in their ability to sell the securities to investors.

- Large Offering: Firm commitment is typically used for large offerings, as the risk of unsold securities is spread across a larger pool of investors.

- Stable Market Conditions: This method is more suitable in stable market conditions where there is less uncertainty about investor demand.

Best Efforts Underwriting

In best efforts underwriting, the underwriter acts as an agent for the issuer, agreeing to use their best efforts to sell the securities to investors. However, the underwriter is not obligated to purchase the securities themselves. The issuer bears the risk of unsold securities in this method.

Risk and Reward

- Risk: The issuer bears the full risk of unsold securities. If the underwriter fails to sell the entire issue, the issuer may be left with unsold securities and unable to raise the desired capital.

- Reward: The issuer may pay a lower underwriting fee compared to firm commitment underwriting. This method also offers the issuer more flexibility in terms of pricing and timing.

Situations for Best Efforts

- Uncertain Demand: This method is suitable for companies with uncertain investor demand or for offerings where the risk of unsold securities is high.

- Smaller Offerings: Best efforts underwriting is often used for smaller offerings, as the risk of unsold securities is less significant.

- Volatile Market Conditions: This method is more suitable in volatile market conditions where there is significant uncertainty about investor appetite.

Underwriting Agreements

The underwriting agreement is a legally binding contract between the issuer of securities and the underwriter(s). It Artikels the terms and conditions under which the underwriter agrees to purchase and distribute the securities to investors. This agreement is crucial for both parties, ensuring a smooth and successful issuance process.

Key Provisions

The underwriting agreement typically includes several key provisions that define the relationship between the issuer and the underwriter. These provisions aim to protect the interests of both parties and ensure a successful offering.

- Purchase commitment: This clause specifies the underwriter’s obligation to purchase a certain number of securities from the issuer, regardless of market conditions. This commitment helps the issuer secure funding and reduces the risk of a failed offering.

- Underwriting spread: The agreement Artikels the underwriter’s compensation, which is the difference between the price at which the underwriter purchases the securities from the issuer and the price at which they are sold to investors. This spread covers the underwriter’s costs and provides a profit margin.

- Best efforts commitment: In some cases, the underwriter may agree to a “best efforts” commitment, where they will use their best efforts to sell the securities but are not obligated to purchase any unsold shares. This option is often used for smaller or riskier offerings.

- Representations and warranties: The issuer typically provides representations and warranties to the underwriter regarding the accuracy of the information provided in the offering documents. These clauses protect the underwriter from potential liabilities arising from misstatements or omissions.

- Indemnification: The agreement often includes indemnification clauses, where the issuer agrees to compensate the underwriter for any losses incurred due to breaches of representations and warranties or other issues related to the offering.

- Termination rights: Both the issuer and the underwriter may have the right to terminate the agreement under certain circumstances, such as if the offering is delayed or if the market conditions become unfavorable.

Role of the Underwriting Syndicate and Lead Underwriter

The underwriting process often involves a group of underwriters known as an underwriting syndicate. The syndicate is led by a lead underwriter, who manages the process and coordinates the efforts of the other underwriters.

- Lead underwriter: The lead underwriter is typically a large investment bank with extensive experience in underwriting securities. They are responsible for negotiating the terms of the underwriting agreement with the issuer, structuring the offering, and managing the syndicate.

- Underwriting syndicate: The syndicate consists of other investment banks or brokerage firms that agree to participate in the offering by purchasing a portion of the securities. This helps to spread the risk and increase the overall distribution of the offering.

Legal and Financial Implications

The underwriting agreement carries significant legal and financial implications for both the issuer and the underwriter.

- Legal implications: The agreement is a legally binding contract that can result in significant financial penalties for breaches of its terms. Both parties must carefully review and understand the terms of the agreement to avoid potential legal disputes.

- Financial implications: The underwriting agreement can have a significant impact on the financial performance of both the issuer and the underwriter. The issuer’s ability to raise capital depends on the success of the offering, while the underwriter’s profitability is tied to the spread and the performance of the securities in the market.

Pricing and Allocation of Securities

The pricing and allocation of securities are crucial steps in the underwriting process, determining the value at which the securities will be offered to investors and how the available shares will be distributed.

Factors Influencing Security Pricing

Several factors influence the pricing of securities during the underwriting process. These factors are considered by the underwriters to ensure the offering is attractive to investors while protecting the issuer’s interests.

- Market Conditions: The overall state of the financial markets plays a significant role in pricing. A strong market with high investor demand generally supports higher pricing, while a weak market may necessitate lower prices.

- Issuer’s Financial Performance: The issuer’s financial health, including its earnings, debt levels, and future prospects, is a critical factor. A company with strong financials and a promising future can command a higher price for its securities.

- Comparable Companies: Underwriters analyze the pricing of securities issued by comparable companies in the same industry or sector. This helps establish a benchmark for the issuer’s securities.

- Interest Rates: Interest rates significantly impact the attractiveness of fixed-income securities. Higher interest rates can make bonds less appealing, leading to lower pricing.

- Risk Profile: The risk associated with the issuer and its securities is a major factor. Higher-risk companies typically have lower pricing for their securities.

- Demand from Investors: The anticipated demand for the securities from investors is also considered. High demand can support higher pricing.

Methods of Security Allocation

Underwriters use various methods to allocate securities to investors. These methods ensure fairness and efficiency in the distribution process.

- Pro Rata Allocation: This method allocates securities to investors based on the proportion of their total orders relative to the total number of shares offered. It ensures fairness and minimizes potential conflicts of interest.

- Priority Allocation: This method prioritizes certain investors, such as long-term institutional investors or existing shareholders, when allocating securities. It can be used to incentivize certain types of investment or reward loyal investors.

- Over-Allotment Option (Greenshoe): This option allows the underwriters to sell additional shares beyond the initial offering amount. It helps stabilize the price of the securities in the secondary market and protect the issuer from potential price declines.

Oversubscription

Oversubscription occurs when the total demand for securities exceeds the number of shares available in the offering. This situation indicates strong investor interest and can create a competitive environment for allocation.

Oversubscription can lead to a “hot IPO” where the demand for shares significantly outpaces the supply, resulting in a rapid price increase after the initial offering.

- Impact on Allocation: In an oversubscribed offering, underwriters must carefully allocate shares to ensure fairness and minimize investor disappointment. This may involve scaling back orders or prioritizing certain investors.

- Pricing Implications: Oversubscription can also influence the pricing of the securities. High demand can support a higher price, especially if the issuer is confident in its future prospects.

Post-Underwriting Activities

The underwriting process doesn’t end with the initial offering of securities. The underwriter plays a crucial role in ensuring the successful launch and stabilization of the newly issued securities in the market. This involves several post-underwriting activities that are essential for the long-term success of the offering.

Underwriter Responsibilities After the Initial Offering

The underwriter’s responsibilities extend beyond the initial offering. They continue to play a vital role in the market’s success, ensuring a smooth transition for the newly issued securities. * Stabilizing the Market: The underwriter is responsible for stabilizing the market for the newly issued securities. This is crucial, especially during the initial trading period when the market is adjusting to the new offering.

The underwriter can buy or sell securities in the open market to prevent excessive price fluctuations and maintain investor confidence.

Distribution of Securities

The underwriter oversees the distribution of securities to investors. This involves ensuring that the allocation process is fair and transparent and that all investors receive their shares according to the agreed-upon terms.

Reporting and Compliance

The underwriter is responsible for reporting to regulatory authorities about the offering. This includes providing information about the offering process, the pricing of the securities, and the distribution of shares.

Market-Making Activities

In some cases, the underwriter may act as a market maker for the newly issued securities. This involves providing liquidity to the market by buying and selling securities to maintain a stable price and ensure that investors can easily trade their shares.

Providing Investor Relations

The underwriter can provide investor relations support to the issuer. This may involve answering investor inquiries, providing information about the company, and facilitating communication between the issuer and investors.

Underwriter’s Role in Market Stabilization

The underwriter’s role in stabilizing the market is crucial for the success of the offering. They are responsible for preventing excessive price fluctuations and maintaining investor confidence during the initial trading period. * Stabilization Activities: The underwriter can use various stabilization activities to control the price of the securities. This may involve buying shares in the open market to support the price or selling shares to prevent excessive price increases.

Stabilization Agreement

The underwriter may enter into a stabilization agreement with the issuer, which Artikels the specific activities that the underwriter can undertake to stabilize the market.

Green Shoe Option

The underwriter may also have a green shoe option, which allows them to purchase additional shares from the issuer if the price of the securities falls below a certain level. This provides the underwriter with additional flexibility to stabilize the market.

Consequences of Underpricing or Overpricing

Underpricing or overpricing securities can have significant consequences for both the issuer and the investors. * Underpricing: When securities are underpriced, the issuer leaves money on the table, meaning they could have raised more capital at a higher price. This can also lead to a surge in demand for the securities, which can result in a volatile market and make it difficult for investors to buy shares.

Overpricing

Overpricing can lead to a decline in the price of the securities after the offering. This can result in losses for investors who bought shares at the initial offering price and can also damage the reputation of the issuer.

The underwriter’s goal is to find a fair price for the securities that is attractive to investors while also maximizing the proceeds for the issuer.

Regulation and Oversight

Securities underwriting is a critical process in the financial markets, and its integrity is essential for investor confidence and market stability. To ensure that the process is conducted fairly and transparently, a comprehensive regulatory framework governs securities underwriting. This framework aims to protect investors, maintain market integrity, and prevent fraud and abuse.

The Regulatory Framework

The regulatory framework governing securities underwriting is designed to protect investors and ensure the fairness and transparency of the process. It encompasses a wide range of regulations, rules, and guidelines issued by various regulatory bodies, both at the federal and state levels. The Securities and Exchange Commission (SEC) is the primary federal regulator of securities markets in the United States, and its role in overseeing securities underwriting is crucial.

The Role of the SEC

The SEC plays a pivotal role in overseeing the securities underwriting process by:* Establishing rules and regulations: The SEC sets forth comprehensive rules and regulations governing the underwriting process, including requirements for registration statements, prospectuses, and disclosures.

Reviewing and approving registration statements

The SEC reviews registration statements filed by issuers and underwriters to ensure that they comply with all applicable regulations and contain accurate and complete information.

Enforcing compliance

The SEC investigates potential violations of securities laws and regulations, and it can take enforcement actions against underwriters and issuers who engage in illegal or unethical practices.

Promoting investor education

The SEC provides information and resources to investors to help them understand the risks and complexities of securities underwriting and make informed investment decisions.

Transparency and Disclosure

Transparency and disclosure are paramount in securities underwriting. The SEC mandates that issuers and underwriters provide investors with full and accurate information about the securities being offered. This information includes:* The issuer’s financial condition: Investors need to understand the issuer’s financial health and its ability to meet its obligations.

The risks associated with the investment

Investors should be aware of the potential risks and uncertainties associated with the securities being offered.

The terms of the offering

Investors need to understand the key terms of the offering, such as the price, maturity date, and interest rate.

The underwriter’s role and compensation

Investors should be informed about the underwriter’s role in the offering and the compensation they will receive.

Challenges and Risks in Securities Underwriting

Securities underwriting, while a lucrative business, comes with inherent challenges and risks. Underwriters face a multitude of uncertainties, including market volatility, potential legal liabilities, and the risk of not being able to sell the securities to investors. Understanding these challenges and risks is crucial for underwriters to make informed decisions and manage their exposure effectively.

Market Volatility

Market volatility can significantly impact the underwriting process. Fluctuations in interest rates, economic conditions, and investor sentiment can affect the demand for securities, making it difficult to price them accurately. For example, during periods of economic uncertainty, investors may become risk-averse, leading to a decrease in demand for new securities. This can force underwriters to lower the offering price or even cancel the deal altogether.

Underwriting Risk, Which of the following describes the securities underwriting process

Underwriting risk refers to the potential loss that an underwriter may incur if they are unable to sell the securities to investors at the offering price. This risk arises from various factors, including:

- Market conditions: If the market deteriorates after the securities are underwritten, investors may be unwilling to purchase them at the offering price, leading to a loss for the underwriter.

- Issuer’s financial health: If the issuer’s financial condition weakens after the underwriting, the value of the securities may decline, potentially resulting in a loss for the underwriter.

- Legal liabilities: Underwriters can face legal liabilities if they misrepresent or omit material information about the issuer or the securities being offered. This can lead to financial losses and reputational damage.

The securities underwriting process, while complex, is essential for the smooth functioning of the capital markets. It allows companies to access funding and investors to diversify their portfolios. By understanding the intricacies of this process, participants can navigate the market with confidence, ensuring a fair and transparent allocation of capital. This process is not just a transaction; it’s a bridge between innovation and growth, connecting companies with investors and fueling the engine of economic progress.

Query Resolution

What are the key risks associated with securities underwriting?

Underwriters face various risks, including market volatility, underpricing or overpricing of securities, and potential legal liabilities. These risks are inherent to the process and require careful analysis and risk mitigation strategies.

What is the role of the Securities and Exchange Commission (SEC) in securities underwriting?

The SEC plays a crucial role in regulating securities underwriting, ensuring transparency, investor protection, and fair market practices. It oversees the disclosure requirements, registration processes, and overall compliance with securities laws.

How does the underwriting process differ for debt and equity securities?

While the core principles remain similar, the specific stages and considerations can vary depending on whether the securities being underwritten are debt or equity. Debt underwriting involves the issuance of bonds or other debt instruments, while equity underwriting focuses on the issuance of stocks.