How to get SBR tax stamp? It’s a question buzzing around, especially for those navigating the sometimes-tricky world of firearm regulations. This isn’t your grandpa’s paperwork; getting that SBR tax stamp involves navigating the ATF website, understanding specific legal requirements, and assembling a pretty comprehensive application. Think of it as a quest – but instead of a dragon, you’re battling bureaucracy.

We’ll break down each step, from gathering the necessary documents to tracking your application status, ensuring you’re fully equipped to conquer this process.

This guide will walk you through the entire process, covering everything from understanding the application process and navigating the ATF website to meeting legal requirements and tracking your application’s progress. We’ll even address some common pitfalls and FAQs to make sure you’re prepared for anything. So, grab your paperwork, and let’s get started!

Understanding the SBR Tax Stamp Application Process

Securing an SBR (silencer) tax stamp involves navigating a specific process governed by the Bureau of Alcohol, Tobacco, Firearms and Explosives (ATF). Understanding this process, from application to approval, is crucial for responsible firearm ownership. Failure to comply with regulations can lead to delays or rejection of your application.

Required Documentation for SBR Tax Stamp Application

The ATF requires specific documentation to process your application. Incomplete submissions are a common cause of delays. Providing all necessary documents upfront streamlines the process. The core documents include Form 1 (Application for Tax Paid Manufacture/Importation of Firearm), a clear photograph of the firearm, and supporting identification documents. Additional documentation might be required depending on individual circumstances.

For example, if the SBR is being manufactured from parts, additional documentation verifying the legality of the parts may be required.

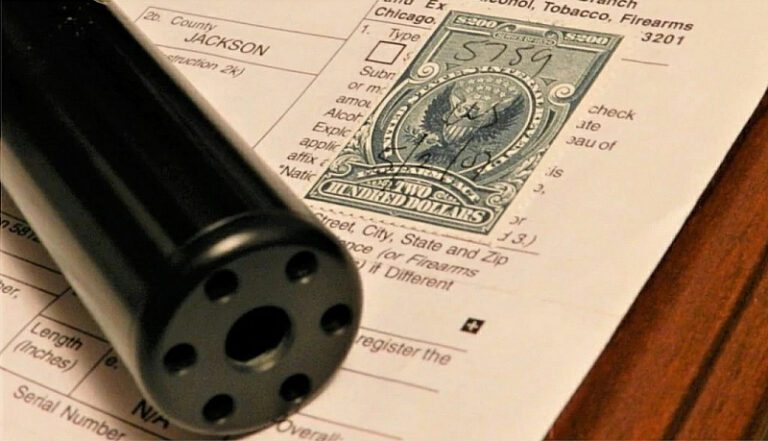

Fees Associated with the SBR Tax Stamp

The application process incurs a non-refundable tax. This fee is set by the ATF and is subject to change. Currently, the tax is $200. It’s crucial to submit the correct amount with your application; insufficient funds will result in processing delays. Additional costs may be associated with things like fingerprint cards, photos, and legal assistance, depending on the applicant’s needs.

For instance, utilizing a third-party service to complete the application or provide legal support will add to the overall expense.

Steps Involved in Applying for an SBR Tax Stamp

The application process for an SBR tax stamp is multi-step. Each step must be followed carefully to avoid errors. First, the applicant must complete Form 1 accurately and completely. This includes providing all necessary information and ensuring that all sections are filled out correctly. Next, the applicant must gather all required documentation and attach it to the completed Form 1.

Then, the applicant must submit the application and payment to the ATF. After submission, the applicant must await the ATF’s review and approval. Finally, upon approval, the applicant will receive their tax stamp. Failure to follow these steps correctly can lead to delays or rejection of the application.

Common Reasons for Application Denials

Application denials for SBR tax stamps often stem from incomplete or inaccurate information. Providing false information is a serious offense and will result in immediate denial. Failure to include all necessary documentation, such as photographs or fingerprints, also leads to rejections. Incomplete or inaccurate Form 1 completion is another common reason for denial. Background checks revealing disqualifying factors, such as prior felony convictions, will also result in denial.

For example, an applicant who fails to disclose a prior felony conviction on their application will likely have their application denied.

Step-by-Step Guide for Completing the Application Form

Completing Form 1 accurately is paramount. Begin by carefully reading all instructions. Then, accurately fill out all personal information sections, ensuring consistency with supporting identification documents. Next, provide a detailed description of the SBR, including manufacturer, model, and serial number. Include clear photographs of the firearm from multiple angles.

Finally, review the completed form thoroughly before submission to ensure accuracy and completeness. Any inconsistencies or missing information will delay processing.

Navigating the ATF Website and Forms: How To Get Sbr Tax Stamp

Successfully navigating the Bureau of Alcohol, Tobacco, Firearms and Explosives (ATF) website and completing the necessary forms is crucial for a smooth SBR tax stamp application process. The ATF website can be initially daunting due to its extensive content and complex legal terminology. However, with a structured approach and understanding of key sections, the process becomes significantly more manageable.

ATF Website Navigation

The ATF website’s structure is organized around various regulatory areas. The section relevant to SBR applications is generally found under “Firearms,” often with sub-categories dedicated to National Firearms Act (NFA) items. Users should prioritize locating the specific page dedicated to NFA tax stamp applications. This page usually provides links to all necessary forms, instructions, and frequently asked questions (FAQs).

A thorough review of the site’s search function can also assist in quickly locating specific documents or information. Understanding the website’s hierarchical structure—from general firearms regulations to specific NFA guidelines—is essential for efficient navigation. Look for clear pathways and utilize the website’s internal search and navigation tools to pinpoint the required forms and information.

Frequently Asked Questions Regarding the Online Application Process

The online application process for an SBR tax stamp involves several steps, each with its own set of potential challenges. Below are answers to frequently asked questions to help clarify common concerns. Understanding these common questions can greatly reduce the stress and confusion associated with completing the application.

- Question: What is the eForms system? Answer: The ATF’s eForms system is the online portal for submitting NFA applications, including SBR tax stamps. It streamlines the application process, allowing for electronic submission and tracking of applications.

- Question: What information is required for the application? Answer: The application requires detailed information about the applicant, including personal details, fingerprints, photographs, and complete details about the firearm being registered as an SBR. Accurate and complete information is crucial for timely processing.

- Question: How long does the application process take? Answer: Processing times vary significantly depending on the ATF’s workload. Applicants should anticipate delays and plan accordingly. While there is no guaranteed timeframe, checking the ATF’s website for current processing times is recommended.

- Question: What happens after submitting the application? Answer: After submission, applicants receive a confirmation number. They can track the application’s status online using this number. The ATF will conduct a background check and review the application’s completeness. Approval or denial will be communicated via mail.

ATF Form Types and Their Purposes

Several forms are involved in the SBR tax stamp application process. Each form serves a distinct purpose, ensuring the ATF receives all the necessary information for review. Using the correct forms and completing them accurately is vital for a successful application.

- Form 1: Used for manufacturing NFA firearms, including SBRs. This form is required if you are constructing the SBR yourself.

- Form 4: Used for the transfer and registration of NFA firearms, including SBRs. This form is used if you are purchasing an SBR from a licensed dealer.

Potential Pitfalls in the Online Application Process and Avoidance Strategies, How to get sbr tax stamp

Several potential pitfalls exist within the online application process. Careful attention to detail and adherence to specific guidelines can significantly reduce the likelihood of encountering these issues.

- Incomplete or Inaccurate Information: Ensure all information provided is accurate and complete. Any discrepancies can lead to delays or rejection.

- Incorrect Document Uploads: Ensure all required documents are uploaded in the correct format and size. Refer to the ATF’s specific guidelines for acceptable file types and sizes.

- Technical Issues: Technical problems can occur. Having a backup plan and ensuring reliable internet access are crucial. If issues persist, contact ATF support immediately.

- Failure to Pay the Tax: Failure to submit the required tax payment will result in application rejection. Verify the correct payment amount and ensure timely submission.

Successfully Uploading Required Documents

The successful uploading of required documents is critical for the application process. The ATF provides specific guidelines regarding acceptable file formats, sizes, and naming conventions. Adhering to these guidelines ensures smooth processing. It’s crucial to carefully review the ATF’s instructions before uploading any documents. Organize your documents ahead of time and ensure they are clearly named and in the correct format to avoid delays or rejection.

For example, photographs should be clear, recent, and meet the specified resolution requirements. Fingerprints must be submitted from a properly licensed and qualified source. These requirements are detailed in the ATF’s guidelines. A test upload of a sample document can help confirm the process is working correctly before uploading all required documentation.

Legal Requirements and Compliance

Possessing a Short Barreled Rifle (SBR) without the proper tax stamp from the Bureau of Alcohol, Tobacco, Firearms and Explosives (ATF) carries significant legal ramifications. Understanding these legal requirements and ensuring strict compliance is crucial for responsible firearm ownership. Failure to comply can result in severe penalties, including substantial fines and imprisonment.

Legal Ramifications of Unregistered SBR Possession

Possession of an SBR without the required tax stamp is a federal crime under the National Firearms Act (NFA). This violation can lead to felony charges, resulting in significant prison time and hefty fines. The severity of the penalties can vary depending on factors such as the individual’s criminal history and the circumstances surrounding the illegal possession. For example, an individual found in possession of an unregistered SBR during a drug raid might face more severe penalties than someone who unknowingly possessed an unregistered firearm inherited from a family member.

Furthermore, the potential for forfeiture of the firearm and other related assets exists. It is imperative to emphasize that ignorance of the law is not a valid defense.

State-Specific Regulations for SBRs

While federal law governs the registration and possession of SBRs, individual states may also have their own regulations. Some states may have stricter laws regarding the types of SBRs permitted or additional licensing requirements. It is the responsibility of the firearm owner to research and understand both federal and state laws applicable to their location. For instance, a state might impose additional background checks or waiting periods beyond the federal requirements.

This necessitates careful examination of both the federal NFA and the relevant state statutes before acquiring or possessing an SBR. Consulting with a legal professional specializing in firearms law is strongly recommended to ensure full compliance.

Penalties for Non-Compliance with SBR Regulations

Penalties for non-compliance with SBR regulations range from significant fines to lengthy prison sentences. The ATF can impose civil and criminal penalties, depending on the nature and severity of the violation. Civil penalties might involve substantial monetary fines, while criminal penalties can lead to felony convictions, imprisonment, and a criminal record. The penalties can be further exacerbated by aggravating factors, such as prior offenses or the involvement of the SBR in a crime.

The potential financial burden, including legal fees and court costs, can also be substantial. The penalties serve as a strong deterrent against non-compliance and underscore the importance of adhering to all applicable regulations.

Correcting Errors on a Submitted Application

If errors are discovered on a submitted SBR tax stamp application, it is crucial to contact the ATF immediately to initiate the correction process. The ATF provides avenues for amending applications, which may involve submitting a corrected form or providing supplemental documentation. Prompt action in correcting errors can prevent delays in processing and avoid potential complications. The specific process for correcting errors will depend on the nature and extent of the mistakes.

The ATF website offers guidance on how to address such situations, and seeking assistance from a firearms attorney is recommended for complex or significant errors. Delaying the correction process can lead to prolonged processing times or even rejection of the application.

Examples of Compliant SBR Modifications and Configurations

Compliance with SBR regulations hinges on adherence to specific modification and configuration guidelines. Modifying an existing firearm to create an SBR requires strict adherence to the NFA’s definition of an SBR, which includes barrel length and overall length restrictions. Examples of compliant modifications might include legally shortening a rifle’s barrel to the permissible length and ensuring the overall length remains within the regulatory limits.

Conversely, non-compliant modifications might involve altering the firearm in a way that violates the NFA’s definitions or regulations. Detailed blueprints and specifications are often required when submitting an application for an SBR, ensuring that all modifications are properly documented and meet legal standards. Consulting with a qualified gunsmith specializing in NFA firearms is highly recommended to ensure compliance.

Preparing for the Application Process

Submitting a successful SBR tax stamp application requires meticulous preparation. Failing to provide complete and accurate information can lead to delays and potential rejection. This section Artikels the key steps to ensure a smooth and efficient application process.

Thorough preparation is paramount to a successful SBR tax stamp application. This involves gathering all necessary documentation, accurately measuring your SBR, and presenting your application in a clear and concise manner. The following steps will guide you through this process.

Application Checklist

A comprehensive checklist ensures you don’t overlook any crucial elements. This minimizes the risk of delays and application rejections. Consider this checklist a roadmap to a successful submission.

- Completed ATF Form 1 (Application for Tax Paid Firearms).

- Two passport-style photographs.

- Accurate measurements of your SBR (detailed below).

- Proof of identity (driver’s license, passport, etc.).

- Proof of residency (utility bill, lease agreement, etc.).

- Payment for the tax stamp.

- Copies of relevant firearm documentation (e.g., bill of sale, manufacturer’s documentation).

- Photographs of the SBR (clear images from multiple angles).

Measuring and Recording SBR Specifications

Accurate measurements are critical for your application. Inaccurate measurements can lead to rejection. Use appropriate measuring tools and record your findings precisely.

The ATF requires specific measurements for your SBR. These typically include overall length, barrel length, and overall weight. Use a high-quality measuring tape and a scale to obtain accurate measurements. Record these measurements in both inches and centimeters. Take multiple measurements and record the average to ensure accuracy.

For example, if three measurements of the overall length are 26.2 inches, 26.1 inches, and 26.3 inches, record the average of 26.2 inches on your application. Similarly, for weight measurements, ensure the scale is properly calibrated before taking measurements. Note that any discrepancies may cause delays or rejection.

Resources for Obtaining Necessary Documentation

Gathering all necessary documentation can sometimes be challenging. Knowing where to look for specific documents saves time and frustration.

- Firearm Manufacturer: Contact the manufacturer of your SBR for any documentation related to the firearm’s specifications and origin.

- Local Law Enforcement: Some local law enforcement agencies may provide assistance in obtaining certain documents or verifying information.

- State and Federal Agencies: Check with relevant state and federal agencies for any required permits or certifications.

- Personal Records: Keep meticulous records of all firearm purchases, modifications, and transfers. This documentation will be essential for your application.

Application Submission Template

A well-structured application improves the efficiency of the review process. Organize your application logically and ensure all information is easily accessible.

While the ATF provides a specific form (Form 1), consider organizing supporting documents in a clear and logical manner. Use a binder or folder to keep everything together. Organize the documents chronologically or by category. Include a cover sheet summarizing the contents. Ensure all pages are clearly numbered.

This organized approach demonstrates professionalism and helps the ATF process your application more efficiently. A poorly organized application can be interpreted as careless and lead to delays.

Communicating with the ATF

Clear and concise communication is vital throughout the application process. Avoid ambiguity and provide all necessary information upfront.

Maintain a professional tone in all communications with the ATF. If you have questions, contact them through official channels and keep records of all correspondence. Be patient and persistent, but avoid excessive or unnecessary contact. Provide clear and concise answers to any requests for additional information. Remember, your goal is to provide them with all the information they need to efficiently process your application.

Proactive and organized communication demonstrates your commitment to compliance and helps expedite the process.

Tracking Your Application Status

Successfully navigating the SBR tax stamp application process requires diligent tracking of your application’s progress. Understanding the various stages and potential delays is crucial for a timely outcome. This section details methods for monitoring your application and addressing any issues that may arise.

Effective tracking minimizes anxiety and ensures you can proactively address any potential problems. A well-defined system allows for timely intervention, preventing unnecessary delays. This involves establishing a clear record-keeping system and understanding the communication channels available for interacting with the ATF.

Application Status Tracking System

Implementing a robust tracking system is paramount. This involves documenting key dates, such as the application submission date, any correspondence received from the ATF, and any follow-up actions taken. A simple spreadsheet or dedicated notebook can suffice, detailing each step of the process. Consider including columns for date, action taken, ATF response (if any), and notes. This organized approach allows for easy identification of potential bottlenecks and facilitates efficient communication with the ATF if needed.

Contacting the ATF

The ATF provides several avenues for inquiring about application status. These include phone, email, and potentially through their online portal (depending on availability and functionality). It’s crucial to have your application’s tracking number readily available when contacting the ATF to expedite the process. Be prepared to provide details about your application, including the date of submission and any relevant correspondence.

Keep detailed records of all communications, including dates, times, and the names of any ATF personnel contacted.

Understanding Application Status Updates

The ATF may provide various status updates throughout the process. These updates could range from simple acknowledgements of receipt to notifications of completion or requests for additional information. Understanding the meaning of these updates is crucial. For instance, a request for additional information requires prompt action to avoid delays. A status indicating “processing” signifies the application is under review, while “approved” signifies the final stage before receiving your stamp.

Knowing what each update means empowers you to react accordingly and manage expectations.

Potential Application Delays and Causes

Delays in the SBR tax stamp application process are common. These can stem from various factors, including incomplete applications, requests for additional information, and the sheer volume of applications processed by the ATF. Backlogs are a frequent cause of delays, and the processing time can fluctuate based on ATF workload and resource allocation. Administrative errors, both on the applicant’s and the ATF’s side, can also contribute to delays.

Understanding these potential causes allows for proactive measures to minimize the risk of delays.

Addressing Application Issues

Effective communication is key to resolving application issues. If you encounter delays or receive a request for additional information, respond promptly and completely. Provide all necessary documentation clearly and accurately. Maintain a professional and courteous tone in all communications. If the issue persists, escalate the matter through the appropriate channels, documenting each step of the process.

Consider seeking assistance from a legal professional specializing in firearms regulations if the issue is complex or unresolved. Examples of effective communication include concise emails summarizing the issue and providing supporting documentation, or formal letters outlining the problem and requesting specific action. Always retain copies of all correspondence.

Post-Approval Procedures

Receiving approval for your SBR tax stamp marks a significant step, but the process isn’t complete until you’ve properly received, stored, and maintained your registration. Understanding post-approval procedures ensures compliance and avoids potential legal complications. This section details the necessary steps to take after ATF approval.

Upon approval, the ATF will mail your tax stamp to the address you provided on your application. This stamp serves as official proof of your registration and must be kept secure and readily accessible for inspection by law enforcement. Failure to possess the stamp when required could result in penalties.

Receiving and Storing the SBR Tax Stamp

The tax stamp will arrive in a standard envelope from the ATF. Carefully inspect the envelope for any signs of tampering. Upon opening, verify that the stamp accurately reflects the information provided on your application. The stamp itself should be treated as a valuable and sensitive document. It should be stored in a secure, fireproof, and preferably waterproof location, separate from the SBR itself.

A dedicated fireproof safe or a safety deposit box are ideal options. Avoid storing it with other important documents, such as passports or birth certificates, to minimize the risk of loss or theft in case of a break-in. Maintaining a detailed record of its location is also recommended.

Responsibilities Associated with Registered SBR Ownership

Possessing a registered SBR comes with legal responsibilities. The owner is legally accountable for the SBR’s safekeeping and proper use, adhering strictly to all applicable federal, state, and local laws and regulations. This includes ensuring the SBR is not transferred or sold without following the proper ATF procedures for transferring ownership. Furthermore, any modifications to the SBR must be reported to the ATF, as Artikeld in the next section.

Improper handling or unauthorized use can result in severe legal consequences.

Maintaining Accurate Records of SBR Ownership and Modifications

Maintaining meticulous records is crucial for demonstrating compliance. This includes keeping a copy of your approved application, the tax stamp itself (stored securely), and any documentation related to modifications or transfers of ownership. It is advisable to maintain a detailed log, noting the date of any modifications, the nature of the modifications, and any supporting documentation such as receipts or invoices.

This log should be stored separately from the tax stamp, ideally in a secure, easily accessible location. Consider using a digital record-keeping system in addition to physical documentation for enhanced security and ease of access.

Reporting Changes in SBR Ownership or Modifications

Any changes in ownership or modifications to your registered SBR require immediate notification to the ATF. Failure to do so is a violation of federal law. The ATF provides specific forms and procedures for reporting these changes. These forms usually require detailed information about the transaction or modification, including dates, parties involved, and a description of the changes.

Retain copies of all submitted paperwork for your records. Delays in reporting these changes can result in significant penalties.

Safe and Secure Storage of SBR Tax Stamp and Related Documentation

Storing the SBR tax stamp and related documentation securely is paramount. A fireproof and waterproof safe, or a safety deposit box at a reputable financial institution, provides the best protection against theft, fire, and water damage. Avoid keeping these documents in easily accessible places, such as a desk drawer or unlocked cabinet. Consider using a combination of physical and digital storage, creating backups of important documents to cloud storage services.

Regularly review your storage methods to ensure continued security and accessibility.

Securing your SBR tax stamp might seem daunting, but with careful planning and a methodical approach, it’s totally achievable. Remember, accuracy and completeness are key to a smooth application process. By following the steps Artikeld in this guide and staying organized, you can confidently navigate the complexities of the ATF regulations and add that SBR to your collection legally and efficiently.

Good luck, and stay safe!

Top FAQs

What happens if my application is denied?

The ATF will usually provide a reason for denial. You can then address the issues raised and reapply.

How long does the whole process take?

Processing times vary, but expect several months. Be patient!

Can I track my application online?

Yes, the ATF website usually offers online tracking once your application is submitted.

What if I make a mistake on my application?

Contact the ATF immediately to explain the error and request guidance on how to correct it. Don’t panic; mistakes happen.

Are there any fees besides the tax stamp?

Potentially, depending on any additional services you might utilize. Check the ATF website for the most up-to-date information.