Are 529 plans municipal securities? Yo, that’s a legit question! 529 plans are like the ultimate college savings plan, and they can totally be used with municipal bonds. Think of it as like a savings account that grows tax-free, and then you can use the money to pay for college, like tuition or room and board. And with municipal bonds, you get that sweet, sweet tax-free interest income, which is like, super awesome for your college fund.

So, yeah, 529 plans can totally be used with municipal securities, and it’s like, a win-win situation for your future self.

These plans are super popular, and there are two main types: state-sponsored and private. State-sponsored plans are run by, you guessed it, the state, and they usually have some pretty sweet benefits, like tax deductions. Private plans are run by investment companies, and they can offer more investment options. But no matter which type you choose, the goal is the same: to save for college and make sure you’re ready to rock that campus life.

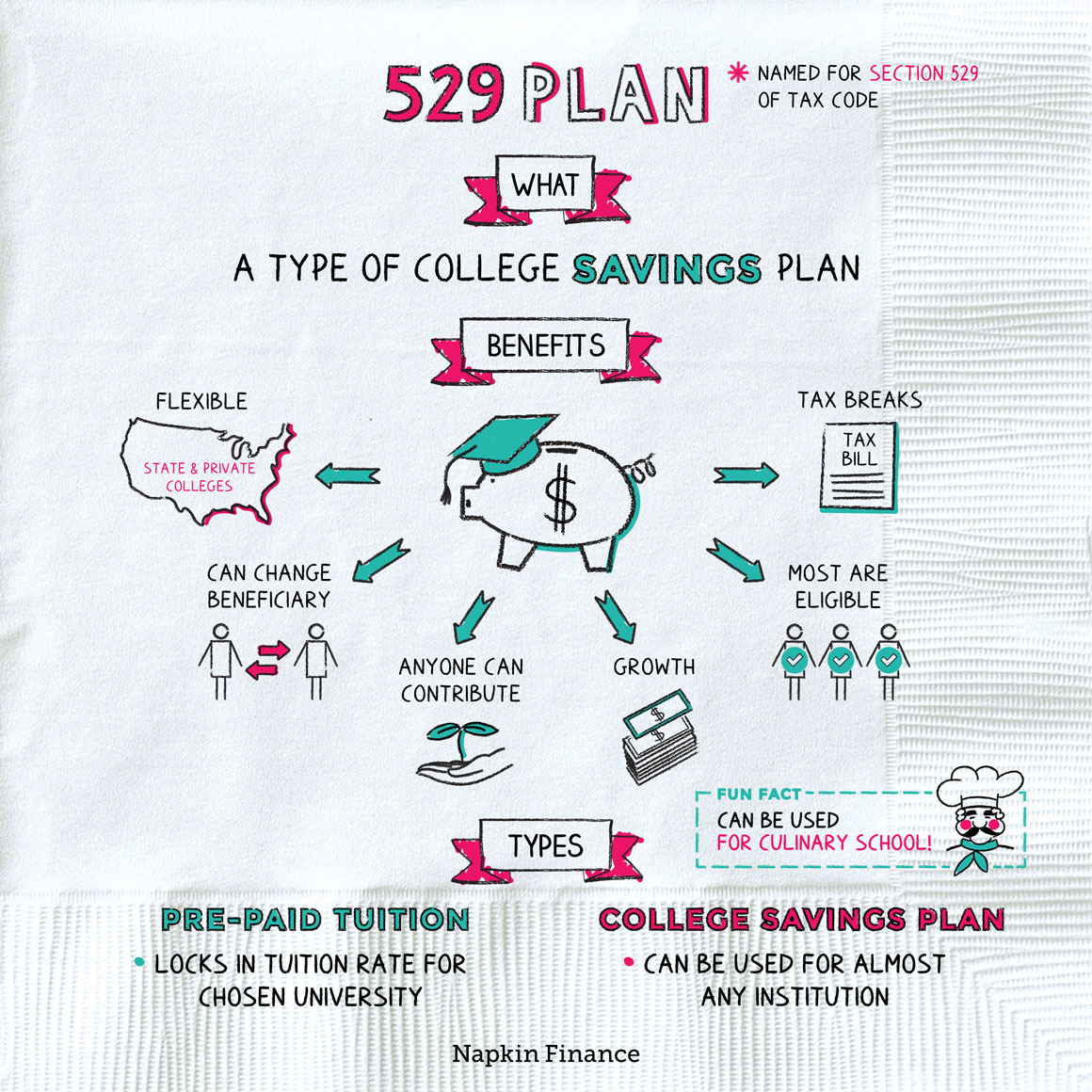

Understanding 529 Plans

plans are a powerful tool for saving for education expenses. They offer significant tax advantages and flexibility, making them an attractive option for families looking to fund their children’s future education. This guide will provide a comprehensive overview of 529 plans, covering their purpose, benefits, types, and tax implications.

Types of 529 Plans

There are two main types of 529 plans: state-sponsored and private. State-sponsored plans are offered by individual states and are typically governed by the state’s laws and regulations. Private 529 plans, on the other hand, are offered by financial institutions, such as banks or investment firms. Both types offer similar benefits, but there are some key differences to consider when choosing the right plan for your needs.

- State-sponsored 529 plans are often more attractive due to potential tax benefits and local investment options. These plans may offer state tax deductions or credits for contributions, and some states may also offer matching programs. However, state-sponsored plans may have limitations regarding investment options and beneficiary changes.

- Private 529 plans offer more flexibility and investment choices, but they may not have the same tax benefits as state-sponsored plans. Private plans are typically managed by financial institutions and offer a wide range of investment options, allowing you to tailor your investment strategy to your risk tolerance and financial goals.

Tax Advantages of 529 Plans

One of the most significant benefits of 529 plans is their tax advantages. These plans offer tax-deferred growth and tax-free withdrawals for qualified education expenses.

- Tax-deferred growth: Earnings on 529 plan investments grow tax-deferred, meaning that you don’t have to pay taxes on the earnings until they are withdrawn. This allows your investments to grow faster, as you’re not paying taxes on the gains along the way.

- Tax-free withdrawals: When you withdraw money from a 529 plan to pay for qualified education expenses, the withdrawals are tax-free. This means you won’t have to pay federal or state income tax on the withdrawals, which can save you a significant amount of money.

Qualified education expenses include tuition and fees, books, supplies, room and board, and other expenses related to attending an eligible educational institution.

Choosing the Right 529 Plan

When choosing a 529 plan, it’s essential to consider several factors, including the plan’s investment options, fees, tax benefits, and beneficiary rules.

- Investment options: The plan’s investment options should align with your risk tolerance and financial goals. Some plans offer a limited number of investment choices, while others offer a wide range of options, including mutual funds, ETFs, and individual stocks.

- Fees: 529 plans typically charge annual fees, which can vary depending on the plan. It’s important to compare fees across different plans to find the most cost-effective option.

- Tax benefits: As mentioned earlier, state-sponsored plans may offer tax deductions or credits for contributions. It’s essential to research the tax benefits available in your state.

- Beneficiary rules: 529 plan beneficiaries can be changed, but there may be limitations or restrictions. It’s important to understand the beneficiary rules before choosing a plan.

Municipal Securities in 529 Plans

Municipal securities, also known as munis, can be a valuable addition to a 529 plan portfolio. They offer tax advantages and can provide diversification benefits.

Tax Advantages of Municipal Bonds

Investing in municipal bonds within a 529 plan offers a unique tax advantage. Interest income earned from municipal bonds is typically exempt from federal income tax. This means that you don’t have to pay taxes on the interest earned from these bonds, which can significantly boost your overall returns.

Potential Returns and Risks

Municipal bonds offer the potential for steady income and capital appreciation, but they also carry some risks.

Potential Returns

- Municipal bonds generally provide lower returns than other types of bonds, such as corporate bonds. However, their tax-free nature can make them attractive for investors in higher tax brackets.

- The interest rates on municipal bonds vary based on factors like the issuer’s creditworthiness, maturity date, and the prevailing interest rates in the market.

Risks

Credit Risk

Municipal bonds are subject to credit risk, which means the issuer might default on their debt obligations.

Interest Rate Risk

Like other bonds, municipal bonds are sensitive to changes in interest rates. If interest rates rise, the value of existing bonds may decline.

Liquidity Risk

Some municipal bonds can be difficult to sell quickly, especially those issued by smaller municipalities.

Call Risk

Some municipal bonds have a call provision that allows the issuer to redeem the bonds before maturity, often at a premium. This can be a risk for investors if they need to reinvest the proceeds at a lower interest rate.

Investment Strategies for 529 Plans with Municipal Securities

Investing in municipal securities within a 529 plan can offer tax advantages and potential diversification benefits. Municipal bonds, also known as munis, are debt securities issued by state and local governments. The interest income from these bonds is typically exempt from federal income tax and, in some cases, state and local taxes. This tax-free advantage can enhance the overall return of a 529 plan portfolio, especially for investors in higher tax brackets.

Potential Investment Strategies

Incorporating municipal securities into a 529 plan portfolio can be achieved through various strategies, each with its own set of considerations:

- Direct Investment in Municipal Bonds: Investors can directly purchase individual municipal bonds through brokerage accounts. This approach offers flexibility in choosing specific bonds based on maturity dates, credit ratings, and interest rates. However, it requires a deeper understanding of the municipal bond market and the ability to manage individual bond holdings.

- Municipal Bond Mutual Funds: These funds provide diversification by investing in a basket of municipal bonds, reducing individual bond risk. They offer professional management and are generally more accessible to investors with limited experience in the bond market.

- Municipal Bond Exchange-Traded Funds (ETFs): ETFs are similar to mutual funds but trade on stock exchanges, offering greater transparency and liquidity. They can provide exposure to specific sectors of the municipal bond market, such as state or local government bonds.

- Target-Date Funds: These funds automatically adjust their asset allocation over time, shifting towards more conservative investments as the beneficiary’s college date approaches. Some target-date funds may include a portion of municipal bonds in their portfolio.

Hypothetical Portfolio Allocation, Are 529 plans municipal securities

A hypothetical 529 plan portfolio might allocate a percentage of its assets to municipal bonds, depending on the investor’s risk tolerance and investment goals. For example, a moderate-risk portfolio could consider the following allocation:

- 60% Equities: This portion could be invested in a diversified mix of stocks, including large-cap, small-cap, and international equities, to capture potential growth opportunities.

- 20% Fixed Income: This portion could be allocated to a combination of municipal bonds and other fixed-income securities, providing stability and income potential.

- 10% Real Estate: Investing in real estate through REITs or other real estate investment vehicles can offer diversification and potential inflation protection.

- 10% Alternative Investments: This portion could be invested in alternative assets such as commodities, private equity, or hedge funds, providing potential diversification and higher returns.

The specific allocation to municipal bonds within the fixed-income portion would depend on factors such as the investor’s tax bracket, the beneficiary’s state of residence, and the desired level of risk.

Potential Municipal Bond Investments

The following table presents a hypothetical example of potential municipal bond investments for a 529 plan, showcasing a range of maturities, credit ratings, and estimated yields:

| Issuer | Maturity Date | Credit Rating | Estimated Yield |

|---|---|---|---|

| City of New York General Obligation Bonds | 2030 | AAA | 3.25% |

| California State University System Revenue Bonds | 2040 | AA+ | 3.50% |

| Texas Department of Transportation Toll Revenue Bonds | 2050 | A+ | 3.75% |

It’s important to note that these are just hypothetical examples, and actual yields and credit ratings may vary. Investors should consult with a financial advisor to determine the most suitable municipal bond investments for their specific circumstances.

Considerations for Choosing Municipal Securities in 529 Plans: Are 529 Plans Municipal Securities

When investing in municipal bonds within a 529 plan, careful consideration should be given to various factors that influence the suitability and potential returns of these investments. These factors include credit risk, maturity, and tax-free interest rates, among others. Understanding these factors is crucial for making informed decisions that align with the long-term financial goals of the beneficiary.

Credit Risk

Credit risk refers to the possibility that the issuer of a municipal bond may default on its debt obligations. Assessing credit risk is paramount in choosing municipal securities, as it directly impacts the safety of your investment.

- Issuer’s Financial Health: Evaluate the issuer’s financial stability by examining its revenue streams, debt levels, and overall financial performance. Stronger financial health indicates a lower risk of default.

- Credit Ratings: Credit rating agencies, such as Moody’s, Standard & Poor’s, and Fitch, assign credit ratings to municipal bonds based on their assessment of the issuer’s creditworthiness. Higher credit ratings, like AAA or AA, signify a lower risk of default.

- Economic Conditions: Economic downturns can negatively impact the financial health of municipalities, potentially leading to higher credit risk. Consider the economic outlook of the region where the bonds are issued.

Maturity

The maturity date of a bond refers to the date when the principal amount is repaid to the bondholder. Maturity affects both the interest rate and the risk associated with the bond.

- Interest Rates: Longer maturities generally come with higher interest rates, as investors require a greater return for tying up their money for a longer period.

- Interest Rate Risk: Bonds with longer maturities are more susceptible to interest rate risk. If interest rates rise after you purchase a bond, the value of your bond may decrease. This is because investors will demand a higher return for similar bonds issued at the higher rates.

- Investment Horizon: Consider the time horizon of your 529 plan when selecting maturity dates. If you anticipate needing the funds sooner, shorter maturities may be more appropriate to mitigate interest rate risk.

Tax-Free Interest Rates

Municipal bonds offer tax-free interest income, which can significantly enhance the after-tax returns of your 529 plan. However, the tax-free nature of the interest income comes with a trade-off.

- Lower Interest Rates: Because municipal bonds offer tax-free interest, they typically have lower interest rates compared to taxable bonds. The tax exemption compensates for the lower return.

- Tax Bracket: The attractiveness of tax-free interest depends on your tax bracket. Higher tax brackets benefit more from the tax exemption, making municipal bonds a potentially more appealing option.

Types of Municipal Bonds

Municipal bonds can be broadly categorized into general obligation bonds and revenue bonds.

- General Obligation Bonds: These bonds are backed by the full faith and credit of the issuing municipality. They are typically considered safer than revenue bonds, as the municipality is obligated to use its general tax revenue to repay the debt.

- Revenue Bonds: These bonds are issued to finance specific projects, such as toll roads, airports, or water treatment plants. Repayment of the debt is dependent on the revenue generated by the project. While revenue bonds may offer higher interest rates, they carry a higher credit risk.

Decision-Making Process Flowchart

[Image: Flowchart showing the decision-making process for choosing municipal bonds for a 529 plan. The flowchart starts with “Investment Goals and Risk Tolerance” and branches out to “Credit Risk Assessment,” “Maturity Selection,” and “Tax-Free Interest Rates.” Each branch further splits into specific factors to consider, ultimately leading to the decision of “Choose Municipal Bonds” or “Consider Other Investment Options.”]

Legal and Regulatory Aspects

Investing in municipal securities within a 529 plan is subject to a specific legal and regulatory framework, encompassing both federal and state laws. Understanding these regulations is crucial for ensuring compliance and maximizing the potential benefits of such investments.

Federal Tax Implications

Federal tax laws play a significant role in the tax implications of investing in municipal securities within a 529 plan. The earnings from municipal bonds are generally exempt from federal income tax, making them attractive for tax-advantaged savings vehicles like 529 plans. This exemption, however, applies only to the federal level.

State Tax Implications

While municipal bonds offer federal tax exemption, state tax implications can vary depending on the issuer of the bond and the state of residence of the 529 plan beneficiary. Some states may offer a tax deduction for contributions to 529 plans, while others may exempt the earnings from state income tax. It is crucial to research the specific tax laws of the state where the beneficiary resides to determine the full tax implications of investing in municipal bonds within a 529 plan.

Risk Considerations

Investing in municipal bonds, like any investment, carries inherent risks. It is essential to thoroughly research and understand these risks before making any investment decisions. Here are some key risks to consider:

- Credit Risk: Municipal bonds are subject to credit risk, meaning the issuer may default on its debt obligations. This risk is influenced by the financial health of the issuing municipality, its ability to generate revenue, and its overall economic outlook.

- Interest Rate Risk: As interest rates rise, the value of existing bonds with fixed interest rates can decline. This is because investors can purchase newly issued bonds with higher interest rates, making older bonds less attractive.

- Inflation Risk: Inflation can erode the purchasing power of bond investments. If inflation rises faster than the interest rate on a bond, the real return on the investment may be negative.

- Liquidity Risk: Some municipal bonds may be less liquid than others, making it difficult to sell them quickly at a fair price. This can be particularly true for bonds issued by smaller municipalities or those with unusual features.

- Call Risk: Some municipal bonds may be callable, meaning the issuer has the right to redeem the bonds before maturity. This can be a disadvantage for investors if interest rates decline after the bonds are issued, as the issuer may call the bonds and issue new ones at a lower interest rate.

Researching Municipal Bond Risks

To mitigate the risks associated with investing in municipal bonds, it is essential to conduct thorough research before making any investment decisions. This research should include:

- Understanding the issuer’s financial health: Examine the issuer’s credit rating, debt levels, revenue sources, and overall economic outlook. Credit rating agencies like Moody’s, Standard & Poor’s, and Fitch Ratings provide independent assessments of the creditworthiness of municipal issuers.

- Analyzing the bond’s terms: Pay attention to the bond’s maturity date, interest rate, coupon structure, and any special features, such as call provisions or sinking funds. Understanding these terms can help you assess the bond’s potential return and risks.

- Considering the bond’s liquidity: Determine how easily the bond can be bought and sold in the market. Bonds issued by larger municipalities or those with more standardized features tend to be more liquid.

- Seeking professional advice: Consult with a qualified financial advisor who specializes in municipal securities to get personalized advice on the risks and potential rewards of investing in municipal bonds within a 529 plan.

So, there you have it! 529 plans are like, a total game-changer when it comes to saving for college. They’re super flexible, and you can invest in all sorts of things, including municipal bonds. And since those bonds give you tax-free interest income, it’s like, a no-brainer! Just remember to do your research and make sure you choose the right plan and investments for your situation.

You got this, dude! Go crush those college dreams!

FAQ Resource

What are the risks of investing in municipal bonds in a 529 plan?

Just like any investment, there are some risks involved. The biggest one is credit risk, which means the issuer of the bond might not be able to pay you back. You also have interest rate risk, which means if interest rates go up, the value of your bonds might go down. But don’t stress, there are ways to mitigate these risks, like investing in bonds with high credit ratings and diversifying your portfolio.

Are there any penalties for withdrawing money from a 529 plan for something other than qualified education expenses?

Yeah, there are some penalties if you use the money for something else. You’ll have to pay taxes on the earnings, and there might be a 10% penalty. But don’t worry, there are some exceptions, like if you’re using the money for certain expenses, like special needs education or apprenticeship programs.

How do I choose the right 529 plan for me?

It depends on your situation, like your state of residence, your income level, and your investment goals. You can check out your state’s plan, as they usually have some pretty good perks. You can also compare plans from different states or look into private plans. It’s like, a whole thing, but it’s worth doing your research to find the best fit for you.