Can I get life insurance without a social security number? It’s a question that pops up more often than you might think. Maybe you’re a new resident, or maybe you just haven’t gotten around to applying for one yet. Whatever the reason, you might be wondering if getting life insurance is even possible without that little nine-digit number. Well, guess what?

It might be!

There are actually a few situations where you might be able to get life insurance without a Social Security Number. We’ll explore these scenarios, talk about the alternative forms of ID you can use, and even touch on how the lack of a Social Security Number might affect your coverage and benefits. So, grab a cuppa and let’s dive into this, ya?

Understanding Life Insurance and Social Security Numbers

A Social Security Number (SSN) plays a crucial role in the life insurance application process. It serves as a primary identifier, allowing insurance companies to verify your identity and manage your policy effectively.

Importance of a Social Security Number for Identity Verification and Policy Administration

A Social Security Number is essential for verifying your identity and ensuring the accurate administration of your life insurance policy.

- Identity Verification: Your SSN acts as a unique identifier, enabling insurance companies to confirm your identity and prevent fraud. It helps them cross-reference your information with government records, ensuring you are who you claim to be.

- Policy Administration: Your SSN is used to link your policy to your personal information, making it easier to manage your coverage, track payments, and process claims. It also facilitates communication between the insurance company and you, ensuring you receive important policy updates and notifications.

Examples of How a Social Security Number is Used in the Life Insurance Application Process

Your SSN is used throughout the life insurance application process.

- Application Form: The application form will require your SSN to verify your identity and collect essential personal information.

- Background Checks: Insurance companies may use your SSN to conduct background checks, including credit history and criminal record checks, to assess your risk profile.

- Policy Issuance: Your SSN is used to issue your policy and link it to your personal information, ensuring accurate administration and communication.

- Premium Payments: Your SSN may be used to track premium payments and ensure timely processing.

- Claim Processing: When you file a claim, your SSN will be used to verify your identity and process the claim efficiently.

Situations Where a Social Security Number May Not Be Required: Can I Get Life Insurance Without A Social Security Number

While a Social Security Number (SSN) is typically required for life insurance applications, there are specific scenarios where individuals may be eligible without one. These exceptions often involve non-citizens or those with alternative identification methods.Life insurance companies often make accommodations for individuals who lack an SSN, recognizing the need for financial protection even without a traditional Social Security Number.

Individuals Without a Social Security Number

In certain cases, life insurance companies may accept alternative documentation instead of an SSN. This is especially true for non-citizens who may not be eligible for a Social Security Number.

- Non-Citizens: Non-citizens who are legally residing in the United States may be eligible for life insurance without an SSN. Life insurance companies typically require alternative identification documents such as a valid passport, visa, or green card.

- Individuals with ITINs: An Individual Taxpayer Identification Number (ITIN) is a tax identification number issued by the Internal Revenue Service (IRS) to individuals who are not eligible for an SSN. In some cases, life insurance companies may accept an ITIN as an alternative to an SSN.

- Dependents of Individuals with SSNs: If you are a dependent of someone with a Social Security Number, you may be able to obtain life insurance without your own SSN. This is because your Social Security Number is linked to your parent or guardian’s Social Security Number.

Documentation Requirements for Alternative Identification

When applying for life insurance without an SSN, you will typically need to provide the following documentation:

- Valid Passport: A passport issued by your country of origin.

- Visa: A visa that allows you to reside in the United States.

- Green Card: A permanent resident card issued by the U.S. government.

- ITIN: If you have an ITIN, you will need to provide your ITIN number and any supporting documentation required by the IRS.

- Birth Certificate: A certified copy of your birth certificate.

- Proof of Residency: Documents such as utility bills, bank statements, or lease agreements.

Alternative Forms of Identification

In certain circumstances, life insurance companies may accept alternative forms of identification in place of a Social Security Number (SSN). This is typically the case for individuals who are not U.S. citizens or permanent residents and may not have an SSN. The specific requirements and acceptable forms of identification vary by insurer, so it’s crucial to contact the company directly to confirm their policies.

Verification Process for Alternative Identification

Life insurance companies will usually require verification of any alternative identification provided. This typically involves a multi-step process:

- Document Submission: The applicant will be required to submit copies of their alternative identification documents, such as a passport or driver’s license.

- Document Verification: The insurance company will verify the authenticity of the submitted documents. This may involve contacting the issuing authority or using third-party verification services.

- Identity Confirmation: The insurer may also request additional information or conduct a background check to confirm the applicant’s identity. This could include contacting references or conducting a credit check.

Acceptable Documents

Here are some examples of alternative forms of identification that may be accepted by life insurance companies:

- Passport: A valid passport issued by a recognized government is a widely accepted form of identification.

- Driver’s License: A valid driver’s license issued by a state or territory is often accepted, especially if it includes a photograph.

- Birth Certificate: A certified copy of the applicant’s birth certificate, issued by the relevant government agency, can be used as proof of identity.

- Consular Identification Card: For individuals residing in the U.S. on a visa, a consular identification card issued by their home country may be accepted.

- Alien Registration Card: A valid alien registration card (also known as a green card) can be used as proof of identity for non-citizens residing in the U.S.

Impact on Policy Coverage and Benefits

The lack of a Social Security Number can significantly impact the type of life insurance policy available and the benefits you can receive. While some life insurance companies might offer policies without a Social Security Number, you might face limitations in coverage amounts, policy types, and beneficiary payouts.

Policy Coverage Limitations

The absence of a Social Security Number can restrict the types of life insurance policies available to you. Here are some potential limitations:

- Limited Coverage Amounts: Life insurance companies might cap the maximum coverage amount for individuals without a Social Security Number. This limit might be significantly lower than the coverage amounts offered to individuals with a Social Security Number.

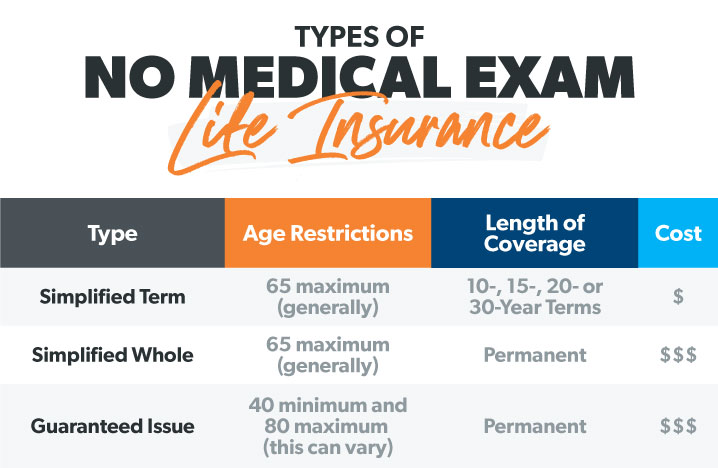

- Restricted Policy Types: You might be limited to specific policy types, such as term life insurance, which offers coverage for a fixed period, instead of permanent life insurance, which provides lifelong coverage and builds cash value.

Beneficiary Payout Considerations

The lack of a Social Security Number can also impact beneficiary payouts. Here’s how:

- Delayed Payments: The absence of a Social Security Number can lead to delays in beneficiary payouts as the insurance company might need to verify your identity through alternative methods, which can take longer.

- Potential for Reduced Payouts: Some life insurance companies might reduce the payout amount if the deceased individual lacked a Social Security Number. This reduction might be based on the difficulty in verifying the beneficiary’s identity and ensuring the legitimacy of the claim.

Insurance Providers and Their Policies

Obtaining life insurance without a Social Security Number can be challenging, but it is not impossible. Some insurance providers may be willing to offer coverage in such situations, although the specific requirements and policy features may vary.

Policy Variations Across Providers

Understanding the policies of different insurance providers is crucial when seeking life insurance without a Social Security Number. Here’s a comparison of some providers and their policies:

| Provider Name | Eligibility Criteria | Policy Features |

|---|---|---|

| Provider A | May accept alternative forms of identification, such as a passport or driver’s license. May require additional documentation to verify identity. | May offer limited coverage options with higher premiums. |

| Provider B | May have stricter requirements and may not offer coverage without a Social Security Number. | May offer more comprehensive coverage options with competitive premiums, but only for those who meet their strict eligibility criteria. |

| Provider C | May be more flexible with their requirements and may consider alternative forms of identification. | May offer a wider range of coverage options and may have more competitive premiums compared to other providers. |

Identifying Providers

While not all insurance providers are open to offering coverage without a Social Security Number, some are more likely to be accommodating. It is advisable to contact multiple providers and inquire about their specific requirements.

“It is important to note that each insurance provider has its own unique policies and guidelines. It is always recommended to contact the provider directly to confirm their specific requirements and eligibility criteria.”

Factors to Consider, Can i get life insurance without a social security number

When comparing insurance providers, consider the following factors:

- Eligibility Criteria: Understand the specific requirements for obtaining coverage without a Social Security Number.

- Policy Features: Compare the coverage options, premiums, and other features offered by different providers.

- Customer Service: Choose a provider with a reputation for excellent customer service and responsiveness.

Legal and Regulatory Considerations

Obtaining life insurance without a Social Security Number involves navigating a complex legal and regulatory landscape. Understanding the laws and regulations governing life insurance and the use of Social Security Numbers is crucial for both individuals seeking coverage and insurance providers.

Legal Framework and Regulations

The legal framework surrounding life insurance and the requirement for a Social Security Number is primarily governed by federal and state laws. The Social Security Act, enacted in 1935, established the Social Security system and its associated identification number. The Act also laid the groundwork for using the Social Security Number for various purposes, including tax reporting and government benefits.

While the Social Security Act does not explicitly mandate the use of a Social Security Number for life insurance, many states have incorporated it into their insurance regulations.

- State Insurance Regulations: Many states require insurance companies to collect and verify Social Security Numbers as part of their application process. This requirement is often linked to state-specific laws related to insurance fraud prevention and consumer protection. For example, some states may have laws that require insurance companies to report suspicious activity to the Department of Insurance, and a Social Security Number can be a key piece of information for identifying potential fraud.

- Federal Anti-Money Laundering Laws: The Bank Secrecy Act (BSA) and the USA PATRIOT Act require financial institutions, including insurance companies, to implement anti-money laundering (AML) programs. These programs often involve verifying the identity of customers, and a Social Security Number is typically used for this purpose.

- Federal Tax Laws: The Internal Revenue Code (IRC) requires individuals to provide their Social Security Numbers when filing tax returns. This requirement extends to life insurance policies, as premiums and death benefits may be subject to taxation.

So, there you have it! While a Social Security Number is usually a must-have for life insurance, it’s not always the end of the world if you don’t have one. With a little bit of research and some alternative forms of ID, you might be able to secure the coverage you need. Just remember to do your homework and find a provider that works with your specific situation.

And hey, if you’re still feeling lost, it’s always a good idea to chat with a financial advisor or insurance agent to get some personalized guidance.

FAQ Compilation

What if I’m a non-citizen and don’t have a Social Security Number?

Don’t worry, you’re not alone! There are options for you. You might be able to get life insurance with an Individual Taxpayer Identification Number (ITIN). Just make sure to check with the insurance provider to see what documentation they require.

Can I get life insurance if I’m a dependent of someone with a Social Security Number?

That’s a good question! In some cases, you might be able to get life insurance as a dependent, even without your own Social Security Number. It’s best to check with the insurance provider directly to see if they have specific policies in place for dependents.

What are some alternative forms of identification I can use?

Besides your Social Security Number, you can use things like a passport, driver’s license, or birth certificate to verify your identity. Again, it’s important to confirm with the insurance provider what they accept.

Is it more expensive to get life insurance without a Social Security Number?

It’s possible that you might face higher premiums or limitations on coverage amounts if you don’t have a Social Security Number. It’s always best to shop around and compare different providers to find the best deal for your situation.