Do You Need Someone’s Social Security Number for Life Insurance? This question arises frequently when individuals seek life insurance, prompting a deeper understanding of the role of Social Security numbers in this process. Life insurance companies utilize Social Security numbers to verify the identity of applicants, ensuring accuracy in determining their age and medical history. This information is crucial for calculating premiums and assessing the risk associated with each policy.

Providing an incorrect or fraudulent Social Security number can have serious consequences, including the denial of coverage or even legal repercussions. Understanding the reasons behind the requirement of Social Security numbers in life insurance applications is essential for navigating this process smoothly and ensuring the validity of your policy.

The Importance of Social Security Numbers in Life Insurance

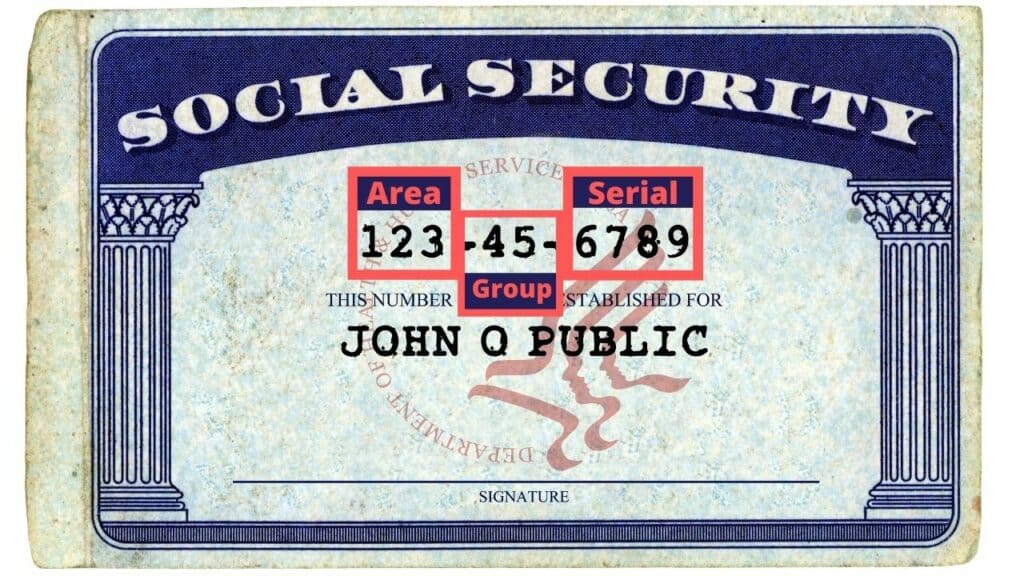

Think of your Social Security number as the key to unlocking your financial identity, especially when it comes to life insurance. It’s not just a random string of numbers; it’s a crucial piece of information that verifies who you are and helps life insurance companies assess your eligibility for coverage.

Verifying Identity

A Social Security number is a fundamental requirement for life insurance applications because it acts as a unique identifier, ensuring that you are who you say you are. It’s like a digital fingerprint, confirming your identity and preventing fraud. Life insurance companies use your Social Security number to cross-reference your information with databases maintained by the Social Security Administration (SSA), verifying your existence and ensuring you’re not a fake applicant.

When Do Life Insurance Companies Require a Social Security Number?: Do You Need Someone’s Social Security Number For Life Insurance

You’re probably wondering, “When exactly do life insurance companies need my Social Security number?” It’s a valid question, and it’s important to understand when and why this information is required. Let’s break down the different stages of the application process where your Social Security number might come into play.

Requirement During the Application Process

Life insurance companies require your Social Security number at various points in the application process. This is not just a formality; it’s a crucial step for verifying your identity, assessing your risk, and ensuring the smooth processing of your application.

- Initial Application: The first time you apply for life insurance, your Social Security number is usually required. This is because it helps the insurance company confirm your identity and begin the process of underwriting. They need to verify who you are and that you’re not a fraudster.

- Underwriting: Once you’ve submitted your application, the insurance company will use your Social Security number to run a background check. This includes checking your credit history and any existing medical records. This helps them assess your risk and determine the appropriate premium for your policy.

- Policy Issuance: Before your life insurance policy can be issued, the insurance company needs your Social Security number to ensure everything is in order and that the policy is being issued to the correct person. This is also necessary for tax reporting purposes.

Situations Where a Social Security Number Is Mandatory

In most cases, providing your Social Security number to a life insurance company is mandatory. It’s a legal requirement for them to verify your identity and assess your risk. Here are some situations where this is particularly important:

- Applying for a large policy: If you’re seeking a significant amount of life insurance coverage, the company will likely require your Social Security number to perform a thorough underwriting process. This is especially true for policies with higher death benefits.

- Policy with a beneficiary: When you designate a beneficiary for your life insurance policy, the insurance company will require your Social Security number to ensure that the correct person receives the death benefit.

Situations Where a Social Security Number May Be Optional

While providing your Social Security number is usually mandatory, there might be situations where it’s optional. For example:

- Small policy amounts: For smaller life insurance policies, some companies may not require your Social Security number if the coverage amount is below a certain threshold. However, this is not always the case, and you should always check with the specific insurer.

- Limited information required: In certain circumstances, the insurance company might be able to verify your identity and assess your risk without needing your Social Security number. This could happen if you have a strong credit history and have provided sufficient alternative identification documents.

Alternative Identification Methods for Life Insurance

Sometimes, life insurance companies may require additional identification documents to verify your identity. These documents are typically used to ensure that the policyholder is who they say they are and that the application is not fraudulent.

Alternative Identification Documents

Here’s a list of common alternative identification documents that life insurance companies may accept:

- Passport: A passport is a globally recognized travel document issued by a government, often considered a strong form of identification.

- Driver’s License: A driver’s license, issued by the state or province, is a widely accepted form of identification.

- Military ID: Military identification cards are issued by the Department of Defense and are considered reliable forms of identification.

- State-Issued ID Card: A state-issued ID card, similar to a driver’s license but without driving privileges, can be used for identification purposes.

- Voter Registration Card: While not as common, a voter registration card can be used as an alternative identification document.

- Utility Bills: Recent utility bills (gas, electricity, water, etc.) with your name and address can be used as proof of residency.

- Bank Statements: Bank statements with your name and address can be used to verify your identity and residency.

- Credit Card Statements: Similar to bank statements, credit card statements can be used for identification purposes.

- Government-Issued Documents: Other government-issued documents, such as a birth certificate or marriage certificate, can be used to verify your identity.

Circumstances for Using Alternative Identification Methods

Life insurance companies may require alternative identification documents in several situations, including:

- Missing or Invalid Social Security Number: If you have a missing or invalid Social Security number, you may need to provide alternative identification documents to prove your identity.

- Foreign Nationals: Foreign nationals who do not have a Social Security number may need to provide alternative identification documents, such as a passport or visa.

- Individuals with Limited Credit History: If you have limited credit history, the life insurance company may require additional documents to verify your identity.

- High-Risk Applications: In cases of high-risk applications, such as those with a history of health problems or a large policy amount, the insurance company may require additional verification.

Suitability of Identification Documents for Life Insurance Applications, Do you need someone’s social security number for life insurance

| Identification Document | Suitability for Life Insurance ||—|—|| Passport | Highly suitable || Driver’s License | Highly suitable || Military ID | Highly suitable || State-Issued ID Card | Suitable || Voter Registration Card | Generally suitable || Utility Bills | Suitable for residency verification || Bank Statements | Suitable for residency and identity verification || Credit Card Statements | Suitable for residency and identity verification || Government-Issued Documents (Birth Certificate, Marriage Certificate) | Suitable for identity verification |

Protecting Your Social Security Number During the Life Insurance Process

Your Social Security number is a crucial piece of information that’s often required for life insurance applications. It’s used to verify your identity, track your application, and determine your eligibility for coverage. However, it’s also a valuable piece of information that can be used for identity theft if it falls into the wrong hands.It’s essential to protect your Social Security number during the life insurance application process, just like you would any other sensitive personal information.

Sharing your Social Security number online or over the phone can expose you to potential risks, so it’s important to be aware of these risks and take steps to protect yourself.

Protecting Your Social Security Number When Applying for Life Insurance

Protecting your Social Security number during the life insurance application process is crucial. It’s like a precious heirloom that needs careful handling. Here’s how you can safeguard it:

- Only Share Your Social Security Number with Reputable Companies: Choose life insurance companies with a strong reputation and a proven track record of protecting customer data. You can check a company’s reputation by reading online reviews or contacting the Better Business Bureau.

- Be Wary of Unsolicited Requests: Never give out your Social Security number to anyone who contacts you unsolicited, even if they claim to be from a life insurance company. If you’re unsure whether a request for your Social Security number is legitimate, contact the company directly to verify.

- Avoid Sharing Your Social Security Number Online: If possible, avoid sharing your Social Security number online. If you must provide it online, ensure the website is secure (look for “https” in the web address and a padlock icon in the address bar).

- Protect Your Documents: Keep all documents containing your Social Security number in a safe and secure location. Shred any documents you no longer need.

- Monitor Your Credit Reports: Regularly check your credit reports for any suspicious activity. This can help you detect identity theft early on.

Understanding Life Insurance Policy Requirements

Navigating the world of life insurance can feel like entering a mystical Balinese temple, filled with intricate details and hidden meanings. To ensure your journey is smooth and rewarding, understanding the specific requirements for each type of life insurance policy is essential. Each policy type has its own set of identification needs, like a unique key unlocking the door to your desired coverage.

Let’s explore the different types of life insurance policies and their corresponding identification requirements.

Identification Requirements for Different Life Insurance Policies

Life insurance policies come in various forms, each designed to meet specific needs. To help you understand these requirements, we’ve compiled a table that Artikels the common identification documents needed for different policy types:| Policy Type | Identification Requirements ||—|—|| Term Life Insurance | Social Security Number, Driver’s License, Proof of Address, Medical Records (for health underwriting) || Whole Life Insurance | Social Security Number, Driver’s License, Proof of Address, Medical Records (for health underwriting) || Universal Life Insurance | Social Security Number, Driver’s License, Proof of Address, Medical Records (for health underwriting) || Variable Life Insurance | Social Security Number, Driver’s License, Proof of Address, Medical Records (for health underwriting), Financial Information (for investment choices) || Indexed Universal Life Insurance | Social Security Number, Driver’s License, Proof of Address, Medical Records (for health underwriting), Financial Information (for investment choices) |Remember, these are general requirements, and specific needs may vary depending on the insurer and policy details.

Always check with your chosen life insurance provider for their specific documentation requirements.

The need for a Social Security number in life insurance applications is rooted in the importance of identity verification and accurate risk assessment. While it is a crucial element in the process, understanding alternative identification methods and safeguarding your Social Security number are essential for a secure and successful application. Ultimately, understanding the nuances of life insurance policy requirements and the role of identification documents ensures a smooth and transparent process, allowing you to secure the financial protection you need for your loved ones.

Common Queries

What happens if I provide an incorrect Social Security number on my life insurance application?

Providing an incorrect Social Security number can lead to delays in processing your application, potential denial of coverage, and even legal consequences. Life insurance companies may investigate discrepancies and take appropriate action.

Can I get life insurance without a Social Security number?

In most cases, a Social Security number is required for life insurance applications. However, certain circumstances may allow for alternative identification methods, such as a passport or driver’s license. It’s best to consult with the insurance company directly to explore available options.

Is my Social Security number safe when applying for life insurance?

Reputable life insurance companies take security measures to protect your personal information, including your Social Security number. However, it’s crucial to be cautious when sharing your Social Security number online or over the phone. Always verify the legitimacy of the company and ensure you’re dealing with a secure platform.