How much food stamps will I get calculator Arkansas? That’s a question many Arkansans ask, and thankfully, understanding the process of determining your Supplemental Nutrition Assistance Program (SNAP) benefits isn’t as daunting as it might seem. This guide breaks down the eligibility criteria, factors influencing your benefit amount, and – ideally – how to use an online calculator (if one exists for Arkansas) to estimate your potential SNAP benefits.

We’ll explore income limits, asset limits, household size, and other crucial factors that play a role in the calculation.

Navigating the SNAP application process can feel overwhelming, but with a clear understanding of the rules and resources available, you can confidently apply for the assistance you need. We’ll cover everything from the necessary documentation to the appeals process, ensuring you have the information you need to successfully navigate the system. Remember, seeking help is a sign of strength, not weakness.

Understanding Arkansas Food Stamp Eligibility

Navigating the Supplemental Nutrition Assistance Program (SNAP), often referred to as food stamps, in Arkansas requires understanding specific eligibility criteria. These criteria encompass income limits, asset limits, and required documentation, all of which impact an applicant’s chances of receiving benefits. This overview clarifies the process and provides examples to illustrate potential scenarios.

Income Limits and Asset Limits

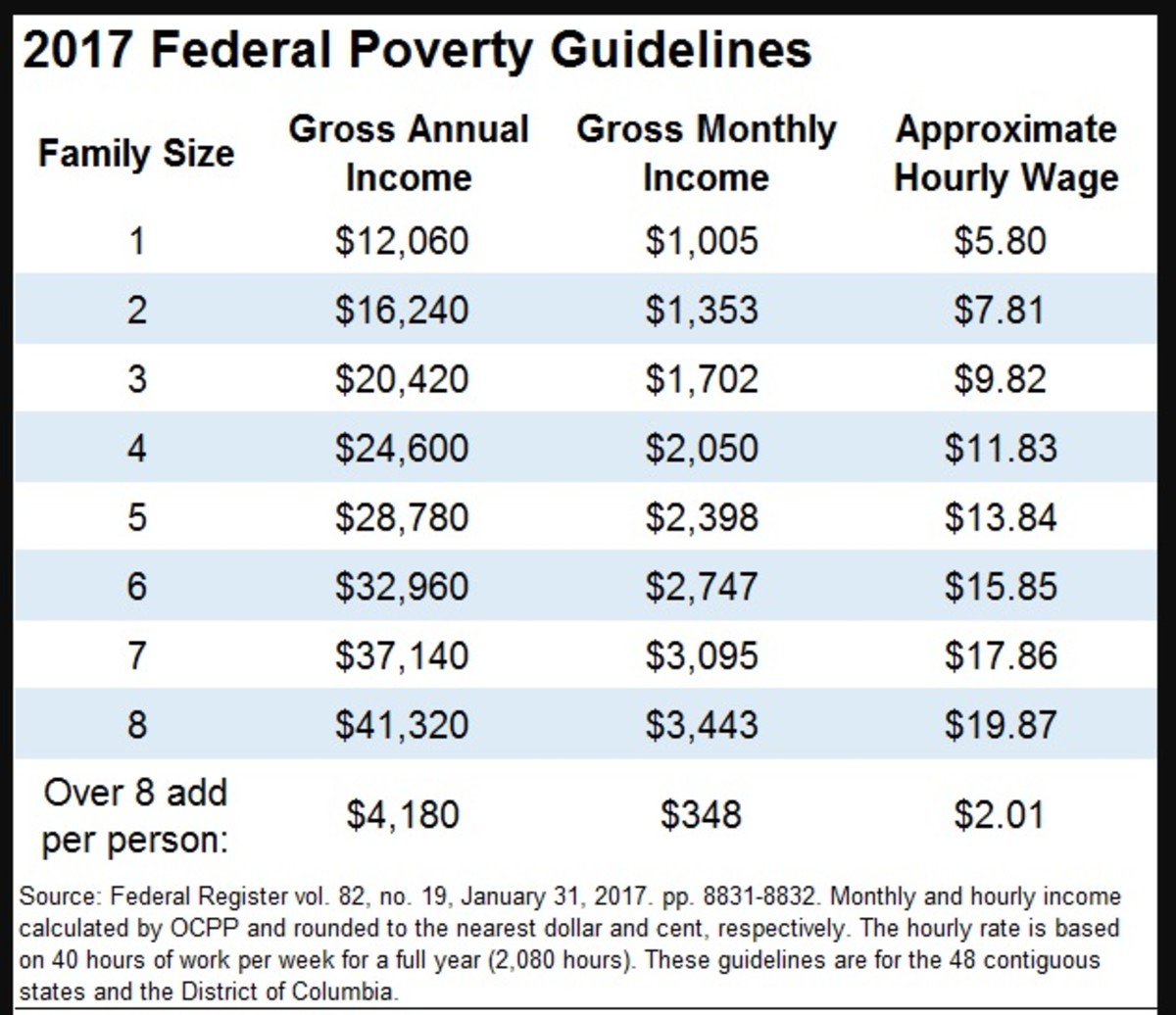

Arkansas’s SNAP program adheres to federal guidelines while incorporating state-specific adjustments. Income limits are crucial determinants of eligibility, varying significantly based on household size and composition. Similarly, asset limits restrict the amount of savings and other assets an individual or household can possess while still qualifying for benefits. Exceeding these limits can result in ineligibility or reduced benefit amounts.

| Household Size | Gross Monthly Income Limit (Example) | Net Monthly Income Limit (Example) | Asset Limit |

|---|---|---|---|

| Single Person | $1,694 | $1,355 | $2,250 |

| Couple | $2,283 | $1,826 | $3,000 |

| Family of Four | $3,442 | $2,754 | $3,750 |

*Note: These are example figures and are subject to change. Applicants should consult the official Arkansas Department of Human Services website for the most current and accurate data.* Gross income includes all sources of income before taxes and deductions, while net income represents income after deductions. Asset limits generally refer to the value of bank accounts, stocks, and other liquid assets.

Required Documentation

Applying for SNAP benefits in Arkansas necessitates providing specific documentation to verify eligibility. This documentation serves to substantiate income, household composition, and other relevant details. Incomplete or inaccurate documentation can delay or even prevent the approval of benefits.The Arkansas Department of Human Services typically requests the following: proof of identity for all household members (such as birth certificates or driver’s licenses); proof of address (such as a utility bill or lease agreement); documentation of income for the past three months (such as pay stubs, bank statements, or tax returns); and documentation of any other assets.

Applicants may also need to provide proof of expenses such as medical bills or child care costs.

Situations Affecting Eligibility

Several circumstances can significantly influence SNAP eligibility in Arkansas. For example, unemployment can reduce income and increase the likelihood of qualification. Conversely, unexpected income fluctuations, such as a sudden inheritance, could impact eligibility.Individuals with disabilities may qualify for higher income limits or exemptions from certain asset limits. Similarly, substantial medical expenses can be considered when determining eligibility, as they can significantly impact a household’s ability to meet basic needs.

For instance, a family facing significant medical bills for a chronically ill child might qualify for higher benefits than a family with comparable income but no such expenses. These are just a few examples, and the specific impact of each situation will be determined on a case-by-case basis by the Arkansas Department of Human Services.

Factors Affecting Benefit Amount

The amount of Supplemental Nutrition Assistance Program (SNAP) benefits an Arkansas household receives isn’t a fixed number; it’s dynamically calculated based on several key factors. Understanding these factors is crucial for accurately determining potential eligibility and benefit levels. This section details the major influences on SNAP benefit calculations in Arkansas.

Household Size and SNAP Benefits

Household size is a primary determinant of SNAP benefit levels. Larger households generally receive higher benefits to reflect their increased food needs. The calculation considers each member of the household, including adults and children, and applies a standardized formula to estimate the monthly food costs for that household size. For instance, a household of four will receive a substantially larger benefit than a household of one, reflecting the greater expense of feeding multiple individuals.

The precise benefit amount is further adjusted based on other factors, as discussed below.

Gross Income Versus Net Income

Arkansas, like other states, uses both gross and net income to assess SNAP eligibility and determine benefit amounts. Gross income represents total income before taxes and deductions, while net income is income after taxes and other allowable deductions. Both are important. While gross income is used to initially screen for eligibility, net income plays a more significant role in calculating the final benefit amount.

Households exceeding the gross income limits are generally ineligible, but those below the gross income limit have their net income considered to determine the precise benefit level. The difference between gross and net income can be substantial, particularly for households with significant deductions for taxes, childcare, or medical expenses.

Other Influencing Factors

Beyond household size and income, several other factors can impact the final SNAP benefit calculation. Housing costs, for example, can significantly influence eligibility and benefit amounts. Arkansas may consider a portion of a household’s housing costs when determining their net income for SNAP purposes. Similarly, unusually high medical expenses can be factored into the calculation, potentially reducing the net income and increasing the benefit amount.

Other factors might include the household’s age and disability status, with certain vulnerable populations potentially receiving increased benefits.

Maximum SNAP Benefit Amounts by Household Size, How much food stamps will i get calculator arkansas

The following table illustrates approximate maximum SNAP benefit amounts for various household sizes in Arkansas. It’s crucial to understand that these are maximums, and the actual benefit received will depend on the household’s income and other factors mentioned above. These figures are subject to change, so it is always best to consult the official Arkansas Department of Human Services website for the most up-to-date information.

| Household Size | Gross Income Limit (Approximate) | Net Income Limit (Approximate) | Maximum Benefit Amount (Approximate) |

|---|---|---|---|

| 1 | $1,000 | $700 | $200 |

| 2 | $1,500 | $1,050 | $350 |

| 3 | $2,000 | $1,400 | $500 |

| 4 | $2,500 | $1,750 | $650 |

Using an Online Calculator (if available)

Determining the precise amount of SNAP benefits an Arkansas household will receive requires careful consideration of several factors. While a dedicated, publicly available online calculator specifically designed for Arkansas SNAP benefit calculation doesn’t appear to exist, understanding the eligibility criteria and calculation methodology allows for a reasonably accurate manual estimation. This section details the process of manual calculation, simulating the functionality of a hypothetical online calculator.Arkansas utilizes a formula based on household size, gross income, and allowable deductions.

This formula is complex and necessitates careful data input to avoid errors. The following steps illustrate a manual calculation, providing a framework that mirrors the functionality a hypothetical online calculator would offer.

Manual SNAP Benefit Calculation in Arkansas

Accurate calculation of SNAP benefits requires precise data input reflecting the household’s circumstances. Errors in data entry can significantly affect the calculated benefit amount. The following steps Artikel a manual calculation, mimicking the process a hypothetical online calculator would follow.

- Determine Household Size and Composition: This includes all individuals residing in the household and their relationship to the head of household (spouse, child, parent, etc.). For example, a household might consist of two adults and one child.

- Calculate Gross Monthly Income: This includes all income from all sources for all household members, such as wages, salaries, self-employment income, unemployment benefits, and Social Security. Suppose the gross monthly income for the example household is $2,500.

- Determine Allowable Deductions: Several deductions reduce gross income to arrive at net income. These include standard deductions based on household size, dependent care costs, medical expenses, and potentially others. The standard deduction varies depending on household size and is defined by the USDA. Assume, for our example, a standard deduction of $175 and no other allowable deductions.

- Calculate Net Income: Subtract allowable deductions from gross income. In our example: $2,500 (Gross Income)

$175 (Standard Deduction) = $2,325 (Net Income).

- Apply the Net Income Limitation: Arkansas, like other states, has net income limits for SNAP eligibility. If the net income exceeds these limits, the household is ineligible. Let’s assume, for our example, that the net income limit for a three-person household is $2,500. In this case, the household is eligible.

- Determine the Benefit Allotment: This step involves using the USDA’s formula for calculating the maximum SNAP benefit based on household size and net income. The formula is complex and involves several variables; however, for our example, let’s assume that based on the net income and household size, the maximum benefit is $400.

Hypothetical Online Calculator Simulation and Discrepancy Analysis

While a dedicated Arkansas SNAP online calculator is not readily available, we can simulate its functionality. A hypothetical calculator would require fields for household size, income sources, and deductions. Inputting our example data (two adults, one child; $2,500 gross monthly income; $175 standard deduction) into such a calculator would ideally yield a result similar to the manual calculation – approximately $400 in monthly SNAP benefits.

Any discrepancies would likely stem from differences in interpretation of the USDA guidelines or rounding errors in the calculator’s algorithms. Precisely replicating the USDA’s formula within a simplified online calculator is challenging, and minor variations are possible. Significant discrepancies, however, would indicate an error in either the manual calculation or the hypothetical online calculator’s programming.

Accessing Resources and Support

Navigating the Arkansas SNAP (Supplemental Nutrition Assistance Program) system requires understanding the available resources and support mechanisms. This section details how to contact the administering agency, apply for benefits, and address potential challenges in the application process. Clear communication and efficient access to information are crucial for successful SNAP application and benefit receipt.Applying for and receiving SNAP benefits in Arkansas involves several steps and potential points of contact.

The Arkansas Department of Human Services (DHS) manages the state’s SNAP program, offering multiple avenues for application and support. Understanding these options and knowing where to find assistance is key to maximizing access to this vital program.

Arkansas Department of Human Services Contact Information

The Arkansas Department of Human Services (DHS) is the primary contact for all SNAP-related inquiries in Arkansas. Their website, arhds.org, provides comprehensive information, including online application portals, eligibility criteria, and contact details for local offices. Individuals can find their local office contact information through the DHS website’s office locator tool. Phone support is also available, though specific numbers may vary depending on the region and specific needs.

Generally, contacting the main DHS number will connect individuals to the appropriate department or local office. It’s advisable to check the DHS website for the most up-to-date contact information, including phone numbers and addresses for local offices.

SNAP Application Process

Arkansas offers multiple ways to apply for SNAP benefits. Applicants can apply online through the Access Arkansas portal, a streamlined online application system managed by the DHS. This online method is often the most convenient and efficient. Alternatively, applications can be submitted via phone by contacting the DHS directly and following their instructions. This method is suitable for individuals who lack internet access or prefer phone-based communication.

Finally, in-person applications are possible at local DHS offices. This option allows for direct interaction with caseworkers and assistance with completing the application. Regardless of the application method chosen, applicants will need to provide documentation verifying their identity, income, and household composition.

Frequently Asked Questions Regarding SNAP Benefits in Arkansas

Understanding common questions surrounding SNAP benefits is crucial for a smooth application process. The following Q&A section addresses frequently encountered issues.

Q: What documents are needed to apply for SNAP benefits?

A: Required documents typically include proof of identity, income verification (pay stubs, tax returns), proof of residency, and information about household members. Specific requirements may vary, so it’s essential to check the DHS website or contact a local office for the most current information.

Q: How long does it take to receive SNAP benefits after applying?

A: Processing times can vary but generally range from a few weeks to several months, depending on the volume of applications and the completeness of the submitted documentation.

Q: What happens if my SNAP application is denied?

A: Applicants have the right to appeal a denial. The DHS website provides detailed information on the appeals process, including deadlines and necessary steps.

Q: Can my benefits be reduced or terminated?

A: Yes, benefits can be adjusted based on changes in income, household size, or other relevant factors. Notification of any changes will be provided, and there is a process for appealing these decisions.

Appealing a SNAP Benefit Denial or Reduction

If a SNAP application is denied or benefits are reduced, applicants have the right to appeal the decision. The appeals process involves submitting a formal request for reconsideration, outlining the reasons for disagreement with the initial determination. This request should include any supporting documentation that contradicts the DHS’s decision. The DHS will review the appeal and issue a final decision.

If the appeal is unsuccessful, further legal avenues may be available. Detailed instructions and forms for the appeals process are accessible on the DHS website. It’s crucial to understand the timeframe for filing an appeal to ensure timely processing of the request.

Illustrative Examples

Understanding the application process for Arkansas SNAP benefits is best illustrated through concrete examples. These scenarios demonstrate how income, expenses, and household size impact the final benefit amount. While specific benefit calculations require using the official Arkansas Department of Human Services (DHS) guidelines and tools, these examples provide a general understanding of the process.

Single Adult SNAP Application

Consider a single adult, John, aged 30, working part-time earning $1,200 per month. His monthly rent is $600, and he spends approximately $200 on utilities and transportation. His net income after taxes is $1,000. Applying the Arkansas SNAP eligibility guidelines (which would need to be checked for the most up-to-date information), a portion of his income would be deducted to determine his net income eligible for SNAP benefits.

His expenses are also factored into the calculation. After deducting allowable expenses from his net income, the resulting figure would then be compared to the maximum SNAP benefit for a single person in Arkansas. This process would determine the amount of SNAP benefits John receives, if any. This process can vary slightly depending on specific expenses and current DHS guidelines.

Family of Four SNAP Application

Let’s consider a family of four: two parents, Mary and David, and two children. Mary earns $2,500 per month as a teacher, and David earns $1,800 per month working in construction. Their combined net monthly income, after taxes, is $3,800. Their monthly expenses include $1,200 for mortgage, $300 for utilities, $400 for transportation, and $800 for childcare. Similar to John’s case, their net income would be adjusted based on allowable deductions.

The difference between their adjusted net income and the maximum allowable income for a family of four would determine their potential SNAP benefit. A family with a higher income and lower expenses would receive a smaller benefit than a family with a lower income and higher expenses. The precise benefit amount depends entirely on the current Arkansas DHS guidelines and the specific financial situation of the family.

Visual Representation of Benefit Calculation

A hypothetical chart illustrating the relationship between income and SNAP benefit amount would have “Monthly Net Income After Allowable Deductions” on the horizontal (x) axis and “Monthly SNAP Benefit Amount” on the vertical (y) axis. The chart would show a downward-sloping line, starting at the maximum benefit amount (for zero income) and gradually decreasing to zero at the maximum allowable income.

Data points could be plotted representing various income levels and their corresponding benefit amounts, demonstrating a clear inverse relationship. The line would likely be segmented to reflect different eligibility thresholds and benefit reduction rates, reflecting the progressive nature of the SNAP benefit system. For example, a data point might show a net income of $1,500 corresponding to a benefit of $200, while another data point at $3,000 might show a benefit of $50, illustrating the reduced benefits as income increases.

It’s crucial to remember this is a hypothetical illustration, and the actual data would be determined by the official Arkansas DHS guidelines and benefit calculation methodology.

So, figuring out your potential Arkansas food stamp benefits involves understanding eligibility, considering various factors affecting the benefit amount, and – ideally – utilizing an online calculator or following a manual calculation process. While the process might seem complex at first glance, breaking it down into manageable steps makes it far more approachable. Remember to utilize the available resources and don’t hesitate to contact the Arkansas Department of Human Services for assistance.

Knowing your rights and accessing available support are crucial steps toward securing the nutritional assistance you deserve.

Popular Questions: How Much Food Stamps Will I Get Calculator Arkansas

What happens if my application for SNAP benefits is denied?

You have the right to appeal the decision. The Arkansas Department of Human Services will provide information on the appeals process.

How often are SNAP benefits reviewed?

Benefit amounts are typically reviewed periodically, often annually, to ensure they align with your current circumstances. You may be required to re-certify your eligibility.

Are there any penalties for providing inaccurate information on my application?

Yes, providing false information can lead to penalties, including the loss of benefits and potential legal consequences.

Can I get SNAP benefits if I’m working part-time?

Yes, employment status is considered, but it doesn’t automatically disqualify you. Your income will be assessed against the eligibility limits.

:max_bytes(150000):strip_icc()/treatment-for-panic-disorder-2584322_color_text_v2-b5c749e9eed846be8a54fba8382b4771.png?w=700)