How to issue a 1099 without social security number? It’s a question that can send shivers down the spine of even the most seasoned tax professional. Imagine trying to explain to the IRS that you paid someone a hefty sum without knowing their social security number. It’s like trying to navigate a maze blindfolded, but with the added pressure of potential penalties.

Don’t worry, though, because this guide will be your trusty flashlight, illuminating the path to a compliant 1099 issuance, even in the absence of a social security number.

Many situations arise where a payee might not have a social security number, such as non-resident aliens or businesses. But fear not, there are alternative identification methods, such as ITINs (Individual Taxpayer Identification Numbers) and foreign tax identification numbers, that can be used in these situations. Think of them as secret codes that unlock the door to a smooth 1099 process.

We’ll explore these alternative identification methods, delve into the procedures for obtaining and verifying them, and guide you through completing the 1099 form without a social security number. So, buckle up and get ready for a tax-filled adventure!

Understanding the Requirements for Issuing a 1099

Issuing a 1099 form is a crucial aspect of tax compliance for businesses that pay independent contractors or other non-employees. It’s a way to accurately report income paid to these individuals and ensure both the payer and payee are fulfilling their tax obligations.

Legal Requirements for Issuing a 1099, How to issue a 1099 without social security number

The Internal Revenue Service (IRS) mandates the issuance of 1099 forms under specific circumstances. It’s important to understand these legal requirements to ensure accurate reporting and avoid potential penalties.

- Income Threshold: The IRS has established a threshold for income paid to independent contractors that triggers the requirement to issue a 1099 form. If a business pays an individual $600 or more during the tax year, it must issue a 1099-NEC form. This threshold applies to payments for services, including but not limited to, consulting, freelance work, and contract labor.

- Type of Payment: The requirement to issue a 1099 form applies to various forms of payment, including cash, checks, credit card payments, and electronic payments. It’s essential to track all payments made to independent contractors, regardless of the payment method.

- Non-Employee Status: The 1099 form is specifically for payments made to individuals who are not employees of the business. This includes independent contractors, freelancers, sole proprietors, and partnerships.

Importance of Accurate Reporting

Accurate reporting of income paid to independent contractors is crucial for both the payer and payee.

- Payer Compliance: By accurately reporting income paid to independent contractors, businesses fulfill their tax obligations. Failure to do so can result in significant penalties and fines from the IRS.

- Payee Compliance: The 1099 form serves as a record of income earned by independent contractors. This information is essential for them to accurately report their income on their tax returns and avoid any potential underreporting or overreporting issues.

- Record Keeping: Issuing and receiving 1099 forms provides a comprehensive record of payments made to independent contractors. This documentation can be valuable for both parties in case of audits or disputes.

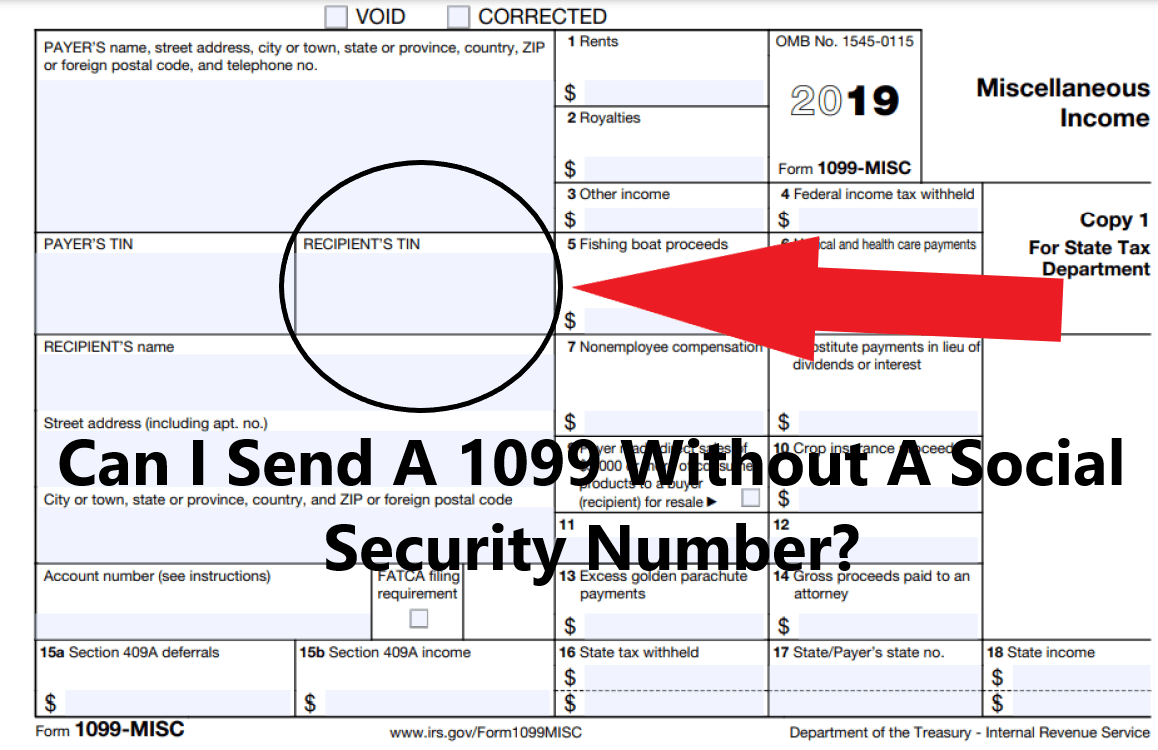

Essential Information for Completing a 1099 Form

To ensure accurate and complete reporting, it’s essential to gather the necessary information about the independent contractor before completing the 1099 form.

- Name and Address: The 1099 form requires the full name and address of the independent contractor. It’s important to verify this information for accuracy.

- Taxpayer Identification Number (TIN): The independent contractor’s TIN, which is either their Social Security number or Employer Identification Number (EIN), is required on the 1099 form.

- Amount Paid: The total amount paid to the independent contractor during the tax year must be accurately reported on the 1099 form. This includes all payments, regardless of the method used.

- Type of Payment: The type of payment made to the independent contractor, such as services, goods, or both, should be clearly indicated on the 1099 form.

Situations Where a Social Security Number May Not Be Available

Sometimes, you might need to issue a 1099 to someone who doesn’t have a Social Security Number (SSN). This can happen for various reasons, like when you’re dealing with non-resident aliens or certain types of businesses. In these cases, you’ll need to use alternative identification methods.

Alternative Identification Methods

When a payee doesn’t have an SSN, you can use alternative identification methods to report their income. These methods are designed to comply with tax regulations and ensure accurate reporting.

- Individual Taxpayer Identification Number (ITIN): An ITIN is a nine-digit number issued by the IRS to individuals who are required to have a U.S. tax identification number but aren’t eligible for an SSN. This is often used by non-resident aliens, foreign students, and certain other individuals. You can request an ITIN through the IRS using Form W-7.

- Foreign Tax Identification Number: Foreign tax identification numbers are used by businesses and individuals who reside outside the U.S. They are similar to ITINs and are used to identify taxpayers in their home country. The specific format and requirements for foreign tax identification numbers vary depending on the country of origin.

Obtaining and Verifying Alternative Identification Numbers

It’s important to obtain and verify alternative identification numbers properly. This ensures accurate reporting and compliance with tax laws.

- Obtain the Number from the Payee: Request the payee to provide their ITIN or foreign tax identification number. They should be able to provide this information directly or can obtain it through the relevant authorities in their country.

- Verify the Number with the IRS: You can verify the ITIN with the IRS through their online verification tool or by contacting them directly. For foreign tax identification numbers, you may need to contact the tax authorities in the payee’s country of residence.

Remember, it’s crucial to keep accurate records of all alternative identification numbers used for 1099 reporting. This helps you comply with tax regulations and avoid any potential penalties.

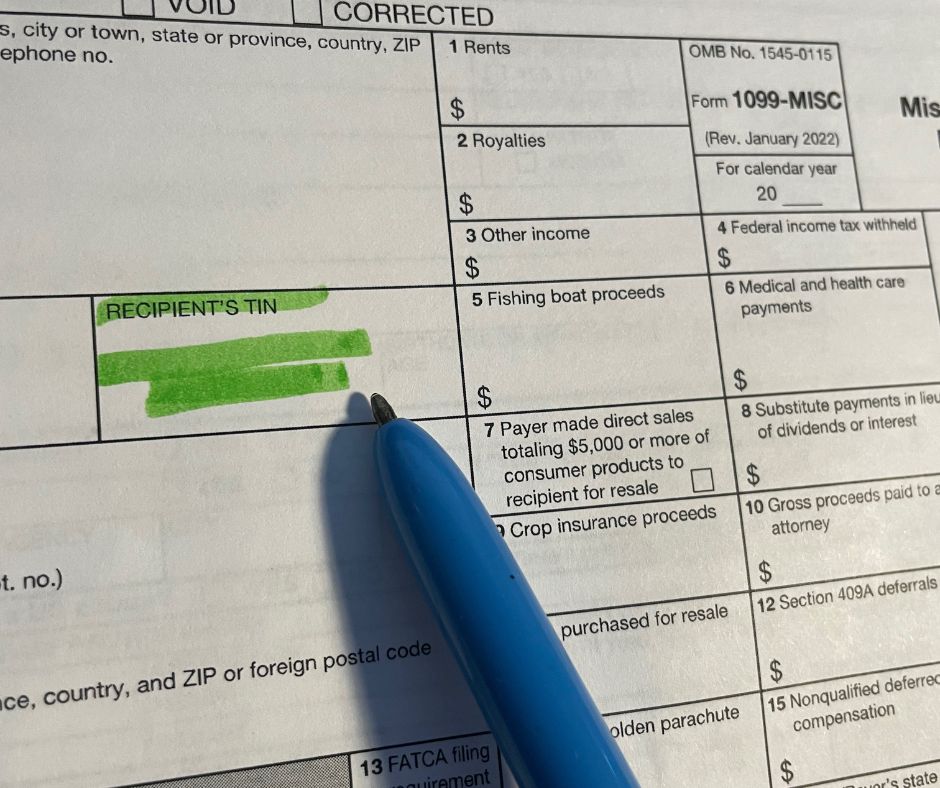

Completing the 1099 Form Without an SSN

If you’re required to issue a 1099 form to a payee who doesn’t have a Social Security Number (SSN), don’t panic! You can still complete the form using an alternative identification number. This guide will walk you through the process step-by-step.

Entering Payee Information

When a payee lacks an SSN, you’ll need to provide their name, address, and an alternative identification number on the 1099 form. This information is crucial for accurate reporting and tax compliance.

- Payee Name: Enter the payee’s full legal name as it appears on their official identification documents, like a passport or driver’s license.

- Payee Address: Input the payee’s complete mailing address, including street address, city, state, and zip code. This ensures the 1099 form reaches the correct recipient.

- Alternative Identification Number: Instead of an SSN, you’ll need to use an alternative identification number. Common alternatives include an Individual Taxpayer Identification Number (ITIN), an Employer Identification Number (EIN), or a foreign tax identification number. The specific type of number will depend on the payee’s circumstances and their tax residency status.

Reporting Payment Details

After entering the payee’s information, you’ll need to accurately report the type and amount of payment made to the payee.

- Type of Payment: Indicate the specific type of payment made to the payee. This could include payments for services, rent, royalties, or other forms of income. The 1099 form has specific boxes for different types of payments.

- Amount of Payment: Enter the total amount of payment made to the payee during the tax year. This includes all payments, regardless of whether they were made in cash, check, or electronically.

Using the Correct Form

If you’re issuing a 1099 form to a foreign payee who doesn’t have an SSN, you may need to use a specific form, like Form 1099-INT (for interest income) or Form 1099-DIV (for dividend income). The correct form will depend on the type of payment and the payee’s tax residency status.

Filing the 1099 Form with the IRS

After you’ve completed the 1099 form, it’s time to send it to the IRS and the recipient. There are two main ways to file 1099 forms with the IRS: online filing and paper filing.

Online Filing

Online filing is a convenient and efficient way to file 1099 forms. You can use various software programs or online services specifically designed for filing tax forms. These services often provide helpful features like automatic calculations and error checking, making the process easier and less prone to mistakes.

Paper Filing

If you prefer the traditional method, you can file 1099 forms by mail. You can obtain the necessary forms from the IRS website or by contacting them directly. When filing by mail, ensure you send the forms to the correct address, as specified by the IRS.

Advantages and Disadvantages of Filing Methods

Online Filing

- Advantages:

- Convenience: File from anywhere with internet access.

- Speed: Faster processing and transmission compared to paper filing.

- Accuracy: Software often provides error checking and calculations.

- Security: Secure transmission of sensitive data.

- Disadvantages:

- Cost: Some online services charge fees for filing.

- Technical Issues: Potential for technical difficulties or software glitches.

Paper Filing

- Advantages:

- Free: No additional costs for filing.

- Simplicity: No need for technical expertise or software.

- Disadvantages:

- Time-consuming: Longer processing time compared to online filing.

- Error-prone: Higher chance of errors due to manual filling.

- Security: Risk of lost or damaged forms during mailing.

Deadlines for Filing 1099 Forms

The deadline for filing 1099 forms depends on the type of payment:

| Payment Type | Deadline |

|---|---|

| Regular Payments | January 31st of the following year |

| Payments to Non-U.S. Citizens | February 15th of the following year |

| Payments for Direct Sales of $5,000 or More | February 15th of the following year |

Additional Considerations for 1099 Issuance

Issuing 1099 forms correctly is crucial for both the payer and the payee, ensuring accurate tax reporting and avoiding potential penalties. This section delves into important aspects to consider when issuing 1099 forms, particularly when a social security number isn’t available.

Maintaining Accurate Records

Keeping detailed and organized records is essential for accurate 1099 reporting. These records serve as proof of payments made to independent contractors and help ensure compliance with tax regulations. Here are some key aspects of maintaining accurate records:

- Payment Records: Maintain detailed records of all payments made to independent contractors, including the date, amount, and purpose of each payment. This can include invoices, receipts, bank statements, or any other documentation that supports the payments.

- Contractor Information: Keep accurate records of the contractor’s name, address, and any other relevant information required for 1099 reporting. This information should be updated regularly to reflect any changes.

- Tax Identification Number: Document the contractor’s tax identification number, whether it’s a social security number, an individual taxpayer identification number (ITIN), or an employer identification number (EIN). This is crucial for accurate reporting and avoiding penalties.

Potential Implications of Incorrect Issuance

Issuing a 1099 form incorrectly can have significant consequences, both for the payer and the payee. These consequences include:

- Penalties for the Payer: The IRS may impose penalties on the payer for failing to file a correct 1099 form or for reporting incorrect information. These penalties can be substantial, especially if the error is deemed intentional or due to negligence.

- Tax Liability for the Payee: An incorrect 1099 form can lead to discrepancies in the payee’s tax return, potentially resulting in underpayment of taxes or even an audit. This can create significant financial burdens for the payee.

- Legal Disputes: Incorrect 1099 reporting can lead to legal disputes between the payer and the payee. This can be time-consuming and costly, potentially impacting business relationships.

Ensuring Compliance with Tax Regulations

To ensure compliance with all relevant tax regulations, it’s essential to stay informed about the latest requirements and guidelines. This includes:

- IRS Publications: The IRS provides various publications and resources specifically related to 1099 reporting. These publications offer detailed guidance on filing requirements, reporting thresholds, and other important information.

- Professional Tax Advice: Consult with a qualified tax professional to ensure accurate 1099 reporting. Tax professionals can provide expert advice on specific situations, helping to avoid potential errors and penalties.

- Staying Updated: Tax laws and regulations are subject to change. Stay informed about any updates or revisions to ensure compliance. Subscribe to relevant tax newsletters or resources to stay up-to-date.

Issuing a 1099 without a social security number might seem like a daunting task, but it’s not an insurmountable obstacle. With the right knowledge and a little bit of effort, you can navigate the process with confidence and ensure compliance with all relevant tax regulations. Remember to maintain accurate records, explore alternative identification methods, and consult with a tax professional if you have any questions.

By following these guidelines, you’ll be well on your way to a smooth and stress-free 1099 experience. So, go forth and conquer the world of 1099s, even without a social security number!

General Inquiries: How To Issue A 1099 Without Social Security Number

What happens if I issue a 1099 without a social security number?

Issuing a 1099 without a social security number or a valid alternative identification number can result in penalties from the IRS. It’s crucial to ensure that you have the correct information before filing.

Can I use a taxpayer identification number (TIN) instead of a social security number?

Yes, you can use a TIN, such as an ITIN or a foreign tax identification number, if the payee doesn’t have a social security number. It’s essential to verify the TIN’s validity and ensure it’s accurately reported on the 1099 form.

How do I obtain an ITIN for a payee?

To obtain an ITIN, the payee needs to file Form W-7 with the IRS. The form requires specific documentation, including proof of identity and foreign status. It’s recommended to consult with a tax professional for guidance on the process.