Is a security system a leasehold improvement? This is a question that often pops up when you’re dealing with commercial leases. A security system can be a valuable asset, but it’s important to understand how it’s treated under the law. If it’s considered a leasehold improvement, it might be subject to different rules and regulations than other property.

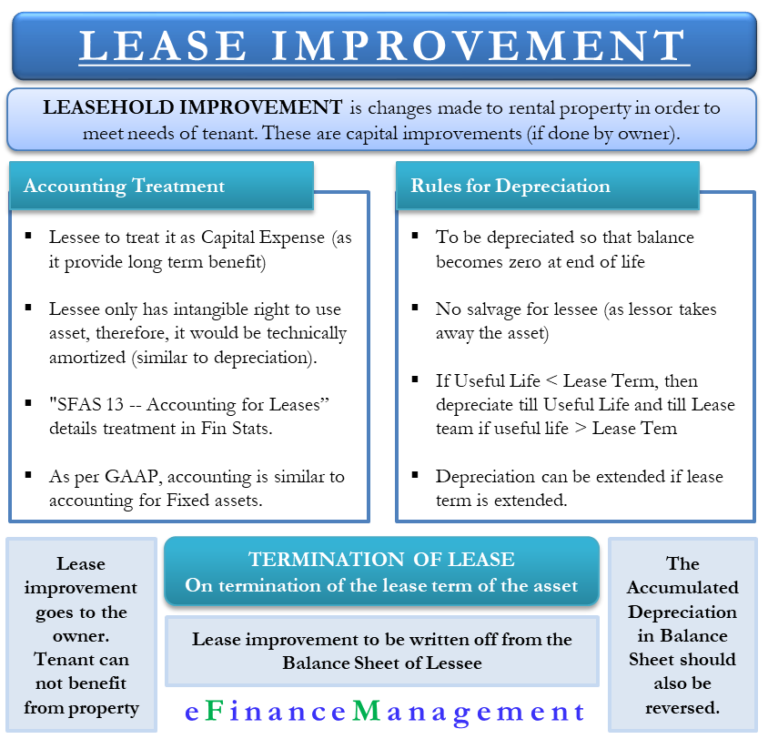

To understand this, we need to delve into the concept of leasehold improvements. Essentially, they’re modifications or additions made to a leased property by the tenant. These improvements are meant to enhance the property’s value or functionality for the tenant’s specific needs. Think of things like installing new flooring, adding a partition, or, yes, even putting in a security system.

But here’s the catch: leasehold improvements are usually considered the tenant’s property, not the landlord’s. So, who owns the security system, and what happens to it when the lease ends? Let’s explore the details.

Defining Leasehold Improvements

:max_bytes(150000):strip_icc()/Leaseholdimprovement_final-8c173dabcc934342b2d2b1399b65675c.png)

Leasehold improvements are modifications or additions made to a property by a tenant, not the property owner, during the term of a lease. They are distinct from real property because they are not permanently attached to the land and belong to the tenant.These improvements are typically made to enhance the tenant’s use of the property and are often considered an investment by the tenant.

They are not considered part of the real estate and do not become the property owner’s assets.

Examples of Leasehold Improvements

Leasehold improvements are common in commercial settings, where tenants often customize their space to meet their specific business needs. Examples of common leasehold improvements include:

- Installing security systems, including alarms, cameras, and access control systems.

- Building partitions and walls to create separate offices or work areas.

- Adding fixtures and appliances, such as lighting, plumbing, and HVAC systems.

- Constructing custom shelving, display cases, or other specialized equipment.

- Installing flooring, carpeting, or other surface treatments.

Legal Definition of Leasehold Improvements

The legal definition of leasehold improvements varies depending on the jurisdiction. However, generally, leasehold improvements are defined as:

“Any improvements or alterations made to leased premises by a tenant that are not considered to be part of the real property and are intended to be removed or replaced at the end of the lease term.”

This definition is supported by various statutes and case law, which recognize that leasehold improvements are separate from the underlying real property and are owned by the tenant.

Security Systems as Leasehold Improvements: Is A Security System A Leasehold Improvement

A security system can be considered a leasehold improvement if it meets certain criteria, primarily relating to its permanence and attachment to the property. This determination is crucial as leasehold improvements are typically subject to different accounting and tax treatments compared to ordinary business expenses.

Factors Determining Leasehold Improvement Status

Whether a security system qualifies as a leasehold improvement depends on several factors, including:

- The terms of the lease agreement: The lease agreement often specifies what constitutes a leasehold improvement and what the tenant is responsible for at the end of the lease term. If the lease agreement explicitly mentions security systems, it can provide clear guidance.

- The nature of the security system: The type of security system and its installation method play a significant role. Systems that are permanently attached to the property, such as hardwired alarm systems, are more likely to be considered leasehold improvements.

- The intent of the installation: If the security system is installed to enhance the property’s value or improve its functionality beyond the tenant’s immediate needs, it’s more likely to be classified as a leasehold improvement.

- The cost of the security system: The cost of the security system can also be a factor. Generally, substantial investments in security systems are more likely to be considered leasehold improvements.

Key Characteristics of a Leasehold Improvement

Security systems that are considered leasehold improvements typically share the following characteristics:

- Permanence: The security system is permanently attached to the property, making it difficult or costly to remove without damaging the property. This could include hardwired alarm systems, security cameras with fixed mounting, or access control systems integrated with the building’s infrastructure.

- Attachment to the property: The security system is directly connected to the property’s electrical or communication systems. This implies that the system is not merely a portable device but an integral part of the property’s security infrastructure.

- Enhancement of property value: The security system adds value to the property by improving its safety and security features. This could include deterring theft, vandalism, or unauthorized access.

Comparison of Leasehold Improvements and Non-Leasehold Improvements

Here’s a comparison of security systems that are considered leasehold improvements and those that are not:

| Feature | Leasehold Improvement | Non-Leasehold Improvement |

|---|---|---|

| Installation | Permanently attached to the property, hardwired, integrated with building systems | Portable, wireless, easily removable |

| Cost | Significant investment, substantial expense | Relatively inexpensive, easily replaceable |

| Purpose | Enhances property value, improves security features | Meets tenant’s immediate security needs, temporary solution |

| Example | Hardwired alarm system with sensors and control panel installed by a licensed contractor | Portable wireless alarm system purchased at a retail store |

Lease Agreements and Security Systems

The language used in lease agreements plays a crucial role in determining the rights and obligations of landlords and tenants regarding security systems. Understanding the clauses related to leasehold improvements, particularly those addressing security systems, is essential for both parties.

Security System Installation and Ownership

The lease agreement should clearly define the responsibilities for installing, owning, and maintaining security systems.

- Tenant Installation: If the tenant is responsible for installing the security system, the lease agreement should Artikel the specifics of the installation, including the type of system, its location, and any limitations. It may also require the tenant to obtain the landlord’s consent before installation.

- Landlord Installation: When the landlord installs the security system, the lease agreement should detail the system’s features, its purpose, and the landlord’s responsibility for its maintenance. This may also include provisions for the tenant’s access and use of the system.

- Ownership: The lease agreement should clearly state who owns the security system. If the tenant installs the system, the landlord may have the right to acquire ownership upon the termination of the lease. Alternatively, the tenant may retain ownership and remove the system upon the lease’s end.

Security System Removal

The lease agreement should address the removal of security systems at the end of the lease term.

- Tenant Removal: If the tenant installed the security system, the lease agreement may allow the tenant to remove the system upon lease termination. However, it may also require the tenant to restore the property to its original condition, potentially excluding the security system.

- Landlord Removal: If the landlord installed the security system, the lease agreement may require the landlord to remove the system upon lease termination, especially if the tenant is not responsible for its installation.

- Damage: The lease agreement may specify the tenant’s responsibility for any damage caused to the property during the removal of the security system. This may include restoring the property to its original condition or compensating the landlord for any damage.

Implications of Different Lease Agreement Provisions

The specific clauses in the lease agreement concerning security systems can have significant implications for both landlords and tenants.

- Landlord’s Perspective: Landlords may want to ensure that any security system installed by the tenant does not compromise the building’s structure or aesthetics. They may also seek to acquire ownership of the system upon lease termination, enhancing the property’s value. Landlords may also include provisions that protect them from liability for any damage caused by the tenant’s security system.

- Tenant’s Perspective: Tenants may want the freedom to install their own security systems for personal safety and peace of mind. They may also want to retain ownership of the system and remove it upon lease termination, especially if they invested in a high-quality system. Tenants may also want to ensure that the lease agreement protects them from unreasonable restrictions on the installation and use of security systems.

Tax Implications of Leasehold Improvements

Leasehold improvements, including security systems, have significant tax implications for both landlords and tenants. Understanding these implications is crucial for making informed financial decisions and maximizing tax benefits.

Depreciation and Amortization

The Internal Revenue Service (IRS) allows businesses to deduct the cost of leasehold improvements over their useful life. This deduction is taken through depreciation or amortization, depending on the type of improvement.

- Depreciation is used for tangible assets with a determinable useful life, such as security systems, fixtures, and equipment. The depreciation method used will depend on the specific asset and the IRS guidelines.

- Amortization is used for intangible assets with a limited life, such as leasehold interests or leasehold improvements that are not physically attached to the property. The amortization period is typically the remaining term of the lease.

Security Systems as Leasehold Improvements

The IRS classifies security systems as leasehold improvements if they are installed in a leased property and are not considered part of the building’s structure. These improvements are typically considered tangible assets and are depreciated over their useful life.

Tax Deductions for Security Systems

The deductibility of security system expenses depends on various factors, including the type of security system, its cost, and the terms of the lease agreement.

- If the security system is considered a leasehold improvement, the cost can be depreciated over its useful life. This allows businesses to deduct a portion of the cost each year, reducing their taxable income.

- The depreciation method used for security systems typically follows the Modified Accelerated Cost Recovery System (MACRS) guidelines. This method allows for accelerated depreciation, meaning a larger portion of the cost can be deducted in the early years of the asset’s life.

Examples of Tax Treatment Variations

The tax treatment of leasehold improvements can vary depending on specific circumstances.

- Example 1: A business leases a retail space and installs a sophisticated security system with cameras, alarms, and access control. This system is considered a leasehold improvement and is depreciated over its useful life. The business can deduct a portion of the cost each year, reducing its taxable income.

- Example 2: A landlord makes improvements to a property before leasing it to a tenant. The landlord may be able to deduct the cost of these improvements through depreciation, even if the tenant is responsible for paying rent for the property. However, the tenant may not be able to deduct the cost of these improvements, as they are not considered leasehold improvements in this scenario.

It is important to consult with a tax professional to determine the specific tax treatment of leasehold improvements in your situation.

Ownership and Removal of Security Systems

The ownership and removal of security systems installed as leasehold improvements are crucial aspects of a lease agreement. Understanding these aspects helps both landlords and tenants navigate the complexities of security system ownership and removal at the end of a lease term.

Ownership of Security Systems

The ownership of a security system installed as a leasehold improvement depends on the specific terms of the lease agreement. Generally, there are two primary scenarios:

- Landlord Ownership: In this scenario, the landlord owns the security system, even though the tenant may have installed it. The lease agreement typically specifies that all improvements made to the property become the landlord’s property. The tenant may have the right to remove the system before the end of the lease term, but only if the lease agreement allows it and the removal doesn’t damage the property.

- Tenant Ownership: The tenant owns the security system, and they have the right to remove it at the end of the lease term. However, this right is often subject to specific conditions, such as the need to restore the property to its original condition and ensuring that the removal doesn’t damage the property.

Removal of Security Systems, Is a security system a leasehold improvement

The process of removing a security system at the end of a lease term is governed by the lease agreement and local laws. The removal process involves several steps:

- Review the Lease Agreement: The lease agreement is the primary document that dictates the removal process. It will specify the tenant’s rights and obligations regarding the removal of security systems.

- Obtain Landlord Permission: Even if the lease agreement allows for removal, it’s advisable to obtain written permission from the landlord before proceeding. This helps prevent any disputes later.

- Professional Removal: It’s best to hire a professional security system installer to remove the system. This ensures that the removal is done correctly and doesn’t damage the property.

- Restoration: After removal, the tenant is typically responsible for restoring the property to its original condition. This may involve patching holes, repainting, or replacing damaged drywall.

- Documentation: It’s essential to document the entire removal process, including photographs of the property before and after the removal, receipts for any materials used, and communication with the landlord.

Examples of Common Scenarios

- Tenant Owned System, Landlord Refuses Removal: If the lease agreement grants the tenant ownership of the security system but the landlord refuses to allow its removal, the tenant may have legal recourse. They could seek legal advice to determine their options, which may include negotiating with the landlord or filing a lawsuit.

- Landlord Owned System, Tenant Wants to Remove: If the lease agreement states that the landlord owns the security system, the tenant may not be able to remove it unless the lease agreement explicitly allows it. The tenant may need to negotiate with the landlord to reach an agreement.

- Security System Damages the Property During Removal: If the removal process causes damage to the property, the tenant may be held liable for the repairs. It’s crucial to hire a qualified professional to minimize the risk of damage.

Understanding the nuances of leasehold improvements, especially when it comes to security systems, is crucial for both landlords and tenants. It helps you navigate the legal and financial implications, ensuring a smooth and hassle-free experience. Whether it’s determining ownership, navigating tax implications, or planning for removal, knowing the rules of the game is essential for a successful lease agreement.

So, before you install that security system, make sure you understand the lease terms and any potential implications. It could save you a lot of trouble in the long run!

FAQ Resource

What are the common types of security systems considered leasehold improvements?

Common types include alarm systems, CCTV cameras, access control systems, and security gates. These systems are typically installed to enhance the safety and security of the leased premises.

Can a tenant remove a security system at the end of the lease?

This depends on the lease agreement. Some leases may allow removal, while others may require the tenant to leave the system in place. It’s crucial to review the lease terms and understand the specific provisions related to leasehold improvements and security systems.

What happens to a security system if a tenant defaults on a lease?

If a tenant defaults on a lease, the landlord may have the right to take possession of the property, including any leasehold improvements, such as the security system. However, the specific legal rights and obligations of both parties will be determined by the lease agreement and applicable state laws.

What are the tax implications of a security system as a leasehold improvement?

The tax treatment of leasehold improvements, including security systems, can vary depending on factors such as the lease terms, the nature of the improvement, and the applicable tax laws. It’s recommended to consult with a tax professional to understand the specific tax implications in your situation.

:max_bytes(150000):strip_icc()/Leaseholdimprovement_final-8c173dabcc934342b2d2b1399b65675c.png?w=1024&resize=1024,1024&ssl=1)