What is a senior secured loan? This type of debt financing offers a unique blend of security and priority for both lenders and borrowers. Senior secured loans are characterized by their position at the top of the capital structure, granting them precedence over other forms of debt in the event of a borrower’s default. The security aspect comes into play with the use of collateral, providing lenders with a tangible asset to recover their investment should the borrower fail to meet their obligations.

These loans play a crucial role in various industries, facilitating business expansion, acquisitions, and refinancing. Understanding the intricacies of senior secured loans, including their benefits, risks, and market dynamics, is essential for both investors and borrowers seeking to navigate the complex world of debt financing.

Introduction to Senior Secured Loans

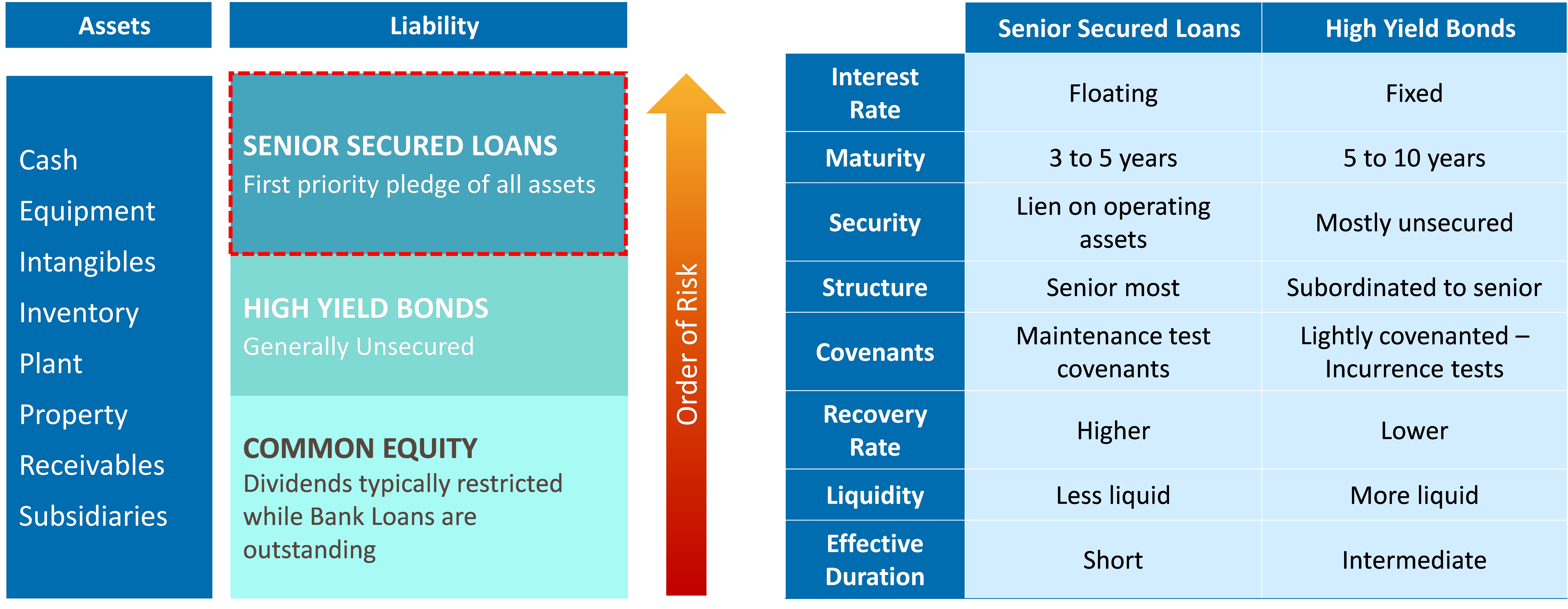

A senior secured loan is a type of debt financing where the lender has a priority claim on specific assets of the borrower in case of default. This means that the lender can seize and sell these assets to recover their loan amount, taking precedence over other creditors. Senior secured loans are typically considered less risky than unsecured loans, as the lender has a greater level of protection.

This lower risk profile often translates to lower interest rates compared to unsecured loans.

Common Assets Used as Collateral, What is a senior secured loan

Senior secured loans often use various assets as collateral, providing the lender with a tangible claim in case of default. Here are some examples of commonly used assets:

- Real Estate: This is a common form of collateral for senior secured loans. The lender can seize and sell the property to recover the loan amount if the borrower defaults.

- Equipment: Businesses often use equipment, such as machinery, vehicles, or other tools, as collateral. The lender can take possession of this equipment and sell it to recoup their investment.

- Inventory: Companies may use their inventory, including raw materials, finished goods, and work-in-progress, as collateral. In case of default, the lender can sell the inventory to recover the loan amount.

- Accounts Receivable: A company’s accounts receivable, representing money owed by customers, can also be used as collateral. The lender can collect these receivables if the borrower fails to repay the loan.

Understanding Seniority and Security

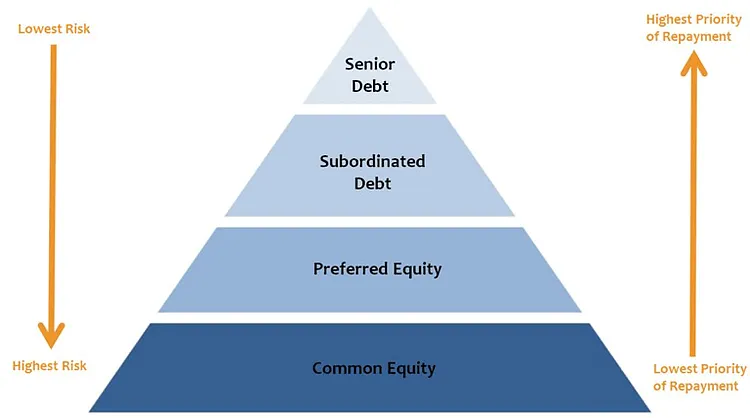

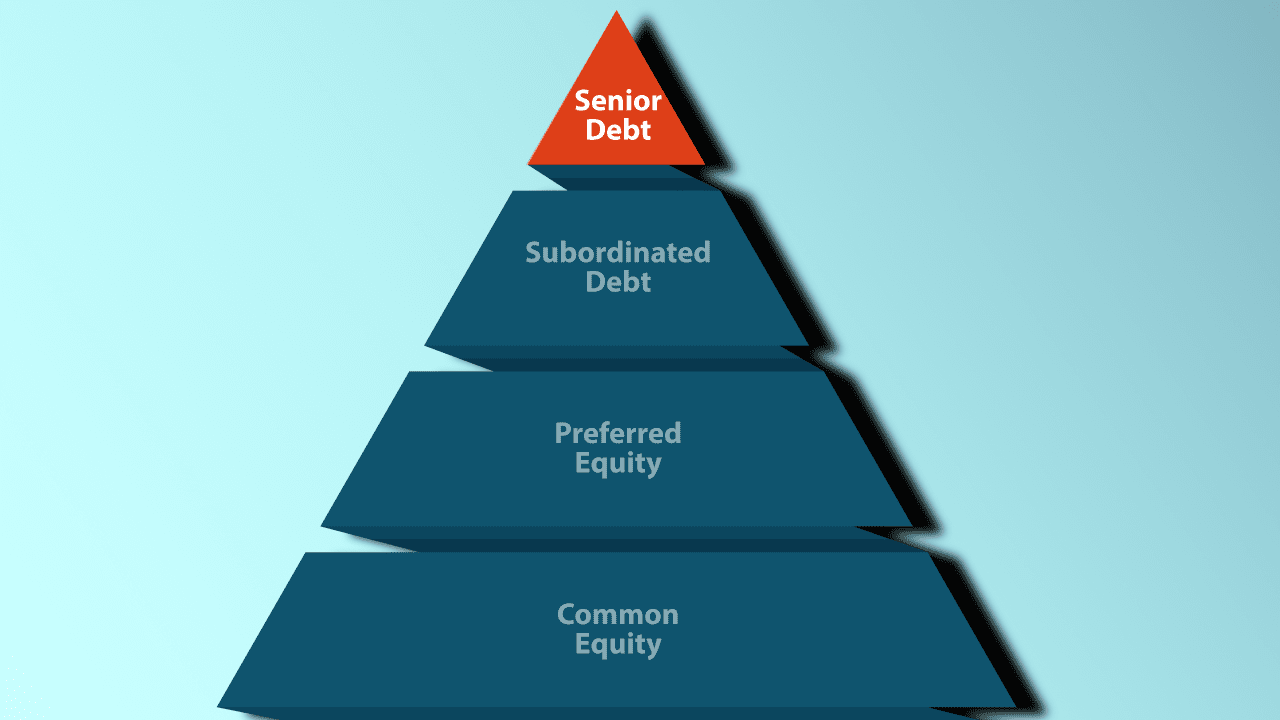

Seniority and security are crucial concepts in debt financing, determining the order in which creditors are repaid in case of a borrower’s default. Senior secured loans, as their name suggests, hold a high position in the hierarchy of debt, providing lenders with greater protection and priority in recovering their investment.

Seniority in Debt Financing

Seniority refers to the order in which different types of debt are repaid in the event of a borrower’s bankruptcy or liquidation. Senior debt, including senior secured loans, has a higher priority than junior debt, such as subordinated debt. This means that senior debt holders are paid back before junior debt holders.

Comparison of Senior Secured Loans with Other Debt Types

- Senior Secured Loans: These loans are backed by specific assets of the borrower, giving lenders the right to seize and sell those assets to recover their investment. They have the highest priority in repayment.

- Unsecured Loans: These loans are not backed by any specific assets. Lenders rely solely on the borrower’s creditworthiness and ability to repay. In case of default, unsecured creditors have a lower priority than secured creditors.

- Subordinated Debt: This type of debt ranks below senior debt in the repayment hierarchy. Subordinated debt holders are only repaid after senior debt holders have been fully compensated.

The Importance of Security in Debt Financing

Security in debt financing provides lenders with additional protection and confidence in their investment. It allows them to recover their investment even if the borrower defaults on their obligations. Security can take various forms, such as:

- Mortgages: These secure loans with real estate as collateral.

- Liens: These are legal claims on specific assets, giving lenders the right to seize and sell those assets in case of default.

- Guarantees: These are promises by a third party to repay the loan if the borrower defaults.

Benefits of Senior Secured Loans

Senior secured loans offer numerous advantages for both borrowers and lenders, making them a popular choice in various financial situations. This section will delve into the key benefits of senior secured loans, examining how they provide favorable conditions for both parties involved in the transaction.

Advantages for Borrowers

Borrowers benefit from the lower interest rates and greater flexibility offered by senior secured loans. The security provided by the loan gives lenders more confidence in the borrower’s ability to repay, leading to more favorable terms.

- Lower Interest Rates: Due to the lower risk associated with senior secured loans, lenders are often willing to offer lower interest rates compared to unsecured loans. This translates to lower borrowing costs for borrowers, saving them money over the loan’s lifetime.

- Greater Flexibility: Senior secured loans typically come with more flexible terms than unsecured loans. This can include longer repayment periods, more relaxed covenants, and greater access to funds. This flexibility can be particularly valuable for borrowers who need a long-term financing solution or who anticipate potential changes in their financial circumstances.

- Increased Access to Capital: The security provided by senior secured loans makes them more attractive to lenders, increasing the likelihood of securing financing. This can be particularly beneficial for borrowers who may have limited access to traditional sources of capital.

Advantages for Lenders

Lenders benefit from the lower risk associated with senior secured loans, providing them with greater confidence in the borrower’s ability to repay. This confidence translates to a lower probability of default and a higher likelihood of recouping their investment.

- Lower Risk: The security interest in the borrower’s assets provides lenders with a safety net in case of default. This reduces the risk of loss, making senior secured loans more attractive to lenders.

- Higher Probability of Repayment: The presence of collateral significantly increases the likelihood of repayment, as lenders can seize and sell the assets to recover their investment in case of default. This makes senior secured loans a more reliable investment for lenders.

- Potential for Higher Returns: While senior secured loans may offer lower interest rates compared to unsecured loans, the lower risk associated with them allows lenders to offer higher returns to investors.

Role in a Diversified Debt Portfolio

Senior secured loans can play a crucial role in a diversified debt portfolio by providing a balance between risk and return. The lower risk associated with senior secured loans can help to mitigate potential losses from higher-risk investments, while the potential for higher returns can enhance overall portfolio performance.

- Risk Mitigation: Senior secured loans can serve as a safe haven within a diversified debt portfolio. Their lower risk profile can help to offset potential losses from other, higher-risk investments, reducing overall portfolio volatility.

- Return Enhancement: While offering lower returns than some higher-risk investments, senior secured loans can still provide a positive return on investment. This can contribute to overall portfolio performance, helping to enhance returns over time.

- Improved Liquidity: Senior secured loans are generally considered more liquid than other types of debt investments, making them easier to sell if needed. This can be particularly valuable for investors who need to access cash quickly.

Risks Associated with Senior Secured Loans: What Is A Senior Secured Loan

While senior secured loans offer advantages for both borrowers and lenders, it’s crucial to acknowledge the potential risks associated with them. Understanding these risks is essential for making informed decisions and mitigating potential negative outcomes.

Risks for Borrowers

Borrowers of senior secured loans face a range of risks, primarily stemming from the loan’s terms and the potential for collateral value fluctuations.

- High Interest Rates: Senior secured loans often come with higher interest rates compared to unsecured loans, reflecting the lower risk for lenders. This can significantly increase the borrower’s debt burden and impact their financial performance.

- Strict Covenants: Senior secured loans typically involve stringent covenants, which are contractual agreements that borrowers must adhere to. These covenants can restrict the borrower’s financial flexibility and operational decisions, potentially hindering their growth or ability to adapt to changing market conditions.

- Collateral Risk: The value of the collateral securing the loan can fluctuate, potentially falling below the outstanding loan amount. If the collateral value drops significantly, the borrower may face difficulties meeting their debt obligations, leading to potential default and the risk of losing their assets.

- Limited Access to Other Financing: The presence of a senior secured loan can restrict the borrower’s ability to obtain additional financing, as lenders may be hesitant to provide further credit due to the existing debt burden and potential claims on the collateral.

Risks for Lenders

While senior secured loans provide a higher level of security for lenders, they are not without risks.

- Valuation Risk: Accurately assessing the value of the collateral is crucial for lenders. If the collateral value is overestimated, lenders may face losses in case of default, especially if the collateral value declines significantly.

- Default Risk: Despite the security provided by the collateral, there is still a risk of borrower default. Factors such as economic downturns, industry-specific challenges, or poor management can lead to borrowers failing to meet their loan obligations.

- Enforcement Risk: Even with a valid security interest, lenders may face challenges in enforcing their rights and recovering their funds. This can involve legal complexities, delays, and potentially significant costs.

Impact of Collateral Value Fluctuations

Collateral value fluctuations are a significant risk for both borrowers and lenders.

- Borrower Perspective: If the value of the collateral declines, borrowers may face pressure to repay the loan to avoid losing their assets. This can strain their financial resources and limit their ability to invest in growth or manage unexpected challenges.

- Lender Perspective: A decline in collateral value can jeopardize the lender’s security and increase the risk of losses in case of default. Lenders may need to reassess their exposure and potentially adjust loan terms or take steps to mitigate the risk.

Examples of Senior Secured Loans

Senior secured loans are a common form of financing used by businesses across various industries. These loans are attractive to lenders because they offer a high level of security and priority in repayment. Here are some real-world examples of senior secured loans in different industries:

Examples of Senior Secured Loans in Different Industries

Senior secured loans are used by companies in a wide range of industries. Here are some examples:

- Technology: A tech startup may use a senior secured loan to fund its growth and expansion. The loan may be secured by the company’s intellectual property, equipment, and other assets.

- Healthcare: A hospital may use a senior secured loan to finance a new wing or purchase new medical equipment. The loan may be secured by the hospital’s real estate and other assets.

- Energy: An oil and gas company may use a senior secured loan to finance exploration and production activities. The loan may be secured by the company’s oil and gas reserves, pipelines, and other assets.

- Manufacturing: A manufacturing company may use a senior secured loan to purchase new equipment or expand its facilities. The loan may be secured by the company’s manufacturing equipment, inventory, and other assets.

- Retail: A retail company may use a senior secured loan to finance inventory purchases or open new stores. The loan may be secured by the company’s inventory, real estate, and other assets.

Case Studies of Senior Secured Loans

- Successful Transaction: In 2021, a leading pharmaceutical company successfully secured a senior secured loan to fund the development of a new cancer drug. The loan was secured by the company’s intellectual property and future royalty payments. The loan enabled the company to complete clinical trials and bring the drug to market, resulting in significant profits for both the company and its investors.

- Unsuccessful Transaction: In 2019, a small tech startup secured a senior secured loan to fund its growth. However, the company’s business model proved to be unsustainable, and it was unable to generate enough revenue to repay the loan. As a result, the lender foreclosed on the company’s assets, leading to the company’s bankruptcy.

Comparison of Senior Secured Loans

Here’s a table comparing different types of senior secured loans based on key features:

| Loan Type | Interest Rate | Maturity | Collateral | Features |

|---|---|---|---|---|

| Term Loan | Fixed or Variable | 5-10 Years | Real Estate, Equipment, Inventory | Amortizing Loan, Covenants |

| Revolving Credit Facility | Variable | 1-5 Years | Accounts Receivable, Inventory | Flexible Borrowing, Credit Limit |

| Asset-Backed Loan | Fixed or Variable | 5-10 Years | Specific Assets (e.g., Accounts Receivable) | Structured Based on Asset Cash Flows |

The Role of Senior Secured Loans in the Market

Senior secured loans have become increasingly popular in recent years, playing a crucial role in various aspects of the financial market. They offer a relatively stable and predictable income stream for lenders while providing flexible financing options for borrowers.

Current Market Trends for Senior Secured Loans

The senior secured loan market is characterized by several trends, including:

- Increased demand: Companies are increasingly seeking senior secured loans due to their flexible terms and lower interest rates compared to traditional bank loans.

- Growing issuance: The volume of senior secured loans issued has been rising steadily, reflecting the growing demand from borrowers and the favorable conditions for lenders.

- Expansion of loan structures: Lenders are offering more innovative loan structures, such as unitranche loans, to cater to the diverse needs of borrowers.

- Focus on ESG: There is a growing emphasis on environmental, social, and governance (ESG) factors in senior secured loan transactions, with lenders incorporating these considerations into their lending decisions.

Impact of Regulatory Changes on Senior Secured Lending

Regulatory changes can have a significant impact on the senior secured loan market. Some of the key regulatory developments include:

- Basel III: These regulations have increased capital requirements for banks, potentially reducing their appetite for senior secured lending.

- Volcker Rule: This rule restricts banks from proprietary trading, which could impact their participation in the senior secured loan market.

- Dodd-Frank Act: This act introduced stricter regulations for the financial industry, including increased oversight of non-bank lenders.

Players Involved in Senior Secured Loan Transactions

The senior secured loan market involves a diverse range of players, each with specific roles and responsibilities. A visual representation of these players could be a chart or diagram illustrating the following:

- Borrowers: Companies seeking financing, ranging from large corporations to small businesses.

- Lenders: Institutions providing the loans, including banks, private equity firms, and hedge funds.

- Arrangers: Investment banks or other financial institutions that facilitate the loan transaction.

- Syndicators: Institutions that help distribute the loan among multiple lenders.

- Agents: Institutions responsible for administering the loan agreement and representing the lenders.

- Rating agencies: Organizations that assess the creditworthiness of borrowers and assign ratings to the loans.

In conclusion, senior secured loans present a compelling option for both borrowers and lenders seeking a balance between risk and reward. By understanding the dynamics of seniority, security, and the various factors that influence their performance, stakeholders can make informed decisions regarding their use. As the debt landscape continues to evolve, senior secured loans will undoubtedly remain a significant instrument in facilitating growth and innovation across diverse sectors.

Essential FAQs

What are some common examples of assets used as collateral for senior secured loans?

Common assets used as collateral include real estate, equipment, inventory, accounts receivable, and intellectual property. The specific type of collateral will vary depending on the industry, the borrower’s financial situation, and the lender’s risk appetite.

What are some of the key risks associated with senior secured loans for borrowers?

Borrowers face risks such as potential loss of collateral if they default on their loan, increased interest rates due to the perceived higher risk, and limitations on their financial flexibility. Additionally, fluctuations in collateral value can impact the borrower’s ability to secure financing.

How do regulatory changes impact the senior secured lending market?

Regulatory changes can influence lending practices, risk appetite, and the availability of credit. For example, new regulations may impact the valuation of collateral, the terms of loan agreements, or the overall lending environment.

.jpg?w=700)