What is doc stamps? Ah, my friend, you’ve stumbled upon a topic as thrilling as a tax audit (almost!). These aren’t the stamps you collect for fun; these tiny squares of paper represent a surprisingly rich history of government revenue and legal wrangling. From ancient times to the modern digital age, doc stamps have played a role in everything from property transfers to the sale of that vintage stamp collection you’ve been eyeing.

Prepare yourself for a journey into the surprisingly captivating world of documentary stamp taxes!

Documentary stamps, essentially, are small adhesive stamps (or their digital equivalents) required by governments to be affixed to certain legal documents. Think of them as tiny, official seals of approval – or, perhaps more accurately, a tiny tax on your paperwork. Their purpose is to generate revenue for the government, and the types of documents that require them, as well as the rates, vary wildly depending on the jurisdiction.

We’ll explore the fascinating intricacies of this system, including the often-confusing calculations and the sometimes-surprising legal implications.

Definition of Doc Stamps

Right, so doc stamps, innit? Basically, they’re like tiny little tax stickers for important bits of paper. Think of them as the government’s way of saying “Right, we’re gonna nick a bit of dosh for this here document.” They’ve been around for ages, and they’re all about making sure the state gets its fair share of the loot.Doc stamps are a type of tax levied on specific legal documents.

They’re essentially a small fee, usually paid in the form of a physical stamp or a digital equivalent, that needs to be affixed to a document to make it legally valid. It’s a way for governments to raise revenue, and it’s been a thing for yonks.

Historical Context of Documentary Stamps

The whole doc stamp thing has a proper long history. Way back when, governments realised they could make a bit of extra cash by taxing important documents. Think wills, property deeds – anything that’s legally significant. It started off with physical stamps, you know, the proper sticky ones, and has evolved into digital systems in some places, but the principle remains the same: a tax on paperwork.

It’s a bit like a historical tax on official bureaucracy, really. Some countries still use physical stamps, which can be quite a collector’s item for stamp enthusiasts. The design and value of these stamps can vary wildly depending on the country and time period. For example, a historical US doc stamp might feature a portrait of a president, whereas a more modern one might have a simpler design.

Examples of Documents Requiring Doc Stamps, What is doc stamps

Loads of different documents might need these little tax stickers. The specific ones vary from place to place, obviously, but some common examples include deeds for houses and land, contracts, and wills. Basically, anything that’s got some serious legal weight to it might need a doc stamp. It’s a way of officially registering the document and ensuring its legality.

In some cases, business agreements or share transfers might also require them, depending on the laws of the specific region. Think of it as an official seal of approval – but one that costs you a bit of money.

Types of Doc Stamps: What Is Doc Stamps

Right, so doc stamps, innit? They’re not all the same, like, totally different depending on where you are and what you’re doing. Think of it like different flavours of crisps – some are salty, some are sweet, some are…well, you get the picture. This bit’s gonna break down the main types and how they differ.

Basically, the type of doc stamp you need depends on the specific legal document and the location. The rates and calculations are also mega-different, so you gotta pay attention, or you’ll be proper skint! We’re talking about things like property transfers, contracts, and all sorts of official bits of paper.

Doc Stamp Types by Jurisdiction and Application

This table breaks down the main types, their locations, what they’re for, and how much they’ll cost you. Obviously, this isn’t exhaustive – laws change quicker than you can say “cheeky Nando’s” – but it gives you a general idea. You’ll always wanna double-check with a professional, especially if you’re dealing with big bucks.

| Stamp Type | Jurisdiction | Purpose | Rate Calculation |

|---|---|---|---|

| Deed Stamp | England and Wales | Transfer of property ownership | Based on the property value; typically a percentage. For example, a £500,000 house might have a stamp duty land tax (SDLT) of several thousand pounds, depending on the current rates. This is different from other jurisdictions, such as Scotland where Land and Buildings Transaction Tax (LBTT) is used. |

| Contract Stamp | Various (e.g., Many US States) | Legal contracts, agreements | Often a flat fee or a percentage of the contract value. Rates vary wildly depending on the state and the type of contract. Some states might have different rates for different contract types, or exemptions for certain situations. |

| Stock Transfer Stamp | Various (e.g., Some US States, historical use in UK) | Transfer of stocks or shares | Usually a fixed fee per share or a percentage of the transaction value, though this is less common now due to electronic trading systems. In the past, this was a much more common type of stamp tax in the UK and many other countries. |

| Bill of Sale Stamp | Various (e.g., Some US States) | Transfer of personal property ownership (e.g., cars, furniture) | Often a flat fee or a percentage of the sale price, similar to contract stamps. The specifics vary hugely from state to state in the US. |

Purpose of Doc Stamps

Right, so doc stamps, innit? They’re not just some random bit of paper stuck on your important bits of paperwork – they’re actually a pretty crucial part of how the government gets its dosh. Basically, they’re a sneaky way to raise some serious cash, which then gets ploughed back into all sorts of things.Doc stamp taxes are all about generating revenue for the government.

Think of it like a little extra charge on certain legal documents – a bit like a tax, but specifically for things like property transfers or share dealings. This revenue stream is pretty significant for many governments, helping to fund public services and infrastructure projects. It’s a way to get money from transactions without hitting people with a massive income tax hike or something equally brutal.

Revenue Utilisation

The money raised from doc stamps gets funnelled into the government’s general fund, which means it’s used to pay for a whole load of stuff. We’re talking about essential public services, like schools, hospitals, and maintaining roads and infrastructure. Imagine the state of the roads if they didn’t have this extra cash flow – absolute carnage, mate! A significant portion might also go towards funding specific government initiatives or programmes, depending on the government’s priorities at the time.

It’s not always crystal clear exactly where every penny goes, but it’s all part of keeping the country ticking over.

Role in Government Revenue Generation

Documentary stamp taxes represent a significant, albeit often overlooked, source of income for governments. While income tax and VAT are usually the big hitters, doc stamps provide a reliable and consistent revenue stream, especially during times of economic uncertainty. For example, during a period of low economic activity, income tax revenue might drop, but doc stamps will still generate income from property transactions and other relevant legal documentation.

It’s a steady income stream that helps to balance the budget.

Economic Impact of Doc Stamps

The economic impact of doc stamps is a bit of a double-edged sword. On the one hand, they generate revenue which is vital for public services. On the other hand, they can act as a small tax on transactions, potentially impacting the cost of things like buying a house or setting up a business. However, the impact is generally considered to be relatively small compared to other taxes, and the benefits of the revenue generated usually outweigh the potential negative effects.

It’s all about finding that sweet spot, innit? Think of it like this: a small price to pay for keeping the country running smoothly.

Calculating Doc Stamp Tax

Right, so you wanna know about working out doc stamp tax? It’s a bit of a faff, but I’ll break it down for you, innit? Basically, it’s a tax on certain legal documents, and the amount you pay depends on the type of document and its value. Think of it like a sneaky extra charge for making things official.

Calculating the tax isn’t rocket science, but it does involve a bit of number crunching. You need to know the document’s value and the applicable tax rate. The rate varies depending on the type of document and the state or region where it’s registered. Sometimes it’s a flat fee, other times it’s a percentage of the document’s value. Proper confusing, I know!

Doc Stamp Tax Calculation for Different Document Types

Different documents have different tax rates, mate. It’s all a bit of a postcode lottery, really. For example, the tax on a property transfer might be significantly higher than the tax on a simple contract. Let’s look at some examples.

| Document Type | Value (£) | Tax Rate | Tax Amount (£) |

|---|---|---|---|

| Property Transfer | 250,000 | 0.5% | 1250 |

| Stock Transfer | 10,000 | 1% | 100 |

| Contract (Standard) | 5000 | £1.50 per £1000 | 7.50 |

These are just examples, obviously. The actual rates vary wildly depending on where you are and what you’re doing. Always check the specific regulations for your area, alright?

Step-by-Step Guide to Determining the Applicable Tax Rate

This is where things get a bit more serious. You need to be proper clued up to get this right.

- Identify the document type: Is it a property transfer, a stock transfer, a contract, or something else entirely? This is crucial because it dictates the tax rate.

- Determine the document’s value: This is usually the price of the property, the value of the stocks, or the monetary value specified in the contract. Make sure you’re using the correct figure.

- Find the applicable tax rate: This is where you’ll need to do some digging. Check your local government website or consult a legal professional. The rate might be a percentage of the document’s value, a flat fee, or a combination of both. Make sure you’re using the correct rate for your specific document and location.

- Calculate the tax amount: Once you have the value and the rate, you can work out the tax. If it’s a percentage, simply multiply the value by the rate. If it’s a flat fee per unit of value, divide the value by the unit and multiply by the fee.

Flowchart Illustrating the Calculation Process

Think of this as a proper visual guide to help you get your head around it.

Imagine a flowchart. It would start with a box saying “Identify Document Type”. Arrows would branch out to different document types (Property Transfer, Stock Transfer, Contract, etc.). Each branch would lead to a box specifying the relevant tax rate (e.g., “0.5%,” “£1.50 per £1000”). From there, an arrow would lead to a box asking “What’s the Document Value?”.

The answer would then be fed into a calculation box to determine the tax amount. Finally, an arrow would lead to a box displaying the “Total Tax Amount”. It’s all about following the right path, based on the specific document and its value. Simple, really, once you get the hang of it.

Legal Implications of Doc Stamps

Right, so doc stamps – they’re not just some random bit of paper, innit? Getting them wrong can be a proper nightmare, leading to some seriously hefty fines and legal woes. Basically, messing about with doc stamps is not a vibe.Dodging doc stamp requirements, or getting the numbers wrong, isn’t just a bit of a cock-up; it’s a legal issue.

The consequences can range from a slap on the wrist (a small fine) to some proper hefty penalties, depending on the seriousness of the error and the amount of tax evaded. We’re talking potential court appearances and a massive dent in your bank balance – not ideal, bruv.

Penalties for Doc Stamp Non-Compliance

Failure to correctly affix or pay doc stamps can result in significant financial penalties. These penalties often include interest charges on the unpaid tax, as well as potential late payment fees. In some cases, depending on the jurisdiction and the nature of the offence (like deliberate evasion), criminal charges could be brought, leading to even more serious consequences.

Think jail time, mate, that’s not a joke. The exact amounts will vary depending on the location and the specifics of the case, but it’s safe to say it’s not cheap to mess with the taxman.

Appealing a Doc Stamp Assessment

If you reckon a doc stamp assessment is wrong, you’re not just stuck with it. There’s usually a process for appealing the assessment. This typically involves submitting a formal appeal within a specific timeframe, providing evidence to support your claim. The appeal process might involve a review by a tax authority, potentially leading to a hearing or a court case.

Getting legal advice is a smart move here – don’t try and DIY this unless you’re a legal eagle yourself.

Relevant Legal Precedents and Case Studies

While specific cases aren’t always publicised widely, there are plenty of examples of legal battles surrounding doc stamp disputes. These cases often revolve around interpretations of the law, the correct calculation of the tax, or whether a particular document even requires a doc stamp in the first place. The outcomes of these cases set precedents that guide future interpretations and applications of doc stamp laws.

A good lawyer will be familiar with these precedents and will be able to use them to your advantage in an appeal. It’s all about knowing the rules, and if you don’t, get someone who does.

Doc Stamps Across Different Jurisdictions

Right, so doc stamps, innit? They’re a total vibe killer when you’re tryna sort out legal stuff, but the rules are proper different depending on where you are. Think of it like trying to order a cheeky Nando’s – the menu’s the same, but the prices and what’s on offer change depending on which branch you’re in. This is a proper minefield, so let’s break it down.Doc stamp laws vary wildly across different states and countries.

What’s a doddle in one place could be a right faff in another. The rates, the types of docs they whack ’em on, and even the exemptions are all over the shop. Getting your head around it all is key to avoid getting stung, bruv.

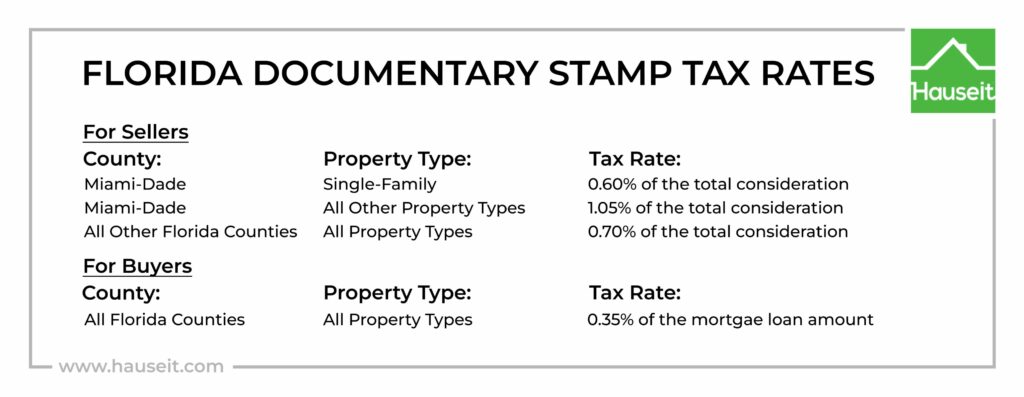

Variations in Doc Stamp Tax Rates

The tax rates for doc stamps are, like, proper random. Some places charge a flat fee, others charge a percentage of the transaction value. It’s a right lottery. For example, imagine you’re buying a house. In one state, you might pay a fixed amount like £500, while in another, you might pay 1% of the house’s value.

That’s a massive difference, especially if you’re buying a gaff for a few hundred grand. This variation makes comparing transactions across different jurisdictions a proper headache.

Document Types Subject to Doc Stamps

It ain’t just houses, mate. Doc stamps can get slapped on loads of different documents. Think deeds, mortgages, contracts, shares – the list goes on. Some places are stricter than others. Some jurisdictions might only tax property transfers, while others might tax pretty much every legal document under the sun.

It’s a proper maze to navigate.

Exemptions and Loopholes

There are some loopholes and exemptions, which is a bit of a relief. Some jurisdictions might offer exemptions for certain types of documents, or for certain types of transactions. For example, some places might exempt charitable organisations or small businesses from paying doc stamps. It’s worth doing your research to see if you can avoid paying these pesky taxes, or at least minimise the amount you pay.

Legal Frameworks and Enforcement

The legal frameworks surrounding doc stamps are, frankly, a right mess. Some jurisdictions have clear and concise laws, while others are a bit vague and open to interpretation. This can lead to confusion and disputes, especially when it comes to calculating the tax and claiming exemptions. It’s a right faff, and you need to make sure you’re on the right side of the law, or you could end up in a spot of bother.

Comparative Table of Doc Stamp Laws

| Jurisdiction | Document Type | Tax Rate | Exemptions |

|---|---|---|---|

| England | Property Transfers | Variable, based on property value | Certain charitable transactions |

| New York, USA | Deeds, Mortgages | Variable, based on property value | Certain government entities |

| California, USA | Deeds, Mortgages, other documents | Variable, based on document type and value | Specific exemptions Artikeld in state law |

| Australia (varies by state) | Property Transfers, other documents | Varies significantly by state and document type | Varies significantly by state |

Exemptions and Exceptions

Right, so doc stamps are a bit of a faff, innit? But thankfully, there are some situations where you can dodge the taxman – or, you know, the state’s tax collection agency. It’s all about knowing the loopholes, bruv.These exemptions and exceptions are generally spelled out in the specific state’s laws, so you’ll need to check your local rules.

It’s not a one-size-fits-all situation, like, at all. It’s proper important to get this right, otherwise you could end up in a right pickle.

Documents Exempt from Doc Stamp Taxes

Certain documents are completely exempt from doc stamp taxes. This means you won’t have to pay anything extra on them, which is a proper result. Think of it as a get-out-of-jail-free card, but for taxes.

For example, many states exempt documents related to government affairs. Things like official court documents, or paperwork involved in the transfer of government property, often slide under the radar. Likewise, documents related to non-profit organisations or charities usually get a free pass. It’s all about what the specific state deems important enough to exempt.

Criteria for Claiming Exemptions

Claiming an exemption isn’t just about knowing the rules; you need the right paperwork to back it up. You’ll generally need to provide evidence that your situation meets the criteria set out in the law. This could be anything from a charity registration number to official government documentation. It’s a bit like having to prove your alibi, only with less dodgy detectives.

The exact documentation needed varies massively depending on the type of exemption you’re claiming and the specific state. So you’ll need to check the local guidelines to make sure you’ve got everything you need. Missing a piece of the puzzle can scupper your whole claim, so it’s worth being thorough.

Common Exemptions

Loads of different things can be exempt, depending on the state. It’s a bit of a minefield, but here are some common examples:

Generally, things like mortgages on a primary residence, transfers of property between family members (sometimes), and certain types of financial instruments might be exempt under specific conditions. Each state has its own set of rules, so it’s crucial to check your local regulations before assuming anything. You’ll find specific details on your state’s revenue or taxation department website.

Affixing and Payment Methods

Right, so you’ve got your head around what doc stamps are and all that malarkey. Now, let’s get down to the nitty-gritty – how you actually slap ’em on your docs and cough up the dosh. It’s not as dodgy as it sounds, I promise.The process of sticking those little stamps onto your important bits of paper is pretty straightforward, depending on the jurisdiction, obviously.

Sometimes, you’ll be dealing with physical stamps that you literally glue on (like, proper old-school). Other times, it might be a digital affair, where you just enter the details into a system and it’s all done electronically. Think of it like paying for your takeaway online versus handing over cash – both get the job done.

Methods of Affixing Doc Stamps

Depending on the type of doc stamp, affixing might involve physically applying a revenue stamp to the document, or it could be a purely electronic process recorded in a government database. For physical stamps, you’ll generally need to ensure they’re securely attached to the document, often in a designated area. For electronic stamps, the process will be guided by the relevant online system, which usually involves entering specific details and confirming the payment.

It’s all about making sure the right stamp is linked to the right document, innit?

Methods of Paying Doc Stamp Tax

Paying for these little stickers isn’t all that different from paying any other bill. Loads of options are usually available, making it pretty convenient, to be fair.

Acceptable Payment Methods

Loads of ways exist to pay your doc stamp tax, mate. You’ll likely find options like:

- Credit/Debit Cards: Most systems these days accept these, making it super easy and quick.

- Electronic Funds Transfer (EFT): This is like paying directly from your bank account – usually super secure.

- Checks/Money Orders: The old-school way, but still accepted in some places.

- Cash: Some offices will let you pay in cash, but this can be a bit more risky, so be careful.

The specific options will vary depending on where you are and the system you’re using, but you’ll generally find a method that suits you.

Steps Involved in Paying Doc Stamp Taxes

Paying your doc stamp tax isn’t rocket science. Here’s the general lowdown:

- Determine the applicable tax amount: Figure out how much you owe based on the document value and the applicable tax rate.

- Choose your payment method: Select your preferred method from the options available (credit card, EFT, check, etc.).

- Submit your payment: Follow the instructions provided by the relevant authority to submit your payment. This might involve online portals, mail, or in-person visits.

- Obtain proof of payment: Always get a receipt or confirmation number to prove you’ve paid up – you don’t want any unexpected drama later, do ya?

- Attach the stamp (if applicable): If you’re dealing with physical stamps, make sure you stick ’em on properly.

So, there you have it – the surprisingly complex and occasionally bewildering world of doc stamps! From their historical origins to their modern applications, these seemingly insignificant pieces of paper play a significant role in our legal and economic systems. While the process of understanding and complying with doc stamp requirements can feel like navigating a bureaucratic maze, hopefully, this exploration has shed some light on the “what,” “why,” and “how” of these tiny tax titans.

Now go forth and stamp responsibly (or at least, consult a professional if you’re unsure!).

Answers to Common Questions

What happens if I forget to put a doc stamp on a document?

Consequences vary by jurisdiction, but generally, expect penalties, fines, and potential legal challenges. It’s best to avoid this headache entirely.

Are there any documents completely exempt from doc stamps?

Yes! Specific exemptions exist, often for government documents or transactions deemed socially beneficial. Check your local regulations for specifics.

How do I pay for doc stamps?

Payment methods vary. Some jurisdictions accept online payments, while others might require checks or in-person payments at designated offices. Always check your jurisdiction’s rules.

Can I get a refund on doc stamps if I made a mistake?

Possibly, but it’s highly dependent on the specific circumstances and the rules of your jurisdiction. It’s best to get things right the first time!