What is the income limit for food stamps in wisconsin – Understanding the income limit for food stamps in Wisconsin is crucial for individuals and families struggling to afford groceries. The FoodShare program, Wisconsin’s version of SNAP (Supplemental Nutrition Assistance Program), provides financial assistance to low-income households to purchase food.

To be eligible for FoodShare, residents must meet specific income requirements, which vary based on household size. This guide explores the income limits for different household sizes, outlining the maximum gross monthly income allowed for each. It also delves into other eligibility factors, such as asset limits, work requirements, and household composition.

Navigating the FoodShare application process can be complex, but this guide aims to provide clarity and support for those seeking assistance. It offers a step-by-step guide on how to apply, the necessary documentation, and the application review timeline. Additionally, the guide provides information on the types of food items eligible for purchase with FoodShare benefits, how to use them at grocery stores and farmers’ markets, and any limitations or restrictions.

Eligibility Criteria for Food Stamps in Wisconsin

To be eligible for FoodShare benefits in Wisconsin, individuals and families must meet certain requirements. These include residency, citizenship, and income and asset limits. The FoodShare program is designed to help low-income households access nutritious food.

Income Limits for FoodShare in Wisconsin

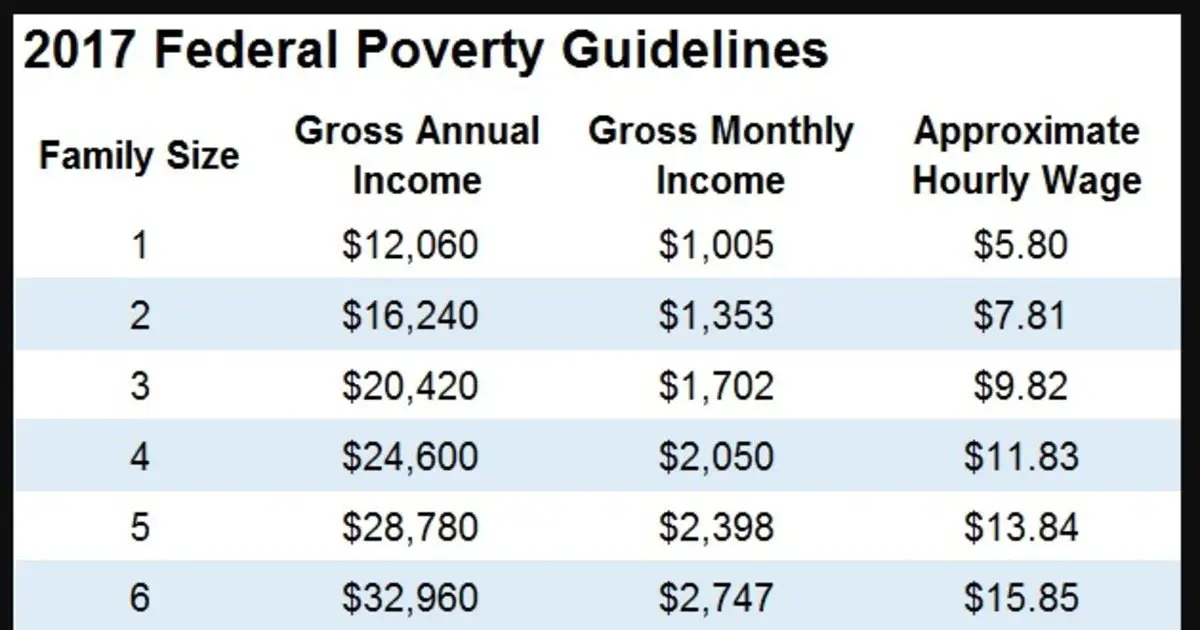

The maximum gross monthly income for FoodShare eligibility varies based on the household size. This income limit represents the highest total income a household can earn before being ineligible for benefits.

| Household Size | Maximum Gross Monthly Income |

|---|---|

| 1 | $1,754 |

| 2 | $2,367 |

| 3 | $2,980 |

| 4 | $3,593 |

| 5 | $4,206 |

| 6 | $4,819 |

| 7 | $5,432 |

| 8 | $6,045 |

Net Income Limits and Calculation

The net income limit for FoodShare in Wisconsin is calculated by subtracting certain deductions from the gross income. These deductions include:

- A standard deduction for each household member.

- A deduction for dependent care expenses.

- A deduction for medical expenses exceeding a certain threshold.

- A deduction for housing expenses exceeding a certain percentage of income.

The net income limit is a lower threshold than the gross income limit, reflecting the fact that some expenses are considered essential and should not be counted against a household’s ability to receive FoodShare benefits.

The net income limit is calculated as follows: Gross income

Deductions = Net income.

Assets and Resources

In addition to income, Wisconsin’s FoodShare program also considers the value of assets and resources when determining eligibility. These assets include savings accounts, vehicles, and real estate. The program aims to ensure that individuals and families have access to essential food resources while also promoting self-sufficiency.

Asset Limits

The asset limits for FoodShare eligibility are set by the federal government. Individuals and families cannot have more than a specific amount of assets to qualify for the program. The current asset limits for FoodShare in Wisconsin are as follows:

- Single Person:$2,000

- Couple:$3,000

- Each Additional Person:$1,000

These limits apply to the total value of all assets, including cash, savings accounts, stocks, bonds, and real estate. However, there are some exceptions to these limits. For example, the value of a primary residence is not considered an asset.

Additionally, individuals may be able to exclude certain assets, such as vehicles, if they are essential for employment or transportation.

Resources

Resources are considered as part of the asset test. These are items that can be converted to cash, such as savings accounts, vehicles, and real estate. The value of resources is counted towards the asset limit.

Savings Accounts

Savings accounts are considered resources and are counted towards the asset limit. However, there are some exceptions to this rule. For example, funds in a special needs trust or a retirement account are not typically considered resources.

Vehicles

Vehicles are also considered resources and are counted towards the asset limit. However, the value of a vehicle used for employment or transportation may be excluded from the asset test. The individual must provide documentation to support the use of the vehicle.

Real Estate

Real estate, such as a house or land, is considered a resource and is counted towards the asset limit. However, the value of a primary residence is not considered an asset. Additionally, individuals may be able to exclude the value of real estate if it is used for employment or income-generating purposes.

Examples of Assets that May Affect Eligibility

Here are some examples of assets that may affect FoodShare eligibility:

- Cash:Any cash on hand, including currency, coins, and checks.

- Savings Accounts:Money in savings accounts, checking accounts, and money market accounts.

- Stocks and Bonds:Investments in stocks and bonds.

- Real Estate:Property owned, such as a house, land, or apartment building, excluding a primary residence.

- Vehicles:The value of any vehicles owned, excluding vehicles used for employment or transportation.

- Precious Metals:Gold, silver, and other precious metals.

- Art and Collectibles:Valuable art, antiques, and collectibles.

It is important to note that the specific rules regarding asset limits and resources may vary depending on the individual’s circumstances. Individuals are encouraged to contact their local FoodShare office for more information.

Work Requirements: What Is The Income Limit For Food Stamps In Wisconsin

In Wisconsin, individuals receiving FoodShare benefits must meet certain work requirements to maintain eligibility. These requirements aim to promote self-sufficiency and encourage employment among able-bodied adults.

The specific work requirements vary depending on the individual’s circumstances and the household’s composition. Generally, adults between the ages of 18 and 49, without dependents, are required to participate in work activities for at least 20 hours per week. These activities can include employment, job training, or community service.

Exemptions from Work Requirements

There are several exemptions from the work requirements. Individuals may be exempt if they are:

- Pregnant or breastfeeding.

- Caring for a child under six years of age.

- Disabled or have a medical condition that prevents them from working.

- A student attending school full-time.

- Participating in a workfare program.

- Unable to find employment due to limited English proficiency.

- A victim of domestic violence.

- A single parent with a child under 18 years of age.

- Caring for an elderly or disabled individual.

Consequences of Failing to Meet Work Requirements

If an individual fails to meet the work requirements, they may face a reduction or termination of their FoodShare benefits. The specific consequences will depend on the individual’s circumstances and the reason for non-compliance. In some cases, individuals may be required to participate in a workfare program or face a temporary suspension of benefits.

Other Eligibility Factors

In addition to income and assets, several other factors can influence eligibility for food stamps in Wisconsin. These factors include immigration status, disability, and household composition.

Immigration Status and Citizenship

Immigration status and citizenship play a significant role in determining eligibility for food stamps. Generally, legal permanent residents (green card holders) and U.S. citizens are eligible. However, certain non-citizens, such as refugees, asylees, and victims of trafficking, may also be eligible.

Disability and Medical Expenses

Individuals with disabilities may be eligible for additional benefits, such as a higher income limit or a waiver of work requirements. Medical expenses can also impact eligibility, as they can be deducted from income when calculating eligibility.

Household Composition

Household composition is a crucial factor in determining food stamp eligibility. The number of dependents in a household, including children, elderly individuals, and disabled individuals, can significantly affect eligibility.

For example, a single parent with two children will have a higher income limit than a single individual without dependents.

Applying for FoodShare

Applying for FoodShare in Wisconsin is a straightforward process that can be completed online, by phone, or in person. The application process involves gathering necessary documentation, completing the application form, and providing supporting information.

Applying for FoodShare, What is the income limit for food stamps in wisconsin

The application process involves several steps. To apply for FoodShare in Wisconsin, you can choose from the following methods:

- Online:You can apply for FoodShare online through the Access Wisconsin website. This option allows you to submit your application securely and conveniently from your computer or mobile device.

- Phone:You can also apply for FoodShare by calling the FoodShare hotline at 1-888-WISCONSIN (1-888-947-2666). This option is helpful if you don’t have access to a computer or prefer to speak to someone directly.

- In Person:You can apply for FoodShare in person at a local Wisconsin Department of Health Services (DHS) office or a community partner agency. This option allows you to get assistance from a trained representative.

Required Documentation

To complete your FoodShare application, you will need to provide the following documentation:

- Proof of Identity:This can include a driver’s license, state-issued ID card, birth certificate, passport, or other official identification.

- Social Security Number:You will need to provide your Social Security number for all household members.

- Proof of Residency:This can include a utility bill, lease agreement, bank statement, or other document that shows your current address.

- Income Information:You will need to provide information about your income from all sources, including wages, salaries, self-employment income, unemployment benefits, and other government assistance.

- Household Composition:You will need to provide information about all household members, including their names, dates of birth, and relationship to you.

- Other Relevant Information:You may need to provide additional information, such as medical expenses, child care costs, or other expenses that may affect your eligibility.

Application Process and Review Timelines

Once you have submitted your application, it will be reviewed by the Wisconsin Department of Health Services (DHS). The review process typically takes up to 30 days, but can vary depending on the complexity of your application.

- Initial Application Review:During the initial review, DHS will verify your information and determine your eligibility for FoodShare.

- Interview:In some cases, you may be required to attend an interview to provide additional information or documentation.

- Decision:Once your application has been reviewed, DHS will notify you of their decision. If you are approved, you will receive your FoodShare benefits.

FoodShare Benefits and Usage

FoodShare benefits can be used to purchase eligible food items at participating retailers, including grocery stores and farmers’ markets. The program aims to provide nutritional assistance to low-income households in Wisconsin.

Types of Eligible Food Items

FoodShare benefits can be used to purchase a wide variety of food items, including:

- Fresh fruits and vegetables

- Meat, poultry, and fish

- Dairy products, such as milk, cheese, and yogurt

- Bread, cereal, and grains

- Legumes, such as beans and lentils

- Seeds and plants for growing food

- Non-alcoholic beverages

FoodShare benefits cannot be used to purchase:

- Alcohol

- Tobacco products

- Pet food

- Vitamins and supplements

- Hot foods

- Prepared meals

- Cleaning supplies

- Cosmetics

Using FoodShare Benefits

FoodShare benefits are typically loaded onto an Electronic Benefits Transfer (EBT) card. This card functions like a debit card and can be used at participating retailers.

Grocery Stores

At most grocery stores, simply swipe your EBT card at the checkout and enter your PIN. The cashier will deduct the cost of your eligible purchases from your FoodShare balance.

Farmers’ Markets

Many farmers’ markets in Wisconsin accept FoodShare benefits. Look for signs indicating that they accept EBT cards. Some markets may have specific procedures for using FoodShare benefits, such as requiring a separate transaction or using a token system.

Limitations and Restrictions

There are certain limitations and restrictions on using FoodShare benefits:

- FoodShare benefits cannot be used to purchase items that are not eligible for the program, such as alcohol, tobacco, or hot food.

- The amount of benefits available each month is based on household size and income.

- FoodShare benefits can only be used at participating retailers. Not all stores accept EBT cards.

- FoodShare benefits cannot be used to withdraw cash.

- There may be a limit on the amount of cash back that can be received when using FoodShare benefits to make a purchase.

Resources and Support

Navigating the FoodShare application process and managing food insecurity can be challenging. Fortunately, various resources and organizations in Wisconsin offer support and guidance to help individuals and families access the assistance they need.

This section will provide information on where to find help with FoodShare applications and benefits, as well as additional resources for addressing food insecurity in Wisconsin.

Assistance with FoodShare Applications and Benefits

Several organizations in Wisconsin provide assistance with FoodShare applications and benefits. These organizations can help individuals navigate the application process, understand eligibility requirements, and resolve any issues they may encounter.

- Wisconsin Department of Health Services (DHS): The DHS website provides comprehensive information about FoodShare, including eligibility criteria, application procedures, and contact details for local offices. Website: https://www.dhs.wisconsin.gov/ Phone:1-800-362-3002

- Wisconsin Hunger Relief Alliance: This organization advocates for food security policies and provides resources to individuals and families facing hunger. Website: https://www.wisconsinhunger.org/ Phone:608-257-0555

- Local Community Action Agencies: These agencies offer various social services, including assistance with FoodShare applications. They can provide personalized guidance and support to individuals and families in their communities. Website: https://www.wisconsincommunityaction.org/

- Food Pantries and Soup Kitchens: These organizations provide food assistance to individuals and families in need. They may offer additional resources and support, such as referrals to other services.

Additional Support for Food Insecurity

Beyond FoodShare, various organizations and programs offer support to address food insecurity in Wisconsin. These resources can provide access to food, nutritional education, and other essential services.

| Organization | Website | Phone | Services |

|---|---|---|---|

| Feeding America Eastern Wisconsin | https://feedingamericawi.org/ | (414) 431-3663 | Food pantries, meal programs, and nutrition education |

| Second Harvest Foodbank of Southern Wisconsin | https://www.secondharvestmadison.org/ | (608) 246-6933 | Food distribution network, community gardens, and food rescue programs |

| Wisconsin Farmers Market Association | https://www.wisconsinfarmersmarkets.org/ | (608) 257-1353 | Information on farmers markets and local food access programs |

Final Review

The FoodShare program plays a vital role in ensuring food security for low-income individuals and families in Wisconsin. By understanding the eligibility criteria, including income limits, asset restrictions, and work requirements, individuals can determine their potential for receiving FoodShare benefits.

This guide serves as a valuable resource for navigating the application process and maximizing the benefits of this essential program. Remember, seeking assistance is a sign of strength, and resources are available to help those facing food insecurity.

Questions Often Asked

What are the specific income limits for a family of four in Wisconsin?

The maximum gross monthly income for a family of four in Wisconsin is $3,150. This limit may vary slightly depending on deductions and other factors. It’s recommended to consult the official FoodShare website for the most up-to-date information.

What happens if my income fluctuates throughout the year?

The FoodShare program considers your average income over a three-month period. This means that if your income fluctuates, your eligibility will be based on your average income over those three months. It’s important to report any significant changes in income to the FoodShare office.

Can I still receive FoodShare benefits if I am working?

Yes, you can still receive FoodShare benefits if you are working. The program considers your earnings when determining eligibility, but it also considers other factors, such as the number of dependents you have and your work expenses.

Where can I find additional resources and support for food insecurity?

The FoodShare website provides a comprehensive list of resources, including food pantries, soup kitchens, and other organizations that offer assistance to individuals and families facing food insecurity. Additionally, you can contact the Wisconsin Department of Health Services for guidance and support.