What does secured bond mean? In the world of finance, a secured bond is like a loan with a safety net. It’s a debt instrument where the issuer pledges a specific asset as collateral, offering investors a layer of protection against default. Think of it like borrowing money for a car, but with the car itself serving as collateral. If you can’t repay the loan, the lender can take possession of the car.

Secured bonds operate on the same principle, providing a degree of comfort to investors by guaranteeing a tangible asset in case the issuer fails to meet their obligations.

The existence of collateral plays a crucial role in mitigating risk for investors. It serves as a safety cushion, offering a higher level of security compared to unsecured bonds. This makes secured bonds particularly appealing to risk-averse investors seeking a balance between potential returns and the safeguarding of their capital.

Defining Secured Bonds

Secured bonds are a type of debt security that offers investors a higher level of protection compared to unsecured bonds. This protection stems from the fact that secured bonds are backed by specific assets, known as collateral. If the issuer of a secured bond defaults on their debt obligations, the bondholders have the right to claim and sell these assets to recover their investment.

Understanding Secured Bonds

A secured bond is essentially a loan where the lender (bondholder) receives a guarantee in the form of collateral. This collateral serves as a safety net for the bondholder, ensuring they can recover some or all of their investment even if the issuer faces financial difficulties.

Types of Collateral for Secured Bonds

The specific assets that can be used as collateral for secured bonds vary depending on the issuer and the type of bond. Here are some common examples:

- Real Estate: Mortgage-backed securities are a prime example. These bonds are secured by real estate properties, such as homes or commercial buildings. If the borrower defaults, the bondholders can foreclose on the property and sell it to recover their investment.

- Equipment: Bonds issued by companies that own equipment, such as manufacturing plants or transportation vehicles, can be secured by these assets. This ensures that bondholders have a claim on the equipment if the company fails to repay its debts.

- Financial Assets: Secured bonds can also be backed by financial assets, such as stocks, bonds, or cash. These assets are typically held in a trust account, providing bondholders with a clear claim in case of default.

Collateral and its Role

Collateral serves as a crucial element in mitigating risk for bondholders. It acts as a safety net, offering investors a tangible asset to claim in case the bond issuer defaults on its obligations.

When a bond is secured, the issuer pledges a specific asset as collateral. This asset can be anything from real estate or equipment to inventory or accounts receivable. In the event of default, bondholders have the right to seize and sell the collateral to recover their investment. This process helps minimize potential losses for investors, making secured bonds generally considered less risky than unsecured bonds.

The Process of Claiming Collateral

The process of claiming collateral upon default involves a series of steps, including:

- Default Notice: When the issuer fails to meet its obligations, bondholders typically receive a formal default notice.

- Legal Action: Bondholders may initiate legal proceedings to enforce their rights and claim the collateral.

- Collateral Seizure: The court may authorize the seizure of the collateral and its subsequent sale.

- Proceeds Distribution: The proceeds from the sale of the collateral are distributed to the bondholders in accordance with the terms of the bond agreement.

Types of Secured Bonds

Secured bonds are a type of debt security that is backed by specific assets, known as collateral. This collateral provides investors with an additional layer of protection in case the issuer defaults on its debt obligations. Different types of secured bonds are categorized based on the type of collateral backing them.

Mortgage-Backed Bonds

Mortgage-backed bonds are a type of secured bond backed by a pool of mortgages. These bonds are issued by government agencies, private companies, or financial institutions. Investors who purchase mortgage-backed bonds receive regular interest payments from the underlying mortgages. The principal is repaid as homeowners make their mortgage payments.

Mortgage-backed bonds offer investors a relatively safe investment option, as the underlying mortgages provide collateral. However, the value of these bonds can fluctuate based on interest rates and the performance of the housing market.

Asset-Backed Bonds

Asset-backed bonds are another type of secured bond backed by a pool of assets, such as auto loans, credit card receivables, or equipment leases. These bonds are typically issued by financial institutions or special purpose entities.

Asset-backed bonds can offer investors a higher yield than traditional bonds, but they also carry a higher risk. The risk of default is dependent on the underlying assets and the creditworthiness of the borrowers.

Other Types of Secured Bonds

Besides mortgage-backed and asset-backed bonds, there are other types of secured bonds, including:

- Collateralized Debt Obligations (CDOs): These bonds are backed by a pool of debt securities, such as mortgages, auto loans, or credit card receivables. CDOs are structured into different tranches, each with a different risk profile.

- Equipment Trust Certificates: These bonds are backed by specific equipment, such as airplanes or railroad cars. They are typically issued by companies that lease or finance equipment.

- Municipal Bonds: These bonds are issued by state and local governments. Some municipal bonds are secured by specific assets, such as toll roads, airports, or water treatment plants.

Advantages and Disadvantages of Secured Bonds

:max_bytes(150000):strip_icc()/what-difference-between-secured-and-unsecured-debts.asp-final-c2040f78625b44d98372ea024fa51697.png)

Secured bonds offer investors a higher degree of safety compared to unsecured bonds, as they are backed by specific assets. This means that if the issuer defaults on the bond payments, investors have the right to claim the collateral to recover their investment. This makes secured bonds particularly attractive to risk-averse investors who prioritize capital preservation.

Advantages of Secured Bonds

- Lower Risk of Default: Secured bonds are backed by specific assets, providing investors with a safety net in case of default. The collateral serves as a guarantee that investors will receive their principal and interest payments. This makes secured bonds a relatively safe investment option, particularly for risk-averse investors.

- Priority in Claim: In the event of a company’s bankruptcy, secured bondholders have priority over unsecured bondholders in claiming the company’s assets. This means that they are more likely to recover their investment, even if the company is unable to meet its obligations.

- Higher Credit Ratings: Secured bonds typically receive higher credit ratings than unsecured bonds due to their lower risk of default. This makes them more attractive to investors and may result in lower interest rates.

Disadvantages of Secured Bonds, What does secured bond mean

- Limited Returns: Secured bonds often offer lower interest rates compared to unsecured bonds due to their lower risk. This is because investors are willing to accept lower returns in exchange for the added security of collateral.

- Collateral Risks: While collateral provides a safety net, it is not without risk. The value of the collateral may decline, or it may be difficult to liquidate in a timely manner. This can impact the recovery amount for investors in case of default.

- Limited Investment Opportunities: Secured bonds are less common than unsecured bonds, limiting the investment options available to investors. This can make it challenging to find secured bonds that meet specific investment goals.

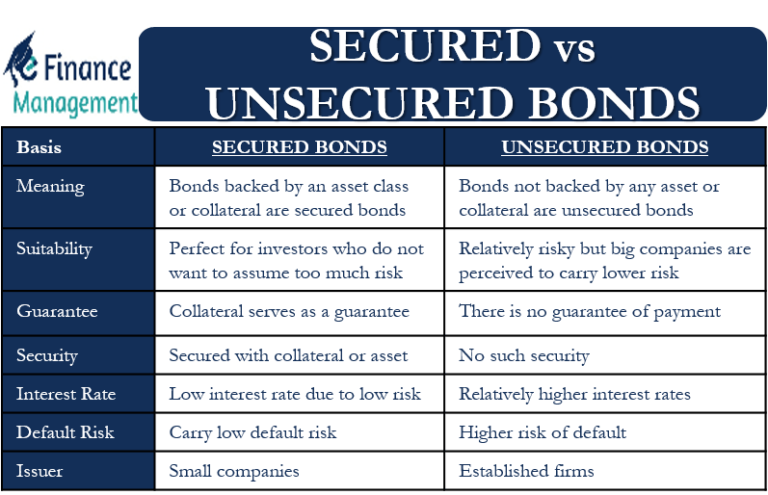

Comparison of Secured and Unsecured Bonds

| Feature | Secured Bonds | Unsecured Bonds |

|---|---|---|

| Risk | Lower | Higher |

| Returns | Lower | Higher |

| Collateral | Yes | No |

| Credit Rating | Higher | Lower |

| Investment Options | Limited | More abundant |

Secured Bonds in the Market

Secured bonds play a vital role in the fixed-income market, providing investors with a relatively safe and predictable stream of income. Their popularity is influenced by various factors, including prevailing interest rates and overall economic conditions.

Current Market Trends

The demand for secured bonds fluctuates based on the economic landscape. During periods of economic uncertainty, investors often gravitate towards secured bonds as they offer a degree of protection against potential losses. This is because secured bonds are backed by specific assets, providing a safety net in case the issuer defaults.

- Interest Rate Environment: When interest rates rise, the attractiveness of fixed-income securities, including secured bonds, may decline. This is because investors can earn higher returns on newly issued bonds with higher interest rates. Conversely, when interest rates fall, secured bonds become more appealing as their fixed interest payments offer a stable income stream in a low-yield environment.

- Economic Conditions: During periods of economic expansion, investors may be more willing to take on risk, leading to a potential shift towards higher-yielding investments. However, in times of economic contraction or recession, investors often seek the safety and security of secured bonds, driving up their demand.

Real-World Applications of Secured Bonds

Secured bonds are used across a wide range of industries, providing financing for various purposes.

- Real Estate: Mortgage-backed securities (MBS), a type of secured bond, are commonly used to finance residential and commercial real estate projects. These bonds are backed by a pool of mortgages, offering investors a stream of income from mortgage payments. The underlying mortgages serve as collateral, providing protection in case of default.

- Infrastructure: Secured bonds are often used to fund large-scale infrastructure projects, such as highways, bridges, and airports. These bonds may be backed by specific assets related to the project, such as tolls or lease payments, ensuring repayment even if the issuer faces financial difficulties.

- Energy: Secured bonds can be used to finance energy projects, such as power plants and renewable energy facilities. These bonds may be backed by assets such as the power plant itself, long-term power purchase agreements, or other revenue streams related to the project.

Visual Representation of the Secured Bond Market

Imagine a pie chart representing the broader fixed-income market. The secured bond market would occupy a significant slice of this pie, highlighting its importance within the overall fixed-income landscape. The size of the secured bond market segment would fluctuate over time, reflecting changes in investor preferences, economic conditions, and prevailing interest rates.

Secured bonds offer a unique blend of potential returns and risk mitigation. While the presence of collateral provides a degree of comfort, understanding the specific type of collateral, the issuer’s financial health, and the market conditions is crucial for making informed investment decisions. By navigating the world of secured bonds with a discerning eye, investors can potentially access attractive opportunities while managing their exposure to risk.

FAQ Corner: What Does Secured Bond Mean

What are some examples of assets that can serve as collateral for secured bonds?

Common examples include real estate (mortgage-backed bonds), equipment (asset-backed bonds), and even receivables (accounts receivable bonds).

How does the process of claiming collateral work if a bond issuer defaults?

The process varies depending on the specific terms of the bond agreement. Generally, bondholders have the right to seize and sell the collateral to recover their investment. However, the value of the collateral may not fully cover the outstanding debt, resulting in potential losses for investors.

What are the key differences between secured and unsecured bonds?

Secured bonds offer the protection of collateral, making them generally considered less risky than unsecured bonds. However, unsecured bonds often have higher interest rates to compensate for the lack of collateral. Ultimately, the choice between secured and unsecured bonds depends on individual risk tolerance and investment goals.

.jpg?w=700)