Do VA disability benefits count as income for food stamps? This question often arises for veterans seeking assistance with food security. Navigating the complex world of government benefits can be overwhelming, especially when trying to understand how different income sources are considered.

Understanding how VA disability benefits are treated for SNAP eligibility is crucial for veterans who may rely on this program for sustenance.

The Supplemental Nutrition Assistance Program (SNAP), commonly known as food stamps, aims to provide nutritional assistance to low-income individuals and families. However, the eligibility criteria for SNAP are strict, and income is a primary factor in determining qualification. This includes not only wages but also various other forms of income, including government benefits.

This is where the question of VA disability benefits comes into play. Do these benefits count as income for SNAP eligibility? The answer, as we’ll explore, is not always straightforward.

VA Disability Benefits and Food Stamp Eligibility

VA disability benefits are a crucial source of income for many veterans, but they can also impact their eligibility for SNAP benefits (food stamps). The Supplemental Nutrition Assistance Program (SNAP) provides food assistance to low-income individuals and families, and it uses income and asset thresholds to determine eligibility.

Understanding how VA disability benefits are considered in the context of SNAP eligibility is essential for veterans seeking this assistance.

How VA Disability Benefits Are Considered

VA disability benefits are considered income for SNAP purposes, meaning they are included in the calculation of your household’s total income. However, there are some exceptions and considerations:

- Non-countable Income:A portion of your VA disability benefits may be considered “non-countable” income for SNAP eligibility. This is because the government recognizes that VA disability benefits are meant to offset expenses related to your disability, such as medical costs, assistive devices, or home modifications.

- Deductions:SNAP allows for certain deductions from your gross income, including a deduction for disability-related expenses. This can reduce your countable income and potentially increase your chances of qualifying for SNAP benefits.

Income Thresholds for SNAP Eligibility

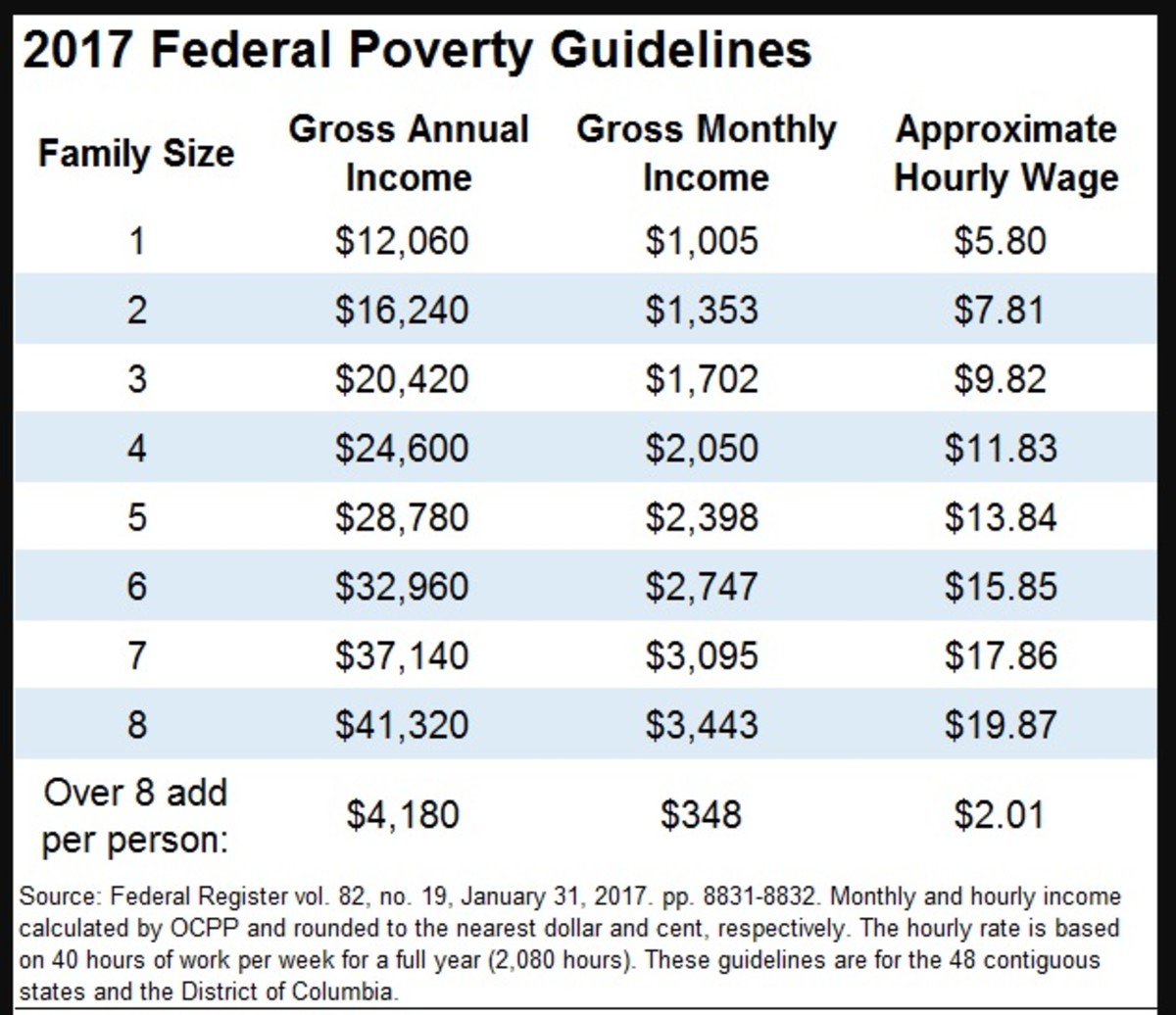

SNAP eligibility is based on income thresholds, which vary depending on your household size and state of residence. These thresholds are set to ensure that SNAP benefits are available to individuals and families who meet certain income requirements.

- Gross Income:The gross income threshold for SNAP eligibility is the maximum amount of income your household can earn before being ineligible for benefits.

- Net Income:After applying deductions, such as the disability-related expense deduction, the remaining income is considered your “net income.”

Examples of How VA Disability Benefits Impact SNAP Eligibility, Do va disability benefits count as income for food stamps

To illustrate how VA disability benefits can impact SNAP eligibility, let’s consider a few examples:

- Example 1:A single veteran receives $1,500 per month in VA disability benefits. Their state’s gross income threshold for a single-person household is $2,000 per month. Since their VA benefits are below the threshold, they are likely eligible for SNAP.

- Example 2:A veteran couple receives $2,500 per month in VA disability benefits and has no other income. Their state’s gross income threshold for a two-person household is $3,000 per month. Since their VA benefits exceed the threshold, they are unlikely to be eligible for SNAP unless they qualify for a deduction for disability-related expenses.

Federal and State Regulations: Do Va Disability Benefits Count As Income For Food Stamps

The rules governing whether VA disability benefits are considered income for SNAP eligibility are determined by a combination of federal and state regulations. While federal law provides a general framework, states have the flexibility to implement their own policies within certain boundaries.

Federal Regulations Regarding VA Disability Benefits for SNAP Eligibility

Federal regulations define SNAP eligibility based on income and assets. VA disability benefits are specifically addressed in the Food and Nutrition Service (FNS) regulations. The FNS considers VA disability benefits as income for SNAP purposes.

“VA disability benefits are considered income for SNAP purposes.”

State-Specific Regulations and Policies

While federal regulations mandate the inclusion of VA disability benefits in income calculations, states can implement policies that affect the inclusion of these benefits.

State-Specific Exclusions

Some states have implemented policies that exclude certain portions of VA disability benefits from income calculations for SNAP eligibility.

“States can exclude certain portions of VA disability benefits from income calculations for SNAP eligibility.”

State-Specific Deductions

Other states have implemented policies that allow for deductions from VA disability benefits before they are considered income for SNAP purposes.

“States can allow deductions from VA disability benefits before they are considered income for SNAP eligibility.”

Comparison of Rules Across Different States

States differ in their policies regarding the inclusion of VA disability benefits in income calculations for SNAP eligibility. Some states have implemented policies that exclude certain portions of VA disability benefits from income calculations, while others have implemented policies that allow for deductions from VA disability benefits before they are considered income.

Examples of State Policies

State A

Excludes the first $200 of VA disability benefits from income calculations.

State B

Allows for a deduction of $100 from VA disability benefits before they are considered income.

State C

Does not have any state-specific policies regarding VA disability benefits and SNAP eligibility.It is crucial for individuals seeking SNAP benefits to consult with their state’s SNAP office to determine the specific policies that apply in their state.

Deductions and Exemptions

Deductions and exemptions can significantly impact your SNAP eligibility and benefit amount. They are expenses that are subtracted from your gross income to determine your net income, which is used to calculate your SNAP benefits.

Deductions for Medical Expenses

The SNAP program recognizes that medical expenses can significantly impact a household’s ability to afford food. Therefore, you can deduct certain medical expenses from your income to determine your SNAP eligibility.

Deductible Medical Expenses:

- Unreimbursed medical expenses for yourself, your spouse, or your dependents.

- Medical expenses paid for by a third party, such as insurance, but that exceed 20% of your gross monthly income.

- Medical expenses paid for by a third party that are not considered “medical expenses” for SNAP purposes, such as copayments, deductibles, and coinsurance.

Deductions for Work Expenses

The SNAP program recognizes that work expenses can also impact a household’s ability to afford food. Therefore, you can deduct certain work expenses from your income to determine your SNAP eligibility.

Deductible Work Expenses:

- Childcare expenses, which include the cost of daycare, preschool, and after-school programs.

- Transportation expenses, which include the cost of gas, parking, tolls, and public transportation.

- Uniforms and work supplies, which include the cost of uniforms, tools, and equipment that are required for your job.

- Job training expenses, which include the cost of tuition, fees, and books for job training programs.

Deductions for Other Expenses

You may be eligible for other deductions based on your specific circumstances. These deductions can include:

Deductible Other Expenses:

- Shelter expenses, such as rent, mortgage payments, and property taxes.

- Energy expenses, such as heating and cooling costs.

- Child support payments.

- Court-ordered payments.

- Certain disability-related expenses, such as the cost of assistive devices.

Impact of Deductions on SNAP Eligibility

Deductions can significantly affect your SNAP eligibility and benefit amount. The more deductions you are eligible for, the lower your net income will be, which can increase your chances of qualifying for SNAP and receiving a higher benefit amount.

Example:Let’s say you receive $1,000 in VA disability benefits each month. You also have $200 in medical expenses and $100 in work expenses. Your gross income for SNAP purposes would be $1,000. However, after deducting your medical and work expenses, your net income would be $700.

This lower net income could make you eligible for SNAP benefits.

Impact on SNAP Benefits

The inclusion or exclusion of VA disability benefits as income for SNAP eligibility can significantly affect the amount of SNAP benefits a person receives. Understanding how these benefits are treated under SNAP regulations is crucial for individuals seeking assistance.The impact of VA disability benefits on SNAP benefits is determined by several factors, including the individual’s income, deductions, and state-specific regulations.

VA Disability Benefits as Income for SNAP

VA disability benefits are generally considered income for SNAP purposes. This means they are included in the calculation of a household’s gross monthly income, which determines their eligibility for SNAP and the amount of benefits they receive. However, there are some exceptions and deductions that can reduce the impact of VA disability benefits on SNAP eligibility.

Deductions and Exemptions

Several deductions and exemptions can reduce the impact of VA disability benefits on SNAP eligibility. These deductions can include:* Standard Deduction:This deduction is a fixed amount that is subtracted from a household’s gross income before calculating their net income. The standard deduction varies by household size.

Earned Income Deduction

This deduction is based on a household’s earned income and is designed to help households with low earnings keep more of their income.

Child Care Costs

This deduction allows households to deduct the cost of child care for children under 13 years old who are in the household.

Medical Expenses

This deduction allows households to deduct medical expenses that exceed a certain percentage of their income.

Housing Costs

This deduction allows households to deduct a portion of their housing costs, including rent or mortgage payments, property taxes, and homeowner’s insurance.

Impact of Income Levels and Deductions

The amount of SNAP benefits a household receives is determined by their net income, which is their gross income minus deductions. The following examples illustrate how different income levels and deductions can affect SNAP benefits:* Example 1:A single individual receives $1,000 in VA disability benefits and has no other income.

Their gross income is $1,000. After subtracting the standard deduction of $170, their net income is $830. Based on their net income, they may be eligible for SNAP benefits.

Example 2

A family of four receives $2,000 in VA disability benefits and has $1,000 in earned income. Their gross income is $3,000. After subtracting the standard deduction of $420, their net income is $2,580. Based on their net income, they may not be eligible for SNAP benefits.

However, if they have significant medical expenses, they may be able to deduct a portion of their medical expenses, reducing their net income and making them eligible for SNAP benefits.

Consequences of Misclassifying VA Disability Benefits

Misclassifying VA disability benefits as income for SNAP eligibility can have serious consequences. If a household incorrectly reports VA disability benefits as income, they may:* Receive less SNAP benefits:If VA disability benefits are incorrectly included in a household’s income, they may receive less SNAP benefits than they are entitled to.

Lose SNAP eligibility

If a household’s income exceeds the SNAP eligibility limits after incorrectly including VA disability benefits, they may lose their SNAP benefits altogether.

Face penalties

Households that intentionally misrepresent their income to receive SNAP benefits may face penalties, including fines and imprisonment.

Resources and Assistance

Navigating the complexities of SNAP eligibility and VA disability benefits can feel overwhelming. Luckily, several resources and organizations exist to provide support and guidance. This section Artikels key resources, steps for navigating the application process, and contact information for local agencies.

Navigating the SNAP Application Process

The SNAP application process involves several steps, and understanding the process related to VA disability benefits is crucial. Here’s a step-by-step guide:

- Determine Eligibility:Begin by assessing your eligibility for SNAP. This involves factors like income, household size, and assets. While VA disability benefits are not considered income for SNAP purposes, it’s essential to accurately report all other sources of income.

- Gather Necessary Documents:Prepare documents like proof of identity, residency, income, and expenses. Include documentation of your VA disability benefits, as this will be essential for demonstrating your income situation.

- Submit Your Application:Applications can be submitted online, by mail, or in person at your local SNAP office. Be sure to complete all sections accurately and provide all required documentation.

- Interview and Verification:You may be required to participate in an interview to verify your information. This interview will cover your income, expenses, and household size, including how your VA disability benefits affect your overall financial situation.

- Receive a Decision:You’ll receive a decision on your SNAP application within a specified timeframe. If approved, you’ll receive an EBT card allowing you to purchase eligible food items.

Contacting Local Agencies and Organizations

Reaching out to local agencies and organizations can provide personalized assistance with SNAP applications and VA disability benefits.

- Local SNAP Offices:Contact your local SNAP office for information about application requirements, eligibility, and assistance with the application process. You can find the contact information for your local office through the USDA’s Food and Nutrition Service website.

- State-Level Agencies:Many states have dedicated agencies that administer SNAP benefits and can provide guidance on eligibility and application procedures. These agencies often offer resources for veterans and individuals receiving VA disability benefits.

- Veterans Service Organizations:Organizations like the Veterans of Foreign Wars (VFW), the American Legion, and the Disabled American Veterans (DAV) offer support and resources for veterans, including assistance with benefits like SNAP and VA disability. These organizations can provide information on eligibility, application procedures, and advocate for veterans’ rights.

- Community Action Agencies:Community action agencies often provide assistance with SNAP applications, as well as other social services. They can offer support with navigating the application process, gathering necessary documents, and understanding eligibility requirements.

- Legal Aid Organizations:If you face legal challenges related to SNAP eligibility or VA disability benefits, legal aid organizations can provide assistance. These organizations often offer free or low-cost legal services to individuals with limited income.

Additional Resources

Several online resources provide comprehensive information about SNAP and VA disability benefits.

- USDA’s Food and Nutrition Service Website:This website offers detailed information about SNAP, including eligibility requirements, application procedures, and benefits information.

- VA Benefits Website:The VA website provides information about various benefits available to veterans, including disability benefits. It offers resources for understanding eligibility criteria, filing claims, and navigating the benefits process.

- National Coalition for the Homeless:This organization provides resources and information on housing, food, and other essential services for individuals experiencing homelessness. Their website offers guidance on accessing SNAP benefits and other support programs.

Closing Summary

The inclusion or exclusion of VA disability benefits in income calculations for SNAP eligibility can significantly impact a veteran’s access to food assistance. Understanding the complex interplay of federal and state regulations, deductions, and exemptions is essential for veterans to navigate the application process and ensure they receive the benefits they deserve.

Resources and assistance are available to help veterans navigate this process and secure the support they need.

Frequently Asked Questions

What are the income thresholds for SNAP eligibility?

Income thresholds for SNAP eligibility vary based on household size, state, and other factors. These thresholds are updated regularly and can be found on the USDA website or through your local SNAP office.

Are there any state-specific regulations regarding VA disability benefits and SNAP?

Yes, some states have specific regulations that may influence how VA disability benefits are treated for SNAP eligibility. It’s important to check with your state’s SNAP office for details.

Can I deduct medical expenses from my income for SNAP eligibility?

Yes, medical expenses can be deducted from your income for SNAP eligibility. However, the specific deductions allowed may vary by state. Consult with your local SNAP office for details.

Where can I find more information about SNAP eligibility and VA disability benefits?

You can find information about SNAP eligibility on the USDA website and through your local SNAP office. The VA website also provides resources for veterans regarding disability benefits. You can also contact local organizations that specialize in assisting veterans with benefits and services.