Do you have to report plasma donations to food stamps? This question arises for many individuals seeking financial assistance through the Supplemental Nutrition Assistance Program (SNAP), also known as food stamps. While plasma donation can provide a valuable source of income, it’s crucial to understand how it might affect your eligibility for food stamps.

This article will delve into the complexities of reporting plasma donations, exploring the legal requirements, ethical considerations, and potential consequences of non-disclosure.

Navigating the relationship between plasma donation and food stamps can be challenging, as eligibility criteria vary depending on the state and the specific circumstances of each individual. We will break down the essential aspects of food stamp eligibility, including income and asset limits, and provide guidance on how plasma donations are considered within the program’s framework.

By understanding the reporting requirements and potential impacts, you can ensure you are navigating the system responsibly and maximizing your access to essential resources.

Plasma Donation and Food Stamps

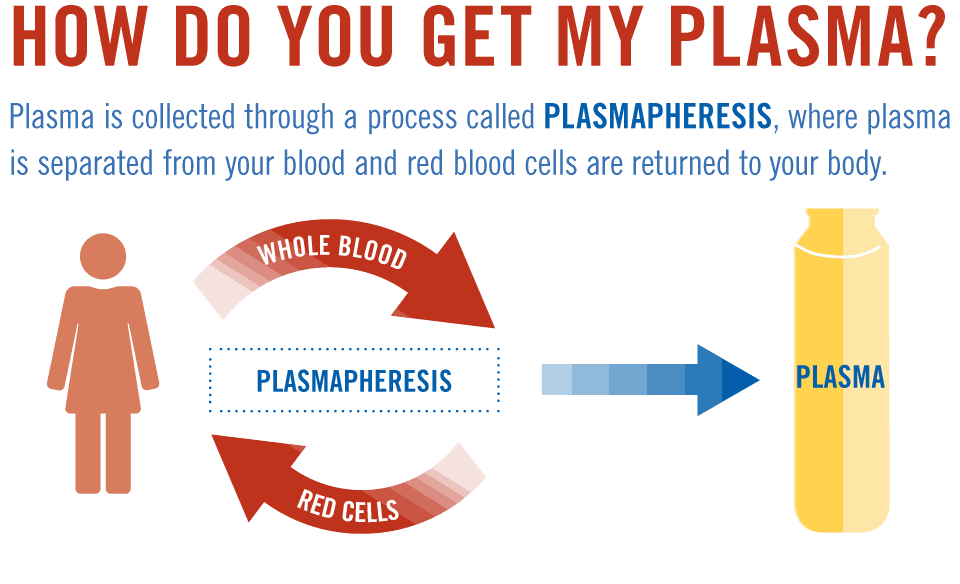

Plasma donation is a process where individuals donate their plasma, a component of blood, for medical purposes. This can be a way to earn extra money, but it also raises questions about its impact on food stamp eligibility.

Plasma Donation as Income, Do you have to report plasma donations to food stamps

Plasma donation centers often compensate donors for their time and plasma. This compensation is considered income, and it can affect eligibility for government assistance programs like food stamps.

- Plasma donation payments are considered earned income and must be reported to the government.

- The amount of income earned from plasma donation can affect eligibility for food stamps, as the program has income limits.

- If your plasma donation income exceeds the program’s income limits, you may no longer be eligible for food stamps.

Examples of How Plasma Donation Might Be Considered Income

Here are some examples of how plasma donation might be considered income:

- Direct payments:Plasma donation centers often provide direct payments to donors for their plasma, which is considered earned income.

- Gift cards:Some centers offer gift cards as compensation, which can be used for purchases, and the value of the gift card is considered income.

- Other benefits:Some centers provide additional benefits like discounts or free services, which can be considered income if they have a monetary value.

Food Stamp Program Eligibility Criteria

The Food Stamp Program, officially known as the Supplemental Nutrition Assistance Program (SNAP), provides financial assistance to low-income households to purchase food. To be eligible for SNAP benefits, individuals must meet specific criteria related to their income, assets, and household size.

Income and Asset Limits

To qualify for SNAP benefits, individuals must meet specific income and asset limits. These limits vary based on household size and state.

The maximum gross monthly income for a household of one person is $1,635.

For instance, a household of one person can have a gross monthly income of up to $1,635 to qualify for SNAP benefits. These limits are adjusted based on the household size. The program also considers asset limits. Assets include things like cash, savings, and property.

The maximum asset limit for a household of one person is $2,000. This limit is adjusted for larger households.

Household Income Determination

The Food Stamp Program uses a specific formula to determine household income. This formula considers all income sources, including wages, salaries, unemployment benefits, and Social Security benefits.

Household income is calculated by subtracting deductions from gross income.

Deductions include expenses like medical costs, childcare, and work-related expenses. The program calculates the household’s net income after deducting these expenses. This net income is then compared to the income eligibility limits to determine if the household qualifies for SNAP benefits.

Reporting Income from Plasma Donation

It’s super important to know the rules about reporting your plasma donation income to the food stamp program. This can affect how much you get and even if you qualify. It’s like, if you don’t tell them, you might be in trouble, so be sure to check the rules.

State Requirements for Reporting Income

States have different rules about reporting plasma donation income. It’s like, every state has its own vibe. You gotta check with your state’s food stamp program to see what they say.

- Some states might not require you to report it if it’s under a certain amount, like $20 a month. It’s like, they’re chill with the small stuff.

- Other states might make you report every single penny, even if it’s just a few bucks. They’re more strict, you know?

Consequences of Not Reporting Income

If you don’t report your plasma donation income and you’re supposed to, you might get in trouble. It’s like, you could get kicked off the food stamp program or even have to pay back some of the benefits you received.

It’s not worth the risk, so be careful!

- They might find out you’re not being honest, and that’s a big no-no.

- You could end up with a big ol’ fine or even jail time, depending on how serious it is.

Reporting Process

Reporting your plasma donation income is usually pretty simple. It’s like, you just gotta tell them what you made.

- You can usually do it online, over the phone, or in person at your local food stamp office.

- They’ll ask you for your income information, and that’s it.

Legal and Ethical Considerations

The relationship between plasma donation and food stamps is governed by a complex interplay of federal regulations and ethical considerations. This section delves into the legal framework surrounding plasma donation and food stamps, explores ethical considerations related to reporting income from plasma donation, and examines potential conflicts of interest or biases in the reporting process.

Legal Framework

The legal framework governing plasma donation and food stamps is multifaceted, involving federal regulations and state-specific guidelines. The Supplemental Nutrition Assistance Program (SNAP), commonly known as food stamps, is a federal program that provides food assistance to low-income individuals and families.

The program’s eligibility is determined by income and assets, including income from plasma donation. The Food and Nutrition Service (FNS) of the U.S. Department of Agriculture (USDA) administers SNAP and has established regulations for reporting income from plasma donation.

These regulations mandate that individuals receiving SNAP benefits must report all income sources, including plasma donation earnings. Failure to do so can result in penalties, including overpayment recovery and suspension of benefits.

Ethical Considerations

Reporting income from plasma donation raises several ethical considerations. The principle of honesty and transparency in benefit programs is paramount. Individuals receiving SNAP benefits have an ethical obligation to report all income sources accurately and promptly. However, there may be instances where individuals are hesitant to report plasma donation earnings due to concerns about stigma or potential reduction in benefits.

The ethical dilemma lies in balancing the need for accurate reporting with the potential impact on recipients’ access to essential food assistance.

Potential Conflicts of Interest or Biases

The reporting process for income from plasma donation can be susceptible to potential conflicts of interest or biases. For example, plasma donation centers may have financial incentives to encourage donors to underreport their earnings, potentially leading to inaccurate reporting.

Furthermore, SNAP administrators may have a vested interest in minimizing benefit costs, potentially leading to biases in reviewing and verifying income reports. These conflicts of interest and biases can compromise the integrity of the reporting process and create challenges in ensuring fair and equitable access to SNAP benefits.

Resources and Guidance: Do You Have To Report Plasma Donations To Food Stamps

This section provides resources for individuals seeking information about plasma donation and food stamps. Understanding the rules and regulations regarding income reporting from plasma donation is crucial to avoid potential issues with your food stamp benefits.

Contact Information for Relevant Agencies

Contacting the appropriate agencies can help you get the information you need about plasma donation and food stamps. Here’s a table with contact information for relevant government agencies and organizations:

| Agency/Organization | Website | Phone Number |

|---|---|---|

| Food and Nutrition Service (FNS) | https://www.fns.usda.gov/ | (800) 221-5689 |

| Your State’s SNAP Office | [Insert your state’s SNAP website] | [Insert your state’s SNAP phone number] |

| Plasma Donation Centers | [Contact individual plasma donation centers for specific information] | [Contact individual plasma donation centers for specific information] |

Steps for Reporting Income from Plasma Donation

Reporting your plasma donation income correctly is crucial for maintaining your food stamp benefits. Here’s a flowchart illustrating the steps involved:

Start| Did you receive income from plasma donation?| Yes| Report the income to your SNAP office| No| Continue with your regular SNAP application process| End

Final Review

In conclusion, understanding the reporting requirements for plasma donations to food stamps is vital for individuals seeking SNAP benefits. While plasma donation can provide a source of income, it’s crucial to comply with the program’s regulations to avoid potential penalties.

By remaining transparent and informed, you can ensure that your access to food stamps is not jeopardized while responsibly managing your financial resources. Remember, seeking guidance from state agencies and utilizing available resources can help you navigate the complexities of this system effectively.

FAQ Guide

How often do I have to report my plasma donation income?

The frequency of reporting varies depending on the state and program requirements. Typically, you’ll need to report your income monthly or quarterly. It’s essential to consult with your local SNAP office for specific guidelines.

Can I deduct expenses related to plasma donation from my reported income?

In some cases, you might be able to deduct certain expenses related to plasma donation, such as transportation costs. However, eligibility for such deductions varies by state. Contact your local SNAP office for clarification.

What if I accidentally fail to report my plasma donation income?

If you accidentally fail to report your income, it’s crucial to inform your local SNAP office as soon as possible. They may be able to work with you to rectify the situation, but it’s important to be transparent and cooperative.

Is there a specific form to report plasma donation income?

The reporting process can vary by state. Some states might have dedicated forms for reporting income from plasma donation, while others may require you to use a general income reporting form. Contact your local SNAP office for guidance.

Where can I find additional information about plasma donation and food stamps?

For comprehensive information, you can contact your local SNAP office, visit the website of the United States Department of Agriculture (USDA), or consult with a legal aid organization specializing in food stamp assistance.