Where to deduct attorney fees for social security disability is a question many individuals facing the complex process of securing disability benefits grapple with. Navigating the Social Security Administration’s labyrinthine system can be overwhelming, often leading individuals to seek legal guidance. But the cost of legal representation can be a significant financial burden, especially for those already struggling with the challenges of disability.

This guide explores the intricacies of deducting attorney fees from your Social Security Disability benefits, ensuring you understand your rights and options.

The Social Security Administration (SSA) has specific regulations governing attorney fees for disability claims. These regulations aim to ensure that attorneys are fairly compensated for their services while protecting beneficiaries from excessive fees. Understanding these regulations is crucial for navigating the process of deducting attorney fees and maximizing your benefits.

Understanding Attorney Fees and Social Security Disability

Navigating the Social Security Disability (SSD) system can be complex and challenging, and seeking legal representation is often a wise decision to increase your chances of success. However, understanding the costs associated with legal assistance is crucial. This section will provide insights into the various types of attorney fees involved in SSD claims, common scenarios where these fees arise, and the factors influencing their amount.

Types of Attorney Fees

Attorney fees in SSD cases are typically contingent fees, meaning the attorney’s compensation is a percentage of the benefits you receive. This structure ensures that you only pay for legal representation if your claim is successful.

- Contingent Fee: This is the most common type of fee arrangement in SSD cases. The attorney receives a percentage of your back benefits and future monthly payments, typically ranging from 25% to 33 1/3%.

- Hourly Fee: In rare cases, attorneys may charge an hourly fee for their services. This arrangement is less common in SSD cases, but it may be considered if the case is particularly complex or involves extensive litigation.

- Flat Fee: Some attorneys may offer a flat fee for specific services, such as preparing an appeal or representing you at a hearing. This arrangement can be beneficial for claimants with straightforward cases who need assistance with specific tasks.

Common Scenarios Involving Attorney Fees

Attorney fees are often incurred in the following scenarios:

- Initial Application: An attorney can assist you in preparing a strong initial application, ensuring all necessary documentation is submitted and that your medical conditions are accurately described.

- Appeals: If your initial application is denied, an attorney can guide you through the appeals process, including the reconsideration, hearing, and appeals council levels.

- Litigation: If your claim is denied at the appeals council level, you can file a lawsuit in federal court. An attorney can represent you in court, advocating for your rights and presenting evidence to support your claim.

Factors Influencing Attorney Fee Amount

Several factors influence the amount of attorney fees charged in SSD cases:

- Complexity of the Case: Cases involving complex medical conditions, multiple impairments, or extensive litigation typically involve higher fees.

- Experience of the Attorney: Attorneys with extensive experience in SSD law may charge higher fees due to their expertise and track record of success.

- Location: Attorney fees can vary depending on the geographic location of the attorney’s practice.

- Outcome of the Case: In contingent fee arrangements, the attorney’s fee is typically calculated as a percentage of the benefits awarded.

Legal Framework Governing Attorney Fees

The Social Security Administration (SSA) has strict regulations governing attorney fees in SSD cases. The SSA’s regulations ensure that attorney fees are reasonable and that claimants are protected from excessive charges.

- Fee Agreement: Attorneys must have a written fee agreement with their clients outlining the terms of their representation, including the fee structure and any limitations.

- SSA Approval: The SSA must approve any attorney fees before they can be paid. Attorneys must submit a fee petition to the SSA, outlining the services they provided and the fee they are requesting.

- Maximum Fee: The SSA limits attorney fees to 25% of past-due benefits and 25% of future monthly benefits. However, the maximum fee can be increased to 33 1/3% if the case involves litigation in federal court.

Deductible Attorney Fees for Social Security Disability

When you hire an attorney to help you with your Social Security Disability claim, they will likely charge you a fee for their services. These fees are often referred to as “deductible attorney fees” because they are deducted from your Social Security Disability benefits.

Deductible Attorney Fees

Deductible attorney fees are a common practice in Social Security Disability cases. They are fees that an attorney charges for their services in helping you obtain Social Security Disability benefits. The Social Security Administration (SSA) has strict regulations and guidelines governing how much an attorney can charge and how these fees are deducted from your benefits.

Methods for Deducting Attorney Fees

There are two primary methods for deducting attorney fees from Social Security Disability benefits:

- Percentage of Past-Due Benefits: This method involves calculating a percentage of your past-due benefits (the back payments you receive for the period you were disabled but not receiving benefits) and deducting that amount as the attorney’s fee. The SSA sets a maximum percentage that can be deducted, which is currently 25% of your past-due benefits.

- Contingency Fee Agreement: This method involves an agreement where the attorney receives a percentage of the benefits you receive only if your claim is successful. This percentage is typically capped at 25% of the past-due benefits. If your claim is denied, the attorney does not receive any fees.

Regulations and Guidelines

The SSA has specific regulations and guidelines regarding attorney fees in Social Security Disability cases. These regulations are designed to protect beneficiaries and ensure that attorneys are fairly compensated for their services. Key aspects of these regulations include:

- Maximum Fee: The SSA sets a maximum fee that an attorney can charge, which is currently 25% of the past-due benefits. This percentage is applied to the total past-due benefits, not just the portion of the benefits the attorney helped to secure.

- Fee Agreement: The attorney must have a written fee agreement with you, outlining the terms of their representation and the fee arrangement. This agreement must be approved by the SSA before any fees can be deducted.

- SSA Approval: The SSA must approve the attorney’s fee before any deductions can be made from your benefits. This ensures that the fee is reasonable and complies with the SSA’s regulations.

Examples of Fee Deductions, Where to deduct attorney fees for social security disability

Here are some examples of how attorney fees are deducted from Social Security Disability benefits:

- Past-Due Benefits: If you are awarded past-due benefits of $10,000 and your attorney has a fee agreement for 25%, the attorney’s fee would be $2,500. This fee would be deducted from your past-due benefits, leaving you with $7,500.

- Ongoing Monthly Payments: Attorney fees can also be deducted from your ongoing monthly payments. However, the SSA has a limit on the amount that can be deducted each month. The monthly deduction limit is currently 25% of your monthly benefit amount. If your monthly benefit is $1,000, the maximum monthly deduction for attorney fees would be $250.

Tax Implications of Attorney Fees

Attorney fees paid for Social Security Disability claims can have tax implications. It is crucial to understand how the IRS treats these fees for tax purposes to ensure you comply with tax regulations and potentially benefit from available deductions or credits.

IRS Treatment of Attorney Fees

The IRS generally considers attorney fees paid for Social Security Disability claims as non-deductible expenses. This means you cannot deduct these fees on your tax return as a business expense or medical expense. However, there are specific exceptions and considerations that may affect the taxability of these fees.

Reporting Attorney Fees on Tax Returns

- If you receive a lump-sum back payment of Social Security Disability benefits, you may need to report the attorney fees as part of your income. This is because the IRS considers the attorney fees as part of the total benefit amount.

- If you receive regular monthly Social Security Disability benefits, the attorney fees are generally not included in your taxable income. However, it is essential to consult with a tax professional to ensure proper reporting of the fees.

Potential Tax Deductions or Credits

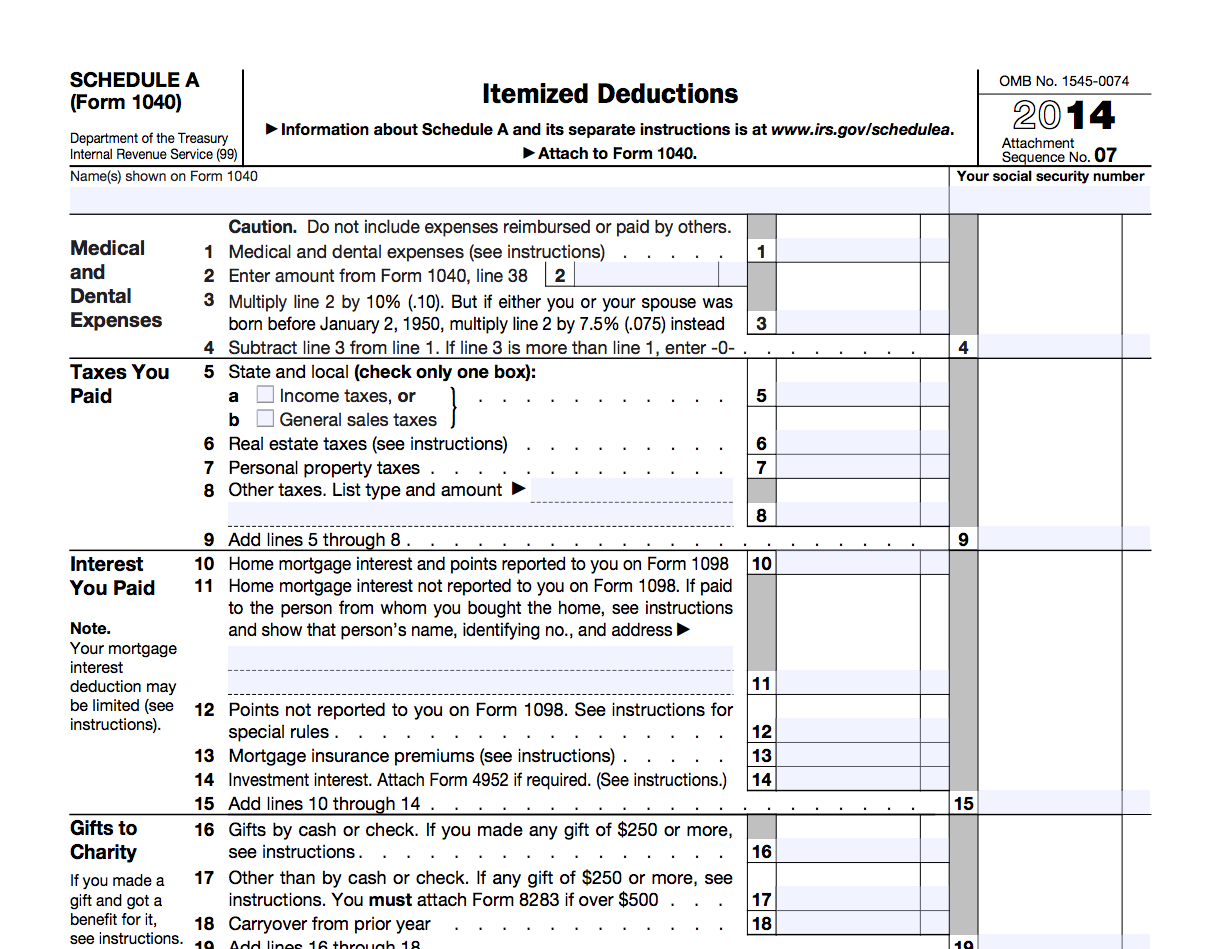

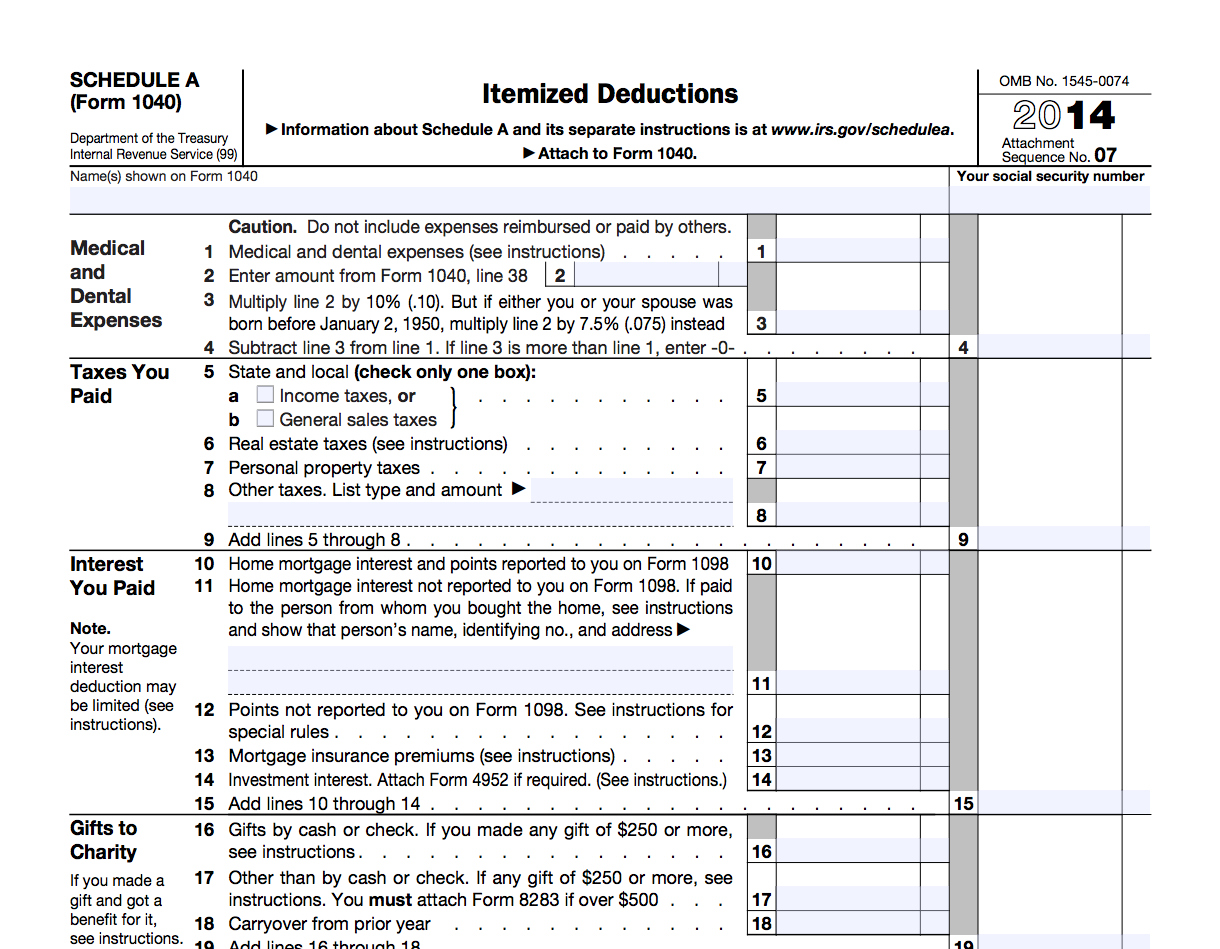

- In some cases, you may be able to deduct attorney fees as a medical expense if the fees were incurred for medical-related legal services, such as a medical malpractice claim.

- You may also be able to claim a tax credit for certain expenses related to a disability, such as expenses for medical care, transportation, and assistive devices. However, it is essential to meet specific eligibility requirements and consult with a tax professional to determine if you qualify for these deductions or credits.

Negotiating and Managing Attorney Fees

Negotiating attorney fees is crucial for Social Security Disability claimants, as it can significantly impact the overall cost of legal representation. A clear understanding of fee structures, negotiation strategies, and fee agreement management can help claimants make informed decisions and minimize financial burden.

Negotiating Attorney Fees

Negotiating attorney fees with a Social Security Disability attorney is essential for ensuring a fair and transparent arrangement. While attorneys typically charge a contingency fee based on a percentage of the benefits awarded, it’s important to discuss the fee structure in detail and understand the potential costs involved.

- Discuss Fee Percentage: Attorneys typically charge a percentage of back benefits awarded, ranging from 25% to 33.33%. Negotiate a fee percentage that aligns with your financial situation and the complexity of your case.

- Clarify Fee Calculation: Understand how the attorney calculates the fee. For instance, some attorneys may calculate fees based on the total amount of benefits awarded, while others may deduct certain expenses from the total before calculating the fee.

- Inquire about Additional Fees: Discuss any potential additional fees, such as filing fees or administrative costs. It’s essential to be aware of all potential costs associated with legal representation.

- Compare Fee Structures: Consider consulting with multiple attorneys to compare fee structures and understand different approaches to representing clients.

Fee Agreement

A fee agreement is a legally binding document that Artikels the terms of the attorney-client relationship, including the fee structure, payment terms, and responsibilities of both parties.

- Review Fee Agreement Carefully: Carefully review the fee agreement before signing it. Ensure you understand all terms and conditions, including the fee percentage, payment schedule, and any limitations or exceptions.

- Negotiate Fee Agreement Terms: If necessary, negotiate the fee agreement terms to ensure they are fair and reasonable. This may include requesting a lower fee percentage or negotiating a payment plan.

- Retain a Copy: Keep a copy of the signed fee agreement for your records. This will provide you with a reference point for any questions or disputes that may arise.

Minimizing Legal Costs

While attorney fees are an important part of the legal process, claimants can take steps to minimize the overall cost of legal representation.

- Prepare Thoroughly: Gather all necessary documentation and information related to your disability claim. This will help your attorney efficiently prepare your case and reduce the time and effort required.

- Communicate Effectively: Communicate regularly with your attorney and provide prompt responses to any requests for information. This can help streamline the process and avoid unnecessary delays.

- Understand the Process: Educate yourself about the Social Security Disability process. This will help you understand the steps involved and make informed decisions about your case.

Seeking Legal Advice: Where To Deduct Attorney Fees For Social Security Disability

Navigating the Social Security Disability (SSD) process can be complex and challenging, especially when dealing with medical evidence, bureaucratic procedures, and legal requirements. Seeking legal advice from a qualified SSD attorney can significantly increase your chances of a successful claim and ensure your rights are protected.

An experienced SSD attorney can provide valuable guidance and support throughout the application process. They possess in-depth knowledge of SSD laws and regulations, understand the complexities of medical documentation, and can effectively advocate for your case before the Social Security Administration (SSA).

Choosing an SSD Attorney

When selecting an SSD attorney, consider the following factors:

- Experience: Look for an attorney who specializes in SSD law and has a proven track record of success.

- Reputation: Research the attorney’s reputation through online reviews, bar association ratings, and client testimonials.

- Communication: Choose an attorney who communicates effectively, explains legal concepts clearly, and is responsive to your questions and concerns.

- Fees: Understand the attorney’s fee structure, including contingency fees, hourly rates, and any upfront costs.

- Accessibility: Ensure the attorney is available to meet with you, discuss your case, and answer your questions.

Finding Qualified Attorneys

Several resources can help you find qualified SSD attorneys:

- State Bar Associations: Most state bar associations maintain attorney directories that allow you to search for attorneys by specialization, location, and other criteria.

- Legal Aid Organizations: Legal aid organizations often provide free or low-cost legal assistance to individuals who cannot afford an attorney.

- Online Directories: Websites such as Avvo and FindLaw offer attorney profiles, reviews, and ratings.

- Referrals: Ask family, friends, or healthcare professionals for recommendations.

Free Consultations

Many SSD attorneys offer free consultations to potential clients. During a consultation, you can discuss your case, ask questions, and learn more about the attorney’s experience and approach.

- Initial Contact: Contact the attorney’s office by phone, email, or online form to schedule a consultation.

- Consultation Preparation: Gather relevant information, such as your medical records, employment history, and any prior SSD applications.

- Consultation Discussion: During the consultation, be prepared to discuss your medical condition, disability-related limitations, and your understanding of the SSD process.

- Decision: After the consultation, carefully consider the attorney’s experience, fees, and communication style before making a decision.

Navigating the world of Social Security Disability and attorney fees can be daunting. However, by understanding the rules, regulations, and options available to you, you can ensure that you are fairly compensated for your disability while receiving the legal support you need. Remember, seeking guidance from a qualified attorney can provide you with the necessary clarity and direction, helping you navigate the complex process with confidence.

FAQ Insights

Can I deduct attorney fees from my back payments?

Yes, the SSA allows for attorney fees to be deducted from your past-due benefits. The maximum fee allowed is 25% of your past-due benefits, or $6,000, whichever is less.

Can I negotiate my attorney fees?

Absolutely! You have the right to negotiate attorney fees with your chosen legal representative. It’s important to discuss the scope of services, potential costs, and payment options upfront.

What if I’m not satisfied with my attorney’s services?

If you are unhappy with your attorney’s services, you have the right to seek representation from another attorney. Be sure to communicate your concerns with your current attorney first, and explore options for resolving any issues.

Do I need to pay taxes on my attorney fees?

No, attorney fees for Social Security Disability claims are generally not taxable. However, it’s always best to consult with a tax professional for specific guidance based on your individual circumstances.