Why do landlords need social security numbers? It’s a question that often arises when applying for a rental property. Landlords require this information for a multitude of reasons, primarily to ensure the safety and financial stability of their investment. This seemingly simple request plays a crucial role in the tenant screening process, acting as a vital tool for landlords to make informed decisions about who they rent to.

The legal landscape, tenant identity verification, and mitigating fraud are all interconnected with the use of Social Security numbers in the rental process. By understanding the rationale behind this requirement, both landlords and prospective tenants can navigate the rental market with greater clarity and transparency.

Legal Requirements for Tenant Screening

Landlords have a legal right to collect information about potential tenants, including their Social Security numbers, as part of the tenant screening process. This information helps landlords make informed decisions about who to rent to, ensuring the safety and security of their property and other tenants.

Federal Laws

Federal laws, such as the Fair Housing Act (FHA), the Equal Credit Opportunity Act (ECOA), and the Fair Credit Reporting Act (FCRA), provide a framework for tenant screening practices. These laws ensure that landlords conduct background checks fairly and without discrimination based on protected characteristics.

- The Fair Housing Act prohibits discrimination in housing based on race, color, religion, national origin, sex, familial status, or disability.

- The Equal Credit Opportunity Act prohibits discrimination in lending based on factors such as race, color, religion, national origin, sex, marital status, age, or receipt of public assistance.

- The Fair Credit Reporting Act regulates the collection, use, and disclosure of consumer credit information. It also provides consumers with the right to access and correct their credit reports.

State Laws

Many states have their own laws that further regulate tenant screening practices. These laws may specify the types of information landlords can collect, the methods they can use to collect it, and the permissible uses of the information.

- For example, some states limit the amount of time landlords can keep tenant screening reports.

- Other states require landlords to provide tenants with a copy of their screening report.

Importance of Tenant Screening

Tenant screening is essential for protecting landlords’ interests. By conducting thorough background checks, landlords can:

- Reduce the risk of financial losses from non-payment of rent or property damage.

- Ensure the safety and security of their property and other tenants.

- Minimize the likelihood of disruptive or problematic tenants.

Verifying Tenant Identity and Creditworthiness

Landlords need to verify a tenant’s identity and creditworthiness to ensure they are renting to a responsible individual who can afford the rent and maintain the property. This process is crucial for mitigating risks and protecting their investment. Social Security numbers play a vital role in this process, as they serve as a unique identifier and are linked to credit reports, providing valuable insights into a tenant’s financial history.

The Role of Social Security Numbers in Identity Verification

Social Security numbers are issued by the Social Security Administration (SSA) to every U.S. citizen and lawful permanent resident. They are used for various purposes, including tracking income and taxes, verifying identity, and accessing government benefits. In the context of tenant screening, landlords use Social Security numbers to confirm a tenant’s identity and residency.

- Verification of Identity: Landlords can use a tenant’s Social Security number to cross-reference it with public records, such as the SSA database, to confirm their identity. This helps to prevent fraud and ensure that the person applying for the rental is who they claim to be.

- Background Checks: Landlords often use Social Security numbers to conduct background checks through reputable third-party screening services. These checks can reveal criminal history, eviction records, and other relevant information that helps landlords assess a tenant’s suitability.

The Role of Credit Reporting Agencies in Tenant Screening

Credit reporting agencies play a crucial role in tenant screening by providing landlords with access to a tenant’s credit history. These agencies compile and maintain credit reports that reflect a person’s financial behavior, including payment history, debt levels, and credit utilization.

- Credit Reports: Credit reports contain detailed information about a tenant’s financial history, including their payment history on loans, credit cards, and other accounts. This information allows landlords to assess a tenant’s ability to manage their finances and make timely payments.

- Credit Scores: Credit scores are numerical representations of a tenant’s creditworthiness. They are calculated based on the information contained in their credit reports and range from 300 to 850. A higher credit score generally indicates a lower risk for landlords, as it suggests a tenant has a good track record of managing their finances.

The Connection Between Social Security Numbers and Credit History

Social Security numbers are directly linked to credit reports. When a person applies for credit, their Social Security number is used to create a unique credit file that is maintained by the credit reporting agencies. This file tracks their credit history, allowing lenders and landlords to access their financial information.

- Credit File Creation: When a person applies for a credit card, loan, or other credit-related product, their Social Security number is used to create a unique credit file. This file is then used to track their credit activity, including payments, debt balances, and inquiries.

- Credit History Tracking: The credit reporting agencies maintain credit files and update them regularly with information from lenders and other creditors. This ensures that the credit reports accurately reflect a person’s financial history and allow landlords to assess their creditworthiness.

Preventing Fraud and Eviction Risks

Landlords rely on Social Security numbers to help verify the identity of potential tenants and mitigate the risk of fraudulent applications. By checking the Social Security number against official databases, landlords can confirm the tenant’s identity and reduce the likelihood of renting to someone who is not who they claim to be. This helps landlords protect themselves from financial losses and legal complications.

The Consequences of Renting to Tenants with a History of Evictions

Landlords must carefully consider the potential consequences of renting to tenants with a history of evictions. Previous evictions can indicate a pattern of irresponsible behavior, financial instability, or a disregard for lease agreements. These factors can significantly increase the risk of future problems, including:

- Increased likelihood of non-payment: Tenants with a history of evictions may be more likely to default on rent payments, leading to financial losses for the landlord.

- Damage to property: Past evictions can be associated with damage to the property, requiring costly repairs.

- Legal disputes: Tenants with eviction records may be more likely to engage in legal disputes with landlords, leading to increased legal expenses and time.

- Reputational damage: Renting to tenants with eviction histories can damage the landlord’s reputation and make it more difficult to attract responsible tenants in the future.

Tenant Screening with Social Security Numbers, Why do landlords need social security number

Tenant screening with Social Security numbers is a crucial tool for landlords to verify the identity of potential tenants and assess their creditworthiness and eviction history. By using a reputable tenant screening service, landlords can obtain comprehensive reports that include:

- Social Security number verification: Confirms the tenant’s identity and reduces the risk of fraudulent applications.

- Credit history: Provides insights into the tenant’s financial responsibility and ability to pay rent.

- Eviction history: Reveals any past evictions, giving landlords a clearer understanding of the tenant’s rental history.

- Criminal background check: Offers information about the tenant’s criminal record, helping landlords make informed decisions about potential risks.

“Tenant screening with Social Security numbers can be a valuable tool for landlords to minimize risks, protect their property, and ensure a smoother rental experience.”

Protecting Landlord Property and Finances

Landlords have a significant financial investment in their rental properties, and tenant screening plays a crucial role in safeguarding this investment. By conducting thorough background checks, landlords can minimize the risk of financial losses and property damage.

Benefits of Tenant Screening with Social Security Numbers

The use of Social Security numbers in tenant screening offers several advantages, making it a valuable tool for landlords to protect their property and finances.

| Benefit | Description |

|---|---|

| Accurate Identification | Social Security numbers provide a reliable means of verifying a tenant’s identity, reducing the risk of fraud and identity theft. |

| Comprehensive Background Checks | Social Security numbers enable landlords to access detailed credit reports, criminal history records, and other vital information that helps assess a tenant’s reliability and trustworthiness. |

| Financial Stability Assessment | By examining a tenant’s credit history and income, landlords can gain insights into their financial stability, reducing the likelihood of rent delinquency or financial hardship. |

| Reduced Eviction Risks | Thorough tenant screening, including the use of Social Security numbers, can help landlords identify potential tenants with a history of evictions, reducing the risk of future eviction proceedings. |

Risks of Renting to Tenants Without Proper Screening

Renting to tenants without conducting proper screening, including the use of Social Security numbers, exposes landlords to various risks that can negatively impact their property and finances.

- Financial Loss: Tenants with poor credit history or unstable income are more likely to default on rent payments, resulting in financial losses for landlords.

- Property Damage: Tenants with a history of property damage or criminal activity pose a higher risk of damaging the rental property, leading to costly repairs.

- Eviction Costs: Landlords may face significant legal expenses and time delays in evicting tenants who fail to comply with lease agreements, especially if proper screening was not conducted.

- Legal Liability: Landlords could be held liable for the actions of tenants, such as criminal activity or negligent behavior, if they did not conduct thorough screening.

- Increased Insurance Premiums: Landlords with a history of tenant-related issues may face higher insurance premiums, increasing their overall costs.

Financial Stability of Landlords Through Tenant Screening

Tenant screening plays a vital role in ensuring the financial stability of landlords by minimizing the risk of financial losses and property damage.

- Reduced Rent Delinquency: Screening for tenants with a history of financial responsibility reduces the likelihood of rent delinquency, ensuring a steady income stream for landlords.

- Lower Repair Costs: Screening for tenants with a history of property damage or criminal activity can help prevent costly repairs and maintain the value of the rental property.

- Reduced Eviction Expenses: By selecting reliable tenants, landlords can minimize the risk of eviction proceedings, saving significant legal fees and time.

- Increased Property Value: Well-maintained rental properties with responsible tenants attract higher rental rates and increase the overall value of the property.

- Peace of Mind: Knowing that their tenants have been thoroughly screened provides landlords with peace of mind, reducing stress and anxiety associated with managing rental properties.

Tenant Rights and Privacy Considerations

Landlords must strike a delicate balance between their need to gather information about potential tenants and respecting tenants’ privacy rights. Using Social Security numbers for tenant screening is a sensitive topic, and landlords must adhere to legal guidelines and ethical practices.

Legal Implications of Using Social Security Numbers

Landlords must use tenant information, including Social Security numbers, only for legitimate purposes related to the rental process. Using this information for unauthorized purposes is illegal and can lead to serious consequences.

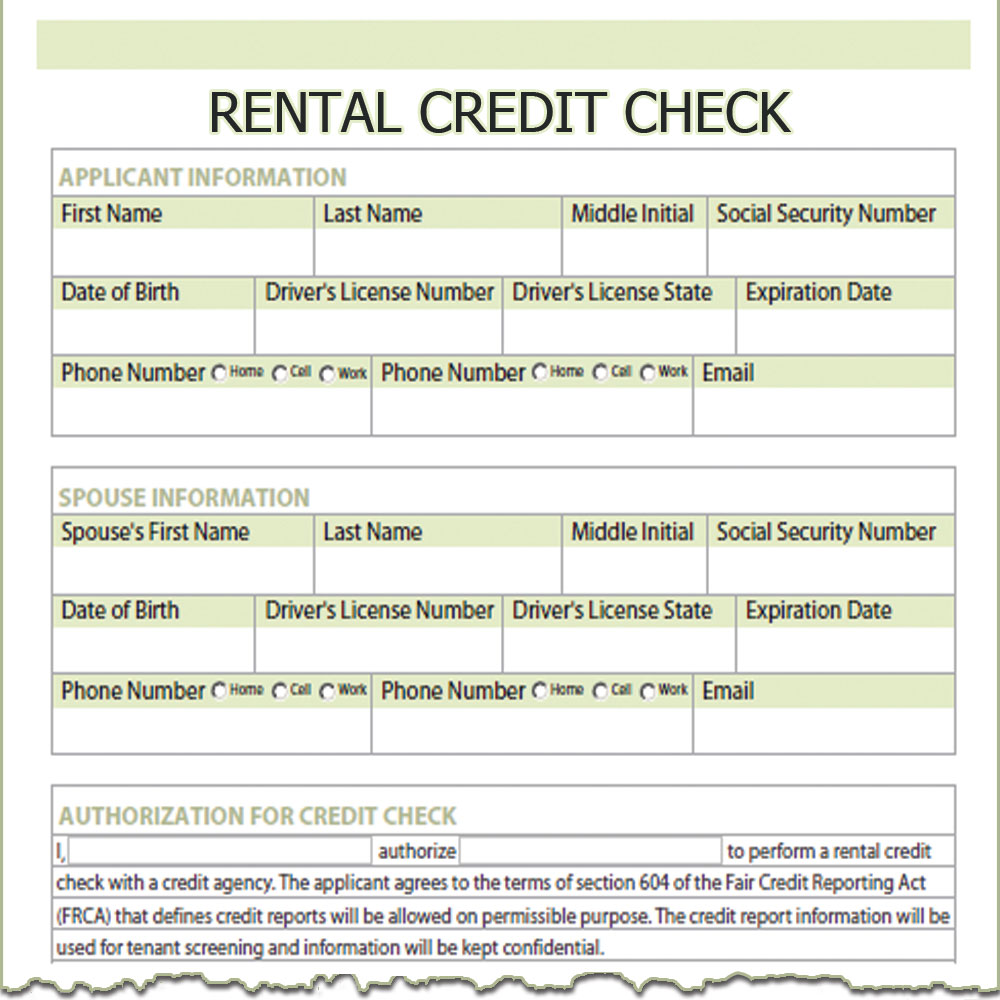

The Fair Credit Reporting Act (FCRA) protects consumers’ privacy and ensures that their credit information is used responsibly.

- Landlords must obtain tenant consent before accessing their credit reports.

- They must use the information solely for rental-related purposes, such as verifying identity, assessing creditworthiness, and determining rental eligibility.

- Landlords must provide tenants with copies of their credit reports and the opportunity to dispute any inaccuracies.

Best Practices for Ethical and Responsible Use of Tenant Information

Landlords should establish clear policies and procedures for handling tenant information to ensure ethical and responsible use.

- Transparency: Inform tenants about the types of information collected, how it will be used, and their rights to access and dispute the information.

- Data Security: Implement robust security measures to protect tenant information from unauthorized access, use, or disclosure.

- Limited Access: Grant access to tenant information only to authorized personnel who have a legitimate need for it.

- Data Retention: Dispose of tenant information securely once it is no longer needed.

In conclusion, landlords require Social Security numbers as part of a comprehensive tenant screening process to protect their property, finances, and legal standing. This practice, while sometimes perceived as intrusive, is essential for establishing a secure and responsible rental environment. By understanding the legal framework, the benefits of tenant screening, and the importance of responsible information usage, both landlords and tenants can navigate the rental process with confidence, fostering a mutually beneficial relationship.

FAQ Resource: Why Do Landlords Need Social Security Number

Is it legal for landlords to require my Social Security number?

Yes, it is generally legal for landlords to request your Social Security number as part of the tenant screening process. This is often supported by state and federal laws designed to protect landlords’ interests.

What happens if I refuse to provide my Social Security number?

If you refuse to provide your Social Security number, the landlord may decline your application. They may have legitimate concerns about your identity and creditworthiness, making them hesitant to rent to you.

How can I ensure my Social Security number is used responsibly?

You should only provide your Social Security number to reputable landlords and property management companies. Always inquire about their tenant screening procedures and privacy policies. You can also consider using a credit monitoring service to alert you to any suspicious activity involving your Social Security number.