How to calculate income for food stamps – Navigating the complexities of food stamp eligibility can be daunting, especially when it comes to understanding how your income is calculated. Knowing the rules is crucial for determining whether you qualify for this essential assistance program. This guide provides a comprehensive overview of the income calculation process, covering various income sources, deductions, and special considerations.

By understanding the intricacies of this process, you can confidently determine your eligibility for food stamps and access the support you need.

The Supplemental Nutrition Assistance Program (SNAP), commonly known as food stamps, is a federal program that provides financial assistance to low-income households for purchasing food. Eligibility for SNAP is determined by several factors, including income, household size, and assets. Understanding how your income is calculated is crucial for determining your eligibility and maximizing your benefits.

Eligibility for Food Stamps

To receive food stamps, you must meet certain eligibility requirements, including income and asset limits. These requirements ensure that the program assists those who need it most.

Income Limits for Food Stamps

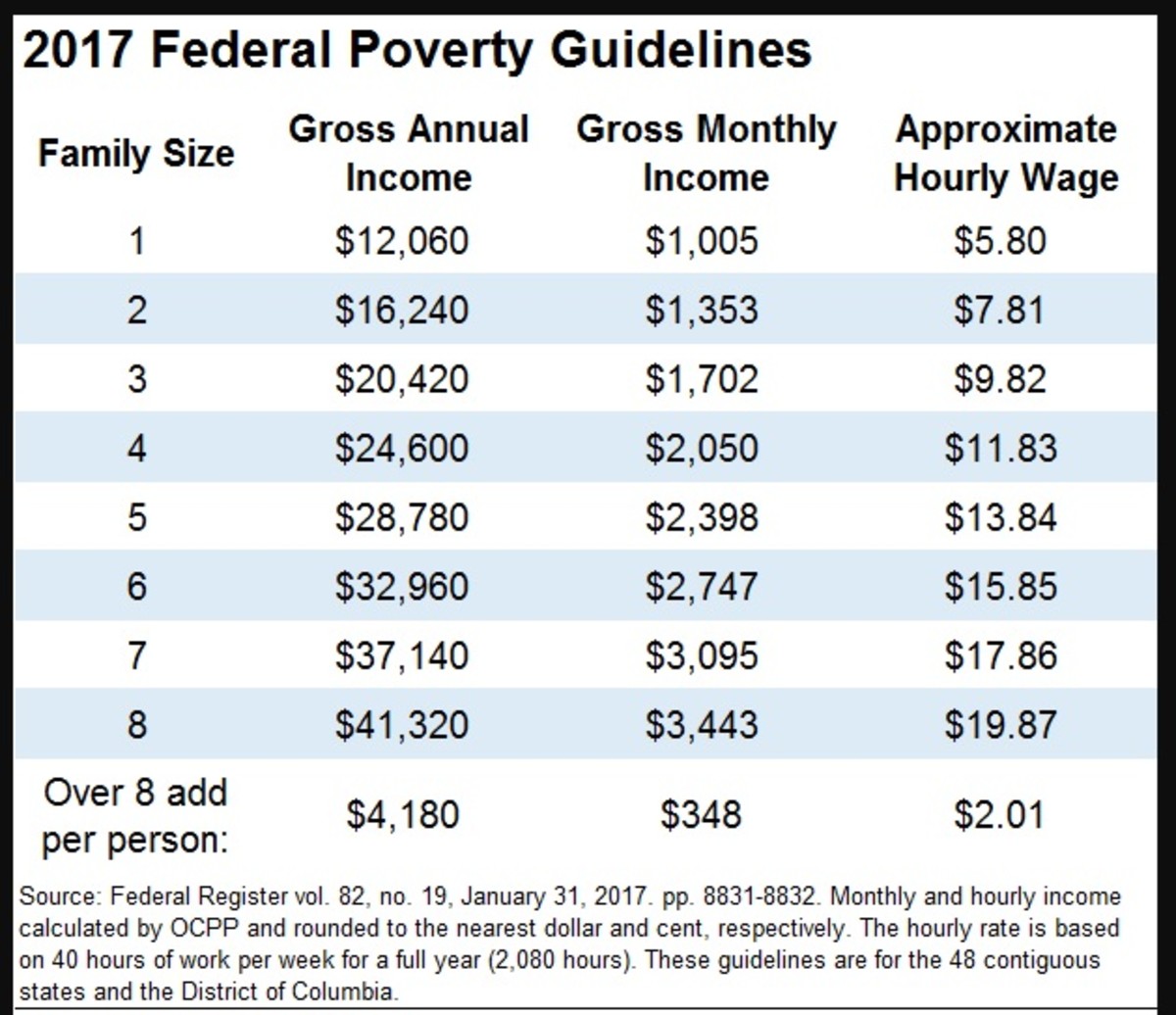

The income limits for food stamps vary depending on household size and state. Generally, your household’s gross monthly income must be at or below a certain threshold to qualify. Income is calculated based on a variety of factors, including:

The gross monthly income is your total income before taxes and deductions.

Income Sources Considered

- Earned Income:This includes wages, salaries, tips, commissions, and self-employment income.

- Unearned Income:This includes income from sources such as unemployment benefits, Social Security, pensions, child support, and alimony.

- Other Income:This may include income from dividends, interest, and rental property.

Income Sources Not Considered

- Certain government benefits:This includes payments from programs such as TANF (Temporary Assistance for Needy Families), SSI (Supplemental Security Income), and SNAP (Supplemental Nutrition Assistance Program) benefits.

- Certain educational assistance:This includes payments from programs such as Pell Grants and other federal student aid.

- Income from certain sources:This may include income from gambling winnings, lottery prizes, and certain scholarships.

Income Calculation for Eligibility

- Gross Income:Your total income before taxes and deductions is considered.

- Deductions:Certain deductions are allowed, such as a standard deduction, dependent care expenses, and medical expenses.

- Net Income:Your gross income minus your deductions is your net income, which is used to determine your eligibility.

Table of Income Sources and Eligibility

| Income Source | Counted for Eligibility | Maximum Income Allowed | Notes |

|---|---|---|---|

| Wages and Salaries | Yes | Varies by household size and state | Gross income before taxes and deductions is counted. |

| Unemployment Benefits | Yes | Varies by household size and state | Gross income before taxes and deductions is counted. |

| Social Security Benefits | Yes | Varies by household size and state | Gross income before taxes and deductions is counted. |

| Child Support Payments Received | Yes | Varies by household size and state | Gross income before taxes and deductions is counted. |

| Interest and Dividends | Yes | Varies by household size and state | Gross income before taxes and deductions is counted. |

| Rental Income | Yes | Varies by household size and state | Gross income before taxes and deductions is counted. |

| TANF (Temporary Assistance for Needy Families) Payments | No | N/A | These payments are not counted towards income for food stamp eligibility. |

| SSI (Supplemental Security Income) Payments | No | N/A | These payments are not counted towards income for food stamp eligibility. |

| Pell Grants | No | N/A | These grants are not counted towards income for food stamp eligibility. |

| Gambling Winnings | Yes | Varies by household size and state | Gross income before taxes and deductions is counted. |

Income Calculation Methods

To determine your eligibility for food stamps, the government assesses your household’s income. This income is calculated using specific methods, which we’ll discuss below.

Methods for Calculating Income

There are two main methods for calculating income for food stamp eligibility: gross income and net income.

- Gross income includes all income before taxes and deductions. This includes wages, salaries, tips, self-employment income, unemployment benefits, and other sources of income.

- Net income, on the other hand, is calculated after deducting certain expenses from gross income. These deductions can include taxes, child care costs, and medical expenses.

Comparing Gross and Net Income

The method used to calculate income for food stamp eligibility can significantly impact a household’s eligibility. Here’s a breakdown of the differences:

- Gross income is a broader measure of income, including all income sources. This method may result in higher income levels, potentially leading to lower food stamp benefits or even ineligibility.

- Net income takes into account certain deductions, which can reduce the overall income amount. This method may result in lower income levels, potentially increasing the likelihood of eligibility and benefit amounts.

Examples of Income Calculation Methods

Let’s illustrate how these methods work with examples:

| Income Calculation Method | Description | Example |

|---|---|---|

| Gross Income | Includes all income before taxes and deductions. | A household with a gross income of $2,000 per month would include all sources of income, such as wages, salaries, tips, and self-employment income, before any taxes or deductions are applied. |

| Net Income | Calculated after deducting certain expenses from gross income. | The same household with a gross income of $2,000 per month, but with $500 in taxes and $200 in child care expenses, would have a net income of $1,300 ($2,000

|

Income Deductions

When calculating income for food stamp eligibility, certain deductions can be applied to reduce the total income, making it easier to qualify for benefits. These deductions aim to account for expenses that impact a household’s ability to afford food.

Standard Deduction

The standard deduction is a fixed amount subtracted from a household’s gross income to account for basic living expenses. This deduction varies depending on the household size.

The standard deduction is applied to every household, regardless of income.

Work Expenses

Individuals who work can deduct certain work-related expenses from their income. These deductions help account for the costs associated with earning income.

- Child Care Costs: Parents who work and need childcare can deduct the cost of childcare for children under 13 years old. The deduction is limited to the actual cost of care, or the maximum allowable amount set by the state, whichever is lower.

- Job-Related Transportation: Deductions for transportation expenses related to work are allowed. These include costs for public transportation, fuel, and vehicle maintenance.

- Work-Related Supplies: If an individual needs to purchase supplies for their job, they can deduct these expenses from their income. This can include items like uniforms, tools, and equipment.

Medical Expenses

Individuals with significant medical expenses can deduct a portion of these costs from their income.

- Medical Expenses: Deductions for medical expenses include costs for health insurance premiums, doctor’s visits, prescription drugs, and other medical treatments.

Other Deductions

In addition to the standard deduction, work expenses, and medical expenses, there are other deductions that may apply, depending on the individual’s circumstances.

- Shelter Costs: If a household pays a significant portion of their income towards rent or mortgage payments, they may be eligible for a deduction for shelter costs.

- Child Support Payments: Individuals who pay child support can deduct the amount they pay from their income.

- Dependent Care Expenses: If an individual is caring for a disabled family member, they may be eligible for a deduction for dependent care expenses.

Example of Income Deductions

| Deduction Type | Calculation Method | Example |

|---|---|---|

| Standard Deduction | Fixed amount based on household size | A household of 3 receives a standard deduction of $450. |

| Child Care Costs | Actual cost of care, up to a maximum allowable amount | A parent pays $500 per month for childcare. The maximum allowable amount in their state is $600. They can deduct $500 from their income. |

| Medical Expenses | Deductible amount is based on a percentage of income | An individual pays $1,000 per month in medical expenses. Their income is $2,000 per month. They can deduct $500 (50% of their income) from their income for medical expenses. |

Special Considerations for Income Calculation

Calculating income for food stamp eligibility can be complex, especially when dealing with unique income sources. It’s important to understand how different income types are treated for eligibility purposes. This section will discuss special considerations for income calculation, including income from self-employment, pensions, and disability benefits.

Income from Self-Employment

Income from self-employment is calculated differently than income from traditional employment. The SNAP program uses a specific method to determine how much self-employment income counts towards eligibility.The SNAP program considers net income from self-employment. This means that the expenses associated with running the business are deducted from the gross income before calculating the net income.

The formula for calculating net income from self-employment is:

Net Income = Gross Income

Business Expenses

For example, a self-employed individual who earns $3,000 in gross income but incurs $1,000 in business expenses would have a net income of $2,000. This net income would then be used to determine eligibility for food stamps.

Income from Pensions

Pensions are treated as unearned income for food stamp eligibility. This means that the entire amount of the pension is counted towards income, even if it is only a portion of the individual’s total income.For example, an individual receiving a $1,000 monthly pension would have $1,000 counted towards their monthly income for food stamp eligibility, regardless of their other income sources.

Income from Disability Benefits

Disability benefits, such as Social Security Disability Insurance (SSDI) and Supplemental Security Income (SSI), are generally not counted towards income for food stamp eligibility. This is because these benefits are designed to help individuals with disabilities meet their basic needs, including food.However, there are some exceptions to this rule.

For example, if an individual receives disability benefits and also works, the income from their work may be counted towards their food stamp eligibility.

| Special Income Source | Calculation Method | Example |

|---|---|---|

| Self-Employment Income | Net Income = Gross Income

| A self-employed individual with $3,000 in gross income and $1,000 in business expenses has a net income of $2,000. |

| Pension Income | The entire amount of the pension is counted towards income. | An individual receiving a $1,000 monthly pension has $1,000 counted towards their monthly income. |

| Disability Benefits | Generally not counted towards income. | An individual receiving SSDI or SSI benefits would typically not have their benefits counted towards their income for food stamp eligibility. |

Resources for Assistance: How To Calculate Income For Food Stamps

Navigating the complex world of food stamp eligibility and income calculation can be challenging. Fortunately, various resources are available to provide guidance and support throughout the process.

Government Websites

These government websites offer comprehensive information on food stamp programs, eligibility criteria, and income calculation methods. They also provide access to online applications and resources for assistance.

| Resource Name | Description | Contact Information |

|---|---|---|

| Food and Nutrition Service (FNS) | The FNS is the federal agency responsible for administering the SNAP program. Their website provides information on program eligibility, benefits, and how to apply. | Website: https://www.fns.usda.gov/ |

| Your State’s SNAP Website | Each state has its own SNAP website with specific information on local eligibility requirements, application procedures, and contact details for assistance. | To find your state’s website, visit the FNS website and click on the “State SNAP Websites” link. |

Community Organizations

Community organizations play a vital role in assisting individuals with food stamp applications and income calculations. They often provide personalized guidance, support with completing forms, and advocacy services.

| Resource Name | Description | Contact Information |

|---|---|---|

| Local Food Banks | Food banks often provide resources and assistance with food stamp applications. They can connect individuals with local agencies and offer information on food assistance programs. | To find a local food bank, visit the Feeding America website: https://www.feedingamerica.org/ |

| Community Action Agencies | Community action agencies offer a range of services, including assistance with food stamp applications, income calculations, and other social services. | To find a community action agency, visit the National Association of Community Action Agencies website: https://www.naca.org/ |

| Legal Aid Organizations | Legal aid organizations provide free legal assistance to low-income individuals, including help with navigating the food stamp application process and resolving any eligibility disputes. | To find a legal aid organization, visit the Legal Aid Society website: https://www.legalaidsociety.org/ |

Other Resources, How to calculate income for food stamps

Additional resources can provide valuable information and support for individuals seeking assistance with food stamp income calculations.

- SNAP Benefit Calculator:This online tool can help estimate potential SNAP benefits based on income and household size. Many state websites offer similar calculators.

- Financial Literacy Programs:Workshops and resources on budgeting, financial management, and income tracking can be helpful in understanding income calculations and managing finances.

- Support Groups:Connecting with others who have experience with the food stamp program can provide valuable insights and support.

Conclusion

Navigating the complexities of food stamp eligibility can be challenging, but understanding the income calculation process is essential for maximizing your benefits. Remember, it’s important to seek guidance from reputable sources like government websites, community organizations, and financial advisors.

By taking the time to understand your eligibility and utilizing the resources available, you can confidently access the support you need to ensure food security for yourself and your family.

Key Questions Answered

What happens if I get a raise at work?

A raise in your income will affect your eligibility for SNAP. The increase in your income may cause you to exceed the income limits for SNAP, resulting in a reduction or termination of your benefits. It’s important to report any changes in your income to the SNAP office promptly to avoid any potential overpayment or penalties.

What if I have a job but don’t get paid every week?

Your income is calculated based on a monthly average, even if you receive your paychecks less frequently. The SNAP office will take your total income for the month and divide it by the number of weeks in the month to determine your weekly income.

This helps ensure a consistent and fair assessment of your income, regardless of your pay schedule.

Can I still get food stamps if I have a part-time job?

Yes, you can still be eligible for SNAP even if you have a part-time job. Your eligibility will depend on your total income, household size, and other factors. The SNAP office will assess your income from all sources, including part-time work, to determine your eligibility for benefits.

Can I get food stamps if I am a student?

Students may be eligible for SNAP if they meet the income and asset requirements. Your eligibility will depend on your income, household size, and whether you are considered a dependent student. It’s important to contact your local SNAP office to determine your eligibility and explore any specific guidelines for students.