Do variable annuity contracts typically have charges and fees? Nah, lu kira makan gratis? Of course they do! These investments, while potentially lucrative, come with a whole slew of fees that can significantly impact your returns. Think of it like this: you’re buying a fancy car, but there are hidden costs like insurance, maintenance, and maybe even a hefty parking fee in a fancy mall.

Understanding these charges is crucial to making an informed decision, so let’s dive into the nitty-gritty.

This guide breaks down the various types of fees associated with variable annuities, exploring factors that influence their cost, and showing you how these fees can affect your long-term investment growth. We’ll also arm you with strategies to minimize these expenses and navigate the often-complex world of annuity fee disclosures. So, grab your kopi susu, and let’s get started!

Types of Variable Annuity Charges and Fees

Variable annuities, while offering potential growth through market participation, come with a range of fees and charges that can significantly impact your overall returns. Understanding these costs is crucial for making informed investment decisions. It’s important to remember that these fees can vary significantly between different annuity providers and specific contract types.

Mortality and Expense Risk Charges

Mortality and expense risk charges are two distinct types of fees within variable annuities. Mortality risk charges cover the insurance company’s risk associated with guaranteeing death benefits. Essentially, the insurer needs to set aside funds to ensure it can pay out death benefits to beneficiaries even if the investment performance is poor. Expense risk charges, on the other hand, compensate the insurer for the ongoing costs of managing the annuity contract, such as administrative expenses and investment management fees.

These two charges are often bundled together but it’s vital to understand that they represent different aspects of the annuity’s risk profile. A higher mortality risk charge might reflect a contract with a more generous death benefit guarantee. Similarly, a higher expense risk charge might indicate a contract with more complex features or a higher level of ongoing administrative support.

Surrender Charges

Surrender charges are penalties applied when you withdraw funds from your variable annuity before a specified period. These charges are designed to discourage early withdrawals and protect the insurance company from losses associated with short-term investment fluctuations. The amount of the surrender charge typically decreases over time, often following a schedule Artikeld in the contract. For example, a contract might have a 7% surrender charge in the first year, decreasing by 1% annually until it reaches zero after seven years.

Early withdrawals will reduce your investment returns significantly due to these penalties, so it is critical to consider the surrender period before investing in a variable annuity.

Fee Structures of Different Variable Annuity Products

Variable annuity fee structures can vary considerably depending on the specific product features. Some annuities have higher fees in exchange for features such as guaranteed minimum income benefits (GMIBs) or guaranteed minimum accumulation benefits (GMABs). These benefits provide a degree of downside protection, but this security comes at a cost. Other annuities may have simpler fee structures with lower overall charges, but may lack these guarantees.

It’s essential to compare the total cost of ownership across different products, taking into account all fees and charges, rather than focusing on a single aspect of the fee structure.

Comparison of Variable Annuity Fees

| Fee Type | Typical Range | Impact on Returns | Example |

|---|---|---|---|

| Mortality and Expense Risk Charges | 0.5% – 2.0% annually | Reduces annual investment growth | A 1.5% annual charge on a $100,000 investment reduces returns by $1,500 per year. |

| Surrender Charges | 0%

| Significantly reduces withdrawals, especially early withdrawals | A 5% surrender charge on a $20,000 withdrawal results in a $1,000 loss. |

| Administrative Fees | 0.25% – 1.0% annually | Reduces annual investment growth | A 0.75% annual charge on a $50,000 investment reduces returns by $375 per year. |

| Investment Management Fees (within sub-accounts) | Variable, depending on the underlying fund | Reduces returns within the specific sub-account | An expense ratio of 1.2% within a specific mutual fund sub-account. |

Factors Influencing Variable Annuity Charges

So, we’ve covered the

- types* of fees you’ll find in a variable annuity contract. Now, let’s dig into what actually

- influences* the size of those fees. It’s not a simple equation, and several interconnected factors play a significant role. Think of it like a complex recipe – each ingredient affects the final taste.

The cost of your variable annuity isn’t a fixed number; it’s dynamic, changing based on a variety of circumstances. Understanding these influences empowers you to make more informed decisions when choosing a contract.

Investment Options and Their Impact on Costs

The investment options you select within your variable annuity directly influence its overall expense. Different sub-accounts, like those invested in stocks, bonds, or money market funds, have varying expense ratios. These expense ratios represent the annual cost of managing those specific investments. For example, a sub-account investing in actively managed equities will generally have a higher expense ratio than a passively managed index fund sub-account.

Choosing higher-cost investment options naturally increases your overall annuity fees. You might find that some sub-accounts within the same annuity have expense ratios ranging from 0.5% to 1.5% annually, significantly impacting your returns over time.

Contract Duration and Fee Structure

The length of your variable annuity contract is another crucial factor. Some fees, like mortality and expense risk charges, are often expressed as a percentage of your contract value, meaning longer durations usually translate to higher total fees paid. Conversely, some contracts may offer lower fees for longer commitment periods, acting as an incentive to stay invested. Consider a hypothetical scenario: a 10-year contract might have a lower annual fee than a shorter-term contract, but the total fees paid over the life of the longer contract will still likely be higher due to the longer investment period.

Insurance Company Practices and Market Conditions

Insurance companies, like any business, have their own pricing strategies. Their operational costs, profit margins, and competitive landscape all influence the fees they charge. Additionally, prevailing market conditions can impact fees. For instance, during periods of low interest rates, insurance companies may adjust their fees to maintain profitability. Conversely, during periods of market volatility, the risk charges may increase to offset potential losses.

These adjustments are often not immediately transparent to the consumer and may be reflected in changes to mortality and expense risk charges or other fees.

Key Factors Influencing Variable Annuity Charges: A Summary

To summarize, here’s a prioritized list of the most impactful factors:

- Investment Sub-account Selection: The expense ratios of your chosen investments are the most direct and significant determinant of your overall costs.

- Contract Duration: Longer contracts generally mean higher total fees, even if the annual percentage is lower.

- Insurance Company Pricing Strategies: The insurer’s operational costs and profit goals directly influence the fees they charge.

- Market Conditions: Economic factors and market volatility can impact risk charges and other fees.

Impact of Charges on Investment Returns

Variable annuity contracts, while offering diversification and tax advantages, come with various charges and fees that can significantly impact your long-term investment returns. Understanding how these fees accumulate over time is crucial for making informed investment decisions. Even seemingly small fees can dramatically reduce your final investment value, especially over extended periods.Understanding the long-term effect of different fee structures is essential for maximizing your investment’s growth potential.

High fees effectively reduce your rate of return, meaning less money in your pocket when you retire. Let’s explore this further with a hypothetical example.

Hypothetical Scenario: Twenty-Year Investment Growth

Let’s imagine you invest $10,000 in a variable annuity with an average annual return of 7%. We’ll compare two scenarios: one with high fees (2% annually) and one with low fees (1% annually). These fees are illustrative and vary widely depending on the specific contract. We’ll assume the 7% return is net of any investment management fees within the underlying funds, focusing solely on the impact of the variable annuity’s charges.

| Year | High Fees (2%)

| Low Fees (1%)

|

|---|---|---|

| 0 | $10,000 | $10,000 |

| 5 | $12,762.82 | $14,025.52 |

| 10 | $16,672.21 | $19,671.51 |

| 15 | $21,957.52 | $27,590.32 |

| 20 | $28,845.03 | $38,696.84 |

After 20 years, the investment with high fees is worth $28,845.03, while the investment with low fees is worth $38,696.84. This demonstrates a significant difference of $9,851.81, purely due to the difference in fees.

Visual Representation of Investment Growth

Imagine a graph with two lines representing investment growth over 20 years. The x-axis represents time (in years), and the y-axis represents investment value (in dollars). One line, sharply ascending, represents the investment with low fees (1%). This line shows a consistently steeper incline reflecting higher returns. The second line, also ascending but at a noticeably slower rate, represents the investment with high fees (2%).

The difference between the two lines widens dramatically over time, visually illustrating the cumulative effect of fees. The gap between the lines at year 20 clearly shows the significant loss of potential investment growth due to higher fees. The visual would powerfully demonstrate how seemingly small differences in annual fees translate to substantial differences in final investment value over a long investment horizon.

The Erosive Effect of High Charges

High charges significantly erode investment gains, particularly over longer time horizons. This is because fees are deducted annually, reducing the principal amount available to earn future returns. This effect compounds over time, leading to exponentially larger differences in final investment value compared to lower-fee options. The longer the investment period, the more pronounced this erosive effect becomes.

Choosing a variable annuity with lower fees is therefore crucial for maximizing long-term investment growth.

Strategies for Minimizing Variable Annuity Fees: Do Variable Annuity Contracts Typically Have Charges And Fees

:max_bytes(150000):strip_icc()/Term-a-annuity-d4d5906faea940828244ef128f416cc5.jpg)

So, you’ve learned about the various fees associated with variable annuities. Now, let’s talk about how to keep those costs down. Minimizing fees is crucial because they can significantly impact your long-term investment returns. Even small differences in fees can add up to substantial savings or losses over time.

Identifying Variable Annuities with Lower Fee Structures, Do variable annuity contracts typically have charges and fees

Finding a variable annuity with a competitive fee structure requires diligent research. Don’t just focus on the advertised returns; carefully scrutinize the expense ratios, mortality and expense risk charges, and any other fees listed in the prospectus. Websites that compare annuity products can be helpful, but always verify the information independently by reviewing the official product documents.

Look for annuities with lower expense ratios, as this is often the biggest single cost. Remember, lower isn’t always better; you need to balance low fees with the features and benefits that meet your needs. For example, a lower-fee annuity might lack certain rider benefits that are important to you.

Negotiating Lower Fees with Insurance Companies

While not always successful, negotiating lower fees is a possibility, particularly if you’re investing a substantial sum. Prepare beforehand by researching competing products and their fee structures. When contacting the insurance company, be polite but firm. Explain that you’ve found comparable products with lower fees and that you’re considering other options. You might not get the exact fees you want, but a willingness to negotiate can sometimes yield a small reduction.

Remember, this is a strategy best suited for larger investments.

Variable Annuity Investment Options and Fees

Different investment options within a variable annuity will have varying fee structures. For instance, actively managed sub-accounts generally have higher expense ratios than passively managed index funds. Index funds, tracking a specific market index, typically have lower expense ratios due to their simpler investment strategy. Therefore, choosing passively managed options can often lead to lower overall fees.

However, actively managed funds might offer the potential for higher returns, although this comes with increased risk and fees. The choice depends on your risk tolerance and investment goals.

Importance of Reviewing the Contract’s Fee Schedule

Before investing in any variable annuity, meticulously review the contract’s fee schedule. This document, usually included in the prospectus, details all applicable fees, including expense ratios, mortality and expense risk charges, surrender charges, and any other fees. Don’t just skim it; understand each fee and how it impacts your investment. If anything is unclear, contact the insurance company for clarification before committing your money.

A thorough understanding of the fees is essential to making an informed investment decision.

Comparing Fees of Different Variable Annuity Contracts

Comparing variable annuity fees requires a systematic approach. First, obtain prospectuses from several different insurance companies. Then, create a spreadsheet to compare key fees, such as the expense ratio, mortality and expense risk charges, and surrender charges. Express these fees as percentages of your investment to make direct comparisons easier. Finally, consider the overall cost of the annuity, including all fees, relative to the potential benefits offered, such as death benefits or guaranteed income riders.

This systematic comparison will allow you to make a more informed choice.

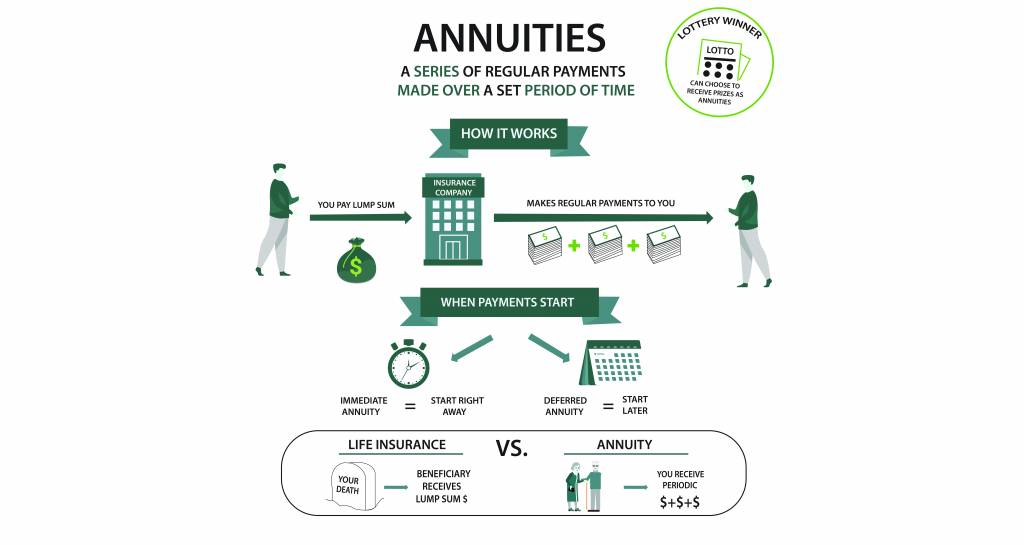

Disclosure of Variable Annuity Fees

Understanding the fee structure of a variable annuity is crucial before investing. Insurance companies are legally obligated to clearly disclose all associated charges, but the complexity of these disclosures can often make it challenging for investors to fully grasp the financial implications. This section will examine the methods used for fee disclosure, the importance of understanding these documents, potential areas of ambiguity, legal requirements, and provide a checklist for review.

Methods of Fee Disclosure

Variable annuity fee disclosures are typically provided in a prospectus, a summary prospectus, and sometimes supplementary documents. The prospectus is a comprehensive document containing detailed information about the annuity, including all fees and expenses. The summary prospectus provides a condensed version of the key information, including fees, but may lack the granular detail found in the full prospectus. These documents are often lengthy and filled with financial jargon, requiring careful review.

Supplementary materials might include illustrations or examples that attempt to show the impact of fees over time, though these should be viewed with a critical eye as they may present best-case scenarios.

Importance of Understanding Fee Disclosure Documents

Thoroughly understanding the fee disclosure documents is paramount to making an informed investment decision. The fees can significantly impact your overall returns, potentially eating into your investment growth over time. Failure to fully comprehend the fee structure could lead to unexpected financial losses and disappointment. A clear understanding allows for comparison between different variable annuity contracts and helps investors choose the option that best aligns with their financial goals and risk tolerance.

Areas of Ambiguity or Complexity in Fee Disclosure Statements

Fee disclosures can be complex due to the numerous types of fees involved (mortality and expense risk charges, administrative fees, surrender charges, etc.). The way these fees are expressed (as percentages, dollar amounts, or a combination) can also contribute to ambiguity. Moreover, the impact of fees on long-term investment growth isn’t always clearly illustrated, and the potential for hidden or indirectly charged fees can make it difficult to determine the true cost of the annuity.

For example, the calculation of mortality and expense risk charges can be complex and difficult to independently verify. Also, the timing of when certain fees are deducted (front-end, back-end, or ongoing) is often a point of confusion.

Legal and Regulatory Requirements for Disclosing Variable Annuity Fees

The disclosure of variable annuity fees is governed by strict legal and regulatory requirements, primarily enforced by the Securities and Exchange Commission (SEC) and state insurance departments. These regulations mandate that all material fees and expenses be clearly disclosed in a readily understandable manner. Failure to comply with these regulations can result in significant penalties for the insurance companies.

The SEC requires that prospectuses contain plain English summaries to help investors understand complex financial information. However, even with these requirements, ambiguities can still arise.

Checklist for Reviewing a Variable Annuity’s Fee Disclosure Document

Before investing in a variable annuity, carefully review the fee disclosure documents using this checklist:

- Identify all fees and expenses, including mortality and expense risk charges, administrative fees, surrender charges, and any other applicable charges.

- Understand how each fee is calculated and when it is deducted.

- Compare the fees with those of similar variable annuity contracts from other insurance companies.

- Analyze the impact of fees on projected returns using both the provided illustrations and your own independent calculations, if possible.

- Pay close attention to the surrender charge schedule and understand the implications of withdrawing funds before a certain period.

- Look for any hidden or indirectly charged fees that may not be immediately apparent.

- If anything is unclear, contact the insurance company or a financial advisor for clarification.

So, there you have it! Navigating the world of variable annuity fees might seem like wading through a swamp of jargon, but armed with the right knowledge, you can make informed decisions. Remember, understanding these fees isn’t just about saving a few bucks; it’s about maximizing your investment potential and ensuring your retirement dreams don’t get bogged down by unexpected expenses.

Don’t be a ‘korban’ of hidden fees – be smart, be informed, and invest wisely!

FAQ Explained

What’s the difference between a mortality and expense risk charge?

A mortality and expense risk charge covers the insurance company’s costs associated with the death benefit and the administration of the annuity. It’s like paying for insurance on your investment, basically.

Can I negotiate annuity fees?

It’s not always easy, but sometimes you can! It’s worth trying to negotiate, especially if you’re investing a large sum. Just be prepared to shop around and show you’ve done your homework.

Are there any variable annuities with NO fees?

Highly unlikely, my friend. All annuities have some sort of fees. The key is to find those with the

-lowest* fees that still meet your needs.

How often are these fees deducted?

Usually, these fees are deducted regularly, either annually or monthly, directly from your investment. Check your contract for the specifics.