What is cost reimbursement contract – What is a cost reimbursement contract? This type of agreement, in essence, allows a client to pay a contractor for the actual costs incurred in completing a project, plus a predetermined fee or percentage for profit. Unlike fixed-price contracts, where the total cost is set upfront, cost reimbursement contracts provide flexibility, particularly when project scope or requirements are uncertain or subject to change.

This approach is often employed in complex, high-risk projects where accurate cost estimation is challenging, such as in research and development, government contracts, and construction projects with unpredictable site conditions.

The core principle of cost reimbursement contracts lies in shared risk and responsibility. The client assumes the risk of potential cost overruns, while the contractor benefits from the potential to earn a higher profit if costs are kept under control. The success of such contracts hinges on transparent cost accounting, meticulous documentation, and a strong collaborative relationship between the client and contractor.

Definition of Cost Reimbursement Contract

A cost reimbursement contract, also known as a “cost-plus” contract, is a type of agreement where the buyer (the customer) pays the seller (the contractor) for all the actual costs incurred in completing a project, plus an agreed-upon fee or profit margin. It’s like saying, “Hey, we’ll pay you for all the stuff you buy and all the work you do, plus a little extra for your effort.”

Core Principle of Cost Reimbursement Contracts

The core principle of cost reimbursement contracts is that the buyer assumes the risk of cost overruns, while the seller is incentivized to minimize costs. This means that the seller is essentially reimbursed for all their expenses, ensuring they don’t lose money. But it also means that the buyer might end up paying more than they initially expected if the project costs exceed the original estimate.

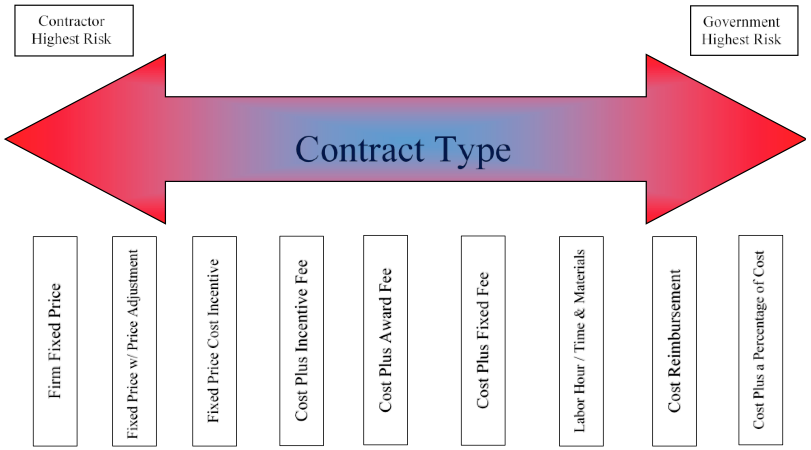

Difference from Fixed-Price Contracts

Cost reimbursement contracts are different from fixed-price contracts, where the buyer agrees to pay a predetermined amount for the project, regardless of the actual costs incurred. In a fixed-price contract, the seller bears the risk of cost overruns, while the buyer enjoys the certainty of knowing exactly how much they will pay.

Industries and Situations Where Cost Reimbursement Contracts are Commonly Used

Cost reimbursement contracts are often used in situations where:

- The scope of work is uncertain or complex, making it difficult to estimate costs accurately.

- The project involves high-risk activities or potential unforeseen challenges.

- The buyer needs to maintain close control over the project and its costs.

- The buyer desires a strong incentive for the seller to minimize costs.

Some industries where cost reimbursement contracts are commonly used include:

- Government contracting: The government often uses cost reimbursement contracts for complex projects like defense systems, research and development, and infrastructure projects, as the scope and costs can be highly unpredictable.

- Engineering and construction: Cost reimbursement contracts are sometimes used for large-scale construction projects where the design or environmental conditions may change during the project, leading to unforeseen costs.

- Research and development: Research projects are often highly uncertain and involve significant experimentation, making cost reimbursement contracts a suitable option for these types of projects.

Key Features of Cost Reimbursement Contracts

Cost reimbursement contracts are unique in their structure and how they handle project expenses. Unlike fixed-price contracts where the price is set upfront, cost reimbursement contracts allow for more flexibility and adaptability, especially for projects with unpredictable costs or scope changes. Let’s explore the key features that make these contracts distinct.

Cost Reimbursable Clause

The cost reimbursable clause is the heart of this contract type. It Artikels the specific costs that the contractor can be reimbursed for, along with the methods used to calculate and track these costs. This clause defines the scope of reimbursement and sets the foundation for the contract’s financial structure. It’s like a roadmap, ensuring both parties are on the same page about what’s included and how expenses will be managed.

Types of Cost Reimbursement Contracts

There are various types of cost reimbursement contracts, each with its own nuances. Understanding these variations is crucial for choosing the right contract for a specific project.

Cost Plus Fixed Fee (CPFF)

In CPFF contracts, the contractor is reimbursed for all allowable costs incurred during the project, plus a fixed fee agreed upon beforehand. The fixed fee acts as the contractor’s profit margin, ensuring they are compensated for their expertise and efforts. This type of contract provides a clear and predictable profit for the contractor, while the client bears the risk of potential cost overruns.

Cost Plus Incentive Fee (CPIF)

CPIF contracts introduce an incentive fee structure, motivating the contractor to control costs and achieve project goals. The incentive fee is determined based on pre-defined performance targets, like project completion on time or within budget. The contractor receives a higher incentive fee for exceeding these targets, encouraging them to prioritize efficiency and quality.

Cost Plus Percentage of Cost (CPPC)

CPPC contracts reimburse the contractor for all allowable costs incurred, plus a percentage of those costs as a fee. This fee structure can incentivize the contractor to maximize costs, potentially leading to higher project expenses. This type of contract is less common due to the potential for cost inflation and the lack of strong incentives for cost control.

Cost Plus Award Fee (CPAF)

CPAF contracts provide a fixed fee for the contractor’s services, along with an additional award fee based on their performance. The award fee is determined subjectively, based on factors like project success, quality, and adherence to deadlines. This approach allows for greater flexibility in rewarding contractors for their contributions beyond just meeting cost targets.

Essential Elements of a Cost Reimbursement Contract

- Clear Definition of Allowable Costs: This element is crucial for avoiding disputes. The contract should explicitly define which costs are reimbursable and which are not, leaving no room for ambiguity. This can include direct costs like materials and labor, as well as indirect costs like overhead and administrative expenses.

- Cost Tracking and Reporting Mechanisms: Robust cost tracking and reporting mechanisms are essential for transparency and accountability. The contract should Artikel how costs will be documented, verified, and reported to the client. Regular reporting helps ensure that both parties are informed about the project’s financial status and can identify any potential issues early on.

- Auditing Provisions: Auditing provisions allow the client to independently verify the contractor’s cost reports. This safeguards the client’s interests and helps maintain financial integrity throughout the project. The contract should clearly define the scope of the audit, the auditor’s responsibilities, and the timeframe for conducting the audit.

- Payment Schedule: The payment schedule Artikels the timing and frequency of reimbursements. This element ensures timely payments to the contractor while providing the client with a clear understanding of their financial obligations. The schedule should specify the payment milestones, the payment methods, and any applicable penalties for late payments.

- Dispute Resolution Mechanism: Disputes can arise in any project, so it’s essential to have a clear and fair dispute resolution mechanism in place. This mechanism should Artikel the steps for resolving disagreements, including mediation, arbitration, or litigation. It’s crucial to have a defined process for handling disputes to avoid delays and maintain a constructive working relationship between the parties.

Advantages of Cost Reimbursement Contracts

![]()

Cost reimbursement contracts, while they might sound a bit complex, offer some pretty sweet advantages for both the contractor and the client. Let’s break down why they’re so popular, especially when you need a bit more flexibility in your project.

Advantages for the Contractor

The contractor is the one who actually does the work, so let’s see what makes this contract type so appealing to them.

- Reduced Risk: This is a big one. The contractor doesn’t have to worry about losing money if the project costs more than expected. The client covers all the costs, so the contractor is pretty much guaranteed to make a profit. It’s like having a safety net for your business.

- More Flexibility: Think of it as having a little more freedom to make decisions on the fly. The contractor can change the scope of work, add new features, or even make adjustments to the design without having to go through a whole bunch of paperwork. It’s all about being adaptable and responsive to changing needs.

- Better Opportunities: Cost reimbursement contracts can open doors for contractors to take on more complex or risky projects that they might not be able to handle with a fixed-price contract. It’s a chance to showcase their skills and expertise on projects that are truly challenging and rewarding.

Advantages for the Client

Now, let’s flip the script and see why clients love cost reimbursement contracts.

- Greater Control: The client gets to call the shots, making all the major decisions about the project. They have a lot of say in how the project is run, from the initial planning stages to the final execution. It’s all about having that control over the outcome.

- High-Quality Work: Since the contractor is getting reimbursed for all their costs, they’re motivated to deliver the best possible quality. It’s all about making sure the client gets their money’s worth and is happy with the final product.

- Better Innovation: Cost reimbursement contracts allow for more room for innovation and creativity. The client can explore new ideas and approaches without worrying about exceeding a fixed budget. It’s a chance to push boundaries and come up with truly unique solutions.

Comparison to Fixed-Price Contracts

Alright, let’s compare cost reimbursement contracts to the other big player in the game: fixed-price contracts.

- Risk and Reward: In a fixed-price contract, the contractor takes on more risk, but they also have the potential for a higher profit if they can complete the project under budget. With cost reimbursement, the contractor’s risk is lower, but their potential profit is also capped. It’s all about balancing risk and reward.

- Flexibility: Fixed-price contracts are pretty rigid. The scope of work is set in stone, and any changes can lead to disputes and delays. Cost reimbursement contracts, on the other hand, are much more flexible, allowing for adjustments and changes along the way. It’s about being adaptable and responsive to changing needs.

- Control: In a fixed-price contract, the client has less control over the project, as the contractor is responsible for delivering the work within a set budget. With cost reimbursement, the client has a much greater say in the project, with more control over the decision-making process.

Disadvantages of Cost Reimbursement Contracts

While cost reimbursement contracts offer some advantages, they also come with inherent risks that need careful consideration. The potential for cost overruns, budget issues, and disputes can make these contracts less desirable for certain projects.

Potential Risks Associated with Cost Reimbursement Contracts, What is cost reimbursement contract

The nature of cost reimbursement contracts, where the contractor is reimbursed for actual costs incurred, can create several potential risks for the client. These risks are primarily associated with the lack of a fixed price, which can lead to unpredictable costs and potential financial burdens.

- Cost Overruns: One of the most significant risks is the possibility of cost overruns. Without a fixed price, the client is exposed to the contractor’s actual costs, which can exceed the initial estimates due to unforeseen circumstances, changes in scope, or inefficiencies in the contractor’s operations. This can lead to significant financial strain on the client.

- Lack of Incentive for Cost Control: Cost reimbursement contracts can sometimes disincentivize the contractor from controlling costs effectively. Since the contractor is reimbursed for all allowable costs, they may not be as motivated to find cost-saving solutions or manage expenses efficiently. This can result in higher overall project costs.

- Potential for Abuse: In some cases, there’s a potential for the contractor to inflate costs or submit unreasonable expenses. This can be challenging to detect and can lead to significant financial losses for the client. It’s essential to have robust cost control measures in place and to carefully scrutinize all expenses.

- Increased Administrative Burden: Cost reimbursement contracts require extensive documentation and auditing to ensure that costs are legitimate and reasonable. This can increase the administrative burden on both the client and the contractor, requiring additional resources and time for cost tracking and verification.

Cost Overruns and Budget Issues

Cost overruns are a common concern with cost reimbursement contracts. Without a fixed price, the client has limited control over the project’s budget. Unforeseen circumstances, such as changes in scope, material price fluctuations, or unexpected delays, can easily lead to escalating costs. This can strain the client’s budget and potentially lead to project delays or cancellations.

- Lack of Budget Clarity: Cost reimbursement contracts lack the clarity of a fixed price, making it difficult to accurately predict and manage project costs. This can create challenges in budgeting and financial planning, as the client may not have a clear understanding of the total project cost until it is completed.

- Unforeseen Expenses: Cost overruns can arise from unforeseen expenses that were not included in the initial estimates. These expenses could include unexpected site conditions, changes in regulations, or delays caused by external factors. The client is responsible for covering these additional costs, which can significantly impact the project’s budget.

- Difficulty in Monitoring Costs: Without a fixed price, it can be challenging for the client to monitor and control project costs effectively. The contractor is responsible for submitting cost reports, but the client must carefully review and audit these reports to ensure accuracy and prevent cost overruns.

Lack of Clear Price Limits and Disputes

The absence of a fixed price in cost reimbursement contracts can lead to disputes between the client and the contractor. Without clear price limits, disagreements can arise regarding the reasonableness of costs, the scope of work, and the interpretation of contract terms.

- Disagreements Over Allowable Costs: Cost reimbursement contracts often require the client to approve all costs incurred by the contractor. Disagreements can arise over which costs are considered allowable and reasonable, leading to disputes and potential delays in project progress.

- Scope Creep and Changes in Requirements: Changes in project scope or requirements are common in construction projects. In cost reimbursement contracts, these changes can lead to disputes over the cost of additional work and the extent of the contractor’s responsibility.

- Interpretation of Contract Terms: Cost reimbursement contracts often involve complex terms and conditions, which can be subject to different interpretations by the client and the contractor. These differences in interpretation can lead to disputes over the scope of work, the allocation of costs, and the contractor’s responsibilities.

Cost Reimbursement Contract Management: What Is Cost Reimbursement Contract

Managing cost reimbursement contracts effectively is crucial for both the contractor and the client. It requires a structured approach to ensure that costs are monitored, budgets are adhered to, and the project is completed on time and within scope.

Best Practices for Managing Cost Reimbursement Contracts

Effective management of cost reimbursement contracts involves implementing best practices that promote transparency, accountability, and efficient project execution.

- Regular cost reporting: Establish clear reporting procedures for the contractor to submit detailed cost breakdowns at predetermined intervals. This allows the client to track expenses, identify potential cost overruns, and take corrective actions.

- Detailed budget review: Conduct regular budget reviews to assess the accuracy and completeness of the contractor’s cost estimates. Identify any discrepancies or potential cost overruns early on and adjust the budget accordingly.

- Cost control measures: Implement cost control measures such as value engineering, cost-benefit analysis, and cost-reduction initiatives. This helps optimize resource utilization and minimize unnecessary expenses.

- Performance monitoring: Monitor the contractor’s performance against key performance indicators (KPIs) related to cost, schedule, and quality. This provides insights into project progress and identifies any potential issues that may impact the budget.

- Change management: Establish a formal change management process to track and approve all changes to the project scope, budget, or schedule. This helps maintain control over costs and prevent scope creep.

- Risk management: Identify and assess potential risks that could impact the project budget. Develop mitigation strategies to minimize the likelihood and impact of these risks.

Framework for Monitoring Costs and Ensuring Budget Adherence

Monitoring costs and ensuring budget adherence is a critical aspect of cost reimbursement contract management. Here’s a framework that can be used:

- Cost baseline: Establish a detailed cost baseline that includes all anticipated costs, including direct costs, indirect costs, and contingency funds. This serves as a benchmark for tracking actual expenses.

- Cost tracking system: Implement a cost tracking system that captures all project expenses, including labor, materials, equipment, and overhead. This system should be integrated with the project management system to provide real-time visibility into project costs.

- Cost variance analysis: Regularly analyze cost variances between the cost baseline and actual expenses. This helps identify areas where costs are exceeding the budget and enables corrective actions to be taken.

- Cost forecasting: Develop cost forecasts to predict future expenses based on historical data and project progress. This helps anticipate potential cost overruns and allows for proactive adjustments to the budget.

- Cost control meetings: Hold regular cost control meetings with the contractor to review cost performance, identify potential issues, and develop mitigation strategies.

Importance of Clear Communication and Collaboration

Clear communication and collaboration between the contractor and client are essential for successful cost reimbursement contract management. This involves:

- Open and transparent communication: Foster an environment of open and transparent communication between the contractor and client.

- Regular meetings: Schedule regular meetings to discuss project progress, cost performance, and any potential issues.

- Documentation: Maintain comprehensive documentation of all project communications, decisions, and agreements.

- Early problem identification: Encourage early identification and resolution of potential problems that could impact the project budget.

- Shared understanding: Ensure a shared understanding of the project scope, budget, and deliverables.

Examples of Cost Reimbursement Contracts

Cost reimbursement contracts are often used in situations where the scope of work is complex, uncertain, or subject to change. This is because they provide flexibility for both the buyer and the seller, allowing for adjustments to be made as the project progresses.

Industries Where Cost Reimbursement Contracts Are Used

Cost reimbursement contracts are commonly used in various industries, including:

- Government Contracting: The government often uses cost reimbursement contracts for large-scale projects, such as defense contracts, research and development, and infrastructure projects. These projects often involve complex technical requirements and uncertain timelines, making cost reimbursement contracts a suitable choice.

- Construction: Cost reimbursement contracts can be used for complex construction projects, such as bridges, tunnels, or large-scale commercial buildings. The use of these contracts allows for flexibility in dealing with unforeseen site conditions or changes in project requirements.

- Aerospace and Defense: The aerospace and defense industry relies heavily on cost reimbursement contracts, especially for research and development projects, where the scope of work may evolve as new technologies are developed.

- Engineering and Consulting: Cost reimbursement contracts are common in engineering and consulting services, where the scope of work can be complex and require ongoing collaboration between the client and the contractor.

- IT and Software Development: Cost reimbursement contracts can be used for complex software development projects, where the scope of work may change as the project progresses. These contracts allow for flexibility in responding to evolving user requirements or technological advancements.

Scenarios Where Cost Reimbursement Contracts Are Beneficial

Here are some scenarios where cost reimbursement contracts can be advantageous:

- Uncertain Scope of Work: When the exact scope of work is unknown or subject to change, a cost reimbursement contract provides flexibility to adjust the project as needed.

- High Risk Projects: For projects with high risk or uncertainty, a cost reimbursement contract can be used to share the risk between the buyer and the seller.

- Research and Development: Cost reimbursement contracts are often used for research and development projects, where the outcome is uncertain and may require ongoing adjustments.

- Complex Projects: For projects with complex technical requirements or multiple stakeholders, a cost reimbursement contract can provide a framework for managing the project effectively.

- Long-Term Projects: Cost reimbursement contracts can be used for long-term projects, where the scope of work may change over time. These contracts provide flexibility to adapt to changing needs and requirements.

Examples of Cost Reimbursement Contracts

Here are some real-world examples of cost reimbursement contracts in different industries:

| Industry | Contract Type | Key Features |

|---|---|---|

| Government Contracting | Cost Plus Fixed Fee (CPFF) | The contractor is reimbursed for all allowable costs incurred plus a fixed fee. |

| Construction | Cost Plus Percentage of Cost (CPPC) | The contractor is reimbursed for all allowable costs incurred plus a percentage of the total cost. |

| Aerospace and Defense | Cost Plus Incentive Fee (CPIF) | The contractor is reimbursed for all allowable costs incurred plus an incentive fee based on performance targets. |

| Engineering and Consulting | Cost Plus Award Fee (CPAF) | The contractor is reimbursed for all allowable costs incurred plus an award fee based on subjective performance criteria. |

| IT and Software Development | Time and Materials (T&M) | The contractor is reimbursed for the time and materials used on the project, plus a markup for overhead and profit. |

Cost reimbursement contracts offer a unique balance of flexibility and risk-sharing, making them a suitable choice for specific project scenarios. However, the potential for cost overruns and the need for rigorous cost control necessitate careful planning, clear communication, and robust contract management. Understanding the intricacies of cost reimbursement contracts, their advantages, disadvantages, and best practices for effective management is crucial for ensuring successful project execution and achieving mutually beneficial outcomes.

FAQ

What are the common types of cost reimbursement contracts?

There are several types, including Cost Plus Fixed Fee (CPFF), Cost Plus Incentive Fee (CPIF), and Cost Plus Percentage of Cost (CPPC). Each type varies in how the contractor’s profit is calculated, with CPFF offering a fixed fee, CPIF providing incentives for cost savings, and CPPC based on a percentage of total costs.

How are costs monitored and controlled in a cost reimbursement contract?

Regular cost reporting, audits, and budget reviews are essential. The contract typically includes provisions for cost control measures, such as approval requirements for certain expenses and mechanisms for dispute resolution.

What are some of the risks associated with cost reimbursement contracts?

Risks include potential cost overruns, lack of clear price limits, disputes over cost allocation, and the possibility of contractor inefficiency or fraud.