How does a cost plus contract work? Yo, let’s be real, negotiating contracts can be totally confusing, especially when you’re dealing with something as complex as a cost-plus contract. Think of it like this: it’s a deal where the buyer pays all the project costs PLUS an agreed-upon fee for the seller’s effort. It’s a wild ride, but we’re gonna break down exactly how it all goes down, from the different types of cost-plus contracts to the potential pitfalls and how to dodge ’em.

Get ready to level up your contract game!

Cost-plus contracts are commonly used when the project scope is uncertain or highly complex. Imagine building a custom spaceship – you can’t exactly nail down the price beforehand! This contract type shifts a lot of the risk from the seller to the buyer, making it a pretty unique beast in the business world. We’ll explore the various flavors of cost-plus contracts – like cost-plus-fixed-fee and cost-plus-incentive-fee – and see how they differ in terms of risk and reward.

We’ll also look at what costs are included (and excluded!), how to negotiate a fair deal, and how to avoid getting totally ripped off.

Defining Cost-Plus Contracts

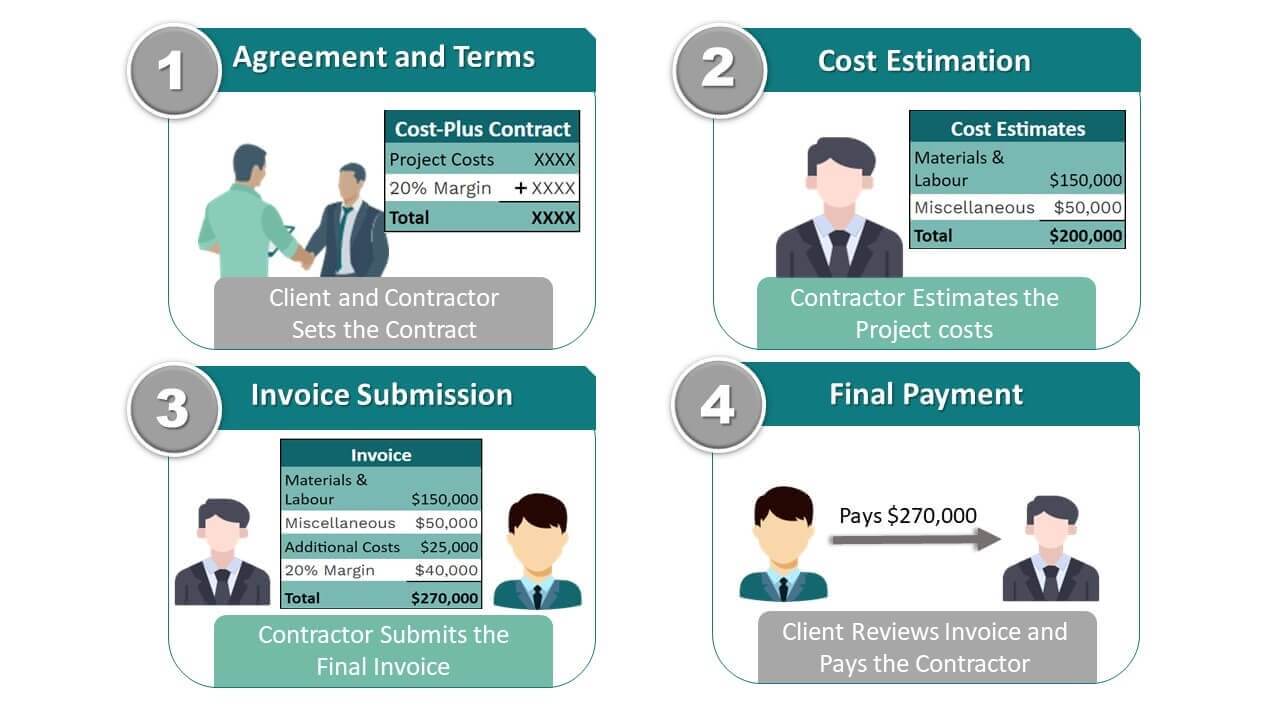

Right, so cost-plus contracts, innit? Basically, they’re a bit like ordering a custom-built banger – you pay for the bits and the labour, plus a bit extra for the builder’s profit margin. It’s all about transparency, bruv, but it can get a bit pricey if you’re not careful.A cost-plus contract is a type of agreement where the buyer reimburses the seller for all allowable costs incurred in performing the contract, plus an agreed-upon fee or percentage of those costs as profit.

This means the final price isn’t set in stone at the start – it’s determined after the work is done. The key characteristics are the reimbursement of actual costs and the addition of a predetermined profit margin. This makes it ideal for projects where the scope is uncertain or might change along the way, like, you know, building a spaceship or something.

Industries Using Cost-Plus Contracts

Cost-plus contracts are proper common in industries where it’s tricky to nail down the exact costs upfront. Think about projects with a lot of unknowns or where there’s a high degree of customisation. We’re talking aerospace, defence, construction (especially massive projects), and research and development. These industries often deal with complex, one-off projects where precise cost estimation before work starts is practically impossible.

For example, imagine trying to give a fixed price for building a bespoke bridge across a gorge – too many variables!

Comparison of Cost-Plus and Other Contract Types

Here’s a lowdown comparing cost-plus to other contract types. It’s a bit like choosing your mates for a five-a-side match – each type has its own strengths and weaknesses.

| Contract Type | Price Determination | Risk Allocation | Suitability |

|---|---|---|---|

| Cost-Plus | Costs + Fee/Percentage | Shared between buyer and seller | Uncertain scope, complex projects |

| Fixed-Price | Predetermined price | Primarily on seller | Clearly defined scope, low risk |

| Time and Materials | Hourly rate + materials cost | Shared, but leans towards buyer | Smaller projects, repairs, maintenance |

| Unit Price | Price per unit x quantity | Shared, depending on pricing accuracy | Projects with well-defined units of work |

Types of Cost-Plus Contracts: How Does A Cost Plus Contract Work

Right, so you’ve got the lowdown on what a cost-plus contract is, but there are loads of different types, innit? It’s not a one-size-fits-all kinda deal. Think of it like choosing your Nando’s – you’ve got your peri-peri, your lemon and herb, and a whole load more options, each with its own vibe. Let’s break down the main ones.Cost-plus contracts are all about reimbursing the supplier for their costs, but how that extra bit – the profit – is calculated varies wildly.

The different types all manage risk differently, and choosing the right one depends entirely on the project and how much you’re willing to, like, take a punt.

Cost-Plus-Fixed-Fee (CPFF)

This is a pretty standard type. Basically, the buyer pays all the supplier’s allowable costs, plus a fixed fee agreed upon beforehand. Think of it as a set bonus regardless of how much the project costs. The fee is usually a percentage of the estimated cost, but it’s fixed – no matter how much the project balloons, the supplier gets their fixed fee.

Risk is mainly on the buyer’s shoulders here; if costs go through the roof, so does the final bill.

- Advantages: Supplier’s motivated to keep costs down (to a point!), clear pricing structure for the fee.

- Disadvantages: Big risk for the buyer if costs spiral out of control; supplier might not be as incentivised to be mega-efficient.

Cost-Plus-Incentive-Fee (CPIF)

This one’s a bit more nuanced. The buyer still pays all allowable costs, but the fee isn’t fixed. It’s linked to how well the supplier performs against certain targets. Smash those targets? You’ll get a bigger bonus.

Miss them? Your bonus takes a hit. This is all about sharing the risk – the supplier’s got skin in the game. It’s like a performance-related bonus at your job, but on a massive scale.

- Advantages: Encourages both parties to work together, balances risk, potential for cost savings.

- Disadvantages: Can be complex to set up, requires careful target setting and monitoring, potential for disputes over target achievement.

Cost-Plus-Percentage-of-Cost (CPPC)

This is, like, the OG cost-plus contract, but it’s generally considered a bit dodgy nowadays. The supplier gets reimbursed for all allowable costs, plus a percentage of those costs as a fee. So, the more the project costs, the bigger their profit. This gives the supplier minimal incentive to control costs, which is a massive no-no. Think of it as a commission-only sales job – incentivizes selling loads, regardless of profit margins.

- Advantages: Simple to understand (in theory).

- Disadvantages: Massive incentive for cost overruns, high risk for the buyer, generally avoided due to its inherent flaws.

Cost Elements Included in a Cost-Plus Contract

Right, so you’re tryna get your head around cost-plus contracts, innit? Basically, it’s a deal where the buyer pays all the supplier’s costs plus a bit extra for profit. Knowing what costs are included is mega important, otherwise, you’re gonna end up proper skint or, worse, ripped off.

Cost-plus contracts are all about transparency, bruv. Both parties need to be on the same page about what’s included in the “cost” bit. This means properly documenting everything, from the price of materials to the wages of the builders. Without this, it’s a recipe for disaster, trust me.

Direct and Indirect Costs

Direct costs are, like, the stuff that’s directly linked to making your product or service. Think materials, labour directly involved in production, and stuff like that. Indirect costs are more like the overheads – rent, admin, general business expenses, the lot. Getting a handle on both is crucial for a fair deal.

Accurate Cost Accounting and Record-Keeping

Keeping proper records is dead important, yeah? It’s not just about avoiding arguments later. Proper accounting helps you manage your cash flow, see where you’re spending your money, and spot any areas where you can save some dosh. It’s all about being organised and avoiding any dodgy dealings, basically. If you can’t prove your costs, you’re stuffed.

Allowable and Unallowable Costs

The contract will usually spell out what costs are “allowable” – meaning the buyer will pay them – and which ones are “unallowable” – meaning you’re on your own with those. Allowable costs are usually things like direct materials and labour. Unallowable costs are often things like lavish entertainment or fines for breaking rules. It’s all about being fair and square, so get it sorted before you even start.

Common Cost Categories and Examples

| Cost Category | Description | Allowable Example | Unallowable Example |

|---|---|---|---|

| Direct Materials | Raw materials directly used in production | Cost of timber for a house build | Luxury office furniture for admin staff |

| Direct Labour | Wages of workers directly involved in production | Wages of carpenters building a house | Salary of a CEO’s personal assistant (unless specifically agreed) |

| Indirect Labour | Wages of support staff not directly involved in production | Salary of a project manager overseeing the build | Salary of a marketing executive unrelated to the project |

| Overhead Costs | General business expenses | Rent of the factory/office | Penalties for late project delivery (unless explicitly included) |

| Travel Expenses | Costs related to business travel | Travel expenses for site visits | First-class airfare for a non-essential trip |

| Subcontractor Costs | Costs paid to subcontractors | Payments to electricians working on a house | Payments to a subcontractor for work outside the scope of the project |

Contract Negotiation and Management

Right, so you’ve got your cost-plus contract all figured out, innit? But before you sign on the dotted line, there’s a whole load of stuff to sort out. Negotiation and management are key to making sure you don’t get totally ripped off, or end up spending ages chasing your tail.Negotiating a cost-plus contract isn’t just about haggling over the fee; it’s about setting up a solid foundation for the whole project.

It’s all about making sure everyone’s on the same page, from the get-go. This involves a proper understanding of what needs to be done, how much it’s gonna cost, and what happens if things go pear-shaped. You need to nail down all the details and be completely transparent about costs, so there are no surprises further down the line.

Defining the Scope of Work

Getting the scope of work absolutely spot-on is mega important. If it’s not crystal clear what’s included, you’ll end up with massive arguments and cost overruns. Think of it like this: if you’re building a shed, you need to specify everything – the size, materials, even the type of paint. No room for ambiguity, bruv! A detailed specification, including drawings and schedules, is a must.

Any changes after the contract’s signed usually mean extra costs and potential delays, so be thorough!

Managing Costs and Preventing Cost Overruns

Cost overruns are a total nightmare, so you need a plan to avoid them. Regular monitoring of the project’s progress and expenses is crucial. You need to check in regularly with the other party to see if things are on track, and if not, figure out what’s causing the delays or extra costs. Having regular meetings, keeping detailed records, and maybe even using project management software can really help.

It’s also worth thinking about setting up a system of approvals for any changes or additional costs. This ensures everyone’s on board before any extra money is spent.

Effective Communication and Collaboration

Communication is king, mate. You need open and honest communication throughout the whole project. Regular meetings, clear reporting, and a willingness to listen to each other’s concerns are essential. Building a good relationship with the other party will make a massive difference. If you’re both on the same wavelength, you’re far more likely to sort out problems quickly and efficiently.

This includes regular progress updates, transparent financial reporting, and clear channels for raising any issues that crop up. A collaborative approach, rather than an adversarial one, is the way to go.

Risk Assessment and Mitigation

Right, so cost-plus contracts, they’re a bit of a double-edged sword, innit? Loads of potential for both the buyer and the seller to get, well, a bit cheesed off if things go pear-shaped. Let’s break down the risks and how to dodge ’em.Basically, cost-plus contracts are all about transparency, but even with that, things can go sideways.

It’s all about understanding the potential pitfalls and having a plan B, C, and maybe even D, ready to go.

Potential Risks for Buyers and Sellers

For buyers, the main worry is cost overruns. Imagine you’re getting a new kitchen fitted, and the contractor keeps finding “unexpected” issues, pushing the price way higher than you agreed. That’s the nightmare scenario. Sellers, on the other hand, could face the risk of not making enough profit if the actual costs end up being higher than anticipated.

Or, they might get hit with unexpected delays, which can eat into their margins. It’s a bit of a gamble for both sides, really.

Risk Mitigation Strategies

So, how do you avoid a total disaster? Well, for starters, thorough planning is key. Before signing anything, make sure you’ve got a really detailed scope of work, and both parties are completely on the same page about what’s included and what’s not. Regular progress meetings are also dead handy – keeping a close eye on costs and timelines prevents any nasty surprises.

Buyers should also consider independent cost estimations to make sure the seller’s figures aren’t, shall we say, a bit optimistic. Sellers, meanwhile, need to be super accurate with their initial cost estimates, building in a bit of a buffer for unforeseen expenses. Proper project management and clear communication are absolute lifesavers.

Risk Management Process Flowchart

Imagine a flowchart: It starts with “Contract Initiation,” leading to “Risk Identification” (listing potential problems for both buyer and seller). Then, “Risk Analysis” assesses the likelihood and impact of each risk. Next, “Risk Response Planning” develops mitigation strategies. This leads to “Contract Implementation,” with regular monitoring and communication. If problems arise, there’s a “Risk Monitoring and Control” loop back to the “Risk Response Planning” stage.

Finally, “Contract Closure” wraps things up. Each stage should have clear decision points and actions, ensuring proactive risk management throughout the contract lifecycle.

Key Contract Clauses for Risk Mitigation

To avoid getting totally ripped off, it’s vital to include specific clauses. Here’s what you need:

- A clearly defined scope of work, leaving no room for ambiguity.

- A detailed payment schedule, tied to milestones achieved, to avoid paying for work not done.

- A process for change orders, specifying how additional work will be priced and approved.

- Mechanisms for dispute resolution, preventing things from escalating into a full-blown drama.

- Clauses limiting the seller’s liability for unforeseen circumstances, balancing risk fairly.

- Regular reporting requirements, keeping both parties in the loop about progress and costs.

Illustrative Example of a Cost-Plus Contract Scenario

Right, so picture this: Imagine a wickedly talented coder, let’s call him Dave, who’s been tasked with building a banging new app for a massive corporation, “MegaCorp.” MegaCorp’s got no clue about the tech side of things, so they decide to go with a cost-plus contract with Dave. It’s all about transparency, innit?MegaCorp agrees to cover all of Dave’s legit expenses involved in building the app, plus a juicy profit margin on top.

This means Dave gets paid for every bit of effort he puts in, plus a bit extra for his skills and expertise. Think of it as a “pay-as-you-go” deal, but with a guaranteed profit for Dave.

Project Costs and Fee Determination

Dave starts cracking on with the app. He meticulously tracks every single cost: his own salary (£50k), the cost of software licenses (£5k), cloud computing fees (£2k), and even his fancy artisan coffee habit (£1k – gotta stay caffeinated, right?). He keeps all his receipts, man, because MegaCorp needs proof. After a few months of solid coding, Dave’s total costs reach £58,000.Now, the contract states that Dave gets a 15% fee on top of his allowable costs.

So, his profit is calculated as 15% of £58,000, which equals £8,700. That’s a pretty sweet deal for Dave!

Final Cost and Profit Breakdown

Right, let’s break it down:Dave’s Total Allowable Costs: £58,000Dave’s Fee (15% of costs): £8,700Total Project Cost for MegaCorp: £66,700 (£58,000 + £8,700)Dave’s total earnings: £66,700 (Costs covered + Fee)MegaCorp’s total expenditure: £66,700See? It’s all pretty straightforward. MegaCorp knows exactly what they’re paying for, and Dave gets fairly compensated for his efforts and risk. It’s a win-win, bruv. Obviously, this is a simplified example, and real-world scenarios are often more complex, but you get the general vibe.

Legal and Ethical Considerations

Right, so cost-plus contracts, they sound chill, but there’s a whole load of legal and ethical stuff you need to be mega-aware of. Basically, it’s all about making sure everyone’s on the same page and nobody’s getting ripped off, innit? Transparency is key, and dodgy dealings can land you in a right pickle.Potential Legal Issues in Cost-Plus ContractsCost-plus contracts can be a bit of a minefield legally.

One major issue is the potential for cost overruns. If the contract isn’t super clear about what costs are included and how they’re tracked, you could end up with a massive bill that wasn’t expected. Another biggie is the risk of fraud or even just plain old dodgy accounting practices. If the seller isn’t keeping proper records, or worse, is making things up, the buyer could be left high and dry.

Also, disputes over the interpretation of the contract itself can easily crop up. It’s crucial to have a solid, watertight contract to begin with, and that means getting some proper legal advice.

Ethical Responsibilities of Buyer and Seller

Both the buyer and the seller have a moral obligation to act with integrity. The buyer needs to be fair and reasonable in their dealings, avoiding any attempts to exploit the seller’s position. This includes making sure the contract is fair and doesn’t set unrealistic expectations. The seller, on the other hand, has a duty to be transparent and honest about their costs.

They shouldn’t inflate prices or pad their expenses just to make a bigger profit. It’s all about building trust and maintaining a good working relationship. If either party acts dodgy, the whole thing can fall apart.

Potential Conflicts of Interest and Their Avoidance, How does a cost plus contract work

Conflicts of interest are a massive problem in cost-plus contracts. Imagine the seller using materials from a company they own, inflating the price to boost their own profits. Or maybe the buyer pressures the seller to cut corners to save money, putting quality at risk. To avoid this, it’s vital to have clear guidelines on what constitutes a conflict of interest and establish independent oversight.

Things like regular audits and independent cost verification can help to ensure everything is on the level. Full transparency and open communication are crucial to prevent these conflicts from ever arising.

Legal and Ethical Best Practices for Cost-Plus Contracts

It’s all about being upfront and honest from the start. Here’s a few top tips:

- Clearly define all allowable costs in the contract, leaving no room for ambiguity.

- Establish a robust system for tracking and verifying costs, using independent audits where appropriate.

- Ensure both parties understand their ethical obligations and commit to acting with integrity.

- Implement mechanisms for identifying and managing potential conflicts of interest.

- Regularly review the contract and its performance to ensure it remains fair and equitable for both sides.

- Seek legal advice to ensure the contract complies with all relevant laws and regulations.

So, there you have it – the lowdown on cost-plus contracts. While they might seem kinda scary at first, understanding the different types, potential risks, and negotiation strategies can totally change the game. Remember, clear communication and a well-defined scope of work are your best friends. With a little know-how, you can navigate the world of cost-plus contracts like a boss and score some sweet deals.

Now go forth and conquer those contracts!

FAQ Insights

What if costs go way over budget in a cost-plus contract?

That’s a major risk with cost-plus contracts. Strong oversight, detailed budgeting, and clear contract clauses about cost controls are crucial to prevent runaway spending. It’s all about proactive management.

Are there any situations where a cost-plus contract isn’t a good idea?

Yeah, totally. If you’re on a tight budget or need a super precise price upfront, a fixed-price contract is probably a better bet. Cost-plus is best for projects with uncertain scopes or those needing highly specialized expertise.

How do I choose the right type of cost-plus contract?

It depends on your risk tolerance and the project’s specifics. A cost-plus-fixed-fee offers more certainty, while a cost-plus-incentive-fee can motivate the seller to keep costs down. Talk to a lawyer or experienced contract negotiator!