How much do futures contracts cost – So, you wanna get into futures contracts, eh? But hold up, mate, before you dive in headfirst, you gotta know how much it’s gonna cost you. Futures contracts aren’t exactly cheap, but they can be a real game-changer if you know what you’re doing. Think of them like a bet on the future, but instead of betting on your mates’ football team, you’re betting on things like oil prices or the stock market.

Pretty risky, but potentially very rewarding.

The cost of a futures contract depends on a few things, like the initial margin, which is basically a deposit you need to make to get started. Then there are margin calls, which are like extra payments you might have to make if the market moves against you. And, of course, there are brokerage fees, which are like the admin charges for trading.

It all adds up, so you gotta be sure you’re prepared before you jump in.

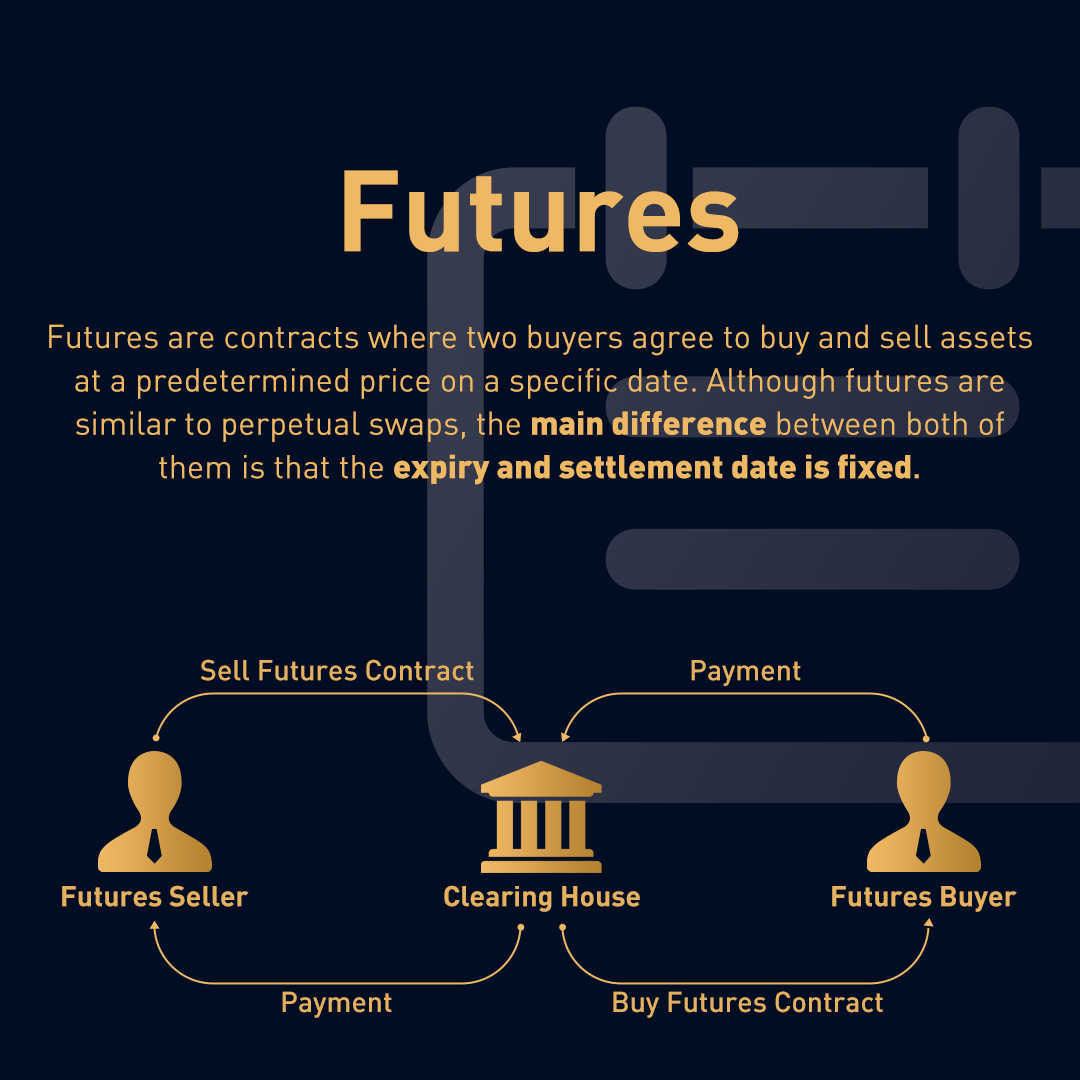

Introduction to Futures Contracts

Futures contracts are legally binding agreements to buy or sell a specific asset at a predetermined price on a future date. They are essential components of financial markets, providing a mechanism for managing price risk and speculating on future price movements.Futures contracts are standardized agreements that specify the asset being traded, the quantity, the delivery date, and the quality of the asset.

They are traded on organized exchanges, ensuring transparency and liquidity. This standardized nature facilitates price discovery and efficient trading.

Key Characteristics of Futures Contracts

Futures contracts are characterized by several key features:

- Standardized Contracts: Each futures contract specifies the asset, quantity, delivery date, and quality of the asset, ensuring uniformity and facilitating trading.

- Exchange Trading: Futures contracts are traded on organized exchanges, providing a centralized marketplace for buyers and sellers to interact. This ensures transparency, liquidity, and price discovery.

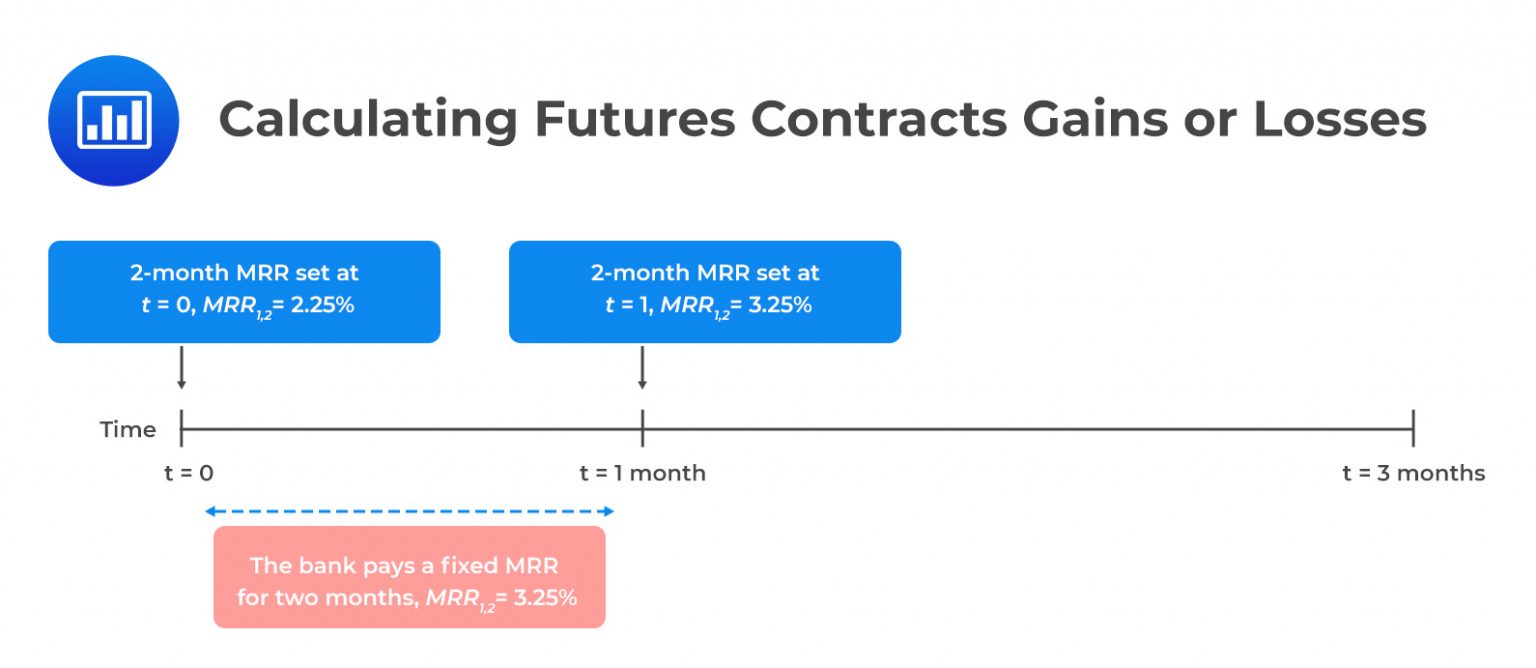

- Marking to Market: Daily settlement of gains and losses based on the current market price of the futures contract. This practice minimizes counterparty risk and ensures that all market participants are exposed to the current market conditions.

Types of Futures Contracts

Futures contracts cover a wide range of assets, including:

- Commodity Futures: Contracts for agricultural products like wheat, corn, and soybeans; energy products like crude oil and natural gas; and metals like gold and silver.

- Financial Futures: Contracts for financial instruments like interest rates, currencies, stock indices, and bonds.

Cost Components of Futures Contracts

Futures contracts, while seemingly simple to understand, involve several cost components that traders must consider. These costs directly impact the profitability of a futures trading strategy. Understanding these components is crucial for making informed trading decisions.

Initial Margin Requirement

The initial margin is a deposit required by the clearinghouse to ensure the performance of the futures contract. It serves as a guarantee against potential losses. This margin is not a cost in itself, but it represents a portion of the trader’s capital that is tied up during the life of the contract.

The initial margin requirement is a percentage of the contract’s notional value, and it varies depending on the underlying asset, contract size, and market volatility.

For example, a futures contract on a stock index with a notional value of $100,000 may require an initial margin of $5,000, representing a 5% margin requirement. This means the trader needs to deposit $5,000 to enter the contract.

Margin Calls

Margin calls occur when the market moves against the trader’s position, and the account balance falls below the maintenance margin level. The maintenance margin is typically a lower percentage of the contract’s notional value than the initial margin.

When a margin call is triggered, the trader must deposit additional funds to bring the account balance back up to the initial margin level.

Margin calls are not a direct cost, but they represent a potential loss of trading capital. If a trader fails to meet a margin call, the clearinghouse may liquidate their position, leading to a loss of the initial margin and any potential profits.

Brokerage Fees

Brokerage fees are charged by the brokerage firm for facilitating the trade. These fees vary depending on the broker, the trading platform, and the contract traded.

Common brokerage fees include commission fees, platform fees, and data fees.

Commission fees are typically charged per contract traded. Platform fees are charged for using the brokerage’s trading platform, and data fees are charged for access to real-time market data.These fees directly impact the overall cost of trading futures contracts. It’s essential for traders to compare brokerage fees from different firms to find the most cost-effective option.

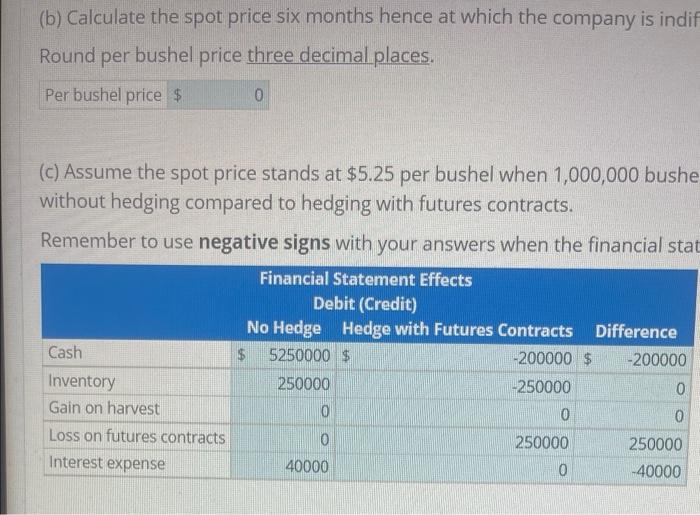

Determining the Cost of a Futures Contract: How Much Do Futures Contracts Cost

The cost of a futures contract is determined by the price of the underlying asset and other factors that influence its value. Understanding these factors is crucial for investors to make informed decisions when trading futures contracts.

Relationship Between Futures Price and Underlying Asset Price

The futures price reflects the market’s expectation of the underlying asset’s price at the contract’s expiration date. This relationship is influenced by several factors, including:* Spot Price: The current market price of the underlying asset.

Time Value

The time remaining until the contract expires, which accounts for the cost of carrying the asset over time.

Interest Rates

Higher interest rates generally lead to higher futures prices, as the cost of borrowing money to purchase the asset increases.

Storage Costs

The cost of storing the underlying asset until the contract’s expiration date.

Market Volatility

Higher volatility in the underlying asset’s price generally results in higher futures prices, as traders demand a premium for taking on more risk.

Factors Influencing the Cost of a Futures Contract

The cost of a futures contract is influenced by several factors, including:* Interest Rates: Higher interest rates increase the cost of carrying the underlying asset until the contract’s expiration date, resulting in higher futures prices. For example, if interest rates rise, the cost of borrowing money to purchase a commodity like gold will increase, leading to a higher futures price.

Storage Costs

The cost of storing the underlying asset, such as warehousing costs for commodities, influences the futures price. Higher storage costs increase the cost of carrying the asset, resulting in a higher futures price.

Market Volatility

Higher volatility in the underlying asset’s price increases the risk associated with holding the asset until the contract’s expiration date. To compensate for this increased risk, traders demand a premium, resulting in a higher futures price. For example, if the price of oil is highly volatile, the futures price for oil will likely be higher to reflect the increased risk.

Calculating the Cost of a Futures Contract

The cost of a futures contract can be calculated based on current market conditions. Here’s an example: Scenario: You want to buy a futures contract for 100 ounces of gold, with a current spot price of $1,800 per ounce and an expiration date in three months. Calculation:* Futures Price: The futures price will be higher than the spot price to reflect the cost of carrying the gold for three months.

Interest Rate

Assume a 2% annual interest rate.

Storage Costs

Assume a storage cost of $1 per ounce per month.The futures price can be calculated using the following formula:

Futures Price = Spot Price + (Interest Rate x Spot Price x Time) + (Storage Costs x Time)

Futures Price = $1,800 + (0.02 x $1,800 x 0.25) + ($1 x 3)

Futures Price = $1,800 + $9 + $3

Futures Price = $1,812

Therefore, the cost of the futures contract for 100 ounces of gold would be $1,812 x 100 = $181,200.

Trading Costs vs. Potential Profits

Futures contracts offer the potential for substantial profits, but they also carry significant risks. Understanding the costs associated with trading futures and the potential rewards is crucial for making informed trading decisions. This section will explore the risks and potential rewards associated with trading futures contracts and compare the costs of futures trading to other investment options.

Risk and Reward of Futures Trading

Futures contracts are leveraged instruments, meaning that a small amount of capital can control a large position. This leverage magnifies both potential profits and losses. For example, a trader might need to deposit only 5% of the total value of a futures contract to open a position. If the price of the underlying asset moves in their favor, they can realize a large profit.

However, if the price moves against them, they could lose much more than their initial investment.The potential for high profits is one of the main attractions of futures trading. However, this potential for high profits is accompanied by a high level of risk. Futures contracts are highly volatile, and their prices can fluctuate rapidly. This volatility can lead to significant losses, even for experienced traders.

Cost Comparison with Other Investment Options

Futures trading involves various costs, including brokerage fees, exchange fees, and margin requirements. These costs can vary depending on the futures contract, the broker, and the trading platform.Compared to other investment options, such as stocks or bonds, futures trading can be more expensive. Stocks and bonds typically have lower brokerage fees and margin requirements. However, futures contracts offer greater leverage, which can potentially lead to higher profits.

Comparison of Costs and Benefits

The following table summarizes the potential costs and benefits of trading futures contracts:| Feature | Costs | Benefits ||—|—|—|| Leverage | Higher margin requirements | Potential for higher profits || Volatility | High risk of losses | Potential for high returns || Trading Costs | Brokerage fees, exchange fees | Access to a wide range of markets || Liquidity | Highly liquid markets | Ability to trade quickly and efficiently || Flexibility | Variety of contract types | Potential for hedging and speculation |It is important to note that the costs and benefits of futures trading can vary depending on the specific contract, the trader’s experience, and the market conditions.

Practical Considerations for Futures Trading

Futures trading, while potentially lucrative, involves inherent risks that require careful consideration and a robust understanding of the underlying mechanics. To navigate this complex market successfully, traders must be aware of the specific contract specifications, settlement procedures, and risk management strategies. This section delves into practical considerations for futures trading, offering insights into managing risk, leveraging hedging strategies, and understanding the role of futures in speculation.

Understanding Contract Specifications and Settlement Procedures

Futures contracts are standardized agreements to buy or sell an underlying asset at a predetermined price and future date. Understanding the contract specifications is crucial for effective trading. These specifications include the underlying asset, contract size, trading unit, expiration date, and delivery procedures.

- Underlying Asset: The underlying asset can be a commodity (e.g., gold, oil), financial instrument (e.g., stock index, interest rate), or currency. Each asset has unique characteristics that influence its price movement and trading dynamics.

- Contract Size: This specifies the quantity of the underlying asset to be delivered upon contract maturity. The contract size can vary significantly depending on the asset, influencing the financial exposure of a trade.

- Trading Unit: The trading unit defines the minimum number of contracts that can be traded. For instance, a single futures contract may represent 100 barrels of oil or 100,000 shares of a stock index.

- Expiration Date: The expiration date marks the end of the contract, at which point the buyer is obligated to take delivery of the asset, and the seller is obligated to deliver it. Futures contracts have different expiration dates, and understanding the timing is essential for managing trading strategies.

- Delivery Procedures: The delivery procedures Artikel the process of transferring the underlying asset from the seller to the buyer at contract maturity. These procedures can vary depending on the asset and the exchange where the contract is traded.

Managing Risk and Mitigating Potential Losses

Futures trading involves inherent risks due to the leverage involved and the volatility of the underlying asset prices. Effective risk management is crucial to minimize potential losses.

- Margin Requirements: Futures trading requires margin, which is a deposit that acts as collateral for the contract. The margin requirement varies depending on the underlying asset and the exchange. It serves as a buffer against potential losses and ensures the fulfillment of obligations.

- Stop-Loss Orders: Stop-loss orders are pre-set price levels at which a trade is automatically closed to limit potential losses. This strategy helps to mitigate losses when market movements go against the trader’s position.

- Position Limits: Exchanges may impose position limits to prevent excessive concentration of risk in the hands of a single trader. This measure helps to maintain market stability and prevent manipulation.

- Diversification: Diversifying across multiple futures contracts with different underlying assets can help to reduce overall risk by spreading exposure. This strategy can mitigate the impact of adverse price movements in any single asset.

- Risk Tolerance: Understanding your own risk tolerance is essential for determining the appropriate trading strategies. It involves assessing how much risk you are comfortable taking and setting limits accordingly. This helps to avoid impulsive decisions and manage emotional biases that can lead to significant losses.

Futures Contracts: Hedging and Speculation, How much do futures contracts cost

Futures contracts are widely used for both hedging and speculation.

Hedging

Hedging involves using futures contracts to offset potential losses from price fluctuations in an underlying asset.

Example: A farmer who plans to sell wheat in six months can hedge against potential price declines by selling wheat futures contracts. If the price of wheat falls, the farmer will experience a loss on the spot market but gain on the futures market, offsetting the loss.

Speculation

Speculation involves using futures contracts to profit from anticipated price movements. Speculators take on higher risk but also have the potential for greater rewards.

Example: A trader who believes that the price of oil will rise can buy oil futures contracts. If the price of oil rises, the trader will profit from the difference between the purchase price and the selling price.

Trading futures contracts can be a bit of a rollercoaster, mate. You could make a fortune, or you could lose your shirt. But if you do your research, manage your risk, and understand the costs involved, you could be in for a wild ride. Just remember, it’s all about playing it smart and knowing your limits. So, go on, have a crack at it, but don’t go overboard, alright?

FAQ Explained

What’s the minimum amount I need to start trading futures contracts?

The minimum amount you need to start trading futures contracts depends on the specific contract and the broker you choose. It can range from a few hundred pounds to several thousand pounds.

How do I calculate the cost of a futures contract?

The cost of a futures contract is determined by the futures price, which is influenced by factors like interest rates, storage costs, and market volatility. You can find the current futures price on a trading platform or financial news website.

What are the potential profits from trading futures contracts?

The potential profits from trading futures contracts are unlimited, but so are the potential losses. The profit or loss you make depends on the price movement of the underlying asset and the size of your position.

Are futures contracts a good investment for beginners?

Futures contracts can be very risky for beginners. They require a good understanding of financial markets and risk management. It’s best to start with other investment options, such as stocks or bonds, and gain experience before venturing into futures trading.