How much does 1 futures contract cost? Aduh, pertanyaan kayak gini bikin kepala puyeng, ya? Bayangin aja, kayak lagi belanja di pasar, cuma barangnya bukan cabe rawit, tapi kontrak masa depan! Harga naik-turunnya nggak karuan, bisa bikin jantung deg-degan kayak lagi naik wahana di Dufan. Tapi tenang, kita bahas tuntas, dari biaya margin sampe komisi broker yang bikin dompet kita agak ‘melas’.

Siap-siap, perjalanan seru ini bakal ngebuka mata lo tentang dunia perdagangan berjangka!

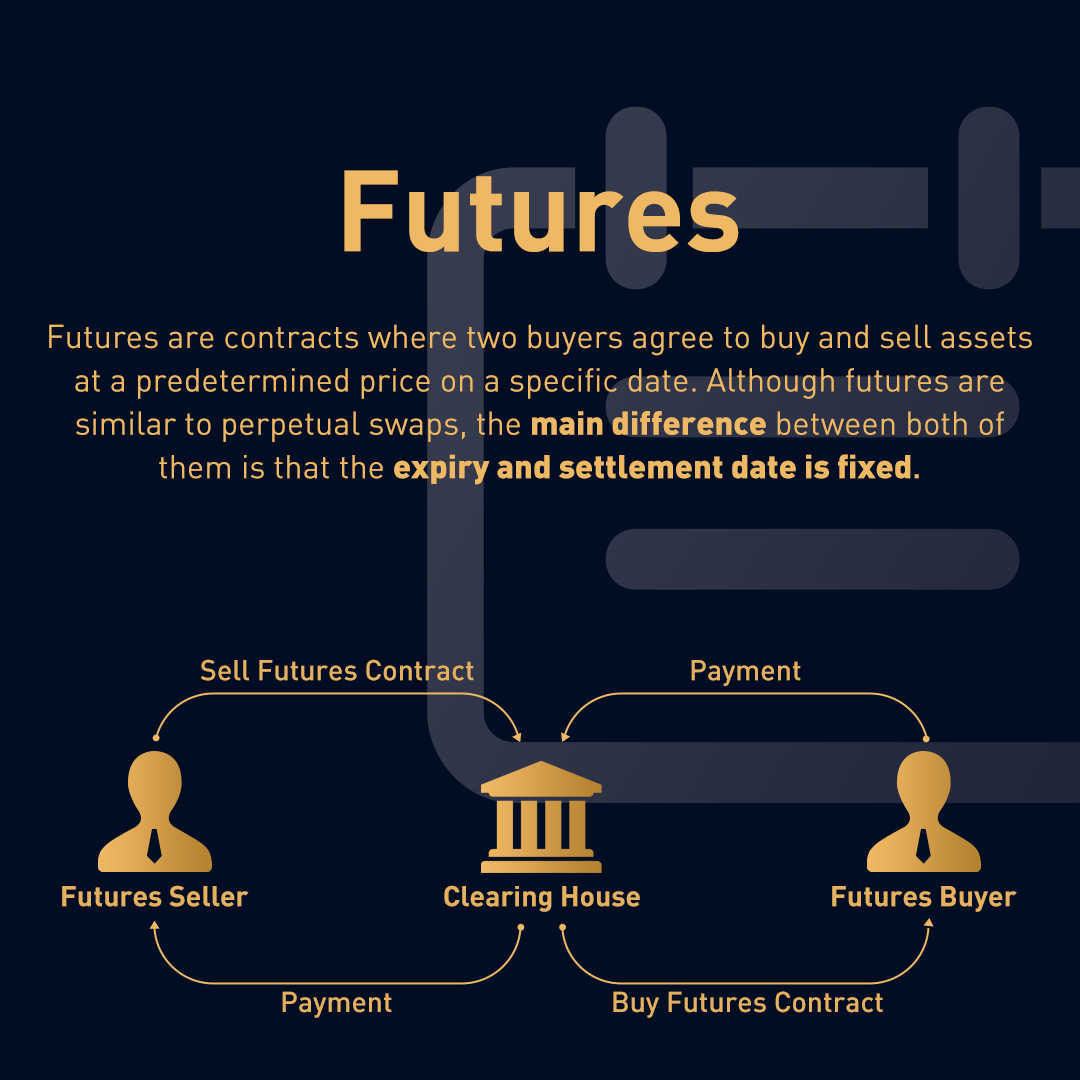

Futures contracts, singkatnya, adalah perjanjian untuk membeli atau menjual aset tertentu di masa depan dengan harga yang sudah disepakati. Harga kontrak ini dipengaruhi banyak faktor, mulai dari suplai dan demand, gejolak pasar, hingga kebijakan pemerintah. Ada berbagai jenis kontrak, mulai dari komoditas (emas, minyak), hingga indeks saham. Ukuran kontrak juga berbeda-beda, jadi biaya totalnya pun beragam. Kita akan membahas semua itu, lengkap dengan perhitungan biaya margin, komisi broker, dan potensi risiko yang perlu diwaspadai.

Pokoknya, setelah baca ini, lo bakal jadi ‘jagoan’ dalam memahami harga kontrak berjangka!

Understanding Futures Contracts

Yo, peeps! Futures contracts? Sounds kinda complicated, right? Nah, it’s not as scary as it seems. Think of it like pre-ordering something super hype, but instead of a limited-edition sneaker, it’s, like, gold or oil or even a stock index. You agree to buy or sell it at a specific price on a specific date in the future.

It’s all about managing risk and speculating on price movements.

Futures Contract Components

A futures contract has some key parts. First, you got the underlying asset – what you’re actually buying or selling (think coffee beans, corn, gold, etc.). Then there’s the contract size – the amount of the asset you’re agreeing to trade. The delivery date is when the actual exchange of the asset happens (though many contracts are settled in cash).

Finally, the price is the agreed-upon price for the asset on that future date.

Factors Influencing Futures Prices

Several things mess with futures prices. Supply and demand are major players – if everyone wants gold, the price goes up. Global events – like a war or a pandemic – can also shake things up. Government policies, economic reports, and even weather patterns can significantly impact prices, especially for agricultural futures. Think of a crazy drought in Brazil impacting coffee futures prices.

It’s a wild ride!

Types of Futures Contracts

There are tons of different futures contracts out there, each covering a different asset class. You’ve got agricultural futures (like corn, soybeans, wheat), energy futures (crude oil, natural gas), metal futures (gold, silver, copper), and financial futures (stock indices, interest rates, currencies). For example, a coffee futures contract lets you lock in a price for coffee beans months in advance, helping coffee roasters budget and manage risk.

Similarly, a gold futures contract allows investors to hedge against inflation or speculate on gold price movements.

Comparison of Futures Contracts

| Asset Class | Contract Size | Trading Exchange | Typical Margin |

|---|---|---|---|

| Crude Oil | 1,000 barrels | NYMEX | ~USD 5,000 |

| Gold | 100 troy ounces | COMEX | ~USD 5,000 |

| S&P 500 Index | USD 250 x Index | CME | ~USD 10,000 |

| Corn | 5,000 bushels | CBOT | ~USD 2,000 |

Margin Requirements and Costs

Yo, Surabaya kids! So you’re digging futures trading, huh? Sweet. But before you start raking in the rupiah, you gotta understand themargin*. Think of it like the deposit you need to play the game. It’s not the full cost of the contract, just a fraction.

This keeps things manageable and prevents massive losses.Margin requirements are like the rules of the game – you gotta follow ’em. They protect both you and the broker. Basically, it’s all about risk management.

Initial Margin

This is the initial cash or securities you need to deposit to open a futures position. It’s a percentage of the contract’s value, and it acts as collateral. The higher the volatility of the underlying asset, the higher the initial margin requirement. For example, if the initial margin for a particular contract is 5%, and the contract value is IDR 10,000,000, you’d need to deposit IDR 500,000 to open the position.

Maintenance Margin

Think of this as the minimum amount you need to keep in your account. If your account balance drops below the maintenance margin level due to adverse price movements, you’ll get a margin call. This is a notification from your broker asking you to deposit more funds to bring your account back up to the initial margin level. Failing to meet a margin call can lead to the liquidation of your position.

Variation Margin

This is the extra money you either get or have to deposit each day to reflect the changes in the market value of your position. If the market moves in your favor, you might receive a variation margin payment. Conversely, if the market moves against you, you’ll need to deposit more variation margin. It’s essentially a daily settlement of profits or losses.

Calculating Margin Costs for a Single Contract

Understanding how margin affects the overall cost is crucial. While you don’t pay the full contract value upfront, margin requirements influence your trading capital. A higher margin requirement means you need more capital tied up, reducing your ability to open more positions. Also, remember that interest might be charged on the margin amount, adding to your overall costs.Here’s a step-by-step on calculating the cost:

- Step 1: Determine the contract value. This is usually readily available from your broker.

- Step 2: Find the initial margin requirement percentage for that contract. This is also provided by your broker and varies based on the contract and market conditions.

- Step 3: Calculate the initial margin amount:

Initial Margin Amount = Contract Value

- Initial Margin Percentage - Step 4: Consider potential variation margin calls. This is difficult to predict precisely but depends on market volatility and your position size.

- Step 5: Account for any interest charges on the margin amount. Brokers usually specify their interest rates.

- Step 6: Add up the initial margin, potential variation margin, and interest charges to determine your total margin cost.

Remember: Margin trading magnifies both profits and losses. While it allows you to control a large position with a smaller investment, it also increases your risk. Always trade responsibly and within your means.

Brokerage Fees and Commissions: How Much Does 1 Futures Contract Cost

Yo, Surabaya kids! So you’re digging into futures trading, huh? Smart move, but remember, it ain’t all sunshine and rainbows. Besides the price of the contract itself, you gotta factor in the hidden costs – brokerage fees and commissions. These can seriously impact your profit, so let’s break it down.

Basically, brokerage fees are charges levied by your broker for executing trades on your behalf. These fees vary wildly depending on the broker, the type of contract, and even the volume of your trading. Think of it like this: it’s the cost of using their platform and services to access the futures market. Ignoring these costs can be a major bummer for your bottom line.

Types of Brokerage Fees

There are a few different ways brokers will hit you with fees. It’s not always just a flat rate, it’s way more complicated than that. Some common fees include:

- Commission per contract: This is the most straightforward fee – a fixed amount charged for each contract you buy or sell. Think of it like a toll you pay to enter the futures highway.

- Transaction fees: Some brokers slap on extra fees for each trade, regardless of the number of contracts. This is like a sneaky extra charge at the toll booth.

- Minimum fees: Some brokers have a minimum fee per trade, even if your commission per contract is lower. This means you’ll always pay at least a certain amount, no matter how small your trade is.

- Data fees: You might pay extra for real-time market data. This helps you make better decisions, but it costs extra.

- Inactive account fees: If you don’t trade for a while, some brokers will charge you for the privilege of keeping your account open. So keep active, or pay up!

Comparison of Brokerage Fee Structures

Different brokers have different pricing models, so shopping around is crucial. Some brokers offer lower commissions but higher minimum fees, while others might have a higher commission but no minimums. It all depends on your trading style and volume.

| Broker | Commission per Contract (IDR) | Transaction Fee (IDR) | Minimum Fee (IDR) |

|---|---|---|---|

| Broker A (Example) | 10,000 | 5,000 | 25,000 |

| Broker B (Example) | 15,000 | 0 | 0 |

| Broker C (Example) | 8,000 | 10,000 | 15,000 |

Note: These are purely illustrative examples. Actual fees will vary significantly and should be checked directly with the brokerage.

Impact of Brokerage Fees on Total Cost

Brokerage fees directly add to the overall cost of your futures contracts. Let’s say you buy one contract at 100,000 IDR and your broker charges 10,000 IDR in commission. Your total cost is now 110,000 IDR. If you’re trading multiple contracts or frequently, these fees can quickly add up and eat into your potential profits. Always factor these costs into your trading strategy to avoid unpleasant surprises.

Contract Size and Pricing

Yo, peeps! So we’ve talked about futures contracts, margins, and fees. Now let’s get into the nitty-gritty: how much these things actually cost. It’s not just a flat fee; it depends on something called “contract size.”Contract size is basically the amount of the underlying asset you’re agreeing to buy or sell. Think of it like this: you’re not buying one apple, you’re buying a whole crate.

The bigger the crate (contract size), the more it’ll cost you, even if the price per apple (price per unit of the underlying asset) stays the same. This affects your total cost significantly, especially when dealing with pricey stuff like gold or oil.

Contract Size and Total Cost Calculation

The total cost of a futures contract is calculated by multiplying the contract size by the price per unit of the underlying asset. This gives you the notional value of the contract. Then, you add in your margin requirement and any brokerage fees.

Total Cost = (Contract Size x Price per Unit) + Margin + Brokerage Fees

Let’s say you’re trading gold futures. A standard gold contract might be for 100 troy ounces. If the price of gold is $1,900 per ounce, the notional value of the contract is $190,000 (100 ounces x $1,900/ounce). Your margin might be, say, $9,500, and your brokerage fees $50. Your total initial cost would then be $20,050.

See? It adds up quickly.

Examples of Contract Sizes

Different commodities and financial instruments have different contract sizes. For example:* Gold: Often 100 troy ounces.

Crude Oil

Could be 1,000 barrels.

Soybeans

Might be 5,000 bushels.

S&P 500 Index

This represents a certain value of the index, often $250 times the index value. So, if the S&P 500 is at 4,500, the notional value of one contract is $1,125,000 ($250 x 4,500).

Visual Representation of Contract Size, Price, and Total Cost

Imagine a graph. The horizontal axis represents contract size (in, say, ounces of gold). The vertical axis represents total cost (in dollars). If the price per ounce is constant, you’ll see a straight line sloping upwards. A larger contract size will always mean a higher total cost.

Now, imagine another line representing the same contract size, but with a higher price per ounce. That line will be steeper, showing how a higher price per unit also increases the total cost dramatically. Essentially, the graph shows a direct, positive relationship: as contract size or price per unit increases, the total cost also increases. The steeper the slope, the more significant the impact of price changes on the total cost.

Impact of Market Volatility

Yo, Surabaya kids! Trading futures contracts can be like riding a rollercoaster – sometimes it’s smooth sailing, other times it’s a wild, stomach-churning ride. Market volatility is the big factor that determines how bumpy that ride will be, impacting both the price and the cost of your contract. Let’s break it down.Market volatility, basically how much the price of something bounces around, massively affects futures contracts.

High volatility means prices swing wildly up and down in short periods. This directly impacts the cost of your contract because the price you bought it at can change dramatically in a matter of minutes, hours, or even days. This can lead to both massive profits and equally massive losses, depending on which way the market swings and your position.

Price Fluctuations in Volatile Markets, How much does 1 futures contract cost

Think of it like this: you buy a futures contract for, say, coffee beans at Rp 10,000 per contract. If the market suddenly gets super volatile due to a bad harvest or some other crazy news, the price might jump to Rp 12,000 quickly. That’s a nice profit for you if you’re long (expecting prices to rise). But if the price crashes to Rp 8,000, you’re facing a significant loss.

The bigger the swings, the bigger the potential gains or losses. The speed of these changes is what makes volatile markets both exciting and terrifying.

Risks Associated with Volatile Markets

Trading futures in volatile markets is inherently risky. The potential for rapid and substantial losses is very real. You could be wiped out pretty quickly if you’re not careful. Margin calls – where your broker demands more money to cover potential losses – become a real threat. Failing to meet a margin call can lead to your position being liquidated (sold off) at a loss, possibly even a huge one.

Basically, you could lose more than you initially invested. This is why proper risk management is absolutely crucial.

Risk Management Strategies

So, how do you survive the volatility rollercoaster? Here are some tips:

- Diversification: Don’t put all your eggs in one basket. Spread your investments across different contracts or asset classes to reduce your overall risk.

- Hedging: Use futures contracts to protect yourself against potential losses in other investments. For example, a farmer might use futures contracts to lock in a price for their crop, protecting them from price drops.

- Stop-Loss Orders: These orders automatically sell your contract if the price falls below a certain level, limiting your potential losses. It’s like a safety net.

- Position Sizing: Don’t bet the farm on a single trade. Only invest an amount you can afford to lose.

- Proper Research and Analysis: Don’t just jump in blindly. Understand the market, the factors influencing it, and the risks involved before making any trades. Use reliable sources and learn to read market signals.

Scenario: Volatility’s Impact on Contract Cost

Let’s say you buy a gold futures contract for Rp 500,000 per ounce. Over a week, the market experiences significant volatility.

| Day | Price per ounce | Your Profit/Loss |

|---|---|---|

| 1 | Rp 500,000 | Rp 0 |

| 2 | Rp 520,000 | Rp 20,000 |

| 3 | Rp 480,000 | Rp -20,000 (total loss from initial price) |

| 4 | Rp 510,000 | Rp 10,000 (total profit from initial price) |

| 5 | Rp 490,000 | Rp -10,000 (total loss from initial price) |

| 6 | Rp 530,000 | Rp 30,000 (total profit from initial price) |

| 7 | Rp 515,000 | Rp 15,000 (total profit from initial price) |

See how the cost (and your profit/loss) fluctuates wildly? This is the impact of volatility. One day you’re up, the next you’re down. That’s why careful planning and risk management are crucial.

Other Relevant Costs

Yo, so we’ve talked about margin and brokerage fees, but there’s more to the cost of futures trading than just that. Think of it like this: you’re not just paying for the ticket to the game, you’re also paying for the snacks, the merch, and maybe even a ride home. These extra costs can seriously impact your overall profit, so it’s crucial to understand them.These additional costs can add up quickly, especially if you’re a frequent trader or if you’re dealing with volatile markets.

Ignoring them could mean the difference between a solid profit and a total wipeout. Let’s break down what you might encounter.

Data and Software Fees

Many traders rely on real-time market data and sophisticated trading software to make informed decisions. These tools aren’t free. Data subscriptions can cost anywhere from a few hundred rupiah a month for basic info to thousands for premium packages with advanced analytics and charting capabilities. Trading platforms themselves might also charge monthly or annual fees, depending on the features offered.

For example, a popular platform might charge Rp 500,000 per month for access to their advanced charting tools and real-time data feeds. Meanwhile, a simpler platform might only charge Rp 100,000 per month for basic functionality. The difference in cost reflects the difference in the quality and quantity of data and analytical tools provided.

Financing Costs

If you’re using borrowed funds to increase your trading capital, you’ll need to factor in interest charges. This is like taking out a loan – you’ll pay interest on the amount you borrow. Interest rates vary depending on the lender and the market conditions. Imagine you borrow Rp 10,000,000 to increase your trading capital, and the interest rate is 10% per annum.

The annual interest cost would be Rp 1,000,000. This is a significant expense that needs to be considered when calculating your overall trading costs.

Taxes

Don’t forget taxes! Profits from futures trading are taxable income in most jurisdictions. The specific tax rates and regulations vary greatly depending on your location and the applicable tax laws. It’s crucial to consult with a tax professional to understand your tax obligations and properly account for these costs. Ignoring taxes could lead to serious legal and financial consequences.

For example, in some regions, capital gains taxes could be as high as 20% on your trading profits, significantly reducing your net earnings.

Exchange and Clearing Fees

Every time you buy or sell a futures contract, the exchange and clearinghouse charge fees. These fees cover their operational costs and are usually a small percentage of the contract value. These fees might seem insignificant individually, but they can accumulate quickly, especially for high-volume traders. The exact amounts vary depending on the specific exchange and contract. For instance, a typical exchange fee could range from Rp 10,000 to Rp 50,000 per contract, depending on the underlying asset and the contract size.

- Data and Software Fees: These range from a few hundred thousand rupiah to several million rupiah per month, depending on the features and data provided.

- Financing Costs: Interest charges on borrowed funds vary depending on the lender and interest rates.

- Taxes: Tax rates on futures trading profits vary significantly by location and tax laws. Consult a tax professional.

- Exchange and Clearing Fees: These are usually a small percentage of the contract value, accumulating over time.

Jadi, berapa sih sebenarnya biaya satu kontrak berjangka? Jawabannya: tergantung! Banyak faktor yang mempengaruhi, mulai dari jenis aset, ukuran kontrak, volatilitas pasar, hingga kebijakan broker. Tapi, semoga penjelasan di atas udah ngasih gambaran yang lebih jelas. Inget, trading berjangka itu penuh risiko, jadi jangan asal terjun tanpa ilmu dan persiapan yang matang. Pelajari dengan teliti, kalkulasi risiko dengan bijak, dan jangan sampai dompet nangis gara-gara salah langkah! Selamat berinvestasi (tapi hati-hati, ya!).

Detailed FAQs

Apa bedanya initial margin dan maintenance margin?

Initial margin adalah deposit awal yang dibutuhkan untuk membuka posisi, sedangkan maintenance margin adalah jumlah minimum yang harus dipertahankan di akun untuk menghindari margin call (penambahan dana).

Gimana cara memilih broker yang tepat untuk trading futures?

Perhatikan reputasi broker, biaya komisi dan platform trading yang ditawarkan. Bandingkan beberapa broker sebelum memutuskan.

Apa itu margin call dan bagaimana cara mengatasinya?

Margin call terjadi ketika saldo akun turun di bawah maintenance margin. Cara mengatasinya adalah dengan menambah dana ke akun atau menutup sebagian posisi.

Apakah ada biaya tersembunyi dalam trading futures?

Bisa jadi ada biaya tambahan seperti biaya data market, biaya penyimpanan, atau biaya lainnya tergantung kebijakan broker. Pastikan untuk memahami semua biaya sebelum memulai trading.