How much does an oil futures contract cost sets the stage for this exploration of the complex world of oil trading. Understanding the costs associated with oil futures contracts is essential for anyone considering entering this market, as it directly impacts potential profits and losses. From initial margin requirements to brokerage fees, navigating these costs is crucial for successful trading.

Oil futures contracts are legally binding agreements to buy or sell a specific quantity of crude oil at a predetermined price on a future date. These contracts play a vital role in the global energy market, providing a mechanism for producers, refiners, and consumers to manage price risk and secure their future oil supplies. The cost of entering into an oil futures contract is influenced by a variety of factors, including the underlying price of oil, market volatility, and the specific terms of the contract.

Understanding Oil Futures Contracts: How Much Does An Oil Futures Contract Cost

Oil futures contracts are agreements to buy or sell a specific quantity of crude oil at a predetermined price on a future date. These contracts are traded on organized exchanges, allowing market participants to manage price risk and speculate on future oil prices.

Key Features of Oil Futures Contracts

Oil futures contracts have several key features that define their terms and conditions:

- Contract Size: The standard contract size for oil futures is typically 1,000 barrels. This means that each contract represents the right to buy or sell 1,000 barrels of crude oil.

- Trading Unit: Oil futures contracts are traded in units of 1,000 barrels. Therefore, one contract represents 1,000 barrels of crude oil.

- Delivery Date: Each oil futures contract has a specific delivery date. This is the date on which the buyer is obligated to take delivery of the oil, and the seller is obligated to deliver it.

Types of Oil Futures Contracts

There are several different types of oil futures contracts traded globally, each representing a specific type of crude oil:

- West Texas Intermediate (WTI): This is the benchmark crude oil contract traded on the New York Mercantile Exchange (NYMEX). WTI is a light, sweet crude oil produced in the United States.

- Brent: This is the benchmark crude oil contract traded on the Intercontinental Exchange (ICE). Brent is a medium, sweet crude oil produced in the North Sea.

- Dubai Crude: This is a benchmark crude oil contract traded on the Dubai Mercantile Exchange (DME). Dubai crude is a medium, sour crude oil produced in the United Arab Emirates.

Factors Affecting Oil Futures Contract Prices

The price of oil futures contracts is influenced by a complex interplay of factors, including global supply and demand dynamics, geopolitical events, and economic conditions. These factors can significantly impact the price of oil, which in turn affects the value of futures contracts.

Global Supply and Demand

Global supply and demand for oil are the primary drivers of oil futures prices. When demand exceeds supply, prices tend to rise. Conversely, when supply exceeds demand, prices typically fall.

- Production Levels: Changes in production levels from major oil-producing countries, such as Saudi Arabia, Russia, and the United States, can significantly impact global supply and, consequently, oil prices. For example, disruptions in production due to political instability, natural disasters, or OPEC production cuts can lead to higher oil prices.

- Economic Growth: Strong economic growth often translates to increased demand for oil as businesses and consumers require more energy. Conversely, economic slowdowns or recessions can lead to reduced demand and lower oil prices.

- Alternative Energy Sources: The development and adoption of alternative energy sources, such as solar and wind power, can impact oil demand. As these technologies become more efficient and cost-effective, they could potentially reduce reliance on fossil fuels, influencing oil prices in the long run.

Geopolitical Events

Geopolitical events, such as wars, political instability, and sanctions, can have a significant impact on oil futures prices.

- Conflicts in Oil-Producing Regions: Conflicts in oil-producing regions can disrupt production and supply chains, leading to higher oil prices. For example, the 2003 invasion of Iraq and the ongoing conflict in Libya have significantly impacted oil markets.

- Sanctions: Sanctions imposed on oil-producing countries can limit exports and reduce supply, leading to higher prices. For example, sanctions imposed on Iran and Venezuela have affected their oil production and exports, influencing global oil prices.

- Political Instability: Political instability in oil-producing countries can create uncertainty and disrupt production, impacting oil prices. For example, the political unrest in Nigeria has led to production disruptions and contributed to higher oil prices.

Economic Conditions

Economic conditions, such as interest rates, inflation, and currency exchange rates, can also influence oil futures prices.

- Interest Rates: Higher interest rates can make it more expensive to borrow money, potentially reducing investment in oil exploration and production, which could lead to lower supply and higher oil prices.

- Inflation: High inflation can erode the purchasing power of consumers, potentially reducing demand for oil and leading to lower prices.

- Currency Exchange Rates: Fluctuations in currency exchange rates can impact the cost of oil for importers. A weaker US dollar, for example, can make oil more expensive for buyers using other currencies, potentially leading to higher prices.

Seasonal Variations

Seasonal variations can also influence oil futures prices.

- Refinery Maintenance: Refineries often undergo scheduled maintenance during certain periods of the year, which can temporarily reduce refining capacity and lead to higher oil prices.

- Heating Demand: During winter months, demand for heating oil increases, potentially leading to higher oil prices.

Speculation and Arbitrage

Speculation and arbitrage play a significant role in shaping oil futures contract prices.

- Speculation: Speculators buy or sell futures contracts based on their expectations of future price movements. If speculators anticipate higher oil prices, they may buy futures contracts, potentially driving up prices. Conversely, if they anticipate lower prices, they may sell futures contracts, potentially driving down prices.

- Arbitrage: Arbitrageurs seek to profit from price discrepancies between different markets. They may buy oil futures contracts in one market and sell them in another market where prices are higher, profiting from the price difference. Arbitrage can help to stabilize prices across different markets.

Costs Associated with Oil Futures Contracts

Trading oil futures contracts involves more than just the price of the underlying commodity. Several costs are associated with entering and managing these contracts, which are crucial to consider before entering the market.

Initial Margin Requirement

The initial margin is a deposit that traders must make to open a futures contract. It acts as a security deposit, ensuring that traders can cover potential losses. The margin requirement is set by the exchange and can fluctuate based on the volatility of the underlying oil price.

The initial margin is a percentage of the contract value, which is determined by the exchange based on factors like the contract size and volatility.

For example, if the initial margin requirement for a single contract is $5,000 and the trader wants to buy 10 contracts, they need to deposit $50,000. This deposit is held by the broker and can be used to cover potential losses in the trade.

Maintenance Margin, How much does an oil futures contract cost

The maintenance margin is the minimum amount of money that must be maintained in the margin account. If the account balance falls below the maintenance margin, the trader will receive a margin call, requiring them to deposit additional funds to bring the account back up to the initial margin level. This mechanism helps manage potential losses and prevents traders from incurring significant losses.

The maintenance margin is typically a percentage of the initial margin, usually around 75%.

For instance, if the initial margin is $5,000 and the maintenance margin is 75%, the trader needs to maintain at least $3,750 in their account. If the account balance drops below this threshold, the trader will receive a margin call.

Other Costs

Besides the initial and maintenance margins, several other costs are associated with trading oil futures contracts.

- Brokerage Fees: These are commissions charged by brokers for executing trades. They can vary based on the broker, the volume of trading, and the type of account.

- Exchange Fees: Exchanges charge fees for trading contracts. These fees can include clearing fees, transaction fees, and regulatory fees.

- Interest Costs: If a trader holds a futures contract for an extended period, they may incur interest costs on the margin deposit.

Strategies for Trading Oil Futures Contracts

Trading oil futures contracts involves taking positions based on market expectations and utilizing strategies to manage risk and profit. Common strategies include long and short positions, hedging, and arbitrage.

Long and Short Positions

Long and short positions are fundamental trading strategies in oil futures contracts.

- Long Position: A long position is taken when a trader believes the price of oil will increase. They buy a futures contract at a specific price and expect to sell it at a higher price in the future, profiting from the price difference. For example, a trader might buy a contract for 1,000 barrels of Brent crude oil at $80 per barrel, expecting the price to rise to $85 per barrel.

If their prediction is correct, they can sell the contract at $85, making a profit of $5,000 (1,000 barrels x $5).

- Short Position: A short position is taken when a trader believes the price of oil will decrease. They sell a futures contract at a specific price and expect to buy it back at a lower price in the future, profiting from the price difference. For example, a trader might sell a contract for 1,000 barrels of WTI crude oil at $75 per barrel, expecting the price to fall to $70 per barrel.

If their prediction is correct, they can buy back the contract at $70, making a profit of $5,000 (1,000 barrels x $5).

Hedging

Hedging involves using oil futures contracts to mitigate price risk. This strategy is often employed by companies that rely heavily on oil, such as oil producers, refineries, and airlines.

- Producers: Oil producers can hedge against a decline in oil prices by selling futures contracts. If the price of oil falls, the loss on the futures contract can offset the loss on the sale of their oil. For example, an oil producer could sell a futures contract for 1,000 barrels of WTI crude oil at $75 per barrel. If the price of oil falls to $70 per barrel, the producer will lose $5,000 on the sale of their oil but will make a profit of $5,000 on the futures contract, effectively hedging against the price decline.

- Consumers: Oil consumers can hedge against an increase in oil prices by buying futures contracts. If the price of oil rises, the gain on the futures contract can offset the increase in the cost of oil. For example, an airline could buy futures contracts for 1,000 barrels of jet fuel at $80 per barrel. If the price of jet fuel rises to $85 per barrel, the airline will pay more for their fuel but will make a profit of $5,000 on the futures contract, effectively hedging against the price increase.

Risks Associated with Trading Oil Futures Contracts

Trading oil futures contracts involves significant risk.

- Market Volatility: Oil prices are highly volatile and can fluctuate significantly in response to geopolitical events, economic conditions, and supply and demand dynamics. This volatility can lead to substantial losses for traders who misjudge market movements.

- Counterparty Risk: Counterparty risk arises from the possibility that the other party to a futures contract may not be able to fulfill their obligations. This risk is particularly relevant for over-the-counter (OTC) contracts, where there is no central clearinghouse to guarantee performance.

Real-World Examples of Oil Futures Contract Trading

The world of oil futures contracts is not merely theoretical. It’s a dynamic marketplace where traders and investors engage in active buying and selling of these contracts, driven by various factors that influence the price of crude oil. To understand the practical application of oil futures contracts, let’s delve into real-world examples and explore the data that drives these transactions.

Recent Historical Data on Oil Futures Contract Prices

The table below presents recent historical data on oil futures contract prices for different grades of crude oil, offering insights into price fluctuations and market trends.

| Contract Date | Opening Price | Closing Price | High | Low | Volume ||—|—|—|—|—|—|| 2023-10-26 | $85.00 | $86.50 | $87.25 | $84.50 | 1,200,000 || 2023-10-27 | $86.75 | $85.25 | $87.00 | $85.00 | 950,000 || 2023-10-28 | $85.50 | $84.75 | $86.00 | $84.25 | 1,050,000 || 2023-10-29 | $84.25 | $83.50 | $85.00 | $83.00 | 800,000 || 2023-10-30 | $83.75 | $84.00 | $84.50 | $83.25 | 750,000 |

Price Fluctuations of a Specific Oil Futures Contract

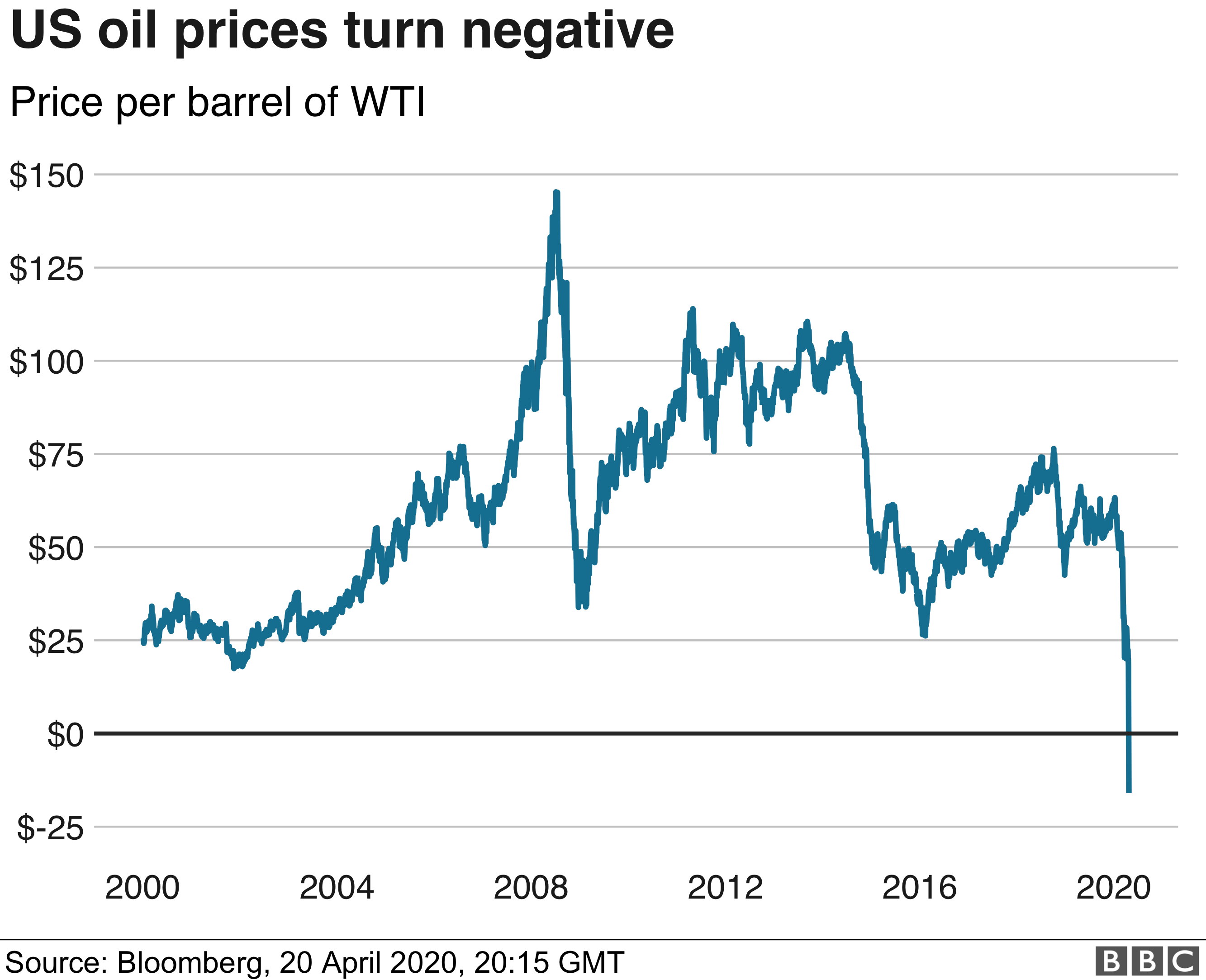

To illustrate the price fluctuations of a specific oil futures contract, consider the West Texas Intermediate (WTI) crude oil futures contract traded on the New York Mercantile Exchange (NYMEX). The chart below depicts the price movements of the WTI futures contract over the past six months.

The chart would show the price of the WTI futures contract on the y-axis and the date on the x-axis. The line would depict the price fluctuations over the chosen time period, highlighting the highs, lows, and overall trends.

In conclusion, understanding the costs associated with oil futures contracts is crucial for any trader looking to participate in this market. From initial margin requirements to brokerage fees, these costs can significantly impact potential profits and losses. While trading oil futures offers opportunities for profit, it also carries inherent risks. By carefully considering the costs involved and employing sound trading strategies, individuals can navigate this complex market and potentially reap the rewards of successful trading.

FAQ Corner

What is the minimum amount of money I need to trade an oil futures contract?

The minimum amount you need to trade an oil futures contract is determined by the initial margin requirement, which varies depending on the specific contract and the brokerage firm you are using. The initial margin serves as a deposit to cover potential losses.

How do I determine the cost of an oil futures contract?

The cost of an oil futures contract is determined by the underlying price of oil, the contract size, and the delivery date. The contract size represents the amount of oil being traded, and the delivery date specifies when the oil is to be delivered. The price of the contract is quoted per barrel of oil.

What are the risks associated with trading oil futures contracts?

Trading oil futures contracts carries inherent risks, including market volatility, counterparty risk, and the potential for significant losses. Market volatility refers to fluctuations in the price of oil, which can result in unexpected gains or losses. Counterparty risk arises from the possibility that the other party to the contract may default on their obligations.