How much does it cost to break a phone contract? This seemingly simple question unravels a surprisingly complex web of fees, balances, and legal considerations. Understanding the true cost involves more than just a glance at your contract; it requires navigating a landscape of early termination fees, remaining balances, and potential impacts on your credit score. Let’s delve into the details and empower you to make informed decisions.

Breaking a phone contract often incurs significant financial penalties. These penalties vary greatly depending on your carrier, the length of your contract, the remaining term, and any promotional offers you received. Factors like paying off the phone itself, potential hidden fees, and even the impact on your credit report all play a crucial role in determining the total cost.

This guide will equip you with the knowledge to anticipate these costs and explore alternative solutions.

Early Termination Fees

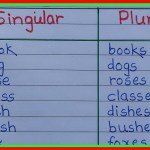

Breaking a phone contract early often incurs significant charges. These fees, known as early termination fees (ETFs), are designed to compensate the carrier for lost revenue due to the premature end of the contract. The amount varies widely depending on several factors, including the carrier, the length of the contract, the remaining term, and sometimes even the specific phone plan.Early Termination Fee StructuresCarriers typically calculate ETFs based on the remaining contract term.

A common approach involves a declining scale, where the fee is highest at the beginning of the contract and gradually decreases over time. Some carriers may also use a flat fee for a certain period, followed by a declining fee structure. Others might base the ETF on the remaining subsidy owed on the phone, meaning a more expensive phone will lead to a higher ETF.

It’s crucial to carefully review the contract terms before signing to understand the ETF structure.

Examples of Early Termination Fee Calculations

Let’s illustrate how different carriers might calculate ETFs. Imagine a 24-month contract with a $1000 phone.* Carrier A (Declining Scale): Might charge $500 for termination after 6 months, $300 after 12 months, and $100 after 18 months. The fee declines proportionally to the remaining contract months.

Carrier B (Flat Fee/Declining Scale Hybrid)

Could have a flat $400 ETF for the first 12 months, then a declining fee afterward, perhaps dropping $50 per month thereafter.

Carrier C (Subsidy Based)

Might charge an ETF based on the remaining subsidy on the phone. If half the subsidy is still owed after 12 months, the ETF might be $500.

Comparison of Early Termination Fees Across Major Mobile Providers

Precise ETF amounts vary considerably and change frequently. It’s essential to check each carrier’s website for the most up-to-date information. However, we can provide a general comparison based on typical structures:Generally, larger carriers might have higher initial ETFs, reflecting their higher upfront subsidies or promotional offers. Smaller, budget-friendly carriers may have lower ETFs or even waive them entirely under certain circumstances.

Always verify details directly with the provider.

Range of Early Termination Fees

The following table illustrates a possible range of ETFs based on contract length and remaining term. These are illustrative examples and may not reflect actual fees from any specific provider. Always consult the individual carrier’s terms and conditions.

| Contract Length (Months) | Remaining Term (Months) | Low End ETF ($) | High End ETF ($) |

|---|---|---|---|

| 24 | 24 | 400 | 800 |

| 24 | 12 | 200 | 500 |

| 24 | 6 | 50 | 200 |

| 12 | 12 | 250 | 500 |

| 12 | 6 | 100 | 250 |

| 12 | 0 | 0 | 0 |

Remaining Contract Balance

Understanding your remaining contract balance is crucial when considering breaking your phone contract. This balance represents the portion of your agreement’s total cost that you still owe the provider. Calculating this amount accurately helps you make informed decisions about early termination or potential upgrades.Calculating the remaining balance typically involves subtracting any payments already made from the total contract cost.

This total cost is determined at the outset of the contract and is often influenced by several factors.

Methods of Calculating Remaining Contract Balance

The calculation of the remaining contract balance usually starts with the total cost of the contract. This is determined by the phone’s price (often subsidized), the chosen plan’s monthly fee, and the contract duration. The provider then subtracts all payments made to date. This simple subtraction method might be adjusted to account for promotional offers or other financial arrangements.

Some providers may offer online tools or customer service assistance to calculate this balance precisely.

Factors Influencing Remaining Balance

Several factors can influence the final remaining balance. Promotional offers, such as discounted upfront costs or waived activation fees, reduce the overall contract cost, thereby decreasing the remaining balance. Conversely, adding features or upgrading your phone mid-contract increases the total cost, resulting in a higher remaining balance. Early upgrades often involve a new contract with a potentially higher total cost.

Paying extra each month to reduce the contract length will also affect the remaining balance.

Hypothetical Scenario

Let’s imagine a two-year contract with a total cost of $1200 (including phone and plan). After 12 months, the customer has made 12 monthly payments of $

50. The remaining balance would be calculated as follows

Total Contract Cost ($1200)

Payments Made ($600) = Remaining Balance ($600)

This is a simplified example. Additional fees or discounts could alter the final amount.

Common Misconceptions about Remaining Balances

Understanding the specifics of your contract is key to avoiding misunderstandings. Here are some common misconceptions:

- Misconception 1: The remaining balance is simply the number of months left multiplied by the monthly payment. This is often inaccurate due to initial discounts or fees spread across the contract duration.

- Misconception 2: Promotional offers always reduce the final remaining balance proportionally. The way promotions are applied to the total contract cost can vary, sometimes impacting the monthly payment more than the overall cost.

- Misconception 3: Upgrading your phone doesn’t affect the remaining balance of your previous contract. Upgrading often involves a new contract, with a new total cost and a new remaining balance calculation.

Paying Off the Phone

Paying off your phone’s remaining balance is one way to escape an early termination fee when breaking a mobile phone contract. This method involves settling the outstanding amount owed to the carrier for the subsidized device. The process, however, varies slightly depending on the carrier and your specific contract terms.

Payment Options

Mobile carriers typically offer several ways to pay off your phone. These options can affect both the convenience and the overall cost of the process. Understanding these differences is crucial in making an informed decision.

- Online Payment Portals: Most carriers provide secure online portals where you can log in to your account and make a one-time payment towards your phone’s balance. This method is often quick and convenient, with immediate confirmation of payment. The payment methods usually include credit cards, debit cards, and sometimes even electronic bank transfers.

- In-Store Payments: You can also visit a carrier’s retail store to pay off your phone in person. This option allows for immediate interaction with a representative who can assist with any questions or concerns. Payment methods accepted in-store usually mirror those available online.

- Mail-in Payments: Some carriers accept payments via mail. This usually involves sending a check or money order to a designated address. This method is generally the slowest, requiring processing time before the payment is reflected in your account. It also carries a higher risk of payment loss or delay.

Challenges in Early Payoff

While paying off the phone seems straightforward, several challenges can arise. These challenges can impact both the speed and ease of the process.

- Locating Accurate Balance Information: Accurately determining the precise remaining balance can be tricky. It’s crucial to contact your carrier directly to get the most up-to-date figure to avoid unexpected charges or shortfalls.

- Payment Processing Time: Depending on the payment method chosen, processing time can vary significantly. Online payments are typically instantaneous, while mail-in payments can take several business days or even longer to process. This delay could impact the timing of your contract termination.

- Potential Fees: While paying off the phone avoids early termination fees associated with breaking the contract, there might be other minor fees involved, such as a small processing fee for early payoff, though this is less common.

Impact on Overall Cost

The cost of paying off your phone directly impacts the total cost of breaking your contract. While it eliminates the early termination fee, you’ll still be responsible for the remaining balance on the phone itself. For example, if you owe $300 on your phone and the early termination fee is $200, paying off the phone will cost you $300, whereas breaking the contract without paying off the phone would cost you $500 ($300 phone balance + $200 ETF).

Therefore, this method can be significantly cheaper than simply paying the early termination fee, especially if you’re far into your contract.

Alternatives to Breaking the Contract

Breaking a phone contract often incurs significant fees. Fortunately, several alternatives exist that may save you money and hassle. Exploring these options before resorting to early termination is highly recommended. This section Artikels some viable alternatives and their associated benefits and drawbacks.

Contract Transfer, How much does it cost to break a phone contract

Transferring your phone contract to another person is a potential solution, avoiding early termination charges. This involves finding a suitable individual willing to assume the remaining contract obligations. The feasibility of this option depends on your carrier’s policies and the willingness of a potential transferee.

Examples of situations where contract transfer might be feasible include gifting the phone and contract to a family member, transferring it to a friend in need of a phone plan, or even selling the phone and contract together. However, the process is not always straightforward and may involve additional administrative steps.

Advantages of contract transfer include avoiding early termination fees and potentially recovering some of the phone’s value if sold with the contract. Disadvantages include finding a suitable transferee, navigating the carrier’s transfer process, and ensuring the transferee’s creditworthiness meets the carrier’s requirements. The process may also involve paperwork and administrative delays.

Negotiating with the Carrier

Negotiating with your mobile carrier to modify your contract terms is another option. This could involve requesting a reduced early termination fee, upgrading to a different plan with lower monthly payments, or extending the contract length. The success of this approach hinges on your negotiation skills and the carrier’s willingness to compromise.

Situations where negotiation might be successful include demonstrating financial hardship, experiencing unexpected life changes, or pointing out poor service or unmet contract promises. The carrier might be more willing to negotiate if you’ve been a loyal customer with a good payment history.

Advantages of negotiation include avoiding or reducing early termination fees and potentially securing a more suitable plan. Disadvantages include the time and effort required to negotiate, the possibility of rejection, and the potential for a less favorable outcome than initially hoped for. Success depends heavily on individual circumstances and the carrier’s policies.

Selling the Phone Separately

Selling your phone independently, without transferring the contract, is another possibility. This option involves accepting the early termination fee but recouping some of the phone’s cost through resale. The market value of your phone will dictate how much you can recover.

This is a suitable option when the early termination fee is relatively low compared to the resale value of the phone. For example, if you have a high-demand phone model that retains its value well, this could be a financially viable option.

Advantages include recovering some of the phone’s cost, regardless of the early termination fee. Disadvantages include the effort involved in selling the phone (advertising, meeting buyers, etc.), potentially accepting a lower price than desired, and still incurring the early termination fee. The resale value is dependent on the phone’s condition and market demand.

Decision-Making Flowchart

The following flowchart illustrates the decision-making process for choosing the best alternative:

Start -> Assess Early Termination Fee -> High Fee? (Yes/No) -> Yes: Explore Contract Transfer, Negotiation with Carrier, Selling Phone Separately -> No: Accept Early Termination Fee -> Evaluate Options (Consider advantages/disadvantages of each) -> Select Best Option -> End

Legal Aspects of Contract Termination

Understanding the legal framework surrounding mobile phone contracts is crucial for consumers. This section Artikels consumer rights, circumstances allowing contract breach without penalty, relevant legal precedents, and applicable consumer protection laws. Knowing your rights can help you navigate potential disputes and avoid unnecessary costs.

Consumers possess significant legal protections when it comes to contracts, including mobile phone agreements. These protections vary by jurisdiction, but generally revolve around principles of fairness, transparency, and the avoidance of unfair contract terms. Understanding these rights empowers consumers to challenge unfair practices and seek redress when necessary.

Circumstances for Penalty-Free Contract Termination

Several circumstances may allow consumers to break a phone contract without incurring early termination fees. These typically involve situations where the provider has breached the contract, or where unforeseen circumstances render continued adherence to the contract unduly burdensome.

For example, if the mobile network provider consistently fails to deliver the promised service – such as significantly deficient network coverage or repeated service outages – this could constitute a breach of contract. Similarly, situations involving unforeseen circumstances like job loss or serious illness may, depending on the specific contract terms and applicable laws, provide grounds for early termination without penalty.

However, it is crucial to demonstrate a legitimate reason for termination and to follow the contract’s stipulated procedures for early termination, if any.

Legal Precedents Regarding Early Termination Fees

Numerous court cases have addressed the legality and fairness of early termination fees. These cases often hinge on whether the fees are considered a genuine pre-estimate of damages or a penalty designed to deter customers from leaving.

In many jurisdictions, courts have ruled against excessively high or disproportionate early termination fees, deeming them penalties rather than legitimate compensation for the provider’s losses. For instance, a case might involve a consumer challenging a $500 early termination fee for a contract with a remaining balance of only $100, arguing that the fee is punitive and not reflective of actual damages incurred by the provider.

The outcome of such cases varies depending on the specific facts, the contract’s wording, and the relevant jurisdiction’s laws.

Relevant Consumer Protection Laws

Consumer protection laws vary across different regions and countries, but common threads often include stipulations regarding contract transparency, fair contract terms, and the right to dispute unfair practices.

Many jurisdictions have laws that prohibit unfair contract terms, including excessively high early termination fees. These laws often require providers to clearly disclose all fees and charges upfront and to ensure that contract terms are readily understandable. Furthermore, consumers typically have the right to complain to regulatory bodies if they believe a provider has engaged in unfair or deceptive practices.

These bodies can investigate complaints, mediate disputes, and, in some cases, impose penalties on providers found to be in violation of consumer protection laws. Examples include the Federal Communications Commission (FCC) in the United States and Ofcom in the United Kingdom, each with its own set of regulations and enforcement mechanisms.

Impact of Credit Score: How Much Does It Cost To Break A Phone Contract

Breaking a phone contract can potentially impact your credit score, although the severity depends on how the contract termination is handled and the payment method used. Failing to fulfill the financial obligations Artikeld in your contract can negatively affect your credit report, potentially leading to a lower credit score. Conversely, responsible handling of the termination process can minimize or even avoid any negative impact.The impact on your credit score hinges on whether the outstanding balance is reported to credit bureaus.

Late payments, charge-offs, and collections related to the unpaid contract balance are all negative marks that can significantly lower your credit score. The length of time these negative marks remain on your report also plays a crucial role in affecting your creditworthiness.

Credit Reporting Practices for Phone Contracts

Most mobile carriers report account information, including payments and outstanding balances, to at least one of the major credit bureaus (Equifax, Experian, and TransUnion). This means that missed or late payments on your phone bill, especially after contract termination, will likely be reflected in your credit report. The specific reporting practices may vary depending on the carrier and your payment history.

For example, a single missed payment might not immediately damage your credit score, but consistent late payments or a significant outstanding balance will certainly lead to a negative impact. Conversely, consistently making on-time payments can positively contribute to your credit score.

Payment Methods and Credit Reports

Different payment methods can affect how your phone contract information is reported. Using automatic payments reduces the risk of missed payments and helps maintain a positive payment history. Manual payments, on the other hand, increase the risk of late payments if you forget or fail to make timely payments. If you choose to pay off the remaining balance in a lump sum after terminating the contract, ensuring timely payment is crucial to avoiding negative impacts on your credit report.

Failure to make this final payment could result in a negative mark on your credit history.

Minimizing Negative Credit Impacts

To minimize the negative impact on your credit score when terminating a phone contract, prioritize prompt and full payment of any remaining balance. Consider setting up automatic payments to avoid accidental late payments. Contact your carrier proactively to discuss payment options and explore solutions if you anticipate difficulties in meeting your financial obligations. Review your credit report regularly to ensure accuracy and identify any potential issues related to your phone contract.

Disputes can be filed with the credit bureaus if inaccurate information is reported.

Steps to Protect Credit Scores

Before terminating your phone contract, understand the terms and conditions, including early termination fees and payment schedules. Carefully calculate the remaining balance to ensure you have sufficient funds to pay it off. Maintain open communication with your carrier throughout the termination process. If you face financial hardship, explore options such as negotiating a payment plan with your carrier to avoid default.

Regularly monitor your credit report for any inaccuracies or negative marks related to your phone contract and take steps to address them promptly. This proactive approach can help safeguard your credit score and maintain your financial health.

Hidden Fees and Charges

Breaking a phone contract often involves more than just the early termination fee. Several hidden or less-obvious charges can significantly increase the final cost, leaving consumers surprised and frustrated. Understanding these potential expenses is crucial for making informed decisions.Hidden fees are typically disclosed in the fine print of the contract or in separate documents provided during the signup process.

However, this information is often buried within lengthy legal jargon, making it difficult for consumers to understand the full financial implications of early termination. Furthermore, some carriers may not proactively highlight these fees unless specifically asked about them.

Examples of Unexpected Charges

Consumers might encounter unexpected charges in various scenarios. For example, if a phone is damaged before the contract ends and insurance wasn’t purchased, repair or replacement costs could be substantial. Similarly, outstanding payments for accessories or add-on services purchased with the phone plan might be added to the final bill. If the contract includes a device financing plan, failing to return the device in good condition might lead to additional charges for damage or missing components.

Finally, some carriers charge a fee for processing the early termination request itself, in addition to the early termination fee.

Common Hidden Fees and Their Potential Costs

| Fee Type | Description | Potential Cost | Example |

|---|---|---|---|

| Early Termination Fee (ETF) | Fee for breaking the contract before the term is up. | Varies greatly by carrier and remaining contract length; can range from $100 to $1000+ | A customer with 12 months remaining on a $500 phone might owe $300 ETF. |

| Device Payment Balance | Remaining amount owed on the financed phone. | Depends on the phone’s price and payment plan; can be several hundred dollars. | A customer who paid for only 6 months of a 24-month installment plan still owes 18 months’ worth of payments. |

| Returned Device Fee | Charges for damage or missing components when returning a financed phone. | Varies depending on the extent of the damage; can range from $50 to the full replacement cost. | A customer who returns a phone with a cracked screen might be charged $150 for repair costs. |

| Account Closure Fee | Fee for closing the account early. | Generally a small fee, often under $25. | A $10 account closure fee is added to the final bill. |

So, how much

-does* it cost to break a phone contract? The answer, as we’ve seen, isn’t a single number. It’s a calculation influenced by numerous variables, from your carrier’s policies to your personal financial situation. By understanding the intricacies of early termination fees, remaining balances, and alternative options, you can approach contract termination with clarity and confidence, minimizing the financial impact and protecting your credit.

Remember to always carefully review your contract and explore all available avenues before making a decision.

FAQ Explained

What happens if I don’t pay the early termination fee?

Failure to pay the early termination fee can negatively impact your credit score and potentially lead to collections efforts by your carrier.

Can I transfer my contract to someone else?

Some carriers allow contract transfers, but this depends on their specific policies and may involve additional fees or verification processes.

Does paying off the phone completely eliminate early termination fees?

Not necessarily. While paying off the phone reduces the overall cost, many carriers still charge an early termination fee.

What are some hidden fees I should watch out for?

Be aware of potential fees for early activation cancellation, restocking fees, and charges for returning the phone in damaged condition.